Gulfport Energy Corporation (NYSE: GPOR) (“Gulfport” or the

“Company”) today reported financial and operating results for the

three and twelve months ended December 31, 2024 and provided its

2025 outlook.

Full Year 2025 Outlook

- Optimized development program and portfolio allocation expected

to drive capital efficiencies and deliver strong corporate

margins

- Estimate net daily liquids production increase of over 30%(1)

compared to full year 2024, with a range of 18.0 to 20.5 MBbl per

day

- Expect to deliver flat year-over-year net daily equivalent

production with a range of 1.04 Bcfe to 1.065 Bcfe per day

- Full-year drilling and completion capital per foot of completed

lateral expected to decrease by approximately 20% when compared to

full year 2024, including approximately 10% well cost

reductions

- Plan to invest total base capital expenditures of $370 million

to $395 million, including $35 million to $40 million on

maintenance leasehold and land investment

- Plan to continue to allocate substantially all adjusted free

cash flow(2), excluding acquisitions, toward common share

repurchases

"Building on our momentum from last year, the 2025 development

program reflects significant efficiency gains that we expect will

allow us to increase operated activity while maintaining total base

capital invested and improve our annual operated D&C capital

per foot of completed lateral by approximately 20% when compared to

2024. The 2025 plan highlights our transition from delineation to

development mode in the Marcellus and includes development

targeting the Utica lean condensate acreage recently acquired

through our discretionary acreage acquisitions. We forecast this

activity to deliver total net liquids production growth of over 30%

year over year, increasing our liquids production, as a percent of

total production, to double digits and positioning the Company to

capture a significant increase in expected adjusted free cash flow

generation while maintaining exposure to an improving natural gas

environment. The Company plans to remain consistent in our adjusted

free cash flow allocation framework and will continue to return

substantially all of our 2025 adjusted free cash flow, excluding

discretionary acreage acquisitions, through common stock

repurchases," commented John Reinhart, President and CEO.

Fourth Quarter 2024

- Delivered total net production of 1.06 Bcfe per day

- Produced total net liquids production of 16.2 MBbl per day, an

increase of 7% over third quarter 2024 and 13% over fourth quarter

2023

- Incurred capital expenditures, excluding discretionary acreage

acquisitions, of $56.3 million, below analyst consensus

expectations

- Reported $273.2 million of net loss, $85.4 million of adjusted

net income(2) and $202.8 million of adjusted EBITDA(2), above

analyst consensus expectations

- Generated $148.8 million of net cash provided by operating

activities and $125.2 million of adjusted free cash flow(2)

- Closed on opportunistic discretionary acreage acquisitions

totaling $6.0 million

- Repurchased 491 thousand shares of common stock for

approximately $80.1 million

Full Year 2024 and Recent Highlights

- Delivered total net production of 1.05 Bcfe per day

- Produced total net liquids production of 14.4 MBbl per day

- Incurred capital expenditures, excluding discretionary acreage

acquisitions, of $385.3 million, below analyst consensus

expectations

- Reported $261.4 million of net loss, $282.5 million of adjusted

net income(2) and $731.1 million of adjusted EBITDA(2), above

analyst consensus expectations

- Generated $650.0 million of net cash provided by operating

activities and $256.8 million of adjusted free cash flow(2)

- Maintained a strong balance sheet and low financial leverage,

with liquidity at December 31, 2024 totaling $899.7 million

- Expanded common stock repurchase authorization by 54% percent

to a total of $1.0 billion, with approximately $406.8 million(3)

remaining

- Returned substantially all full-year adjusted free cash

flow(2), excluding discretionary acreage acquisitions, to

shareholders by repurchasing 1.2 million shares of common stock for

approximately $184.5 million

- Allocated $44.8 million toward discretionary acreage

acquisitions, expanding high-quality resource base and adding over

a year of Utica liquids-rich inventory at current development

pace

- Achieved significant operational efficiencies in the Utica,

with average drilling footage per day and completion hours pumped

per day improving by approximately 10% and 25% year-over-year,

respectively

Reinhart continued, "Gulfport's 2024 development program

delivered attractive results highlighted by our high-quality

resource base and the continued improvement of operating

efficiencies leading to strong financial results for the full year.

