STATEMENT

OF INVESTMENTS

BNY Mellon Strategic Municipals, Inc.

June 30, 2024 (Unaudited)

| | | | | | | | | | |

| |

Description

| Coupon

Rate (%) | | Maturity Date | | Principal Amount

($) | | Value

($) | |

Long-Term

Municipal Investments - 145.3% | | | | | |

Alabama - 3.5% | | | | | |

Alabama

Special Care Facilities Financing Authority, Revenue Bonds (Methodist Home for the Aging Obligated

Group) | | 6.00 | | 6/1/2050 | | 5,970,000 | | 5,619,193 | |

Black Belt Energy Gas

District, Revenue Bonds, Refunding (Gas Project) Ser. D1 | | 5.50 | | 2/1/2029 | | 5,555,000 | a | 5,897,599 | |

Jefferson County, Revenue Bonds, Refunding | | 5.25 | | 10/1/2049 | | 2,500,000 | | 2,679,864 | |

Jefferson County, Revenue Bonds, Refunding | | 5.50 | | 10/1/2053 | | 1,250,000 | | 1,355,728 | |

| | 15,552,384 | |

Alaska

- .6% | | | | | |

Northern Tobacco Securitization Corp., Revenue Bonds, Refunding,

Ser. A | | 4.00 | | 6/1/2050 | | 3,000,000 | | 2,707,957 | |

Arizona

- 5.5% | | | | | |

Arizona Industrial Development Authority, Revenue Bonds (Academics

of Math & Science Project) | | 5.00 | | 7/1/2054 | | 1,275,000 | b | 1,247,849 | |

Arizona Industrial Development Authority, Revenue Bonds (Legacy

Cares Project) Ser. A | | 6.00 | | 7/1/2051 | | 1,000,000 | b,c | 60,000 | |

Arizona Industrial Development Authority, Revenue Bonds (Legacy

Cares Project) Ser. A | | 7.75 | | 7/1/2050 | | 5,770,000 | b,c | 346,200 | |

Arizona Industrial Development Authority, Revenue Bonds (Sustainable

Bond) (Equitable School Revolving Fund Obligated Group) Ser. A | | 5.25 | | 11/1/2053 | | 2,000,000 | | 2,120,670 | |

Arizona Industrial Development Authority, Revenue Bonds,

Refunding (BASIS Schools Projects) Ser. A | | 5.25 | | 7/1/2047 | | 1,600,000 | b | 1,606,016 | |

Arizona Industrial Development Authority, Revenue Bonds,

Refunding (BASIS Schools Projects) Ser. D | | 5.00 | | 7/1/2047 | | 1,035,000 | b | 1,027,998 | |

Arizona Industrial Development Authority, Revenue Bonds,

Refunding (BASIS Schools Projects) Ser. D | | 5.00 | | 7/1/2051 | | 380,000 | b | 373,363 | |

Glendale Industrial Development Authority, Revenue Bonds,

Refunding (Sun Health Services Obligated Group) Ser. A | | 5.00 | | 11/15/2054 | | 1,170,000 | | 1,128,130 | |

La Paz County Industrial Development Authority, Revenue Bonds

(Harmony Public Schools) Ser. A | | 5.00 | | 2/15/2036 | | 2,480,000 | b | 2,502,844 | |

Maricopa County Industrial Development Authority, Revenue

Bonds (Benjamin Franklin Charter School Obligated Group) | | 6.00 | | 7/1/2052 | | 3,000,000 | b | 3,090,036 | |

Maricopa County Industrial Development Authority, Revenue

Bonds, Refunding (Paradise Schools Projects Paragon Management) | | 5.00 | | 7/1/2047 | | 2,000,000 | b | 2,000,376 | |

STATEMENT

OF INVESTMENTS (Unaudited) (continued)

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount

($) | | Value

($) | |

Long-Term

Municipal Investments - 145.3% (continued) | | | | | |

Arizona

- 5.5% (continued) | | | | | |

Tender Option Bond

Trust Receipts (Series 2018-XF2537), (Salt Verde Financial Corporation, Revenue Bonds) Recourse, Underlying

Coupon Rate 5.00% | | 6.38 | | 12/1/2037 | | 4,030,000 | b,d,e | 4,393,573 | |

The Phoenix Arizona Industrial Development Authority, Revenue

Bonds, Refunding (BASIS Schools Projects) Ser. A | | 5.00 | | 7/1/2035 | | 2,360,000 | b | 2,375,543 | |

The Phoenix Arizona Industrial Development Authority, Revenue

Bonds, Refunding (BASIS Schools Projects) Ser. A | | 5.00 | | 7/1/2046 | | 2,000,000 | b | 1,999,759 | |

| | 24,272,357 | |

Arkansas

- .6% | | | | | |

Arkansas Development Finance Authority, Revenue Bonds (Sustainable

Bond) (U.S. Steel Corp.) | | 5.70 | | 5/1/2053 | | 2,600,000 | | 2,722,431 | |

California

- 4.6% | | | | | |

California County Tobacco Securitization Agency, Revenue

Bonds, Refunding, Ser. A | | 4.00 | | 6/1/2049 | | 1,400,000 | | 1,297,707 | |

California Municipal

Finance Authority, Revenue Bonds, Refunding (HumanGood California Obligated Group) Ser. A | | 5.00 | | 10/1/2044 | | 1,000,000 | | 1,017,587 | |

California Municipal

Finance Authority, Revenue Bonds, Refunding (William Jessup University) | | 5.00 | | 8/1/2039 | | 1,000,000 | b | 914,604 | |

California Statewide Communities Development Authority, Revenue

Bonds (Loma Linda University Medical Center Obligated Group) Ser. A | | 5.25 | | 12/1/2056 | | 1,000,000 | b | 1,007,991 | |

Golden State Tobacco Securitization Corp., Revenue Bonds,

Refunding (Tobacco Settlement Asset) Ser. B | | 5.00 | | 6/1/2051 | | 1,500,000 | | 1,555,028 | |

Orange County Community Facilities District, Special Tax

Bonds, Ser. A | | 5.00 | | 8/15/2052 | | 1,500,000 | | 1,532,016 | |

San Diego County Regional

Airport Authority, Revenue Bonds, Ser. B | | 5.00 | | 7/1/2051 | | 4,750,000 | | 4,933,659 | |

Tender Option Bond Trust Receipts (Series 2022-XF3024), (San

Francisco City & County, Revenue Bonds, Refunding, Ser. A) Recourse, Underlying Coupon Rate 5.00% | | 7.02 | | 5/1/2044 | | 7,860,000 | b,d,e | 8,087,249 | |

| | 20,345,841 | |

Colorado - 6.7% | | | | | |

Colorado

Health Facilities Authority, Revenue Bonds (CommonSpirit Health Obligated Group) | | 5.25 | | 11/1/2052 | | 1,500,000 | | 1,598,542 | |

Colorado Health Facilities Authority, Revenue Bonds (Covenant

Retirement Communities & Services Obligated Group) | | 5.00 | | 12/1/2048 | | 1,250,000 | | 1,267,802 | |

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount

($) | | Value

($) | |

Long-Term

Municipal Investments - 145.3% (continued) | | | | | |

Colorado

- 6.7% (continued) | | | | | |

Colorado Health Facilities

Authority, Revenue Bonds, Refunding (Covenant Living Communities & Services Obligated Group) Ser.

