| SECURITIES AND EXCHANGE COMMISSION |

|

| |

|

| Washington, D.C. 20549 |

|

| _______________ |

|

| |

|

| SCHEDULE 13D |

| |

INFORMATION TO BE INCLUDED IN STATEMENTS FILED PURSUANT

TO RULE 13d-1(a) AND AMENDMENTS THERETO FILED PURSUANT TO

RULE 13d-2(a) |

| |

| Under the Securities Exchange Act of 1934 |

| (Amendment No.) |

| |

|

Lamb Weston Holdings,

Inc. |

| (Name of Issuer) |

| |

|

Common Stock, par

value $1.00 per share |

| (Title of Class of Securities) |

| |

|

513272104 |

| (CUSIP Number) |

| |

|

Eleazer Klein, Esq.

Adriana Schwartz, Esq. |

| 919 Third Avenue |

| New York, New York 10022 |

|

(212) 756-2000 |

| (Name, Address and Telephone Number of Person |

| Authorized to Receive Notices and Communications) |

| |

|

October 11, 2024 |

| (Date of Event which Requires |

| Filing of this Schedule) |

If the filing person has previously filed a statement on Schedule 13G to

report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(e), 13d-1(f) or 13d-1(g),

check the following box. [ ]

NOTE: Schedules filed in paper format shall include a signed original

and five copies of the schedule, including all exhibits. See Rule 13d-7 for other parties to whom copies are to be sent.

(Continued on following pages)

(Page 1 of 14 Pages)

___________________

The information required on the remainder of this cover page shall not

be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (the “Act”) or otherwise

subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

| CUSIP No. 513272104 | SCHEDULE 13D | Page 2 of 14 Pages |

| 1 |

NAME OF REPORTING PERSON

JANA PARTNERS MANAGEMENT, LP |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) x

(b) ¨ |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS

AF |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH |

7 |

SOLE VOTING POWER

7,131,339 Shares (including options to purchase 3,230,400

Shares) |

| 8 |

SHARED VOTING POWER

0 |

| 9 |

SOLE DISPOSITIVE POWER

7,131,339 Shares (including options to purchase 3,230,400

Shares) |

| 10 |

SHARED DISPOSITIVE POWER

0 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

7,131,339 Shares (including options to purchase 3,230,400

Shares) |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) (see Item 5)

5.0% |

| 14 |

TYPE OF REPORTING PERSON

IA, PN |

| |

|

|

|

|

| CUSIP No. 513272104 | SCHEDULE 13D | Page 3 of 14 Pages |

| 1 |

NAME OF REPORTING PERSON

BRADLEY ALFORD |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) x

(b) ¨ |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS

PF |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

United States |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH |

7 |

SOLE VOTING POWER

19,233 Shares |

| 8 |

SHARED VOTING POWER

0 |

| 9 |

SOLE DISPOSITIVE POWER

19,233 Shares |

| 10 |

SHARED DISPOSITIVE POWER

0 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

19,233 Shares |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) (see Item 5)

Less than 0.1% |

| 14 |

TYPE OF REPORTING PERSON

IN |

| |

|

|

|

|

| CUSIP No. 513272104 | SCHEDULE 13D | Page 4 of 14 Pages |

| 1 |

NAME OF REPORTING PERSON

DIANE DIETZ |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) x

(b) ¨ |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS

PF |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

United States |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH |

7 |

SOLE VOTING POWER

73,888 Shares |

| 8 |

SHARED VOTING POWER

0 |

| 9 |

SOLE DISPOSITIVE POWER

73,888 Shares |

| 10 |

SHARED DISPOSITIVE POWER

0 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

73,888 Shares |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) (see Item 5)

0.1% |

| 14 |

TYPE OF REPORTING PERSON

IN |

| |

|

|

|

|

| CUSIP No. 513272104 | SCHEDULE 13D | Page 5 of 14 Pages |

| 1 |

NAME OF REPORTING PERSON

JOHN P. GAINOR JR. |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) x

(b) ¨ |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS

PF |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

United States |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH |

7 |

SOLE VOTING POWER

16,000 Shares |

| 8 |

SHARED VOTING POWER

0 |

| 9 |

SOLE DISPOSITIVE POWER

16,000 Shares |

| 10 |

SHARED DISPOSITIVE POWER

0 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

16,000 Shares |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) (see Item 5)

