Kinsale Capital Group, Inc. (NYSE: KNSL) reported net income of

$114.2 million, $4.90 per diluted share, for the third quarter of

2024 compared to $76.1 million, $3.26 per diluted share, for the

third quarter of 2023. Net income included after-tax catastrophe

losses of $10.8 million in the third quarter of 2024 and $0.9

million in the third quarter of 2023. Net income was $305.7

million, $13.10 per diluted share, for the first nine months of

2024 compared to $204.7 million, $8.79 per diluted share, for the

first nine months of 2023. Net income included after-tax

catastrophe losses of $13.9 million in the first nine months of

2024 and $3.3 million in the first nine months of 2023.

Net operating earnings(1) were $97.9 million, $4.20 per diluted

share, for the third quarter of 2024 compared to $77.2 million,

$3.31 per diluted share, for the third quarter of 2023. Net

operating earnings(1) were $267.0 million, $11.44 per diluted

share, for the first nine months of 2024 compared to $201.1

million, $8.63 per diluted share, for the first nine months of

2023.

Highlights for the quarter included:

- Diluted earnings per share increased by 50.3% to $4.90 compared

to the third quarter of 2023

- Diluted operating earnings(1) per share increased by 26.9% to

$4.20 compared to the third quarter of 2023

- Gross written premiums increased by 18.8% to $448.6 million

compared to the third quarter of 2023

- Net investment income increased by 46.4% to $39.6 million

compared to the third quarter of 2023

- Underwriting income(2) was $86.9 million in the third quarter

of 2024, resulting in a combined ratio(5) of 75.7%

- Annualized operating return on equity(7) was 28.2% for the nine

months ended September 30, 2024

“Our third quarter results reflect the continued execution of

our strategy of disciplined underwriting and technology-enabled low

costs. Our reported 75.7% combined ratio includes a modest 3.8

points of net catastrophe losses. Looking ahead, we remain

confident in our ability to drive profitable growth and deliver

long-term value for stockholders,” said Chairman and Chief

Executive Officer, Michael P. Kehoe.

Results of Operations

Underwriting Results

Gross written premiums were $448.6 million for the third quarter

of 2024 compared to $377.8 million for the third quarter of 2023,

an increase of 18.8%. Gross written premiums were $1.4 billion for

the first nine months of 2024 compared to $1.2 billion for the

first nine months of 2023, an increase of 21.6%. The increase in

gross written premiums during the third quarter and first nine

months of 2024 over the same periods last year reflected strong

submission flow from brokers and a favorable, yet increasingly

competitive, pricing environment.

Underwriting income(2) was $86.9 million, resulting in a

combined ratio(5) of 75.7% for the third quarter of 2024, compared

to $72.4 million and a combined ratio(5) of 74.8% for the same

period last year. The increase in underwriting income(2) quarter

over quarter was largely due to combination of premium growth and

lower relative net commissions offset in part by higher catastrophe

losses. Loss(3) and expense(4) ratios were 56.1% and 19.6%,

respectively, for the third quarter of 2024 compared to 53.9% and

20.9% for the third quarter of 2023. Results for the third quarters

of 2024 and 2023 included net favorable development of loss

reserves from prior accident years of $10.1 million, or 2.8 points,

and $9.1 million, or 3.2 points, respectively. The loss ratio for

the third quarter of 2024 included 3.8 points of net catastrophe

losses, primarily related to Hurricanes Helene, Francine and Beryl

and tornadoes in the Midwest. Net catastrophe losses were

negligible for the third quarter of 2023.

Underwriting income(2) was $228.0 million, resulting in a

combined ratio(5) of 77.6% for the first nine months of 2024,

compared to $185.5 million and a combined ratio(5) of 76.7% for the

first nine months of 2023. The increase in underwriting income(2)

was primarily due to a combination of premium growth and lower

relative net commissions offset in part by higher catastrophe

losses. Loss(3) and expense(4) ratios were 57.1% and 20.5%,

respectively, for the first nine months of 2024 compared to 55.5%

and 21.2% for the first nine months of 2023. Results for the first

nine months of 2024 and 2023 included net favorable development of

loss reserves from prior accident years of $28.1 million, or 2.7

points, and $28.6 million, or 3.6 points, respectively. The loss

ratio for the first nine months of 2024 included 1.7 points of net

catastrophe losses, primarily related to Hurricanes Helene,

Francine and Beryl and tornadoes in the Midwest. Net catastrophe

losses were negligible for the first nine months of 2023.

