- Amended Fidelity bond filed pursuant to Rule 17g-1(g)(1) of the Investment Company Act of 1940 (40-17G/A)

25 Juillet 2011 - 11:19PM

Edgar (US Regulatory)

Excess Bond (7-92)

Form 17020842 (Ed. 7-92)

Page 1 of 1

Excess Bond (7-92) R

Form 17-02-0842 (Ed. 7-92) R

Page 1 of 5

Excess Bond (7-92)

Form 17-02-0842 (Ed. 7-92)

Page 2 of 5

Excess Bond (7-92)

Form 17-02-0842 (Ed. 70-2)

Page 3 of 5

Excess Bond (7-92)

Form 17-02-0842 (Ed. 7-92)

Page 4 of 5

Excess Bond (7-92)

Form 17020842 (Ed. 70-2)

Page 5 of 5

Excess Bond

Form 17-02-1003 (Ed. 7-92)

Excess Bond

Form 17-02-1 067 (Rev. 9-93)

Page 1

Excess Bond

Form 17-02-1067 (Rev. 9-93)

Page 2

Excess Bond

Form 17-02-1067 (Rev. 993)

Page 3

Q08-393 (0212008)

Page 1

Q09-688 (04/2009)

Page 1

14-02-9228 (02/2010)

Page 1

Excess Bond

Form 17-02-0949 (Rev. 1-97)

Page 1

10-02-1 295 (ed.

612007)

POLICYHOLDER

DISCLOSURE NOTICE OF

TERRORISM INSURANCE COVERAGE

(for policies with no terrorism exclusion or sublimit)

You are hereby notified that, under the Terrorism Risk Insurance Act (the 'Act"), effective December 26, 2007, this policy makes available to you insurance for losses arising out of certain acts of terrorism. Terrorism is defined as any act certified by the Secretary of the Treasury, in concurrence with the Secretary of State and the Attorney General of the United States, to be an act of terrorism; to be a violent act or an act that is dangerous to human life, property or infrastructure; to have resulted in damage within the United States, or outside the United States in the case of an air carrier or vessel or the premises of a United States Mission; and to have been committed by an individual or individuals as part of an effort to coerce the civilian population of the United States or to influence the policy or affect the conduct of the United States Government by coercion.

You should know that the insurance provided by your policy for losses caused by acts of

terrorism is partially reimbursed by the United States under the formula set forth in the

Act. Under this formula, the United States pays 85% of covered terrorism losses that exceed the statutorily established deductible to be paid by the insurance company

providing the coverage.

However, if aggregate insured losses attributable to terrorist acts certified under the Act

exceed $100 billion in a Program Year (January

1

through December 31), the Treasury shall not make any payment for any portion of the amount of such losses that exceeds

$100 billion.

10-02-1281 (Ed. 1/2003)

If aggregate insured losses attributable to terrorist acts certified under the Act exceed $100 billion in a Program Year (January 1 through December 31) and we have met our insurer deductible under the Act, we shall not be liable for the payment of any portion of the amount Of such losses that exceeds $100 billion, and in such case insured losses up to that amount are subject to pro rata allocation in accordance with procedures established by the Secretary of the Treasury.

The portion of your policy's annual premium that is attributable to insurance for such acts of terrorism is: $ -0-.

If you have any questions about this notice, please contact your agent or broker.

10-02-1281 (Ed. 1/2003)

Excess Bond (7-92)

Form 17020842 (Ed. 792)

Page 1 of I

Excess Bond (7-92)

Form 17-02-0842 (Ed. 7-92)

Page 1 of 1

Excess Bond (7-92) R

Form 17-02-0842 (Ed. 7-92) R

Page 1 of 5

Excess Bond (7-92)

Form 17-02-0842 (Ed. 7-92)

Page 2 of 5

Excess Bond (7-92)

Form 17-02-0842 (Ed. 70-2)

Page 3 of 5

Excess Bond (7-92)

Form 17-02-0842 (Ed. 7-92)

Page 4 of 5

Excess Bond (7-92)

Form 17-02-0842 (Ed. 70-2)

Page5of5

Excess Bond

Form 17-02-1003 (Ed. 7-92)

Q08-393 (02/2008)

Page 1

Q09-688 (04/2009)

Page 1

Excess Bond

Form 17-02-1 067 (Rev. 9-93)

Page 1

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BONDS IN EFFECT MORE THAN SIXTY (60) DAYS

|

|

|

|

|

|

|

If this bond has been in effect

for

sixty (60) days or more, or if it is a renewal of a bond

|

|

|

|

|

|

|

issued by the COMPANY, it may be terminated by the COMPANY by mailing or delivering

|

|

|

|

|

|

|

to the ASSURED and to the authorized agent or broker, if any, written notice of termination

|

|

|

|

|

|

|

at least fifteen (15) days before the effective date of termination. Furthermore, when the

|

|

|

|

|

|

|

bond is a renewal or has been in effect for sixty (60) days or more, the COMPANY may

|

|

|

|

|

|

|

terminate only for one or more of the reasons stated in a. (1 )-(7) above.

|

|

|

|

|

|

|

NOTICE OF TERMINATION

|

|

|

|

|

|

|

Notice of termination under this Section a. shall be mailed to the ASSURED and to the

|

|

|

|

|

|

|

authorized agent or broker, if any, at the address shown on the DECLARATIONS of this

|

|

|

|

|

|

|

bond. The COMPANY, however, may deliver any notice instead of mailing it.

