FALSE000169402800016940282023-01-242023-01-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): January 24, 2024

LIBERTY ENERGY INC.

(Exact name of registrant as specified in its charter) | | | | | | | | | | | | | | |

| | | | |

| Delaware | | 001-38081 | | 81-4891595 |

(State or Other Jurisdiction

of Incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

950 17th Street, Suite 2400

Denver, Colorado 80202

(Address and Zip Code of Principal Executive Offices)

(303) 515-2800

(Registrant’s Telephone Number, Including Area Code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | | | | | | | | | | | | | | | | |

| ☐ | | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | | |

| ☐ | | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | | |

| ☐ | | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | | |

| ☐ | | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | |

| Securities registered pursuant to Section 12(b) of the Act |

| | | | | | |

| Title of each class | | Trading symbol(s) | | Name of each exchange on which registered |

| | | | | | |

| Class A Common Stock, par value $0.01 | | LBRT | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition

On January 24, 2024, Liberty Energy Inc., a Delaware corporation (the “Company”), issued a press release announcing its results for the fourth quarter and full year ended December 31, 2023. The full text of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

This information is not deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934 and is not incorporated by reference into any Securities Act of 1933 registration statements.

Item 9.01. Financial Statements and Exhibits

(d)Exhibits. | | | | | | | | |

| | |

Exhibit

No. | | Description |

| |

| 99.1 | | | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | | | LIBERTY OILFIELD SERVICES INC. |

| | | |

| Dated: January 24, 2024 | | | | By: | | /s/ R. Sean Elliott |

| | | | | | R. Sean Elliott |

| | | | | | Chief Legal Officer and Corporate Secretary |

Liberty Energy Inc. Announces Fourth Quarter and Full Year 2023 Financial and Operational Results and Increase in Existing Share Repurchase Authorization to $750 Million

January 24, 2024

Denver - (Business Wire) - Liberty Energy Inc. (NYSE: LBRT; “Liberty” or the “Company”) announced today full year and fourth quarter 2023 financial and operational results.

Summary Results and Highlights

•Revenue of $4.7 billion for the year ended December 31, 2023

•Net income1 of $556 million, or $3.15 fully diluted earnings per share (“EPS”), for the year ended December 31, 2023, up 39% and 49%, respectively. EPS grew faster than net income due to reduced share count

•Adjusted EBITDA2 of $1.2 billion, a 41% increase over the prior year, for the year ended December 31, 2023

•Achieved 40% Adjusted Pre-Tax Return on Capital Employed (“ROCE”)3 and 34% Cash Return on Capital Invested (“CROCI”)4 for the year ended December 31, 2023

•Distributed $241 million to shareholders in 2023 through share repurchases and the cash dividend fully funded from free cash flow

•Fourth quarter 2023 revenue of $1.1 billion and net income1 of $92 million, or $0.54 fully diluted earnings per share

•Fourth quarter 2023 Adjusted EBITDA2 of $253 million

•Repurchased and retired 1.2% of shares outstanding during the fourth quarter, and a cumulative 11.7% of shares outstanding since reinstating the repurchase program in July 2022

•Increased and extended share repurchase authorization to $750 million through July 2026 with $422 million of authorization remaining

•Raised quarterly cash dividend by 40% to $0.07 per share beginning in the fourth quarter of 2023

•Expanded digiTechnologiesSM commercial deployments with the most efficient, lowest emissions natural gas frac engines that will serve as the primary source of future horsepower

•Launched and rapidly expanded Liberty Power Innovations (“LPI”), to support increased natural gas usage across Liberty frac fleets

•Achieved four consecutive quarterly average daily pumping efficiency records

•Announced partnership with Tamboran to develop the new Beetaloo shale gas basin in Australia

•Launched Bettering Human Lives Foundation with early focus on promoting clean cooking fuels, complementing company initiatives on alleviating poverty

“Liberty delivered a second consecutive year of record earnings per share. Our portfolio of advanced technology and vertical integration enhanced our superior service quality and drove record-breaking operational efficiencies. Full year Adjusted Pre-Tax ROCE3 of 40% and CROCI4 of 34% both exceeded the prior year,” commented Chris Wright, Chief Executive Officer. “Strong free cash flow generation supported our leading return of capital program. Since program reinstatement in July 2022, we have distributed $375 million to shareholders through share buybacks and cash dividends. We have now retired an equivalent of 33% of the shares issued for the acquisition of SLB’s OneStim® business three years ago.”

1 Net income attributable to controlling and non-controlling interests.

2 “Adjusted EBITDA” is not presented in accordance with generally accepted accounting principles in the United States (“U.S. GAAP”). Please see the supplemental financial information in the table under “Reconciliation of Net Income to EBITDA and Adjusted EBITDA” at the end of this earnings release for a reconciliation of the non-GAAP financial measure of Adjusted EBITDA to its most directly comparable GAAP financial measure.