We repurchased approximately 7% of our total common shares

outstanding through our ongoing stock repurchase program while

maintaining a strong balance sheet and continuing accretive

inventory additions in the Utica liquids-rich window, adding over a

year of largely lean condensate inventory. After adjusting for

adjusted free cash flow utilized for discretionary acreage

acquisitions, the Company allocated substantially all of our

adjusted free cash flow to repurchasing our common stock during

2024, returning approximately 96% of our adjusted free cash flow to

shareholders throughout the year."

A company presentation to accompany the Gulfport earnings

conference call can be accessed by clicking here.

- Assumes midpoint of 2025 guidance.

- A non-GAAP financial measure. Reconciliations of these non-GAAP

measures and other disclosures are provided with the supplemental

financial tables available on our website at

www.gulfportenergy.com.

- As of February 20, 2025.

Operational Update

The table below summarizes Gulfport's operated drilling and

completion activity for the full year of 2024:

Year Ended December 31,

2024

Gross

Net

Lateral Length

Spud

Utica

20

19.7

15,300

SCOOP

2

1.8

11,500

Drilled

Utica

18

17.4

16,000

SCOOP

3

2.4

12,400

Completed

Utica

16

15.4

17,800

SCOOP

3

2.4

12,400

Turned-to-Sales

Utica

16

15.4

17,800

SCOOP

3

2.4

12,400

Gulfport’s net daily production for the full year of 2024

averaged 1.05 Bcfe per day, primarily consisting of 841.7 MMcfe per

day in the Utica and Marcellus and 212.4 MMcfe per day in the

SCOOP. For the full year of 2024, Gulfport’s net daily production

mix was comprised of approximately 92% natural gas, 6% natural gas

liquids ("NGL") and 2% oil and condensate.

Three Months Ended December

31, 2024

Three Months Ended December

31, 2023

Year Ended December 31,

2024

Year Ended December 31,

2023

Production

Natural gas (Mcf/day)

958,075

976,820

967,633

959,743

Oil and condensate (Bbl/day)

5,229

3,498

3,986

3,733

NGL (Bbl/day)

11,004

10,923

10,431

12,018

Total (Mcfe/day)

1,055,472

1,063,341

1,054,136

1,054,251

Average Prices

Natural gas:

Average price without the impact of

derivatives ($/Mcf)

$

2.51

$

2.37

$

2.02

$

2.37

Impact from settled derivatives

($/Mcf)

$

0.48

$

0.54

$

0.80

$

0.42

Average price, including settled

derivatives ($/Mcf)

$

2.99

$

2.91

$

2.82

$

2.79

Oil and condensate:

Average price without the impact of

derivatives ($/Bbl)

$

65.05

$

73.47

$

69.64

$

73.27

Impact from settled derivatives

($/Bbl)

$

0.70

$

(3.32

)

$

0.11

$

(2.53

)

Average price, including settled

derivatives ($/Bbl)

$

65.75

$

70.15

$

69.75

$

70.74

NGL:

Average price without the impact of

derivatives ($/Bbl)

$

31.59

$

26.65

$

29.56

$

27.29

Impact from settled derivatives

($/Bbl)

$

(0.61

)

$

2.72

$

(0.56

)

$

2.07

Average price, including settled

derivatives ($/Bbl)

$

30.98

$

29.37

$

29.00

$

29.36

Total:

Average price without the impact of

derivatives ($/Mcfe)

$

2.93

$

2.69

$

2.41

$

2.73

Impact from settled derivatives

($/Mcfe)

$

0.43

$

0.51

$

0.73

$

0.40

Average price, including settled

derivatives ($/Mcfe)

$

3.36

$

3.20

$

3.14

$

3.13

Selected operating metrics

Lease operating expenses ($/Mcfe)

