Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

24 Janvier 2025 - 10:49PM

Edgar (US Regulatory)

PORTFOLIO

OF

INVESTMENTS

as

of

November

30,

2024

(Unaudited)

Voya

Global

Equity

Dividend

and

Premium

Opportunity

Fund

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK

:

97.4%

Australia

:

1.9%

50,912

Ampol

Ltd.

$

967,636

0.2

103,965

Computershare

Ltd.

2,166,135

0.4

398,755

Medibank

Pvt

Ltd.

995,846

0.2

187,570

QBE

Insurance

Group

Ltd.

2,450,514

0.5

191,018

Scentre

Group

459,538

0.1

901,804

Telstra

Group

Ltd.

2,322,345

0.5

9,362,014

1.9

Bermuda

:

0.6%

32,920

Axis

Capital

Holdings

Ltd.

3,062,877

0.6

Canada

:

3.7%

15,381

Canadian

Imperial

Bank

of

Commerce

-

XTSE

998,411

0.2

80,684

Cenovus

Energy,

Inc.

1,278,220

0.3

29,559

iA

Financial

Corp.,

Inc.

2,825,528

0.6

88,283

Keyera

Corp.

2,911,343

0.6

44,393

Parkland

Corp.

1,146,250

0.2

61,927

Pembina

Pipeline

Corp.

2,551,301

0.5

11,238

Rogers

Communications,

Inc.

-

Class

B

401,343

0.1

70,566

Suncor

Energy,

Inc.

2,807,923

0.6

13,818

Thomson

Reuters

Corp.

2,254,622

0.4

28,103

TMX

Group

Ltd.

888,625

0.2

18,063,566

3.7

Denmark

:

0.8%

87,919

Danske

Bank

A/S

2,529,622

0.5

2,648

Pandora

A/S

427,268

0.1

34,059

Tryg

A/S

786,023

0.2

3,742,913

0.8

France

:

1.9%

8,526

BNP

Paribas

SA

509,647

0.1

30,425

Carrefour

SA

463,339

0.1

25,158

Cie

Generale

des

Etablissements

Michelin

SCA

818,462

0.2

35,196

Credit

Agricole

SA

471,374

0.1

21,855

Danone

SA

1,494,873

0.3

4,865

Eiffage

SA

439,263

0.1

55,176

Getlink

SE

902,246

0.2

3,891

Ipsen

SA

449,992

0.1

211,901

Orange

SA

2,258,442

0.4

13,870

Sanofi

1,347,152

0.3

9,154,790

1.9

Germany

:

1.7%

5,603

Allianz

SE

1,734,486

0.4

131,226

Deutsche

Telekom

AG,

Reg

4,198,033

0.9

11,795

(1)

Scout24

SE

1,063,521

0.2

10,525

Symrise

AG

1,164,288

0.2

8,160,328

1.7

Hong

Kong

:

1.0%

646,000

BOC

Hong

Kong

Holdings

Ltd.

1,993,235

0.4

85,500

CK

Hutchison

Holdings

Ltd.

447,123

0.1

17,300

Jardine

Matheson

Holdings

Ltd.

711,722

0.2

162,000

Power

Assets

Holdings

Ltd.

1,064,885

0.2

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK:

(continued)

Hong

Kong

(continued)

58,000

Swire

Pacific

Ltd.

-

Class

A

$

477,566

0.1

4,694,531

1.0

Ireland

:

0.1%

5,653

Medtronic

PLC

489,211

0.1

Israel

:

0.2%

95,920

Bank

Leumi

Le-Israel

BM

1,093,113

0.2

Italy

:

1.4%

760,908

Intesa

Sanpaolo

SpA

2,920,768

0.6

90,604

(1)

Poste

Italiane

SpA

1,272,167

0.2

76,067

UniCredit

SpA

2,921,868

0.6

7,114,803

1.4

Japan

:

4.7%

118,100

Central

Japan

Railway

Co.

2,432,229

0.5

91,700

Chubu

Electric

Power

Co.,

Inc.