A | | 4.00 | | 12/1/2050 | | 4,500,000 | | 3,972,560 | |

Colorado High Performance

Transportation Enterprise, Revenue Bonds (C-470 Express Lanes System) | | 5.00 | | 12/31/2056 | | 1,245,000 | | 1,245,440 | |

Denver City & County, Revenue Bonds, Refunding (United

Airlines Project) | | 5.00 | | 10/1/2032 | | 1,000,000 | | 1,000,108 | |

Dominion Water &

Sanitation District, Revenue Bonds, Refunding | | 5.88 | | 12/1/2052 | | 4,500,000 | | 4,542,107 | |

Hess Ranch Metropolitan District No. 6, GO, Ser. A1 | | 5.00 | | 12/1/2049 | | 2,000,000 | | 1,829,200 | |

Rampart Range Metropolitan

District No. 5, Revenue Bonds | | 4.00 | | 12/1/2051 | | 2,000,000 | | 1,537,927 | |

Regional Transportation

District, Revenue Bonds, Refunding (Denver Transit Partners) Ser. A | | 4.00 | | 7/15/2034 | | 1,500,000 | | 1,522,024 | |

Tender Option Bond Trust Receipts (Series 2020-XM0829), (Colorado

Health Facilities Authority, Revenue Bonds, Refunding (CommonSpirit Health Obligated Group) Ser. A1)

Recourse, Underlying Coupon Rate 4.00% | | 5.95 | | 8/1/2044 | | 4,440,000 | b,d,e | 5,191,123 | |

Tender Option Bond Trust Receipts (Series 2023-XM1124), (Colorado

Health Facilities Authority, Revenue Bonds (Adventist Health System/Sunbelt Obligated Group) Ser. A)

Recourse, Underlying Coupon Rate 4.00% | | 3.04 | | 11/15/2048 | | 5,535,000 | b,d,e | 5,296,474 | |

Vauxmont Metropolitan District, GO, Refunding (Insured; Assured

Guaranty Municipal Corp.) | | 3.25 | | 12/15/2050 | | 650,000 | | 542,483 | |

| | 29,545,790 | |

Connecticut

- 1.4% | | | | | |

Connecticut Health & Educational Facilities Authority, Revenue

Bonds (The Hartford University) Ser. P | | 5.38 | | 7/1/2052 | | 1,500,000 | | 1,434,219 | |

Connecticut Health & Educational Facilities Authority, Revenue

Bonds, Refunding (Fairfield University) Ser. T | | 4.00 | | 7/1/2055 | | 1,000,000 | | 938,111 | |

Connecticut Housing Finance Authority, Revenue Bonds, Refunding,

Ser. A1 | | 3.65 | | 11/15/2032 | | 410,000 | | 404,600 | |

Harbor Point Infrastructure

Improvement District, Tax Allocation Bonds, Refunding (Harbor Point Project) | | 5.00 | | 4/1/2039 | | 3,500,000 | b | 3,513,846 | |

| | 6,290,776 | |

Delaware

- .2% | | | | | |

Delaware Economic Development Authority, Revenue Bonds (ACTS

Retirement-Life Communities Obligated Group) Ser. B | | 5.25 | | 11/15/2053 | | 1,000,000 | | 1,036,612 | |

STATEMENT

OF INVESTMENTS (Unaudited) (continued)

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount

($) | | Value

($) | |

Long-Term

Municipal Investments - 145.3% (continued) | | | | | |

District

of Columbia - .5% | | | | | |

Metropolitan Washington Airports Authority, Revenue Bonds,

Refunding (Dulles Metrorail) Ser. B | | 4.00 | | 10/1/2049 | | 2,500,000 | | 2,356,247 | |

Florida - 9.5% | | | | | |

Atlantic

Beach, Revenue Bonds (Fleet Landing Project) Ser. A | | 5.00 | | 11/15/2053 | | 3,000,000 | | 3,013,850 | |

Capital Trust Agency, Revenue Bonds (WFCS Portfolio Projects)

Ser. A | | 5.00 | | 1/1/2056 | | 750,000 | b | 696,272 | |

Collier County Industrial Development Authority, Revenue

Bonds (NCH Healthcare System Project) (Insured; Assured Guaranty Municipal Corp.) Ser. A | | 5.00 | | 10/1/2049 | | 1,700,000 | | 1,811,946 | |

Florida Housing Finance

Corp., Revenue Bonds (Insured; GNMA, FNMA, FHLMC) Ser. 1 | | 4.40 | | 7/1/2044 | | 2,500,000 | | 2,512,344 | |

Greater Orlando Aviation Authority, Revenue Bonds, Ser. A | | 4.00 | | 10/1/2049 | | 4,685,000 | | 4,401,962 | |

Hillsborough County

Port District, Revenue Bonds (Tampa Port Authority Project) Ser. B | | 5.00 | | 6/1/2046 | | 3,500,000 | | 3,566,569 | |

Lee Memorial Health System, Revenue Bonds, Refunding, Ser.

A1 | | 4.00 | | 4/1/2049 | | 1,650,000 | | 1,559,683 | |

Miami-Dade County, Revenue

Bonds | | 0.00 | | 10/1/2045 | | 3,000,000 | f | 1,116,551 | |

Miami-Dade County Water & Sewer System, Revenue Bonds

(Insured; Build America Mutual) | | 4.00 | | 10/1/2051 | | 1,550,000 | | 1,501,093 | |

Palm Beach County Health

Facilities Authority, Revenue Bonds (ACTS Retirement-Life Communities Obligated Group) | | 5.00 | | 11/15/2045 | | 2,850,000 | | 2,908,107 | |

Palm Beach County Health

Facilities Authority, Revenue Bonds (ACTS Retirement-Life Communities Obligated Group) Ser. B | | 5.00 | | 11/15/2042 | | 735,000 | | 764,206 | |

Palm Beach County Health

Facilities Authority, Revenue Bonds (Lifespace Communities Obligated Group) Ser. B | | 4.00 | | 5/15/2053 | | 2,600,000 | | 1,992,546 | |

Palm Beach County Health Facilities Authority, Revenue Bonds,

Refunding (Lifespace Communities Obligated Group) Ser. C | | 7.63 | | 5/15/2058 | | 1,000,000 | | 1,115,865 | |

Seminole County Industrial Development Authority, Revenue

Bonds, Refunding (Legacy Pointe at UCF Project) | | 5.75 | | 11/15/2054 | | 2,500,000 | | 2,396,112 | |

Tender Option Bond Trust Receipts (Series 2023-XM1122), (Miami-Dade

FL County Water & Sewer System, Revenue Bonds, Refunding, Ser. B) Recourse, Underlying Coupon Rate

4.00% | | 3.37 | | 10/1/2049 | | 12,750,000 | b,d,e | 12,282,214 | |

| | 41,639,320 | |

Georgia - 7.3% | | | | | |

Atlanta

Water & Wastewater, Revenue Bonds (Proctor Creek Watershed) Ser. D | | 3.50 | | 11/1/2028 | | 880,000 | b | 863,998 | |

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount

($) | | Value

($) | |

Long-Term

Municipal Investments - 145.3% (continued) | | | | | |

Georgia

- 7.3% (continued) | | | | | |

Georgia Municipal Electric

Authority, Revenue Bonds (Plant Vogtle Units 3&4 Project) Ser. A | | 5.00 | | 7/1/2052 | | 3,250,000 | | 3,395,849 | |

Main Street Natural Gas, Revenue Bonds, Ser. A | | 5.00 | | 6/1/2030 | | 1,500,000 | a | 1,586,462 | |

Main Street Natural Gas, Revenue Bonds, Ser. A | | 5.00 | | 9/1/2031 | | 3,500,000 | a | 3,718,534 | |

Tender Option Bond Trust Receipts (Series 2016-XM0435), (Private

Colleges & Universities Authority, Revenue Bonds, Refunding (Emory University)) Recourse, Underlying

Coupon Rate 5.00% | | 6.88 | | 10/1/2043 | | 10,000,000 | b,d,e | 10,016,218 | |

Tender Option Bond Trust Receipts (Series 2020-XM0825), (Brookhaven

Development Authority, Revenue Bonds (Children's Healthcare of Atlanta) Ser. A) Recourse, Underlying

Coupon Rate 4.00% | | 4.33 | | 7/1/2044 | | 6,340,000 | b,d,e | 6,705,310 | |

Tender Option Bond Trust Receipts (Series 2023-XF3183), (Municipal

Electric Authority of Georgia, Revenue Bonds (Plant Vogtle Units 3 & 4 Project) Ser. A) Recourse,

Underlying Coupon Rate 5.00% | | 6.68 | | 1/1/2059 | | 3,600,000 | b,d,e | 3,644,859 | |

