Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

03 Octobre 2024 - 4:38PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of October 2024

Commission File Number: 001-31528

IAMGOLD Corporation

(Translation of registrant's name into English)

150 King Street West; Suite 2200

Toronto, Ontario, Canada M5H 1J9

Tel: (416) 360-4710

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

☐ Form 20-F ☒ Form 40-F

SUBMITTED HEREWITH

Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

IAMGOLD CORPORATION |

| |

(Registrant) |

| |

|

|

| Date: October 3, 2024 |

By: |

/s/ Tim Bradburn |

| |

|

Tim Bradburn |

| |

Title: |

Senior Vice President, General Counsel and

Corporate Secretary |

FORM 51-102F3

MATERIAL CHANGE REPORT

Item 1: Name and Address of Company

IAMGOLD Corporation

150 King Street West, Suite 2200

Toronto, ON

M5H 1J9

Item 2: Date of Material Change

September 30, 2024

Item 3: News Release

The news release in respect of this material change was disseminated over GlobeNewswire on September 30, 2024. A copy of the news release has been filed on SEDAR+ and is available at www.sedarplus.ca.

Item 4: Summary of Material Change

IAMGOLD Corporation (the "Company") has provided Sumitomo Metal Mining Co., Ltd. ("Sumitomo") with the required 60 days formal notice of the Company's intention to exercise the right to repurchase the 9.7% interest of the Côté Gold Mine ("Côté Gold") that was transferred to Sumitomo as part of the JV funding and Amending Agreement entered into on December 19, 2022. This transaction is expected to close on November 30, 2024, and will return IAMGOLD to its full 70% interest in Côté Gold.

Item 5: Full Description of Material Change

5.1 Full Description of Material Change

The Company has provided Sumitomo with the required 60 days formal notice of the Company's intention to exercise the right to repurchase the 9.7% interest of the Côté Gold that was transferred to Sumitomo as part of the JV funding and Amending Agreement entered into on December 19, 2022. This transaction is expected to close on November 30, 2024, and will return IAMGOLD to its full 70% interest in Côté Gold.

The Company intends to use the cash proceeds from its "bough deal" equity financing that closed on May 24, 2024 to finance the repurchase of the 9.7% interest of the Côté Gold Mine.

Forward Looking Statements

This report contains forward-looking statements. All statements, other than of historical fact, that address activities, events or developments that the Company believes, expects or anticipates will or may occur in the future, including without limitation, statements with respect to the exercise of the over-allotment option by the underwriters and use of the proceeds of the Offering. Forward-looking statements are generally identifiable by use of the words "will", "continue", "expect", "estimate", "intend", "to have", "plan" or "project" or the negative of these words or other variations on these words or comparable terminology. Forward-looking statements are subject to a number of risks and uncertainties, many of which are beyond the Company's ability to control or predict, that may cause the actual results of the Company to differ materially from those discussed in the forward-looking statements. Factors that could cause actual results or events to differ materially from current expectations include, among other things, without limitation, failure to meet expected, estimated or planned gold production, cash costs, margin expansion, capital expenditures and exploration expenditures and failure to establish estimated mineral resources, the possibility that future exploration results will not be consistent with the Company's expectations, changes in the Company's relationship with Sumitomo, instability in financial markets, currency exchange risk, change in world gold markets, cybersecurity risks, and other risks disclosed in IAMGOLD's most recent Form 40-F/Annual Information Form on file with the SEC and Canadian provincial securities regulatory authorities. Any forward-looking statement speak only as of the date on which it is made and, except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any forward-looking statement.

5.2 Disclosure for Restructuring Transactions

Not applicable.

Item 6: Reliance on subsection 7.1(2) of National Instrument 51-102

Not applicable.

Item 7: Omitted Information

Not applicable.

Item 8: Executive Officer

The executive officer of IAMGOLD is knowledgeable about the material change and may be contacted at the following number:

Tim Bradburn, Senior Vice President, General Counsel and Corporate Secretary

Phone: 416-360-4710

Item 9: Date of Report

October 3, 2024

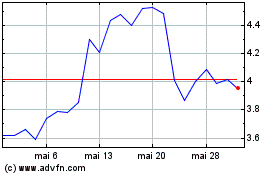

Iamgold (NYSE:IAG)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

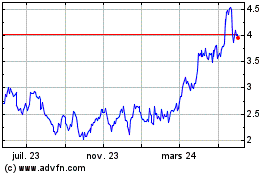

Iamgold (NYSE:IAG)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024