3 Adjusted Pre-Tax Return on Capital Employed (“ROCE”) is a non-U.S. GAAP operational measure. Please see the supplemental financial information in the table under “Calculation of Adjusted Pre-Tax Return on Capital Employed” at the end of this earnings release for a calculation of this measure.

4 Cash Return on Capital Invested (“CROCI”) is a non-U.S. GAAP operational measure. Please see the supplemental financial information in the table under “Calculation of Cash Return on Capital Invested” at the end of this earnings release.

“A revolutionary shift towards next generation frac technologies is at the core of our strategic plan in 2024. Liberty brings together leading pump technology, mobile power generation, and CNG fuel supply, a unique value proposition that offers the most effective, reliable solution to maximize efficiency, reduce emissions, and lower fuel costs. By the end of 2024, we expect 90% of our fleets will be primarily powered by natural gas,” continued Mr. Wright. “The success of our technology transition is buttressed by dependable natural gas fuel supply through LPI. We plan to double LPI’s capacity in 2024 to meet rising demand.”

“We are confident that our diversified and innovative business enables strong future cash flow generation and supports capital allocation priorities. The board-approved increase in our share repurchase authorization to $750 million, coupled with last quarter’s dividend payment increase, enhances our ability to return capital to shareholders while maintaining flexibility to execute on our long-term investment objectives.”

“As we look ahead, global energy demand continues to rise as the world’s seven billion less fortunate aspire to attain the energy-rich lifestyles of the lucky one billion. Liberty recently invested in Oklo, a small modular nuclear reactor company, and Fervo, enhanced geothermal technology, which have the potential to provide reliable, affordable energy solutions to help meet these demands,” continued Mr. Wright. “Earlier this month, we launched the Bettering Human Lives Foundation to address the most urgent challenges of energy access. The Foundation strives to increase access to clean cooking fuels by supporting technology development and entrepreneurs in Africa. We are excited by the prospect of uplifting women, children and communities by improving health, safety and quality of life.”

Outlook

Entering 2024, the fundamental outlook for the frac industry is stable. Service prices remain relatively steady as the industry’s supply of marketed fleets was right sized in response to lower completions activity. Many fleets exited the market both from accelerated attrition of older equipment and the deliberate idling of underutilized fleets to match customer demand. Operators continue to demand technologies that provide significant emissions reductions and fuel savings. Liberty’s digiTechnologies, LPI business, integrated service offering and scale position us as the provider of choice to support operators’ increasing service demands. Against this backdrop, demand for Liberty services is positioned to rise, albeit slowly, from current levels.

Today, E&P operators are better served with larger, well capitalized integrated frac companies that can meet their technical demands and more complex needs. Engineering and innovation have led to rising shale productivity. Service companies have worked with operators to drive efficiencies, including faster completions, longer laterals and completion design optimization, helping to offset the gradual decline in reservoir quality. The trend toward higher intensity fracs raises demand for horsepower, serving to keep frac assets well utilized and drive service company returns.

Global oil and gas markets continue to contend with commodity price fluctuations, owing to developments in geopolitics, interest rates, and macroeconomic data. Range bound oil prices have not meaningfully changed E&P operator plans to deliver flat to modest production growth. Further, as North American oil production continues to reach record levels, more frac activity will be required to offset production decline. Near term natural gas markets are under pressure, but domestic power demand growth and increased LNG exports are expected to lead to a more robust 2025. Long term demand for reliable, affordable energy continues to rise with increasing global living standards, and North American operators likely serve as the largest provider of incremental oil and gas supply globally. These trends should support a durable, multi-year cycle ahead for services.

“We enter 2024 with significant competitive advantages and the flexibility to execute on our long-term strategic investments that enhance our cash generation capabilities. Through cycles, we achieved a 12-year average CROCI of 24% by offering a compelling, differential service for our customers,” continued Mr. Wright.

“Looking to the first quarter, we anticipate flattish sequential revenue and Adjusted EBITDA driven by seasonal trends and a cautious start for E&P activity. This is expected to be followed by a modest increase in our

activity in subsequent quarters. For the full year, we expect strong free cash flow generation, with continued investment in digiTechnologies and LPI business. We are confident that our technology transition better positions us to deliver superior, durable returns over cycles.”

Share Repurchase Program

On January 23, 2024, the Board increased Liberty’s existing share repurchase authorization announced July 25, 2022 to $750 million, a $250 million increase from the previously authorized and upsized amount. The Board also extended the authorization through July 31, 2026.

During the quarter ended December 31, 2023, Liberty repurchased and retired 2,031,736 shares of Class A common stock at an average of $19.21 per share, representing 1.2% of shares outstanding, for approximately $39 million.

