UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the

Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement |

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule

14a-6(e)(2)) |

| ☐ |

Definitive Proxy Statement |

| ☒ |

Definitive Additional Materials |

| ☐ |

Soliciting Material under Rule 14a-12 |

LL Flooring Holdings, Inc.

(Name of registrant as specified in its charter)

(Name of person(s) filing proxy statement, if other than the registrant): N/A

Payment of Filing Fee (Check the appropriate box):

| ☐ |

Fee paid previously with preliminary materials. |

| ☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules

14a-6(i)(1) and 0-11. |

The Right Board to Oversee LL Flooring's Strategic Direction June 17, 2024

1

Forward Looking Statements Certain statements in this presentation may

include statements of the Company’s expectations, intentions, plans and beliefs t hat constitute “forward-looking statements” within the meanings of the Private Securities Litigation Reform Act of 1995. These statements, which may

be identified by words such as “may,” “will,” “should,” “expects,” “intends,” “plans,” “anticipates,” “assumes,” “believes,”

“thinks,” “estimates,” “seeks,” “predicts,” “could,” “projects,” “targets,” “potential,” “will likely result,” and other similar terms and

phrases, are based on the beliefs of the Company’s management, as well as assumptions made by, and information currently available to, the Company’s management as of the date of such statements. These statements are subject to risks and

uncertainties, all of which are difficult to predict and many of which are beyond t he Company’s control. These risks include, without limitation, the impact of any of the following: reduced consumer spending due to slower growth, economic

recession, inflation, higher interest rates, and consumer sentiment; our advertising and overall marketing strategy, including anticipating consumer trends and increasing brand awareness; the results of our ongoing strategic review; a sustained

period of inflation impacting consumer spending; our inability to execute on our key initiatives or if such key initiatives do not yield desired results; stock price volatility; competition, including alternative e-commerce offerings; liquidity

and/or capital resources changes and the impact of any changes or limitations, including, without limitation, ability to borrow funds and/or renew or roll over existing indebtedness; transportation availability and costs, including the impact of the

war in Ukraine and the conflict in the middle east on the Company’s European and Asian suppliers; potential disruptions to supply chain and product availability related to forced labor and other trade regulations; including with respect to the

Uyghur Forced Labor Prevention Act; inability to hire and/or retain employees; inability to staff stores due to overall pressures in the labor market; the outcomes of legal proceedings, and the related impact on liquidity; reputational harm;

inability to open new stores with acceptable financial returns, find suitable locations for our new stores, and fund other capital expenditures; managing growth; disruption in our ability to distribute our products, including due to severe weather;

operating an office in China; managing third-party installers and product delivery companies; renewing store, warehouse, or other corporate leases; maintaining optimal inventory for consumer demand; our and our suppliers’ compliance with

complex and evolving rules, regulations, and laws at the federal, state, and local levels having an overreliance on limited or sole-source suppliers; damage to our assets; availability of suitable hardwood, carpet and other products, including

disruptions from the impacts of severe weather and supply chain constraints; product liability claims, marketing substantiation claims, wage and hour claims, and other labor and employment claims; sufficient insurance coverage, including

cybersecurity insurance; disruptions due to cybersecurity threats, including any impacts from a network security incident; the handling of confidential customer information, including the impacts from the California Consumer Privacy Act, California

Privacy Rights Act and other applicable data privacy laws and regulations; management information systems and customer relationship management system disruptions; obtaining products domestically and from abroad, including tariffs, the effects of

antidumping and countervailing duties, and delays in shipping and transportation whether due to international events, such as the Red Sea shipping crisis, or scenarios outside of the Company’s control; impact of changes in accounting guidance,

including implementation guidelines and interpretations related to Environmental, Social, and Governance matters; deficiencies or weaknesses in internal controls; and anti-takeover provisions. The Company specifically disclaims any obligation to

update these statements, which speak only as of the dates on which such statements are made, except as may be required under the federal securities laws. Additional factors are set forth in the Company’s Annual Report on Form 10-K and Form

10-K/A for the year ended December 31, 2023, under the captions “Risk Factors”, the Company’s quarterly report on Form 10-Q for the quarter ended March 31, 2024, and subsequent filings with the SEC. 2

Executive Summary • Addressed product and sourcing issues and took

steps to repair damage to Company’s credibility and reputation that resulted while Tom Sullivan served as Executive Chair and Interim CEO and had direct oversight over sourcing initiatives The Boardhas been taking and • Oversaw

recruitment of refreshed senior leadership team to drive transformation continues to take decisive actions • Worked with senior leadership team in its strategy development, including recent setting of five strategic priorities to position

Company to capture market opportunity and drive growth and value creation to position LL Flooring for success • Following period of consistent, solid financial performance and managing through COVID demand spike, working with senior leadership

team to navigate recent macroeconomic challenges • With assistance of financial and legal advisors, the Board is conducting a thorough review of all options to maximize value, including considering a sale of the Company The Board has been

conducting • Approaching process with an open mind and focus on fairly measuring offers against Company's standalone plan a thorough review of strategic • Has engaged with potential bidders on level playing field since first receipt of

unsolicited non-binding Indication of Interest in alternatives since August 2023 January 2022, including F9 (Tom Sullivan) • Committing the necessary time and care to constructively evaluate alternatives in a complex environment • Under

Board oversight, senior leadership team is positioning company to capitalize on anticipated industry tailwinds and larger LL Flooring is well-positioned market opportunity expanding further into soft-surface market and pursuing Pro customer to

capitalize on improving • Implementing strategy to increase brand awareness and deliver more consistent end-to-end customer experience across market conditions; positive omnichannel network that is gaining traction and driving profitability

change is underway • Optimizing existing retail footprint, relocating underperforming stores and closing unprofitable stores to drive profitability • Board comprises nine directors, eight of whom are independent, with right mix of skills

and experience to oversee Company's The Board has highly qualified and strategic direction independent directors; no need • Directors up for re-election have made significant contributions to the Company, collectively serving on all four of

the Board's for further change at this time committees and overseeing the development of the Company's five strategic priorities as well as execution of strategic alternatives process 3

Executive Summary (Continued) • If Tom Sullivan and his two other

nominees are elected, would remove superior talent and critical skills from Board, and risk derailing progress being made in executing on Company’s strategy and completing strategic alternatives process Tom Sullivan and his nominees •

Two additional candidates put forth by Mr. Sullivan have longstanding relationships with him, and currently work for F9 Investments or Cabinets To Go, latter of which competes with LL Flooring bring no incremental value to the Board • Mr.