Less than 0.1% |

| 14 |

TYPE OF REPORTING PERSON

IN |

| |

|

|

|

|

| CUSIP No. 513272104 | SCHEDULE 13D | Page 6 of 14 Pages |

| 1 |

NAME OF REPORTING PERSON

TIMOTHY R. MCLEVISH |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) x

(b) ¨ |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS

PF |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

United States |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH |

7 |

SOLE VOTING POWER

40,500 Shares |

| 8 |

SHARED VOTING POWER

0 |

| 9 |

SOLE DISPOSITIVE POWER

40,500 Shares |

| 10 |

SHARED DISPOSITIVE POWER

0 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

40,500 Shares |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) (see Item 5)

Less than 0.1% |

| 14 |

TYPE OF REPORTING PERSON

IN |

| |

|

|

|

|

| CUSIP No. 513272104 | SCHEDULE 13D | Page 7 of 14 Pages |

| 1 |

NAME OF REPORTING PERSON

JOSEPH E. SCALZO |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) x

(b) ¨ |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS

PF |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

United States |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH |

7 |

SOLE VOTING POWER

7,885 Shares |

| 8 |

SHARED VOTING POWER

0 |

| 9 |

SOLE DISPOSITIVE POWER

7,885 Shares |

| 10 |

SHARED DISPOSITIVE POWER

0 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

7,885 Shares |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) (see Item 5)

Less than 0.1% |

| 14 |

TYPE OF REPORTING PERSON

IN |

| |

|

|

|

|

| CUSIP No. 513272104 | SCHEDULE 13D | Page 8 of 14 Pages |

| Item 1. |

SECURITY AND ISSUER. |

| |

| This statement on Schedule 13D relates to the shares (“Shares”) of common stock, par value $1.00 per share, of Lamb Weston Holdings, Inc., a Delaware corporation (the “Issuer”). The principal executive office of the Issuer is located at 599 S. Rivershore Lane, Eagle, Idaho 83616. |

| |

| Item 2. |

IDENTITY AND BACKGROUND. |

| |

| (a)

This statement is filed by (i) JANA Partners Management, LP, a Delaware limited partnership (“JANA”), (ii)

Bradley Alford (“Mr. Alford”), (iii) Diane Dietz (whose legal name is Diane Dietz Suciu) (“Ms.

Dietz”), (iv) John P. Gainor Jr. (“Mr. Gainor”), (v) Timothy R. McLevish (“Mr.

McLevish”), and (vi) Joseph E. Scalzo (“Mr. Scalzo,” together with (ii) through (v), the

“Nominees,” and (i) through (vi) collectively, the “Reporting Persons”). JANA is a

private money management firm which holds the Shares reported as beneficially owned by it in various accounts under its management

and control. JANA Partners Management GP, LLC (the “JANA GP”) is the general partner of

JANA. Barry Rosenstein is the Founder of the GP and JANA (the “JANA Principal”). |

| |

| (b) The principal business address of JANA, the JANA GP and the JANA Principal is 767 Fifth Avenue, 8th Floor, New York, New York 10153. The principal business address of each of the Nominees is c/o JANA Partners Management LP, 767 Fifth Avenue, 8th Floor, New York, New York 10153. |

| |

| (c)

The principal business of JANA and the JANA Principal is investing for accounts under their management. The principal business of

the JANA GP is acting as the general partner of JANA. The principal business of each of: (i) Mr. Alford is serving as a corporate

director and as an investor and advisor in the consumer sector after previously serving as the Chairman and CEO of Nestlé

USA, (ii) Ms. Dietz is serving as a corporate director and as an investor and advisor in the consumer sector after serving as

President and CEO of Rodan & Fields, LLC, a premium skincare brand, and CMO of Safeway, Inc., a food and drug retailer, (iii)

Mr. Gainor is serving as a corporate director after previously serving as President and CEO of International Dairy Queen Inc., (iv)

Mr. McLevish is serving as Managing Partner of Strategic Advisory Partners LLC, an investing and advisory business, and as a

corporate director after previously serving as Executive Chairman of the board of the Issuer, as CFO of Kraft Foods Inc. and

Kraft Foods Group, Inc., a packaged foods company, CFO of Carrier Global Corporation, an HVAC manufacturing company, and CFO at

