0000200406false00002004062024-09-202024-09-200000200406us-gaap:CommonStockMember2024-09-202024-09-200000200406jnj:A5.50NotesDue2024Member2024-09-202024-09-200000200406jnj:A1.150NotesDueNovember2028Member2024-09-202024-09-200000200406jnj:A3.20NotesDueNovember2032Member2024-09-202024-09-200000200406jnj:A1.650NotesDue2035Member2024-09-202024-09-200000200406jnj:A3.350NotesDueNovember2036Member2024-09-202024-09-200000200406jnj:A3.550NotesDueNovember2044Member2024-09-202024-09-20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The

Securities Exchange Act of 1934

Date of report (Date of earliest event reported):

September 20, 2024

Johnson & Johnson

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| New Jersey | 1-3215 | 22-1024240 |

(State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

One Johnson & Johnson Plaza, New Brunswick, New Jersey 08933

(Address of Principal Executive Offices)

(Zip Code)

Registrant's telephone number, including area code:

732-524-0400

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, Par Value $1.00 | JNJ | New York Stock Exchange |

| 5.50% Notes Due November 2024 | JNJ24BP | New York Stock Exchange |

| 1.150% Notes Due November 2028 | JNJ28 | New York Stock Exchange |

| 3.20% Notes Due November 2032 | JNJ32 | New York Stock Exchange |

| 1.650% Notes Due May 2035 | JNJ35 | New York Stock Exchange |

| 3.350% Notes Due November 2036 | JNJ36A | New York Stock Exchange |

| 3.550% Notes Due November 2044 | JNJ44 | New York Stock Exchange |

Item 7.01 Regulation FD Disclosure

On September 20, 2024, the Company announced that its subsidiary, Red River Talc LLC (“Red River”), filed a voluntary prepackaged Chapter 11 bankruptcy case today in the in U.S. Bankruptcy Court for the Southern District of Texas Houston Division to fully and finally resolve of all current and future claims related to ovarian cancer arising from cosmetic talc litigation against the Company and its affiliates in the United States. Red River filed the bankruptcy case after it received the support of the overwhelming majority (approximately 83%) of the current claimants for the proposed bankruptcy plan (the “Plan”). After extensive negotiations with counsel for claimants who initially opposed the Plan, Red River agreed to increase its contribution to the settlement by $1.75 billion to a present value of approximately $8 billion.

The press release further discussing this announcement is attached below as Exhibit 99.1.

Item 9.01 Financial statements and exhibits

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description of Exhibit |

| | |

| 104 | | The cover page from this Current Report on Form 8-K, formatted in Inline XBRL. |

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| JOHNSON & JOHNSON |

| (Registrant) |

| |

| By: | /s/ Robert J. Decker, Jr. |

| Robert J. Decker, Jr. Controller (Principal Accounting Officer) |

Exhibit 99.1

| | | | | | | | |

| Media contact:

media-relations@its.jnj.com | Investor contact:

investor-relations@its.jnj.com |

For Immediate Release

Johnson & Johnson Announces that its Subsidiary, Red River Talc LLC, has Filed a Voluntary Prepackaged Chapter 11 Case to Resolve All Current and Future Ovarian Cancer Talc Claims

Approximately 83% of Current Claimants and the Future Claims Representative Support the Proposed Bankruptcy Plan

Red River Increased its Settlement Commitment by $1.75 Billion to Approximately $8 Billion

NEW BRUNSWICK, N.J. – Sept. 20, 2024 – Johnson & Johnson (NYSE: JNJ) (the “Company”) announced that its subsidiary, Red River Talc LLC (“Red River”), filed a voluntary prepackaged Chapter 11 bankruptcy case today in the U.S. Bankruptcy Court for the Southern District of Texas (the “Bankruptcy Court”) to fully and finally resolve all current and future claims related to ovarian cancer arising from cosmetic talc litigation against the Company and its affiliates in the United States.

Red River filed the bankruptcy case after it received the support of the overwhelming majority (approximately 83%) of current claimants for the proposed bankruptcy plan (the “Plan”).

•The support far exceeds the 75% approval threshold required by the U.S. Bankruptcy Code to secure confirmation of the Plan.

•The Plan is also supported by the Future Claims Representative, an attorney representing the future claimants.

“The overwhelming support for the Plan demonstrates the Company’s extensive, good-faith efforts to resolve this litigation for the benefit of all stakeholders,” said Erik Haas, Worldwide Vice President of Litigation, Johnson & Johnson. “This Plan is fair and equitable to all parties and, therefore, should be expeditiously confirmed by the Bankruptcy Court.”

After extensive negotiations with counsel for claimants who initially opposed the Plan, Red River agreed to increase its contribution to the settlement by $1.75 billion to approximately $8 billion.

•Red River agreed to commit an additional $1.1 billion to the bankruptcy trust for distribution to claimants.