Sullivan and his two other nominees have limited to no demonstrated knowledge of critical current corporate governance issues, lack critical skills in current business issues facing Company and none of Mr. Sullivan's candidates except for Mr.

Sullivan himself have any prior experience serving on Board of public company • Mr. Sullivan may be attempting to force sale of LL Flooring to himself at a price that may undervalue Company by installing himself and two of his hand-picked

employees on the Board Tom Sullivan is conflicted • During Company's strategic review process, Mr. Sullivan refused to enter into standard confidentiality provision, to which and pushing a personal other interested parties agreed agenda to

opportunistically • During an attempt by Board to reach a proposed compromise in this proxy contest by appointing one of Mr. Sullivan's acquire LL Flooring nominees, Mr. Sullivan’s representatives requested as part of such compromise

that he receive diligence access to Company. • Mr. Sullivan has been involved in litigation with companies he has founded, including civil racketeering derivative complaint and litigation related to violating terms of Memorandum of

Understanding signed between Cabinets To Go (CTG) Tom Sullivan has a highly and LL Flooring under which CTG would not sell flooring in competition with LL Flooring questionable ethical and • Mr. Sullivan made public statements about his

interest in acquiring LL Flooring and then reversed those statements while timing his trades of LL Flooring stock in a manner that benefitted his own personal portfolio and whipsawed other investors leadership track record • During Mr.

Sullivan's tenure as Executive Chairman and/or Interim CEO, with his direct oversight of sourcing, Company was raided by FBI for potential environmental crimes, pleaded guilty to charges related to sourcing of illegally logged timber from Far East

Russia and false statements on Lacey Act declarations, and had products fail testing by California Air Resources Board for formaldehyde emissions; Mr. Sullivan also made questionable decision to be interviewed as part of '60 Minutes' exposé on

Company's product sourcing and quality • From time of FBI raid in 2013, when Mr. Sullivan was serving as Executive Chairman, to time of Mr. Sullivan’s departure from Board and Company, LL Flooring’s stock price declined by ~86%,

representing the destruction of ~$3 billion* in market capitalization (details on following page) 4 *Calculated using 30,700,000 shares outstanding

Market Capitalization (in Billions) While Executive Chair and Interim CEO,

Tom Sullivan Oversaw ~86% Share Price Decline and ~$3 Billion Market Capitalization Loss LL Flooring (then Lumber Liquidators) NYSE Stock Price and Market Cap Sep 2013 – Dec 2016 September 26, 2013: Government served search warrants on the

Company 140 Closing Market $4.0 Share Price Capitalization* 120 $3.5 September $110.80 $3.4B 25, 2013 100 $3.0 December $2.5 80 $15.74 $438M 30, 2016 $2.0 60 Gain (Loss) (~86%) (~$3B) December 30, 2016: $1.5 Disclosure of Tom Sullivan ceasing 40 to

be an employee of the Company $1.0 20 $0.5 $0.0 0 5 *Calculated using 30,700,000 shares outstanding Share Price Sep '13 Dec '13 Mar '14 Jun '14 Sep '14 Dec '14 Mar '15 Jun '15 Sep '15 Dec '15 Mar '16 Jun '16 Sep '16 Dec '16 Billions

Our Board is overseeing execution of a strategy to drive growth, improve

profitability and maximize value

LL Flooring is an Industry-Leading Flooring Retailer Business Overview

Product offering complemented by best-in-class installation and delivery services • Over the last 30 years, LL Flooring (NYSE: LL) has grown into an industry-leading specialty retailer of an extensive assortment of both hard Installation and

and soft-surface flooring products and associated installation services Delivery Services • Has an extensive and innovative range of hard and soft-surface flooring 14% options through 14+ private brand names in a highly fragmented industry

Do-It-Yourself Moldings, Pro • Offers flooring products and installation services to consumers and Accessories, (DIY) flooring-focused Pros such as flooring installers, remodelers and small-to- and Other 41% Revenue by Revenue by 34% medium

home builders ( Pros ) Product Type Customer Type 15% • Utilizes a geographically diverse network of retail stores across the U.S. as well as a growing eCommerce platform Solid and Engineered Manufactured • Deep and robust global

supplier network which maintains the highest Wood Products product quality and most competitive pricing 23% 48% Do-It-For-Me (DIFM) • Veteran, innovative executive team with significant industry experience 25% and a track record of operational

excellence FY 2023 Key Metrics Tile Vinyl Hardwood 36% $323M Gross margin Gross profit $905M ($44)M Revenue Adj. EBITDA* Laminate Bamboo & Cork Hybrid Resilient 7 *See slide 33 for GAAP to Non-GAAP reconciliation

LL Flooring has a Scaled, Nationwide Retail Footprint with Opportunity to

Expand Further Into Underpenetrated Markets (1) Strong National Footprint of Efficient + Profitable Stores… …Focused on Highly Attractive Population Centers 11 • 435 stores across 47 U.S. states and distribution through East Coast,

1 3 1 West Coast and Central state-of-the-art distribution centers, creating a 1 9 7 6 scaled footprint for a significant competitive advantage relative to 2 22 12 1 8 independent operators 1 13 2 7 21 3 • Significant embedded growth present

within existing footprint as certain 15 2 3 15 9 15 9 markets are underpenetrated and poised for future expansion due to 3 4 40 10 5 attractive demographics and lack of competitors in the area 2 8 5 17 18 • Management is focused on optimizing

the Company’s existing retail 9 7 1 3 footprint and through a data-driven process, is relocating 10 3 4 7 13 underperforming stores and closing unprofitable stores to drive increased profitability 6 30 • The Company maintains three

state-of-the-art distribution centers which 33 are strategically located to allow the Company to effectively serve its expansive retail footprint Headquarters Distribution Centers 1 – 12 stores (2) 13 – 25 stores Underrepresented States