Walgreens Boots Alliance, Inc., a retail and drugstore company, and (v) Mr. Scalzo is serving as a corporate director after serving

as President and CEO of The Simply Good Foods Company and serving in numerous executive positions at various other consumer

companies such as Dean Foods Company, The WhiteWave Foods Company and The Gillette Company. |

| |

| (d) None of the Reporting Persons, the JANA GP, or the JANA Principal has, during the last five years, been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors). |

| |

| (e) None of the Reporting Persons, the JANA GP, or the JANA Principal has, during the last five years, been a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of such proceeding was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violation with respect to such laws. |

| |

| (f) JANA is a limited partnership organized in Delaware. The JANA Principal is a citizen of the United States of America. The JANA GP is a limited liability company organized in Delaware. Each of the Nominees is a citizen of the United States of America. |

| CUSIP No. 513272104 | SCHEDULE 13D | Page 9 of 14 Pages |

| Item 3. |

SOURCE AND AMOUNT OF FUNDS OR OTHER CONSIDERATION. |

| |

| The

7,131,339 Shares (including options to purchase 3,230,400 Shares) reported herein as beneficially owned by JANA were acquired at

an aggregate purchase price of approximately $336 million. Such Shares were acquired with investment funds in accounts

managed by JANA and margin borrowings described in the following sentence. Such Shares are held by the investment funds

managed by JANA in commingled margin accounts, which may extend margin credit to JANA from time to time, subject to applicable

federal margin regulations, stock exchange rules and credit policies. In such instances, the positions held in the margin

accounts are pledged as collateral security for the repayment of debit balances in the account. The margin accounts bear

interest at a rate based upon the broker’s call rate from time to time in effect. Because other securities are held

in the margin accounts, it is not possible to determine the amounts, if any, of margin used to purchase the Shares reported

herein. |

| |

| Of

the 19,233 Shares reported herein as beneficially owned by Mr. Alford, 10,400 were acquired at an aggregate purchase price of approximately

$0.7 million and 8,833 were received by Mr. Alford in connection with the spin-off of the Issuer from Conagra Brands, Inc (“Conagra”). |

| |

| The 73,888 Shares reported herein as beneficially owned by Ms. Dietz were acquired at an aggregate purchase price of approximately $4.6 million. |

| |

| The 16,000 Shares reported herein as beneficially owned by Mr. Gainor were acquired at an aggregate purchase price of approximately $1.0 million. |

| |

| Of the 40,500 Shares reported herein as beneficially owned by Mr. McLevish, 38,500 were acquired at an aggregate purchase price of approximately $2.4 million and 2,000 were awarded to Mr. McLevish as compensation in connection with his past service with the Issuer and received in connection with the spin-off of the Issuer from Conagra. |

| |

| The 7,885 Shares reported herein as beneficially owned by Mr. Scalzo

were acquired at an aggregate purchase price of approximately $0.5 million. |

| Item 4. |

PURPOSE OF TRANSACTION. |

| |

| The Reporting Persons acquired the Shares because they believe the Shares are undervalued and represent an attractive investment opportunity. JANA, with the assistance of the other Reporting Persons and Continental Grain (as defined below), intends to have discussions with the Issuer's board of directors and management regarding topics including: (1) the litany of self-inflicted missteps that have led to underperformance for shareholders; (2) financial performance and core operating deficiencies in areas including customer demand planning and retention, raw potato procurement, ERP system implementation and management, product and manufacturing quality assurance, pricing strategy, retail execution and overhead cost management; (3) capital spending, including aligning capacity expansion projects with utilization, improving returns on capital, re-evaluating long-term capital expenditure targets and providing detailed public disclosure on other capital spending amounts; (4) share repurchase strategy and execution; (5) investor communications, including by acknowledging the magnitude of impact from the Issuer’s mis-execution on its recent capacity utilization levels, which we believe trail North American peers; (6) management compensation practices, including adding targets focused on returns on capital to deprioritize pursuit of growth at any cost; (7) environmental, health and safety practices; (8) oversight and disclosure regarding use of the Issuer’s corporate resources; (9) corporate governance, board composition and management; and (10) initiation of a review of strategic alternatives, particularly given the history of interest in the Issuer and the Issuer’s poor performance for shareholders. |

| CUSIP No. 513272104 | SCHEDULE 13D | Page 10 of 14 Pages |

| The Reporting Persons may also take other steps to increase stockholder value as well as pursue other plans or proposals that relate to or would result in any of the matters set forth in subparagraphs (a)-(j) of Item 4 of Schedule 13D. The Reporting Persons intend to communicate with the Issuer’s management and Board about, and may enter into negotiations and agreements with them regarding, the foregoing and communicate with other shareholders or other third parties regarding the Issuer. The Reporting Persons may exchange information with any such persons pursuant to appropriate confidentiality or similar agreements, which may contain customary standstill provisions. The Reporting Persons may change their intentions with respect to any and all matters referred to in this Item 4. They may also take steps to explore and prepare for various plans and actions, and propose transactions, before forming an intention to engage in such plans or actions or proceed with such transactions. |