$

0.20

$

0.17

$

0.18

$

0.18

Taxes other than income ($/Mcfe)

$

0.08

$

0.08

$

0.08

$

0.09

Transportation, gathering, processing and

compression expense ($/Mcfe)

$

0.91

$

0.91

$

0.91

$

0.91

Recurring cash general and administrative

expenses ($/Mcfe) (non-GAAP)

$

0.15

$

0.15

$

0.13

$

0.12

Interest expenses ($/Mcfe)

$

0.16

$

0.16

$

0.16

$

0.15

Capital Investment

Capital investment was $385.3 million (on an incurred basis) for

the full year of 2024, of which $327.4 million related to drilling

and completion (“D&C”) activity and $57.9 million related to

maintenance leasehold and land investment. In addition, Gulfport

invested approximately $44.8 million in discretionary acreage

acquisitions.

Common Stock Repurchase Program

Gulfport repurchased approximately 491 thousand shares of common

stock during the fourth quarter for approximately $80.1 million. As

of February 20, 2025, the Company had repurchased approximately 5.6

million shares of common stock at a weighted average price of

$105.57 per share since the program initiated in March 2022,

totaling approximately $593.2 million in aggregate. The Company

currently has approximately $406.8 million of remaining capacity

under the share repurchase program.

Financial Position and Liquidity

As of December 31, 2024, Gulfport had approximately $1.5 million

of cash and cash equivalents, $38.0 million of borrowings under its

revolving credit facility, $63.8 million of letters of credit

outstanding, $25.7 million of outstanding 2026 senior notes and

$650.0 million of outstanding 2029 senior notes.

Gulfport’s liquidity at December 31, 2024, totaled approximately

$899.7 million, comprised of the $1.5 million of cash and cash

equivalents and approximately $898.2 million of available borrowing

capacity under its revolving credit facility.

During 2024, the Company paid $4.2 million of cash dividends to

holders of its preferred stock.

2025 Guidance

Gulfport released operational guidance and outlook for the full

year 2025, including full year expense estimates and projections

for production and capital expenditures. Gulfport's 2025 guidance

assumes commodity strip prices as of January 27, 2025, adjusted for

applicable commodity and location differentials, and no property

acquisitions or divestitures.

Year Ending

December 31, 2025

Low

High

Production

Average daily gas equivalent

(MMcfe/day)

1,040

1,065

Average daily liquids production

(MBbl/day)

18.0

20.5

% Gas

~89%

Realizations (before hedges)

Natural gas (differential to NYMEX settled

price) ($/Mcf)

$(0.20)

$(0.35)

NGL (% of WTI)

40%

50%

Oil (differential to NYMEX WTI)

($/Bbl)

$(5.50)

$(6.50)

Expenses

Lease operating expense ($/Mcfe)

$0.19

$0.22

Taxes other than income ($/Mcfe)

$0.08

$0.10

Transportation, gathering, processing and

compression ($/Mcfe)

$0.93

$0.97

Recurring cash general and

administrative(1,2) ($/Mcfe)

$0.12

$0.14

Total

Capital expenditures (incurred)

(in millions)

Operated D&C

$335

$355

Maintenance leasehold and land

$35

$40

Total base capital expenditures

$370

$395

(1) Recurring cash G&A includes

capitalization. It excludes non-cash stock compensation and

expenses related to the continued administration of our prior

Chapter 11 filing.

(2) This is a non-GAAP measure.

Reconciliations of these non-GAAP measures and other disclosures

are provided with the supplemental financial tables available on

our website at www.gulfportenergy.com.

Derivatives

Gulfport enters into commodity derivative contracts on a portion

of its expected future production volumes to mitigate the Company's

exposure to commodity price fluctuations. For details, please refer

to the "Derivatives" section provided with the supplemental

financial tables available on our website at

ir.gulfportenergy.com.

