Installed Building Products, Inc. (the "Company" or "IBP")

(NYSE: IBP), an industry-leading installer of insulation and

complementary building products, today announced results for the

third quarter ended September 30, 2024.

Third Quarter 2024 Highlights (Comparisons are to Prior Year

Period)

- Net revenue increased 7.7% to an all-time record of $760.6

million

- Installation revenue increased 7.9% to $713.7 million, as

growth across all end markets combined with sales from IBP's recent

acquisitions

- Other revenue, net of eliminations, which includes IBP’s

manufacturing and distribution operations, increased to $46.9

million from $45.3 million

- Net income increased 0.9% to a third quarter record of $68.6

million

- Adjusted EBITDA* increased 1.4% to an all-time record of $132.3

million

- Net income per diluted share increased 1.7% to an all-time

record of $2.44

- Adjusted net income* increased 1.5% to $80.1 million, or $2.85

per diluted share

- At September 30, 2024, IBP had $406.2 million in cash and cash

equivalents

- Repurchased 100,000 shares of common stock at a total cost of

$20.7 million

- Declared third quarter dividend of $0.35 per share that was

paid to shareholders on September 30, 2024

Recent Developments

- IBP’s Board of Directors declared the fourth quarter regular

cash dividend of $0.35 per share

- In October 2024, acquired Insulation Supplies, a specialty

distributor focused on insulation and related accessories and

machinery sales

“I want to acknowledge the emotional devastation and personal

loss many people across the Southeast and Mid-Atlantic regions of

the United States experienced as a result of two hurricanes that

made landfall in late September and early October,” said Brad

Wheeler, Chief Operating Officer. “Our thoughts are with all those

affected, particularly in Florida and North Carolina. Several of

our branches were affected, but thanks to a total team effort and

our Employee Financial Assistance program, we were able to swiftly

mobilize resources to restore operations and support our employees

when they needed it most.”

“IBP delivered record third-quarter revenue and profitability,

with each end market, from residential to commercial, growing

organically. Our talented and committed employees across the

country focused on what they can control by providing our customers

with reliable, high-quality building product installation service.

The long-term view on demand for our installed service is

unchanged. We believe residential and commercial end market trends

are favorable as builders work to meet demand through the increased

supply of houses, apartments, and commercial structures,” stated

Jeff Edwards, Chairman and Chief Executive Officer.

“Our capital allocation initiatives remain consistent with two

additional acquisitions closing in July and October. Year-to-date,

we have acquired over $73 million in annual revenue. Based on our

current acquisition pipeline, we expect more deals to be completed

before year end and although deal timing is hard to predict, our

outlook for 2025 is positive. In addition, during the nine-month

period ending September 2024, we utilized our strong cash flow

generation and healthy balance sheet to repurchase approximately

$66 million of our common stock and pay $75 million in dividends,”

continued Mr. Edwards.

“As we approach the final month of 2024, we are positioned to

close out the year on a favorable note and begin 2025 from a

position of strength,” concluded Mr. Edwards.

Acquisition Update

IBP continues to prioritize profitable growth through its proven

strategy of acquiring well-run installers of insulation and

complementary building products. To date in 2024, IBP has acquired

over $73 million of annual revenue.

During the 2024 third quarter and in October 2024, IBP completed

the following acquisitions:

- In July 2024, IBP acquired Euroview Enterprises, LLC, Contract

Mirror and Supply Co., and CLM Solutions, LLC (collectively

“Euroview”), an Illinois-based residential and commercial installer

of building products in key construction markets in the Midwest.

Euroview has annual revenue of approximately $20 million.

- In October 2024, IBP acquired Wholesale Insulation Supply, Inc.

doing business as Insulation Supplies, a specialty distributor

focused on supplying fiberglass insulation, spray foam insulation,

cellulose insulation, and related accessories and machinery to

residential and commercial end markets with annual revenue of over

$22 million.

2024 Fourth Quarter Cash Dividend

IBP’s Board of Directors has approved the Company’s quarterly

cash dividend of $0.35 per share, payable on December 31, 2024, to

stockholders of record on December 15, 2024. The fourth quarter

regular cash dividend represents a 6% increase from last year’s

fourth quarter cash dividend payment.

Share Repurchases

During the three months ended September 30, 2024, IBP

repurchased 100,000 shares of its common stock in a privately

negotiated transaction at a total cost of $20.7 million. At

September 30, 2024, the Company had approximately $234 million

available under its stock repurchase program.

Third Quarter 2024 Results Overview

For the third quarter of 2024, net revenue was $760.6 million,

an increase of 7.7% from $706.5 million for the third quarter of

2023. On a consolidated same branch basis, net revenue increased

5.2% from the prior year quarter, supported by growth in our

residential and commercial end markets. Residential sales growth

within the Company's Installation segment was up 5.0% on a same

branch basis in the quarter, both single-family and multi-family

same branch sales increased from the prior year quarter. Commercial

sales in the Installation segment were up 6.1% from the prior year

quarter on a same branch basis.

Gross profit improved 6.1% to $256.8 million from $242.1 million

in the prior year quarter. Gross profit and adjusted gross profit*

as a percent of net revenue were both 33.8%, compared to 34.3% in

the same period last year. Adjusted gross profit primarily adjusts

for the Company’s share-based compensation expense.

Selling and administrative expense, as a percent of total

revenue, was 19.1% compared to 18.2% in the prior year quarter.

