Delivers annual sales of $6,841 million,

adjusted EBITDA of $1,469 million and earnings per share of

$0.38

Specialties-driven EBITDA reaches 70% of total

adjusted EBITDA for the year and 73% in the fourth quarter

ICL (NYSE: ICL) (TASE: ICL), a leading global specialty

minerals company, today reported its financial results for the

fourth quarter and full year ended December 31, 2024. Consolidated

annual sales were $6,841 million versus $7,536 million in 2023. Net

income was $407 million versus $647 million, while adjusted net

income was $484 million versus $715 million in 2023. Annual

adjusted EBITDA was $1,469 million versus $1,754 million in 2023.

Diluted earnings per share for 2024 were $0.32, while adjusted

diluted EPS was $0.38. Operating cash flow was $1,468 million in

2024, similar to adjusted EBITDA, while free cash flow was $758

million. For 2024, the Company distributed $242 million in

dividends to its shareholders.

For the fourth quarter of 2024, consolidated sales were $1,601

million versus $1,690 million in the fourth quarter of 2023. Net

income and adjusted net income for the fourth quarter of 2024 were

$70 million and $104 million, respectively, versus $67 million and

$123 million, respectively, for the fourth quarter of 2023.

Adjusted EBITDA in the fourth quarter was $347 million versus $357

million in the fourth quarter of 2023. Fourth quarter diluted

earnings per share were $0.06, with adjusted diluted EPS of $0.08,

versus $0.05 and $0.10, respectively in the fourth quarter of 2023.

Operating cash flow was $452 million in the fourth quarter of 2024,

similar to the fourth quarter of 2023.

“ICL delivered 2024 adjusted EBITDA of $1,469 million, with our

specialties-driven businesses contributing 70% of that amount, as

we continued to focus on cash generation while increasing market

share across Industrial Products, Phosphate Solutions and Growing

Solutions. We remain committed to growing our leadership position

for these three businesses,” said Raviv Zoller, president and CEO

of ICL. “During 2024, amidst persistent potash price declines and

geopolitical challenges, we achieved strong profitability and

cashflow, introduced dozens of innovative specialties products,

developed new global partnerships, set production records at

multiple sites, completed complementary bolt-on acquisitions, and

continued to be vigilant in the execution of cost savings and

efficiency efforts, all while continuing to drive significant value

to our shareholders through dividends. As a result of these items,

as well as prudent timing of potash deliveries, we are entering

2025 in a solid position and looking forward to improving market

conditions in key end-markets.”

For 2025, the Company expects the specialties-driven segments'

EBITDA to be between $0.95 billion to $1.15 billion. For Potash,

the Company expects 2025 sales volumes to be between 4.5 million

metric tons and 4.7 million metric tons. (1a).

Financial Figures and non-GAAP Financial Measures

10-12/2024

10-12/2023

1-12/2024

1-12/2023

$

millions

% of

Sales

$

millions

% of

Sales

$

millions

% of

Sales

$

millions

% of

Sales

Sales

1,601

-

1,690

-

6,841

-

7,536

-

Gross profit

535

33

560

33

2,256

33

2,671

35

Operating income

147

9

149

9

775

11

1,141

15

Adjusted operating income (1)

190

12

211

12

873

13

1,218

16

Net income attributable to the

Company's shareholders

70

4

67

4

407

6

647

9

Adjusted net income attributable

to the Company’s shareholders (1)

104

6

123

7

484

7

715

9

Diluted earnings per share (in

dollars)

0.06

-

0.05

-

0.32

-

0.50

-

Diluted adjusted earnings per

share (in dollars) (2)

0.08

-

0.10

-

0.38

-

0.55

-

Adjusted EBITDA (2)(3)

347

22

357

21

1,469

21

1,754

23

Cash flows from operating

activities (4)

452

-

452

-

1,468

-

1,710

-

Purchases of property, plant and

equipment and intangible assets (5)

267

-

255

-

713

-

780

-

(1)

See “Adjustments to Reported Operating and

Net income (non-GAAP)” below.

(2)

See "Adjusted EBITDA and Diluted Adjusted

Earnings Per Share for the periods of activity" below.

(3)

In 2024, the Company’s adjusted EBITDA was

positively impacted by an immaterial accounting reclassification.

For further information, see below in our Potash segment

results.

(4)

Commencing Q2 2024, management

reclassified interest received as cash flows from investing

activities and interest paid as cash flows from financing

activities, instead of under cash provided by operating

activities.

(5)

See “Condensed consolidated statements of

cash flows (unaudited)” in the appendix below.

Segment Information

Industrial Products

The Industrial Products segment produces bromine from a highly

concentrated solution in the Dead Sea and bromine‑based compounds

at its facilities in Israel, the Netherlands and China. In

addition, the segment produces several grades of salts, magnesium

chloride, magnesia-based products, phosphorus-based products and

functional fluids.

Results of operations and key

indicators

10-12/2024

10-12/2023

1-12/2024

1-12/2023

$ millions

$ millions

$ millions

$ millions

Segment Sales

280

299

1,239

1,227

Sales to external customers

275

294

1,220

1,206

Sales to internal customers

5

5

19

21

Segment Operating

Income

55

39

224

220

Depreciation and amortization

15

17

57

57

Segment EBITDA

70

56

281

277

Capital expenditures

38

29

94

91

Significant highlights for the fourth quarter

- Flame retardants: Bromine-based sales decreased year-over-year

while phosphorus-based sales increased year-over-year, with higher

volumes, mainly in Europe, due to the implementation of duties on

imports of tris (2-chloro-1-methylethyl) phosphate (TCPP) from

China.

- Elemental bromine: Sales were nearly flat year-over-year, as

operational efficiencies allowed higher gross margins.

- Clear brine fluids: Sales decreased year-over-year, as oil and

gas demand in the Eastern Hemisphere remained softer, due to the

drilling cycle operations, resulting in lower volumes sold.

- Specialty minerals: Sales increased slightly year-over-year,

due to growth in demand from the pharma and food end-markets, which

was partially offset by lower demand for certain industrial

applications.