| Item 5. |

INTEREST IN SECURITIES OF THE ISSUER. |

| |

| (a) The percentage of Shares reported to be beneficially owned by the Reporting Persons is based upon 142,597,776 Shares outstanding as of September 25, 2024, as reported in the Issuer’s Quarterly Report on Form 10-Q for the quarterly period ended August 25, 2024 filed with the SEC on October 2, 2024. |

| |

| As

of the close of business on the date hereof, JANA may be deemed to beneficially own 7,131,339 Shares (including options to purchase

3,230,400 Shares), representing approximately 5.0% of the Shares outstanding. |

| |

| As of the close of business on the date hereof, Mr. Alford may be deemed to beneficially own 19,233 Shares, representing less than 0.1% of the Shares outstanding. |

| As of the close of business on the date hereof, Ms. Dietz may be deemed to beneficially own 73,888 Shares, representing 0.1% of the Shares outstanding. |

| |

| As of the close of business on the date hereof, Mr. Gainor may be deemed to beneficially own 16,000 Shares, representing less than 0.1% of the Shares outstanding. |

| |

| As of the close of business on the date hereof, Mr. McLevish may be deemed to beneficially own 40,500 Shares, representing less than 0.1% of the Shares outstanding. |

| |

| As of the close of business on the date hereof, Mr. Scalzo may be deemed to beneficially own 7,885 Shares, representing less than 0.1% of the Shares outstanding. |

| |

| The

Reporting Persons and Continental Grain Company, a Delaware corporation ("Continental Grain"), and certain of its related

entities and persons (together with Continental Grain, the "Continental Grain Reporting Persons") may be deemed to be

members of a "group" within the meaning of Section 13(d)(3) of the Exchange Act. The Continental Grain Reporting Persons are

separately filing on Schedule 13D with respect to their beneficial ownership of the Shares. Based on information and belief, the Continental

Grain Reporting Persons may be deemed to beneficially own an aggregate of 345,350 Shares. Accordingly, in the aggregate, the Reporting

Persons and the Continental Grain Reporting Persons may be deemed to beneficially own an aggregate of 7,634,195 Shares, representing

approximately 5.4% of the Shares outstanding. Each of the Reporting Persons expressly disclaims beneficial ownership of the Shares

beneficially owned by the other Reporting Persons and the Continental Grain Reporting Persons. |

| CUSIP No. 513272104 | SCHEDULE 13D | Page 11 of 14 Pages |

| (b)

JANA has sole voting and dispositive power over 7,131,339 Shares (including options to purchase 3,230,400 Shares), which power is

exercised by the JANA Principal. Mr. Alford has sole voting and dispositive power over 19,233 Shares. Ms.

Dietz has sole voting and dispositive power over 73,888 Shares. Mr. Gainor has sole voting and dispositive power over

16,000 Shares. Mr. McLevish has sole voting and dispositive power over 40,500 Shares. Mr. Scalzo has sole

voting and dispositive power over 7,885 Shares. |

| |

| (c)

Information concerning transactions in the Shares effected by the Reporting Persons during the past sixty (60) days is set forth

in Schedule A hereto and is incorporated herein by reference. All of the transactions in Shares listed herein were

effected in the open market through various brokerage entities. |

| |

| (d) No person (other than the Reporting Persons) is known to have the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of, the Shares. |

| |

| (e) Not applicable. |

| Item 6. |

CONTRACTS, ARRANGEMENTS, UNDERSTANDINGS OR RELATIONSHIPS WITH RESPECT TO SECURITIES OF THE ISSUER. |

| |

| Each of the Nominees has entered into a nomination agreement (collectively, the “Nominee Agreements”) with JANA substantially in the form attached as Exhibit 99.1 to this Schedule 13D whereby the Nominees agreed to become members of a slate of nominees and stand for election as directors of the Issuer in connection with a proxy solicitation which may be conducted in respect of the Issuer’s 2025 annual meeting of stockholders (the “2025 Annual Meeting”). Pursuant to the Nominee Agreements, JANA has agreed to pay the costs of soliciting proxies in connection with the 2025 Annual Meeting, and to defend and indemnify the Nominees against, and with respect to, any losses that may be incurred by the Nominees in the event they become a party to litigation based on their nomination as candidates for election to the Board and the solicitation of proxies in support of their election. Each of the Nominees received compensation under the Nominee Agreement in the amount of $60,000, and will receive an additional $155,000 in the event of his or her appointment or election. Each of the Nominees agreed to hold Shares with a market-value equal to $215,000 (adjusted for taxes) as of the date of his or her election or appointment (subject to certain exceptions), until the later of when he or she is no longer a director of the Issuer and three years (subject to certain exceptions). The foregoing summary of the Nominee Agreement is not complete and is qualified in its entirety by reference to the full text of the form of Nominee Agreement, a copy of which is attached as Exhibit 99.1 and is incorporated by reference herein. |

