Global Medicine Spending to Reach $2.3 Trillion by 2028 as More Patients Get Access to Better Therapies, Says IQVIA Institute Report

17 Janvier 2024 - 12:00PM

Business Wire

- Growth outlook is raised by 2 percentage points despite lower

expectations for COVID-19 vaccines and therapeutics

- This increase in growth outlook is driven by more patients

getting treated with better medicines, especially in immunology,

endocrinology, and oncology

- Medicine use in Latin America and Asia will grow faster than

other regions over the next five years

- Global use of medicines grew by 14% over the past five years

and a further 12% increase is expected through 2028, bringing

annual use to 3.8 trillion defined daily doses

- Global spending on medicine using list prices grew by 35% over

the past five years and is forecast to increase by 38% through

2028

- The updated outlook for the U.S. market, using estimated net

prices, is being raised by 3 percentage points to 2-5% CAGR through

2028, reflecting higher recent growth and expected further

increased patient use of higher value therapies

Global spending and demand for medicines will increase over the

next five years to approximately $2.3 trillion by 2028 as more

patients get access to new and better medicines, according to a new

report from the IQVIA Institute for Human Data Science titled, “The

Global Use of Medicines 2024 – Outlook through 2028.”

This updated projection raises the growth outlook by two

percentage points despite lower expectations for COVID-19 vaccines

and therapeutics. Overall, global use and spending on medicines is

exceeding pre-pandemic growth rates and is expected to continue

significantly above these trends through 2028.

“The continued growth in spending is driven by an increase in

the volume of medicines, which reflects that more patients globally

are getting access to novel medicines with better clinical

outcomes,” said Murray Aitken, senior vice president and executive

director of the IQVIA Institute for Human Data Science. “Global

health systems have demonstrated remarkable resilience in the face

of the pandemic, global inflation and regional conflicts, and have

moved forward to adopt novel therapies and increase usage

overall.”

A few key highlights of the report include:

- Therapy area drivers of medicine use: The volume use of

medicine for specific therapy areas has been growing since 2018,

with notably high growth in immunology, endocrinology and oncology.

These areas of increasing usage have been driven by novel

therapies, some first launched several years ago, with their wider

adoption having a larger impact than new medicines. In immunology,

per capita utilization of products and the type of products used

varies across developed countries, with nearly half of immunology

biologic volume facing biosimilar competition, leading to increased

use. In endocrinology, GLP-1 agonists have seen rapid uptake

in both diabetes and obesity, predominantly in the U.S. and other

developed markets, raising expectations for future growth with

these weight loss breakthroughs. Oncology has seen higher growth in

developing regions since 2018, driven by expanded access to

traditional chemotherapy, while wealthier countries have been

increasing the use of novel targeted therapies.

- Lower expectations for COVID-19 vaccines and

therapeutics: COVID-19 continues to have an impact on

pharmaceutical markets globally, but at a level much lower than

previously estimated. The lower level of vaccinations seen to date

and expected through 2028 have resulted in a $200 billion reduction

in the eight-year cumulative spending estimates. Countries around

the world are now narrowing their priority focus to

immuno-comprimised and elderly patients and planning fewer booster

shots. As many countries are vaccinating at rates below their

pre-pandemic trend, millions are left less protected from

preventable diseases.

- Spending and growth by regions and key countries: The

global medicine market — using list price levels — is expected to

grow at 5–8% CAGR through 2028, reaching about $2.3 trillion in

total market size. It is expected that manufacturer net sales will

be lower than this due to the impact of confidential rebates,

government mandated discounts, and clawbacks. In the U.S. and

EU4+UK, list-price growth is projected at 6-9% and 4-7%,

respectively, while historic data suggest net payer spending will

be about 2-5% for both. Spending and volume growth will follow

diverging trends by region. The U.S. market, on a net price basis,

is forecast to grow 2-5% CAGR through 2028, an upward adjustment

from the prior five-year forecast of -1–2% CAGR. This reflects the

improved outlook for novel medicines and the expected early impact

from the Inflation Reduction Act. Spending in the five major

European countries is expected to increase by $70 billion through

2028, driven by new brands. Latin America, Eastern Europe, and

countries in Asia are expected to return to steady growth,

outpacing the global market. Japan spending growth is projected to

grow -1 to 2% through 2028 as robust brand growth is offset by a

shift to annual price cuts.