During the year ended December 31, 2023, Liberty repurchased and retired 13,705,622 shares of Class A common stock at an average of $14.80 per share, representing 7.7% of shares outstanding, for approximately $203 million.

Liberty has cumulatively repurchased and retired 11.7% of shares outstanding at program commencement on July 25, 2022. With the program expansion, total remaining authorization for future common share repurchases is approximately $422 million.

The shares may be repurchased from time to time in open market transactions, through block trades, in privately negotiated transactions, through derivative transactions or by other means in accordance with federal securities laws. The timing, as well as the number and value of shares repurchased under the program, will be determined by the Company at its discretion and will depend on a variety of factors, including management’s assessment of the intrinsic value of the Company’s common stock, the market price of the Company’s common stock, general market and economic conditions, available liquidity, compliance with the Company’s debt and other agreements, applicable legal requirements, and other considerations. The exact number of shares to be repurchased by the Company is not guaranteed, and the program may be suspended, modified, or discontinued at any time without prior notice. The Company expects to fund the repurchases by using cash on hand, borrowings under its revolving credit facility and expected free cash flow to be generated through the authorization period.

Cash Dividend

During the quarter ended December 31, 2023, Liberty paid a quarterly cash dividend of $0.07 per share of Class A common stock, or approximately $12 million in aggregate to shareholders. During the year ended December 31, 2023, Liberty paid cash dividends of $38 million in aggregate to shareholders.

On January 23, 2023, the Board declared a cash dividend of $0.07 per share of Class A common stock, to be paid on March 20, 2024 to holders of record as of March 6, 2024.

Future declarations of quarterly cash dividends are subject to approval by the Board of Directors and to the Board’s continuing determination that the declarations of dividends are in the best interests of Liberty and its stockholders. Future dividends may be adjusted at the Board’s discretion based on market conditions and capital availability.

2023 Full Year Results

For the year ended December 31, 2023, revenue grew to $4.7 billion, an increase of 14% from $4.1 billion for the year ended December 31, 2022.

Net income1 (after taxes) totaled $556 million for the year ended December 31, 2023 compared to $400 million for the year ended December 31, 2022.

Adjusted EBITDA2 of $1.2 billion for the year ended December 31, 2023, increased 41% from $860 million for the year ended December 31, 2022. Please refer to the reconciliation of Adjusted EBITDA (a non-GAAP measure) to net income (a GAAP measure) in this earnings release.

Fully diluted earnings per share was $3.15 for the year ended December 31, 2023 compared to $2.11 for the year ended December 31, 2022.

Fourth Quarter Results

For the fourth quarter of 2023, revenue was $1.1 billion, a decrease of 12% from $1.2 billion in the fourth quarter of 2022 and a decrease of 12% from $1.2 billion in the third quarter of 2023.

Net income1 (after taxes) totaled $92 million for the fourth quarter of 2023 compared to $153 million in the fourth quarter of 2022 and $149 million in the third quarter of 2023.

Adjusted EBITDA2 of $253 million for the fourth quarter of 2023 decreased 15% from $295 million in the fourth quarter of 2022 and decreased 21% from $319 million in the third quarter of 2023. Please refer to the reconciliation of Adjusted EBITDA (a non-GAAP measure) to net income (a GAAP measure) in this earnings release.

Fully diluted earnings per share was $0.54 for the fourth quarter of 2023 compared to $0.82 for the fourth quarter of 2022 and $0.85 for the third quarter of 2023.

Balance Sheet and Liquidity

As of December 31, 2023, Liberty had cash on hand of $37 million, an increase from third quarter levels, and total debt of $140 million drawn on the secured asset-based revolving credit facility (“ABL Facility”), an $83 million decrease from third quarter. Total liquidity, including availability under the credit facility, was $314 million as of December 31, 2023.

Conference Call

Liberty will host a conference call to discuss the results at 8:00 a.m. Mountain Time (10:00 a.m. Eastern Time) on Thursday, January 25, 2024. Presenting Liberty’s results will be Chris Wright, Chief Executive Officer, Ron Gusek, President, and Michael Stock, Chief Financial Officer.

Individuals wishing to participate in the conference call should dial (833) 255-2827, or for international callers (412) 902-6704. Participants should ask to join the Liberty Energy call. A live webcast will be available at http://investors.libertyfrac.com. The webcast can be accessed for 90 days following the call. A telephone replay will be available shortly after the call and can be accessed by dialing (877) 344-7529, or for international callers (412) 317-0088. The passcode for the replay is 7557611. The replay will be available until February 1, 2024.

About Liberty

Liberty is a leading North American energy services firm that offers one of the most innovative suites of completion services and technologies to onshore oil and natural gas exploration and production companies. Liberty was founded in 2011 with a relentless focus on developing and delivering next generation technology for the sustainable development of unconventional energy resources in partnership with our customers. Liberty is headquartered in Denver, Colorado. For more information about Liberty, please contact Investor Relations at IR@libertyenergy.com.