| |

| JANA

beneficially owns 32,304 call options for 3,230,400 Shares with a strike price of $30.00 and which expire on December 20, 2024. |

| |

| Except

as set forth herein, the Reporting Persons have no contracts, arrangements, understandings or relationships (legal or otherwise)

with respect to any securities of the Issuer, including any class of the Issuer’s securities used as a reference security, in

connection with any of the following: call options, put options, security-based swaps or any other derivative

securities, transfer or voting of any of the securities, finder’s fees, joint ventures, loan or option arrangements,

guarantees of profits, division of profits or loss, or the giving or withholding of proxies. |

| Item 7. |

MATERIAL TO BE FILED AS EXHIBITS. |

| |

|

| Exhibit 99.1: |

Form of Nominee Agreement |

| |

|

| Exhibit 99.2: |

Joint Filing Agreement, dated October 18, 2024 |

| CUSIP No. 513272104 | SCHEDULE 13D | Page 12 of 14 Pages |

SIGNATURES

After reasonable inquiry

and to the best of his or its knowledge and belief, the undersigned certifies that the information set forth in this statement is true,

complete and correct.

Dated: October 18, 2024

| |

JANA PARTNERS MANAGEMENT, LP |

| |

|

| |

|

| |

By: |

/s/ Jennifer Fanjiang |

| |

Name: |

Jennifer Fanjiang |

| |

Title: |

Partner, Chief Legal Officer and Chief Compliance Officer |

| |

|

|

| |

|

/s/ Bradley Alford |

| |

|

BRADLEY ALFORD |

| |

|

|

| |

|

| |

|

/s/ Diane Dietz |

| |

|

DIANE DIETZ |

| |

|

|

| |

|

| |

|

/s/ John P. Gainor Jr. |

| |

|

JOHN P. GAINOR JR |

| |

|

|

| |

|

| |

|

/s/ Timothy R. McLevish |

| |

|

TIMOTHY R. MCLEVISH |

| |

|

|

| |

|

|

| |

|

/s/ Joseph E. Sclazo |

| |

|

JOSEPH E. SCALZO |

| CUSIP No. 513272104 | SCHEDULE 13D | Page 13 of 14 Pages |

SCHEDULE A

Transactions in the Shares of the Issuer During

the Past Sixty (60) Days

The following tables set forth

all transactions in the Shares effected during the past sixty (60) days by the Reporting Persons. Except as noted below, all such transactions

were effected in the open market through brokers and the price per share includes commissions. Where a price range is provided in the

column Price Range ($), the price reported in that row’s Price Per Share ($) column is a weighted average price. These Shares were

purchased/sold in multiple transactions at prices between the price ranges indicated in the Price Range ($) column. The Reporting Person

will undertake to provide to the staff of the SEC, upon request, full information regarding the number of Shares purchased/sold at each

separate price.