Summary of Operating Results

The Company’s operating results for the three and nine months

ended September 30, 2024 and 2023 are summarized as follows:

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

($ in thousands)

Gross written premiums

$

448,646

$

377,789

$

1,427,060

$

1,173,599

Ceded written premiums

(98,709

)

(83,509

)

(295,833

)

(215,248

)

Net written premiums

$

349,937

$

294,280

$

1,131,227

$

958,351

Net earned premiums

$

348,752

$

281,502

$

990,731

$

775,706

Fee income

8,489

6,841

25,572

20,028

Losses and loss adjustment expenses

200,240

155,552

580,351

441,628

Underwriting, acquisition and insurance

expenses

70,139

60,348

207,960

168,567

Underwriting income(2)

$

86,862

$

72,443

$

227,992

$

185,539

Loss ratio(3)

56.1

%

53.9

%

57.1

%

55.5

%

Expense ratio(4)

19.6

%

20.9

%

20.5

%

21.2

%

Combined ratio(5)

75.7

%

74.8

%

77.6

%

76.7

%

Annualized return on equity(6)

33.9

%

33.9

%

32.3

%

32.7

%

Annualized operating return on

equity(7)

29.1

%

34.4

%

28.2

%

32.1

%

(1)

Net operating earnings is a non-GAAP

financial measure. See discussion of "Non-GAAP Financial Measures"

below.

(2)

Underwriting income is a non-GAAP

financial measure. See discussion of "Non-GAAP Financial Measures"

below.

(3)

Loss ratio, expressed as a percentage, is

the ratio of losses and loss adjustment expenses to the sum of net

earned premiums and fee income.

(4)

Expense ratio, expressed as a percentage,

is the ratio of underwriting, acquisition and insurance expenses to

the sum of net earned premiums and fee income.

(5)

The combined ratio is the sum of the loss

ratio and expense ratio as presented. Calculations of each

component may not add due to rounding.

(6)

Annualized return on equity is net income

expressed on an annualized basis as a percentage of average

beginning and ending stockholders’ equity during the period.

(7)

Annualized operating return on equity is

net operating earnings expressed on an annualized basis as a

percentage of average beginning and ending stockholders’ equity

during the period.

The following tables summarize losses incurred for the current

accident year and the development of prior accident years for the

three and nine months ended September 30, 2024 and 2023:

Three Months Ended

September 30, 2024

Three Months Ended

September 30, 2023

Losses and Loss Adjustment

Expenses

% of Sum of Earned Premiums

and Fee Income

Losses and Loss Adjustment

Expenses

% of Sum of Earned Premiums

and Fee Income

Loss ratio:

($ in thousands)

Current accident year

$

196,750

55.1

%

$

163,545

56.7

%

Current accident year - catastrophe

losses

13,615

3.8

%

1,154

0.4

%

Effect of prior accident year

development

(10,125

)

(2.8

)%

(9,147

)

(3.2

)%

Total

$

200,240

56.1

%

$

155,552

53.9

%

Nine Months Ended

September 30, 2024

Nine Months Ended

September 30, 2023

Losses and Loss Adjustment

Expenses

% of Sum of Earned Premiums

and Fee Income

Losses and Loss Adjustment

Expenses

% of Sum of Earned Premiums

and Fee Income

Loss ratio:

($ in thousands)

Current accident year

$

590,810

58.1

%

$

466,056

58.6

%

Current accident year - catastrophe

losses

17,613

1.7

%

4,179

0.5

%

Effect of prior accident year

development

(28,072

)

(2.7

)%

(28,607

)

(3.6

)%

Total

$

580,351

57.1

%

$

441,628

55.5

%

Investment Results

Net investment income was $39.6 million in the third quarter of

2024 compared to $27.1 million in the third quarter of 2023, an

increase of 46.4%. Net investment income was $108.4 million in the

first nine months of 2024 compared to $72.0 million in the first

nine months of 2023, an increase of 50.7%. These increases were

driven by growth in the Company's investment portfolio generated

largely from the investment of strong operating cash flows and

higher interest rates relative to the prior year period. Net

operating cash flows were $763.3 million in the first nine months

of 2024 compared to $648.3 million in the first nine months of

2023, an increase of 17.7%. The Company’s investment portfolio had

an annualized gross investment return(8) of 4.3% for the first nine

months of 2024 compared to 3.9% for the same period last year.

