Mueller Industries, Inc. (NYSE: MLI) announces results for the

second quarter of 2024. Comparisons are to the second quarter of

2023.

- Net Sales of $997.7 million versus $897.0 million

- Operating Income of $210.0 million versus $210.7 million

- Earnings Before Taxes of $222.9 million versus $241.0

million

- Net Income of $160.2 million versus $177.7 million

- Diluted EPS of $1.41 versus $1.561

Second Quarter Financial and Operating Highlights:

- COMEX copper averaged $4.55 per pound during the quarter, 18.4%

higher than in the second quarter of 2023.

- The increase in net sales was attributable to higher unit

shipments in most of our businesses, price increases tied to higher

copper prices, and the inclusion of one month of reported sales for

our recently acquired Nehring business.

- In 2023, we reported an insurance settlement gain of $19.5

million related to the August 2022 fire at our Westermeyer

facility. Adjusting for this gain, our quarterly operating income

performance improved by 9.8% over the prior year period.

- Net cash generated from operations was $100.8 million, and our

cash balance was $825.7 million at quarter end. Cash deployed

during the quarter included $566.6 million for acquisitions and

$15.1 million in stock repurchases.

- Our current ratio remains solid at 4.7 to 1.

Regarding the quarter performance and outlook, Greg Christopher,

Mueller’s CEO said, “Our businesses continue to perform well

despite persistent heightened inflation and restrained construction

activity. We maintain a positive long-term outlook for our

business. Our internal investments are paying off, and we expect

they will yield even greater benefits as market conditions improve.

Moreover, our acquisition of Nehring Electrical Works, which we

completed during the quarter, provides a substantial platform for

expansion in the energy infrastructure space.”

_____________________________

1

Diluted EPS for the second quarter of 2023

has been adjusted retroactively to reflect the two-for-one stock

split that took effect on October 20, 2023.1 Diluted EPS for the

second quarter of 2023 has been adjusted retroactively to reflect

the two-for-one stock split that took effect on October 20,

2023.

Mueller Industries, Inc. (NYSE: MLI) is an industrial

corporation whose holdings manufacture vital goods for important

markets such as air, water, oil and gas distribution; climate

comfort; food preservation; energy transmission; medical;

aerospace; and automotive. It includes a network of companies and

brands throughout North America, Europe, Asia, and the Middle

East.

*********************

Statements in this release that are not strictly historical may

be “forward-looking” statements, which involve risks and

uncertainties. These include economic and currency conditions,

continued availability of raw materials and energy, market demand,

pricing, competitive and technological factors, and the

availability of financing, among others, as set forth in the

Company’s SEC filings. The words “outlook,” “estimate,” “project,”

“intend,” “expect,” “believe,” “target,” “encourage,” “anticipate,”

“appear,” and similar expressions are intended to identify

forward-looking statements. The reader should not place undue

reliance on forward-looking statements, which speak only as of the

date of this report. The Company has no obligation to publicly

update or revise any forward-looking statements to reflect events

after the date of this report.

MUELLER INDUSTRIES,

INC.

CONDENSED CONSOLIDATED

STATEMENTS OF INCOME

(Unaudited)

For the Quarter Ended

For the Six Months Ended

(In thousands, except per share data)

June 29, 2024

July 1, 2023

June 29, 2024

July 1, 2023

Net sales

$

997,745

$

896,984

$

1,847,399

$

1,868,176

Cost of goods sold

724,990

639,272

1,333,693

1,318,070

Depreciation and amortization

10,018

10,416

19,187

21,073

Selling, general, and administrative

expense

52,731

56,062

101,088

108,693

Gain on insurance settlement

—

(19,466

)

—

(19,466

)

Operating income

210,006

210,700

393,431

439,806

Interest expense

(107

)

(135

)

(222

)

(278

)

Interest income

14,383

7,732

31,628

13,967

Realized and unrealized gains on

short-term investments

—

20,820

365

22,730

Other (expense) income, net

(1,356

)

1,841

(726

)

2,167

Income before income taxes

222,926

240,958

424,476

478,392

Income tax expense

(58,384

)

(62,122

)

(110,218

)

(123,479

)

(Loss) income from unconsolidated

affiliates, net of foreign tax

(1,095

)

715

(9,102

)

(269

)

Consolidated net income

163,447

179,551

305,156

354,644

Net income attributable to noncontrolling

interests

(3,282

)

(1,840

)

(6,628

)

(3,694

)

Net income attributable to Mueller

Industries, Inc.

$

160,165

$

177,711

$

298,528

$

350,950

Weighted average shares for basic earnings

per share (1)

111,216

111,320

111,316

111,354

Effect of dilutive stock-based awards

(1)

2,763

2,680

2,746

2,046

Adjusted weighted average shares for

diluted earnings per share (1)

113,979

114,000

114,062

113,400

Basic earnings per share (1)

$

1.44

$

1.60

$

2.68

$

3.15

Diluted earnings per share (1)

$

1.41

$

1.56

$

2.62

$

3.09

Dividends per share (1)

$

0.20

$

0.15

$

0.40

$

0.30

(1) Adjusted retroactively to reflect the

two-for-one stock split that occurred on October 20, 2023.

MUELLER INDUSTRIES,

INC.