Results analysis for the period October

– December 2024

Sales

Expenses

Operating

income

$ millions

Q4 2023 figures

299

(260

)

39

Quantity

(13

)

10

(3

)

Price

(6

)

-

(6

)

Exchange rates

-

-

-

Raw materials

-

6

6

Energy

-

2

2

Transportation

-

(4

)

(4

)

Operating and other expenses

-

21

21

Q4 2024 figures

280

(225

)

55

- Quantity – The negative impact on

operating income was primarily related to a decrease in sales

volumes of bromine-based flame retardants and clear brine fluids.

This was partially offset by higher sales volumes of

phosphorus-based flame retardants.

- Price – The negative impact on

operating income was primarily due to lower selling prices of

bromine-based industrial solutions and bromine-based flame

retardants.

- Raw materials – The positive

impact on operating income was mainly due to decreased costs of

Bisphenol A (BPA).

- Operating and other expenses – The

positive impact on operating income was primarily related to

operational efficiencies due to higher production.

Potash

The Potash segment produces and sells mainly potash, salts,

magnesium and electricity. Potash is produced in Israel using an

evaporation process to extract potash from the Dead Sea at Sodom

and in Spain using conventional mining from an underground mine.

The segment also produces and sells pure magnesium, magnesium

alloys and chlorine. In addition, the segment sells salt products

produced at its potash site in Spain. The segment operates a power

plant in Sodom, which supplies electricity and steam to ICL

facilities in Israel with any surplus electricity sold to external

customers.

Results of operations and key

indicators

10-12/2024

10-12/2023

1-12/2024

1-12/2023

$ millions

$ millions

$ millions

$ millions

Segment Sales

422

474

1,656

2,182

Potash sales to external

customers

315

336

1,237

1,693

Potash sales to internal

customers

30

49

95

129

Other and eliminations (1)

77

89

324

360

Gross Profit

162

231

650

1,171

Segment Operating

Income

69

122

250

668

Depreciation and amortization

61

46

242

175

Segment EBITDA (2)

130

168

492

843

Capital expenditures

116

132

332

384

Potash price - CIF ($ per

tonne)

285

345

299

393

(1)

Primarily includes salt produced in Spain, metal magnesium-based

products, chlorine and sales of surplus electricity produced by

ICL’s power plant at the Dead Sea in Israel.

(2)

Following a nonmaterial accounting

reclassification of certain assets, the Potash segment's EBITDA for

Q4 2024 increased by $16 million and for the full year of 2024 by

$65 million.

Significant highlights for the fourth quarter

- ICL's potash price (CIF) per tonne of $285 in the fourth

quarter was 4% lower than the third quarter and 17% lower

year-over-year.

- The Grain Price Index fell by 1.1% during the fourth quarter of

2024, with soybeans, wheat and rice 6.1%, 2.7% and 1.8% lower,

respectively, while corn prices increased by 6.8%.

- The WASDE (World Agricultural Supply and Demand Estimates)

report, published by the USDA in February 2025, showed a continued

decrease in the expected ratio of global inventories of grains to

consumption to 26.5% for the 2024/25 agriculture year, compared to

28.2% for the 2023/24 agriculture year and 28.6% for the 2022/23

agriculture year.

- In December 2024, as part of ICL's 2025-2027 Chinese framework

agreements, ICL signed contracts with its Chinese customers to

supply 2,500,000 metric tonnes of potash with mutual options for an

additional 960,000 metric tonnes in aggregate, over the course of

the three-year term. Prices for the quantities to be supplied

according to the framework agreements will be established in line

with prevailing market prices in China as of the relevant date of

supply.

- Metal Magnesium: Sales decreased year-over-year, as lower

prices offset higher volumes.

Additional segment

information

Global potash market - average prices and imports:

Average prices

10-12/2024

10-12/2023

VS Q4 2023

7-9/2024

VS Q3 2024

Granular potash – Brazil

CFR spot

($ per tonne)

288

336

(14.3

)%

300

(4.0

)%

Granular potash – Northwest

Europe

CIF spot/contract

(€ per tonne)

338

388

(12.9

)%

340

(0.6

)%

Standard potash – Southeast

Asia

CFR spot

($ per tonne)

292

318

(8.2

)%

283

3.2

%

Potash imports

To Brazil

million tonnes

2.9

3.4

(14.7

)%

3.9

(25.6

)%

To China

million tonnes

3.4

3.6

(5.6

)%

2.8

21.4

%

To India

million tonnes

1.2

0.8

50.0

%

0.6

100.0

%

Sources: CRU (Fertilizer Week Historical

Price: December 2024), SIACESP (Brazil), United Port Services

(Brazil), FAI (India), Chinese customs data, Global Trade Tracker

(GTT).

Potash – Production and

Sales

Thousands of tonnes

10-12/2024

10-12/2023

1-12/2024

1-12/2023

Production

1,178

1,139

4,502

4,420

Total sales (including internal

sales)

1,259

1,179

4,556

4,683

Closing inventory

229

284

229

284

Fourth quarter 2024

- Production – Production was 39

thousand tonnes higher year-over-year, mainly due to higher

production in Spain.

- Sales – The quantity of potash

sold was 80 thousand tonnes higher year-over-year, mainly due to

higher sales volumes in India and Europe, partially offset by lower

sales volumes in Brazil, the US and China.

Full year 2024

- Production – Production was 82

thousand tonnes higher year-over-year, mainly due to operational

improvements in Spain, which outweighed operational challenges and

war-related issues at the Dead Sea.

- Sales – The quantity of potash

sold was 127 thousand tonnes lower year-over-year, mainly due to

decreased sales volumes in China and Brazil, partially offset by

higher sales volumes in Europe, India and the US.

Results analysis for the period October

– December 2024

Sales

Expenses

Operating

income

$ millions

Q4 2023 figures

474

(352

)

122

Quantity

38

(19

)

19

Price

(90

)

-

(90

)

Exchange rates

-

1

1

Raw materials

-

(1

)

(1

)

Energy

-

(3

)

(3

)

Transportation

-

10

10

Operating and other expenses

-

11

11

Q4 2024 figures

422

(353

)

69

- Quantity – The positive impact on

operating income was primarily related to an increase in sales

volumes of magnesium, as well as an increase in potash sales

volumes in India and Europe, partially offset by lower potash sales

volumes in Brazil, the US and China.

