Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

26 Décembre 2024 - 4:42PM

Edgar (US Regulatory)

Portfolio

of

Investments

October

31,

2024

JPC

(Unaudited)

PRINCIPAL

/

SHARES

DESCRIPTION

RATE

MATURITY

VALUE

LONG-TERM

INVESTMENTS

-

158.9%

(99.5%

of

Total

Investments)

2222448164

$1,000

PAR

(OR

SIMILAR)

INSTITUTIONAL

PREFERRED

-

85.8%

(53.8%

of

Total

Investments)

2222448164

AUTOMOBILES

&

COMPONENTS

-

0.9%

(0.5%

of

Total

Investments)

$

14,869,000

(a)

General

Motors

Financial

Co

Inc

5.750

%

N/A

$

14,407,563

8,014,000

(a)

General

Motors

Financial

Co

Inc

5.700

N/A

7,734,297

TOTAL

AUTOMOBILES

&

COMPONENTS

22,141,860

BANKS

-

35.1%

(22.0%

of

Total

Investments)

10,850,000

(a)

Bank

of

America

Corp

4.375

N/A

10,450,739

4,450,000

(a)

Bank

of

America

Corp

6.300

N/A

4,510,124

6,955,000

(a)

Bank

of

America

Corp

6.100

N/A

6,945,954

45,134,000

(a)

Bank

of

America

Corp

6.125

N/A

45,845,488

743,000

Bank

of

Montreal

7.300

11/26/84

773,366

8,080,000

Bank

of

Montreal

7.700

05/26/84

8,450,403

3,000,000

(a)

Bank

of

Nova

Scotia/The

4.900

N/A

2,972,225

9,650,000

(b)

Bank

of

Nova

Scotia/The

8.000

01/27/84

10,195,283

10,550,000

Bank

of

Nova

Scotia/The

8.625

10/27/82

11,301,424

27,500,000

(a),(c)

Citigroup

Inc

3.875

N/A

26,577,645

7,175,000

(a)

Citigroup

Inc

7.375

N/A

7,502,445

14,589,000

(a)

Citigroup

Inc

5.950

N/A

14,536,572

22,389,000

(a),(c)

Citigroup

Inc

6.250

N/A

22,657,467

19,799,000

(a)

Citigroup

Inc

4.000

N/A

19,266,734

32,448,000

(a)

Citigroup

Inc

7.625

N/A

34,525,209

33,702,000

(a)

Citigroup

Inc

7.125

N/A

34,625,030

16,219,000

(a)

Citigroup

Inc

7.000

N/A

17,164,876

10,740,000

(a)

Citigroup

Inc

4.150

N/A

10,272,094

7,000,000

(a),(d)

Citizens

Financial

Group

Inc

(TSFR3M

+

3.265%)

7.854

N/A

6,961,369

5,529,000

(a),(d)

Citizens

Financial

Group

Inc

(TSFR3M

+

3.419%)

8.008

N/A

5,495,157

3,976,000

(a)

Citizens

Financial

Group

Inc

5.650

N/A

3,940,270

9,515,000

(a)

Citizens

Financial

Group

Inc

4.000

N/A

9,018,824

14,700,000

(a)

CoBank

ACB

6.450

N/A

14,764,930

17,983,000

(a)

CoBank

ACB

6.250

N/A

17,912,791

5,800,000

(d),(e)

Corestates

Capital

III

(TSFR3M

+

0.832%)

5.950

02/15/27

5,713,336

6,450,000

(a),(b),(e)

Farm

Credit

Bank

of

Texas

6.200

N/A

6,353,250

3,060,000

(a),(e)

Farm

Credit

Bank

of

Texas

5.700

N/A

3,029,279

16,256,000

(a),(d)

Fifth

Third

Bancorp

(TSFR3M

+

3.295%)

7.898

N/A

16,190,233

1,225,000

(a)

Fifth

Third

Bancorp

4.500

N/A

1,206,646

18,714,000

(a),(d)

First

Citizens

BancShares

Inc

/NC

(TSFR3M

+

4.234%)

9.180

N/A

19,087,999

910,000

(a)

Goldman

Sachs

Group

Inc

/The

4.400

N/A

898,763

20,300,000

(a)

Huntington

Bancshares

Inc

/OH

5.625

N/A

20,216,902

25,000,000

(a)

Huntington

Bancshares

Inc

/OH

4.450

N/A

23,901,915

13,830,000

(a)

JPMorgan

Chase

&

Co

3.650

N/A

13,385,028

59,179,000

(a)

JPMorgan

Chase

&

Co

6.875

N/A

62,533,325

3,600,000

(b)

JPMorgan

Chase

&

Co

8.750

09/01/30

4,287,899

2,800,000

(a)

KeyCorp

5.000

N/A

2,691,448

8,000,000

KeyCorp

Capital

III

7.750

07/15/29

8,282,253

2,395,000

(a)

M&T

Bank

Corp

5.125

N/A

2,358,568

2,000,000

(b),(d)

M&T

Bank

Corp

(TSFR3M

+

1.262%)

5.918

01/15/27

1,938,720

5,960,000

(a)

M&T

Bank

Corp

3.500

N/A

5,422,461

34,335,000

(a),(c)

PNC

Financial

Services

Group

Inc

/The

6.250

N/A

34,372,631

6,605,000

(a)

PNC

Financial

Services

Group

Inc

/The

6.000

N/A

6,612,219

9,520,000

(a)

PNC

Financial

Services

Group

Inc

/The

3.400

N/A

8,775,031

18,235,000

(a)

PNC

Financial

Services

Group

Inc

/The

6.200

N/A

18,387,390

2,923,000

(a)