~7,408 435 $1.9 Million 47 Average square feet per Number of stores Average revenue per store States served store as of LTM 03/31/24 as of LTM 03/31/24 (1) As of Q1 2024 8 (2) Represents states with lower Company penetration given state size and

population

LL Flooring's Strong Senior Management Team is Driving Transformation and

Positioning the Company for Success Charles Tyson Robert Madore Mission-driven culture drives best-in-class President & Chief Executive Officer Executive Vice President & Chief 5+ years at LL Flooring Financial Officer solutions for

customers Joined July 2023 Strong, unique competitive Culture designed to support Laura Massaro Andrew Wadhams positioning driving transformation innovation and growth Senior Vice President, Chief Senior Vice President, Retail and Marketing Officer

Commercial Sales Joined July 2023 Joined July 2023 Large, comprehensive Compelling growth strategies portfolio of product offerings Douglas Clark Alice Givens Senior Vice President, Merchandising Chief Legal, Ethics & Compliance Officer

Customer-centric culture Experienced leaders & Supply Chain 3+ years at LL Flooring and approach at the helm 6+ years at LL Flooring Kristian Lesher Lisa Robinson-Davis Senior Vice President, Chief Technology Officer Senior Vice President,

Enterprise Quality, LL Flooring’s commitment to building a diverse Joined January 2023 Product Compliance & Customer Care Joined August 2022 customer-obsessed workforce delivers an exceptional customer experience Customer Embrace Arrive

with Seize Be Own Our Obsessed Diversity Integrity Opportunities Resilient Outcomes 9

Mar '24 Jan '24 Nov '23 Sep '23 Jul '23 May '23 Mar '23 Jan '23 Nov '22 Sep

'22 Jul '22 May '22 Mar '22 Jan '22 Nov '21 Sep '21 Jul '21 May '21 Mar '21 Jan '21 Nov '20 Sep '20 Jul '20 May '20 Mar '20 Jan '20 Nov '19 Sep '19 Jul '19 May '19 Mar '19 Jan '19 Nov '18 Sep '18 Jul '18 May '18 Mar '18 Jan '18 Nov '17 Sep '17 Jul

'17 May '17 Mar '17 Jan '17 The LL Flooring Board and Management Team Have Been Navigating a Challenging Macroeconomic Backdrop... COVID-19 Demand Spike Macroeconomic and Consistent Financial Performance $20 $120 Operational Challenges After 5+

years of consistent financial $90 $15 performance, LL Flooring experienced several $60 $10 macroeconomic and operational challenges $30 $5 in 2022-2023, however, $0 the Company has $0 implemented various ($30) strategic initiatives to ($5) weather

these challenges ($60) and position LL Flooring for long-term success ($10) ($90) PF Adj. EBITDA TTM PF Adj. EBTDA Key Commentary • Shortly following the onset of COVID-19, the U.S. housing • Following elevated demand levels experienced

during COVID-19, the U.S. • From January 2017 – June 2022, the Company’s market went into overdrive, with sales of existing homes housing and repair & remodeling markets faced broad headwinds primarily financial performance was

highly consistent, which increasing as consumers moved out of urban driven by (i) softness in existing home sales, (ii) elevated interest rates, was primarily driven by (i) strength in the U.S. housing environments and into areas with more access to

green and (iii) inflationary cost pressures, all of which drove softness in home and repair & remodeling markets, (ii) strong same- spaces / nature improvement spending and big-ticket discretionary spending, causing a store sales growth (both

volume and average ticket decline in LL Flooring’s volume of transactions and average ticket size size), (iii) gross margin improvement due to a product • With more consumers forced to stay at home due to mix shift toward vinyl &

engineered products, and Government mandated lockdowns, U.S. consumers used • The Company also faced operational challenges associated with certain (iv) operating leverage within the Company’s fixed this time to invest in home

improvement projects with the inventory imported from Vietnam and Korea that was detained by U.S. cost base excess cash flow typically spent on entertainment and Customers and Border Protection, which increased operating expenses and travel, driving

a meaningful increase in demand for flooring resulted in the Company choosing to return inventory to affected vendors and flooring-related products 10

...And Positioning the Company to Capitalize on Anticipated Favorable

Industry Tailwinds and Larger Market Opportunity as it Further Expands into Soft-Surface United States Flooring Market, 2019 — 2028 ($ in millions) (1) Slight decrease in 2023 Carpet & area rugs Hard-surf acing f looring $36 billion due to

a decline from Total Addressable Market outsized COVID-related demand in 2021 and 2022 Inclusive of soft-surface flooring $44,109 $35,842 Planned entry $34,726 $33,330 through carpet expansion $27,364 $27,700 $31,714 $23,162 $20,380 $22,930 $23

billion $16,048 $16,696 Hard-surface flooring market $12,951 $12,680 $12,395 $11,796 $11,316 $11,004 2019 2020 2021 2022E 2023E 2028E LL Flooring's historical focus Large Market Supported by Long-term Housing and Remodeling Tailwinds LL Flooring has

potential for significant expansion in addressable market through Higher interest rates and housing price Aging housing stock expected to Rising housing demand as entering soft-surface flooring appreciation leading to home retention millennials

transition into their increase consumer demand for and increased spending on renovation construction and remodeling services prime home-buying years Source: Catalina Floor Coverings Industry Trends Report, 2022 11 (1) Hard-surface flooring includes

wood flooring, ceramic floor and wall tile, Viny tile, Vinyl Sheet, Other resilient flooring, laminate flooring, Stone floor and wall tile