Adjusted selling and administrative expense*, as a percent of net

revenue, was 18.5% compared to 17.7% in the prior year quarter.

Net income was $68.6 million, or $2.44 per diluted share,

compared to $68.0 million, or $2.40 per diluted share in the prior

year quarter. Net profit margin for the third quarter was 9.0%

compared to 9.6% in the prior year quarter. Adjusted net income*

was $80.1 million, or $2.85 per diluted share, compared to $78.9

million, or $2.79 per diluted share in the prior year quarter.

Adjusted net profit margin* for the third quarter was 10.5%

compared to 11.2% in the prior year quarter. Adjusted net income

accounts for the impact of non-core items in both periods,

including an addback for non-cash amortization expense related to

acquisitions.

EBITDA* was $127.3 million, a 0.4% increase from $126.8 million

in the prior year quarter. Adjusted EBITDA* was $132.3 million, a

1.4% increase from $130.5 million in the prior year quarter,

representing an adjusted EBITDA margin* of 17.4% and 18.5%,

respectively.

Net profit, adjusted net profit, and adjusted EBITDA margin

reductions during the quarter were primarily due to a greater

proportion of our single-family sales shifting to production

builders as well as higher growth in non-insulation product sales

relative to a year ago. Additionally, we experienced initial

start-up costs related to building out our internal distribution

operations and higher insurance expense from the prior year

period.

Conference Call and Webcast

The Company will host a conference call and webcast on November

7, 2024 at 10:00 a.m. Eastern Time to discuss these results. To

participate in the call, please dial 877-407-0792 (domestic) or

201-689-8263(international). The live webcast will be available at

www.installedbuildingproducts.com in the investor relations

section. A replay of the conference call will be available through

December 7, 2024, by dialing 844-512-2921 (domestic) or

412-317-6671 (international) and entering the passcode

13748499.

About Installed Building Products

Installed Building Products, Inc. is one of the nation's largest

new residential insulation installers and is a diversified

installer of complementary building products, including

waterproofing, fire-stopping, fireproofing, garage doors, rain

gutters, window blinds, shower doors, closet shelving and mirrors

and other products for residential and commercial builders located

in the continental United States. The Company manages all aspects

of the installation process for its customers, from direct purchase

and receipt of materials from national manufacturers to its timely

supply of materials to job sites and quality installation. The

Company offers its portfolio of services for new and existing

single-family and multi-family residential and commercial building

projects in all 48 continental states and the District of Columbia

from its national network of over 250 branch locations.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the federal securities laws, including with respect

to the housing market and the commercial market, our operations,

industry and economic conditions, our financial and business model,

payment of dividends, the demand for our services and product

offerings, expansion of our national footprint and end markets,

diversification of our products, our ability to grow and strengthen

our market position, our ability to pursue and integrate

value-enhancing acquisitions and the expected amount of acquired

revenue, our ability to improve sales and profitability, and

expectations for demand for our services and our earnings.

Forward-looking statements may generally be identified by the use

of words such as "anticipate," "believe," "expect," "intends,"

"plan," and "will" or, in each case, their negative, or other

variations or comparable terminology. These forward-looking

statements include all matters that are not historical facts. By

their nature, forward-looking statements involve risks and

uncertainties because they relate to events and depend on

circumstances that may or may not occur in the future. Any

forward-looking statements that we make herein and in any future

reports and statements are not guarantees of future performance,

and actual results may differ materially from those expressed in or

suggested by such forward-looking statements as a result of various

factors, including, without limitation, general economic and

industry conditions; increases in mortgage interest rates and

rising home prices; inflation and interest rates; the material

price and supply environment; the timing of increases in our

selling prices; the risk that the Company may reduce, suspend or

eliminate dividend payments in the future; and the factors

discussed in the “Risk Factors” section of the Company’s Annual

Report on Form 10-K for the year ended December 31, 2023, as the

same may be updated from time to time in our subsequent filings

with the Securities and Exchange Commission. In addition, any

future declaration of dividends will be subject to the final

determination of our Board of Directors. Any forward-looking

statement made by the Company in this press release speaks only as

of the date hereof. New risks and uncertainties arise from time to

time, and it is impossible for the Company to predict these events

or how they may affect it. The Company has no obligation, and does

not intend, to update any forward-looking statements after the date

hereof, except as required by federal securities laws.

*Use of Non-GAAP Financial Measures

In addition to the financial measures prepared in accordance

with U.S. generally accepted accounting principles (“GAAP”), this

press release contains the non-GAAP financial measures of EBITDA,

Adjusted EBITDA, Adjusted EBITDA, net of dispositions, Adjusted

EBITDA margin (i.e., Adjusted EBITDA divided by net revenue),

Adjusted Net Income, Adjusted Net Income, net of dispositions,

Adjusted Net Income per diluted share, Adjusted Gross Profit and

Adjusted Selling and Administrative expense. The reasons for the

use of these measures, reconciliations of EBITDA, Adjusted EBITDA,

Adjusted Net Income, Adjusted Net Income per diluted share,

Adjusted Gross Profit, and Adjusted Selling and Administrative

expense to the most directly comparable GAAP measures and other

information relating to these measures are included below following

the unaudited condensed consolidated financial statements. Non-GAAP

financial measures have limitations as analytical tools and should

not be considered in isolation or as a substitute for IBP’s

financial results prepared in accordance with GAAP.