- Price – The negative impact on

operating income resulted primarily from a decrease of $60 in the

potash price (CIF) per tonne, year-over-year.

- Transportation – The positive

impact on operating income was due to a decrease in inland costs

and marine costs, primarily to Brazil and the US.

- Operating and other expenses – The

positive impact on operating income was primarily related to lower

operational and maintenance costs.

Phosphate Solutions

The Phosphate Solutions segment operates ICL’s phosphate value

chain and uses phosphate rock and fertilizer-grade phosphoric acid

to produce phosphate-based specialty products with higher added

value, as well as to produce and sell phosphate-based

fertilizers.

Results of operations and key

indicators (1)

10-12/2024 (2)

10-12/2023

1-12/2024

1-12/2023

$ millions

$ millions

$ millions

$ millions

Segment Sales

507

515

2,215

2,350

Sales to external customers

475

474

2,049

2,141

Sales to internal customers

32

41

166

209

Segment Operating

Income

81

85

358

350

Depreciation and amortization

51

54

191

207

Segment EBITDA

132

139

549

557

Capital expenditures

147

89

340

270

(1)

In alignment with the Company’s efficiency

plan, which included a change of reporting responsibilities, as of

January 2024, the results of a non-phosphate related business were

allocated from the Phosphate Solutions segment to Other Activities.

Comparative figures have been restated to reflect the

organizational change in the reportable segments.

(2)

For Q4 2024, Phosphate Specialties

accounted for $309 million of segment sales, $44 million of

operating income, $13 million of D&A and $57 million of EBITDA,

while Phosphate Commodities accounted for $198 million of segment

sales, $37 million of operating income, $38 million of D&A and

represented $75 million of EBITDA.

Significant highlights for the fourth quarter

- White phosphoric acid: Sales decreased year-over-year, as

higher volumes mainly in South America were unable to offset lower

prices in all regions.

- Industrial phosphates: Sales decreased year-over-year, as

higher volumes in all major regions did not offset lower prices

related to decreasing cost input prices.

- Food phosphates: Sales were nearly flat year-over-year, as

higher volumes were offset by lower market prices, mainly in North

America, due to reduced raw material costs.

- Battery materials: Sales in Asia increased year-over-year, as

market demand expanded. Elsewhere, the Battery Materials Innovation

and Qualification Center (BM-IQ) in St. Louis is nearing

completion, which will allow ICL to begin qualifying battery

material products for customers. In January 2025, the Company

signed a strategic agreement with Shenzhen Dynanonic Co., Ltd. to

establish LFP production in Europe. The new facility is planned to

be located at ICL's Sallent site in Spain and could substantially

expand the Company’s battery materials business.

- Commodity phosphates: Overall phosphate prices remained stable

in the fourth quarter of 2024, as key markets – including India –

continued to experience a shortage of DAP and export availability

from China remained limited. Key benchmarks were on average 3%

higher quarter-over-quarter.

- Developments in key markets are described below:

- Chinese DAP export prices ended 2024 at $615/mt, $30 above 2023

prices, as the country’s trade policy continued to be a key

determinant of global pricing levels. Offshore shipments were

paused late in the fourth quarter and, at the time of writing,

Chinese DAP/MAP exports for 2024 were estimated at 6 to 7 million

mt – the second lowest amount over the past five years.

- India's DAP price was estimated at $634/mt CFR at the end of

2024 – only $6 lower than at the beginning of the fourth quarter,

defying traditionally lower demand in the Northern Hemisphere.

India imported fewer than 5 million mt of DAP and ended the year

with fewer than 1 million mt of stock versus average annual imports

of 6 million mt and an average end-of-year stock above 2 million mt

between 2019 and 2023.

- Phosphate demand in the US was firm throughout 2024.

Provisional data places fourth quarter arrivals at around 500

thousand mt, consistent with the five-year average. Imports have

been supported by attractive farmer margins during recent years and

the subsequent maximization of planted acreage. Additionally, local

phosphate production has faced various operational challenges.

Recent hurricanes not only interrupted production but also resulted

in stock loss. DAP FOB NOLA ended the fourth quarter at $637/mt,

$25/mt higher than the beginning of the quarter.

- Brazilian MAP/NPS imports accelerated in the third quarter of

2024 and remained firm through the fourth quarter, due to the

planting of the Safra soy crop. Weather conditions improved

consistently through October and November, enabling planting to

progress rapidly and supporting last minute fertilizer demand. The

Brazilian MAP price ended the fourth quarter at $635/mt CFR, flat

compared to the previous quarter.

- Indian phosphoric acid prices are negotiated on a quarterly

basis. The fourth quarter price was settled at $1,060/mt P2O5, $110

higher than the third quarter. For the first quarter of 2025, the

price was settled at $1,055/mt, reflecting a slight decrease in DAP

prices.

- Sulphur FOB Middle East ended the fourth quarter at $165/mt,

$38 higher than prevailing levels at the end of the third quarter.

The increase was driven by strong demand from key end-users,

including Morocco, where a new sulphur burner was ramping up, and,

to a lesser extent, continued tightening of supply.

Additional segment

information

Global phosphate commodities market - average prices:

Average

prices

$ per tonne

10-12/2024

10-12/2023

VS Q4 2023

7-9/2024

VS Q3 2024

DAP

CFR India Bulk Spot

637

594

7

%

598

7

%

TSP

CFR Brazil Bulk Spot

500

422

18

%

513

(3

)%

SSP

CPT Brazil inland 18-20% P2O5

Bulk Spot

270

278

(3

)%

305

(11

)%

Sulphur

Bulk FOB Adnoc monthly Bulk

contract

139

102

36

%

106

31

%

Source: CRU (Fertilizer Week Historical

Prices, December 2024).

Results analysis for the period October

– December 2024

Sales

Expenses

Operating

income

$ millions

Q4 2023 figures

515

(430

)

85

Quantity

15

(5

)

10

Price

(24

)

-

(24

)

Exchange rates

1

3

4

Raw materials

-

17

17

Energy

-

1

1

Transportation

-

6

6

Operating and other expenses

-

(18

)

(18

)

Q4 2024 figures

507

(426

)

81

- Quantity – The positive impact on

operating income was due to higher sales volumes of phosphate-based

food additives and MAP used as raw materials for energy storage

solutions, partially offset by lower sales volumes of phosphate

fertilizers and white phosphoric acid (WPA).