To Drive Growth, Profitability and Value Creation, the LL Flooring Board

and Management Team Have Identified and Begun Executing on Five Clear Strategic Initiatives... 1 2 3 4 5 Continued investment and Driving customer engagement Driving product innovation Increasing Ensuring consistent expansion of Pro business through

CRM rollout and carpet growth brand awareness customer experience 12 12

...And Positive Change is Underway Progress Achieved Across Key Initiatives

as of Q1 2024 • Executed new Pro digital marketing campaign to emphasize the Company's strong value proposition, such as products stock warehouses in every store, one-on-one support expertise and everyday Pro pricing that positions Pro the

Company well in all segments of the Pro marketplace • Saw progress on moving from a transactional selling culture to a relationship building culture with Pro customers • Strategically adding carpet to our category portfolio to broaden LL

Flooring’s appeal to a wider audience that want the convenience of purchasing soft and hard surfaces under one roof Carpet • Extended carpet offerings to 58 more stores, and ended Q1 with carpet in 142 stores • By the end of Q2

2024, the number of stores with a carpet offering is expected to reach 200 • Rolled out CRM to consumer at the end of Q4, and beginning to experience an increase in the dollar value of opportunities for the Company's DIY customers CRM •

Continued to utilize CRM to drive new opportunities in Pro business, contributing to improvement in new order performance • Took steps to increase brand exposure through brand partnerships to drive consumer sales as well as focused Brand

awareness, eCommerce marketing initiatives to drive awareness with Pro customers & product innovation • Experienced a strong improvement in retention and reengagement of those customers coming back to the brand • Saw operational

variability across the store network and focused on improving underperforming regions and Store portfolio & operations, consistency of execution at the store level team and culture • NPS scores increased to their highest levels across Pro,

installation services and at the store level 13

The LL Flooring Management Team is Executing on Meaningful Value Creation

Opportunities Revenue Margin Expansion Cost Reduction Opportunities Opportunities Opportunities Implementing a CRM system to Implemented strategic pricing Identified and is in the process of • • • drive engagement of new and

increases to offset cost increases implementing cost savings initiatives existing Pros driven by the recent inflationary to reduce the Company’s operating environment expense burden Rolling out a robust marketing • campaign aimed at

increasing Focusing on continuing to shift Achieved savings of $17.7 million • • eCommerce penetration, to drive product mix to higher margin with approximately $4.4 million increased traffic to retail locations manufactured products

savings realized in Q1 2024 and more favorable customer conversion • Negotiating with vendors to • Continuing to identify opportunities decrease product, transportation, to optimize store footprint and distribution costs 14

The Company is Pursuing a Distribution Center Sale to Obtain the Financial

Runway to Execute on its Strategic Plan Proposed Purchase Timing Transaction Price Management is pursuing As of March 31, 2024, the The sale process is currently • • • a sale transaction for its current net book value of the

underway with a number of distribution center located Sandston distribution center interested parties in Sandston, Virginia was approximately $39.6 million, which is significantly lower than This transaction is expected • its prospective

market value to improve the Company’s based on third party information liquidity position obtained by the Company 15

Our Board is running a robust exploration of strategic alternatives to

maximize value

The LL Flooring Board has Engaged with Potential Bidders Since the First

Receipt of an Unsolicited Non-Binding Indication of Interest in January 2022 The Company received several unsolicited non-binding Indications of Interest with respect January 2022 – July 2023 to a potential acquisition of the Company. Certain

members of the Board and Management negotiated with each respective counterparty In response to previous inbound expressions of interest, the Board requested Management to commence a thorough review of strategic alternatives, including a potential

sale of the August 2023 – October 2023 Company. J.P. Morgan engaged with numerous potential counterparties to a strategic transaction, certain of whom entered confidentiality agreements. All interested parties were treated on a level playing

field Following Live Ventures’ non-binding Indication of Interest submitted on October 11, 2023, the Company entered into a confidentiality agreement and clean team agreement with Live November 2023 – Current Ventures, providing for a

limited-duration standstill through the end of February 2024. The Company continues to discuss a potential strategic transaction with Live Ventures as well as other interested parties 17

Tom Sullivan Has Long Wanted to Acquire the Company… And His Most

Recent Actions Demonstrate His Continued Interest August 20, 2019: Mr. Sullivan and his wholly-owned company, F9, reported a 5.96% ownership stake in the Company after acquiring 1,346,240 shares for an average price of $7.88 per share, on the belief

that the Company is undervalued. Mr. Sullivan disclosed that he is considering all options, though he had no present plans with his shares September 3, 2019: Mr. Sullivan disclosed that he would like to explore various options and to propose

transactions that may result in a potential sale of the Company or combination between the Company and Cabinets To Go, a subsidiary of F9 2019 September 5, 2019: Mr. Sullivan increased his ownership stake to 7.71% by exercising previously acquired

call options that had a $10 strike price September 13, 2019: Mr. Sullivan decreased his ownership stake to 1.61% by selling 1,250,472 Company shares at an average price of $11.68 per share, and subsequently disclosed that, due to the stock

price’s significant appreciation since he acquired shares in August, he no longer believed the stock was undervalued May 25, 2023: Mr. Sullivan, F9, and the CEO of F9, reported a 9.45% ownership stake in the Company, disclosing that they are

contemplating a possible strategic combination between the Company and Cabinets To Go May 26, 2023: Mr. Sullivan and F9 delivered an unsolicited, non-binding Indication of Interest to acquire the Company for $5.76 per share in cash June 9, 2023: Mr.