Estimated Proved Reserves

Gulfport reported year end 2024 total proved reserves of 4.0

Tcfe, consisting of 3.4 Tcf of natural gas, 22.1 MMBbls of oil and

80.1 MMBbls of natural gas liquids. Gulfport’s year end 2024 total

proved reserves decreased approximately 6% when compared to its

2023 total proved reserves, largely a result of downward revisions

associated with commodity price changes.

The table below provides information regarding the components

driving the 2024 net proved reserve adjustments:

Total (Bcfe)

Proved Reserves, December 31,

2023

4,214

Extensions and discoveries

547

Revisions - performance, ownership and

other assumptions

82

Price revisions

(488

)

Current production

(386

)

Proved Reserves, December 31,

2024

3,969

Proved developed reserves totaled approximately 2,109 Bcfe as of

December 31, 2024 or approximately 53% of Gulfport’s proved

reserves. Proved undeveloped reserves totaled approximately 1,861

Bcfe as of December 31, 2024.

The table below summarizes the Company’s 2024 net proved

reserves:

December 31, 2024

Oil (MMBbl)

Natural Gas

(Bcf)

NGL (MMBbl)

Total (Bcfe)

Utica & Marcellus

Proved developed(1)

4

1,427

8

1,498

Proved undeveloped(1)

13

1,189

36

1,480

Total proved(1)

17

2,616

44

2,978

SCOOP

Proved developed

4

451

23

611

Proved undeveloped

2

289

13

380

Total proved

5

740

36

991

Total

Proved developed

7

1,879

31

2,109

Proved undeveloped

15

1,478

49

1,861

Total proved

22

3,356

80

3,969

Totals may not sum or recalculate due to

rounding.

_____________________

(1) Includes approximately 12 Bcfe and 174

Bcfe of net developed and undeveloped reserves, respectively,

located in the Marcellus target formation.

The following table reconciles the standardized measure of

future net cash flows to the PV-10 value of Gulfport’s proved

reserves:

December 31, 2024

Proved Developed

Proved Undeveloped

Total Proved

($ in millions)

Estimated future net revenue(1)

$

1,620

$

1,876

$

3,496

Present value of estimated future net

revenue (PV-10)(1)

$

1,059

$

699

$

1,757

Standardized measure(1)

$

1,747

Totals may not sum due to rounding.

_____________________

(1)

Estimated future net revenue

represents the estimated future revenue to be generated from the

production of proved reserves, net of estimated production and

future development costs, using prices and costs under existing

economic conditions as of December 31, 2024, and assuming commodity

prices as set forth below. For the purpose of determining prices

used in our reserve reports, we used the unweighted arithmetic

average of the prices on the first day of each month within the

12-month period ended December 31, 2024. The prices used in our

PV-10 measure were the average WTI Spot price of $76.32 per barrel

and the average Henry Hub Spot price of $2.13 per MMBtu, before

basis differential adjustments. These prices should not be

interpreted as a prediction of future prices, nor do they reflect

the value of our commodity derivative instruments in place as of

December 31, 2024. The amounts shown do not give effect to

non-property-related expenses, such as corporate general and

administrative expenses and debt service, or to depreciation,

depletion and amortization. The present value of estimated future

net revenue typically differs from the standardized measure because

the former does not include the effects of estimated future income

tax expense of $10 million as of December 31, 2024.

Management uses PV-10, which is

calculated without deducting estimated future income tax expenses,

as a measure of the value of the Company's current proved reserves

and to compare relative values among peer companies. We also

understand that securities analysts and rating agencies use this

measure in similar ways. While estimated future net revenue and the

present value thereof are based on prices, costs and discount

factors which may be consistent from company to company, the

standardized measure of discounted future net cash flows is

dependent on the unique tax situation of each individual company.

PV-10 should not be considered in isolation or as a substitute for

the standardized measure of discounted future net cash flows or any

other measure of a company's financial or operating performance

presented in accordance with GAAP.