Non-GAAP Financial Measures

This earnings release includes unaudited non-GAAP financial and operational measures, including EBITDA, Adjusted EBITDA, Adjusted Pre-Tax Return on Capital Employed (“ROCE”), and Cash Return on Capital Invested (“CROCI”). We believe that the presentation of these non-GAAP financial and operational measures provides useful information about our financial performance and results of operations. We define Adjusted EBITDA as EBITDA adjusted to eliminate the effects of items such as non-cash stock-based compensation, new fleet or new basin start-up costs, fleet lay-down costs, costs of asset acquisitions, gain or loss on the disposal of assets, bad debt reserves, transaction, severance, and other costs, the loss or gain on remeasurement of liability under our tax receivable agreements, the gain on investments, and other non-recurring expenses that management does not consider in assessing ongoing performance.

Our board of directors, management, investors, and lenders use EBITDA and Adjusted EBITDA to assess our financial performance because it allows them to compare our operating performance on a consistent basis across periods by removing the effects of our capital structure (such as varying levels of interest expense), asset base (such as depreciation, depletion, and amortization) and other items that impact the comparability of financial results from period to period. We present EBITDA and Adjusted EBITDA because we believe they provide useful information regarding the factors and trends affecting our business in addition to measures calculated under GAAP.

We define ROCE as the ratio of pre-tax net income (adding back income tax and tax receivable agreement impacts) for the twelve months ended December 31, 2023 to Average Capital Employed. Average Capital Employed is the simple average of total capital employed (both debt and equity) as of December 31, 2023 and December 31, 2022. CROCI is defined as the ratio of Adjusted EBITDA to the average of the beginning and ending period Gross Capital Invested (total assets plus accumulated depreciation and depletion less non-interest bearing current liabilities). ROCE and CROCI are presented based on our management’s belief that these non-GAAP measures are useful information to investors when evaluating our profitability and the efficiency with which management has employed capital over time. Our management uses ROCE and CROCI for that purpose. ROCE and CROCI are not a measure of financial performance under U.S. GAAP and should not be considered an alternative to net income, or any other financial measures reported in accordance with U.S. GAAP.

Non-GAAP financial and operational measures do not have any standardized meaning and are therefore unlikely to be comparable to similar measures presented by other companies. The presentation of non-GAAP financial and operational measures is not intended to be a substitute for, and should not be considered in isolation from, the financial measures reported in accordance with U.S. GAAP. See the tables entitled Reconciliation and Calculation of Non-GAAP Financial and Operational Measures for a reconciliation or calculation of the non-GAAP financial or operational measures to the most directly comparable GAAP measure.

Forward-Looking and Cautionary Statements

The information above includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of historical facts, included herein concerning, among other things, statements about our expected growth from recent acquisitions, expected performance, future operating results, oil and natural gas demand and prices and the outlook for the oil and gas industry, future global economic conditions, improvements in operating procedures and technology, our business strategy and the business strategies of our customers, the deployment of fleets in the future, planned capital expenditures, future cash flows and borrowings, pursuit of potential acquisition opportunities, our financial position, return of capital to stockholders, business strategy and objectives for future operations, are forward-looking statements. These forward-looking statements are identified by their use of terms and phrases such as “may,” “expect,” “estimate,” “outlook,” “project,” “plan,” “position,” “believe,” “intend,” “achievable,” “forecast,” “assume,” “anticipate,” “will,” “continue,” “potential,” “likely,” “should,” “could,” and similar terms and phrases. However, the absence of these words does not mean that the statements are not forward-looking. Although we believe that the expectations reflected in these forward-looking statements are reasonable, they do involve certain assumptions, risks and uncertainties. The outlook presented herein is subject to change by Liberty without notice and Liberty has no obligation to affirm or update such information, except as required by law. These forward-looking statements represent our expectations or beliefs concerning future events, and it is possible that the results described in this earnings release will not be achieved. These forward-looking statements are subject to certain risks, uncertainties and assumptions identified above or as disclosed from time to time in Liberty's filings with the Securities and Exchange Commission. As a result of these factors, actual results may differ materially from those indicated or implied by such forward-looking statements.

Any forward-looking statement speaks only as of the date on which it is made, and, except as required by law, we do not undertake any obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise. New factors emerge from time to time, and it is not possible for us to predict all such factors. When considering these forward-looking statements, you should keep in mind the risk factors and other cautionary statements in “Item 1A. Risk Factors” included in our Annual Report on Form 10-K for the year ended December 31, 2022 as filed with the SEC on February 10, 2023 and in our other public filings with the SEC. These and other factors could cause our actual results to differ materially from those contained in any forward-looking statements.