Funds are generally invested conservatively in high quality

securities with an average credit quality of "AA-" and the weighted

average duration of the fixed-maturity investment portfolio,

including cash equivalents, was 3.1 years and 2.8 years at

September 30, 2024 and December 31, 2023, respectively. Cash and

invested assets totaled $4.0 billion at September 30, 2024 and $3.1

billion at December 31, 2023.

(8)

Gross investment return is investment

income from fixed-maturity and equity securities (and short-term

investments, if any), before any deductions for fees and expenses,

expressed as a percentage of average beginning and ending book

values of those investments during the period.

Other

The effective tax rates for the nine months ended September 30,

2024 and 2023 were 18.7% and 19.4%, respectively. In the first nine

months of 2024 and 2023, the effective tax rates were lower than

the federal statutory rate of 21% primarily due to the tax benefits

from stock-based compensation, including stock options exercised,

and from tax-exempt investment income.

Stockholders' equity was $1.4 billion at September 30, 2024

compared to $1.1 billion at December 31, 2023. Book value per share

was $61.62 at September 30, 2024 compared to $46.88 at December 31,

2023. Annualized operating return on equity(7) was 28.2% for the

first nine months of 2024, a decrease from 32.1% for the first nine

months of 2023. The decrease was due primarily to higher average

stockholders' equity as a result of profitable growth and an

increase in the fair value of our fixed income portfolio offset in

part by higher net operating earnings.

Share Repurchase Authorization

In October 2024, the Company's Board of Directors authorized a

share repurchase program authorizing the repurchase of up to $100.0

million of the Company's common stock. The shares may be

repurchased from time to time in open market purchases,

privately-negotiated transactions, block purchases, accelerated

share repurchase agreements or a combination of methods and

pursuant to safe harbors provided by Rule 10b-18 and Rule 10b5-1

under the Securities Exchange Act of 1934. The timing, manner,

price and amount of any repurchases under the share repurchase

program will be determined by the Company in its discretion. The

stock repurchase program does not require the Company to repurchase

any specific number of shares, and may be modified, suspended or

terminated at any time.

Non-GAAP Financial Measures

Net Operating Earnings

Net operating earnings is defined as net income excluding the

effects of the change in the fair value of equity securities, after

taxes, net realized investment gains and losses, after taxes, and

change in allowance for credit losses on investments, after taxes.

Management believes the exclusion of these items provides a useful

comparison of the Company's underlying business performance from

period to period. Net operating earnings and percentages or

calculations using net operating earnings (e.g., diluted operating

earnings per share and annualized operating return on equity) are

non-GAAP financial measures. Net operating earnings should not be

viewed as a substitute for net income calculated in accordance with

GAAP, and other companies may define net operating earnings

differently.

For the three and nine months ended September 30, 2024 and 2023,

net income and diluted earnings per share reconcile to net

operating earnings and diluted operating earnings per share as

follows:

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

($ in thousands, except per

share data)

Net operating earnings:

Net income

$

114,229

$

76,115

$

305,749

$

204,706

Adjustments:

Change in the fair value of equity

securities, before taxes

(20,659

)

5,533

(41,871

)

(3,796

)

Income tax expense (benefit) (1)

4,338

(1,162

)

8,793

797

Change in fair value of equity securities,

after taxes

(16,321

)

4,371

(33,078

)

(2,999

)

Net realized investment (gains) losses,

before taxes

8

(4,274

)

(6,737

)

(913

)

Income tax expense (benefit) (1)

(2

)

898

1,415

192

Net realized investment (gains) losses,

after taxes

6

(3,376

)

(5,322

)

(721

)

Change in allowance for credit losses on

investments, before taxes

(4

)

143

(490

)

199

Income tax expense (benefit) (1)

1

(30

)

103

(42

)

Change in allowance for credit losses on

investments, after taxes

(3

)

113

(387

)

157

Net operating earnings

$

97,911

$

77,223

$

266,962

$

201,143

Diluted operating earnings per

share:

Diluted earnings per share

$

4.90

$

3.26

$

13.10

$

8.79

Change in the fair value of equity

securities, after taxes, per share

(0.70

)

0.19

(1.42

)

(0.13

)

Net realized investment (gains) losses,

after taxes, per share

—

(0.14

)

(0.23

)

(0.03

)

Change in allowance for credit losses on

investments, after taxes, per share

—

—

(0.02

)

0.01

Diluted operating earnings per

share(2)

$

4.20

$

3.31

$

11.44

$

8.63

Operating return on equity:

Average equity(3)

$

1,346,076

$

897,789

$

1,260,891

$

834,606

Annualized return on equity(4)

33.9

%

33.9

%

32.3

%

32.7

%

Annualized operating return on

equity(5)

29.1

%

34.4

%

28.2

%

32.1

%

(1)

Income taxes on adjustments to reconcile

net income to net operating earnings use a 21% effective tax

rate.