PNC

Financial

Services

Group

Inc

/The

5.000

N/A

2,887,089

15,580,000

(a),(c),(d)

PNC

Financial

Services

Group

Inc

/The

(TSFR3M

+

3.302%)

8.317

N/A

15,617,875

5,855,000

(a)

Regions

Financial

Corp

5.750

N/A

5,836,426

32,700,000

Toronto-Dominion

Bank/The

8.125

10/31/82

34,454,519

52,724,000

(a),(c)

Truist

Financial

Corp

6.669

N/A

52,442,475

16,800,000

(a),(c)

Truist

Financial

Corp

4.950

N/A

16,604,611

6,687,000

(a)

Truist

Financial

Corp

5.100

N/A

6,490,677

8,955,000

(a),(d)

Truist

Financial

Corp

(TSFR3M

+

3.364%)

8.310

N/A

8,959,907

Portfolio

of

Investments

October

31,

2024

(continued)

JPC

PRINCIPAL/

SHARES

DESCRIPTION

RATE

MATURITY

VALUE

BANKS

(continued)

$

4,465,000

(a)

US

Bancorp

5.300

%

N/A

$

4,408,834

7,295,000

(a)

Wells

Fargo

&

Co

7.625

N/A

7,840,622

36,460,000

(a)

Wells

Fargo

&

Co

6.850

N/A

37,590,734

20,133,000

(a),(c)

Wells

Fargo

&

Co

5.875

N/A

20,085,891

47,516,000

(a)

Wells

Fargo

&

Co

3.900

N/A

46,018,424

24,770,000

(b)

Wells

Fargo

&

Co

7.950

11/15/29

27,895,594

10,021,000

(a),(d)

Zions

Bancorp

NA

(3-Month

LIBOR

+

4.440%)

9.648

N/A

9,917,228

TOTAL

BANKS

909,362,621

CAPITAL

GOODS

-

2.1%

(1.3%

of

Total

Investments)

18,093,000

(b),(e)

AerCap

Global

Aviation

Trust

6.500

06/15/45

18,074,265

9,254,000

(a)

Air

Lease

Corp

6.000

N/A

9,114,825

13,660,000

(a)

Air

Lease

Corp

4.650

N/A

13,247,842

4,837,000

(a)

Air

Lease

Corp

4.125

N/A

4,542,404

1,960,000

(e)

ILFC

E-Capital

Trust

I

6.565

12/21/65

1,566,107

8,474,000

(e)

ILFC

E-Capital

Trust

I

6.815

12/21/65

6,809,749

TOTAL

CAPITAL

GOODS

53,355,192

ENERGY

-

5.5%

(3.5%

of

Total

Investments)

2,798,000

Enbridge

Inc

5.500

07/15/77

2,714,199

17,110,000

(b)

Enbridge

Inc

7.625

01/15/83

18,135,830

1,695,000

Enbridge

Inc

6.000

01/15/77

1,677,487

22,395,000

(b)

Enbridge

Inc

5.750

07/15/80

21,765,833

33,706,000

(b)

Enbridge

Inc

8.500

01/15/84

37,448,748

6,615,000

(a)

Energy

Transfer

LP

6.500

N/A

6,594,145

4,990,000

(b)

Energy

Transfer

LP

8.000

05/15/54

5,287,379

2,550,000

(a)

Energy

Transfer

LP

6.625

N/A

2,496,140

18,259,000

(a)

Energy

Transfer

LP

7.125

N/A

18,560,456

7,362,000

(e)

South

Bow

Canadian

Infrastructure

Holdings

Ltd

7.500

03/01/55

7,645,717

3,490,000

(b)

Transcanada

Trust

5.875

08/15/76

3,477,457

2,468,000

Transcanada

Trust

5.500

09/15/79

2,370,830

16,135,000

Transcanada

Trust

5.600

03/07/82

15,401,863

TOTAL

ENERGY

143,576,084

FINANCIAL

SERVICES

-

16.4%

(10.3%

of

Total

Investments)

22,551,000

(b)

AerCap

Ireland

Capital

DAC

/

AerCap

Global

Aviation

Trust

6.950

03/10/55

23,245,612

14,240,000

(a)

Ally

Financial

Inc

4.700

N/A

11,553,481

12,644,000

(a)

Ally

Financial

Inc

4.700

N/A

11,374,746

4,875,000

(a),(e)

American

AgCredit

Corp

5.250

N/A

4,753,125

30,903,000

(a)

American

Express

Co

3.550

N/A

29,251,142

14,778,000

(a)

Bank

of

New

York

Mellon

Corp/The

4.700

N/A

14,653,569

22,600,000

(a)

Bank

of

New

York

Mellon

Corp/The

3.750

N/A

21,322,616

3,015,000

(a),(e)

Capital

Farm

Credit

ACA

5.000

N/A

2,909,478

17,115,000

(a)

Capital

One

Financial

Corp

3.950

N/A

16,106,299

41,640,000

(a),(c)

Charles

Schwab

Corp/The

4.000

N/A

39,961,797

30,020,000

(a)

Charles

Schwab

Corp/The

5.375

N/A

29,864,869

1,350,000

(a),(e)

Compeer

Financial

ACA

4.875

N/A

1,296,000

3,989,000

Corebridge

Financial

Inc

6.875

12/15/52

4,082,992

1,610,000

(a)

Discover

Financial

Services

5.500

N/A

1,536,400

13,510,000

(a)

Discover

Financial

Services

6.125

N/A

13,472,812

8,100,000

(a),(c)

Equitable

Holdings

Inc

4.950

N/A

8,011,285

8,120,000

(a)

Goldman

Sachs

Group

Inc

/The

5.300

N/A

8,086,791

25,062,000

(a)