The Burke County Development Authority, Revenue Bonds, Refunding

(Oglethorpe Power Corp.) Ser. D | | 4.13 | | 11/1/2045 | | 2,400,000 | | 2,192,358 | |

| | 32,123,588 | |

Hawaii

- .5% | | | | | |

Hawaii Airports System, Revenue Bonds, Ser. A | | 5.00 | | 7/1/2047 | | 1,000,000 | | 1,042,045 | |

Hawaii Department of

Budget & Finance, Revenue Bonds, Refunding (Hawaiian Electric Co.) | | 4.00 | | 3/1/2037 | | 1,500,000 | | 999,422 | |

| | 2,041,467 | |

Idaho

- 1.6% | | | | | |

Power County Industrial Development Corp., Revenue Bonds

(FMC Corp. Project) | | 6.45 | | 8/1/2032 | | 5,000,000 | | 5,015,771 | |

Spring Valley Community

Infrastructure District No. 1, Special Assessment Bonds | | 3.75 | | 9/1/2051 | | 2,000,000 | b | 1,837,793 | |

| | 6,853,564 | |

Illinois

- 9.2% | | | | | |

Chicago Board of Education, GO, Refunding, Ser. A | | 5.00 | | 12/1/2034 | | 1,400,000 | | 1,445,868 | |

Chicago Board of Education, GO,

Ser. D | | 5.00 | | 12/1/2046 | | 2,000,000 | | 2,006,986 | |

Chicago Board of Education, GO,

Ser. H | | 5.00 | | 12/1/2036 | | 2,000,000 | | 2,041,487 | |

Chicago II, GO, Refunding,

Ser. A | | 6.00 | | 1/1/2038 | | 3,000,000 | | 3,121,859 | |

Chicago II, GO, Ser.

A | | 5.00 | | 1/1/2044 | | 4,000,000 | | 4,085,557 | |

Chicago II, GO, Ser.

A | | 5.50 | | 1/1/2049 | | 1,000,000 | | 1,034,141 | |

Chicago Midway International

Airport, Revenue Bonds, Refunding, Ser. C | | 5.00 | | 1/1/2041 | | 1,550,000 | | 1,643,883 | |

Illinois, GO, Refunding, Ser. A | | 5.00 | | 10/1/2029 | | 1,100,000 | | 1,161,531 | |

Illinois, GO, Ser. A | | 5.00 | | 5/1/2038 | | 3,400,000 | | 3,534,709 | |

Illinois, GO, Ser. C | | 5.00 | | 11/1/2029 | | 1,120,000 | | 1,167,387 | |

STATEMENT

OF INVESTMENTS (Unaudited) (continued)

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount

($) | | Value

($) | |

Long-Term

Municipal Investments - 145.3% (continued) | | | | | |

Illinois

- 9.2% (continued) | | | | | |

Illinois, GO, Ser.

D | | 5.00 | | 11/1/2028 | | 2,825,000 | | 2,946,831 | |

Illinois, Revenue

Bonds (Auxiliary Facilities System) Ser. A | | 5.00 | | 4/1/2044 | | 1,000,000 | | 1,000,960 | |

Illinois Finance Authority, Revenue Bonds (Plymouth Place

Obligated Group) Ser. A | | 6.63 | | 5/15/2052 | | 1,000,000 | | 1,047,942 | |

Illinois Finance Authority, Revenue

Bonds, Refunding (Lutheran Life Communities Obligated Group) Ser. A | | 5.00 | | 11/1/2049 | | 1,750,000 | | 1,320,613 | |

Metropolitan Pier & Exposition Authority, Revenue Bonds

(McCormick Place Expansion Project) | | 5.00 | | 6/15/2057 | | 2,000,000 | | 2,033,792 | |

Metropolitan Pier & Exposition Authority, Revenue Bonds

(McCormick Place Project) (Insured; National Public Finance Guarantee Corp.) Ser. A | | 0.00 | | 12/15/2036 | | 2,500,000 | f | 1,495,384 | |

Metropolitan Pier & Exposition Authority, Revenue Bonds,

Refunding (McCormick Place Expansion Project) | | 0.00 | | 12/15/2054 | | 21,800,000 | f | 4,543,268 | |

Sales Tax Securitization Corp., Revenue Bonds, Refunding,

Ser. A | | 4.00 | | 1/1/2038 | | 2,000,000 | | 2,007,382 | |

Tender Option Bond

Trust Receipts (Series 2023-XF1623), (Regional Transportation Authority Illinois, Revenue Bonds, Ser.

B) Non-Recourse, Underlying Coupon Rate 4.00% | | 3.37 | | 6/1/2048 | | 3,000,000 | b,d,e | 2,838,602 | |

| | 40,478,182 | |

Indiana

- 1.5% | | | | | |

Indiana Finance Authority, Revenue Bonds (Ohio Valley Electric

Project) Ser. B | | 3.00 | | 11/1/2030 | | 1,000,000 | | 938,158 | |

Indiana Finance Authority, Revenue

Bonds (Sustainable Bond) | | 7.00 | | 3/1/2039 | | 5,525,000 | b | 3,613,485 | |

Indianapolis Local Public Improvement Bond Bank, Revenue

Bonds (City Moral Obligation) (Insured; Build America Mutual) Ser. F1 | | 5.25 | | 3/1/2067 | | 1,750,000 | | 1,865,700 | |

| | 6,417,343 | |

Iowa

- 1.4% | | | | | |

Iowa Finance Authority, Revenue Bonds, Refunding (Iowa Fertilizer

Co. Project) | | 5.00 | | 12/1/2050 | | 2,515,000 | | 2,667,308 | |

Iowa Finance Authority, Revenue

Bonds, Refunding (Lifespace Communities Obligated Group) Ser. A | | 4.00 | | 5/15/2053 | | 1,000,000 | | 766,364 | |

Iowa Finance Authority, Revenue Bonds, Refunding (Lifespace

Communities Obligated Group) Ser. A | | 4.00 | | 5/15/2046 | | 500,000 | | 406,880 | |

Iowa Student Loan Liquidity Corp., Revenue Bonds, Ser. B | | 5.00 | | 12/1/2031 | | 2,000,000 | | 2,103,241 | |

| | 5,943,793 | |

Kentucky

- 1.2% | | | | | |

Henderson, Revenue Bonds (Pratt Paper Project) Ser. A | | 4.70 | | 1/1/2052 | | 1,000,000 | b | 983,320 | |

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount

($) | | Value

($) | |

Long-Term

Municipal Investments - 145.3% (continued) | | | | | |

Kentucky

- 1.2% (continued) | | | | | |

Kentucky Public Energy

Authority, Revenue Bonds, Ser. A | | 5.00 | | 7/1/2030 | | 1,750,000 | a | 1,835,345 | |

Kentucky Public Energy Authority, Revenue Bonds, Ser. A1 | | 4.00 | | 8/1/2030 | | 2,270,000 | a | 2,263,836 | |

| | 5,082,501 | |

Louisiana - 3.4% | | | | | |

Louisiana

Local Government Environmental Facilities & Community Development Authority, Revenue Bonds, Refunding

(Westlake Chemical Project) | | 3.50 | | 11/1/2032 | | 3,100,000 | | 2,997,362 | |

Louisiana Public Facilities

Authority, Revenue Bonds, Refunding (Tulane University) Ser. A | | 4.00 | | 4/1/2030 | | 115,000 | g | 120,109 | |

New Orleans Aviation Board, Revenue Bonds (General Airport-N

Terminal Project) Ser. A | | 5.00 | | 1/1/2048 | | 1,000,000 | | 1,017,643 | |

Tender Option Bond

Trust Receipts (Series 2018-XF2584), (Louisiana Public Facilities Authority, Revenue Bonds (Franciscan

Missionaries of Our Lady Health System Project)) Non-recourse, Underlying Coupon Rate 5.00% | | 6.59 | | 7/1/2047 | | 10,755,000 | b,d,e | 10,846,781 | |

| | 14,981,895 | |

Maryland - 2.1% | | | | | |

Maryland

Economic Development Corp., Revenue Bonds (Sustainable Bond) (Purple Line Transit Partners) Ser. B | | 5.25 | | 6/30/2055 | | 3,120,000 | | 3,234,090 | |

