Gray Television, Inc. (“Gray”) (NYSE: GTN) announced today the

early tender results of its previously announced offer to purchase

for cash (the “Tender Offer”) any and all of its outstanding 5.875%

Senior Notes due 2026 (the “Notes”), subject to certain terms and

conditions set forth in the Offer to Purchase dated May 20, 2024

(the “Offer to Purchase”).

According to information provided by D.F. King

& Co., Inc., the Information Agent and Tender Agent for the

Tender Offer, as of 11:59 p.m., New York City time, on June 3, 2024

(such date and time, the “Early Tender Date”), Gray had received

valid and not withdrawn tenders from registered holders (each, a

“Holder” and collectively, the “Holders”) of $690,032,000 aggregate

principal amount outstanding of the Notes. Withdrawal rights

expired at 11:59 p.m., New York City Time, on June 3, 2024. Holders

of the Notes who validly tendered and did not withdraw their Notes

prior to the Early Tender Date will receive the “Total

Consideration” for the Notes, which is $1,000.00 per $1,000.00

principal amount of Notes tendered. The Total Consideration

includes the early tender premium for the Notes of $30.00 per

$1,000.00 principal amount of Notes tendered (the “Early Tender

Premium”). Gray expects that the Early Settlement Date will be

today, the first business day after the Early Tender Date (the

“Early Settlement Date”). In addition, Holders whose Notes were

accepted for purchase at or prior to the Early Tender Date will

also receive accrued and unpaid interest up to, but not including,

the Early Settlement Date. All conditions of the Tender Offer were

satisfied or waived by Gray at the Early Tender Date. Gray has

elected to exercise its right to make payment for the Notes that

were validly tendered at or prior to the Early Tender Date and that

are accepted for purchase on the Early Settlement Date.

The following table sets forth the principal amount

of the Notes outstanding, the principal amount of Notes tendered at

the Early Tender Date and the aggregate amount of Notes accepted

for purchase by Gray:

|

Title of Security |

|

CUSIP Numbers |

|

PrincipalAmountOutstanding |

|

Principal AmountTendered at EarlyTender Date |

|

Aggregate PrincipalAmount Acceptedfor

Purchase |

|

5.875% Senior Notes due 2026 |

|

389375 AJ5U42511 AE2 |

|

$700,000,000 |

|

$690,032,000 |

|

$690,032,000 |

|

|

|

|

|

|

|

|

|

|

The Tender Offer is scheduled to expire at 11:59 p.m., New York

City time, on June 17, 2024 (the “Expiration Date”), unless

extended or earlier terminated by Gray. Holders of the Notes who

validly tender their Notes after the Early Tender Date but at or

prior to the Expiration Date will be eligible to receive the Total

Consideration, less the Early Tender Premium. Holders whose Notes

are accepted for purchase after the Early Tender Date but at or

prior to the Expiration Date will also receive accrued and unpaid

interest up to, but not including, the Final Settlement Date, which

Gray expects will be June 18, 2024, the first business day after

the Expiration Date.

The obligation of Gray to accept for purchase, and to pay for,

any Notes validly tendered pursuant to the Tender Offer is

conditioned upon Gray raising funds for the purpose of financing

the Tender Offer that is sufficient to pay the aggregate Tender

Offer Consideration, including payment of accrued and unpaid

interest with respect to all Notes and related costs and expenses

(regardless of the amount of Notes tendered pursuant to the Tender

Offer) on terms and conditions acceptable to Gray, in its sole

discretion. The Tender Offer may be amended, extended, terminated

or withdrawn by Gray in its sole discretion.

Gray has retained Truist Securities, Inc., BofA Securities, Inc.

and Wells Fargo Securities, LLC to serve as Dealer Managers for the

Tender Offer. D.F. King & Co. has been retained to serve as the

Information Agent and Tender Agent for the Tender Offer. Questions

regarding the Tender Offer may be directed to Truist Securities,

Inc. at 3333 Peachtree Road, Atlanta, Georgia 30326, telephone

(404) 926-5262 (collect) Attn: Jim Gibbs. Requests for the Offer to

Purchase may be directed to D.F. King & Co. at (888) 887-0082

(toll-free) or (212) 269-5550 (collect for banks and brokers), and

at GTN@dfking.com.