JANA

| Trade Date |

Shares Purchased (Sold) |

Price Per Share ($) |

Price Range ($) |

| |

|

|

|

| 8/26/2024 |

34,200 |

62.56 |

|

| 8/27/2024 |

23,702 |

62.25 |

|

| 8/28/2024 |

28,000 |

60.88 |

|

| 8/28/2024 |

9,100 |

62.07 |

|

| 8/29/2024 |

9,100 |

61.43 |

|

| 8/30/2024 |

8,054 |

61.91 |

|

| 9/3/2024 |

9,300 |

61.93 |

|

| 9/19/2024 |

32,600 |

65.77 |

|

| 9/20/2024 |

16,300 |

65.39 |

|

| 9/23/2024 |

16,400 |

65.17 |

|

| 9/24/2024 |

29,025 |

65.30 |

|

| 9/25/2024 |

39,015 |

64.50 |

|

| 9/26/2024 |

48,100 |

66.50 |

66.31 – 66.72 |

| 9/30/2024 |

43,800 |

64.94 |

|

| 10/1/2024 |

57,000 |

65.06 |

64.94 – 65.55 |

| 10/2/2024 |

22,961 |

65.45 |

|

| 10/3/2024 |

21,726 |

68.06 |

|

| 10/4/2024 |

32,042 |

68.68 |

|

| 10/7/2024 |

21,473 |

68.59 |

68.59 – 69.21 |

| 10/8/2024 |

14,279 |

70.79 |

|

| 10/9/2024 |

40,665 |

70.97 |

|

| 10/10/2024 |

15,644 |

70.21 |

|

| 10/11/2024 |

41,160 |

71.36 |

|

| 10/16/2024 |

61,635 |

70.55 |

70.05 – 70.68 |

| 10/17/2024 |

45,600 |

70.70 |

70.55 – 70.89 |

| CUSIP No. 513272104 | SCHEDULE 13D | Page 14 of 14 Pages |

Mr. Alford

| Trade Date |

Shares Purchased (Sold) |

Price Per Share ($) |

Price Range ($) |

| |

|

|

|

| 8/23/2024 |

8,000 |

62.55 |

|

Ms. Dietz

| Trade Date |

Shares Purchased (Sold) |

Price Per Share ($) |

Price Range ($) |

| |

|

|

|

| 8/22/2024 |

8,000 |

62.54 |

|

| 8/23/2024 |

8,000 |

62.65 |

|

| 8/26/2024 |

16,000 |

62.70 |

62.67 – 62.73 |

| 8/27/2024 |

13,000 |

62.07 |

62.05 – 62.08 |

| 8/28/2024 |

23,000 |

61.86 |

61.14 – 61.98 |

| 8/28/2024 |

5,000 |

60.90 |

|

| 8/30/2024 |

888 |

62.19 |

|

Mr. Gainor

| Trade Date |

Shares Purchased (Sold) |

Price Per Share ($) |

Price Range ($) |

| |

|

|

|

| 9/9/2024 |

2,000 |

63.69 |

63.68 – 63.70 |

| 9/10/2024 |

6,400 |

63.16 |

62.80 – 63.63 |

| 9/11/2024 |

4,000 |

61.67 |

61.50 – 61.85 |

| 9/13/2024 |

2,171 |

63.72 |

63.70 – 63.85 |

| 9/16/2024 |

1,429 |

65.10 |

64.95 – 65.45 |

Mr. Scalzo

| Trade Date |

Shares Purchased (Sold) |

Price Per Share ($) |

Price Range ($) |

| |

|

|

|

| 9/9/2024 |

7,885 |

63.77 |

|

Exhibit 99.1

Form of Nominee Agreement

This

Nomination Agreement (the "Agreement"), is by and between JANA Partners Management, LP ("JANA," "we"

or "us") and [NAME] ("you").

You

agree that you are willing, should we so elect, to become a member of a slate of nominees (the "Slate") of a JANA affiliate

(the "Nominating Party") which nominees shall stand for election as directors of Lamb Weston Holdings, Inc. ("LW")

in connection with a proxy solicitation (the "Proxy Solicitation") which may be conducted in respect of the 2025 annual

meeting of stockholders of LW (including any adjournment or postponement thereof or any special meeting held in lieu thereof, the "Annual

Meeting") or appointment or election by other means. You further agree to serve as a director of LW if so elected or appointed.

JANA agrees on behalf of the Nominating Party to pay the costs of the Proxy Solicitation. JANA also agrees on behalf of the Nominating

Party to pay you, (i) $60,000.00 within three (3) business days of the date hereof and (ii) in the event that you are elected or appointed

as a director of LW, $155,000.00 within three (3) business days of such election or appointment, provided that to the extent that you

do not own on the date of such election or appointment shares of common stock of LW ("Shares") with a market value (based

on the closing price of the Shares on the date of such election or appointment) equal to at least the estimated after-tax proceeds of

$215,000.00 (assuming a combined federal, state and city tax rate of 45%, rounded to the nearest whole dollar), you agree to purchase

an amount of Shares with a market value (based on the closing price of the Shares on the date of such election or appointment) equivalent

to or greater than such after-tax amount within five (5) business days of receipt of such payment (or such longer period as may be required

to comply with any legal or regulatory requirements or policies of the board of directors of LW (the "Board")). You

agree to hold any Shares purchased by you in accordance with this paragraph (and any other Shares purchased by you which were taken into

account in satisfying the share ownership obligation set forth in the prior sentence) until at least the later of (A) the first date

as of which you are no longer a director of LW and (B) three (3) years from the date of such appointment or election (or if earlier,

the date of the consummation of any merger or sale of LW which has been approved if applicable by the Board and the holders of the requisite

number of Shares).