Goldman

Sachs

Group

Inc

/The

6.125

N/A

24,857,886

925,000

(a)

Goldman

Sachs

Group

Inc

/The

3.800

N/A

885,715

7,600,000

(a)

Goldman

Sachs

Group

Inc

/The

4.950

N/A

7,553,957

28,394,000

(a)

Goldman

Sachs

Group

Inc

/The

7.500

N/A

29,772,486

27,937,000

(a),(c)

Goldman

Sachs

Group

Inc

/The

7.379

N/A

28,048,050

1,915,000

(a)

Goldman

Sachs

Group

Inc

/The

4.125

N/A

1,833,719

32,355,000

(a)

Goldman

Sachs

Group

Inc

/The

7.500

N/A

34,591,863

11,500,000

(a)

Goldman

Sachs

Group

Inc

/The

3.650

N/A

10,945,531

16,795,000

(a)

State

Street

Corp

6.700

N/A

17,290,688

27,956,000

(a),(c)

Voya

Financial

Inc

7.758

N/A

29,497,214

TOTAL

FINANCIAL

SERVICES

426,760,123

PRINCIPAL/

SHARES

DESCRIPTION

RATE

MATURITY

VALUE

FOOD,

BEVERAGE

&

TOBACCO

-

2.3%

(1.5%

of

Total

Investments)

$

10,855,000

(a),(c),(e)

Dairy

Farmers

of

America

Inc

7.125

%

N/A

$

10,312,250

16,840,000

(a),(e)

Land

O'

Lakes

Inc

7.250

N/A

14,213,073

9,260,000

(a),(e)

Land

O'

Lakes

Inc

7.000

N/A

7,523,353

30,110,000

(a),(c),(e)

Land

O'

Lakes

Inc

8.000

N/A

27,927,025

TOTAL

FOOD,

BEVERAGE

&

TOBACCO

59,975,701

INSURANCE

-

14.0%

(8.7%

of

Total

Investments)

1,895,000

Aegon

Ltd

5.500

04/11/48

1,874,352

9,010,000

(b)

American

International

Group

Inc

5.750

04/01/48

8,988,706

17,894,000

(b)

Assurant

Inc

7.000

03/27/48

18,196,404

14,909,000

(b),(e)

Assured

Guaranty

Municipal

Holdings

Inc

6.400

12/15/66

13,626,551

3,725,000

(b)

AXIS

Specialty

Finance

LLC

4.900

01/15/40

3,540,801

19,473,000

(b)

Corebridge

Financial

Inc

6.375

09/15/54

19,388,555

5,695,000

(b)

Enstar

Finance

LLC

5.750

09/01/40

5,597,985

14,208,000

Enstar

Finance

LLC

5.500

01/15/42

13,319,956

19,860,000

(b),(e)

Liberty

Mutual

Group

Inc

7.800

03/15/37

22,045,922

23,055,000

(a)

Markel

Group

Inc

6.000

N/A

23,017,377

20,900,000

(b),(c),(e)

MetLife

Inc

7.875

12/15/37

22,960,426

15,160,000

(a)

MetLife

Inc

3.850

N/A

14,835,063

2,215,000

(a)

MetLife

Inc

5.875

N/A

2,227,889

43,519,000

(b),(e)

MetLife

Inc

9.250

04/08/38

51,581,156

3,000,000

MetLife

Inc

10.750

08/01/39

4,163,718

31,538,000

(b)

Nationwide

Financial

Services

Inc

6.750

05/15/37

32,284,504

13,185,000

(b)

PartnerRe

Finance

B

LLC

4.500

10/01/50

12,057,572

8,238,000

Provident

Financing

Trust

I

7.405

03/15/38

8,864,397

7,770,000

Prudential

Financial

Inc

6.500

03/15/54

8,104,864

2,890,000

(c)

Prudential

Financial

Inc

5.125

03/01/52

2,792,790

3,000,000

(c)

Prudential

Financial

Inc

6.000

09/01/52

3,046,368

7,370,000

Prudential

Financial

Inc

3.700

10/01/50

6,685,925

4,156,000

Prudential

Financial

Inc

5.375

05/15/45

4,130,321

3,900,000

(a),(e)

QBE

Insurance

Group

Ltd

5.875

N/A

3,885,861

34,725,000

QBE

Insurance

Group

Ltd,

Reg

S

6.750

12/02/44

34,775,837

11,975,000

(a),(b),(e)

SBL

Holdings

Inc

7.000

N/A

10,832,739

10,440,000

(a),(e)

SBL

Holdings

Inc

6.500

N/A

8,973,912

TOTAL

INSURANCE

361,799,951

MEDIA

&

ENTERTAINMENT

-

0.4%

(0.3%

of

Total

Investments)

7,694,000

(a),(e)

Farm

Credit

Bank

of

Texas

7.750

N/A

8,055,156

4,065,000

Paramount

Global

6.375

03/30/62

3,763,409

TOTAL

MEDIA

&

ENTERTAINMENT

11,818,565

REAL

ESTATE

MANAGEMENT

&

DEVELOPMENT

-

0.4%

(0.3%

of

Total

Investments)

10,092,000

(e)

EUSHI

Finance

Inc

7.625

12/15/54

10,449,731

TOTAL

REAL

ESTATE

MANAGEMENT

&

DEVELOPMENT

10,449,731

TELECOMMUNICATION

SERVICES

-

1.1%

(0.7%

of

Total

Investments)

2,315,000

Vodafone

Group

PLC

4.125

06/04/81

2,081,806

24,020,000

(b)

Vodafone

Group

PLC

7.000

04/04/79

25,158,836

TOTAL

TELECOMMUNICATION

SERVICES

27,240,642

UTILITIES

-

7.6%

(4.7%

of

Total

Investments)