970,840

0.2

43,100

Dai-ichi

Life

Holdings,

Inc.

1,168,237

0.2

13,100

Daito

Trust

Construction

Co.

Ltd.

1,462,333

0.3

50,800

Daiwa

House

Industry

Co.

Ltd.

1,599,422

0.3

2,000

Disco

Corp.

546,530

0.1

88,700

ENEOS

Holdings,

Inc.

480,296

0.1

3,300

Hoya

Corp.

426,604

0.1

31,700

Japan

Airlines

Co.

Ltd.

527,752

0.1

47,300

Japan

Post

Holdings

Co.

Ltd.

474,348

0.1

97,300

Japan

Tobacco,

Inc.

2,744,825

0.6

34,900

JFE

Holdings,

Inc.

399,347

0.1

30,400

Kirin

Holdings

Co.

Ltd.

424,798

0.1

72,500

Nitto

Denko

Corp.

1,159,114

0.2

40,400

Ono

Pharmaceutical

Co.

Ltd.

464,162

0.1

10,300

Otsuka

Holdings

Co.

Ltd.

598,490

0.1

42,600

Secom

Co.

Ltd.

1,488,475

0.3

92,700

Sekisui

Chemical

Co.

Ltd.

1,500,996

0.3

37,600

Shionogi

&

Co.

Ltd.

533,346

0.1

22,700

Sumitomo

Corp.

487,236

0.1

43,800

Takeda

Pharmaceutical

Co.

Ltd.

1,194,215

0.3

31,900

Trend

Micro,

Inc./Japan

1,758,770

0.4

22,842,365

4.7

Netherlands

:

1.1%

3,815

BE

Semiconductor

Industries

NV

453,606

0.1

489,681

Koninklijke

KPN

NV

1,899,629

0.4

56,222

NN

Group

NV

2,609,170

0.5

3,901

Wolters

Kluwer

NV

651,042

0.1

5,613,447

1.1

Norway

:

0.6%

93,891

DNB

Bank

ASA

1,964,909

0.4

95,699

Telenor

ASA

1,126,794

0.2

3,091,703

0.6

Singapore

:

0.8%

77,700

DBS

Group

Holdings

Ltd.

2,465,564

0.5

50,700

Singapore

Exchange

Ltd.

481,312

0.1

PORTFOLIO

OF

INVESTMENTS

as

of

November

30,

2024

(Unaudited)

(continued)

Voya

Global

Equity

Dividend

and

Premium

Opportunity

Fund

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK:

(continued)

Singapore

(continued)

306,100

Singapore

Technologies

Engineering

Ltd.

$

1,028,880

0.2

3,975,756

0.8

Spain

:

1.4%

31,602

ACS

Actividades

de

Construccion

y

Servicios

SA

1,468,770

0.3

6,729

(1)

Aena

SME

SA

1,457,309

0.3

44,469

Industria

de

Diseno

Textil

SA

2,453,937

0.5

133,438

Repsol

SA

1,670,215

0.3

7,050,231

1.4

Sweden

:

0.6%

43,215

Essity

AB

-

Class

B

1,190,409

0.3

34,994

SKF

AB

-

Class

B

672,799

0.1

52,302

Swedbank

AB

-

Class

A

1,024,545

0.2

2,887,753

0.6

Switzerland

:

1.8%

365

Givaudan

SA,

Reg

1,610,294

0.4

34,234

Holcim

AG

3,489,110

0.7

33,028

Novartis

AG,

Reg

3,501,609

0.7

8,601,013

1.8

United

Kingdom

:

3.2%

125,304

(1)

Auto

Trader

Group

PLC

1,338,477

0.3

129,034

Aviva

PLC

794,665

0.2

146,950

BAE

Systems

PLC

2,296,797

0.5

216,197

BP

PLC

1,058,721

0.2

91,459

British

American

Tobacco

PLC

3,473,624

0.7

364,123

Centrica

PLC

590,543

0.1

41,314

Informa

PLC

450,700

0.1

157,204

NatWest

Group

PLC

806,349

0.2

68,576

Pearson

PLC

1,076,013

0.2

79,200

Sage

Group

PLC

1,322,320

0.3

53,143

Smiths

Group

PLC

1,197,794

0.2

31,071

Whitbread

PLC

1,127,637

0.2

15,533,640

3.2

United

States

:

69.9%

37,740

AbbVie,

Inc.