During the three months ended June 30, 2024, we decided to wind

down the operations of a single new commercial end market-oriented

branch that focused on the installation of a non-core end product,

due to shifting market conditions, an unfavorable contract

settlement, and sub-standard operating performance. All

dispositions figures reflect the results of this single branch. All

net of dispositions figures reflect the exclusion of the results of

this single branch.

INSTALLED BUILDING PRODUCTS,

INC.

CONDENSED CONSOLIDATED STATEMENTS

OF OPERATIONS AND COMPREHENSIVE INCOME

(unaudited, in millions, except

share and per share amounts)

Three months ended September

30,

Nine months ended September

30,

2024

2023

2024

2023

Net revenue

$

760.6

$

706.5

$

2,191.1

$

2,057.9

Cost of sales

503.8

464.4

1,448.4

1,372.9

Gross profit

256.8

242.1

742.7

685.0

Operating expenses

Selling

35.8

32.0

103.6

97.5

Administrative

109.2

96.8

318.5

282.3

Asset impairment

—

—

4.9

—

Amortization

10.5

11.0

31.7

33.7

Operating income

101.3

102.3

284.0

271.5

Other expense, net

Interest expense, net

7.7

9.7

27.8

29.2

Other (income)

(0.3

)

(0.2

)

(0.8

)

(0.5

)

Income before income taxes

93.9

92.8

257.0

242.8

Income tax provision

25.3

24.8

67.3

63.9

Net income

$

68.6

$

68.0

$

189.7

$

178.9

Other comprehensive (loss) income, net of

tax:

Net change on cash flow hedges, net of tax

(provision) benefit of $3.8 and $(2.0) for the three months ended

September 30, 2024 and 2023, respectively, and $2.1 and $(1.6) for

the nine months ended September 30, 2024 and 2023, respectively

(10.6

)

5.5

(5.9

)

4.6

Comprehensive income

$

58.0

$

73.5

$

183.8

$

183.5

Earnings Per Share:

Basic

$

2.45

$

2.41

$

6.75

$

6.35

Diluted

$

2.44

$

2.40

$

6.71

$

6.32

Weighted average shares outstanding:

Basic

27,986,997

28,204,328

28,110,587

28,151,899

Diluted

28,116,557

28,318,633

28,272,667

28,290,533

Cash dividends declared per share

$

0.35

$

0.33

$

2.65

$

1.89

INSTALLED BUILDING PRODUCTS,

INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(unaudited, in millions, except

share and per share amounts)

September 30,

December 31,

2024

2023

ASSETS

Current assets

Cash and cash equivalents

$

406.2

$

386.5

Accounts receivable (less allowance for

credit losses of $11.4 and $11.2 at September 30, 2024 and December

31, 2023, respectively)

451.0

423.3

Inventories

182.3

162.8

Prepaid expenses and other current

assets

85.3

97.4

Total current assets

1,124.8

1,070.0

Property and equipment, net

167.0

137.2

Operating lease right-of-use assets

86.1

78.1

Goodwill

415.1

398.8

Customer relationships, net

169.6

179.6

Other intangibles, net

86.2

89.1

Other non-current assets

23.7

28.5

Total assets

$

2,072.5

$

1,981.3

LIABILITIES AND STOCKHOLDER'S

EQUITY

Current liabilities

Current maturities of long-term debt

$

31.5

$

32.2

Current maturities of operating lease

obligations

31.2

28.3

Current maturities of finance lease

obligations

2.8

2.7

Accounts payable

169.4

158.6

Accrued compensation

68.6

59.6

Other current liabilities

73.2

65.0

Total current liabilities

376.7

346.4

Long-term debt

840.8

835.1

Operating lease obligations

54.6

49.9

Finance lease obligations

6.0

6.6

Deferred income taxes

22.1

24.5

Other long-term liabilities

55.9

48.5

Total liabilities

1,356.1

1,311.0

Commitments and contingencies (Note

16)

Stockholders’ equity

Preferred Stock; $0.01 par value:

5,000,000 authorized and 0 shares issued and outstanding at

September 30, 2024 and December 31, 2023, respectively

—

—

Common stock; $0.01 par value: 100,000,000

authorized, 33,713,662 and 33,587,701 issued and 28,141,744 and

28,367,338 shares outstanding at September 30, 2024 and December

31, 2023, respectively

0.3

0.3

Additional paid in capital

257.0

244.7

Retained earnings

808.4

693.8

Treasury stock; at cost: 5,571,918 and

5,220,363 shares at September 30, 2024 and December 31, 2023,

respectively

(377.1

)

(302.2

)

Accumulated other comprehensive income

27.8

33.7

Total stockholders’ equity

716.4

670.3

Total liabilities and stockholders’

equity

$

2,072.5

$

1,981.3

INSTALLED BUILDING PRODUCTS,

INC.