4,975,000

(b),(e)

AES

Andes

SA

8.150

06/10/55

5,081,146

5,020,000

(e)

AES

Andes

SA

6.350

10/07/79

4,988,368

5,916,000

AES

Corp/The

7.600

01/15/55

6,131,113

6,156,000

(e)

AltaGas

Ltd

7.200

10/15/54

6,171,316

10,915,000

(b)

American

Electric

Power

Co

Inc

3.875

02/15/62

10,297,016

1,285,000

CMS

Energy

Corp

4.750

06/01/50

1,235,957

16,200,000

CMS

Energy

Corp

3.750

12/01/50

14,182,013

6,029,000

Dominion

Energy

Inc

7.000

06/01/54

6,414,862

7,337,000

Duke

Energy

Corp

6.450

09/01/54

7,457,121

4,680,000

(a)

Edison

International

5.000

N/A

4,555,010

1,155,000

(a)

Edison

International

5.375

N/A

1,143,500

41,756,000

(b)

Emera

Inc

6.750

06/15/76

41,807,485

16,384,000

(b)

Entergy

Corp

7.125

12/01/54

16,750,657

13,706,000

NextEra

Energy

Capital

Holdings

Inc

6.750

06/15/54

14,352,019

Portfolio

of

Investments

October

31,

2024

(continued)

JPC

PRINCIPAL/

SHARES

DESCRIPTION

RATE

MATURITY

VALUE

UTILITIES

(continued)

$

4,658,000

PG&E

Corp

7.375

%

03/15/55

$

4,811,332

13,190,000

(a)

Sempra

4.875

N/A

13,079,121

8,976,000

Sempra

4.125

04/01/52

8,513,854

6,440,000

(c)

Southern

Co/The

4.000

01/15/51

6,304,212

7,365,000

(a),(e)

Vistra

Corp

8.875

N/A

7,861,254

1,745,000

(a),(e)

Vistra

Corp

7.000

N/A

1,759,740

12,725,000

(a),(e)

Vistra

Corp

8.000

N/A

13,070,598

TOTAL

UTILITIES

195,967,694

TOTAL

$1,000

PAR

(OR

SIMILAR)

INSTITUTIONAL

PREFERRED

(Cost

$2,200,190,413)

2,222,448,164

SHARES

DESCRIPTION

RATE

VALUE

369688357

$25

PAR

(OR

SIMILAR)

RETAIL

PREFERRED

-

14.3%

(8.9%

of

Total

Investments)

369688357

BANKS

-

2.7%

(1.7%

of

Total

Investments)

107,564

CoBank

ACB

6.200

10,675,716

304,913

Fifth

Third

Bancorp

9.296

7,830,166

825,668

KeyCorp

6

.125

21,013,251

659,461

KeyCorp

6.200

16,453,552

517,064

Regions

Financial

Corp

5.700

12,998,989

TOTAL

BANKS

68,971,674

CAPITAL

GOODS

-

0.2%

(0.1%

of

Total

Investments)

218,500

WESCO

International

Inc

10.625

5,681,000

TOTAL

CAPITAL

GOODS

5,681,000

EQUITY

REAL

ESTATE

INVESTMENT

TRUSTS

(REITS)

-

0.2%

(0.1%

of

Total

Investments)

85,181

Prologis

Inc

8.540

4,984,255

TOTAL

EQUITY

REAL

ESTATE

INVESTMENT

TRUSTS

(REITS)

4,984,255

FINANCIAL

SERVICES

-

4.3%

(2.7%

of

Total

Investments)

146,670

Capital

One

Financial

Corp

5.000

3,037,536

145,721

Equitable

Holdings

Inc

4.300

2,777,442

381,058

Equitable

Holdings

Inc

5.250

8,760,523

116,785

Morgan

Stanley

6.375

2,967,507

842,201

Morgan

Stanley

5.850

21,198,199

79,400

Morgan

Stanley

6.500

2,072,340

746,004

Morgan

Stanley

6.875

18,873,901

631,349

Morgan

Stanley

7.125

15,985,757

774,375

Morgan

Stanley

6.625

20,443,500

144,314

Synchrony

Financial

5.625

2,981,527

494,554

Voya

Financial

Inc

5.350

12,655,637

TOTAL

FINANCIAL

SERVICES

111,753,869

FOOD,

BEVERAGE

&

TOBACCO

-

1.6%

(1.0%

of

Total

Investments)

577,198

CHS

Inc

7.100

14,937,884

117,770

CHS

Inc

7.875

3,136,215

711,041

CHS

Inc

6.750

18,017,779

56,400

(b),(e)

Dairy

Farmers

of

America

Inc

7.875

5,350,069

TOTAL

FOOD,

BEVERAGE

&

TOBACCO

41,441,947

INSURANCE

-

4.5%

(2.8%

of

Total

Investments)

334,249

American

National

Group

Inc

6.625

8,486,582

753,900

American

National

Group

Inc

5.950

18,937,968

462,365

Aspen

Insurance

Holdings

Ltd

8.915

12,248,049

124,080

Aspen

Insurance

Holdings

Ltd

5.625

2,556,048

96,786

Assurant

Inc

5.250

2,174,781

621,947

Athene

Holding

Ltd

6.375

15,635,748

206,658

Athene

Holding

Ltd

7.750

5,536,368

876,205

Athene

Holding

Ltd

6.350

21,966,459

80,000

Axis

Capital

Holdings

Ltd

5.500

1,785,600

63,400

Delphi

Financial

Group

Inc

8.570

1,550,130

342,645

Enstar

Group

Ltd

7.000

7,329,177

219,645

Maiden

Holdings

North

America

Ltd

7.750

4,206,202

300,532

Reinsurance

Group

of

America

Inc

5.750

7,489,257

207,319

Reinsurance

Group

of

America

Inc

7.125

5,522,978

SHARES

DESCRIPTION

RATE

VALUE

INSURANCE

(continued)