- Spending in key therapy areas: Oncology and obesity lead

growth while immunology spending has slowed due to biosimilar

availability and uptake. Many other classes will grow in mid-single

digits. Demand for innovative oncology drugs will drive spending in

this area to about $440 billion by 2028, more than double the

current level, as broader and longer use of therapies – including

100 new drugs expected to be launched during that time – propels a

larger share of drug budgets to this area. Global obesity spending

is projected to grow 24-27% CAGR, reaching $74 billion in 2028 – up

from $24 billion in 2023 – with some scenarios resulting in much

higher or lower spending based on countries’ reimbursement

decisions, which are evolving rapidly. Immunology growth will slow

significantly to 2-5% through 2028 with the arrival of new

biosimilars and even with robust volume growth. New therapies in

rare neurological disorders, Alzheimer’s and migraine are expected

to drive spending growth in neurology.

- Global biotech: Biotech will represent 39% of spending

globally and will include both breakthrough cell and gene therapies

as well as a maturing biosimilar segment. The spending on global

biotech is expected to exceed $892 billion by 2028, with growth

slowing to 9.5-12.5% from biosimilar savings. Specialty medicines

will represent about 43% of global spending in 2028 and 55% of

total spending in leading developed markets. The outlook for

next-generation biotherapeutics includes significantly uncertain

clinical and commercial successes. Cell and gene therapies register

high growth rates driven by wider usage and as many as 50 new

therapies over five years, but the high range of scenarios would

have them represent 1.5% of global spending in 2028.

About the IQVIA Institute for Human Data Science

The IQVIA Institute for Human Data Science contributes to the

advancement of human health globally through timely research,

insightful analysis and scientific expertise applied to granular

non-identified patient-level data.

Fulfilling an essential need within healthcare, the Institute

delivers objective, relevant insights and research that accelerate

understanding and innovation critical to sound decision making and

improved human outcomes. With access to IQVIA’s institutional

knowledge, advanced analytics, technology and unparalleled data,

the Institute works in tandem with a broad set of healthcare

stakeholders to drive a research agenda focused on Human Data

Science, including government agencies, academic institutions, the

life sciences industry, and payers. More information about the

IQVIA Institute can be found at www.IQVIAInstitute.org.

About IQVIA

IQVIA (NYSE:IQV) is a leading global provider of advanced

analytics, technology solutions, and clinical research services to

the life sciences industry. IQVIA creates intelligent connections

across all aspects of healthcare through its analytics,

transformative technology, big data resources and extensive domain

expertise. IQVIA Connected Intelligence™ delivers powerful insights

with speed and agility — enabling customers to accelerate the

clinical development and commercialization of innovative medical

treatments that improve healthcare outcomes for patients. With

approximately 87,000 employees, IQVIA conducts operations in more

than 100 countries.

IQVIA is a global leader in protecting individual patient

privacy. The company uses a wide variety of privacy-enhancing

technologies and safeguards to protect individual privacy while

generating and analyzing information on a scale that helps

healthcare stakeholders identify disease patterns and correlate

with the precise treatment path and therapy needed for better

outcomes. IQVIA’s insights and execution capabilities help biotech,

medical device and pharmaceutical companies, medical researchers,

government agencies, payers and other healthcare stakeholders tap

into a deeper understanding of diseases, human behavior and

scientific advances, in an effort to advance their path toward

cures. To learn more, visit www.iqvia.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240117016673/en/

Nick Childs, IQVIA Investor Relations (Nchilds@us.imshealth.com)

+1.973.316.3828

Trent Brown, IQVIA Media Relations (trent.brown@iqvia.com)

+1.919.780.3221

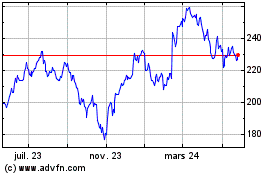

IQVIA (NYSE:IQV)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

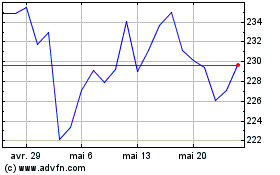

IQVIA (NYSE:IQV)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024