CONDENSED CONSOLIDATED STATEMENTS

OF CASH FLOWS

(unaudited, in millions)

Nine months ended September

30,

2024

2023

Cash flows from operating

activities

Net income

$

189.7

$

178.9

Adjustments to reconcile net income to net

cash provided by operating activities

Depreciation and amortization of property

and equipment

43.1

38.7

Amortization of operating lease

right-of-use assets

24.4

21.7

Amortization of intangibles

31.7

33.7

Amortization of deferred financing costs

and debt discount

1.2

1.4

Provision for credit losses

4.9

4.4

Write-off of debt issuance costs

1.1

0.9

Gain on sale of property and equipment

(1.6

)

(1.5

)

Non-cash stock compensation

13.2

10.6

Asset impairment

4.9

—

Other, net

(10.3

)

(8.8

)

Changes in assets and liabilities,

excluding effects of acquisitions

Accounts receivable

(31.5

)

(28.7

)

Inventories

(16.4

)

18.7

Other assets

5.3

10.7

Accounts payable

7.5

(8.3

)

Income taxes receivable/payable

4.6

(0.2

)

Other liabilities

(6.6

)

(21.7

)

Net cash provided by operating

activities

265.2

250.5

Cash flows from investing

activities

Purchases of property and equipment

(66.7

)

(46.9

)

Acquisitions of businesses, net of cash

acquired of $— in 2024 and 2023, respectively

(41.9

)

(44.8

)

Proceeds from sale of property and

equipment

2.4

2.1

Settlements with interest rate swap

counterparties

13.6

12.2

Other

(1.8

)

(0.5

)

Net cash used in investing activities

$

(94.4

)

$

(77.9

)

Nine months ended September

30,

2024

2023

Cash flows from financing

activities

Proceeds from Term Loan

$

142.9

$

—

Payments on Term Loan

(135.5

)

(3.7

)

Proceeds from vehicle and equipment notes

payable

18.8

28.4

Debt issuance costs

(1.5

)

(0.4

)

Principal payments on long-term debt

(22.7

)

(22.2

)

Principal payments on finance lease

obligations

(2.2

)

(2.2

)

Dividends paid

(75.0

)

(53.8

)

Acquisition-related obligations

(1.5

)

(2.7

)

Repurchase of common stock

(66.4

)

—

Surrender of common stock awards by

employees

(8.0

)

(5.8

)

Net cash used in financing activities

(151.1

)

(62.4

)

Net change in cash and cash

equivalents

19.7

110.2

Cash and cash equivalents at beginning of

period

386.5

229.6

Cash and cash equivalents at end of

period

$

406.2

$

339.8

Supplemental disclosures of cash flow

information

Net cash paid during the period for:

Interest

$

37.0

$

36.3

Income taxes, net of refunds

62.8

64.2

Supplemental disclosure of non-cash

activities

Right-of-use assets obtained in exchange

for operating lease obligations

$

31.5

$

23.2

Property and equipment obtained in

exchange for finance lease obligations

1.9

2.9

Seller obligations in connection with

acquisition of businesses

3.8

8.3

Unpaid purchases of property and equipment

included in accounts payable

5.5

1.9

Accrued excise tax on common stock

repurchases

0.5

—

INSTALLED BUILDING PRODUCTS,

INC.

SEGMENT INFORMATION

(unaudited, in millions)

Information on Segments

Our Company has three operating segments

consisting of Installation, Distribution and Manufacturing. The

Other category reported below reflects the operations of our

Distribution and Manufacturing operating segments.

Three months ended September 30,

2024

Nine months ended September 30,

2024

Installation

Other

Eliminations

Consolidated

Installation

Other

Eliminations

Consolidated

Revenue

$

713.7

$

51.7

$

(4.8

)

$

760.6

$

2,066.9

$

136.0

$

(11.8

)

$

2,191.1

Cost of sales (1)

455.9

37.0

(3.3

)

489.6

1,318.4

98.0

(8.4

)

1,408.0

Segment gross profit

$

257.8

$

14.7

$

(1.5

)

$

271.0

$

748.5

$

38.0

$

(3.4

)

$

783.1

Segment gross profit percentage

36.1

%

28.4

%

30.1

%

35.6

%

36.2

%

27.9

%

28.5

%

35.7

%

Three months ended September 30,

2023

Nine months ended September 30,

2023

Installation

Other

Eliminations

Consolidated

Installation

Other

Eliminations

Consolidated

Revenue

$

661.2

$

47.5

$

(2.2

)

$

706.5

$

1,935.8

$

128.5

$

(6.4

)

$

2,057.9

Cost of sales (1)

419.5

34.0

(1.6

)

451.9

1,248.5

92.8

(4.9

)

1,336.4

Segment gross profit

$

241.7

$

13.5

$

(0.6

)

$

254.6

$

687.3

$

35.7

$

(1.5

)

$

721.5

Segment gross profit percentage

36.6

%

28.4

%

26.4

%

36.0

%

35.5

%

27.8

%

22.4

%

35.1

%

(1)

Cost of sales included in segment gross profit is exclusive of

depreciation and amortization for the three and nine months ended

September 30, 2024 and 2023.

The reconciliation between consolidated

segment gross profit for each period as shown in the tables above

to consolidated income before income taxes as follows:

Three months ended September

30,

Nine months ended September

30,

2024

2023

2024

2023

Segment gross profit - consolidated

$

271.0

$

254.6

$

783.1

$

721.5

Depreciation and amortization (1)

14.2

12.5

40.4

36.5

Gross profit, as reported

256.8

242.1

742.7

685.0

Operating expenses

155.5

139.8

458.7

413.5

Operating income

101.3

102.3

284.0

271.5

Other expense, net

7.4

9.5

27.0

28.7

Income before income taxes

$

93.9

$

92.8

$

257.0

$

242.8

(1)

Depreciation and amortization is excluded

from segment gross profit for the three and nine months ended

September 30, 2024 and 2023.