88,536

Selective

Insurance

Group

Inc

4.600

%

$

1,735,306

TOTAL

INSURANCE

117,160,653

TELECOMMUNICATION

SERVICES

-

0.6%

(0.4%

of

Total

Investments)

20,680

AT&T

Inc

5.000

448,756

686,314

AT&T

Inc

4.750

14,138,068

TOTAL

TELECOMMUNICATION

SERVICES

14,586,824

UTILITIES

-

0.2%

(0.1%

of

Total

Investments)

204,489

NextEra

Energy

Capital

Holdings

Inc

5.650

5,108,135

TOTAL

UTILITIES

5,108,135

TOTAL

$25

PAR

(OR

SIMILAR)

RETAIL

PREFERRED

(Cost

$372,994,657)

369,688,357

SHARES

DESCRIPTION

VALUE

5,211

COMMON

STOCKS

-

0.0%

(0.0%

of

Total

Investments)

5,211

MATERIALS

-

0.0%

(0.0%

of

Total

Investments)

60

LyondellBasell

Industries

NV,

Class

A

5,211

TOTAL

MATERIALS

5,211

TOTAL

COMMON

STOCKS

(Cost

$0)

5,211

PRINCIPAL

DESCRIPTION

(f)

RATE

MATURITY

VALUE

1417606518

CONTINGENT

CAPITAL

SECURITIES

-

54.8%

(34.3%

of

Total

Investments)

1417606518

BANKS

-

45.7%

(28.7%

of

Total

Investments)

$

4,825,000

(a),(c),(e)

Australia

&

New

Zealand

Banking

Group

Ltd/United

Kingdom

6.750

N/A

4,889,216

20,615,000

(a)

Banco

Bilbao

Vizcaya

Argentaria

SA

6.500

N/A

20,619,453

34,227,000

(a)

Banco

Bilbao

Vizcaya

Argentaria

SA

9.375

N/A

37,059,900

17,520,000

(a)

Banco

Bilbao

Vizcaya

Argentaria

SA

6.125

N/A

16,909,102

5,440,000

(a),(b),(e)

Banco

Mercantil

del

Norte

SA/Grand

Cayman

7.500

N/A

5,350,253

3,120,000

(a),(b),(e)

Banco

Mercantil

del

Norte

SA/Grand

Cayman

7.625

N/A

3,095,803

35,600,000

(a)

Banco

Santander

SA

8.000

N/A

37,087,724

9,505,000

(a)

Banco

Santander

SA

4.750

N/A

9,005,143

44,600,000

(a)

Banco

Santander

SA

9.625

N/A

51,363,947

30,085,000

(a)

Barclays

PLC

8.000

N/A

31,096,097

14,778,000

(a)

Barclays

PLC

6.125

N/A

14,697,144

76,877,000

(a)

Barclays

PLC

9.625

N/A

84,593,836

33,437,000

(a),(c),(e)

BNP

Paribas

SA

8.500

N/A

34,912,355

10,656,000

(a),(b),(e)

BNP

Paribas

SA

7.375

N/A

10,752,096

38,609,000

(a),(e)

BNP

Paribas

SA

8.000

N/A

40,149,345

28,795,000

(a),(e)

BNP

Paribas

SA

9.250

N/A

31,055,782

47,851,000

(a),(c),(e)

BNP

Paribas

SA

7.750

N/A

49,556,170

7,595,000

(a),(e)

BNP

Paribas

SA

7.000

N/A

7,561,050

45,870,000

(a),(e)

Credit

Agricole

SA

8.125

N/A

47,055,739

37,831,000

(a),(e)

Credit

Agricole

SA

6.700

N/A

36,771,032

4,466,000

(a),(b)

Credit

Agricole

SA,

Reg

S

8.125

N/A

4,581,446

42,501,000

(a),(b)

HSBC

Holdings

PLC

6.950

N/A

42,323,090

20,269,000

(a)

HSBC

Holdings

PLC

6.875

N/A

20,354,900

39,405,000

(a)

HSBC

Holdings

PLC

8

.000

N/A

41,346,011

24,533,000

(a)

HSBC

Holdings

PLC

6.375

N/A

24,534,570

10,713,000

(a)

HSBC

Holdings

PLC

6.500

N/A

10,671,363

36,120,000

(a)

HSBC

Holdings

PLC

6.000

N/A

35,711,075

30,760,000

(a)

ING

Groep

NV

5.750

N/A

30,411,606

36,830,000

(a)

ING

Groep

NV

6.500

N/A

36,851,325

16,750,000

(a)

ING

Groep

NV,

Reg

S

7.500

N/A

17,150,325

32,590,000

(a),(e)

Intesa

Sanpaolo

SpA

7.700

N/A

32,544,281

21,165,000

(a)

Lloyds

Banking

Group

PLC

7.500

N/A

21,345,089

8,293,000

(a)

Lloyds

Banking

Group

PLC

6.750

N/A

7,952,312

44,473,000

(a)

Lloyds

Banking

Group

PLC

8.000

N/A

46,347,937

9,005,000

(a),(e)

Macquarie

Bank

Ltd/London

6.125

N/A

9,058,931

34,286,000

(a)

NatWest

Group

PLC

8.125

N/A

36,739,643

23,805,000

(a),(b)

NatWest

Group

PLC

8.000

N/A

24,106,014

Portfolio

of

Investments

October

31,

2024

(continued)