(2)

Diluted operating earnings per share may

not add due to rounding.

(3)

Average equity is computed by adding the

total stockholders' equity as of the date indicated to the prior

quarter-end or year-end total, as applicable, and dividing by

two.

(4)

Annualized return on equity is net income

expressed on an annualized basis as a percentage of average

beginning and ending stockholders’ equity during the period.

(5)

Annualized operating return on equity is

net operating earnings expressed on an annualized basis as a

percentage of average beginning and ending stockholders’ equity

during the period.

Underwriting Income

Underwriting income is defined as net income excluding net

investment income, the change in the fair value of equity

securities, net realized investment gains and losses, change in

allowance for credit losses on investments, interest expense, other

expenses, other income and income tax expense. The Company uses

underwriting income as an internal performance measure in the

management of its operations because the Company believes it gives

management and users of the Company's financial information useful

insight into the Company's results of operations and underlying

business performance. Underwriting income should not be viewed as a

substitute for net income calculated in accordance with GAAP, and

other companies may define underwriting income differently.

For the three and nine months ended September 30, 2024 and 2023,

net income reconciles to underwriting income as follows:

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

(in thousands)

Net income

$

114,229

$

76,115

$

305,749

$

204,706

Income tax expense

30,169

19,378

70,316

49,290

Income before income taxes

144,398

95,493

376,065

253,996

Net investment income

(39,644

)

(27,086

)

(108,424

)

(71,953

)

Change in the fair value of equity

securities

(20,659

)

5,533

(41,871

)

(3,796

)

Net realized investment (gains) losses

8

(4,274

)

(6,737

)

(913

)

Change in allowance for credit losses on

investments

(4

)

143

(490

)

199

Interest expense

2,589

2,573

7,575

7,867

Other expenses (6)

692

401

3,451

1,220

Other income

(518

)

(340

)

(1,577

)

(1,081

)

Underwriting income

$

86,862

$

72,443

$

227,992

$

185,539

(6)

Other expenses includes primarily

corporate expenses not allocated to the Company's insurance

operations.

Conference Call

Kinsale Capital Group will hold a conference call to discuss

this press release on Friday, October 25, 2024 at 9:00 a.m.

(Eastern Time). Members of the public may access the conference

call by dialing (800) 715-9871, conference ID# 7469751, or via the

Internet by going to www.kinsalecapitalgroup.com and clicking on

the "Investor Relations" link. A replay of the call will be

available on the website until the close of business on November

22, 2024.

Forward-Looking Statements

This press release contains forward-looking statements as that

term is defined in the Private Securities Litigation Reform Act of

1995. In some cases, such forward-looking statements may be

identified by terms such as "anticipates," "estimates," "expects,"

"intends," "plans," "predicts," "projects," "believes," "seeks,"

"outlook," "future," "will," "would," "should," "could," "may,"

"can have," "prospects" or similar words. Forward-looking

statements involve risks and uncertainties that could cause actual

results to differ materially from those in the forward-looking

statements. Although it is not possible to identify all of these

risks and factors, they include, among others, the following:

inadequate loss reserves to cover the Company's actual losses;

inherent uncertainty of models resulting in actual losses that are

materially different than the Company's estimates; adverse economic

factors; a decline in the Company's financial strength rating; loss

of one or more key executives; loss of a group of brokers that

generate significant portions of the Company's business; failure of

any of the loss limitations or exclusions the Company employs, or

change in other claims or coverage issues; adverse performance of

the Company's investment portfolio; adverse market conditions that

affect its excess and surplus lines insurance operations; and other

risks described in the Company's filings with the Securities and

Exchange Commission. These forward-looking statements speak only as

of the date of this release and the Company does not undertake any

obligation to update or revise any forward-looking information to

reflect changes in assumptions, the occurrence of unanticipated

events, or otherwise.

