Learn CW’s Extraordinary General Meeting of

Shareholders to Approve the Business Combination Expected to be

Held on September 30, 2024

Innventure LLC, an enterprise growth engine (“Innventure”), and

Learn CW Investment Corporation, a special purpose acquisition

company (Nasdaq: LCW) (“Learn CW”), today announced that the U.S.

Securities and Exchange Commission (“SEC”) has declared effective

the registration statement on Form S-4 (as amended, the

“Registration Statement”) filed in connection with the previously

announced proposed business combination between Innventure and

Learn CW (the “Business Combination”). Learn CW is sponsored by

CWAM LC Sponsor LLC, an affiliate of Learn Capital, LLC (“Learn

Capital”), and Commonwealth Asset Management, a Los Angeles-based

asset management platform founded in June 2019.

Learn CW expects to hold an extraordinary general meeting of its

shareholders on September 30, 2024 to seek approval of the Business

Combination and certain other related matters. In addition,

Innventure will solicit written consents of its members to approve

the Business Combination and certain other related matters.

“We’re thrilled to reach this critical milestone on our path to

becoming a publicly traded company,” said Bill Haskell, CEO of

Innventure. “We believe this transaction will better position us to

advance our current family of companies and identify new

technologies that can be the foundation for future growth. We look

forward to offering shareholders access to disruptive companies

that we believe offer early-stage economics with late-stage

risk.”

Subject to satisfaction or waiver of certain closing conditions

set forth in the business combination agreement (the “BCA”) and

upon closing of the Business Combination, the combined company will

be renamed Innventure, Inc., and its common stock and warrants are

expected to be listed on the Nasdaq Global Market under the ticker

symbols “INV” and “INVW,” respectively.

Innventure uses operational expertise to take breakthrough

technologies sourced from multinational corporations to market. In

the process, Innventure builds and scales companies around these

technologies using a systematic, quantitative and repeatable

analysis. Innventure has launched three such companies since its

inception: PureCycle Technologies, AeroFlexx and Accelsius.

PureCycle became a publicly traded company in 2021, and Innventure

currently owns less than 2% of PureCycle.

About Innventure Innventure founds, funds, and operates

companies with a focus on transformative, sustainable technology

solutions acquired or licensed from multinational corporations. As

owner-operators, Innventure takes what it believes to be

breakthrough technologies from early evaluation to scaled

commercialization utilizing an approach designed to help mitigate

risk as it builds disruptive companies it believes have the

potential to achieve a target enterprise value of at least $1

billion. Innventure defines ‘‘disruptive’’ as innovations that have

the ability to significantly change the way businesses, industries,

markets and/or consumers operate.

About Learn CW Investment Corporation Learn CW is a blank

check company that was formed as a Cayman Islands exempted company

for the purpose of effecting a merger, share exchange, asset

acquisition, share purchase, reorganization or similar business

combination with one or more businesses. Learn CW is sponsored by

CWAM LC Sponsor LLC, an affiliate of Learn Capital and Commonwealth

Asset Management. Learn Capital is a leading venture capital firm

focused on early- and mid-stage investments in the $5.4 trillion

global education sector. Learn Capital was founded in 2008 by Rob

Hutter and Greg Mauro, who formerly managed an affiliate of

Founders Fund. The firm possesses decades of founding, operating,

and investing experience in the education, consumer, hard tech, and

enterprise technology sectors. Commonwealth Asset Management is a

Los Angeles-based asset management platform founded in June 2019

and led by Adam Fisher, who is the former Head of Global Macro and

Real Estate at Soros Fund Management LLC and the former founder and

Chief Investment Officer of Commonwealth Opportunity Capital, GP

LLC.

Cautionary Statement Regarding Forward-Looking Statements

This press release contains forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended,

including statements regarding the parties’ or the parties’

respective management team’s expectations, hopes, beliefs,

intentions, plans, prospects or strategies regarding the future,

including the Business Combination, the parties’ ability to close

the Business Combination, the anticipated benefits of the Business

Combination, including revenue growth and financial performance,

product expansion and services, and the financial condition,

results of operations, earnings outlook and prospects of Innventure

and/or Learn CW, including, in all cases, statements for the period

following the consummation of the Business Combination. Any

statements contained herein that are not statements of historical

fact are forward-looking statements. In addition, any statements

that refer to projections, forecasts or other characterizations of

future events or circumstances, including any underlying

assumptions, are forward-looking statements. Forward-looking

statements are typically identified by words such as “anticipate,”

“believe,” “continue,” “could,” “estimate,” “expect,” “forecast,”

“intend,” “may,” “might,” “outlook,” “plan,” “possible,”

“potential,” “predict,” “project,” “should,” “will,” “would” and

other similar words and expressions, but the absence of these words

does not mean that a statement is not forward-looking. The

forward-looking statements contained in this press release are

based on the current expectations and beliefs of the management of

Learn CW and Innventure in light of their respective experience and

their perception of historical trends, current conditions and

expected future developments and their potential effects on Learn

CW and Innventure as well as other factors they believe are

appropriate in the circumstances. There can be no assurance that

future developments affecting Learn CW or Innventure will be those

that we have anticipated. These forward-looking statements involve

a number of risks, uncertainties (some of which are beyond the

control of the parties) or other assumptions that may cause actual

results or performance to be materially different from those

expressed or implied by these forward-looking statements, including

those discussed and identified in the public filings made or to be

made with the SEC by Learn CW, including in the final prospectus

relating to Learn CW’s initial public offering, which was filed

with the SEC on October 12, 2021 under the heading “Risk Factors,”