Maryland Economic Development

Corp., Tax Allocation Bonds (Port Covington Project) | | 4.00 | | 9/1/2050 | | 1,000,000 | | 830,752 | |

Maryland Health & Higher Educational Facilities Authority, Revenue

Bonds (Adventist Healthcare Obligated Group) Ser. A | | 5.50 | | 1/1/2046 | | 3,250,000 | | 3,296,449 | |

Maryland State Transportation Authority, Revenue Bonds, Refunding,

Ser. A | | 4.00 | | 7/1/2037 | | 2,000,000 | | 2,054,907 | |

| | 9,416,198 | |

Massachusetts

- 4.6% | | | | | |

Lowell Collegiate Charter School, Revenue Bonds | | 5.00 | | 6/15/2054 | | 1,620,000 | | 1,607,520 | |

Massachusetts Development

Finance Agency, Revenue Bonds, Refunding (Boston Medical Center Corp. Obligated Group) | | 5.25 | | 7/1/2052 | | 1,500,000 | | 1,603,080 | |

Massachusetts Development

Finance Agency, Revenue Bonds, Refunding (NewBridge Charles Obligated Group) | | 5.00 | | 10/1/2057 | | 1,000,000 | b | 1,001,408 | |

Massachusetts Development Finance Agency, Revenue Bonds,

Ser. T | | 4.00 | | 3/1/2054 | | 1,000,000 | | 972,285 | |

Tender Option Bond

Trust Receipts (Series 2023-XF1604), (Massachusetts State Transportation Fund, Revenue Bonds, Ser.

B) Non-recourse, Underlying Coupon Rate 5.00% | | 6.92 | | 6/1/2053 | | 14,000,000 | b,d,e | 15,145,800 | |

| | 20,330,093 | |

STATEMENT

OF INVESTMENTS (Unaudited) (continued)

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount

($) | | Value

($) | |

Long-Term

Municipal Investments - 145.3% (continued) | | | | | |

Michigan

- 7.6% | | | | | |

Great Lakes Water Authority Sewage Disposal System, Revenue

Bonds, Refunding, Ser. C | | 5.00 | | 7/1/2036 | | 3,000,000 | | 3,062,433 | |

Michigan Finance Authority, Revenue

Bonds (Beaumont Health Credit Group) | | 5.00 | | 11/1/2044 | | 5,065,000 | | 5,120,706 | |

Michigan Finance Authority, Revenue Bonds (Sustainable Bond)

(Henry Ford) | | 5.50 | | 2/28/2057 | | 2,700,000 | | 2,954,564 | |

Michigan Finance Authority, Revenue

Bonds, Refunding (Beaumont-Spectrum) | | 4.00 | | 4/15/2042 | | 1,500,000 | | 1,462,125 | |

Michigan Finance Authority, Revenue Bonds, Refunding (Great

Lakes Water Authority) (Insured; Assured Guaranty Municipal Corp.) Ser. C3 | | 5.00 | | 7/1/2031 | | 1,000,000 | | 1,000,770 | |

Michigan Finance Authority, Revenue Bonds, Refunding (Insured;

National Public Finance Guarantee Corp.) Ser. D6 | | 5.00 | | 7/1/2036 | | 2,000,000 | | 2,001,540 | |

Michigan Finance Authority, Revenue Bonds, Refunding, Ser.

A2 | | 5.00 | | 6/1/2040 | | 4,435,000 | | 4,625,000 | |

Michigan Finance Authority, Revenue

Bonds, Refunding, Ser. D2 | | 5.00 | | 7/1/2034 | | 2,000,000 | | 2,019,905 | |

Tender Option Bond

Trust Receipts (Series 2024-XM1171), (Michigan State University,Revenue Bonds, Ser. A) Non-recourse,

Underlying Coupon Rate 5.25% | | 8.13 | | 8/15/2054 | | 10,000,000 | b,d,e | 10,988,531 | |

| | 33,235,574 | |

Minnesota - .7% | | | | | |

Duluth

Economic Development Authority, Revenue Bonds, Refunding (Essentia Health Obligated Group) Ser. A | | 5.00 | | 2/15/2058 | | 3,000,000 | | 3,020,935 | |

Missouri

- 3.9% | | | | | |

Missouri Housing Development Commission, Revenue Bonds (First

Place HomeOwenership Loan) (Insured; GNMA, FNMA, FHLMC) Ser. A | | 4.60 | | 11/1/2049 | | 1,750,000 | | 1,742,573 | |

St. Louis County Industrial Development Authority, Revenue

Bonds (Friendship Village St. Louis Obligated Group) Ser. A | | 5.13 | | 9/1/2049 | | 2,975,000 | | 2,919,096 | |

St. Louis County Industrial Development Authority, Revenue

Bonds (Friendship Village St. Louis Obligated Group) Ser. A | | 5.13 | | 9/1/2048 | | 2,025,000 | | 1,998,606 | |

St. Louis Land Clearance for Redevelopment Authority, Revenue

Bonds (National Geospatial Intelligence) | | 5.13 | | 6/1/2046 | | 4,580,000 | | 4,594,153 | |

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount

($) | | Value

($) | |

Long-Term

Municipal Investments - 145.3% (continued) | | | | | |

Missouri

- 3.9% (continued) | | | | | |

Tender Option Bond

Trust Receipts (Series 2023-XM1116), (Jackson County Missouri Special Obligation, Revenue Bonds, Refunding,

Ser. A) Non-Recourse, Underlying Coupon Rate 4.25% | | 3.96 | | 12/1/2053 | | 3,000,000 | b,d,e | 2,913,715 | |

The St. Louis Missouri Industrial Development Authority, Tax

Allocation Bonds (St. Louis Innovation District Project) | | 4.38 | | 5/15/2036 | | 3,045,000 | | 2,936,351 | |

| | 17,104,494 | |

Nebraska

- .2% | | | | | |

Omaha Public Power District, Revenue Bonds, Ser. A | | 4.00 | | 2/1/2051 | | 1,000,000 | | 963,408 | |

Nevada

- 1.5% | | | | | |

Clark County School District, GO (Insured; Assured Guaranty

Municipal Corp.) Ser. A | | 4.25 | | 6/15/2041 | | 3,745,000 | | 3,811,481 | |

Reno, Revenue Bonds,

Refunding (Insured; Assured Guaranty Municipal Corp.) | | 4.00 | | 6/1/2058 | | 2,750,000 | | 2,586,462 | |

| | 6,397,943 | |

New

Hampshire - .2% | | | | | |

New Hampshire Business Finance Authority, Revenue Bonds,

Refunding (Sustainable Bond) Ser. B | | 3.75 | | 7/2/2040 | | 1,000,000 | a,b | 835,122 | |

New Jersey - 5.1% | | | | | |

New

Jersey, GO (COVID-19 Emergency Bonds) Ser. A | | 4.00 | | 6/1/2031 | | 1,000,000 | | 1,050,993 | |

New Jersey Economic Development Authority, Revenue Bonds,

Refunding, Ser. XX | | 5.25 | | 6/15/2027 | | 1,855,000 | | 1,879,200 | |

New Jersey Health Care

Facilities Financing Authority, Revenue Bonds (RWJ Barnabas Health Obligated Group) | | 4.00 | | 7/1/2051 | | 1,500,000 | | 1,439,337 | |

New Jersey Higher Education Student Assistance Authority, Revenue

Bonds, Refunding, Ser. A | | 5.00 | | 12/1/2032 | | 1,275,000 | | 1,362,957 | |

New Jersey Housing

& Mortgage Finance Agency, Revenue Bonds, Refunding, Ser. D | | 4.00 | | 4/1/2025 | | 1,560,000 | | 1,556,742 | |

New Jersey Transportation Trust Fund Authority, Revenue Bonds | | 5.00 | | 6/15/2044 | | 2,000,000 | | 2,160,132 | |

New Jersey Transportation

Trust Fund Authority, Revenue Bonds | | 5.25 | | 6/15/2043 | | 2,000,000 | | 2,089,960 | |

New Jersey Transportation Trust Fund Authority, Revenue Bonds | | 5.50 | | 6/15/2050 | | 2,700,000 | | 2,978,730 | |