Sullivan sent a letter to certain members of the Board of Directors and management team, reconfirming the Indication of Interest 2023 delivered on May 26, 2023 August 17, 2023: Mr. Sullivan and F9 withdrew their bid to acquire the Company for $5.76

per share in cash November 14, 2023: Mr. Sullivan and F9 submitted a bid to acquire the Company for $3.00 per share in cash. Mr. Sullivan also delivered a notice to the Company stating his intention to nominate three directors to the Company’s

Board of Directors at the Company’s 2024 Annual Meeting of Stockholders January 18, 2024: F9 notified the Company that it withdrew its $3.00 per share Indication of Interest 2024 May 14, 2024: While discussing a potential cooperation agreement

with the Company regarding Mr. Sullivan's director nominees, Mr. Sullivan’s representatives requested as part of such agreement that he receive diligence access to the Company under a confidentiality agreement 18

The LL Flooring Board is Conducting a Thorough Exploration of Strategic

Alternatives Robust Outreach and Process Outreach Over 25 >18,000 Signed to numerous Parties Board Meetings to discuss documents uploaded Confidentiality Agreements exploration of strategic to data room with numerous alternatives since 2023

interested parties 19

The LL Flooring Board, with Assistance from J.P. Morgan and Skadden, is

Exploring All Options to Maximize Value, including Considering a Sale of the Company • The Board has consistently been transparent • The Board instructed J.P. Morgan to make with the strategic review process and engaged outgoing phone

calls to likely buyers capable of with interested parties on a level playing field completing a transaction and there were no limitations placed on outbound engagement with • The Board is focused on managing the process third parties other

than expected interest combined to drive value creation while also ensuring the with a likelihood of being able to complete a ability to close a deal transaction • The Board will not be influenced to chase an • All qualified and

interested parties that executed a artificial timeline or an unfinanced proposal confidentiality agreement, had access to confidential information including forecasts, and were asked to prepare preliminary non-binding bids 20

The LL Flooring Board is Committing the Necessary Time and Care to

Constructively Evaluate Alternatives in a Complex Environment • The Board took action to explore whether and how • The Board continues to proceed with an open the non-binding bids it received could be mind and a clear focus on fairly

measuring the improved, and has since engaged in a fulsome, bids it receives against the Company’s outlook transparent process while also mindfully • The Board remains committed to choosing the approaching a currently complex situation

path that best drives value creation • The Board has regularly emphasized the importance of obtaining committed financing 21

Experienced, Engaged Board is Actively Implementing Positive

Change

The LL Flooring Board Does Not Need Additional Change at This Time

Best-in-Class Governance Profile 1 Highly Skilled and Independent Directors 2 Significant Recent Refreshment of the Board 3 Highly Engaged and Responsive Board and Management Team 4 Mr. Sullivan’s and Mr. Hammann’s* Nominees Do Not Have

the Skills and Experience 5 Necessary to Lead the Company During This Time 23 *To date, Mr. Hammann has not filed any proxy statement in connection with his nomination.

The Board Possesses a Best-in-Class Governance Profile Independent

Management ✓ Fully independent Board (except CEO)✓ Clawback provisions incorporated into Leadership Compensation Aligned incentive compensation ✓ Independent Chairperson and Oversight with Stockholder Interest ✓

Substantial portion of executive ✓ Annual review of director independence compensation at risk and tied to stockholder value ✓ Robust share ownership guidelines ✓ Each committee charter includes Stockholder- Embedded ✓ No

supermajority voting provisions oversight responsibilities for ESG matters Friendly SustainabilityFocus ✓ No stockholder rights plan ✓ The Nominating and Corporate Bylaws& Charter into Our Board ✓ Director resignation policy

requires Governance Committee advises the Decision Making directors in uncontested elections to resign Board with respect to the oversight of if they do not receive an affirmative ESG topics and reviews and discusses majority vote of shares entitled

to vote with management the Company’s ESG efforts ✓ Board recommended amendment to begin declassifying the Board ✓ Board recommended amendment to allow stockholders the right to remove any director without cause ✓ Annual

“say-on-pay” vote 24

LL Flooring’s Nominees Up for Re-Election Are Highly Qualified and

Engaged Douglas T. Moore Ashish Parmar Nancy M. Taylor Current Chief Information Officer Former Chairman and CEO of Current LL Flooring Independent of Standard Industries, Inc. CleanCore Solutions, Inc., 1847 Board Chair; Former CEO of Goedeker,

Inc., and Goedeker’s Committees: Audit, Tredegar Corporation Compensation Committees: Nominating and Committees: Nominating and Corporate Governance, Compliance Corporate Governance, and Regulatory Affairs Compliance and Regulatory Affairs

• Mr. Moore has more than 25 years of merchandising and • Mr. Parmar has more than 20 years of leadership and • Ms. Taylor has more than 25 years of business, finance, and retail experience and a strong understanding of strategic

and technology experience scaling and growing brands globally leadership experience, and is the former President and CEO of tactical business issues, including store operations, supply across luxury retail, logistics, and consumer electronics

Tredegar Corporation, serving in the role from January 2010 to chain, sourcing and human resource planning, along with June 2015 • He has ample experience in vertically integrated retail supply knowledge of marketing and risk assessment chain,

cybersecurity and enterprise risk management, as • Previously served in various leadership positions at Tredegar prior • Most recently served as Chairman and CEO of CleanCore well as experience leading digital transformations and to her

CEO role, including President of Tredegar Film Products, Solutions, Inc., where he was instrumental in the Company’s delivering a seamless omnichannel experience Senior Vice President of Strategy, and General Counsel initial public offering

• Currently serving as Chief Information Officer of Standard • Brings strong corporate governance knowledge as a public • Served as CEO of 1847 Goedeker,overseeing the Industries, Inc., since February 2024 company director at Verso

Corporation and Malibu Boats, Inc., and Company’s initial public offering and growing the market cap also having served as a director of TopBuild Corp., where she • Held senior leader roles prior to working at Standard from $7 million in

2019 to $254 million at the time of his oversaw a stock price increase of more than 500% since joining the Industries, including multiple positions at Tapestry, Inc. – departure in 2021 Board in April 2018 Senior Vice President, IT –

Global Enterprise Solutions from • Previously served in other chief executive officer and senior 2017 to 2020; Vice President, IT – Supply Chain, and • Has extensive experience evaluating strategic opportunities, having executive

roles at companies in the home goods, home Enterprise Software Engineering & Architecture from 2016 to served as head of the Special Committee of the Verso Board, which improvement and the broader retail industry 2017; and Vice President, IT