JPC

PRINCIPAL

DESCRIPTION

(f)

RATE

MATURITY

VALUE

BANKS

(continued)

$

24,664,000

(a)

NatWest

Group

PLC

6.000

%

N/A

$

24,614,756

12,501,000

(a),(e)

Nordea

Bank

Abp

6.625

N/A

12,563,633

17,000,000

(a),(e)

Nordea

Bank

Abp

6.300

N/A

16,253,814

40,236,000

(a),(e)

Societe

Generale

SA

8.000

N/A

40,771,461

33,667,000

(a),(e)

Societe

Generale

SA

10.000

N/A

35,873,333

8,430,000

(a),(e)

Societe

Generale

SA

8.500

N/A

8,431,268

14,545,000

(a),(e)

Societe

Generale

SA

9.375

N/A

15,212,034

3,046,000

(a),(e)

Standard

Chartered

PLC

6.000

N/A

3,040,048

7,585,000

(a),(e)

Standard

Chartered

PLC

7.750

N/A

7,801,408

TOTAL

BANKS

1,180,172,860

FINANCIAL

SERVICES

-

8.7%

(5.4%

of

Total

Investments)

9,200,000

(a)

Deutsche

Bank

AG,

Reg

S

4.789

N/A

8,967,010

24,200,000

(a)

Deutsche

Bank

AG

7.500

N/A

24,167,855

30,215,000

(a),(c)

Deutsche

Bank

AG

6.000

N/A

29,536,015

46,572,000

(a),(e)

UBS

Group

AG

9.250

N/A

53,920,736

13,310,000

(a),(e)

UBS

Group

AG

7.750

N/A

13,953,924

18,000,000

(a),(b),(e)

UBS

Group

AG

4.875

N/A

17,070,280

23,385,000

(a),(e)

UBS

Group

AG

9.250

N/A

25,482,377

13,675,000

(a)

UBS

Group

AG,

Reg

S

7.000

N/A

13,689,550

41,023,000

(a)

UBS

Group

AG,

Reg

S

6.875

N/A

41,094,380

TOTAL

FINANCIAL

SERVICES

227,882,127

INSURANCE

-

0.4%

(0.2%

of

Total

Investments)

9,243,000

(a)

Phoenix

Group

Holdings

PLC,

Reg

S

8.500

N/A

9,551,531

TOTAL

INSURANCE

9,551,531

TOTAL

CONTINGENT

CAPITAL

SECURITIES

(Cost

$1,384,577,336)

1,417,606,518

SHARES

DESCRIPTION

RATE

VALUE

21979096

CONVERTIBLE

PREFERRED

SECURITIES

-

0.8%

(0.5%

of

Total

Investments)

21979096

BANKS

-

0.8%

(0.5%

of

Total

Investments)

5,849

Bank

of

America

Corp

7.250

7,223,515

11,949

Wells

Fargo

&

Co

7.500

14,755,581

TOTAL

BANKS

21,979,096

TOTAL

CONVERTIBLE

PREFERRED

SECURITIES

(Cost

$24,885,225)

21,979,096

PRINCIPAL

DESCRIPTION

RATE

MATURITY

VALUE

77898115

CORPORATE

BONDS

-

3.0%

(1.9%

of

Total

Investments)

77898115

BANKS

-

1.0%

(0.6%

of

Total

Investments)

24,100,000

(a),(c),(e)

Standard

Chartered

PLC

7.014

N/A

25,624,205

TOTAL

BANKS

25,624,205

ENERGY

-

0.1%

(0.0%

of

Total

Investments)

1,900,000

(c)

Enbridge

Inc

8.250

01/15/84

2,007,023

TOTAL

ENERGY

2,007,023

EQUITY

REAL

ESTATE

INVESTMENT

TRUSTS

(REITS)

-

0.6%

(0.4%

of

Total

Investments)

16,100,000

(e)

Scentre

Group

Trust

2

5.125

09/24/80

15,782,402

TOTAL

EQUITY

REAL

ESTATE

INVESTMENT

TRUSTS

(REITS)

15,782,402

FINANCIAL

SERVICES

-

0.7%

(0.5%

of

Total

Investments)

10,229,000

(g)

Credit

Suisse

Group

AG

7.250

03/12/72

1,201,907

9,090,000

(g)

Credit

Suisse

Group

AG

6.380

02/21/72

1,068,075

8,455,000

(g)

Credit

Suisse

Group

AG

7.500

01/17/72

993,462

18,750,000

(g)

Credit

Suisse

Group

AG

0.000

01/17/72

2,203,125

13,505,000

(g)

Credit

Suisse

Group

AG

7.500

06/11/72

1,586,838

12,800,000

(e)

Scentre

Group

Trust

2

4.750

09/24/80

12,666,714

TOTAL

FINANCIAL

SERVICES

19,720,121

Investments

in

Derivatives

Part

F

of

Form

N-PORT

was

prepared

in

accordance

with

U.S.

generally

accepted

accounting

principles

(“U.S.

GAAP”)

and

in

conformity

with

the

applicable

rules

and

regulations

of

the

U.S.

Securities

and

Exchange

Commission

(“SEC”)

related

to

interim

filings.

Part

F

of

Form

N-PORT

does

not

include

all

information

and

footnotes

required

by

U.S.

GAAP

for

complete

financial

statements.

Certain

footnote

disclosures

normally

included

in

financial

statements

prepared

in

accordance

with

U.S.

GAAP

have

been

condensed

or

omitted

from

this

report

pursuant

to

the

rules

of

the

SEC.