Gray is making the Tender Offer only by, and pursuant to, the

terms of the Offer to Purchase. None of Gray, the Dealer Managers,

the Information Agent or the Tender Agent makes any recommendation

as to whether holders of the Notes should tender or refrain from

tendering their Notes. Holders of the Notes must make their own

decision as to whether to tender Notes and, if so, the principal

amount of the Notes to tender. The Tender Offer is not being made

to holders of the Notes in any jurisdiction in which the making or

acceptance thereof would not be in compliance with the securities,

blue sky or other laws of such jurisdiction. In any jurisdiction in

which the securities laws or blue sky laws require the Tender Offer

to be made by a licensed broker or dealer, the Tender Offer will be

deemed to be made on behalf of Gray by the Dealer Managers or one

or more registered brokers or dealers that are licensed under the

laws of such jurisdiction.

This press release is for informational purposes only and does

not constitute an offer to purchase, or a solicitation of an offer

to purchase, any securities or an offer to sell, or the

solicitation of an offer to sell, any securities, nor does it

constitute an offer or solicitation in any jurisdiction in which

such offer or solicitation is unlawful.

Forward-Looking Statements:

This press release contains certain forward-looking statements

that are based largely on Gray’s current expectations and reflect

various estimates and assumptions by Gray. These statements are

statements other than those of historical fact and may be

identified by words such as “estimates,” “expect,” “anticipate,”

“will,” “implied,” “intend,” “assume” and similar expressions.

Forward-looking statements are subject to certain risks, trends and

uncertainties that could cause actual results and achievements to

differ materially from those expressed in such forward-looking

statements. Such risks, trends and uncertainties, which in some

instances are beyond Gray’s control, include Gray’s ability to

consummate the Tender Offer, including the terms and timing

thereof, and other future events. Gray is subject to additional

risks and uncertainties described in Gray’s quarterly and annual

reports filed with the Securities and Exchange Commission from time

to time, including in the “Risk Factors,” and management’s

discussion and analysis of financial condition and results of

operations sections contained therein, which reports are made

publicly available via its website, www.gray.tv. Any

forward-looking statements in this communication should be

evaluated in light of these important risk factors. This press

release reflects management’s views as of the date hereof. Except

to the extent required by applicable law, Gray undertakes no

obligation to update or revise any information contained in this

communication beyond the date hereof, whether as a result of new

information, future events or otherwise.

About Gray:

Gray Television, Inc. is a multimedia company headquartered in

Atlanta, Georgia. Gray is the nation’s largest owner of top-rated

local television stations and digital assets. Its television

stations serve 114 television markets that collectively reach

approximately 36 percent of US television households. This

portfolio includes 79 markets with the top-rated television station

and 102 markets with the first and/or second highest rated

television station. Gray also owns video program companies Raycom

Sports, Tupelo Media Group, and PowerNation Studios, as well as the

studio production facilities Assembly Atlanta and Third Rail

Studios. Gray owns a majority interest in Swirl Films. For more

information, please visit www.gray.tv.

Gray Contacts:

Jim Ryan, Executive Vice President and Chief

Financial Officer, 404-504-9828Jeff Gignac,

Executive Vice President, Finance, 404-504-9828Kevin P.

Latek, Executive Vice President, Chief Legal and

Development Officer, 404-266-8333

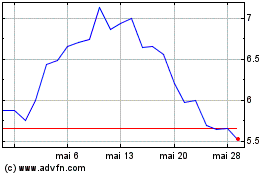

Gray Television (NYSE:GTN)

Graphique Historique de l'Action

De Mai 2024 à Juin 2024

Gray Television (NYSE:GTN)

Graphique Historique de l'Action

De Juin 2023 à Juin 2024