JANA

agrees on behalf of the Nominating Party that JANA will defend, indemnify and hold you harmless from and against any and all losses,

claims, damages, penalties, judgments, awards, settlements, liabilities, costs, expenses and disbursements (including, without limitation,

reasonable attorneys' fees, costs, expenses and disbursements) incurred by you in the event that you become a party, or are threatened

to be made a party, to any civil, criminal, administrative or arbitrative action, suit or proceeding, and any appeal thereof, (i) relating

to your role as a nominee for director of LW on the Slate, or (ii) otherwise arising from or in connection with or relating to the Proxy

Solicitation. Your right of indemnification hereunder shall continue after the Annual Meeting has taken place but only for events that

occurred prior to the Annual Meeting and subsequent to the date hereof. Anything to the contrary herein notwithstanding, JANA is not

indemnifying you for any action taken by you or on your behalf that occurs prior to the date hereof or subsequent to the conclusion of

the Proxy Solicitation or such earlier time as you are no longer a nominee on the Slate or for any actions taken by you as a director

of LW, if you are elected. Nothing herein shall be construed to provide you with indemnification (i) if you are found to have engaged

in a violation of any provision of state or federal law in connection with the Proxy Solicitation, unless you demonstrate that your action

was taken in good faith and in a manner you reasonably believed to be in or not opposed to the best interests of electing the Slate;

(ii) if you acted in a manner that constitutes gross negligence or willful misconduct; or (iii) if you knowingly provided false or misleading

information, or willfully omitted material information, in the JANA Questionnaire (as defined below) or otherwise in connection with

the Proxy Solicitation. You shall promptly notify JANA in writing in the event of any third-party claims actually made against you or

known by you to be threatened if you intend to seek indemnification hereunder in respect of such claims; provided, however, that any

failure by you to notify JANA of any claim shall not relieve JANA of any liability which JANA may have to you except only to the extent

that any such delay in giving or failure to give notice as required materially prejudices the defense of such claim. In addition, upon

your delivery of notice with respect to any such claim, JANA shall promptly assume control of the defense of such claim with counsel

chosen by JANA and shall advise you of the progress thereof and all significant actions proposed. JANA shall not be responsible for any

settlement of any claim against you covered by this indemnity without its prior written consent. However, JANA may not enter into any

settlement of any such claim without your consent unless such settlement includes (i) no admission of liability or guilt by you, and

(ii) an unconditional release of you from any and all liability or obligation in respect of such claim. If you are required to enforce

the obligations of JANA in this Agreement in a court of competent jurisdiction, or to recover damages for breach of this Agreement, JANA

will pay on your behalf, in advance, any and all expenses (including, without limitation, reasonable attorneys' fees, costs, expenses

and disbursements) actually and reasonably incurred by you in such action, regardless of whether you are ultimately determined to be

entitled to such indemnification or advancement of expenses.

You

understand that it may be difficult, if not impossible, to replace a nominee who, such as yourself, has agreed to serve on the Slate

and, if elected, as a director of LW if such nominee later changes his mind and determines not to serve on the Slate or, if elected,

as a director of LW. Accordingly, JANA is relying upon your agreement to serve on the Slate and, if elected, as a director of LW. In

that regard, you may be supplied with a questionnaire (the "JANA Questionnaire") in which you will provide JANA with

information necessary for the Nominating Party to make appropriate disclosure to LW and to use in creating the proxy solicitation materials

to be sent to stockholders of LW and filed with the Securities and Exchange Commission in connection with the Proxy Solicitation. In

the event that the Nominating Party files with the Securities and Exchange Commission any proxy solicitation materials, the Nominating

Party agrees to provide you with an opportunity to comment on those sections of the proxy solicitation materials that relate to any personal

information concerning you contained in such materials.

You

agree that (i) upon request you will promptly complete, sign and return the JANA Questionnaire, (ii) your responses in the JANA Questionnaire

will be true, complete and correct in all respects, and (iii) you will provide any additional information as may be reasonably requested

by JANA. In addition, you agree that upon our request you will execute and return a separate instrument confirming that you consent to

being nominated for election as a director of LW and, if elected, consent to serving as a director of LW. Upon being notified that you

have been chosen, we and the Nominating Party may forward your consent and completed JANA Questionnaire (or summary thereof), to LW,

and we and the Nominating Party may at any time, in our and their discretion, disclose the information contained therein, as well as

the existence and contents of this Agreement. Furthermore, you understand that we may elect, at our expense, to conduct a background

and reference check on you and you agree to complete and execute any necessary authorization forms or other documents required in connection

therewith.