New Jersey Transportation

Trust Fund Authority, Revenue Bonds, Ser. AA | | 5.25 | | 6/15/2033 | | 1,500,000 | | 1,521,374 | |

Tender Option Bond Trust Receipts (Series 2018-XF2538), (New

Jersey Economic Development Authority, Revenue Bonds) Recourse, Underlying Coupon Rate 5.25% | | 7.39 | | 6/15/2040 | | 3,250,000 | b,d,e | 3,309,573 | |

Tobacco Settlement Financing Corp., Revenue Bonds, Refunding,

Ser. B | | 5.00 | | 6/1/2046 | | 2,970,000 | | 2,998,225 | |

| | 22,347,223 | |

STATEMENT

OF INVESTMENTS (Unaudited) (continued)

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount

($) | | Value

($) | |

Long-Term

Municipal Investments - 145.3% (continued) | | | | | |

New York

- 8.7% | | | | | |

New York Convention Center Development Corp., Revenue Bonds

(Hotel Unit Fee) (Insured; Assured Guaranty Municipal Corp.) Ser. B | | 0.00 | | 11/15/2052 | | 7,825,000 | f | 1,895,476 | |

New York Liberty Development Corp., Revenue Bonds, Refunding

(Class 1-3 World Trade Center Project) | | 5.00 | | 11/15/2044 | | 7,000,000 | b | 7,006,913 | |

New York State Dormitory Authority, Revenue Bonds, Refunding

(Montefiore Obligated Group) Ser. A | | 4.00 | | 9/1/2050 | | 1,000,000 | | 898,485 | |

New York Transportation Development Corp., Revenue Bonds

(Delta Air Lines) | | 4.00 | | 1/1/2036 | | 1,000,000 | | 1,000,611 | |

New York Transportation

Development Corp., Revenue Bonds (JFK International Airport Terminal) | | 5.00 | | 12/1/2040 | | 3,535,000 | | 3,720,645 | |

New York Transportation Development Corp., Revenue Bonds

(LaGuardia Airport Terminal B Redevelopment Project) Ser. A | | 5.00 | | 7/1/2046 | | 3,500,000 | | 3,499,829 | |

New York Transportation Development Corp., Revenue Bonds

(LaGuradia Airport Terminal) | | 5.63 | | 4/1/2040 | | 1,000,000 | | 1,088,118 | |

New York Transportation

Development Corp., Revenue Bonds (Sustainable Bond) (JFK International Airport Terminal One Project)

(Insured; Assured Guaranty Municipal Corp.) | | 5.13 | | 6/30/2060 | | 1,000,000 | | 1,035,570 | |

Niagara Area Development Corp., Revenue Bonds, Refunding

(Covanta Project) Ser. A | | 4.75 | | 11/1/2042 | | 2,000,000 | b | 1,880,802 | |

Tender Option Bond Trust Receipts (Series 2022-XM1004), (Metropolitan

Transportation Authority, Revenue Bonds, Refunding (Sustainable Bond) (Insured; Assured Guaranty Municipal

Corp.) Ser. C) Non-Recourse, Underlying Coupon Rate 4.00% | | 3.58 | | 11/15/2047 | | 6,300,000 | b,d,e | 6,138,005 | |

Tender Option Bond Trust Receipts (Series 2024-XM1174), (New

York State Transportation Development Corp., Revenue Bonds (Sustainable Bond) (JFK International Airport

Terminal one Project) (Insured; Assured Guaranty Municipal Corp.)) Recourse, Underlying Coupon Rate 5.25% | | 7.66 | | 6/30/2060 | | 3,730,000 | b,d,e | 3,907,570 | |

Triborough Bridge & Tunnel Authority, Revenue Bonds,

Ser. A1 | | 4.13 | | 5/15/2064 | | 3,000,000 | | 2,891,186 | |

TSASC, Revenue Bonds,

Refunding, Ser. B | | 5.00 | | 6/1/2045 | | 1,165,000 | | 1,051,544 | |

Westchester County

Local Development Corp., Revenue Bonds, Refunding (Purchase Senior Learning Community Obligated Group) | | 5.00 | | 7/1/2046 | | 2,150,000 | b | 2,144,312 | |

| | 38,159,066 | |

North Carolina - 3.1% | | | | | |

North

Carolina Medical Care Commission, Revenue Bonds (The United Methodist Retirement Homes Obligated Group)

Ser. A | | 5.13 | | 10/1/2054 | | 1,250,000 | | 1,289,980 | |

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount

($) | | Value

($) | |

Long-Term

Municipal Investments - 145.3% (continued) | | | | | |

North

Carolina - 3.1% (continued) | | | | | |

North

Carolina Medical Care Commission, Revenue Bonds, Refunding (Lutheran Services for the Aging Obligated

Group) | | 4.00 | | 3/1/2051 | | 2,300,000 | | 1,858,687 | |

North Carolina Medical

Care Commission, Revenue Bonds, Refunding (Pennybyrn at Maryfield) | | 5.00 | | 10/1/2035 | | 1,005,000 | | 1,004,945 | |

Tender Option Bond Trust Receipts (Series 2022-XF1352), (North

Carolina State Medical Care Commission Health Care Facilities, Revenue Bonds (Novant Health Obligated

Group) Ser. A) Non-recourse, Underlying Coupon Rate 4.00% | | 3.68 | | 11/1/2052 | | 10,000,000 | b,d,e | 9,480,067 | |

| | 13,633,679 | |

Ohio

- 6.3% | | | | | |

Buckeye Tobacco Settlement Financing Authority, Revenue Bonds,

Refunding, Ser. B2 | | 5.00 | | 6/1/2055 | | 11,055,000 | | 10,206,486 | |

Canal Winchester Local

School District, GO, Refunding (Insured; National Public Finance Guarantee Corp.) | | 0.00 | | 12/1/2031 | | 3,955,000 | f | 2,995,318 | |

Canal Winchester Local School District, GO, Refunding (Insured;

National Public Finance Guarantee Corp.) | | 0.00 | | 12/1/2029 | | 3,955,000 | f | 3,241,411 | |

Cuyahoga County, Revenue Bonds, Refunding (The MetroHealth

System) | | 5.00 | | 2/15/2052 | | 2,000,000 | | 2,004,740 | |

Franklin County Convention

Facilities Authority, Revenue Bonds (GRTR Columbus Convention Center) | | 5.00 | | 12/1/2044 | | 1,250,000 | | 1,245,203 | |

Greater Cincinnati Development Authority, Revenue Bonds,

Refunding (Duke Energy Co.) (Insured; Assured Guaranty Municipal Corp.) Ser. B | | 4.38 | | 12/1/2058 | | 1,000,000 | | 992,710 | |

Ohio Air Quality Development Authority, Revenue Bonds (Pratt

Paper OH Project) | | 4.50 | | 1/15/2048 | | 2,250,000 | b | 2,233,808 | |

Tender Option Bond Trust Receipts (Series 2024-XF1711), (University

of Cincinnati Ohio Receipt, Revenue Bonds, Ser. A) Non-Recourse, Underlying Coupon Rate 5.00% | | 7.12 | | 6/1/2049 | | 4,525,000 | b,d,e | 4,895,321 | |

| | 27,814,997 | |

Oklahoma - 1.3% | | | | | |

Oklahoma

Development Finance Authority, Revenue Bonds (OU Medicine Project) Ser. B | | 5.50 | | 8/15/2057 | | 1,500,000 | | 1,539,537 | |

Tender Option Bond Trust Receipts (Series 2024-XM1163), (Oklahoma

City Water Utilities Trust, Revenue Bonds, Refunding) Non-Recourse, Underlying Coupon Rate 5.25% | | 7.98 | | 7/1/2064 | | 3,600,000 | b,d,e | 3,995,280 | |

| | 5,534,817 | |

STATEMENT

OF INVESTMENTS (Unaudited) (continued)

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount

($) | | Value

($) | |

Long-Term

Municipal Investments - 145.3% (continued) | | | | | |

Oregon

- .6% | | | | | |

Clackamas County Hospital Facility Authority, Revenue Bonds,

Refunding (Willamette View Obligated Group) Ser. A | | 5.00 | | 11/15/2047 | | 1,500,000 | | 1,432,269 | |

Yamhill County Hospital Authority, Revenue Bonds, Refunding

(Friendsview Retirement Community) Ser. A | | 5.00 | | 11/15/2046 | | 1,250,000 | | 1,040,676 | |

| | 2,472,945 | |

Pennsylvania

- 5.8% | | | | | |

Clairton Municipal Authority, Revenue Bonds, Refunding, Ser.

