Syntiant Completes Acquisition of Knowles’ Consumer MEMS Microphone Division

30 Décembre 2024 - 1:18PM

Syntiant Corp., the recognized leader in low power edge AI

deployments, today announced it has completed the acquisition of

Knowles Corporation’s (NYSE: KN) Consumer MEMS Microphones (CMM)

business for $150 million in cash and stock

.

Knowles’ CMM division is an industry-leading manufacturer and

supplier of high performance SiSonicTM micro-electro-mechanical

systems (MEMS) microphones that are essential for voice and audio

applications in smartphones, smart speakers and wearables, among

other market segments, including autos and household

appliances.

“The addition of the Knowles CMM business gives Syntiant a

leadership position in the rapidly growing, multibillion-dollar

MEMS microphone market, while delivering new solutions that combine

cutting-edge sensors, processors and high-performance machine

learning models, redefining the future of AI-enabled audio and

voice interfaces,” said Kurt Busch, CEO of Syntiant. “As large

language models continue to transform industries by enabling

advanced natural language understanding and automation, we are

accelerating the development of next-generation solutions for

autonomous vehicles, smart home devices, industrial automation and

beyond. Moreover, this acquisition brings invaluable talent and

global customer relationships to Syntiant, reinforcing our ability

even further to innovate and scale globally.”

More than 50 million Syntiant Neural Decision Processors (NDPs)

and deep learning models have been deployed worldwide, delivering

highly accurate, artificial intelligence in edge devices with

ultra-low- power consumption. The integration of advanced MEMS

sensors into Syntiant’s existing hardware-software capabilities

provides customers with a total edge AI audio solution that

simplifies product development and accelerates time-to-market,

while remaining scalable, secure and customizable to fit a wide

range of applications.

Knowles’ CMM division generated revenue of approximately $256

million in 2023. The acquisition was financed through a

collaborative effort led by Khazanah Nasional Berhad and Boardman

Bay Capital Management, which provided equity funding, and

Structural Capital, which arranged debt financing.

“The shifting global supply chain and the rising demand for

chips in emerging technologies like AI have created a significant

opportunity for Malaysia to advance in the semiconductor and

advanced manufacturing value chain," said Dato' Amirul Feisal Wan

Zahir, managing director of Khazanah Nasional Berhad. “Khazanah is

committed to supporting Syntiant’s vision for the growth of

Malaysia’s semiconductor ecosystem, while the acquisition aligns

with our goal of fostering technological advancements in the region

and promoting national economic development.”

“We see this acquisition as a pivotal moment that will enable

Syntiant to offer unparalleled innovations in intelligent voice and

audio solutions,” said Will Graves, chief investment officer at

Boardman Bay Capital Management. “Kurt and his team are true

visionaries. Our financial commitment reflects Boardman Bay’s deep

confidence in their ability to drive the future of edge AI.”

“Syntiant’s commitment to innovation aligns perfectly with our

mission to empower innovative companies,” said Kai Tse, chief

investment officer of Structural Capital. “We believe this deal

will accelerate Syntiant’s growth and strengthen its market

presence, while further enhancing its ability to deliver

transformative solutions across a wide range of industries.”

Needham & Company, LLC served as the exclusive financial

advisor to Syntiant and Latham & Watkins LLP served as its

legal advisor.

About Syntiant Founded in 2017 and

headquartered in Irvine, Calif., Syntiant Corp. is a leader in

delivering hardware and software solutions for edge AI deployment.

The company’s purpose-built silicon and ML models are being

deployed globally to power edge AI speech, audio, sensor and vision

applications across a wide range of consumer and industrial use

cases, from earbuds to automobiles. Syntiant is backed by several

of the world’s leading strategic and financial investors including

Intel Capital, Microsoft’s M12, Applied Ventures, Bosch Ventures,

the Amazon Alexa Fund, and Atlantic Bridge Capital. More

information on the company can be found by

visiting www.syntiant.com or by following Syntiant on

Twitter @Syntiantcorp or LinkedIn.

About the Knowles CMM BusinessKnowles' CMM

business designs and manufactures micro-electro-mechanical systems

(MEMS) microphones, known as SiSonicTM, which enable voice control

communications and superior audio recording for customers across

the ear, compute, IoT and smartphone market segments.

About Khazanah Nasional BerhadKhazanah Nasional

Berhad (“Khazanah”) is the sovereign wealth fund of Malaysia

entrusted to deliver sustainable value for Malaysians. In line with

its long-term strategy of Advancing Malaysia, Khazanah aims to

deliver its purpose by investing in catalytic sectors, creating

value through active stewardship, increasing its global presence,

as well as building capacity and vibrant communities for the

benefit of Malaysians. For more information on Khazanah,

visit www.khazanah.com.my/.

About Boardman Bay Capital ManagementBoardman

Bay Capital Management is a specialized asset manager with deep

expertise in the technology sector. Operating since 2012, the firm

draws on decades of experience as both operators and investors in

global technology. Boardman Bay has built a distinctive portfolio

across public and private markets, with a uniquely dedicated

strategy focused on the optical, semiconductor and “hard

technology” companies that are reshaping data centers and global

technology infrastructure. Managing both venture and public equity

funds, Boardman Bay is a trusted partner for technology companies

poised for their next phase of transformational growth.

About Structural CapitalStructural Capital is

an investment firm that provides growth capital loans to venture

capital and private equity-backed companies in technology and major

growth and innovation sectors. The firm provides flexible financing

solutions to high-growth companies seeking a less dilutive source

of flexible capital. Since starting in 2014, Structural Capital has

successfully launched four funds and manages approximately $1

billion of capital commitments. For more information, please

visit www.structuralcapital.com.

Media Contact:

George MediciPondelWilkinson

Inc.gmedici@pondel.com310-279-5968

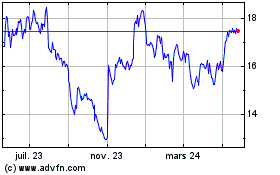

Knowles (NYSE:KN)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

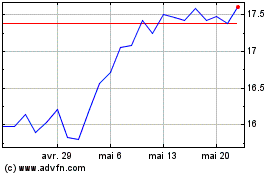

Knowles (NYSE:KN)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025