Contacts:

Michael Stock

Chief Financial Officer

Anjali Voria, CFA

Strategic Finance & Investor Relations Lead

303-515-2851

IR@libertyenergy.com

Liberty Energy Inc.

Selected Financial Data

(unaudited) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | | Year Ended |

| | | | | December 31, | | September 30, | | December 31, | | December 31, |

| | | | | 2023 | | 2023 | | 2022 | | 2023 | | 2022 |

| Statement of Operations Data: | | | | | (amounts in thousands, except for per share data) |

| Revenue | | | | | $ | 1,074,958 | | | $ | 1,215,905 | | | $ | 1,225,592 | | | $ | 4,747,928 | | | $ | 4,149,228 | |

| Costs of services, excluding depreciation, depletion, and amortization shown separately | | | | | 777,251 | | | 850,247 | | | 890,846 | | | 3,349,370 | | | 3,149,036 | |

| General and administrative | | | | | 55,296 | | | 55,040 | | | 49,087 | | | 221,406 | | | 180,040 | |

| Transaction, severance, and other costs | | | | | 249 | | | 202 | | | 544 | | | 2,053 | | | 5,837 | |

| Depreciation, depletion, and amortization | | | | | 118,421 | | | 108,997 | | | 88,213 | | | 421,514 | | | 323,028 | |

| Gain on disposal of assets | | | | | (13) | | | (3,808) | | | (1,562) | | | (6,994) | | | (4,603) | |

| Total operating expenses | | | | | 951,204 | | | 1,010,678 | | | 1,027,128 | | | 3,987,349 | | | 3,653,338 | |

| Operating income | | | | | 123,754 | | | 205,227 | | | 198,464 | | | 760,579 | | | 495,890 | |

| (Gain) loss on remeasurement of liability under tax receivable agreements (1) | | | | | (1,817) | | | — | | | 42,958 | | | (1,817) | | | 76,191 | |

| Gain on investments | | | | | — | | | — | | | — | | | — | | | (2,525) | |

| Interest expense, net | | | | | 6,364 | | | 6,776 | | | 6,756 | | | 27,506 | | | 22,715 | |

| Net income before taxes | | | | | 119,207 | | | 198,451 | | | 148,750 | | | 734,890 | | | 399,509 | |

| Income tax expense (benefit) (1) | | | | | 26,824 | | | 49,843 | | | (4,430) | | | 178,482 | | | (793) | |

| Net income | | | | | 92,383 | | | 148,608 | | | 153,180 | | | 556,408 | | | 400,302 | |

| Less: Net income attributable to non-controlling interests | | | | | — | | | — | | | 311 | | | 91 | | | 700 | |

| Net income attributable to Liberty Energy Inc. stockholders | | | | | $ | 92,383 | | | $ | 148,608 | | | $ | 152,869 | | | $ | 556,317 | | | $ | 399,602 | |

| Net income attributable to Liberty Energy Inc. stockholders per common share: | | | | | | | | | | | | | |

| Basic | | | | | $ | 0.55 | | | $ | 0.88 | | | $ | 0.84 | | | $ | 3.24 | | | $ | 2.17 | |

| Diluted | | | | | $ | 0.54 | | | $ | 0.85 | | | $ | 0.82 | | | $ | 3.15 | | | $ | 2.11 | |

| Weighted average common shares outstanding: | | | | | | | | | | | | | |

| Basic | | | | | 168,016 | | | 169,781 | | | 181,128 | | | 171,845 | | | 184,334 | |

| Diluted (2) | | | | | 172,661 | | | 173,984 | | | 185,904 | | | 176,360 | | | 189,349 | |

| | | | | | | | | | | | | |

| Other Financial and Operational Data | | | | | | | | |

| Capital expenditures (3) | | | | | $ | 133,610 | | | $ | 161,379 | | | $ | 116,087 | | | $ | 576,389 | | | $ | 428,241 | |

| Adjusted EBITDA (4) | | | | | $ | 252,507 | | | $ | 319,213 | | | $ | 295,474 | | | $ | 1,213,068 | | | $ | 860,267 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

(1)During the second quarter of 2021, the Company entered into a three-year cumulative pre-tax book loss driven primarily by Covid-19 which, applying the interpretive guidance to Accounting Standards Codification Topic 740 - Income Taxes, required the Company to recognize a valuation allowance against certain of the Company’s deferred tax assets. During the year ended December 31, 2022, the Company achieved three years of cumulative pre-tax income in the U.S. federal tax jurisdiction, management determined that there is sufficient positive evidence to conclude that it is more likely than not that the Company will realize the Company’s net deferred tax assets in the foreseeable future. For the year ended December 31, 2022 the Company recorded a release of the valuation allowance. In connection with both the recognition and release of a valuation allowance, the Company was also required to remeasure the liability under the tax receivable agreements.