B | | 5.00 | | 12/1/2034 | | 1,000,000 | | 1,078,401 | |

Crawford County Hospital

Authority, Revenue Bonds, Refunding (Meadville Medical Center Project) Ser. A | | 6.00 | | 6/1/2046 | | 1,175,000 | | 1,186,424 | |

Pennsylvania Economic Development Financing Authority, Revenue

Bonds (The Penndot Major Bridges) | | 6.00 | | 6/30/2061 | | 3,000,000 | | 3,294,909 | |

Pennsylvania Higher Educational Facilities Authority, Revenue

Bonds, Refunding (University of Sciences in Philadelphia) | | 5.00 | | 11/1/2036 | | 3,675,000 | | 3,686,345 | |

Pennsylvania Turnpike Commission, Revenue Bonds, Ser. A | | 4.00 | | 12/1/2050 | | 1,500,000 | | 1,406,958 | |

Philadelphia Airport, Revenue

Bonds, Refunding (Private Activity) | | 5.00 | | 7/1/2027 | | 4,300,000 | | 4,448,734 | |

Tender Option Bond Trust Receipts (Series 2022-XF1525), (Pennsylvania

Economic Development Financing Authority UPMC, Revenue Bonds, Ser. A) Recourse, Underlying Coupon Rate

4.00% | | 3.50 | | 5/15/2053 | | 4,000,000 | b,d,e | 3,767,861 | |

Tender Option Bond Trust Receipts (Series 2023-XM1133), (Philadelphia

Water & Wastewater, Revenue Bonds, Refunding (Insured; Assured Guaranty Municipal Corp.) Ser. B)

Non-Recourse, Underlying Coupon Rate 5.50% | | 8.74 | | 9/1/2053 | | 5,820,000 | b,d,e | 6,513,503 | |

| | 25,383,135 | |

Rhode

Island - 1.4% | | | | | |

Tender Option Bond Trust Receipts (Series 2023-XM1117), (Rhode

Island Infrastructure Bank State Revolving Fund, Revenue Bonds, Ser. A) Non-Recourse, Underlying Coupon

Rate 4.13% | | 2.44 | | 10/1/2048 | | 6,000,000 | b,d,e | 6,021,132 | |

South

Carolina - 4.9% | | | | | |

South Carolina Jobs-Economic Development Authority, Revenue

Bonds (Bishop Gadsden Episcopal Retirement Community Obligated Group) | | 5.00 | | 4/1/2054 | | 1,000,000 | | 961,037 | |

South Carolina Jobs-Economic Development Authority, Revenue

Bonds, Refunding (Bon Secours Mercy Health) | | 4.00 | | 12/1/2044 | | 2,810,000 | | 2,738,417 | |

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount

($) | | Value

($) | |

Long-Term

Municipal Investments - 145.3% (continued) | | | | | |

South

Carolina - 4.9% (continued) | | | | | |

South

Carolina Public Service Authority, Revenue Bonds, Refunding (Santee Cooper) Ser. A | | 4.00 | | 12/1/2055 | | 3,000,000 | | 2,716,946 | |

Tender Option Bond Trust Receipts (Series 2016-XM0384), (South

Carolina Public Service Authority, Revenue Bonds, Refunding (Santee Cooper)) Non-recourse, Underlying

Coupon Rate 5.13% | | 5.87 | | 12/1/2043 | | 15,000,000 | b,d,e | 14,990,372 | |

| | 21,406,772 | |

South Dakota - 1.1% | | | | | |

Tender

Option Bond Trust Receipts (Series 2022-XF1409), (South Dakota Heath & Educational Facilities Authority,

Revenue Bonds, Refunding (Avera Health Obligated Group)) Non-Recourse, Underlying Coupon Rate 5.00% | | 7.13 | | 7/1/2046 | | 4,720,000 | b,d,e | 4,782,936 | |

Texas

- 15.6% | | | | | |

Arlington Higher Education Finance Corp., Revenue Bonds (BASIS

Texas Charter Schools) | | 5.00 | | 6/15/2064 | | 1,400,000 | b | 1,383,247 | |

Arlington Higher Education Finance Corp., Revenue Bonds (Uplift

Education) (Insured; Permanent School Fund Guarantee Program) Ser. A | | 4.25 | | 12/1/2053 | | 1,500,000 | | 1,465,200 | |

Beaumont Navigation District, Revenue Bonds (Jefferson Gulf

Coast Energy Project) Ser. A | | 5.25 | | 1/1/2054 | | 1,500,000 | b | 1,505,567 | |

Central Texas Regional Mobility Authority, Revenue Bonds | | 5.00 | | 1/1/2048 | | 2,500,000 | | 2,565,400 | |

Clifton Higher Education

Finance Corp., Revenue Bonds (IDEA Public Schools) Ser. A | | 4.00 | | 8/15/2047 | | 3,100,000 | | 2,856,920 | |

Clifton Higher Education Finance Corp., Revenue Bonds (International

Leadership of Texas) Ser. A | | 5.75 | | 8/15/2045 | | 4,500,000 | | 4,558,164 | |

Clifton Higher Education

Finance Corp., Revenue Bonds (International Leadership of Texas) Ser. D | | 5.75 | | 8/15/2033 | | 1,000,000 | | 1,018,784 | |

Clifton Higher Education Finance Corp., Revenue Bonds (International

Leadership of Texas) Ser. D | | 6.13 | | 8/15/2048 | | 6,000,000 | | 6,098,674 | |

Clifton Higher Education

Finance Corp., Revenue Bonds (Uplift Education) Ser. A | | 4.50 | | 12/1/2044 | | 2,500,000 | | 2,362,542 | |

Clifton Higher Education Finance Corp., Revenue Bonds, Refunding

(IDEA Public Schools) (Insured; Permanent School Fund Guarantee Program) | | 4.00 | | 8/15/2054 | | 1,000,000 | | 948,556 | |

Clifton Higher Education Finance Corp., Revenue Bonds, Refunding

(International Leadership of Texas) (Insured; Permanent School Fund Guarantee Program) Ser. A | | 4.25 | | 8/15/2053 | | 1,000,000 | | 993,608 | |

STATEMENT

OF INVESTMENTS (Unaudited) (continued)

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount

($) | | Value

($) | |

Long-Term

Municipal Investments - 145.3% (continued) | | | | | |

Texas

- 15.6% (continued) | | | | | |

Dallas Independent

School District, GO, Refunding (Insured; Permanent School Fund Guarantee Program) | | 4.00 | | 2/15/2054 | | 2,250,000 | | 2,161,898 | |

Fort Bend County, Revenue Bonds, Refunding (Insured; Assured

Guaranty Municipal Corp.) | | 4.25 | | 3/1/2054 | | 2,500,000 | | 2,427,500 | |

Grand Parkway Transportation

Corp., Revenue Bonds, Refunding | | 4.00 | | 10/1/2049 | | 1,000,000 | | 923,219 | |

Harris County-Houston Sports Authority, Revenue Bonds, Refunding

(Insured; Assured Guaranty Municipal Corp.) Ser. A | | 0.00 | | 11/15/2050 | | 6,500,000 | f | 1,815,638 | |

Houston Airport System, Revenue Bonds, Refunding (Insured;

Assured Guaranty Municipal Corp.) Ser. A | | 4.50 | | 7/1/2053 | | 2,400,000 | | 2,402,254 | |

Houston Airport System, Revenue Bonds, Refunding, Ser. A | | 4.00 | | 7/1/2046 | | 1,610,000 | | 1,536,048 | |

Lamar Consolidated

Independent School District, GO | | 4.00 | | 2/15/2053 | | 1,235,000 | | 1,183,179 | |