6,903,778

1.4

5,862

Acuity

Brands,

Inc.

1,879,885

0.4

16,100

AECOM

1,883,217

0.4

9,544

Allison

Transmission

Holdings,

Inc.

1,130,964

0.2

9,864

Allstate

Corp.

2,045,695

0.4

7,702

Alphabet,

Inc.

-

Class

A

1,301,253

0.3

65,259

Altria

Group,

Inc.

3,768,055

0.8

29,255

Amdocs

Ltd.

2,536,994

0.5

6,172

American

Financial

Group,

Inc.

906,420

0.2

52,970

American

Homes

4

Rent

-

Class

A

2,028,221

0.4

1,306

Ameriprise

Financial,

Inc.

749,605

0.2

13,207

AmerisourceBergen

Corp.

3,322,221

0.7

13,543

AMETEK,

Inc.

2,632,488

0.5

6,859

Aon

PLC

-

Class

A

2,685,573

0.5

7,862

Applied

Materials,

Inc.

1,373,570

0.3

12,726

Assurant,

Inc.

2,890,075

0.6

214,326

AT&T,

Inc.

4,963,790

1.0

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK:

(continued)

United

States

(continued)

15,120

Automatic

Data

Processing,

Inc.

$

4,640,782

0.9

56,142

Baker

Hughes

Co.

2,467,441

0.5

21,647

Black

Hills

Corp.

1,386,923

0.3

82,861

Bristol-Myers

Squibb

Co.

4,907,028

1.0

85,613

Brixmor

Property

Group,

Inc.

2,574,383

0.5

12,833

Broadridge

Financial

Solutions,

Inc.

3,028,845

0.6

14,680

Brown

&

Brown,

Inc.

1,660,308

0.3

5,258

Cabot

Corp.

576,382

0.1

3,882

Capital

One

Financial

Corp.

745,383

0.2

25,292

Cardinal

Health,

Inc.

3,091,694

0.6

15,158

Cboe

Global

Markets,

Inc.

3,271,854

0.7

4,680

Chevron

Corp.

757,832

0.2

10,980

Cigna

Group

3,709,044

0.8

13,781

Cintas

Corp.

3,111,612

0.6

106,327

Cisco

Systems,

Inc.

6,295,622

1.3

42,655

Citigroup,

Inc.

3,022,960

0.6

16,759

CME

Group,

Inc.

3,988,642

0.8

7,004

Coca-Cola

Co.

448,816

0.1

30,408

Colgate-Palmolive

Co.

2,938,325

0.6

35,700

Commerce

Bancshares,

Inc.

2,632,875

0.5

33,575

ConocoPhillips

3,637,515

0.7

15,435

COPT

Defense

Properties

508,583

0.1

119,098

Coterra

Energy,

Inc.

3,182,299

0.7

16,925

CSX

Corp.

618,609

0.1

55,453

CVS

Health

Corp.

3,318,862

0.7

10,217

Delta

Air

Lines,

Inc.

652,049

0.1

5,578

Diamondback

Energy,

Inc.

990,597

0.2

54,946

Dow,

Inc.

2,429,163

0.5

28,745

DT

Midstream,

Inc.

3,050,419

0.6

19,984

DTE

Energy

Co.

2,513,588

0.5

38,376

Edison

International

3,367,494

0.7

7,766

Elevance

Health,

Inc.

3,160,451

0.6

24,706

Entergy

Corp.

3,858,336

0.8

35,509

Equitable

Holdings,

Inc.

1,712,599

0.4

37,106

Equity

Residential

2,844,546

0.6

35,957

Essent

Group

Ltd.

2,077,595

0.4

4,739

Essex

Property

Trust,

Inc.