(2)In accordance with U.S. GAAP, diluted weighted average common shares outstanding for the three months ended December 31, 2022 exclude 38 weighted average shares of Class B common stock outstanding during the period. (share counts presented in 000’s).

(3)Net capital expenditures presented above include investing cash flows from purchase of property and equipment, excluding acquisitions, net of proceeds from the sales of assets.

(4)Adjusted EBITDA is a non-GAAP financial measure. See the tables entitled “Reconciliation and Calculation of Non-GAAP Financial and Operational Measures” below.

| | | | | | | | | | | |

| Liberty Energy Inc. |

| Condensed Consolidated Balance Sheets |

| (unaudited, amounts in thousands) |

| December 31, | | December 31, |

| 2023 | | 2022 |

| Assets | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 36,784 | | | $ | 43,676 | |

| Accounts receivable and unbilled revenue | 587,470 | | | 586,012 | |

| Inventories | 205,865 | | | 214,454 | |

| Prepaids and other current assets | 124,135 | | | 112,531 | |

| Total current assets | 954,254 | | | 956,673 | |

| Property and equipment, net | 1,645,368 | | | 1,362,364 | |

| Operating and finance lease right-of-use assets | 274,959 | | | 139,003 | |

| Other assets | 158,976 | | | 105,300 | |

| Deferred tax asset | — | | | 12,592 | |

| Total assets | $ | 3,033,557 | | | $ | 2,575,932 | |

| Liabilities and Equity | | | |

| Current liabilities: | | | |

| Accounts payable and accrued liabilities | $ | 572,029 | | | $ | 609,790 | |

| Current portion of operating and finance lease liabilities | 67,395 | | | 38,687 | |

| Current portion of long-term debt, net of discount | — | | | 1,020 | |

| Total current liabilities | 639,424 | | | 649,497 | |

| Long-term debt, net of discount | 140,000 | | | 217,426 | |

| Long-term operating and finance lease liabilities | 197,914 | | | 91,785 | |

| Deferred tax liability | 102,340 | | | 1,044 | |

| Payable pursuant to tax receivable agreements | 112,471 | | | 118,874 | |

| Total liabilities | 1,192,149 | | | 1,078,626 | |

| | | |

Stockholders’ equity: | | | |

| Common stock | 1,666 | | | 1,791 | |

| Additional paid in capital | 1,093,498 | | | 1,266,097 | |

| Retained earnings | 752,328 | | | 234,525 | |

| Accumulated other comprehensive loss | (6,084) | | | (7,396) | |

Total stockholders’ equity | 1,841,408 | | | 1,495,017 | |

| Non-controlling interest | — | | | 2,289 | |

| Total equity | 1,841,408 | | | 1,497,306 | |

| Total liabilities and equity | $ | 3,033,557 | | | $ | 2,575,932 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Liberty Energy Inc. |

| Reconciliation and Calculation of Non-GAAP Financial and Operational Measures |

| (unaudited, amounts in thousands) |

| Reconciliation of Net Income to EBITDA and Adjusted EBITDA | | | | |

| Three Months Ended | | Year Ended |

| December 31, | | September 30, | | December 31, | | December 31, |

| 2023 | | 2023 | | 2022 | | 2023 | | 2022 |

| Net income | $ | 92,383 | | | $ | 148,608 | | | $ | 153,180 | | | $ | 556,408 | | | $ | 400,302 | |

| Depreciation, depletion, and amortization | 118,421 | | | 108,997 | | | 88,213 | | | 421,514 | | | 323,028 | |

| Interest expense, net | 6,364 | | | 6,776 | | | 6,756 | | | 27,506 | | | 22,715 | |

| Income tax expense (benefit) | 26,824 | | | 49,843 | | | (4,430) | | | 178,482 | | | (793) | |

| EBITDA | $ | 243,992 | | | $ | 314,224 | | | $ | 243,719 | | | $ | 1,183,910 | | | $ | 745,252 | |

| Stock-based compensation expense | 9,288 | | | 8,595 | | | 5,982 | | | 33,026 | | | 23,108 | |

| Fleet start-up costs | — | | | — | | | 3,833 | | | 2,082 | | | 17,007 | |

| Transaction, severance, and other costs | 249 | | | 202 | | | 544 | | | 2,053 | | | 5,837 | |

| Gain on disposal of assets | (13) | | | (3,808) | | | (1,562) | | | (6,994) | | | (4,603) | |

| Provision for credit losses | 808 | | | — | | | — | | | 808 | | | — | |

| (Gain) loss on remeasurement of liability under tax receivable agreements | (1,817) | | | — | | | 42,958 | | | (1,817) | | | 76,191 | |