Mission Economic Development Corp., Revenue Bonds, Refunding

(Natgasoline Project) | | 4.63 | | 10/1/2031 | | 2,000,000 | b | 1,984,681 | |

North Texas Tollway Authority, Revenue Bonds, Refunding | | 5.00 | | 1/1/2048 | | 2,000,000 | | 2,059,758 | |

Tarrant County Cultural

Education Facilities Finance Corp., Revenue Bonds (Baylor Scott & White Health Project) | | 5.00 | | 11/15/2051 | | 2,000,000 | | 2,107,559 | |

Tender Option Bond

Trust Receipts (Series 2023-XM1125), (Medina Valley Independent School District, GO (Insured; Permanent

School Fund Guarantee Program)) Non-recourse, Underlying Coupon Rate 4.00% | | 3.91 | | 2/15/2053 | | 7,500,000 | b,d,e | 7,177,322 | |

Tender Option Bond Trust Receipts (Series 2024-XM1164), (Texas

University System, Revenue Bonds, Refunding) Non-Recourse, Underlying Coupon Rate 5.25% | | 3.91 | | 3/15/2054 | | 4,000,000 | b,d,e | 4,405,035 | |

Texas Municipal Gas Acquisition & Supply Corp. IV, Revenue

Bonds, Ser. B | | 5.50 | | 1/1/2034 | | 4,000,000 | a | 4,470,204 | |

Texas Private Activity Bond Surface Transportation Corp., Revenue

Bonds (Blueridge Transportation Group) | | 5.00 | | 12/31/2050 | | 1,300,000 | | 1,307,900 | |

Texas Private Activity Bond Surface Transportation Corp., Revenue

Bonds (Segment 3C Project) | | 5.00 | | 6/30/2058 | | 5,000,000 | | 5,106,234 | |

Waxahachie Independent

School District, GO (Insured; Permanent School Fund Guarantee Program) | | 4.25 | | 2/15/2053 | | 1,500,000 | | 1,497,211 | |

| | 68,322,302 | |

U.S.

Related - 1.4% | | | | | |

Guam Housing Corp., Revenue Bonds (Insured; Federal Home

Loan Mortgage Corp.) Ser. A | | 5.75 | | 9/1/2031 | | 770,000 | | 770,820 | |

Puerto Rico, GO,

Ser. A | | 0.00 | | 7/1/2033 | | 381,733 | f | 255,239 | |

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount

($) | | Value

($) | |

Long-Term

Municipal Investments - 145.3% (continued) | | | | | |

U.S.

Related - 1.4% (continued) | | | | | |

Puerto

Rico, GO, Ser. A | | 0.00 | | 7/1/2024 | | 48,128 | f | 48,128 | |

Puerto Rico, GO, Ser. A1 | | 4.00 | | 7/1/2033 | | 296,629 | | 297,743 | |

Puerto Rico, GO, Ser. A1 | | 4.00 | | 7/1/2041 | | 311,133 | | 291,027 | |

Puerto Rico, GO, Ser. A1 | | 4.00 | | 7/1/2046 | | 323,574 | | 293,965 | |

Puerto Rico, GO, Ser. A1 | | 4.00 | | 7/1/2035 | | 266,630 | | 262,432 | |

Puerto Rico, GO, Ser. A1 | | 4.00 | | 7/1/2037 | | 228,839 | | 220,950 | |

Puerto Rico, GO, Ser. A1 | | 5.38 | | 7/1/2025 | | 330,362 | | 333,222 | |

Puerto Rico, GO, Ser. A1 | | 5.63 | | 7/1/2029 | | 2,356,059 | | 2,530,220 | |

Puerto Rico, GO, Ser. A1 | | 5.63 | | 7/1/2027 | | 327,370 | | 341,836 | |

Puerto Rico, GO, Ser. A1 | | 5.75 | | 7/1/2031 | | 312,813 | | 347,966 | |

| | 5,993,548 | |

Utah

- .8% | | | | | |

Utah Charter School Finance Authority, Revenue Bonds, Refunding

(Summit Academy) Ser. A | | 5.00 | | 4/15/2049 | | 1,190,000 | | 1,211,796 | |

Utah Infrastructure

Agency, Revenue Bonds, Refunding, Ser. A | | 5.00 | | 10/15/2037 | | 2,345,000 | | 2,389,113 | |

| | 3,600,909 | |

Virginia

- 4.3% | | | | | |

Tender Option Bond Trust Receipts (Series 2018-XM0593), (Hampton

Roads Transportation Accountability Commission, Revenue Bonds) Non-recourse, Underlying Coupon Rate 5.50% | | 8.71 | | 7/1/2057 | | 7,500,000 | b,d,e | 8,103,251 | |

Virginia Housing Development Authority, Revenue Bonds, Ser.

A | | 4.80 | | 9/1/2059 | | 4,900,000 | | 4,977,385 | |

Virginia Small Business

Financing Authority, Revenue Bonds (Transform 66 P3 Project) | | 5.00 | | 12/31/2052 | | 4,620,000 | | 4,675,053 | |

Williamsburg Economic Development Authority, Revenue Bonds

(William & Mary Project) (Insured; Assured Guaranty Municipal Corp.) Ser. A | | 4.13 | | 7/1/2058 | | 1,250,000 | | 1,207,589 | |

| | 18,963,278 | |

Washington

- .6% | | | | | |

Washington Housing Finance Commission, Revenue Bonds, Refunding

(Presbyterian Retirement Communities Northwest Obligated Group) Ser. A | | 5.00 | | 1/1/2051 | | 3,200,000 | b | 2,667,292 | |

Wisconsin - 4.3% | | | | | |

Public

Finance Authority, Revenue Bonds (ACTS Retirement-Life Communities Obligated Group) Ser. A | | 5.00 | | 11/15/2041 | | 1,000,000 | | 1,042,569 | |

Public Finance Authority, Revenue

Bonds (Cone Health) Ser. A | | 5.00 | | 10/1/2052 | | 1,500,000 | | 1,583,417 | |

Public Finance Authority, Revenue

Bonds (EMU Campus Living) (Insured; Build America Mutual) Ser. A1 | | 5.50 | | 7/1/2052 | | 2,500,000 | | 2,704,732 | |

STATEMENT

OF INVESTMENTS (Unaudited) (continued)

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount

($) | | Value

($) | |

Long-Term

Municipal Investments - 145.3% (continued) | | | | | |

Wisconsin

- 4.3% (continued) | | | | | |

Public Finance Authority, Revenue

Bonds (EMU Campus Living) (Insured; Build America Mutual) Ser. A1 | | 5.63 | | 7/1/2055 | | 2,035,000 | | 2,220,756 | |

Public Finance Authority, Revenue Bonds (Roseman University

of Health Sciences) | | 5.00 | | 4/1/2030 | | 45,000 | b,g | 49,349 | |

Public Finance Authority, Revenue Bonds (Southminster Obligated

Group) | | 5.00 | | 10/1/2053 | | 2,015,000 | b | 1,885,762 | |

Public Finance Authority, Revenue Bonds, Refunding (Mary's

Woods at Marylhurst Project) | | 5.25 | | 5/15/2047 | | 750,000 | b | 734,311 | |

Public Finance Authority, Revenue Bonds, Ser. 1 | | 5.75 | | 7/1/2062 | | 4,875,000 | | 5,327,595 | |

Wisconsin Health &

Educational Facilities Authority, Revenue Bonds (Bellin Memorial Hospital Obligated Group) | | 5.50 | | 12/1/2052 | | 1,250,000 | | 1,356,485 | |

Wisconsin Health &

Educational Facilities Authority, Revenue Bonds, Refunding (St. Camillus Health System Obligated Group) | | 5.00 | | 11/1/2046 | | 2,000,000 | | 1,762,227 | |

| | 18,667,203 | |

Total Investments (cost $637,170,335) | | 145.3% | 637,467,049 | |

Liabilities, Less Cash and Receivables | | (45.3%) | (198,777,162) | |

Net Assets Applicable

to Common Stockholders | | 100.0% | 438,689,887 | |

GO—General

Obligation

a These

securities have a put feature; the date shown represents the put date and the bond holder can take a

specific action to retain the bond after the put date.

b Security exempt from registration pursuant to Rule 144A under

the Securities Act of 1933. These securities may be resold in transactions exempt from registration,

normally to qualified institutional buyers. At June 30, 2024, these securities were valued at $241,211,544

or 54.98% of net assets.

c Non-income

producing—security in default.

d The Variable Rate is determined by the Remarketing Agent in

its sole discretion based on prevailing market conditions and may, but need not, be established by reference

to one or more financial indices.

e Collateral for floating rate borrowings. The coupon rate given

represents the current interest rate for the inverse floating rate security.

f Security issued with a zero coupon. Income is recognized through

the accretion of discount.

g These

securities are prerefunded; the date shown represents the prerefunded date. Bonds which are prerefunded

are collateralized by U.S. Government securities which are held in escrow and are used to pay principal

and interest on the municipal issue and to retire the bonds in full at the earliest refunding date.