A reconciliation of the

standardized measure of discounted future net cash flows to PV-10

is presented above. Neither PV-10 nor the standardized measure of

discounted future net cash flows purport to represent the fair

value of our proved oil and gas reserves.

Fourth Quarter and Full Year 2024 Conference Call

Gulfport will host a teleconference and webcast to discuss its

fourth quarter and full year 2024 results, as well as its 2025

outlook, beginning at 10:00 a.m. ET (9:00 a.m. CT) on Wednesday,

February 26, 2025.

The conference call can be heard live through a link on the

Gulfport website, www.gulfportenergy.com. In addition, you may

participate in the conference call by dialing 866-373-3408

domestically or 412-902-1039 internationally. A replay of the

conference call will be available on the Gulfport website and a

telephone audio replay will be available from February 26, 2025 to

March 12, 2025, by calling 877-660-6853 domestically or

201-612-7415 internationally and then entering the replay passcode

13751354.

Financial Statements and Guidance Documents

Fourth quarter and full year 2024 earnings results and

supplemental information regarding quarterly data such as

production volumes, pricing, financial statements, and non-GAAP

reconciliations are available on our website at

ir.gulfportenergy.com.

Non-GAAP Disclosures

This news release includes non-GAAP financial measures. Such

non-GAAP measures should be not considered as an alternative to

GAAP measures. Reconciliations of these non-GAAP measures and other

disclosures are provided with the supplemental financial tables

available on our website at ir.gulfportenergy.com.

About Gulfport

Gulfport is an independent natural gas-weighted exploration and

production company focused on the exploration, acquisition and

production of natural gas, crude oil and NGL in the United States

with primary focus in the Appalachia and Anadarko basins. Our

principal properties are located in eastern Ohio targeting the

Utica and Marcellus formations and in central Oklahoma targeting

the SCOOP Woodford and SCOOP Springer formations.

Forward Looking Statements

This press release includes “forward-looking statements” for

purposes of the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995, Section 27A of the Securities Act of

1933, as amended, and Section 21E of the Securities Exchange Act of

1934. Forward-looking statements are statements other than

statements of historical fact. They include statements regarding

Gulfport’s current expectations, management's outlook guidance or

forecasts of future events, projected cash flow and liquidity,

inflation, share repurchases and other return of capital plans, its

ability to enhance cash flow and financial flexibility, future

production and commodity mix, plans and objectives for future

operations, the ability of our employees, portfolio strength and

operational leadership to create long-term value and the

assumptions on which such statements are based. Gulfport believes

the expectations and forecasts reflected in the forward-looking

statements are reasonable, Gulfport can give no assurance they will

prove to have been correct. They can be affected by inaccurate or

changed assumptions or by known or unknown risks and uncertainties.

Important risks, assumptions and other important factors that could

cause future results to differ materially from those expressed in

the forward-looking statements are described under "Risk Factors"

in Item 1A of Gulfport’s annual report on Form 10-K for the year

ended December 31, 2024 and any updates to those factors set forth

in Gulfport's subsequent quarterly reports on Form 10-Q or current

reports on Form 8-K (available at

https://www.gulfportenergy.com/investors/sec-filings). Gulfport

undertakes no obligation to release publicly any revisions to any

forward-looking statements, to report events or to report the

occurrence of unanticipated events.

Investors should note that Gulfport announces financial

information in SEC filings, press releases and public conference

calls. Gulfport may use the Investors section of its website

(www.gulfportenergy.com) to communicate with investors. It is

possible that the financial and other information posted there

could be deemed to be material information. The information on

Gulfport’s website is not part of this filing.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250225861642/en/

Investor Contact: Jessica Antle – Vice President,

Investor Relations jantle@gulfportenergy.com 405-252-4550

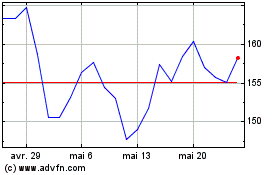

Gulfport Energy (NYSE:GPOR)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Gulfport Energy (NYSE:GPOR)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025