1,471,270

0.3

48,967

Evergy,

Inc.

3,164,737

0.6

19,984

Fortive

Corp.

1,585,331

0.3

47,082

Gaming

and

Leisure

Properties,

Inc.

2,429,902

0.5

42,137

General

Mills,

Inc.

2,791,998

0.6

69,703

Genpact

Ltd.

3,217,490

0.7

12,529

Genuine

Parts

Co.

1,587,800

0.3

53,041

Gilead

Sciences,

Inc.

4,910,536

1.0

39,534

H&R

Block,

Inc.

2,343,576

0.5

9,330

Hancock

Whitney

Corp.

554,015

0.1

5,349

Hanover

Insurance

Group,

Inc.

882,638

0.2

28,276

Hartford

Financial

Services

Group,

Inc.

3,486,714

0.7

40,923

Hewlett

Packard

Enterprise

Co.

868,386

0.2

5,249

Hilton

Worldwide

Holdings,

Inc.

1,330,307

0.3

PORTFOLIO

OF

INVESTMENTS

as

of

November

30,

2024

(Unaudited)

(continued)

Voya

Global

Equity

Dividend

and

Premium

Opportunity

Fund

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK:

(continued)

United

States

(continued)

4,401

Humana,

Inc.

$

1,304,368

0.3

18,314

Ingredion,

Inc.

2,698,385

0.6

17,493

International

Bancshares

Corp.

1,279,263

0.3

58,563

Invitation

Homes,

Inc.

2,005,783

0.4

13,045

Jack

Henry

&

Associates,

Inc.

2,298,268

0.5

48,973

Johnson

&

Johnson

7,591,305

1.6

22,471

Kimberly-Clark

Corp.

3,131,334

0.6

146,843

Kinder

Morgan,

Inc.

4,151,252

0.8

1,517

KLA

Corp.

981,545

0.2

57,327

Kraft

Heinz

Co.

1,832,744

0.4

20,389

Leidos

Holdings,

Inc.

3,372,341

0.7

5,043

Lockheed

Martin

Corp.

2,669,815

0.5

35,822

Loews

Corp.

3,106,842

0.6

15,659

LyondellBasell

Industries

NV

-

Class

A

1,305,021

0.3

9,915

ManpowerGroup,

Inc.

638,229

0.1

15,262

Marsh

&

McLennan

Cos.,

Inc.

3,559,556

0.7

4,875

McKesson

Corp.

3,063,937

0.6

39,059

Merck

&

Co.,

Inc.

3,969,957

0.8

32,950

MetLife,

Inc.

2,907,178

0.6

102,058

MGIC

Investment

Corp.

2,680,043

0.5

12,007

Molson

Coors

Beverage

Co.

-

Class

B

745,154

0.2

31,600

National

Fuel

Gas

Co.

2,021,452

0.4

22,606

NetApp,

Inc.

2,772,400

0.6

25,512

New

Jersey

Resources

Corp.

1,315,909

0.3

1,818

NewMarket

Corp.

970,012

0.2

65,637

NiSource,

Inc.

2,500,113

0.5

23,670

NorthWestern

Corp.

1,307,531

0.3

9,689

NVIDIA

Corp.

1,339,504

0.3

62,314

OGE

Energy

Corp.

2,739,323

0.6

10,832

ONE

Gas,

Inc.

844,571

0.2

17,622

OneMain

Holdings,

Inc.

1,010,622

0.2

37,369

ONEOK,

Inc.

4,245,118

0.9

33,488

PepsiCo,

Inc.

5,473,614

1.1

23,023

PG&E

Corp.

497,987

0.1

41,184

Philip

Morris

International,

Inc.

5,479,943

1.1

24,427

Phillips

66

3,272,729

0.7

21,271

Procter

&

Gamble

Co.

3,813,039

0.8

9,412

Prosperity

Bancshares,

Inc.

788,067

0.2

26,339

Prudential

Financial,

Inc.

3,408,530

0.7

13,805

Qualcomm,

Inc.