The

following is a summary of the inputs used as of June 30, 2024 in valuing the fund’s

investments:

| | | | | | | |

| | Level

1-Unadjusted Quoted Prices | Level 2- Other Significant Observable Inputs | | Level

3-Significant Unobservable Inputs | Total | |

Assets ($) | | |

Investments

in Securities:† | | |

Municipal Securities | - | 637,467,049 | | - | 637,467,049 | |

Liabilities ($) | | |

Other Financial Instruments: | | |

Inverse

Floater Notes†† | - | (126,330,000) | | - | (126,330,000) | |

VMTP Shares†† | - | (78,900,000) | | - | (78,900,000) | |

† See

Statement of Investments for additional detailed categorizations, if any.

†† Certain of the fund’s liabilities are held at carrying amount,

which approximates fair value for financial reporting purposes.

The Financial Accounting Standards Board (“FASB”) Accounting Standards Codification

(“ASC”) is the exclusive reference of authoritative U.S. generally accepted accounting principles

(“GAAP”) recognized by the FASB to be applied by nongovernmental entities. Rules and interpretive

releases of the SEC under authority of federal laws are also sources of authoritative GAAP for SEC registrants.

The fund is an investment company and applies the accounting and reporting guidance of the FASB ASC Topic

946 Financial Services-Investment Companies. The fund’s financial statements are prepared in accordance

with GAAP, which may require the use of management estimates and assumptions. Actual results could differ

from those estimates.

The fair value of a financial instrument is the amount that

would be received to sell an asset or paid to transfer a liability in an orderly transaction between

market participants at the measurement date (i.e., the exit price). GAAP establishes a fair value hierarchy

that prioritizes the inputs of valuation techniques used to measure fair value. This hierarchy gives

the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities

(Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements).

Additionally,

GAAP provides guidance on determining whether the volume and activity in a market has decreased significantly

and whether such a decrease in activity results in transactions that are not orderly. GAAP requires enhanced

disclosures around valuation inputs and techniques used during annual and interim periods.

Various

inputs are used in determining the value of the fund’s investments relating to fair value measurements.

These inputs are summarized in the three broad levels listed below:

Level 1—unadjusted quoted

prices in active markets for identical investments.

Level 2—other significant

observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds,

credit risk, etc.).

Level 3—significant unobservable inputs (including

the fund’s own assumptions in determining the fair value of investments).

The

inputs or methodology used for valuing securities are not necessarily an indication of the risk associated

with investing in those securities.

Changes in valuation techniques may result

in transfers in or out of an assigned level within the disclosure hierarchy. Valuation techniques used

to value the fund’s investments are as follows:

The fund’s Board of Directors (the “Board”)

has designated the Adviser as the fund’s valuation designee to make all fair value determinations with

respect to the fund’s portfolio investments, subject to the Board’s oversight and pursuant to Rule

2a-5 under the Act.

Investments in municipal securities are valued each business day by an independent

pricing service (the “Service”) approved by the Board. Investments for which quoted bid prices are

readily available and are representative of the bid side of the market in the judgment of the Service

are valued at the mean between the quoted bid prices (as obtained by the Service from dealers in such

securities) and asked prices (as calculated by the Service based upon its evaluation of the market for

such securities). Municipal investments (which constitute a majority of the portfolio securities) are

carried at fair value as determined by the Service, based on methods which include consideration of the

following: yields or prices of municipal securities of comparable quality, coupon, maturity and type;

indications as to values from dealers; and general market conditions. The Service is engaged under the

general oversight of the Board. All of the preceding securities are generally categorized within Level

2 of the fair value hierarchy.

When market quotations or official closing prices are not

readily available, or are determined not to accurately reflect fair value, such as when the value of

a security has been significantly affected by events after the close of the exchange or market on which

the security is principally traded, but before the fund calculates its net asset value, the fund may

value these investments at fair value as determined in accordance with the procedures approved by the

Board. Certain factors may be considered when fair valuing investments such as: fundamental analytical

data, the nature and duration of restrictions on disposition, an evaluation of the forces that influence

the market in which the securities are purchased and sold, and public trading in similar securities of

the issuer or comparable issuers. These securities are either categorized within Level 2 or 3 of the

fair value hierarchy depending on the relevant inputs used.

For securities where

observable inputs are limited, assumptions about market activity and risk are used and such securities

are generally categorized within Level 3 of the fair value hierarchy.

Inverse Floater Securities:

The fund participates in secondary inverse floater structures in which fixed-rate, tax-exempt municipal

bonds are transferred to a trust (the “Inverse Floater Trust”). The Inverse Floater Trust typically

issues two variable rate securities that are collateralized by the cash flows of the fixed-rate, tax-exempt

municipal bonds. One of these variable rate securities pays interest based on a short-term floating rate

set by a remarketing agent at predetermined intervals (“Trust Certificates”). A residual interest

tax-exempt security is also created by the Inverse Floater Trust, which is transferred to the fund, and

is paid interest based on the remaining cash flows of the Inverse Floater Trust, after payment of interest

on the other securities and various expenses of the Inverse Floater Trust. An Inverse Floater Trust may

be collapsed without the consent of the fund due to certain termination events such as bankruptcy, default

or other credit event.

The fund accounts for the transfer of bonds to the Inverse

Floater Trust as secured borrowings, with the securities transferred remaining in the fund’s investments,

and the Trust Certificates reflected as fund liabilities in the Statement of Assets and Liabilities.

The fund may invest in inverse floater securities on either a non-recourse or

recourse basis. These securities are typically supported by a liquidity facility provided by a bank or

other financial institution (the “Liquidity Provider”) that allows the holders of the Trust Certificates

to tender their certificates in exchange for payment from the Liquidity Provider of par plus accrued

interest on any business day prior to a termination event. When the fund invests in inverse floater securities

on a non-recourse basis, the Liquidity Provider is required to make a payment under the liquidity facility

due to a termination event to the holders of the Trust Certificates. When this occurs, the Liquidity

Provider typically liquidates all or a portion of the municipal securities held in the Inverse Floater

Trust. A liquidation shortfall occurs if the Trust Certificates exceed the proceeds of the sale of the

bonds in the Inverse Floater Trust (“Liquidation Shortfall”). When a fund invests in inverse floater

securities on a recourse basis, the fund typically enters into a reimbursement agreement with the Liquidity

Provider where the fund is required to repay the Liquidity Provider the amount of any Liquidation Shortfall.

As a result, a fund investing in a recourse inverse floater security bears the risk of loss with respect

to any Liquidation Shortfall.

At June 30, 2024, accumulated net unrealized appreciation

on investments was $296,714, consisting of $17,916,793 gross unrealized appreciation and $17,620,079

gross unrealized depreciation.

At June 30, 2024, the cost of investments

for federal income tax purposes was substantially the same as the cost for financial reporting purposes

(see the Statement of Investments).

Additional investment related disclosures

are hereby incorporated by reference to the annual and semi-annual reports previously filed with the

SEC on Form N-CSR.

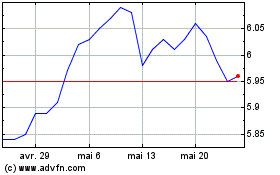

BNY Mellon Strategic Mun... (NYSE:LEO)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

BNY Mellon Strategic Mun... (NYSE:LEO)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025