INSTALLED BUILDING PRODUCTS,

INC.

REVENUE BY END MARKET

(unaudited, in millions)

Three months ended September

30,

Nine months ended September

30,

2024

2023

2024

2023

Installation

Residential new construction

$

548.8

72

%

$

518.1

73

%

$

1,594.0

73

%

$

1,488.9

72

%

Repair and remodel

44.9

6

%

37.8

6

%

127.5

6

%

114.4

6

%

Commercial

120.0

16

%

105.3

15

%

345.4

15

%

332.5

16

%

Net revenues - Installation

$

713.7

94

%

$

661.2

94

%

$

2,066.9

94

%

$

1,935.8

94

%

Other

46.9

6

%

45.3

6

%

124.2

6

%

122.1

6

%

Net revenue, as reported

$

760.6

100

%

$

706.5

100

%

$

2,191.1

100

%

$

2,057.9

100

%

Reconciliation of Non-GAAP Financial Measures

EBITDA, Adjusted EBITDA, Adjusted EBITDA margin, Adjusted Net

Income, Adjusted Gross Profit and Adjusted Selling and

Administrative Expense measure performance by adjusting GAAP net

income, EBITDA, gross profit and selling and administrative

expense, respectively, for certain income or expense items that are

not considered part of our core operations. We believe that the

presentation of these measures provides useful information to

investors regarding our results of operations because it assists

both investors and us in analyzing and benchmarking the performance

and value of our business.

We believe the Adjusted EBITDA measure is useful to investors

and us as a measure of comparative operating performance from

period to period as it measures our changes in pricing decisions,

cost controls and other factors that impact operating performance,

and removes the effect of our capital structure (primarily interest

expense), asset base (primarily depreciation and amortization),

items outside our control (primarily income taxes) and the

volatility related to the timing and extent of other activities

such as asset impairments and non-core income and expenses.

Accordingly, we believe that this measure is useful for comparing

general operating performance from period to period. In addition,

we use various EBITDA-based measures in determining the achievement

of awards under certain of our incentive compensation programs.

Other companies may define Adjusted EBITDA differently and, as a

result, our measure may not be directly comparable to measures of

other companies. In addition, Adjusted EBITDA may be defined

differently for purposes of covenants contained in our revolving

credit facility or any future facility.

Although we use the Adjusted EBITDA measure to assess the

performance of our business, the use of the measure is limited

because it does not include certain material expenses, such as

interest and taxes, necessary to operate our business. Adjusted

EBITDA should be considered in addition to, and not as a substitute

for, GAAP net income as a measure of performance. Our presentation

of this measure should not be construed as an indication that our

future results will be unaffected by unusual or non-recurring

items. This measure has limitations as an analytical tool, and you

should not consider it in isolation or as a substitute for analysis

of our results as reported under GAAP. Because of these

limitations, this measure is not intended as an alternative to net

income as an indicator of our operating performance, as an

alternative to any other measure of performance in conformity with

GAAP or as an alternative to cash flow provided by operating

activities as a measure of liquidity. You should therefore not

place undue reliance on this measure or ratios calculated using

this measure.

We also believe the Adjusted Net Income measure is useful to

investors and us as a measure of comparative operating performance

from period to period as it measures our changes in pricing

decisions, cost controls and other factors that impact operating

performance, and removes the effect of certain non-core items such

as discontinued operations, acquisition related expenses,

amortization expense, the tax impact of these certain non-core

items, and the volatility related to the timing and extent of other

activities such as asset impairments and non-core income and

expenses. To make the financial presentation more consistent with

other public building products companies, beginning in the fourth

quarter 2016 we included an addback for non-cash amortization

expense related to acquisitions. Accordingly, we believe that this

measure is useful for comparing general operating performance from

period to period. Other companies may define Adjusted Net Income

differently and, as a result, our measure may not be directly

comparable to measures of other companies. In addition, Adjusted

Net Income may be defined differently for purposes of covenants

contained in our revolving credit facility or any future

facility.

INSTALLED BUILDING PRODUCTS,

INC.

RECONCILIATION OF GAAP TO

NON-GAAP MEASURES

ADJUSTED NET INCOME

CALCULATIONS

(unaudited, in millions, except

share and per share amounts)

The tables below reconcile Adjusted Net

Income, Adjusted Net Income, net of dispositions, and Adjusted Net

Loss, dispositions to the most directly comparable GAAP financial

measure, net income, for the periods presented therein. We have

included Adjusted Net Income, net of dispositions, in this press

release because it is a key measure used by our management team to

understand the operating performance and profitability of our

business. During the three months ended June 30, 2024, we decided

to wind down the operations of a single new commercial end

market-oriented branch that focused on the installation of a

non-core end product, due to shifting market conditions, an

unfavorable contract settlement, and sub-standard operating

performance. Accordingly, we believe that excluding the financial

results of this branch from our typical Adjusted Net Income measure

of profitability provides useful insight and metrics relevant to

understanding and evaluating the results of our ongoing operations.

The Adjusted Net Loss, dispositions line item included below

represents the Adjusted Net Loss of this single branch. We

currently expect the closing of this branch to be substantially

complete by March 31, 2025.

Per share figures may reflect rounding

adjustments and consequently totals may not appear to sum.