- Price – The negative impact on

operating income was primarily due to lower selling prices of WPA,

as well as phosphate-based food additives and salts, partially

offset by higher phosphate fertilizer selling prices.

- Raw materials –The positive impact

on operating income was due to the lower costs of ammonia and

potassium hydroxide (KOH), partially offset by the higher cost of

sulphur.

- Transportation – The positive

impact on operating income was due to a decrease in marine and

inland transportation costs.

- Operating and other expenses – The

negative impact on operating income was primarily related to higher

maintenance and operational expenses.

Growing Solutions

The Growing Solutions segment aims to achieve global leadership

in plant nutrition by enhancing its position in its core markets of

specialty agriculture, ornamental horticulture, turf and

landscaping, fertilizers and FertilizerpluS, and by targeting

high-growth markets such as Brazil, India, and China. The segment

leverages its unique R&D capabilities, substantial agronomic

experience, global footprint, backward integration to potash,

phosphate and polysulphate and its chemistry know-how, as well as

its ability to integrate and generate synergies from acquired

businesses. The segment continuously works to expand its broad

portfolio of specialty plant nutrition, plant stimulation and plant

health solutions, which consists of enhanced efficiency and

controlled release fertilizers (CRF), water-soluble fertilizers

(WSF), liquid fertilizers and straights (MKP/MAP/PeKacid),

FertilizerpluS, soil and foliar micronutrients, biostimulants, soil

conditioners, seed treatment products and adjuvants.

Results of operations and key

indicators

10-12/2024

10-12/2023

1-12/2024

1-12/2023

$ millions

$ millions

$ millions

millions

Segment Sales

439

478

1,950

2,073

Sales to external customers

435

475

1,932

2,047

Sales to internal customers

4

3

18

26

Segment Operating

Income

31

(5)

128

51

Depreciation and amortization

20

20

74

68

Segment EBITDA

51

15

202

119

Capital expenditures

44

36

98

92

Significant highlights for the fourth quarter

Regional highlights:

- Brazil: Sales decreased year-over-year, mainly due to exchange

rate fluctuations, as lower raw material costs drove higher gross

profit.

- Europe: Sales decreased year-over-year as higher selling prices

were unable to offset lower sales volumes. However, lower raw

material costs drove higher gross profit.

- North America: Sales increased year-over-year due to higher

volumes and higher prices, which contributed to an increase in

gross profit.

- Asia: Sales decreased year-over-year, as higher prices were

unable to offset lower volumes. However, improved product mix drove

higher gross profit.

Product highlights:

- Specialty agriculture (SA): Sales decreased year-over-year, due

to exchange rate fluctuations and lower sales volumes, mainly in

Brazil, which were partially offset by higher sales volumes and

selling prices in the US and India.

- Turf and ornamental (T&O): Sales increased year-over-year,

primarily due to higher sales of ornamental horticulture, driven by

increased demand for CRFs in Europe. In December 2024, the segment

completed its acquisition of GreenBest, a UK-based manufacturer of

specialty fertilizers and tailored solutions. The acquisition

strengthens the Company’s position in the turf and landscape sector

and enhances its presence in the UK market, where GreenBest's

expertise in custom manufacturing capabilities complements the

Company’s existing portfolio.

- FertilizerpluS: Sales decreased year-over-year, driven

primarily by lower sales volumes, mainly in Europe and China, which

were partially offset by higher sales volumes in the US.

Results analysis for the period October

– December 2024

Sales

Expenses

Operating

income

$ millions

Q4 2023 figures

478

(483

)

(5

)

Quantity

(27

)

20

(7

)

Price

10

-

10

Exchange rates

(22

)

18

(4

)

Raw materials

-

32

32

Operating and other expenses

-

5

5

Q4 2024 figures

439

(408

)

31

- Quantity – The negative impact on

operating income was primarily related to lower sales volumes of

specialty agriculture and FertilizerpluS products. This impact was

partially offset by higher sales volumes of turf and ornamental

products.

- Price – The positive impact on

operating income was due to higher selling prices of specialty

agriculture products, mainly in the US and India.

- Exchange rates – The unfavorable

impact on operating income was due to the negative impact on sales

resulting from the depreciation of the average exchange rate of the

Brazilian real against the US dollar, which exceeded the positive

impact from lower operational costs.

- Raw materials – The positive

impact on operating income was primarily related to lower costs for

commodity fertilizers and nitrogen.

- Operating and other expenses – The

positive impact on operating income was primarily related to lower

maintenance and operational costs.

Financing expenses, net

Net financing expenses in the fourth quarter of 2024 amounted to

$33 million, the same as the corresponding quarter of last

year.

Tax expenses

In the fourth quarter of 2024, the Company’s reported tax

expenses amounted to $33 million, compared to $33 million in the

corresponding quarter of last year, reflecting an effective tax

rate of 29% and 28%, respectively.

Liquidity and Capital Resources

As of December 31, 2024, the Company’s cash, cash equivalents,

short-term investments and deposits amounted to $442 million

compared to $592 million as of December 31, 2023. In addition, the

Company maintained about $1.2 billion of unused credit facilities,

as of December 31, 2024.

Outstanding net debt

As of December 31, 2024, ICL’s net financial liabilities

amounted to $1,851 million, a decrease of $244 million compared to

December 31, 2023.

Credit facilities

Sustainability-linked Revolving Credit

Facility (RCF)

In April 2023, the Company entered into a Sustainability-Linked

Revolving Credit Facility Agreement between its subsidiary ICL

Finance B.V., as borrower, and a consortium of 12 international

banks for $1,550 million.

In April 2024, all the banks agreed to extend the RCF agreement

for an additional year which is now due to expire in April 2029. As

of December 31, 2024, the Company had utilized about $520 million

of its $1,550 million credit facility framework.

Securitization

The total amount of the Company's committed securitization

facility framework is $300 million, with an additional $100 million

uncommitted. As of December 31, 2024, ICL had utilized

approximately $176 million of the facility’s framework.

