Nextdoor Reports Fourth Quarter and Full Year 2024 Results

27 Février 2025 - 10:05PM

Business Wire

- Q4 revenue of $65 million, +17% year-over-year; Q4 WAU of 45.9

million, +10% year-over-year

- Q4 GAAP net loss of $12 million; Adjusted EBITDA of $3 million;

Operating Cash Flow of $11 million

- Exceeded 100M Verified Neighbors at year-end 2024

Nextdoor Holdings, Inc. (NYSE: KIND) today announced results for

the fourth quarter and full year ended December 31, 2024.

Nextdoor's highlighted metrics for the fourth quarter ended

December 31, 2024 include:

- Total Weekly Active Users (WAU) of 45.9 million increased 10%

year-over-year.

- Revenue of $65.2 million increased 17% year-over-year.

- Net loss was $12.1 million, compared to $40.5 million in the

year-ago period.

- Adjusted EBITDA was $3.0 million, compared to a $14.0 million

loss in the year-ago period, reflecting 30 percentage points of

year-over-year margin improvement.

Nextdoor's highlighted metrics for the year ended December 31,

2024 include:

- Revenue of $247.3 million increased 13% year-over-year.

- Net loss was $98.1 million, compared to $147.8 million in the

year-ago period.

- Adjusted EBITDA loss was $18.2 million, compared to $74.1

million in the year-ago period.

- Cash, cash equivalents, and marketable securities were $427.0

million as of December 31, 2024.

"Our Q4 results reflect our continued progress and disciplined

approach," said Nextdoor CEO Nirav Tolia. "We delivered positive

quarterly Adjusted EBITDA for the first time as a public company,

supported by continued user growth and improved performance for

advertisers using our Nextdoor Ads Platform."

"We are now making a decisive shift from vision to execution on

NEXT, our complete product transformation. We are encouraged by the

useful early signals we have seen, and excited to deliver these

changes by mid-2025."

For more detailed information on our operating and financial

results for the fourth quarter and full year ended December 31,

2024, as well as our outlook, please reference our Shareholder

Letter posted to our Investor Relations website located at

investors.nextdoor.com.

Three Months Ended December

31,

Year Ended December

31,

(in thousands)

2024

2023

2024

2023

Revenue

$

65,228

$

55,557

$

247,276

$

218,309

Loss from operations

$

(17,097

)

$

(47,654

)

$

(121,639

)

$

(172,284

)

Net loss

$

(12,123

)

$

(40,530

)

$

(98,063

)

$

(147,765

)

Adjusted EBITDA(1)

$

3,043

$

(14,042

)

$

(18,207

)

$

(74,107

)

(1) The following is a reconciliation of net loss, the most

comparable GAAP measure, to adjusted EBITDA for the periods

presented above:

Three Months Ended December

31,

Year Ended December

31,

(in thousands)

2024

2023

2024

2023

Net loss

$

(12,123

)

$

(40,530

)

$

(98,063

)

$

(147,765

)

Depreciation and amortization

591

1,413

3,898

5,769

Stock-based compensation

19,874

22,290

74,055

83,025

Interest income

(5,322

)

(7,145

)

(24,381

)

(25,780

)

Provision for income taxes

23

42

706

756

Restructuring charges

—

9,888

25,578

9,888

Adjusted EBITDA

$

3,043

$

(14,042

)

$

(18,207

)

$

(74,107

)

Nextdoor will host a conference call at 2:00 p.m. PT/5:00 p.m.

ET today to discuss these results and outlook. A live webcast of

our fourth quarter and full year 2024 earnings release call will be

available in the Events & Presentations section of Nextdoor’s

Investor Relations website located at investors.nextdoor.com. After

the live event, the audio recording for the webcast can be accessed

on the same website for approximately one year.

Nextdoor uses its Investor Relations website

(investors.nextdoor.com), its X handle (x.com/Nextdoor), its

LinkedIn Home Page (linkedin.com/company/nextdoor-com), and Nirav

Tolia’s LinkedIn posts (https://www.linkedin.com/in/niravtolia/)

and X posts (https://x.com/niravtolia) as a means of disseminating

or providing notification of, among other things, news or

announcements regarding its business or financial performance,

investor events, press releases, and earnings releases, and as a

means of disclosing material nonpublic information and for

complying with its disclosure obligations under Regulation FD.

Non-GAAP Financial Measures

To supplement our condensed consolidated financial statements,

which are prepared in accordance with GAAP, we present certain

non-GAAP financial measures, such as Adjusted EBITDA, in this press

release. Our use of non-GAAP financial measures has limitations as

an analytical tool, and these measures should not be considered in

isolation or as a substitute for analysis of financial results as

reported under GAAP.

We use non-GAAP financial measures in conjunction with financial

measures prepared in accordance with GAAP for planning purposes,

including in the preparation of our annual operating budget, as a

measure of our core operating results and the effectiveness of our

business strategy, and in evaluating our financial performance.

Non-GAAP financial measures provide consistency and comparability

with past financial performance, facilitate period-to-period

comparisons of core operating results, and also facilitate

comparisons with other peer companies, many of which use similar

non-GAAP financial measures to supplement their GAAP results. In

addition, Adjusted EBITDA is widely used by investors and

securities analysts to measure a company's operating performance.

We exclude the following items from one or more of our non-GAAP

financial measures: stock-based compensation expense (non-cash

expense calculated by companies using a variety of valuation

methodologies and subjective assumptions), depreciation and

amortization (non-cash expense), interest income, provision for

income taxes, and, if applicable, acquisition-related costs.

Investors are cautioned that there are material limitations

associated with the use of non-GAAP financial measures as an

analytical tool. In particular, (1) stock-based compensation

expense has recently been, and will continue to be for the

foreseeable future, a significant recurring expense for our

business and an important part of our compensation strategy, (2)

although depreciation and amortization expense are non-cash

charges, the assets subject to depreciation and amortization may

have to be replaced in the future, and our non-GAAP measures do not

reflect cash capital expenditure requirements for such replacements

or for new capital expenditure requirements, and (3) adjusted

EBITDA does not reflect: (a) changes in, or cash requirements for,

our working capital needs; (b) interest expense, or the cash

requirements necessary to service interest or principal payments on

our debt, which reduces cash available to us; or (c) tax payments

that may represent a reduction in cash available to us. The

non-GAAP measures we use may be different from non-GAAP financial

measures used by other companies, limiting their usefulness for

comparison purposes. We compensate for these limitations by

providing specific information regarding the GAAP items excluded

from these non-GAAP financial measures.

About Nextdoor

Nextdoor (NYSE: KIND) is the essential neighborhood network.

Neighbors, public agencies and businesses use Nextdoor to connect

around local information that matters in more than 340,000

neighborhoods across 11 countries. Nextdoor builds innovative

technology to foster local community, and brands and businesses of

all sizes use Nextdoor’s proprietary advertising platform to engage

with neighborhoods at scale. Download the app and join the

neighborhood at nextdoor.com. For more information and media

assets, visit nextdoor.com/newsroom.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250227754427/en/

Investor Relations:

John T. Williams jwilliams@nextdoor.com ir@nextdoor.com or visit

investors.nextdoor.com

Media Relations: Kelsey Grady Antonia Gray

press@nextdoor.com

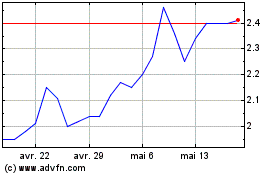

Nextdoor (NYSE:KIND)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

Nextdoor (NYSE:KIND)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025