You

further agree that (i) you will treat confidentially all information relating to the Proxy Solicitation which is non-public, confidential

or proprietary in nature; (ii) you will not issue, publish or otherwise make any public statement or any other form of communication

relating to LW or the Proxy Solicitation without the prior approval of JANA; and (iii) you will not agree to serve, or agree to be nominated

to stand for election by LW or any other stockholder of LW (other than JANA), as a director of LW without the prior approval of JANA.

In

addition to the purchases of Shares required by the second paragraph above, you or your affiliates may invest in securities of LW. With

respect to any such purchases during the term of this Agreement, (i) you agree to consult with JANA and provide necessary information

so that we may comply with any applicable disclosure or other obligations which may result from such investment and (ii) JANA or its

affiliates shall prepare and complete any required disclosures including all regulatory filings related thereto. With respect to any

such purchases made pursuant to this paragraph you agree on behalf of yourself and your affiliates not to dispose of any such securities

prior to the termination of this Agreement.

Each

of us recognizes that should you be elected or appointed to the Board all of your activities and decisions as a director will be governed

by applicable law and subject to your fiduciary duties, as applicable, to LW and to the stockholders of LW and, as a result, that there

is, and can be, no agreement between you and JANA that governs the decisions which you will make as a director of LW.

This

Agreement shall automatically terminate on the earliest to occur of (i) the conclusion of the Annual Meeting, (ii) your election or appointment

to the Board or (iii) the termination of the Proxy Solicitation, provided, however, that the first, second, third, your confidentiality

obligations in the sixth, eighth, and tenth paragraphs of this Agreement shall survive such termination.

This

Agreement sets forth the entire agreement between JANA and you as to the subject matter contained herein, and cannot be amended, modified

or terminated except by a writing executed by JANA and you. Any prior agreements with respect to this subject matter are hereby terminated.

This Agreement shall be governed by and construed in accordance with the laws of the State of New York, without giving effect to principles

of conflicts of law.

[Signature

Page Follows]

Agreed to as

of the date both parties have signed:

| JANA PARTNERS

MANAGEMENT, LP |

|

| |

|

| |

|

| By: |

|

|

| Name: |

|

| Title: |

|

| Date: |

|

| |

|

| |

|

| |

|

| [NAME] |

|

| |

|

| |

|

| Date: |

|

|

| |

|

|

|

Exhibit 99.2

Joint Filing Agreement, dated October 18, 2024

PURSUANT TO RULE 13d-1(k)

The undersigned acknowledge and

agree that the foregoing statement on Schedule 13D is filed on behalf of each of the undersigned and that all subsequent amendments to

this statement on Schedule 13D may be filed on behalf of each of the undersigned without the necessity of filing additional joint filing

agreements. The undersigned acknowledge that each shall be responsible for the timely filing of such amendments, and for the completeness

and accuracy of the information concerning him, her or it contained herein and therein, but shall not be responsible for the completeness

and accuracy of the information concerning the others, except to the extent that he, she or it knows that such information is inaccurate.

Dated: October 18, 2024

|

JANA PARTNERS MANAGEMENT, LP |

| |

|

| |

|

| |

By: |

/s/ Jennifer Fanjiang |

| |

Name: |

Jennifer Fanjiang |

| |

Title: |

Partner, Chief Legal Officer and Chief Compliance Officer |

| |

|

|

| |

|

/s/ Bradley Alford |

| |

|

BRADLEY ALFORD |

| |

|

|

| |

|

| |

|

/s/ Diane Dietz |

| |

|

DIANE DIETZ |

| |

|

|

| |

|

| |

|

/s/ John P. Gainor Jr. |

| |

|

JOHN P. GAINOR JR |

| |

|

|

| |

|

| |

|

/s/ Timothy R. McLevish |

| |

|

TIMOTHY R. MCLEVISH |

| |

|

|

| |

|

|

| |

|

/s/ Joseph E. Sclazo |

| |

|

JOSEPH E. SCALZO |

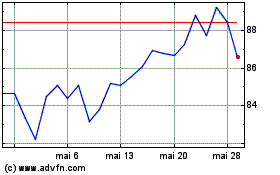

Lamb Weston (NYSE:LW)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Lamb Weston (NYSE:LW)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024