Ratings and financial covenants

Fitch Ratings

In June of 2024, Fitch Ratings reaffirmed the Company’s

long-term issuer default rating and senior unsecured rating at

'BBB-'. The outlook on the long-term issuer default rating is

stable.

S&P Ratings

In July of 2024, S&P reaffirmed the Company’s international

credit rating and senior unsecured rating of 'BBB-'. In addition,

S&P Maalot reaffirmed the Company’s credit rating of 'ilAA'

with a stable rating outlook.

Financial covenants

As of December 31, 2024, the Company was in compliance with all

of the financial covenants stipulated in its financing

agreements.

Dividend Distribution

In connection with ICL’s fourth quarter 2024 results, the Board

of Directors declared a dividend of 4.03 cents per share, or

approximately $52 million. The dividend will be paid on March 25,

2025. The record date is March 12, 2025.

About ICL

ICL Group Ltd. is a leading global specialty minerals company,

which creates impactful solutions for humanity’s sustainability

challenges in the food, agriculture, and industrial markets. ICL

leverages its unique bromine, potash, and phosphate resources, its

global professional workforce, and its sustainability focused

R&D and technological innovation capabilities, to drive the

Company’s growth across its end markets. ICL shares are dual listed

on the New York Stock Exchange and the Tel Aviv Stock Exchange

(NYSE and TASE: ICL). The Company employs more than 12,000 people

worldwide, and its 2024 revenue totaled approximately $7 billion.

For more information, visit the Company’s website at

www.icl-group.com1.

We disclose in this quarterly report non-IFRS financial measures

titled adjusted operating income, adjusted net income attributable

to the Company’s shareholders, diluted adjusted earnings per share,

and adjusted EBITDA. Our management uses adjusted operating income,

adjusted net income attributable to the Company’s shareholders,

diluted adjusted earnings per share, and adjusted EBITDA to

facilitate operating performance comparisons from period to period.

We calculate our adjusted operating income by adjusting our

operating income to add certain items, as set forth in the

reconciliation table under “Adjustments to reported operating, and

net income (non-GAAP)” below. Certain of these items may recur. We

calculate our adjusted net income attributable to the Company’s

shareholders by adjusting our net income attributable to the

Company’s shareholders to add certain items, as set forth in the

reconciliation table under “Adjustments to reported operating, and

net income (non-GAAP)” below, excluding the total tax impact of

such adjustments. We calculate our diluted adjusted earnings per

share by dividing adjusted net income by the weighted-average

number of diluted ordinary shares outstanding. Our adjusted EBITDA

is calculated as net income before financing expenses, net, taxes

on income, share in earnings of equity-accounted investees,

depreciation and amortization, and certain adjustments presented in

the reconciliation table under “Consolidated adjusted EBITDA, and

diluted adjusted Earnings Per Share for the periods of activity”

below, which were adjusted for in calculating the adjusted

operating income.

You should not view adjusted operating income, adjusted net

income attributable to the Company’s shareholders, diluted adjusted

earnings per share or adjusted EBITDA as a substitute for operating

income or net income attributable to the Company’s shareholders

determined in accordance with IFRS, and you should note that our

definitions of adjusted operating income, adjusted net income

attributable to the Company’s shareholders, diluted adjusted

earnings per share, and adjusted EBITDA may differ from those used

by other companies. Additionally, other companies may use other

measures to evaluate their performance, which may reduce the

usefulness of our non-IFRS financial measures as tools for

comparison. However, we believe adjusted operating income, adjusted

net income attributable to the Company’s shareholders, diluted

adjusted earnings per share, and adjusted EBITDA provide useful

information to both management, and investors by excluding certain

items that management believes are not indicative of our ongoing

operations. Our management uses these non-IFRS measures to evaluate

the Company's business strategies and management performance. We

believe that these non IFRS measures provide useful information to

investors because they improve the comparability of our financial

results between periods and provide for greater transparency of key

measures used to evaluate our performance.

(1a) The Company only provides guidance on a non-GAAP basis. The

Company does not provide a reconciliation of forward-looking

adjusted EBITDA (non-GAAP) to GAAP net income (loss), due to the

inherent difficulty in forecasting, and quantifying certain amounts

that are necessary for such reconciliation, in particular, because

special items such as restructuring, litigation, and other matters,

used to calculate projected net income (loss) vary dramatically

based on actual events, the Company is not able to forecast on a

GAAP basis with reasonable certainty all deductions needed in order

to provide a GAAP calculation of projected net income (loss) at

this time. The amount of these deductions may be material, and

therefore could result in projected GAAP net income (loss) being

materially less than projected adjusted EBITDA (non-GAAP). The

guidance speaks only as of the date hereof. We undertake no

obligation to update any of these forward-looking statements to

reflect events or circumstances after the date of this news release

or to reflect actual outcomes, unless required by law. The Company

provides guidance for Specialties-driven EBITDA, which includes

Industrial Products, Growing Solutions and Phosphate Solutions, as

the Phosphate Solutions business is now predominantly

specialties-focused. For our Potash business we provide sales

volumes guidance. The Company believes this information provides

greater transparency, as these new metrics are less impacted by

fertilizer commodity prices, given the extreme volatility in recent

years.

We present a discussion in the period-to-period comparisons of

the primary drivers of change in the Company’s results of

operations. This discussion is based in part on management’s best

estimates of the impact of the main trends on our businesses. We

have based the following discussion on our financial statements.

You should read such discussion together with our financial

statements.

_________________

1 The reference to our website is intended to be an inactive

textual reference and the information on, or accessible through,

our website is not intended to be part of this Form 6-K.

Adjustments to Reported Operating and Net income

(non-GAAP)

10-12/2024

10-12/2023

1-12/2024

1-12/2023

$ millions

$ millions

$ millions

$ millions

Operating income

147

149

775

1,141

Charges related to the security

situation in Israel (1)

17

14

57

14

Impairment and write-off of

assets and provision for site closure (2)

20

34

35

49

Provision for early retirement

(3)

4

16

4

16

Legal proceedings (4)

2

(2

)

2

(2

)

Total adjustments to operating

income

43

62

98

77

Adjusted operating

income

190

211

873

1,218

Net income attributable to the

shareholders of the Company

70

67

407

647

Total adjustments to operating

income

43

62

98

77

Total tax adjustments (5)

(9

)

(6

)

(21

)

(9

)

Total adjusted net income -

shareholders of the Company

104

123

484

715

(1)

For 2024 and 2023, reflects charges

relating to the security situation in Israel.

