Johnson & Johnson Announces that its Subsidiary, Red River Talc LLC, has Filed a Voluntary Prepackaged Chapter 11 Case to Resolve All Current and Future Ovarian Cancer Talc Claims

20 Septembre 2024 - 9:43PM

Business Wire

Approximately 83% of Current Claimants and the Future Claims

Representative Support the Proposed Bankruptcy Plan

Red River Increased its Settlement Commitment by $1.75 Billion

to Approximately $8 Billion

Johnson & Johnson (NYSE: JNJ) (the “Company”) announced that

its subsidiary, Red River Talc LLC (“Red River”), filed a voluntary

prepackaged Chapter 11 bankruptcy case today in the U.S. Bankruptcy

Court for the Southern District of Texas (the “Bankruptcy Court”)

to fully and finally resolve all current and future claims related

to ovarian cancer arising from cosmetic talc litigation against the

Company and its affiliates in the United States.

Red River filed the bankruptcy case after it received the

support of the overwhelming majority (approximately 83%) of current

claimants for the proposed bankruptcy plan (the “Plan”).

- The support far exceeds the 75% approval threshold required by

the U.S. Bankruptcy Code to secure confirmation of the Plan.

- The Plan is also supported by the Future Claims Representative,

an attorney representing the future claimants.

“The overwhelming support for the Plan demonstrates the

Company’s extensive, good-faith efforts to resolve this litigation

for the benefit of all stakeholders,” said Erik Haas, Worldwide

Vice President of Litigation, Johnson & Johnson. “This Plan is

fair and equitable to all parties and, therefore, should be

expeditiously confirmed by the Bankruptcy Court.”

After extensive negotiations with counsel for claimants who

initially opposed the Plan, Red River agreed to increase its

contribution to the settlement by $1.75 billion to approximately $8

billion.

- Red River agreed to commit an additional $1.1 billion to the

bankruptcy trust for distribution to claimants.

- The Company backed Red River’s commitments and also agreed to

contribute an additional $650 million to resolve the claims for

legal fees and expenses sought by plaintiffs’ counsel for their

leadership roles in the multi-district litigation, where most of

the filed ovarian claims are pending.

- In aggregate, the contemplated settlement represents a present

value of approximately $8 billion to be paid over 25 years,

totaling approximately $10 billion nominal.

The Plan is in the best interests of the ovarian

claimants.

- The Plan constitutes one of the largest settlements ever

reached in a mass tort bankruptcy case.

- The Plan affords claimants a far better recovery than they

stand to recover at trial. Most ovarian claimants have not

recovered and will not recover anything at trial. Indeed, the

Company has prevailed in approximately 95% of ovarian cases tried

to date, including every ovarian case tried over the last six

years. In addition, based on the historical run rate, it would take

decades to litigate the remaining cases, and therefore, most

claimants will never have “their day in court.”

- Counsel representing the overwhelming majority of current

ovarian claimants assisted in the development of and support the

Plan.

The Plan enables a full and final resolution of the Company’s

ovarian talc litigation.

- The Plan would resolve 99.75% of all pending talc lawsuits

against Johnson & Johnson and its affiliates in the United

States.

- The 0.25% remaining pending talc lawsuits relate to

mesothelioma and are being addressed outside of the Plan; the

Company has already resolved 95% of mesothelioma lawsuits filed to

date.

- The Company previously reached settlement agreements to resolve

the State consumer protection claims and all talc-related claims

against it in the bankruptcy cases filed by suppliers of the

Company’s talc (Imerys Talc America, Inc., Cyprus Mines

Corporation, and their related parties).

The Company reiterates that none of the talc-related claims

against it have merit. The claims are premised on allegations that

have been rejected by independent experts, as well as governmental

and regulatory bodies, for decades. Additional information on the

Company’s position and the science supporting the safety of talc is

available at www.FactsAboutTalc.com.

Court filings and information about Red River’s Chapter 11 case

are available on a separate website administered by its claims

agent, Epiq, at https://dm.epiq11.com/RedRiverTalc.

About Johnson & Johnson

At Johnson & Johnson, we believe health is everything. Our

strength in healthcare innovation empowers us to build a world

where complex diseases are prevented, treated, and cured, where

treatments are smarter and less invasive, and solutions are

personal. Through our expertise in Innovative Medicine and MedTech,

we are uniquely positioned to innovate across the full spectrum of

healthcare solutions today to deliver the breakthroughs of

tomorrow, and profoundly impact health for humanity. Learn more at

https://www.jnj.com.

Cautions Concerning Forward-Looking Statement

This press release contains “forward-looking statements” as

defined in the Private Securities Litigation Reform Act of 1995

regarding the proposed prepackaged Chapter 11 bankruptcy plan. The

reader is cautioned not to rely on these forward-looking

statements. The information contained in this press release is for

informational purposes only and should not be construed as a

commitment by the Company to engage in any specific strategy or

course of action. Due to the inherent uncertainty of litigation,

the Company cannot predict the timing, ultimate outcome or

financial impact of this matter, or any other ongoing or future

litigation. The forward-looking statements in this press release

are based on current expectations of future events. If underlying

assumptions prove inaccurate or known or unknown risks or

uncertainties materialize, actual results could vary materially

from the expectations and projections of LLT Management LLC, Red

River Talc LLC and/or Johnson & Johnson. A further list and

descriptions of these risks, uncertainties and other factors can be

found in Johnson & Johnson’s Annual Report on Form 10-K for the

fiscal year ended December 31, 2023, including in the sections

captioned “Cautionary Note Regarding Forward-Looking Statements”

and “Item 1A. Risk Factors,” and in Johnson & Johnson’s

subsequent Quarterly Reports on Form 10-Q and other filings with

the Securities and Exchange Commission. Copies of these filings are

available online at www.sec.gov, www.jnj.com or on request from

Johnson & Johnson. Any forward-looking statement made in this

release speaks only as of the date of this release. None of LLT

Management LLC, Red River Talc LLC nor Johnson & Johnson

undertakes to update any forward-looking statement as a result of

new information or future events or developments. The Company

expressly disclaims all liability in respect to actions taken or

not taken based on any or all the contents of this press

release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240920786746/en/

Media: media-relations@its.jnj.com

Investors: investor-relations@its.jnj.com

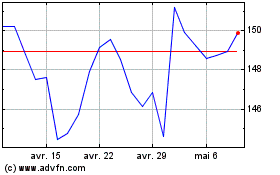

Johnson and Johnson (NYSE:JNJ)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

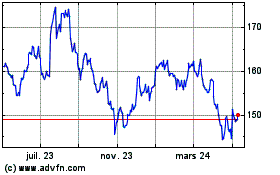

Johnson and Johnson (NYSE:JNJ)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024