– Supply Chain, and Enterprise was formed in response to an unsolicited offer to take the Company Software Engineering from 2014 to 2017 private in July 2021. The process resulted in an agreement to sell • Currently serves in a limited

role as a Managing Director the company in an all-cash transaction at a 57% premium over the of Fahrenheit Advisors, where he has served since • Recognized in 2021 as one of the “50 Innovative Technology unaffected stock price prior to

the initial unsolicited offer October 2022 Leaders” in Forbes’ inaugural CIO NEXT List • Possesses a strong understanding of strategic planning, • Key leader in strategic change initiatives to drive growth, risk assessment

and international operations develop corporate strategy, drive new business opportunities, create modern consumer centric capabilities and transform the way brands and retailers work 25

The LL Flooring Board Possesses Relevant Skills and Expertise Terri Funk

Graham Famous P. Rhodes Joseph M. Nowicki Right mix of skills and experience to oversee Director since 2018 Director since 2017 Director since 2020 the execution of the Company’s five core • Previously served as Executive Vice President

and Chief • Previously served as Chief Marketing Officer – Red Envelope for • Current Chief Marketing Officer for Apex Service Partners, LLC Financial Officer of Beacon Building Products. from 2013 until Provide Commerce from July

2013 to September 2014 since January 2024 growth strategies, June 2020 support the team’s • Former Senior Vice President and Chief Marketing Officer at Jack • Served as corporate Vice President, Chief Marketing and • Former

Chief Financial Officer, Chief Compliance Officer and in the Box Inc. from September 2007 to December 2012 Technical Officer of Blue Compass RV, LLC from November delivery of high-touch Treasurer of Spartan Motors, Inc. 2019 to January 2024 •

Brings over 30 years of branding and marketing experience in the service for our customers • Brings significant financial and information technology experience retail industry, including extensive knowledge of digital and • Former

Executive Vice President and Chief Marketing Officer of and drive value to the Board eCommerce business Bluegreen Vacations Corporation from August 2017 to September 2019 and former Vice President of Digital Marketing • Has served as a

director of UniFirst Corporation since April 2022 • Has served as a director of Sprouts Farmers Market, Inc. since and Customer Experience for AutoNation, Inc. from 2015 to 2017 Added 3 new directors and previously served as a director of

Diversified Restaurant 2013 and previously served as a director of CV Sciences, Inc. Holdings, Inc. from 2010 to 2020 and ASV Holdings, Inc. from from August 2019 until May 2022, 1-800 Contacts between 2015 • Brings more than 20 years of

experience in retail across in last 5 years, 2017 to 2019 to 2016 and Hot Topic, Inc. from June 2012 to June 2013 automotive, consumer marketplace and residential HVAC, demonstrating plumbing and electrical services commitment to ongoing refreshment

David A. Levin Martin F. Roper Charles E. Tyson Director since 2017 Director since 2006 Director since 2020 • Previously served as President and Chief Executive Officer and • Current Chief Executive Officer and a director of The Vita

Coco • Appointed President and Chief Executive Officer of LL Flooring in Director of Destination XL Group, Inc. for ~18 years Company, Inc. (formerly All Market, Inc.) since May 2022 and May 2020 previously served as Co-Chief Executive Officer

from January • Previously served as acting Chief Executive Officer • Previously served as Interim President from February 2020 until 2021 to May 2022 of Destination XL Group, Inc. from January 2019 to April 2019 May 2020 and previously

served as Chief Customer Experience • Former President of All Market, Inc. from September 2019 until Officer from June 2018 until May 2020 • Brings to the Board more than 35 years of retail experience and January 2021 and former

President and Chief Executive Officer more than 20 years of executive leadership experience • Previously held various senior roles at Advance Auto Parts, Inc. of The Boston Beer Company, Inc. for ~17 years from 2008 to 2017 and served in a

variety of Senior Vice • Formerly a director of Christopher & Banks Corporation from • Has strategic development and financial skills, and possesses President roles at Office Max and Office Depot 2012 to 2016 deep experience in

public relations, consumer marketing, • Possesses deep retail and commercial experience and has investor relations and product development and risk served in senior leadership roles at multiple publicly-traded management companies •

Served on the board of directors of Boston Beer, Financial • Has served as a director of The Container Store Group, Inc. since Information Technologies, LLC. and Bio-Nutritional Research March 2024 Group, Inc. 26

Election of Mr. Sullivan’s nominees or Mr. Hammann* would remove

superior talent and critical skills from our Board *To date, Mr. Hammann has not filed any proxy statement in connection with his nomination.

The Nominating and Corporate Governance Committee Engaged Meaningfully and

Fairly with Mr. Sullivan’s and Mr. Hammann’s* Nominees • Nominating and Corporation Governance Committee interviewed Mr. Sullivan’s and Mr. Hammann’s* nominees to the Board Nominee Interviews • Based on the

skills, qualifications and potential conflicts of Mr. Sullivan, his nominees and Mr. Hammann*, the Nominating and Corporate Governance Committee recommended that the Board nominate and support the incumbent directors We believe Mr. Sullivan still

intends to purchase the Company and is • To avoid a distracting and expensive election contest, the Company’s counsel contacted F9’s counsel, attempting to place his noting that it is in the Company’s and its shareholders'

best interest to enter into a potential cooperation agreement and agree to appoint one of F9’s nominees, Jason Delves, to the Board hand-picked nominees Meaningful (both of which currently Attempts to • F9 rejected this proposal, noting

that it would only be prepared to enter a cooperation agreement if (a) all negotiate with F9 three of its nominees were appointed to the Board, (b) the Board agreed to not increase the Board size and work for him) on the (c) F9 received access to

the Company’s data room and diligence information Board in order to • Accordingly, the Company and F9 were not able to agree on terms of a potential cooperation agreement facilitate such a sale, possibly to the detriment of the

Company’s shareholders • Nominating and Corporate Governance Committee raised concerns based on its interviews that Mr. Sullivan may be pursuing a personal agenda to acquire the Company at a price that may undervalue the Company Conflict

of Interest for Mr. Sullivan • While Mr. Sullivan has not expressly stated his intention in recent public filings, his intention is clear based and his Nominees on his demands, made through his representatives, to continue performing diligence

on the Company in an effort to acquire the Company 28 *To date, Mr. Hammann has not filed any proxy statement in connection with his nomination.