| Gain on investments | — | | | — | | | — | | | — | | | (2,525) | |

| Adjusted EBITDA | $ | 252,507 | | | $ | 319,213 | | | $ | 295,474 | | | $ | 1,213,068 | | | $ | 860,267 | |

| | | | | | | | | | | |

| Calculation of Cash Return on Capital Invested |

| Twelve Months Ended |

| December 31, |

| 2023 | | 2022 |

| Adjusted EBITDA (1) | $ | 1,213,068 | | | |

| Gross Capital Invested | | | |

| Total assets | $ | 3,033,557 | | | $ | 2,575,932 | |

| Add back: Accumulated depreciation, depletion, and amortization | 1,501,685 | | | 1,141,656 | |

| Less: Accounts payable and accrued liabilities | 572,029 | | | 609,790 | |

| Total Gross Capital Invested | $ | 3,963,213 | | | $ | 3,107,798 | |

| | | |

| Average Gross Capital Invested (2) | $ | 3,535,506 | | | |

| Cash Return on Capital Invested (3) | 34 | % | | |

(1)Adjusted EBITDA is a non-GAAP financial measure. See the tables entitled “Reconciliation and Calculation of Non-GAAP Financial and Operational Measures” above.

(2)Average Gross Capital Invested is the simple average of Gross Capital Invested as of December 31, 2023 and 2022.

(3)Cash Return on Capital Invested is the ratio of Adjusted EBITDA, as reconciled above, for the twelve months ended December 31, 2023 to Average Gross Capital Invested.

| | | | | | | | | | | |

| Calculation of Adjusted Pre-Tax Return on Capital Employed |

| Twelve Months Ended |

| December 31, |

| 2023 | | 2022 |

| Net income | $ | 556,408 | | | |

| Add back: Income tax expense | 178,482 | | | |

| Less: Gain on remeasurement of liability under tax receivable agreements (1) | (1,817) | | | |

| Adjusted Pre-tax net income | $ | 733,073 | | | |

| Capital Employed | | | |

| Total debt, net of discount | $ | 140,000 | | | $ | 218,446 | |

| Total equity | 1,841,408 | | | 1,497,306 | |

| Total Capital Employed | $ | 1,981,408 | | | $ | 1,715,752 | |

| | | |

| Average Capital Employed (2) | $ | 1,848,580 | | | |

| Adjusted Pre-Tax Return on Capital Employed (3) | 40 | % | | |

(1)Gain on remeasurement of the liability under tax receivable agreements is a result of a change in the estimated future effective tax rate and should be excluded in the determination of pre-tax return on capital employed.

(2)Average Capital Employed is the simple average of Total Capital Employed as of December 31, 2023 and 2022.

(3)Adjusted Pre-tax Return on Capital Employed is the ratio of adjusted pre-tax net income for the twelve months ended December 31, 2023 to Average Capital Employed.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Reconciliation of Historical Net Income (Loss) to EBITDA and Adjusted EBITDA | | |

| | Year Ended December 31, |

| | 2022 | | 2021 | | 2020 | | 2019 | | 2018 | | 2017 | | 2016 | | 2015 | | 2014 | | 2013 | | 2012 |

| Net income (loss) | | $ | 400,302 | | | $ | (187,004) | | | $ | (160,674) | | | $ | 74,864 | | | $ | 249,033 | | | $ | 168,501 | | | $ | (60,560) | | | $ | (9,061) | | | $ | 34,519 | | | $ | 8,881 | | | $ | 25,807 | |

| Depreciation, depletion, and amortization | | 323,028 | | | 262,757 | | | 180,084 | | | 165,379 | | | 125,110 | | | 81,473 | | | 41,362 | | | 36,436 | | | 21,749 | | | 12,881 | | | 5,875 | |

| Interest expense, net | | 22,715 | | | 15,603 | | | 14,505 | | | 14,681 | | | 17,145 | | | 12,636 | | | 6,126 | | | 5,501 | | | 3,610 | | | 1,139 | | | — | |

| Income tax (benefit) expense | | (793) | | | 9,216 | | | (30,857) | | | 14,052 | | | 40,385 | | | — | | | — | | | — | | | — | | | — | | | — | |

| EBITDA | | $ | 745,252 | | | $ | 100,572 | | | $ | 3,058 | | | $ | 268,976 | | | $ | 431,673 | | | $ | 262,610 | | | $ | (13,072) | | | $ | 32,876 | | | $ | 59,878 | | | $ | 22,901 | | | $ | 31,682 | |

| Stock-based compensation expense | | 23,108 | | | 19,946 | | | 17,139 | | | 13,592 | | | 5,450 | | | — | | | — | | | — | | | — | | | — | | | — | |

| Fleet start-up costs | | 17,007 | | | 2,751 | | | 12,175 | | | 4,519 | | | 10,069 | | | 13,955 | | | 4,280 | | | 1,044 | | | 4,502 | | | 2,711 | | | — | |