Three months ended September

30,

Nine months ended September

30,

2024

2023

2024

2023

Net income, as reported

$

68.6

$

68.0

$

189.7

$

178.9

Adjustments for adjusted net income

Share-based compensation expense

4.5

3.5

13.2

10.6

Acquisition related expenses

0.5

0.2

1.6

1.3

Amortization expense (1)

10.5

11.0

31.7

33.7

Legal reserve

—

—

—

1.3

Loan refinancing expenses (2)

—

—

4.1

—

Asset impairment (3)

—

—

4.9

—

Tax impact of adjusted items at a

normalized tax rate (4)

(4.0

)

(3.8

)

(14.4

)

(12.2

)

Adjusted net income

$

80.1

$

78.9

$

230.8

$

213.6

Less: Adjusted net income (loss),

dispositions (5)

0.1

(1.0

)

(6.4

)

(1.7

)

Adjusted net income, net of

dispositions

$

80.0

$

79.9

$

237.2

$

215.3

Weighted average shares outstanding

(diluted)

28,116,557

28,318,633

28,272,667

28,290,533

Diluted net income per share, as

reported

$

2.44

$

2.40

$

6.71

$

6.32

Adjustments for diluted adjusted net

income, net of tax impact, per share (6)

0.41

0.39

1.45

1.23

Diluted adjusted net income per share

$

2.85

$

2.79

$

8.16

$

7.55

Less: Diluted adjusted net income (loss),

dispositions, net of tax impact, per share (5)

—

(0.04

)

(0.23

)

(0.06

)

Diluted adjusted net income, net of

dispositions per share

$

2.85

$

2.83

$

8.39

$

7.61

(1)

Addback of all non-cash amortization

resulting from business combinations.

(2)

Includes $1.1 million of non-cash

write-off of capitalized loan expense and $3.0 million of cash paid

to third parties in connection with loan refinancing for the nine

months ended September 30, 2024.

(3)

During the nine months ended September 30,

2024, we recognized intangible and asset impairment charges for a

combined amount of $4.9 million related to winding down the

operations of a branch that installs one of our non-core building

products.

(4)

Normalized effective tax rate of 26.0%

applied to periods presented.

(5)

Represents adjusted net income (loss) and

diluted adjusted net income (loss), per share of a single branch.

Please see preceding paragraph at the beginning of this section for

additional information.

(6)

Includes adjustments related to the items

noted above, net of tax.

Three months ended September

30,

Nine months ended September

30,

2024

2023

2024

2023

Net income (loss), dispositions, as

reported

$

0.1

$

(1.1

)

$

(10.2

)

$

(1.9

)

Amortization expense

—

0.1

0.2

0.3

Asset impairment (1)

—

—

4.9

—

Tax impact of adjusted items at a

normalized tax rate (2)

—

—

(1.3

)

(0.1

)

Adjusted net income (loss), dispositions

(3)

$

0.1

$

(1.0

)

$

(6.4

)

$

(1.7

)

(1)

During the nine months ended September 30,

2024, we recognized intangible and asset impairment charges for a

combined amount of $4.9 million related to winding down the

operations of a branch that installs one of our non-core building

products.

(2)

Normalized effective tax rate of 26.0%

applied to periods presented.

(3)

Represents Adjusted net income (loss) of a

single branch. Please see preceding paragraph at the beginning of

this section for additional information.

INSTALLED BUILDING PRODUCTS,

INC.

RECONCILIATION OF GAAP TO

NON-GAAP MEASURES

ADJUSTED GROSS PROFIT

CALCULATIONS

(unaudited, in millions)

The table below reconciles Adjusted Gross

Profit to the most directly comparable GAAP financial measure,

gross profit, for the periods presented therein.

Three months ended September

30,

Nine months ended September

30,

2024

2023

2024

2023

Gross profit

$

256.8

$

242.1

$

742.7

$

685.0

Share-based compensation expense

0.2

0.3

0.8

0.7

Adjusted gross profit

$

257.0

$

242.4

$

743.5

$

685.7

Gross profit margin

33.8

%

34.3

%

33.9

%

33.3

%

Adjusted gross profit margin

33.8

%

34.3

%

33.9

%

33.3

%

INSTALLED BUILDING PRODUCTS,

INC.

RECONCILIATION OF GAAP TO

NON-GAAP MEASURES

ADJUSTED SELLING AND

ADMINISTRATIVE EXPENSE CALCULATIONS

(unaudited, in millions)

The table below reconciles Adjusted

Selling and Administrative to the most directly comparable GAAP

financial measure, selling and administrative, for the periods

presented therein.

Three months ended September

30,

Nine months ended September

30,

2024

2023

2024

2023

Selling expense

$

35.8

$

32.0

$

103.6

$

97.5

Administrative expense

109.2

96.8

318.5

282.3

Selling and Administrative expense, as

reported

145.0

128.8

422.1

379.8

Share-based compensation expense

4.1

3.3

12.3

10.0

Acquisition related expenses

0.5

0.2

1.6

1.3

Legal reserve

—

—

—

1.3

Adjusted Selling and Administrative

expense

$

140.4

$

125.3

$

408.2

$

367.2

Selling and Administrative expense - %

Total revenue

19.1

%

18.2

%

19.3

%

18.5

%

Adjusted Selling and Administrative

expense - % Total revenue

18.5

%

17.7

%

18.6

%

17.8

%

INSTALLED BUILDING PRODUCTS,

INC.