The LL Flooring Board Determined that Mr. Sullivan’s and Mr.

Hammann’s* Candidates Do Not Offer Skills and Experiences the Board Needs at this Time Mr. Sullivan’s and Mr. Overall Lack of Critical Skills in Current Overall Lack of Public Board Experience Hammann’s* Nominees XX

Business Issues Facing the Company Offer No Incremental Overall Limited to No Demonstrated Knowledge Tom Sullivan and His Nominees Have Value to the Company’s XX of Critical Current Corporate Governance Issues Questionable Conflicts of

Interest Board of Directors: The Nominating and Corporate Governance Committee considers a number of factors in selecting a director for the Board including: Unlike Mr. Sullivan’s and Mr. Hammann’s* Nominees, the Current Directors of the

Board Ability of prospective Extent to which Extent to which the prospective Meet All of the nominees to prospective nominees nominees help the Board reflect the Following Criteria: represent the contribute to the diversity of the Company’s

interests of Board’s range of talent, stockholders, employees, customers all stockholders skills and expertise and communities in which it operates 29 *To date, Mr. Hammann has not filed any proxy statement in connection with his

nomination.

The Election of Mr. Sullivan and His Nominees is Not in the Best Interest

of LL Flooring Shareholders Jill Witter: Tom Sullivan: John Jason Delves: – No public company Board experience – No public company Board experience except for – No public company Board experience LL Flooring – No operational

experience – No public company executive experience – Highly questionable ethical and leadership track record – Conflict of interest given relationship with Tom Sullivan and role – Conflict of interest given relationship with

Tom as Chief Legal Officer and Secretary of F9 – Oversaw value destruction while serving as Executive Sullivan and role as President and CEO of Chairman and/or Interim CEO of LL Flooring (then Lumber Cabinets to Go – Despite claim to

have relevant wood product industry credentials, Liquidators), including an ~86% share price decline and all experience is tangential at best with companies that are in – Vast majority of career has been spent at small, ~$3 billion reduction

in market capitalization from Sept. vastly different industries than a flooring retailer family-owned companies 2013 to Dec. 2016 – Led the lawsuit against Cabinets to Go for violation of MOU while – Lacks cogent, complete business plan

serving as Chief Legal Officer of Lumber Liquidators – Holds narrow, outdated view of the Company and – Was exited from her role at LL Flooring ideas that are part of his strategy would set the Company backwards 30

Does Tom Sullivan Have LL Flooring's Shareholders Best Interests in Mind or

is He More Focused on His Own Wallet? Mr. Sullivan opportunistically timed LL Flooring stock purchases in the open market and public commentary, benefitting his own personal portfolio and whipsawing other investors August 20, 2019 – Mr.

Sullivan and September 5, 2019 – Mr. Sullivan 14 his wholly-owned company, F9, increases his ownership stake reported a 5.96% ownership stake to 7.71% by exercising previously September 3, 2019 – Mr. Sullivan September 13, 2019 –

Mr. Sullivan in the Company after acquiring acquired call options that had a discloses that he would like to decreases his ownership stake to 1.61% 1,346,240 shares for an average $10 strike price 13 explore various options and to by selling

1,250,472 Company shares at price of $7.88 per share, on the belief propose transactions which may an average price of $11.68 that the Company is undervalued. result in a potential sale of the Mr. Sullivan disclosed that he is per share, and

subsequently discloses that, 12 Company or combination between considering all options, though he due to the stock price’s significant the Company and Cabinets To Go, has no present plans with his shares appreciation since he acquired

shares in a subsidiary of F9 August, he no longer believes (a) the stock 11 is undervalued and (b) that a strategic transaction with the Company is prudent 10 9 8 7 31

Market Capitalization (in Billions) Should Someone with Tom

Sullivan’s Track Record be Trusted to Oversee LL Flooring’s Path Forward? LL Flooring NYSE Stock Price and Market Cap Sept 2013 – Dec 2016 Damages from Mr. Sullivan's Tenure with LL Flooring September 26, 2013: • Lacey Act

violation as the result of importing illegally logged wood 2013 Government served search warrants on LL Flooring 140 − Settled in 2015 for $13.2 million • California’s Air Regulation Board first informed Lumber Liquidators that

$4.0 flooring samples failed testing for formaldehyde emissions ~$3 Billion ~86% − Settled in 2016 120 of Value Share Price $3.5 • Defective product litigation regarding Morning Star Strand Bamboo 2014 Destruction* Decline filed 100

− Settled in 2019 for $30 million $3.0 2015 • Chinese Laminate class actions regarding formaldehyde and abrasion $2.5 consolidated into MDL 80 − Settled in 2018 for $36 million • Interview with 60 Minutes as part of

exposé claiming laminate flooring $2.0 from China had unsafe levels of formaldehyde. 60 • Securities fraud regarding falsity of claims made by the company in the $1.5 December 30, 2016: aftermath of the 60 Minutes interview Tom Sullivan

departs the Company − Settled in 2019 for $33 million 40 $1.0 • Cabinets To Go (CTG) was involved in litigation with LL Flooring 2019 related to CTG violating the terms of a MOU under which CTG would 20 $0.5 not sell flooring in

competition with LL Flooring $112.2M + Reputational Damage 0 $0.0 = Significant Value Destruction 32 *Calculated using 30,700,000 shares outstanding Share Price Sep '13 Dec '13 Mar '14 Jun '14 Sep '14 Dec '14 Mar '15 Jun '15 Sep '15 Dec '15 Mar '16

Jun '16 Sep '16 Dec '16 Billions

Reputational and Financial Damage Under Oversight of Tom Sullivan In a note

to clients, Piper Jaffray analysts wrote that the [“60 Minutes”] report was “Lumber Liquidators lied to investors and to the public about its compliance worse than the firm had prepared for. Piper said the report was worse than

expected with formaldehyde regulations for the flooring it sold – all to protect its stock based on these three points: price,” said Assistant Attorney General Brian A. Benczkowski of the Justice • How specific the story was.