(2)

For 2024, reflects mainly a write-off of

assets resulting from the closure of small sites in Israel and

Turkey, and an impairment of assets due to a regulatory decision

that mandated the cessation of a certain project. For 2023,

reflects mainly a write-off of assets related to restructuring at

certain sites, including site closures and facility modifications,

as part of the Company’s global efficiency plan.

(3)

For 2024 and 2023, reflects provisions for

early retirement, due to restructuring at certain sites, as part of

the Company’s global efficiency plan.

(4)

For 2024, reflects reimbursement of

arbitration costs associated with the Ethiopian potash project. For

2023, reflects a reversal of a legal provision.

(5)

For 2024 and 2023, reflects the tax impact

of adjustments made to operating income.

Consolidated adjusted EBITDA and diluted adjusted Earnings

Per Share for the periods of activity

Calculation of adjusted EBITDA was made as follows:

10-12/2024

10-12/2023

1-12/2024

1-12/2023

$ millions

$ millions

$ millions

$ millions

Net income

81

84

464

687

Financing expenses, net

33

33

140

168

Taxes on income

33

33

172

287

Less: Share in earnings of

equity-accounted investees

-

(1

)

(1

)

(1

)

Operating income

147

149

775

1,141

Depreciation and amortization

157

146

596

536

Adjustments (1)

43

62

98

77

Total adjusted EBITDA

(2)

347

357

1,469

1,754

(1)

See "Adjustments to Reported Operating and

Net income (non-GAAP)" above.

(2)

In 2024, the Company’s adjusted EBITDA was

positively impacted by an immaterial accounting reclassification.

For further information, see our Potash segment results above.

Calculation of diluted adjusted earnings per share was made as

follows:

10-12/2024

10-12/2023

1-12/2024

1-12/2023

$ millions

$ millions

$ millions

$ millions

Net income attributable to the

Company's shareholders

70

67

407

647

Adjustments (1)

43

62

98

77

Total tax adjustments

(9

)

(6

)

(21

)

(9

)

Adjusted net income -

shareholders of the Company

104

123

484

715

Weighted-average number of

diluted ordinary shares outstanding (in thousands)

1,290,330

1,290,575

1,290,039

1,290,668

Diluted adjusted earnings per

share (in dollars) (2)

0.08

0.10

0.38

0.55

(1)

See "Adjustments to Reported Operating and

Net income (non-GAAP)" above.

(2)

The diluted adjusted earnings per share is

calculated by dividing the adjusted net income shareholders of the

Company by the weighted-average number of diluted ordinary shares

outstanding (in thousands).

Consolidated Results Analysis

Results analysis for the period October – December

2024

Sales

Expenses

Operating

income

$ millions

Q4 2023 figures

1,690

(1,541

)

149

Total adjustments Q4 2023

-

62

62

Adjusted Q4 2023

figures

1,690

(1,479

)

211

Quantity

26

(7

)

19

Price

(92

)

-

(92

)

Exchange rates

(23

)

22

(1

)

Raw materials

-

51

51

Energy

-

(1

)

(1

)

Transportation

-

11

11

Operating and other expenses

-

(8

)

(8

)

Adjusted Q4 2024

figures

1,601

(1,411

)

190

Total adjustments Q4 2024*

-

(43

)

(43

)

Q4 2024 figures

1,601

(1,454

)

147

* See "Adjustments to reported Operating

and Net income (non-GAAP)" above.

- Quantity – The positive impact on

operating income was primarily due to higher sales volumes of

potash, magnesium, MAP used as a raw material for energy storage

solutions, and phosphate-based food additives. These were partially

offset by lower sales volumes of specialty agriculture

products.

- Price – The negative impact on

operating income was primarily related to a decrease of $60 in the

potash price (CIF) per tonne year-over-year, as well as lower

selling prices of white phosphoric acid (WPA) and phosphate-based

food additives. These were partially offset by higher selling

prices of specialty agriculture products and phosphate

fertilizers.

- Exchange rates – The unfavorable

impact on operating income was mainly due to a negative impact on

sales resulting from the depreciation of the average exchange rate

of the Brazilian real against the US dollar, which slightly

exceeded its positive impact on operational costs.

- Raw materials – The positive

impact on operating income was due to the lower cost of commodity

fertilizers and raw materials used in the production of industrial

solutions products, ammonia and nitrogen. This impact was partially

offset by higher costs for sulphur.

- Transportation – The positive

impact on operating income resulted from lower inland and marine

transportation costs.

- Operating and other expenses - The

negative impact on operating income was primarily related to higher

maintenance and operational costs, which was partially offset by

operational efficiencies, mainly in the Industrial Products

segment.

Security situation in Israel

In October 2023, the Israeli government declared a state of war

in response to attacks on its civilians in the south of the

country, which escalated to other areas. The security situation has

presented several challenges, including disruptions in supply

chains and shipping routes, personnel shortages due to recurring

rounds of mobilization for reserve duty, additional costs to

protect Company sites/assets, effects of reluctance to perform

contractual obligations in Israel during hostilities, various bans

and limitations on trade and cooperation with Israel related

entities, and fluctuations in foreign currency exchange rates

relative to the Israeli shekel. Additionally, regional tensions

involving Houthis attacks and threats to commercial vessels have

intensified, disrupting shipping routes and commercial shipping

arrangements, leading to increased shipping costs.

The Company continues to take measures to ensure the safety of

its employees and business partners, as well as the communities in

which it operates. It has also implemented supportive measures to

accommodate employees called for reserve duty, aiming to minimize

any potential impact on its business, and to avoid disruptions to

production activities at its facilities in Israel.

The security situation in the last year has not had a material

impact on the Company's business results. However, as the

developments related to the war, as well as its duration, are

unpredictable, the Company is unable to estimate the extent of the

war’s potential impact on its future business and results. The

Company continuously monitors developments and will take all

necessary actions to minimize any negative consequences to its

operations and assets.