RECONCILIATION OF GAAP TO

NON-GAAP MEASURES

EBITDA AND ADJUSTED EBITDA

CALCULATIONS

(unaudited, in millions)

The tables below reconcile EBITDA,

Adjusted EBITDA, Adjusted EBITDA, net of dispositions and Adjusted

EBITDA, dispositions to the most directly comparable GAAP financial

measure, net income, for the periods presented therein. We have

included Adjusted EBITDA, net of dispositions, in this press

release because it is a key measure used by our management team to

understand the operating performance and profitability of our

business. During the three months ended June 30, 2024, we decided

to wind down the operations of a single new commercial end

market-oriented branch that focused on the installation of a

non-core end product, due to shifting market conditions, an

unfavorable contract settlement, and sub-standard operating

performance. Accordingly, we believe that excluding the financial

results of this branch from our typical Adjusted EBITDA measure of

profitability provides useful insight and metrics relevant to

understanding and evaluating the results of our ongoing operations.

The Adjusted EBITDA, dispositions line item included below

represents the Adjusted EBITDA of this single branch. We currently

expect the closing of this branch to be substantially complete by

March 31, 2025.

Three months ended September

30,

Nine months ended September

30,

2024

2023

2024

2023

Net income, as reported

$

68.6

$

68.0

$

189.7

$

178.9

Interest expense

7.7

9.7

27.8

29.2

Provision for income tax

25.3

24.8

67.3

63.9

Depreciation and amortization

25.7

24.3

74.9

72.4

EBITDA

127.3

126.8

359.7

344.4

Acquisition related expenses

0.5

0.2

1.6

1.3

Share based compensation expense

4.5

3.5

13.2

10.6

Legal reserve

—

—

—

1.3

Asset impairment (1)

—

—

4.9

—

Adjusted EBITDA

$

132.3

$

130.5

$

379.4

$

357.6

Adjusted EBITDA, dispositions (2)

0.2

(1.2

)

(8.4

)

(1.7

)

Adjusted EBITDA, net of dispositions

(3)

$

132.1

$

131.7

$

387.8

$

359.3

Net profit margin

9.0

%

9.6

%

8.7

%

8.7

%

EBITDA margin

16.7

%

18.0

%

16.4

%

16.7

%

Adjusted EBITDA margin

17.4

%

18.5

%

17.3

%

17.4

%

Adjusted EBITDA margin, net of

dispositions (3)

17.4

%

18.7

%

17.7

%

17.6

%

(1)

During the nine months ended September 30,

2024, we recognized intangible and asset impairment charges for a

combined amount of $4.9 million related to winding down the

operations of a branch that installs one of our non-core building

products.

(2)

Represents Adjusted EBITDA of a single

branch. Please see preceding paragraph at the beginning of this

section for additional information.

(3)

Adjusted EBITDA, net of dispositions and

Adjusted EBITDA margin, net of dispositions exclude the results of

a single branch. Please see preceding paragraph at the beginning of

this section for additional information.

Three months ended September

30,

Nine months ended September

30,

2024

2023

2024

2023

Net revenue, as reported

$

760.6

$

706.5

$

2,191.1

$

2,057.9

Less: net revenue, dispositions (1)

3.3

3.3

2.8

14.8

Net revenue, net of dispositions

$

757.3

$

703.2

$

2,188.3

$

2,043.1

(1)

Represents net revenue of a single branch.

Please see preceding paragraph at the beginning of this section for

additional information.

Three months ended September

30,

Nine months ended September

30,

2024

2023

2024

2023

Net income (loss), dispositions, as

reported

$

0.1

$

(1.1

)

$

(10.2

)

$

(1.9

)

Interest expense

0.1

0.1

0.2

0.4

(Benefit) for income tax

—

(0.4

)

(3.6

)

(0.7

)

Depreciation and amortization

—

0.2

0.3

0.5

EBITDA, dispositions

0.2

(1.2

)

(13.3

)

(1.7

)

Asset impairment (1)

—

—

4.9

—

Adjusted EBITDA, dispositions (2)

$

0.2

$

(1.2

)

$

(8.4

)

$

(1.7

)

(1)

During the nine months ended September 30,

2024, we recognized intangible and asset impairment charges for a

combined amount of $4.9 million related to winding down the

operations of a branch that installs one of our non-core building

products.

(2)

Represents Adjusted EBITDA of a single

branch. Please see preceding paragraph at the beginning of this

section for additional information.

INSTALLED BUILDING PRODUCTS,

INC.

SUPPLEMENTARY TABLE

(unaudited)

Three months ended September

30,

Nine months ended September

30,

2024

2023

2024

2023

Period-over-period Growth

Consolidated Sales Growth

7.7%

(1.8)%

6.5%

3.8%

Consolidated Same Branch Sales Growth

5.2%

(5.2)%

4.3%

(0.3)%

Installation

Sales Growth

7.9%

(1.7)%

6.8%

3.4%

Same Branch Sales Growth

5.4%

(5.4)%

4.6%

(0.5)%

Single-Family Sales Growth

8.8%

(8.7)%

7.7%

(6.0)%

Single-Family Same Branch Sales Growth

5.7%

(12.2)%

5.1%

(9.7)%

Multi-Family Sales Growth

3.6%

30.9%

7.5%

36.4%

Multi-Family Same Branch Sales Growth

2.4%

28.4%

6.6%

34.7%

Residential Sales Growth

7.7%

(2.7)%

7.7%

0.6%

Residential Same Branch Sales Growth

5.0%

(6.0)%

5.4%

(2.8)%

Commercial Sales Growth(1)