Department’s Criminal Division. “False and misleading financial reports • The evidence provided by 60 Minutes. undermine the integrity of our securities markets and harm investors. The • A poor on-camera interview by the

company's founder Tom Sullivan who Department and our law enforcement partners are committed to doing conceded that the video evidence called into question the company's everything we can to ensure that those who commit securities fraud are held

oversight of its suppliers. accountable.” - Piper Jaffray Research Report, March 2, 2015 “This resolution holds Lumber Liquidators accountable for misleading the investing public,” said U.S. Attorney G. Zachary Terwilliger of the

Eastern District of Virginia. “It also recognizes that the company has cooperated with the government's investigation, completely replaced its senior executive team, Lumber Liquidators Plunges After TV Report of Tainted Flooring and installed

experienced executives who have displayed a commitment to Shares of the flooring retailer fell more than 20 percent after a report Sunday night building an ethical corporate culture. We will continue to ensure that market on “60

Minutes,” the CBS News program, said that some of the company’s laminate wood contained potentially hazardous levels of formaldehyde, a known carcinogen. participants can trust information communicated by public companies when making

investment decisions. My thanks to our prosecutorial team and our The flooring in question came from factories in China and was mislabeled as safe, investigative partners for their outstanding work on this case.” according to the report. -

U.S. Department of Justice Press Release, March 12, 2019 By Wednesday, the stock had sunk more than 30 percent since Friday’s close. The company had already withdrawn from the annual Raymond James investor conference, where it had been

scheduled to present. Regulators scrambled to respond to the report, even as federal lawmakers called for an investigation. - The New York Times, March 4, 2015 33

Tom Sullivan’s Ideas for LL Flooring are Outdated and Fail to

Recognize Current Industry Landscape Mr. Sullivan ideas would significantly limit the Company’s market opportunity and competitive positioning, Get back to the preventing the Company from capitalizing on the soft flooring and Pro market

opportunities. Further, Mr. Company’s roots Sullivan fails to take into consideration the irreparable damage done to the Lumber Liquidators brand that is affiliated in customers’ minds with poor quality The LL Flooring Board and

management team have identified and are executing on five strategic priorities Operational to drive growth and capitalize on anticipated industry tailwinds and the larger opportunity in the current and strategic environment. This includes expansion

into Pro and soft surface and transitioning the Company into a Mr. Sullivan has a highly improvements modern, customer-centric brand supported by innovative tools and digital platform integration questionable ethical and leadership track record The

Company continues to leverage high/low pricing strategies through strong vendor partnerships. and is pushing a Sales strategy The merchandising organization has partnered with vendors to bring innovative products (i.e. Duravana) personal agenda that

is to market, sourced ethically and compliantly. Further, the Company has an effective feedback loop not in the best interests established with store support center and field employees, including numerous touchpoints for regional managers, store

visits and weekly review of consolidated feedback of all the Company’s shareholders The Company has a number of active work streams underway to further rationalize costs. In addition to Expense analysis actions taken last year with respect to

payroll and other cost reduction, actions were recently taken in Q1’24 to restructure and curtail expenses for a total of approximately $4 million. Management conducts a monthly profitability and cash flow review across the store portfolio to

determine potential closures and optimization opportunities. The Company has brought certain marketing functions in-house, reducing annual agency marketing expense by $1.2M with continued savings planned in 2025 34

The LL Flooring Board is Committed to Acting in the Best Interests of All

of the Company's Shareholders The Board has taken decisive actions Vote today “FOR” ONLY LL Flooring’s three to position LL Flooring for success highly qualified and engaged director nominees The Board is conducting a on the

universal WHITE proxy card thorough review of strategic alternatives The Board unanimously recommends that shareholders vote “FOR” the election of each of the three nominees proposed by LL Flooring is well-positioned the Board, Douglas

T. Moore, Ashish Parmar and Nancy M. to capitalize on improving Taylor, on the universal WHITE proxy card. market conditions; positive change is underway The Board has highly qualified and independent directors; no need for further change at this

time 35 35

GAAP to Non-GAAP Reconciliation 2023 Operaring Loss, as reported (GAAP)

(80,786) 1 Depreciation & Amortization 19,420 EBITDA (61,366) GROSS PROFIT/MARGIN ADJUSTMENT ITEMS: 2 Vinyl Charges 5,426 3 Antidumping and Countervailing Adjustments 10,809 Gross Profit/Margin Adjustment Items Subtotal 16,235 SG&A

ADJUSTMENT ITEM: 4 Legal and Professional Fees 886 SG&A Adjustment Items Subtotal 886 Adjusted EBITDA (44,245) 1. This amount includes depreciation expenses and asset impairment charges associated with store closures. 2. This amount represents

costs related to CBP detention on flooring products that contain PVC as a consequence of the UFLPA. 3. This amount represents net antidumping and countervailing (income)/expense associated with applicable prior-year shipments of engineered hardwood

from China. 36 4. This amount represents charges to earnings related to our defense of certain significant legal actions during the period. This does not include all legal costs incurred by the Company.

37

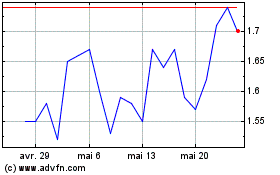

LL Flooring (NYSE:LL)

Graphique Historique de l'Action

De Mai 2024 à Juin 2024

LL Flooring (NYSE:LL)

Graphique Historique de l'Action

De Juin 2023 à Juin 2024