| Transaction, severance, and other costs | | 5,837 | | | 15,138 | | | 21,061 | | | — | | | 834 | | | 4,015 | | | 5,877 | | | 446 | | | — | | | — | | | — | |

| (Gain) loss on disposal of assets | | (4,603) | | | 779 | | | (411) | | | 2,601 | | | (4,342) | | | 148 | | | (2,673) | | | 423 | | | 494 | | | — | | | — | |

| Provision for credit losses | | — | | | 745 | | | 4,877 | | | 1,053 | | | — | | | — | | | — | | | 6,424 | | | — | | | — | | | — | |

| Loss (gain) on remeasurement of liability under tax receivable agreements | | 76,191 | | | (19,039) | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| Gain on investments | | (2,525) | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| Adjusted EBITDA | | $ | 860,267 | | | $ | 120,892 | | | $ | 57,899 | | | $ | 290,741 | | | $ | 443,684 | | | $ | 280,728 | | | $ | (5,588) | | | $ | 41,213 | | | $ | 64,874 | | | $ | 25,612 | | | $ | 31,682 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Calculation of Historical Cash Return on Capital Invested |

| | Year Ended December 31, | | |

| | 2022 | | 2021 | | 2020 | | 2019 | | 2018 | | 2017 | | 2016 | | 2015 | | 2014 | | 2013 | | 2012 | | 2011 |

| Adjusted EBITDA (1) | | $ | 860,267 | | | $ | 120,892 | | | $ | 57,899 | | | $ | 290,741 | | | $ | 443,684 | | | $ | 280,728 | | | $ | (5,588) | | | $ | 41,213 | | | $ | 64,874 | | | $ | 25,612 | | | $ | 31,682 | | | |

| Gross Capital Invested | | | | | | | | | | | | | | | | | | | | | | | | |

| Total assets | | $ | 2,575,932 | | | $ | 2,040,660 | | | $ | 1,889,942 | | | $ | 1,283,429 | | | $ | 1,116,501 | | | $ | 852,103 | | | $ | 451,845 | | | $ | 296,971 | | | $ | 331,671 | | | $ | 174,813 | | | $ | 107,225 | | | $ | 35,699 | |

| Add back: Accumulated depreciation, depletion, and amortization | | 1,141,656 | | | 863,194 | | | 622,530 | | | 455,687 | | | 307,277 | | | 198,453 | | | 117,779 | | | 77,057 | | | 40,715 | | | 19,082 | | | 6,196 | | | 321 | |

| Less: Accounts payable and accrued liabilities | | 609,790 | | | 528,468 | | | 311,721 | | | 226,567 | | | 219,351 | | | 220,494 | | | 118,949 | | | 52,688 | | | 99,005 | | | 26,600 | | | 13,275 | | | 1,718 | |

| Total Gross Capital Invested | | $ | 3,107,798 | | | $ | 2,375,386 | | | $ | 2,200,751 | | | $ | 1,512,549 | | | $ | 1,204,427 | | | $ | 830,062 | | | $ | 450,675 | | | $ | 321,340 | | | $ | 273,381 | | | $ | 167,295 | | | $ | 100,146 | | | $ | 34,302 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Average Gross Capital Invested (2) | | $ | 2,741,592 | | | $ | 2,288,069 | | | $ | 1,856,650 | | | $ | 1,358,488 | | | $ | 1,017,245 | | | $ | 640,369 | | | $ | 386,008 | | | $ | 297,361 | | | $ | 220,338 | | | $ | 133,721 | | | $ | 67,224 | | | |

| Cash Return on Capital Invested (3) | | 31 | % | | 5 | % | | 3 | % | | 21 | % | | 44 | % | | 44 | % | | (1) | % | | 14 | % | | 29 | % | | 19 | % | | 47 | % | | |

(1)Adjusted EBITDA is a non-GAAP financial measure. See the tables entitled “Reconciliation and Calculation of Historical Non-GAAP Financial and Operational Measures” above.

(2)Average Gross Capital Invested is the simple average of Gross Capital Invested as of the end of the current year and prior year.

(3)Cash Return on Capital Invested is the ratio of Adjusted EBITDA, as reconciled above, for the year then ended to Average Gross Capital Invested.

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

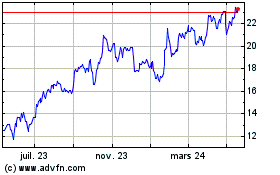

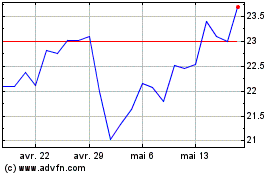

Liberty Energy (NYSE:LBRT)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Liberty Energy (NYSE:LBRT)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024