Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

14 Août 2024 - 12:06PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of August 2024

Commission File Number 001-33098

Mizuho Financial Group, Inc.

(Translation of registrant’s name into English)

5-5, Otemachi 1-chome

Chiyoda-ku, Tokyo 100-8176

Japan

(Address of principal

executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form

20-F or Form 40-F. Form 20-F ☒ Form 40-F ☐

THIS REPORT ON FORM 6-K SHALL BE DEEMED TO BE INCORPORATED BY

REFERENCE INTO THE PROSPECTUS FORMING A PART OF MIZUHO FINANCIAL GROUP, INC.’S REGISTRATION STATEMENT ON FORM F-3 (FILE NO. 333-266555) AND TO BE A PART OF SUCH PROSPECTUS FROM THE DATE ON WHICH THIS

REPORT IS FURNISHED, TO THE EXTENT NOT SUPERSEDED BY DOCUMENTS OR REPORTS SUBSEQUENTLY FILED OR FURNISHED.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

|

|

|

| Date: |

|

August 14, 2024 |

|

| Mizuho Financial Group, Inc. |

|

|

| By: |

|

/s/ Takefumi Yonezawa |

| Name: |

|

Takefumi Yonezawa |

| Title: |

|

Senior Executive Officer / Group CFO |

August 14, 2024

To whom it may concern:

|

|

|

| Company Name: |

|

Mizuho Financial Group, Inc. |

| Representative: |

|

Masahiro Kihara, President & CEO |

| Head Office: |

|

1-5-5 Otemachi, Chiyoda-ku, Tokyo |

| Stock Code Number: |

|

8411 |

|

|

(Tokyo Stock Exchange (Prime Market)) |

Announcement regarding Capital Ratio as of June 30, 2024

Mizuho Financial Group, Inc. hereby announces Capital Ratio as of June 30, 2024, as shown in the appendix.

Capital Ratio

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Consolidated |

|

|

|

|

|

(%, Billions of yen) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Mizuho Financial Group

International Standard |

|

As of

June 30, 2024 |

|

|

Change |

|

|

As of

March 31, 2024 |

|

|

|

|

| (1) Total Capital Ratio |

|

|

17.65 |

|

|

|

0.72 |

|

|

|

16.93 |

|

| (2) Tier 1 Capital Ratio |

|

|

15.63 |

|

|

|

0.78 |

|

|

|

14.85 |

|

| (3) Common Equity Tier 1 Capital Ratio |

|

|

13.17 |

|

|

|

0.44 |

|

|

|

12.73 |

|

| (4) Total Capital |

|

|

12,770.6 |

|

|

|

456.0 |

|

|

|

12,314.6 |

|

| (5) Tier 1 Capital |

|

|

11,311.1 |

|

|

|

509.3 |

|

|

|

10,801.8 |

|

| (6) Common Equity Tier 1 Capital |

|

|

9,527.2 |

|

|

|

267.2 |

|

|

|

9,259.9 |

|

| (7) Risk-weighted Assets |

|

|

72,324.8 |

|

|

|

(395.3 |

) |

|

|

72,720.2 |

|

| (8) Total Required Capital (7)x8% |

|

|

5,785.9 |

|

|

|

(31.6 |

) |

|

|

5,817.6 |

|

|

|

|

| |

|

Consolidated |

|

|

Non-Consolidated |

|

| Mizuho Bank International

Standard |

|

As of

June 30, 2024 |

|

|

Change |

|

|

As of

March 31, 2024 |

|

|

As of

June 30, 2024 |

|

| (1) Total Capital Ratio |

|

|

16.37 |

|

|

|

0.61 |

|

|

|

15.76 |

|

|

|

15.59 |

|

| (2) Tier 1 Capital Ratio |

|

|

14.26 |

|

|

|

0.66 |

|

|

|

13.60 |

|

|

|

13.36 |

|

| (3) Common Equity Tier 1 Capital Ratio |

|

|

11.56 |

|

|

|

0.30 |

|

|

|

11.26 |

|

|

|

10.44 |

|

| (4) Total Capital |

|

|

10,832.3 |

|

|

|

431.6 |

|

|

|

10,400.6 |

|

|

|

9,470.7 |

|

| (5) Tier 1 Capital |

|

|

9,434.9 |

|

|

|

461.3 |

|

|

|

8,973.6 |

|

|

|

8,117.6 |

|

| (6) Common Equity Tier 1 Capital |

|

|

7,652.3 |

|

|

|

221.2 |

|

|

|

7,431.0 |

|

|

|

6,346.6 |

|

| (7) Risk-weighted Assets |

|

|

66,155.1 |

|

|

|

195.9 |

|

|

|

65,959.1 |

|

|

|

60,743.2 |

|

| (8) Total Required Capital (7)x8% |

|

|

5,292.4 |

|

|

|

15.6 |

|

|

|

5,276.7 |

|

|

|

4,859.4 |

|

|

|

|

| |

|

Consolidated |

|

|

Non-Consolidated |

|

| Mizuho Trust & Banking

International Standard |

|

As of

June 30, 2024 |

|

|

Change |

|

|

As of

March 31, 2024 |

|

|

As of

June 30, 2024 |

|

| (1) Total Capital Ratio |

|

|

29.95 |

|

|

|

0.96 |

|

|

|

28.99 |

|

|

|

29.49 |

|

| (2) Tier 1 Capital Ratio |

|

|

29.94 |

|

|

|

0.96 |

|

|

|

28.98 |

|

|

|

29.49 |

|

| (3) Common Equity Tier 1 Capital Ratio |

|

|

29.94 |

|

|

|

0.96 |

|

|

|

28.98 |

|

|

|

29.49 |

|

| (4) Total Capital |

|

|

477.5 |

|

|

|

0.8 |

|

|

|

476.7 |

|

|

|

445.9 |

|

| (5) Tier 1 Capital |

|

|

477.4 |

|

|

|

0.8 |

|

|

|

476.6 |

|

|

|

445.8 |

|

| (6) Common Equity Tier 1 Capital |

|

|

477.4 |

|

|

|

0.8 |

|

|

|

476.6 |

|

|

|

445.8 |

|

| (7) Risk-weighted Assets |

|

|

1,594.4 |

|

|

|

(49.9 |

) |

|

|

1,644.4 |

|

|

|

1,511.7 |

|

| (8) Total Required Capital (7)x8% |

|

|

127.5 |

|

|

|

(3.9 |

) |

|

|

131.5 |

|

|

|

120.9 |

|

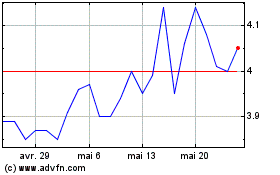

Mizuho Financial (NYSE:MFG)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

Mizuho Financial (NYSE:MFG)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025