Forward-looking Statements

This announcement contains statements that constitute

“forward‑looking statements”, many of which can be identified by

the use of forward‑looking words such as “anticipate”, “believe”,

“could”, “expect”, “should”, “plan”, “intend”, “estimate”,

“strive”, “forecast”, “targets” and “potential”, among others.

Forward‑looking statements appear in a number of places in this

announcement and include, but are not limited to, statements

regarding our intent, belief or current expectations.

Forward‑looking statements are based on our management’s beliefs

and assumptions and on information currently available to our

management. Such statements are subject to risks and uncertainties,

and the actual results may differ materially from those expressed

or implied in the forward‑looking statements due to various

factors, including, but not limited to:

Changes in exchange rates or prices compared to those we are

currently experiencing; loss or impairment of business licenses or

mineral extractions permits or concessions; volatility of supply

and demand and the impact of competition; the difference between

actual reserves and our reserve estimates; natural disasters and

cost of compliance with environmental regulatory legislative and

licensing restrictions including laws and regulation related to,

and physical impacts of climate change and greenhouse gas

emissions; failure to "harvest" salt which could lead to

accumulation of salt at the bottom of the evaporation Pond 5 in the

Dead Sea; disruptions at our seaport shipping facilities or

regulatory restrictions affecting our ability to export our

products overseas; general market, political or economic conditions

in the countries in which we operate; price increases or shortages

with respect to our principal raw materials; delays in termination

of engagements with contractors and/or governmental obligations;

the inflow of significant amounts of water into the Dead Sea which

could adversely affect production at our plants; labor disputes,

slowdowns and strikes involving our employees; pension and health

insurance liabilities; Pandemics may create disruptions, impacting

our sales, operations, supply chain and customers; changes to

governmental incentive programs or tax benefits, creation of new

fiscal or tax related legislation; and/or higher tax liabilities;

changes in our evaluations and estimates, which serve as a basis

for the recognition and manner of measurement of assets and

liabilities; failure to integrate or realize expected benefits from

mergers and acquisitions, organizational restructuring and joint

ventures; currency rate fluctuations; rising interest rates;

government examinations or investigations; disruption of our, or

our service providers', information technology systems or breaches

of our, or our service providers', data security; failure to retain

and/or recruit key personnel; inability to realize expected

benefits from our cost reduction program according to the expected

timetable; inability to access capital markets on favorable terms;

cyclicality of our businesses; changes in demand for our fertilizer

products due to a decline in agricultural product prices, lack of

available credit, weather conditions, government policies or other

factors beyond our control; sales of our magnesium products being

affected by various factors that are not within our control; our

ability to secure approvals and permits from the authorities in

Israel to continue our phosphate mining operations in Rotem Amfert

Israel; volatility or crises in the financial markets; hazards

inherent to mining and chemical manufacturing; the failure to

ensure the safety of our workers and processes; litigation,

arbitration and regulatory proceedings; exposure to third party and

product liability claims; product recalls or other liability claims

as a result of food safety and food-borne illness concerns;

insufficiency of insurance coverage; closing of transactions,

mergers and acquisitions; war or acts of terror and/or political,

economic and military instability in Israel and its region;

including the current state of war declared in Israel and any

resulting disruptions to our supply and production chains; filing

of class actions and derivative actions against the Company, its

executives and Board members; The Company is exposed to risks

relating to its current and future activity in emerging markets;

and other risk factors discussed under ”Item 3 - Key Information—

D. Risk Factors" in the Company's Annual Report on Form 20-F for

the year ended December 31, 2023, filed with the U.S. Securities

and Exchange Commission (the “SEC”) on March 14, 2023 (the “Annual

Report”).

Forward looking statements speak only as at the date they are

made, and we do not undertake any obligation to update them in

light of new information or future developments or to release

publicly any revisions to these statements in order to reflect

later events or circumstances or to reflect the occurrence of

unanticipated events.

This report for the fourth quarter of 2024 (the “Quarterly

Report”) should be read in conjunction with the Annual Report and

the report for the first, second and third quarters of 2024

published by the Company (the “prior quarterly reports”), including

the description of the events occurring subsequent to the date of

the statement of financial position, as filed with the U.S.

SEC.

Appendix:

Condensed Consolidated Statements of

Financial Position as of (Unaudited)

December 31,

2024

December 31,

2023

$ millions

$ millions

Current assets

Cash and cash equivalents

327

420

Short-term investments and

deposits

115

172

Trade receivables

1,260

1,376

Inventories

1,626

1,703

Prepaid expenses and other

receivables

258

363

Total current assets

3,586

4,034

Non-current assets

Deferred tax assets

143

152

Property, plant and equipment

6,462

6,329

Intangible assets

869

873

Other non-current assets

261

239

Total non-current

assets

7,735

7,593

Total assets

11,321

11,627

Current liabilities

Short-term debt

384

858

Trade payables

1,002

912

Provisions

63

85

Other payables

879

783

Total current

liabilities

2,328

2,638

Non-current

liabilities

Long-term debt and debentures

1,909

1,829

Deferred tax liabilities

481

489

Long-term employee

liabilities

331

354

Long-term provisions and

accruals

230

224

Other

55

56

Total non-current

liabilities

3,006

2,952

Total liabilities

5,334

5,590

Equity

Total shareholders’ equity

5,724

5,768

Non-controlling interests

263

269

Total equity

5,987

6,037

Total liabilities and

equity

11,321

11,627

Condensed Consolidated Statements of

Income (Unaudited)

(In millions except per share data)

For the three-month period

ended

December 31

For the year ended

December 31

2024

2023

2024

2023

$ millions

$ millions

$ millions

$ millions

Sales

1,601

1,690

6,841

7,536

Cost of sales

1,066

1,130

4,585

4,865

Gross profit

535

560

2,256

2,671

Selling, transport and marketing

expenses

281

286

1,114

1,093

General and administrative

expenses

68

71

259

260

Research and development

expenses

19

17

69

71

Other expenses

33

44

60

128

Other income

(13

)

(7

)

(21

)

(22

)

Operating income

147

149

775

1,141

Finance expenses

71

38

181

259

Finance income

(38

)

(5

)

(41

)

(91

)

Finance expenses, net

33

33

140

168

Share in earnings of

equity-accounted investees

-

1

1

1

Income before taxes on

income

114

117

636

974

Taxes on income

33

33

172

287

Net income

81

84

464

687

Net income attributable to the

non-controlling interests

11

17

57

40

Net income attributable to the

shareholders of the Company

70

67

407

647

Earnings per share

attributable to the shareholders of the Company:

Basic earnings per share (in

dollars)

0.06

0.05

0.32

0.50

Diluted earnings per share (in

dollars)

0.06

0.05

0.32

0.50

Weighted-average number of

ordinary shares outstanding:

Basic (in thousands)

1,290,260

1,289,449

1,289,968

1,289,361

Diluted (in thousands)

1,290,330

1,290,575

1,290,039

1,290,668

The accompanying notes are an integral part of these condensed

consolidated interim financial statements.