For

PRINCIPAL

DESCRIPTION

RATE

MATURITY

VALUE

INSURANCE

-

0.6%

(0.4%

of

Total

Investments)

$

2,670,000

(e)

Fidelis

Insurance

Holdings

Ltd

6.625

%

04/01/41

$

2,627,842

6,150,000

(b),(e)

Liberty

Mutual

Insurance

Co

7.697

10/15/97

7,127,152

5,000,000

QBE

Insurance

Group

Ltd,

Reg

S

5.875

06/17/46

5,009,370

TOTAL

INSURANCE

14,764,364

TOTAL

CORPORATE

BONDS

(Cost

$130,139,657)

77,898,115

PRINCIPAL

DESCRIPTION

RATE

MATURITY

VALUE

5,074,526

U.S.

GOVERNMENT

AND

AGENCY

OBLIGATIONS

-

0.2%

(0.1%

of

Total

Investments)

5,074,526

4,883,000

CoBank

ACB

7.250

07/01/73

5,074,526

TOTAL

U.S.

GOVERNMENT

AND

AGENCY

OBLIGATIONS

(Cost

$4,883,000)

5,074,526

TOTAL

LONG-TERM

INVESTMENTS

(Cost

$4,117,670,288)

4,114,699,987

PRINCIPAL

DESCRIPTION

RATE

MATURITY

VALUE

SHORT-TERM

INVESTMENTS

-

0.8% (0.5%

of

Total

Investments)

20,058,564

REPURCHASE

AGREEMENTS

-

0.8%

(0.5%

of

Total

Investments)

20,058,564

20,058,564

(h)

Fixed

Income

Clearing

Corporation

1.520

11/01/24

20,058,564

TOTAL

REPURCHASE

AGREEMENTS

(Cost

$20,058,564)

20,058,564

TOTAL

SHORT-TERM

INVESTMENTS

(Cost

$20,058,564)

20,058,564

TOTAL

INVESTMENTS

-

159.7%

(Cost

$4,137,728,852

)

4,134,758,551

BORROWINGS

-

(26.6)%

(

i

),(j)

(689,000,000)

REVERSE

REPURCHASE

AGREEMENTS,

INCLUDING

ACCRUED

INTEREST

-

(18.2)%(k)

(

471,489,203)

TFP

SHARES,

NET

-

(16.2)%(l)

(418,504,422)

OTHER

ASSETS

&

LIABILITIES,

NET

- 1.3%

32,716,618

NET

ASSETS

APPLICABLE

TO

COMMON

SHARES

-

100%

$

2,588,481,544

Futures

Contracts

-

Long

Description

Number

of

Contracts

Expiration

Date

Notional

Amount

Value

Unrealized

Appreciation

(Depreciation)

U.S.

Treasury

10-Year

Note

1,747

12/24

$

199,759,064

$

192,988,906

$

(6,770,158)

U.S.

Treasury

Ultra

Bond

142

12/24

19,093,869

17,838,750

(1,255,119)

Total

$218,852,933

$210,827,656

$(8,025,277)

Interest

Rate

Swaps

-

OTC

Uncleared

Counterparty

Notional

Amount

Fund

Pay/Receive

Floating

Rate

Floating

Rate

Index

Fixed

Rate

(Annualized)

Fixed

Rate

Payment

Frequency

Effective

Date

(m)

Optional

Termination

Date

Maturity

Date

Value

Unrealized

Appreciation

(Depreciation)

Morgan

Stanley

Capital

Services,

LLC

$

798,500,000

Receive

1-Month

LIBOR

1.994%

Monthly

6/01/18

7/01/25

7/01/27

$

12,410,982

$

12,410,982

Morgan

Stanley

Capital

Services,

LLC

138,000,000

Receive

1-Month

LIBOR

2.364%

Monthly

7/01/19

7/01/26

7/01/28

3,503,723

3,503,723

Total

$

15,914,705

Portfolio

of

Investments

October

31,

2024

(continued)

JPC

a

full

set

of

the

Fund’s

notes

to

financial

statements,

please

refer

to

the

Fund’s

most

recently

filed

annual

or

semi-annual

report.

Fair

Value

Measurements

The

Fund’s

investments

in

securities

are

recorded

at

their

estimated

fair

value

utilizing

valuation

methods

approved

by

the

Board

of

Directors/

Trustees.

Fair

value

is

defined

as

the

price

that

would

be

received

upon

selling

an

investment

or

transferring

a

liability

in

an

orderly

transaction

to

an

independent

buyer

in

the

principal

or

most

advantageous

market

for

the

investment.

U.S.

GAAP

establishes

the

three-tier

hierarchy

which

is

used

to

maximize

the

use

of

observable

market

data

and

minimize

the

use

of

unobservable

inputs

and

to

establish

classification

of

fair

value

measurements

for

disclosure

purposes.

Observable

inputs

reflect

the

assumptions

market

participants

would

use

in

pricing

the

asset

or

liability.

Observable

inputs

are

based

on

market

data

obtained

from

sources

independent

of

the

reporting

entity.

Unobservable

inputs

reflect

management’s

assumptions

about

the

assumptions

market

participants

would

use

in

pricing

the

asset

or

liability.

Unobservable

inputs

are

based

on

the

best

information

available

in

the

circumstances.

The

following

is

a

summary

of

the

three-tiered

hierarchy

of

valuation

input

levels.

Level

1

–

Inputs

are

unadjusted

and

prices

are

determined

using

quoted

prices

in

active

markets

for

identical

securities.

Level

2

–

Prices

are

determined

using

other

significant

observable

inputs

(including

quoted

prices

for

similar

securities,

interest

rates,

credit

spreads,

etc.).

Level

3

–

Prices

are

determined

using

significant

unobservable

inputs

(including

management’s

assumptions

in

determining

the

fair

value

of

investments).