About Kinsale Capital Group, Inc.

Kinsale Capital Group, Inc. is a specialty insurance group

headquartered in Richmond, Virginia, focusing on the excess and

surplus lines market.

KINSALE CAPITAL GROUP, INC.

AND SUBSIDIARIES

Unaudited Consolidated

Statements of Income and Comprehensive Income

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Revenues

(in thousands, except per

share data)

Gross written premiums

$

448,646

$

377,789

$

1,427,060

$

1,173,599

Ceded written premiums

(98,709

)

(83,509

)

(295,833

)

(215,248

)

Net written premiums

349,937

294,280

1,131,227

958,351

Change in unearned premiums

(1,185

)

(12,778

)

(140,496

)

(182,645

)

Net earned premiums

348,752

281,502

990,731

775,706

Fee income

8,489

6,841

25,572

20,028

Net investment income

39,644

27,086

108,424

71,953

Change in the fair value of equity

securities

20,659

(5,533

)

41,871

3,796

Net realized investment gains (losses)

(8

)

4,274

6,737

913

Change in allowance for credit losses on

investments

4

(143

)

490

(199

)

Other income

518

340

1,577

1,081

Total revenues

418,058

314,367

1,175,402

873,278

Expenses

Losses and loss adjustment expenses

200,240

155,552

580,351

441,628

Underwriting, acquisition and insurance

expenses

70,139

60,348

207,960

168,567

Interest expense

2,589

2,573

7,575

7,867

Other expenses

692

401

3,451

1,220

Total expenses

273,660

218,874

799,337

619,282

Income before income taxes

144,398

95,493

376,065

253,996

Total income tax expense

30,169

19,378

70,316

49,290

Net income

114,229

76,115

305,749

204,706

Other comprehensive income

(loss)

Change in net unrealized losses on

available-for-sale investments, net of taxes

63,464

(23,511

)

47,866

(20,109

)

Total comprehensive income

$

177,693

$

52,604

$

353,615

$

184,597

Earnings per share:

Basic

$

4.93

$

3.30

$

13.21

$

8.89

Diluted

$

4.90

$

3.26

$

13.10

$

8.79

Weighted-average shares

outstanding:

Basic

23,175

23,058

23,150

23,036

Diluted

23,335

23,315

23,333

23,298

KINSALE CAPITAL GROUP, INC.

AND SUBSIDIARIES

Unaudited Condensed

Consolidated Balance Sheets

September 30, 2024

December 31, 2023

Assets

(in thousands)

Investments:

Fixed-maturity securities at fair

value

$

3,467,038

$

2,711,759

Equity securities at fair value

365,626

234,813

Real estate investments, net

15,045

14,791

Short-term investments

—

5,589

Total investments

3,847,709

2,966,952

Cash and cash equivalents

111,691

126,694

Investment income due and accrued

26,083

21,689

Premiums receivable, net

134,952

143,212

Reinsurance recoverables, net

318,636

247,836

Ceded unearned premiums

55,370

52,516

Deferred policy acquisition costs, net of

ceding commissions

110,590

88,395

Intangible assets

3,538

3,538

Deferred income tax asset, net

34,995

55,699

Other assets

88,679

66,443

Total assets

$

4,732,243

$

3,772,974

Liabilities & Stockholders'

Equity

Liabilities:

Reserves for unpaid losses and loss

adjustment expenses

$

2,160,763

$

1,692,875

Unearned premiums

844,701

701,351

Payable to reinsurers

43,215

47,582

Accounts payable and accrued expenses

39,780

44,922

Debt

184,053

183,846

Other liabilities

24,782

15,566

Total liabilities

3,297,294

2,686,142

Stockholders' equity

1,434,949

1,086,832

Total liabilities and stockholders'

equity

$

4,732,243

$

3,772,974

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241024163547/en/

Kinsale Capital Group, Inc. Bryan Petrucelli Executive Vice

President, Chief Financial Officer and Treasurer 804-289-1272

ir@kinsalecapitalgroup.com

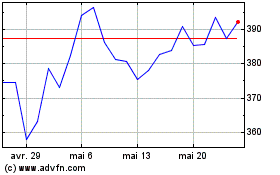

Kinsale Capital (NYSE:KNSL)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Kinsale Capital (NYSE:KNSL)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025