2,188,507

0.4

3,788

Ralph

Lauren

Corp.

876,543

0.2

8,512

Raytheon

Technologies

Corp.

1,037,017

0.2

31,953

Regency

Centers

Corp.

2,415,327

0.5

13,086

Reinsurance

Group

of

America,

Inc.

2,988,842

0.6

13,661

Republic

Services,

Inc.

2,982,196

0.6

52,105

Rithm

Capital

Corp.

586,181

0.1

51,763

Rollins,

Inc.

2,605,232

0.5

23,246

RPM

International,

Inc.

3,226,080

0.7

10,020

Ryder

System,

Inc.

1,691,777

0.3

19,497

Sempra

Energy

1,826,284

0.4

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK:

(continued)

United

States

(continued)

4,443

Sherwin-Williams

Co.

$

1,765,648

0.4

10,608

Skyworks

Solutions,

Inc.

929,155

0.2

34,254

SLM

Corp.

937,875

0.2

9,135

Snap-on,

Inc.

3,377,118

0.7

38,835

SS&C

Technologies

Holdings,

Inc.

3,003,499

0.6

36,742

Synchrony

Financial

2,480,820

0.5

20,262

Tapestry,

Inc.

1,261,917

0.3

15,269

Texas

Roadhouse,

Inc.

3,134,268

0.6

3,839

TJX

Cos.,

Inc.

482,524

0.1

6,800

Tradeweb

Markets,

Inc.

-

Class

A

921,400

0.2

13,971

Travelers

Cos.,

Inc.

3,716,845

0.8

14,011

UnitedHealth

Group,

Inc.

8,549,512

1.8

51,727

Unum

Group

3,977,806

0.8

124,022

Verizon

Communications,

Inc.

5,499,135

1.1

8,571

Visa,

Inc.

-

Class

A

2,700,551

0.6

4,554

Watts

Water

Technologies,

Inc.

-

Class

A

982,708

0.2

79,802

Wells

Fargo

&

Co.

6,078,518

1.2

143,725

Wendy's

Co.

2,638,791

0.5

8,178

Xcel

Energy,

Inc.

593,396

0.1

341,354,216

69.9

Total

Common

Stock

(Cost

$391,617,243)

475,888,270

97.4

EXCHANGE-TRADED

FUNDS

:

0.4%

9,312

iShares

MSCI

EAFE

Value

ETF

509,832

0.1

6,599

iShares

Russell

1000

Value

ETF

1,318,415

0.3

1,828,247

0.4

Total

Exchange-Traded

Funds

(Cost

$1,573,579)

1,828,247

0.4

PREFERRED

STOCK

:

0.6%

Germany

:

0.6%

24,886

Henkel

AG

&

Co.

KGaA

2,123,844

0.4

21,025

Porsche

Automobil

Holding

SE

772,015

0.2

2,895,859

0.6

Total

Preferred

Stock

(Cost

$3,219,369)

2,895,859

0.6

Total

Long-Term

Investments

(Cost

$396,410,191)

480,612,376

98.4

PORTFOLIO

OF

INVESTMENTS

as

of

November

30,

2024

(Unaudited)

(continued)

Voya

Global

Equity

Dividend

and

Premium

Opportunity

Fund

Shares

RA

Value

Percentage

of

Net

Assets

SHORT-TERM

INVESTMENTS

:

0.7%

Mutual

Funds

:

0.7%

3,256,000

(2)

BlackRock

Liquidity

Funds,

FedFund,

Institutional

Class,

4.530%

(Cost

$3,256,000)

$

3,256,000

0.7

Total

Short-Term

Investments

(Cost

$3,256,000)

$

3,256,000

0.7

Total

Investments

in

Securities

(Cost

$399,666,191)

$

483,868,376

99.1

Assets

in

Excess

of

Other

Liabilities

4,401,066

0.9

Net

Assets

$

488,269,442

100.0

(1)

Securities

with

purchases

pursuant

to

Rule

144A

or

section

4(a)(2),

under

the

Securities

Act

of

1933

and

may

not

be

resold

subject

to

that

rule

except

to

qualified

institutional

buyers.