or made or to be made by Learn SPAC Holdco, Inc., including in the

Registration Statement. These risks and uncertainties include:

expectations regarding Innventure’s strategies and future financial

performance, including its future business plans, expansion and

acquisition plans or objectives, prospective performance and

opportunities and competitors, revenues, products and services,

pricing, operating expenses, product and service acceptance, market

trends, liquidity, cash flows and uses of cash, capital

expenditures, and Innventure’s ability to invest in growth

initiatives; the implementation, market acceptance and success of

Innventure’s business model and growth strategy; Innventure’s

future capital requirements and sources and uses of cash; that

Innventure will have sufficient capital upon the approval of the

Business Combination to operate as anticipated; Innventure’s

ability to obtain funding for its operations and future growth;

developments and projections relating to Innventure’s competitors

and industry; the occurrence of any event, change or other

circumstances that could give rise to the termination of the BCA;

the outcome of any legal proceedings that may be instituted against

Learn SPAC Holdco, Inc., Learn CW or Innventure following

announcement of the BCA and the transactions contemplated therein;

the inability to complete the Business Combination due to, among

other things, the failure to obtain Learn CW shareholder approval;

regulatory approvals; the risk that the announcement and

consummation of the Business Combination disrupts Innventure’s

current plans; the ability to recognize the anticipated benefits of

the Business Combination; unexpected costs related to the Business

Combination; the amount of any redemptions by existing holders of

Learn CW’s common stock being greater than expected; limited

liquidity and trading of Learn CW’s securities; geopolitical risk

and changes in applicable laws or regulations; the possibility that

Learn CW and/or Innventure may be adversely affected by other

economic, business, and/or competitive factors; the potential

characterization of Innventure as an investment company subject to

the Investment Company Act of 1940; operational risk; and the risk

that the consummation of the Business Combination is significantly

delayed or does not occur. Should one or more of these risks or

uncertainties materialize, or should any of our assumptions prove

incorrect, actual results may vary in material respects from those

projected in these forward-looking statements. All forward-looking

statements in this press release are made as of the date hereof,

based on information available to Learn CW and Innventure as of the

date hereof, and Learn CW and Innventure assume no obligation to

update any forward-looking statement, whether as a result of new

information, future events or otherwise, except as may be required

under applicable law.

Additional Information and Where to Find It In connection

with the Business Combination, Learn SPAC Holdco, Inc. has filed

the Registration Statement with the SEC containing a preliminary

proxy statement of Learn CW, a preliminary consent solicitation

statement of Innventure and a preliminary prospectus with respect

to the combined company’s securities to be issued in connection

with the Business Combination. The Registration Statement has been

declared effective and a definitive proxy statement/consent

solicitation statement/prospectus relating to the Business

Combination is being mailed to Learn CW shareholders and will be

sent to Innventure unitholders. This press release does not contain

all the information that should be considered concerning the

Business Combination and is not intended to form the basis of any

investment decision or any other decision in respect of the

Business Combination. Learn CW’s shareholders, Innventure’s

unitholders and other interested persons are urged to read the

definitive proxy statement/consent solicitation

statement/prospectus and any amendments or supplements thereto and

any other documents filed in connection with the Business

Combination, as these materials will contain important information

about Innventure, Learn CW, the combined company and the Business

Combination. The definitive proxy statement/consent

solicitation statement/prospectus and other relevant materials for

the Business Combination will be mailed to shareholders of Learn CW

as of a record date to be established for voting on the Business

Combination. Such shareholders will also be able to obtain copies

of the definitive proxy statement/consent solicitation

statement/prospectus and other documents filed with the SEC,

without charge, once available, at the SEC’s website at

www.sec.gov, or by directing a request to Learn CW Investment

Corporation, 11755 Wilshire Blvd., Suite 2320, Los Angeles,

California 90025.

Participants in the Solicitation Innventure, Learn CW and

their respective directors, executive officers, other members of

management, and employees, under SEC rules, may be deemed to be

participants in the solicitation of proxies of Learn CW’s

shareholders in connection with the Business Combination.

Information regarding the persons who may, under SEC rules, be

deemed participants in the solicitation of Learn CW’s shareholders

in connection with the Business Combination are set forth in the

Registration Statement and will also be set forth in the definitive

proxy statement/consent solicitation statement/prospectus when

available. Investors and security holders may obtain more detailed

information regarding the names and interests in the Business

Combination of Learn CW’s directors and officers in Learn CW’s

filings with the SEC and such information is also set forth in the

Registration Statement and will be included in the proxy statement

of Learn CW in connection with the Business Combination.

No Offer or Solicitation This press release shall not

constitute an offer to sell or the solicitation of an offer to buy

any securities, or a solicitation of any vote or approval, nor

shall there be any sale of any such securities in any state or

jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of any such state or jurisdiction. This press

release does not constitute either advice or a recommendation

regarding any securities. No offering of securities shall be made

except by means of a prospectus meeting the requirements of the

Securities Act of 1933, as amended, or an exemption therefrom.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240910729450/en/

Media: Laurie Steinberg, Solebury Strategic

Communications press@innventure.com

Investor Relations: Sloan Bohlen, Solebury Strategic

Communications investorrelations@innventure.com

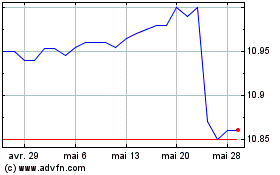

Learn CW Investment (NYSE:LCW)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Learn CW Investment (NYSE:LCW)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025