|

|

|

|

|

|

|

RETURN PREMIUM CALCULATIONS

|

|

|

|

|

|

|

The COMPANY shall refund the unearned premium computed pro rata if this bond is

|

|

|

|

|

|

|

terminated by the COMPANY."

|

|

2

|

.

|

It is further understood and agreed that for the purposes of Section 6., Termination, any occurrence

|

|

|

|

listed in Parts (d), (e) or (f) of that Section shall be considered to be a request by the ASSURED to

|

|

|

|

immediately terminate this bond.

|

|

3

|

.

|

By adding a new Section reading as follows:

|

|

|

|

"Section 9. Election To Conditionally Renew/Nonrenew This Bond

|

|

|

|

A.

|

CONDITIONAL RENEWAL

|

|

|

|

|

If the COMPANY conditionally renews this bond subject to:

|

|

|

|

|

1

|

.

|

Change of limits of liability;

|

|

|

|

|

2

|

.

|

Change in type of coverage;

|

|

|

|

|

3

|

.

|

Reduction of coverage;

|

|

|

|

|

4

|

.

|

Increased deductible;

|

|

|

|

|

5

|

.

|

Addition of exclusion; or

|

|

|

|

|

6

|

.

|

Increased premiums in excess of 10%, exclusive of any premium increased due to and

|

|

|

|

|

|

|

commensurate with insured value added; or as a result of experience rating, retrospective

|

|

|

|

|

|

|

rating

|

or audit; the COMPANY shall send notice as provided in B. NOTICES OF

|

|

|

|

|

|

|

NONRENEWAL AND CONDITIONAL RENEWAL immediately below.

|

|

|

|

B.

|

NOTICES OF NONRENEWAL AND CONDITIONAL RENEWAL

|

|

|

|

|

1

|

.

|

If the COMPANY elects not to renew this bond, or to conditionally renew this bond as

|

|

|

|

|

|

|

provided in Section A. herein, the COMPANY shall mail or deliver written notice to the

|

|

|

|

|

|

|

ASSURED at least sixty (60) but not more than one hundred twenty (120) days before:

|

|

|

|

|

|

|

(a)

|

The expiration date; or

|

|

|

|

|

|

|

(b)

|

The anniversary date if this bond has been written for a term of more than one year.

|

Excess Bond

Form I 7-02-1067 (Rev. 993)

Page 2

Excess Bond

Form 17-02-1067 (Rev. 993)

Page 3

14-02-9228 (02/2010)

Page 1

Excess Bond

Form 17-02-0698 (Rev. 5-02)

Page 1

Excess Bond

Form I 7-02-0698 (Rev. 5-02)

Page 2

Excess Bond

Form 17-02-0698 (Rev. 502)

Page 2

Excess Bond

Form 17-02-0949 (Rev. 1-97)

Page 1

IMPORTANT NOTICE TO POLICYHOLDERS

AU of the members of the Chubb Group of Insurance companies doing business in the United States (hereinafter "Chubb") distribute their products through licensed insurance brokers and agents ("producers"). Detailed information regarding the types of compensation paid by Chubb to producers on US insurance transactions is available under the Producer Compensation link located at the bottom of the page at www.chubb.com, or by calling 1866-588-9478. Additional information may be available from your producer.

Thank you for choosing Chubb.

10-02-1295 (ed. 6/2007)

POLICYHOLDER

DISCLOSURE NOTICE OF

TERRORISM INSURANCE COVERAGE

(for

policies with no terrorism exclusion or sublimit)

You are hereby notified that, under the Terrorism Risk Insurance Act (the "Act"), effective December 26, 2007, this policy makes available to you insurance for losses arising out of certain acts of terrorism. Terrorism is defined as any act certified by the Secretary of the Treasury, in concurrence with the Secretary of State and the Attorney General of the United States, to be an act of terrorism; to be a violent act or an act that is dangerous to human life, property or infrastructure; to have resulted in damage within the United States, or outside the United States in the case of an air carrier or vessel or the premises of a United States Mission; and to have been committed by an individual or individuals as part of an effort to coerce the civilian population of the United States or to influence the policy or affect the conduct of the United States Government by coercion.

You should know that the insurance provided by your policy for losses caused by acts of

terrorism is partially reimbursed by the United States under the formula set forth in the

Act. Under this formula, the United States pays 85% of covered terrorism losses that exceed the statutorily established deductible to be paid by the insurance company

providing the coverage.

However, if aggregate insured losses attributable to terrorist acts certified under the Act exceed $100 billion in a Program Year (January 1 through December 31), the Treasury shall not make any payment for any portion of the amount of such losses that exceeds $100 billion.

10-02-1281 (Ed. 1/2003)

If aggregate insured losses attributable to terrorist acts certified under the Act exceed $100 billion in a Program Year (January 1 through December 31) and we have met our insurer deductible under the Act, we shall not be liable for the payment of any portion of the amount Of such losses that exceeds $100 billion, and in such case insured losses up to that amount are subject to pro rata allocation in accordance with procedures established by the Secretary of the Treasury.

The portion of your policy's annual premium that is attributable to insurance for such acts of terrorism is: $ -O-

If you have any questions about this notice, please contact your agent or broker.

1OO2-1281 (Ed. 1/2003)

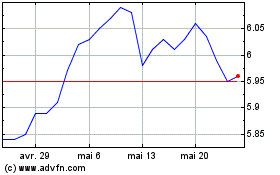

BNY Mellon Strategic Mun... (NYSE:LEO)

Graphique Historique de l'Action

De Sept 2024 à Oct 2024

BNY Mellon Strategic Mun... (NYSE:LEO)

Graphique Historique de l'Action

De Oct 2023 à Oct 2024