Current Report Filing (8-k)

16 Juin 2023 - 10:16PM

Edgar (US Regulatory)

0001577670

false

0001577670

2023-06-15

2023-06-15

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): June 15, 2023

Ladder Capital Corp

(Exact name of registrant as specified in its charter)

| Delaware |

001-36299 |

80-0925494 |

| (State or other jurisdiction |

(Commission |

(I.R.S. Employer |

| of incorporation) |

File Number) |

Identification No.) |

| 320

Park Avenue, 15th Floor | |

|

| New York, New York | |

10022 |

| (Address of principal

executive offices) | |

(Zip Code) |

Registrant’s telephone number, including area code: (212) 715-3170

Not Applicable

Former name or former

address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR

240.14d- 2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR

240.13e- 4(c))

Securities

registered pursuant to Section 12(b) of the Act:

| Title of Each Class | |

Trading Symbol(s) | |

Name

of Each

Exchange on Which Registered |

| Class A common stock, $0.001 par value | |

LADR | |

New York Stock Exchange |

Indicate by check mark whether the registrant is an

emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 5.02. Departure of Directors or Certain

Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

On June 15, 2023 (the “Effective

Date”), Paul J. Miceli, the Chief Financial Officer of Ladder Capital Corp (“Ladder”), entered into an amended and

restated employment agreement with Ladder Capital Finance LLC (“LCF”), a subsidiary of Ladder, effective as of the

Effective Date (the “Miceli Employment Agreement”). The Miceli Employment Agreement supersedes in its entirety that

certain employment agreement entered into by and between LCF and Mr. Miceli, dated as of February 9, 2021.

Also on the Effective Date, Kelly Porcella, the

Chief Administrative Officer, General Counsel and Secretary of Ladder, entered into an employment agreement with LCF, effective as of

the Effective Date (the “Porcella Employment Agreement” and, together with the “Miceli Employment Agreement,”

the “Employment Agreements”).

The Employment Agreements each provide the applicable

executive with a base salary of not less than a specified amount per year ($350,000 for Mr. Miceli and $225,000 for Ms. Porcella), as

well as the opportunity to participate in LCF’s standard employee benefits programs. The Employment Agreements do not provide for

a fixed term of employment. In addition, the Employment Agreements provide that the applicable executive will be eligible to receive an

annual cash bonus and an annual equity incentive grant, each pursuant to a framework previously agreed to by the Chief Executive Officer

of Ladder and the Board of Directors of Ladder. This framework determines the portion (if any) of the targeted annual bonus pool that

may be paid to, and the terms of any annual equity award (if any) that may be granted to, each member of Ladder’s management team

(which includes Mr. Miceli and Ms. Porcella).

Pursuant to the Employment Agreements, in the

event that the applicable executive retires at the age of at least 62 and with at least ten years of service with LCF, then (i) any unvested

time-based equity awards will vest on the five year anniversary of such retirement date, and (ii) any unvested performance-based equity

awards will continue to be eligible to vest in accordance with the applicable performance vesting criteria, and to the extent such performance

vesting criteria is satisfied, will vest on the five year anniversary of such retirement date, in each case, so long as such executive

does not at any time during such five-year period engage or otherwise work in the commercial real estate business in a manner that is

in competition with LCF, Ladder and their respective subsidiaries and affiliates.

Pursuant to the Employment Agreements, upon a

termination by LCF without cause or by the applicable executive for good reason (in each case as defined in the applicable Employment

Agreement), subject to the applicable executive’s execution and non-revocation of a release of claims in favor of LCF, Ladder and

their respective subsidiaries and affiliates, such executive will be entitled to receive the following:

| ● | a cash severance payment equal to the lesser of (i) $1,000,000 and (ii) the sum of (x) such executive’s annual base salary in

effect at the time of termination and (y) the average of the annual cash bonuses (if any) paid to such executive with respect to the two

calendar years preceding the termination date (collectively, the “Cash Severance”), with 50% of the Cash Severance payable

in a lump sum within sixty days of the release effective date and the remaining 50% of the Cash Severance payable in twelve equal monthly

installments commencing within sixty days of the release effective date (however, if such termination date occurs within one year of a

change in control (as defined in the Ladder Capital Corp 2023 Omnibus Incentive Plan), or if, as of the date of such executive’s

termination, Ladder has previously entered into a definitive binding agreement with a buyer that would result in a change in control and

such definitive binding agreement remains in effect, then all of the Cash Severance will be payable in a lump sum within sixty days of

the release effective date, as permitted by law); |

| ● | a prorated portion of such executive’s annual cash bonus for the calendar year in which such termination occurs based on actual

performance, payable at the same time that performance bonuses for such calendar year are paid to other senior executives of LCF (however,

this amount cannot exceed an amount equal to $1,000,000 minus the amount of the Cash Severance); and |

| ● | reimbursements for continued health care for up to three months immediately following such executive’s termination (or six months

if LCF has elected to extend such executive’s non-competition obligation), as permitted by law. |

Pursuant to the Employment Agreements, each applicable

executive is subject to a confidentiality covenant, a 90-day post-termination non-competition covenant (which LCF can elect to extend

for an additional 90 days subject to certain conditions, including continued payment of base salary during such 90-day period), and a

two-year post-termination non-solicitation of employees, independent contractors, investors and customers covenant.

The foregoing summary of the Employment Agreements

is qualified in its entirety by reference to the Miceli Employment Agreement and the Porcella Employment Agreement, a copy of each of

which is filed herewith as Exhibit 10.1 and Exhibit 10.2, respectively, and each of which is incorporated by reference herein.

| Item 9.01. |

Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

LADDER CAPITAL CORP |

| |

|

|

| |

|

|

| |

By: |

/s/ Kelly Porcella |

| |

Name: |

Kelly Porcella |

| |

Title: |

Chief Administrative Officer & General Counsel |

| |

|

|

| Date: June 16, 2023 |

|

|

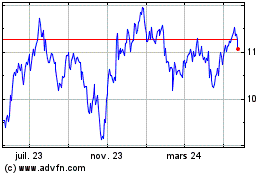

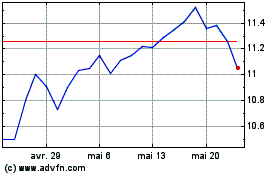

Ladder Capital (NYSE:LADR)

Graphique Historique de l'Action

De Mai 2024 à Juin 2024

Ladder Capital (NYSE:LADR)

Graphique Historique de l'Action

De Juin 2023 à Juin 2024