7.7%

3.7%

2.0%

17.7%

Commercial Same Branch Sales Growth

6.1%

(1.3)%

(0.1)%

11.8%

Other

(2)

Sales Growth

9.1%

(0.7)%

6.0%

12.0%

Same Branch Sales Growth

7.2%

(0.7)%

4.7%

4.5%

Same Branch Sales

Growth - Installation

Volume Growth(3)

2.6%

(10.8)%

0.0%

(10.1)%

Price/Mix Growth(3)

2.7%

3.5%

4.3%

8.6%

U.S. Housing

Market(4)

Total Completions Growth

22.7%

(1.4)%

13.7%

5.0%

Single-Family Completions Growth

5.7%

(4.7)%

2.5%

(2.1)%

Multi-Family Completions Growth

62.3%

5.0%

37.7%

24.6%

(1)

Our commercial end market consists of

heavy and light commercial projects.

(2)

Other business segment category includes

our manufacturing and distribution businesses operating

segments.

(3)

The heavy commercial end market is

excluded from these metrics given its much larger per-job revenue

compared to our average job.

(4)

U.S. Census Bureau data, as revised.

INSTALLED BUILDING PRODUCTS, INC.

INCREMENTAL REVENUE AND ADJUSTED

EBITDA MARGINS

(unaudited, in millions)

Revenue Increase

Three months ended September

30,

Nine months ended September

30,

2024

% Total

2023

% Total

2024

% Total

2023

% Total

Same Branch

$

36.6

67.7

%

$

(37.4

)

295.9

%

$

88.5

66.4

%

$

(6.5

)

(8.7

)%

Acquired

17.5

32.3

%

24.8

(195.9

)%

44.7

33.6

%

81.0

108.7

%

Total

$

54.1

100.0

%

$

(12.6

)

100.0

%

$

133.2

100.0

%

$

74.5

100.0

%

Adjusted EBITDA Margin Contributions

*

Three months ended September

30,

Nine months ended September

30,

2024

% Margin

2023

% Margin

2024

% Margin

2023

% Margin

Same Branch(1)

$

(1.4

)

(3.8

)%

$

5.5

(14.7

)%

$

13.7

15.5

%

$

19.1

(293.8

)%

Acquired

3.3

18.9

%

4.8

19.4

%

8.1

18.1

%

14.7

18.1

%

Total

$

1.9

3.5

%

$

10.3

(81.7

)%

$

21.8

16.4

%

$

33.8

45.4

%

(1)

Same branch adjusted EBITDA margin

contribution percentage is a percentage of same branch revenue

increase.

*

During the three months ended September

30, 2023, same branch and total revenue declined while same branch

and total adjusted EBITDA increased. During the nine months ended

September 30, 2023, same branch revenue declined while same branch

adjusted EBITDA increased. The negative % margin result in both

periods does not reflect a decremental margin, but rather, a

quotient with mixed signs for the numerator and denominator.

Revenue Increase, Net of Dispositions

(1)

Three months ended September

30,

Nine months ended September

30,

2024

% Total

2023

% Total

2024

% Total

2023

% Total

Same Branch

$

36.6

67.7

%

$

(30.7

)

520.3

%

$

100.5

69.2

%

$

(1.1

)

(1.4

)%

Acquired

17.5

32.3

%

24.8

(420.3

)%

44.7

30.8

%

81.0

101.4

%

Total

$

54.1

100.0

%

$

(5.9

)

100.0

%

$

145.2

100.0

%

$

79.9

100.0

%

(1)

Please see the section - Reconciliation of

GAAP to Non-GAAP measures EBITDA and Adjusted EBITDA calculations -

in this press release for additional information.

Adjusted EBITDA, Net of Dispositions

Margin Contributions (1) *

Three months ended September

30,

Nine months ended September

30,

2024

% Margin

2023

% Margin

2024

% Margin

2023

% Margin

Same Branch(2)

$

(2.8

)

(7.7

)%

$

6.5

(21.2

)%

$

20.4

20.3

%

$

19.3

(1754.5

)%

Acquired

3.3

18.9

%

4.8

19.4

%

8.1

18.1

%

14.7

18.1

%

Total

$

0.5

0.9

%

$

11.3

(191.5

)%

$

28.5

19.6

%

$

34.0

42.6

%

(1)

Please see the section - Reconciliation of

GAAP to Non-GAAP measures EBITDA and Adjusted EBITDA calculations -

in this press release for additional information.

(2)

Same branch adjusted EBITDA margin

contribution percentage is a percentage of same branch revenue

increase.

*

During the three months ended September

30, 2023, same branch and total revenue declined while same branch

and total adjusted EBITDA increased. During the nine months ended

September 30, 2023, same branch revenue declined while same branch

adjusted EBITDA increased. The negative % margin result in both

periods does not reflect a decremental margin, but rather, a

quotient with mixed signs for the numerator and denominator.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241106262424/en/

Investor Relations: 614-221-9944

investorrelations@installed.net

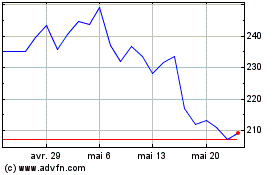

Installed Building Produ... (NYSE:IBP)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

Installed Building Produ... (NYSE:IBP)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025