CONDENSED CONSOLIDATED

STATEMENTS OF INCOME, CONTINUED

(Unaudited)

For the Quarter Ended

For the Six Months Ended

(In thousands)

June 29, 2024

July 1, 2023

June 29, 2024

July 1, 2023

Summary Segment Data:

Net sales:

Piping Systems Segment

$

688,469

$

638,005

$

1,278,637

$

1,300,484

Industrial Metals Segment

195,341

146,266

351,408

311,500

Climate Segment

130,532

123,954

247,342

276,908

Elimination of intersegment sales

(16,597

)

(11,241

)

(29,988

)

(20,716

)

Net sales

$

997,745

$

896,984

$

1,847,399

$

1,868,176

Operating income:

Piping Systems Segment

$

162,258

$

151,142

$

304,938

$

314,996

Industrial Metals Segment

29,693

17,971

53,964

45,186

Climate Segment

38,993

57,067

71,568

111,055

Unallocated income (expenses)

(20,938

)

(15,480

)

(37,039

)

(31,431

)

Operating income

$

210,006

$

210,700

$

393,431

$

439,806

MUELLER INDUSTRIES,

INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(Unaudited)

(In thousands)

June 29, 2024

December 30, 2023

ASSETS

Cash and cash equivalents

$

825,655

$

1,170,893

Short-term investments

—

98,146

Accounts receivable, net

522,572

351,561

Inventories

406,217

380,248

Other current assets

50,347

39,173

Total current assets

1,804,791

2,040,021

Property, plant, and equipment, net

471,443

385,165

Operating lease right-of-use assets

34,534

35,170

Other assets

755,417

298,945

Total assets

$

3,066,185

$

2,759,301

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current portion of debt

$

785

$

796

Accounts payable

198,537

120,485

Current portion of operating lease

liabilities

8,000

7,893

Other current liabilities

179,906

187,964

Total current liabilities

387,228

317,138

Long-term debt

74

185

Pension and postretirement liabilities

11,696

12,062

Environmental reserves

14,808

15,030

Deferred income taxes

20,023

19,134

Noncurrent operating lease liabilities

26,330

26,683

Other noncurrent liabilities

33,168

10,353

Total liabilities

493,327

400,585

Total Mueller Industries, Inc.

stockholders’ equity

2,546,103

2,337,445

Noncontrolling interests

26,755

21,271

Total equity

2,572,858

2,358,716

Total liabilities and equity

$

3,066,185

$

2,759,301

MUELLER INDUSTRIES,

INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(Unaudited)

For the Six Months Ended

(In thousands)

June 29, 2024

July 1, 2023

Cash flows from operating

activities

Consolidated net income

$

305,156

$

354,644

Reconciliation of consolidated net income

to net cash provided by operating activities:

Depreciation and amortization

19,349

21,252

Stock-based compensation expense

13,476

12,459

Provision for doubtful accounts

receivable

(67

)

(80

)

Loss from unconsolidated affiliates

9,102

269

Dividends from unconsolidated

affiliates

3,541

—

Insurance proceeds - noncapital

related

15,000

9,854

Gain on disposals of properties

(1,286

)

(141

)

Unrealized gain on short-term

investments

—

(20,820

)

Gain on sales of securities

(365

)

—

Gain on insurance settlement

—

(19,466

)

Deferred income tax (benefit) expense

(1,509

)

2,406

Changes in assets and liabilities, net of

effects of businesses acquired:

Receivables

(132,012

)

(77,701

)

Inventories

6,706

(12,149

)

Other assets

8,511

(5,571

)

Current liabilities

30,276

(14,460

)

Other liabilities

(2,375

)

(976

)

Other, net

872

1,310

Net cash provided by operating

activities

$

274,375

$

250,830

Cash flows from investing

activities

Capital expenditures

$

(25,603

)

$

(29,221

)

Acquisition of businesses, net of cash

acquired

(566,577

)

—

Investments in unconsolidated

affiliates

(8,700

)

—

Insurance proceeds - capital related

—

24,646

Purchase of short-term investments

—

(106,231

)

Purchase of long-term investments

(7,976

)

—

Proceeds from the maturity of short-term

investments

—

217,863

Proceeds from the sale of securities

96,465

—

Issuance of notes receivable

(3,800

)

—

Proceeds from sales of properties

3,976

142

Dividends from unconsolidated

affiliates

—

797

Net cash (used in) provided by investing

activities

$

(512,215

)

$

107,996

MUELLER INDUSTRIES,

INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(Unaudited)

For the Six Months Ended

(In thousands)

June 29, 2024

July 1, 2023

Cash flows from financing

activities

Dividends paid to stockholders of Mueller

Industries, Inc.

$

(44,488

)

$

(33,402

)

Repurchase of common stock

(42,994

)

(19,303

)

Repayments of debt

(111

)

(130

)

Issuance (repayment) of debt by

consolidated joint ventures, net

11

(143

)

Net cash used to settle stock-based

awards

(2,002

)

(2,588

)

Net cash used in financing activities

$

(89,584

)

$

(55,566

)

Effect of exchange rate changes on

cash

(4,784

)

4,825

(Decrease) increase in cash, cash

equivalents, and restricted cash

(332,208

)

308,085

Cash, cash equivalents, and restricted

cash at the beginning of the period

1,174,223

465,296

Cash, cash equivalents, and restricted

cash at the end of the period

$

842,015

$

773,381

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240722255882/en/

Jeffrey A. Martin (901) 753-3226

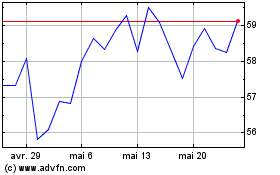

Mueller Industries (NYSE:MLI)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Mueller Industries (NYSE:MLI)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025