MBIA Inc. Declares Extraordinary Cash Dividend on MBIA Inc. Common Stock and Dividends from National Public Finance Guarantee Corporation

07 Décembre 2023 - 10:37PM

Business Wire

MBIA Inc. (NYSE:MBI) today announced that its Board of Directors

declared an extraordinary cash dividend on MBIA common stock of

$8.00 per share to shareholders of record as of December 18 to be

paid on December 22, which totals approximately $409 million, based

on 51.1 million shares outstanding. The information is also

available in the Current Report on Form 8-K dated December 7, 2023

available at sec.gov.

The Company also announced on December 7, 2023, the New York

Department of Financial Services ("NYDFS") approved a $550 million

extraordinary dividend to be paid to MBIA by its wholly-owned

subsidiary National Public Finance Guarantee Corporation

("National"), and separately, on November 20, 2023 the Corporation

received a $97.245 million as of right dividend from National.

The remainder of the dividends from National are being retained

by MBIA and are intended to be used for general corporate purposes

including, but not limited to, future operating expenses and debt

service obligations.

Bill Fallon, MBIA Inc. CEO, said, "We are pleased to provide

this extraordinary distribution of shareholder value to our

shareholders and significantly improve MBIA's liquidity for its

stakeholders. We will continue to pursue additional measures to

enhance shareholder value as we take steps to achieve the ultimate

resolution of the Company."

MBIA expects that National will continue to seek approval to pay

additional extraordinary dividends to MBIA in future years.

However, there can be no assurance whether or when NYDFS will

approve such requests and, if the NYDFS does approve such

dividends, in what amounts. Furthermore, any future dividend

payments by MBIA to shareholders are within the absolute discretion

of our board of directors and will depend on, among other things,

the receipt of additional extraordinary dividends from National,

our results of operations, working capital requirements, capital

expenditure requirements, financial condition, level of

indebtedness, contractual restrictions with respect to the payment

of dividends, business opportunities, anticipated cash needs,

provisions of applicable law and other factors that our board of

directors may deem relevant.

For U.S. federal income tax purposes, distributions made by MBIA

to a U.S. shareholder, other than with respect to holders of

unvested restricted shares, generally will constitute dividends

solely to the extent of our current and accumulated earnings and

profits (“E&P”). Through September 30, 2023 we do not have

current and accumulated E&P and based on our current analysis,

we do not expect to have any current or accumulated E&P through

December 31, 2023. Thus, we expect that the dividend will be

treated as a tax-free return of investment up to an investor’s

adjusted cost basis in its shares, and that if an investor’s

adjusted cost basis is reduced to zero, any remaining portion of

the dividend will be taxed as capital gains. Future dividends, if

any, may or may not receive similar tax treatment.

The process of determining current and accumulated E&P

requires a final determination of our financial results for the

year and a review of certain other factors that will be announced

with our full year 2023 financial results on February 28, 2024. To

the extent that we do in fact have current or accumulated E&P

in 2023, the dividend will be taxed as a dividend to the extent of

such current or accumulated E&P. The amount of the dividend

payable to holders of unvested restricted shares will be taxed as

ordinary income. Shareholders should consult their own tax

professionals regarding their receipt of this dividend.

Forward-Looking Statements

Any forward-looking statements made in this press release

reflect MBIA’s current views with respect to future events and are

made pursuant to the safe harbor provisions of the Private

Securities Litigation Reform Act of 1995. The words “believe”,

“anticipate”, “project”, “plan”, “expect”, “estimate”, “intend”,

“will likely result”, “looking forward”, or “will continue” and

similar expressions identify forward-looking statements. Such

statements involve risks and uncertainties that may cause actual

results to differ materially from those set forth in these

statements. These risks and uncertainties include, but are not

limited to, increased credit losses or impairments on public

finance obligations that National insures issued by state, local

and territorial governments and finance authorities and other

providers of public services, located in the U.S. or abroad, that

are experiencing fiscal stress; the possibility that loss reserve

estimates are not adequate to cover potential claims; a disruption

in the cash flow from National or an inability to access the

capital markets and our exposure to significant fluctuations in

liquidity and asset values in the global credit markets as a result

of collateral posting requirements; our ability to fully implement

our strategic plan; the possibility that MBIA Insurance Corporation

will have inadequate liquidity or resources to timely pay claims as

a result of higher than expected losses on certain insured

transactions or as a result of a delay or failure in collecting

expected recoveries, which could lead the NYDFS to put MBIA

Insurance Corporation into a rehabilitation or liquidation

proceeding under Article 74 of the New York Insurance Law and/or

take such other actions as the NYDFS may deem necessary to protect

the interests of MBIA Insurance Corporation’s policyholders;

deterioration in the economic environment and financial markets in

the United States or abroad, real estate market performance, credit

spreads, interest rates and foreign currency levels; and the

effects of changes to governmental regulation, including insurance

laws, securities laws, tax laws, legal precedents and accounting

rules, and other risk factors identified in the Company’s filings

with the Securities and Exchange Commission, including its Annual

Report on Form 10-K for the year ended December 31, 2022. Readers

are cautioned not to place undue reliance on these forward-looking

statements, which are made as of December 7, 2023. MBIA undertakes

no obligation to publicly update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise, except as required by law.

MBIA Inc., headquartered in Purchase, New York, is a holding

company whose subsidiaries provide financial guarantee insurance

for the public and structured finance markets. Please visit MBIA's

website at www.mbia.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231207181065/en/

MBIA Inc. Greg Diamond, 914-765-3190 Managing Director Head of

Investor and Media Relations greg.diamond@mbia.com

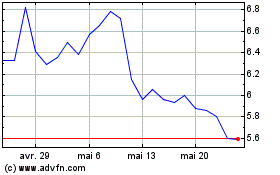

MBIA (NYSE:MBI)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

MBIA (NYSE:MBI)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025