•The Company backed Red River’s commitments and also agreed to contribute an additional $650 million to resolve the claims for legal fees and expenses sought by plaintiffs’ counsel for their leadership roles in the multi-district litigation, where most of the filed ovarian claims are pending.

•In aggregate, the contemplated settlement represents a present value of approximately $8 billion to be paid over 25 years, totaling approximately $10 billion nominal.

The Plan is in the best interests of the ovarian claimants.

•The Plan constitutes one of the largest settlements ever reached in a mass tort bankruptcy case.

•The Plan affords claimants a far better recovery than they stand to recover at trial. Most ovarian claimants have not recovered and will not recover anything at trial. Indeed, the Company has prevailed in approximately 95% of ovarian cases tried to date, including every ovarian case tried over the last six years. In addition, based on the historical run rate, it would take decades to litigate the remaining cases, and therefore, most claimants will never have “their day in court.”

•Counsel representing the overwhelming majority of current ovarian claimants assisted in the development of and support the Plan.

Exhibit 99.1

| | | | | | | | |

| Media contact:

media-relations@its.jnj.com | Investor contact:

investor-relations@its.jnj.com |

The Plan enables a full and final resolution of the Company’s ovarian talc litigation.

•The Plan would resolve 99.75% of all pending talc lawsuits against Johnson & Johnson and its affiliates in the United States.

•The 0.25% remaining pending talc lawsuits relate to mesothelioma and are being addressed outside of the Plan; the Company has already resolved 95% of mesothelioma lawsuits filed to date.

•The Company previously reached settlement agreements to resolve the State consumer protection claims and all talc-related claims against it in the bankruptcy cases filed by suppliers of the Company’s talc (Imerys Talc America, Inc., Cyprus Mines Corporation, and their related parties).

The Company reiterates that none of the talc-related claims against it have merit. The claims are premised on allegations that have been rejected by independent experts, as well as governmental and regulatory bodies, for decades. Additional information on the Company’s position and the science supporting the safety of talc is available at www.FactsAboutTalc.com.

Court filings and information about Red River’s Chapter 11 case are available on a separate website administered by its claims agent, Epiq, at https://dm.epiq11.com/RedRiverTalc.

About Johnson & Johnson

At Johnson & Johnson, we believe health is everything. Our strength in healthcare innovation empowers us to build a world where complex diseases are prevented, treated, and cured, where treatments are smarter and less invasive, and solutions are personal. Through our expertise in Innovative Medicine and MedTech, we are uniquely positioned to innovate across the full spectrum of healthcare solutions today to deliver the breakthroughs of tomorrow, and profoundly impact health for humanity. Learn more at https://www.jnj.com.

Cautions Concerning Forward-Looking Statement

This press release contains “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995 regarding the proposed prepackaged Chapter 11 bankruptcy plan. The reader is cautioned not to rely on these forward-looking statements. The information contained in this press release is for informational purposes only and should not be construed as a commitment by the Company to engage in any specific strategy or course of action. Due to the inherent uncertainty of litigation, the Company cannot predict the timing, ultimate outcome or financial impact of this matter, or any other ongoing or future litigation. The forward-looking statements in this press release are based on current expectations of future events. If underlying assumptions prove inaccurate or known or unknown risks or uncertainties materialize, actual results could vary materially from the expectations and projections of LLT Management LLC, Red River Talc LLC and/or Johnson & Johnson. A further list and descriptions of these risks, uncertainties and other factors can be found in Johnson & Johnson’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023, including in the sections captioned “Cautionary Note Regarding Forward-Looking Statements” and “Item 1A. Risk Factors,” and in Johnson & Johnson’s subsequent Quarterly Reports on Form 10-Q and other filings with the Securities and Exchange Commission. Copies of these filings are available online at www.sec.gov, www.jnj.com or on request from Johnson & Johnson. Any forward-looking statement made in this release speaks only as of the date of this release. None of LLT Management LLC, Red River Talc LLC nor Johnson & Johnson undertakes to update any forward-looking statement as a result of new information or future events or developments. The Company expressly disclaims all liability in respect to actions taken or not taken based on any or all the contents of this press release.

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=jnj_A5.50NotesDue2024Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=jnj_A1.150NotesDueNovember2028Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=jnj_A1.650NotesDue2035Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=jnj_A3.20NotesDueNovember2032Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=jnj_A3.350NotesDueNovember2036Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=jnj_A3.550NotesDueNovember2044Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

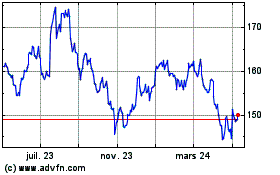

Johnson and Johnson (NYSE:JNJ)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

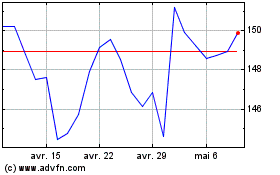

Johnson and Johnson (NYSE:JNJ)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025