(2)

Rate

shown

is

the

7-day

yield

as

of

November

30,

2024.

Sector

Diversification

Percentage

of

Net

Assets

Financials

23.1

%

Health

Care

13.7

Industrials

13.2

Consumer

Staples

9.2

Energy

8.3

Information

Technology

6.4

Utilities

6.3

Communication

Services

5.5

Consumer

Discretionary

4.5

Real

Estate

4.1

Materials

3.7

Exchange-Traded

Funds

0.4

Short-Term

Investments

0.7

Assets

in

Excess

of

Other

Liabilities

0.9

Net

Assets

100.0%

Portfolio

holdings

are

subject

to

change

daily.

PORTFOLIO

OF

INVESTMENTS

as

of

November

30,

2024

(Unaudited)

(continued)

Voya

Global

Equity

Dividend

and

Premium

Opportunity

Fund

Fair

Value

Measurements

The

following

is

a

summary

of

the

fair

valuations

according

to

the

inputs

used

as

of

November

30,

2024

in

valuing

the

assets

and

liabilities:

Quoted

Prices

in

Active

Markets

for

Identical

Investments

(Level

1)

Significant

Other

Observable

Inputs

#

(Level

2)

Significant

Unobservable

Inputs

(Level

3)

Fair

Value

at

November

30,

2024

Asset

Table

Investments,

at

fair

value

Common

Stock

Australia

$

—

$

9,362,014

$

—

$

9,362,014

Bermuda

3,062,877

—

—

3,062,877

Canada

18,063,566

—

—

18,063,566

Denmark

—

3,742,913

—

3,742,913

France

—

9,154,790

—

9,154,790

Germany

—

8,160,328

—

8,160,328

Hong

Kong

711,722

3,982,809

—

4,694,531

Ireland

489,211

—

—

489,211

Israel

—

1,093,113

—

1,093,113

Italy

—

7,114,803

—

7,114,803

Japan

—

22,842,365

—

22,842,365

Netherlands

1,899,629

3,713,818

—

5,613,447

Norway

1,126,794

1,964,909

—

3,091,703

Singapore

—

3,975,756

—

3,975,756

Spain

—

7,050,231

—

7,050,231

Sweden

1,190,409

1,697,344

—

2,887,753

Switzerland

—

8,601,013

—

8,601,013

United

Kingdom

—

15,533,640

—

15,533,640

United

States

341,354,216

—

—

341,354,216

Total

Common

Stock

367,898,424

107,989,846

—

475,888,270

Exchange-Traded

Funds

1,828,247

—

—

1,828,247

Preferred

Stock

2,123,844

772,015

—

2,895,859

Short-Term

Investments

3,256,000

—

—

3,256,000

Total

Investments,

at

fair

value

$

375,106,515

$

108,761,861

$

—

$

483,868,376

Other

Financial

Instruments+

Forward

Foreign

Currency

Contracts

—

2,783,016

—

2,783,016

Total

Assets

$

375,106,515

$

111,544,877

$

—

$

486,651,392

Liabilities

Table

Other

Financial

Instruments+

Written

Options

$

—

$

(10,187,117)

$

—

$

(10,187,117)

Total

Liabilities

$

—

$

(10,187,117)

$

—

$

(10,187,117)

#

The

earlier

close

of

the

foreign

markets

gives

rise

to

the

possibility

that

significant

events,

including

broad

market

moves,

may

have

occurred

in

the

interim

and

may

materially

affect

the

value

of

those

securities.

To

account

for

this,

the

Fund

may

frequently

value

many

of

its

foreign

equity

securities

using

fair

value

prices

based

on

third

party

vendor

modeling

tools

to

the

extent

available.

Accordingly,

a

portion

of

the

Fund’s

investments

are

categorized

as

Level

2

investments.

+

Other

Financial

Instruments

may

include

open

forward

foreign

currency

contracts,

futures,

centrally

cleared

swaps,

OTC

swaps

and

written

options.