The

following

table

summarizes

the

market

value

of

the

Fund's

investments

as

of

the

end

of

the

reporting

period,

based

on

the

inputs

used

to

value

them:

Level

1

Level

2

Level

3

Total

Long-Term

Investments:

$1,000

Par

(or

similar)

Institutional

Preferred

$

–

$

2,222,448,164

$

–

$

2,222,448,164

$25

Par

(or

similar)

Retail

Preferred

369,688,357

–

–

369,688,357

Common

Stocks

5,211

–

–

5,211

Contingent

Capital

Securities

–

1,417,606,518

–

1,417,606,518

Convertible

Preferred

Securities

21,979,096

–

–

21,979,096

Corporate

Bonds

–

70,844,708

7,053,407

77,898,115

U.S.

Government

and

Agency

Obligations

–

5,074,526

–

5,074,526

Short-Term

Investments:

Repurchase

Agreements

–

20,058,564

–

20,058,564

Investments

in

Derivatives:

Futures

Contracts*

(8,025,277)

–

–

(8,025,277)

Interest

Rate

Swaps*

–

15,914,705

–

15,914,705

Total

$

383,647,387

$

3,751,947,185

$

7,053,407

$

4,142,647,979

*

Represents

net

unrealized

appreciation

(depreciation).

For

Fund

portfolio

compliance

purposes,

the

Fund’s

industry

classifications

refer

to

any

one

or

more

of

the

industry

sub-classifications

used

by

one

or

more

widely

recognized

market

indexes

or

ratings

group

indexes,

and/or

as

defined

by

Fund

management.

This

definition

may

not

apply

for

purposes

of

this

report,

which

may

combine

industry

sub-classifications

into

sectors

for

reporting

ease.

All

percentages

shown

in

the

Portfolio

of

Investments

are

based

on

net

assets

applicable

to

common

shares

unless

otherwise

noted.

(a)

Perpetual

security.

Maturity

date

is

not

applicable.

(b)

Investment,

or

portion

of

investment,

has

been

pledged

to

collateralize

the

net

payment

obligations

for

investments

in

reverse

repurchase

agreements.

As

of

the

end

of

the

reporting

period,

investments

with

a

value

of

$518,223,327

have

been

pledged

as

collateral

for

reverse

repurchase

agreements.

(c)

Investment,

or

portion

of

investment,

is

hypothecated.

The

total

value

of

investments

hypothecated

as

of

the

end

of

the

reporting

period

was

$402,229,645.

(d)

Variable

rate

security.

The

rate

shown

is

the

coupon

as

of

the

end

of

the

reporting

period.

(e)

Security

is

exempt

from

registration

under

Rule

144A

of

the

Securities

Act

of

1933,

as

amended.

These

securities

are

deemed

liquid

and

may

be

resold

in

transactions

exempt

from

registration,

which

are

normally

those

transactions

with

qualified

institutional

buyers.

As

of

the

end

of

the

reporting

period,

the

aggregate

value

of

these

securities

is

$941,774,636

or

22.8%

of

Total

Investments.

(f)

Contingent

Capital

Securities

(“

CoCos

”)

are

hybrid

securities

with

loss

absorption

characteristics

built

into

the

terms

of

the

security

for

the

benefit

of

the

issuer.

For

example,

the

terms

may

specify

an

automatic

write-down

of

principal

or

a

mandatory

conversion

into

the

issuer’s

common

stock

under

certain

adverse

circumstances,

such

as

the

issuer’s

capital

ratio

falling

below

a

specified

level.

(g)

For

fair

value

measurement

disclosure

purposes,

investment

classified

as

Level

3.

(h)

Agreement

with

Fixed

Income

Clearing

Corporation,

1.520%

dated

10/31/24

to

be

repurchased

at

$20,059,411

on

11/1/24,

collateralized

by

Government

Agency

Securities,

with

coupon

rate

4.000%

and

maturity

date

6/30/28,

valued

at

$20,459,902.

(

i

)

Borrowings

as

a

percentage

of

Total

Investments

is

16.7%.

(j)

The

Fund

may

pledge

up

to

100%

of

its

eligible

investments

(excluding

any

investments

separately

pledged

as

collateral

for

specific

investments

in

derivatives,

when

applicable)

in

the

Portfolio

of

Investments

as

collateral

for

borrowings.

As

of

the

end

of

the

reporting

period,

investments

with

a

value

of

$1,443,720,929

have

been

pledged

as

collateral

for

borrowings.

(k)

Reverse

Repurchase

Agreements,

including

accrued

interest

as

a

percentage

of

Total

investments

is

11.4%.

(l)

TFP

Shares,

Net

as

a

percentage

of

Total

Investments

is

10.1%.

(m)

Effective

date

represents

the

date

on

which

both

the

Fund

and

counterparty

commence

interest

payment

accruals

on

each

contract.

LIBOR

London

Inter-Bank

Offered

Rate

Reg

S

Regulation

S

allows

U.S.

companies

to

sell

securities

to

persons

or

entities

located

outside

of

the

United

States

without

registering

those

securities

with

the

Securities

and

Exchange

Commission.

Specifically,

Regulation

S

provides

a

safe

harbor

from

the

registration

requirements

of

the

Securities

Act

for

the

offers

and

sales

of

securities

by

both

foreign

and

domestic

issuers

that

are

made

outside

the

United

States.

TSFR

3M

CME

Term

Secured

Overnight

Financing

Rate

3

Month

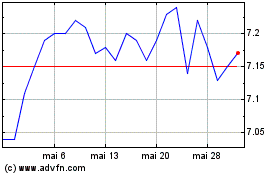

Nuveen Preferred and Inc... (NYSE:JPC)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Nuveen Preferred and Inc... (NYSE:JPC)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025