Condensed Consolidated Statements of

Cash Flows (Unaudited)

For the three-month period

ended

For the year ended

December 31,

2024

December 31,

2023

December 31,

2024

December 31,

2023

$ millions

$ millions

$ millions

$ millions

Cash flows from operating

activities

Net income

81

84

464

687

Adjustments for:

Depreciation and amortization

157

146

596

536

Fixed assets impairment

7

-

14

-

Exchange rate, interest and

derivative, net

47

(51

)

152

24

Tax expenses

33

33

172

287

Change in provisions

3

9

(50

)

(32

)

Other

7

22

13

29

254

159

897

844

Change in inventories

(102

)

50

(7

)

465

Change in trade receivables

68

47

26

252

Change in trade payables

87

66

104

(101

)

Change in other receivables

66

37

39

26

Change in other payables

39

16

43

(210

)

Net change in operating assets

and liabilities

158

216

205

432

Income taxes paid, net of

refund

(41

)

(7

)

(98

)

(253

)

Net cash provided by operating

activities (*)

452

452

1,468

1,710

Cash flows from investing

activities

Proceeds (payments) from

deposits, net

(5

)

(10

)

56

(88

)

Purchases of property, plant and

equipment and intangible assets

(267

)

(255

)

(713

)

(780

)

Proceeds from divestiture of

assets and businesses, net of transaction expenses

-

-

19

4

Interest received (*)

3

3

17

10

Business combinations

(2

)

-

(74

)

-

Other

1

-

1

1

Net cash used in investing

activities

(270

)

(262

)

(694

)

(853

)

Cash flows from financing

activities

Dividends paid to the Company's

shareholders

(68

)

(68

)

(251

)

(474

)

Receipts of long-term debt

278

149

889

633

Repayments of long-term debt

(383

)

(183

)

(1,302

)

(836

)

Receipts (Repayments) of

short-term debt

(8

)

64

(1

)

(25

)

Interest paid (*)

(43

)

(40

)

(122

)

(125

)

Receipts (payments) from

transactions in derivatives

(3

)

(1

)

(2

)

5

Dividend paid to the

non-controlling interests

-

-

(57

)

(15

)

Net cash used in financing

activities

(227

)

(79

)

(846

)

(837

)

Net change in cash and cash

equivalents

(45

)

111

(72

)

20

Cash and cash equivalents as of

the beginning of the period

393

307

420

417

Net effect of currency

translation on cash and cash equivalents

(21

)

2

(21

)

(17

)

Cash and cash equivalents as

of the end of the period

327

420

327

420

(*) Reclassification - of interest

received as cash flows from investing activities and interest paid

as cash flows from financing activities, instead of under cash

provided by operating activities.

Operating segment data

Industrial

Products

Potash

Phosphate

Solutions

Growing

Solutions

Other

Activities

Reconciliations

Consolidated

$ millions

For the three-month period

ended December 31, 2024

Sales to external parties

275

373

475

435

43

-

1,601

Inter-segment sales

5

49

32

4

-

(90

)

-

Total sales

280

422

507

439

43

(90

)

1,601

Cost of sales

177

260

344

313

44

(72

)

1,066

Segment operating income

(loss)

55

69

81

31

(8

)

(38

)

190

Other expenses not allocated to

the segments

(43

)

Operating income

147

Financing expenses, net

(33

)

Income before income taxes

114

Depreciation, amortization and

impairment

15

61

51

20

4

13

164

Capital expenditures

38

116

147

44

3

12

360

Capital expenditures as part of

business combination

-

-

-

4

-

-

4

Operating segment data (cont'd)

Industrial

Products

Potash

Phosphate

Solutions

Growing

Solutions

Other

Activities

Reconciliations

Consolidated

$ millions

For the three-month period

ended December 31, 2023

Sales to external parties

294

408

474

475

39

-

1,690

Inter-segment sales

5

66

41

3

(1

)

(114

)

-

Total sales

299

474

515

478

38

(114

)

1,690

Cost of sales

217

243

348

375

45

(98

)

1,130

Segment operating income

(loss)

39

122

85

(5

)

(12

)

(18

)

211

Other expenses not allocated to

the segments

(62

)

Operating income

149

Financing expenses, net

(33

)

Share in earnings of

equity-accounted investees

1

Income before income taxes

117

Depreciation and amortization

17

46

54

20

6

3

146

Capital expenditures

29

132

89

36

6

12

304

Information based on geographical location

The following table presents the distribution of the operating

segments sales by geographical location of the customer:

10-12/2024

10-12/2023

$

millions

% of

sales

$

millions

% of

sales

USA

280

17

295

17

Brazil

276

17

347

21

China

274

17

284

17

Spain

73

5

77

5

Israel

69

4

72

4

Germany

65

4

68

4

India

64

4

29

2

United Kingdom

58

4

74

4

France

48

3

63

4

Netherlands

37

2

27

2

All other

357

23

354

20

Total

1,601

100

1,690

100

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250224694694/en/

Investor and Press Contact – Global Peggy Reilly Tharp VP,

Global Investor Relations +1-314-983-7665

Peggy.ReillyTharp@icl-group.com

Investor and Press Contact - Israel Adi Bajayo ICL Spokesperson

+972-3-6844459 Adi.Bajayo@icl-group.com

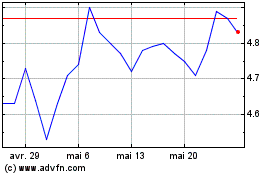

ICL (NYSE:ICL)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

ICL (NYSE:ICL)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025