Forward

foreign

currency

contracts,

futures

and

centrally

cleared

swaps

are

fair

valued

at

the

unrealized

appreciation

(depreciation)

on

the

instrument.

OTC

swaps

and

written

options

are

valued

at

the

fair

value

of

the

instrument.

At

November

30,

2024,

the

following

forward

foreign

currency

contracts

were

outstanding

for

Voya

Global

Equity

Dividend

and

Premium

Opportunity

Fund:

Currency

Purchased

Currency

Sold

Counterparty

Settlement

Date

Unrealized

Appreciation

(Depreciation)

USD

12,520,750

JPY

1,742,300,000

Brown

Brothers

Harriman

&

Co.

12/17/24

$

850,201

USD

8,139,546

GBP

6,200,000

Brown

Brothers

Harriman

&

Co.

12/17/24

250,448

USD

4,566,262

AUD

6,800,000

Morgan

Stanley

&

Co.

International

PLC

12/17/24

130,382

USD

21,690,644

EUR

19,500,000

Standard

Chartered

Bank

12/17/24

1,070,740

USD

8,846,528

CAD

12,000,000

State

Street

Bank

and

Trust

Co.

12/17/24

270,535

PORTFOLIO

OF

INVESTMENTS

as

of

November

30,

2024

(Unaudited)

(continued)

Voya

Global

Equity

Dividend

and

Premium

Opportunity

Fund

Currency

Purchased

Currency

Sold

Counterparty

Settlement

Date

Unrealized

Appreciation

(Depreciation)

USD

4,645,477

CHF

3,900,000

State

Street

Bank

and

Trust

Co.

12/17/24

$

210,710

$

2,783,016

At

November

30,

2024,

the

following

OTC

written

equity

options

were

outstanding

for

Voya

Global

Equity

Dividend

and

Premium

Opportunity

Fund:

Description

Counterparty

Put/

Call

Expiration

Date

Exercise

Price

Number

of

Contracts

Notional

Amount

Premiums

Received

Fair

Value

Consumer

Staples

Select

Sector

SPDR

Fund

JPMorgan

Chase

Bank

N.A.

Call

01/10/25

USD

83.630

371,981

USD

30,956,259

$

267,975

$

(385,087)

Financial

Select

Sector

SPDR

Fund

Citibank

N.A.

Call

12/13/24

USD

47.110

1,713,122

USD

87,951,684

1,861,650

(7,419,214)

FTSE

100

Index

Morgan

Stanley

&

Co.

International

PLC

Call

12/27/24

GBP

8,144.250

5,010

GBP

41,519,373

540,446

(1,326,561)

Health

Care

Select

Sector

SPDR

Fund

UBS

AG

Call

12/13/24

USD

149.220

150,940

USD

22,250,065

389,576

(93,720)

Industrial

Select

Sector

SPDR

Fund

Royal

Bank

of

Canada

Call

01/10/25

USD

144.610

277,273

USD

39,924,539

536,357

(779,780)

Nikkei

225

Index

BNP

Paribas

Call

12/27/24

JPY

39,029.340

56,726

JPY

2,167,388,710

319,777

(182,755)

$

3,915,781

$

(10,187,117)

Currency

Abbreviations:

AUD

—

Australian

Dollar

CAD

—

Canadian

Dollar

CHF

—

Swiss

Franc

EUR

—

EU

Euro

GBP

—

British

Pound

JPY

—

Japanese

Yen

USD

—

United

States

Dollar

Net

unrealized

appreciation

consisted

of:

Gross

Unrealized

Appreciation

$

95,368,318

Gross

Unrealized

Depreciation

(11,166,133)

Net

Unrealized

Appreciation

$

84,202,185

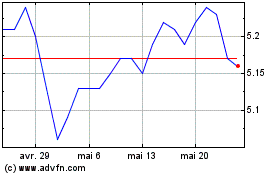

Voya Global Equity Divid... (NYSE:IGD)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Voya Global Equity Divid... (NYSE:IGD)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025