Molina Healthcare to Acquire ConnectiCare

23 Juillet 2024 - 3:00PM

Business Wire

Transaction expands Molina’s Government managed

care presence into Connecticut and is expected to add $1.00 per

share to new store embedded earnings1

Molina Healthcare, Inc. (NYSE: MOH) (“Molina” or the “Company”)

announced today that it has entered into a definitive agreement to

acquire ConnectiCare Holding Company, Inc. (“ConnectiCare”), a

wholly owned subsidiary of EmblemHealth, Inc. The purchase price

for the transaction is $350 million, representing 25% of expected

2024 premium revenue of $1.4 billion.

ConnectiCare is a leading health plan in the state of

Connecticut serving approximately 140,000 members across

Marketplace, Medicare, and certain commercial products as of June

30, 2024. The acquisition represents a strong strategic fit for

Molina, adding an established government business, recognized

brand, and a statewide provider network. The acquisition is

expected to add $1.00 per share to new store embedded earnings.

“The addition of ConnectiCare to Molina brings a well-rounded

government sponsored healthcare plan, and a new state, to our

portfolio,” said Joe Zubretsky, President and CEO of Molina.

“Today’s announcement demonstrates the continuing success of our

strategy of acquiring stable revenue streams, deploying capital

efficiently, and delivering value through the application of the

standard Molina playbook.”

Molina intends to fund the purchase with cash on hand. The

transaction is subject to the receipt of applicable federal and

state regulatory approvals, and the satisfaction of other customary

closing conditions. It is expected to close in the first half of

2025.

About Molina Healthcare

Molina Healthcare, Inc., a FORTUNE 500 company, provides managed

healthcare services under the Medicaid and Medicare programs and

through the state insurance marketplaces. For more information

about Molina Healthcare, please visit MolinaHealthcare.com.

1 See Reconciliation notes below.

Safe Harbor Statement under the Private Securities Litigation

Reform Act of 1995.

This press release contains forward-looking statements regarding

our intended acquisition of ConnectiCare Holding Company, Inc.

(“ConnectiCare”), including the expected timing of the closing of

the acquisition, ConnectiCare’s expected 2024 premium revenues, and

our expected new store embedded earnings. In some cases, you can

identify forward-looking statements by words such as “guidance”,

“future”, “anticipates”, “believes”, “embedded”, “estimates”,

“expects”, “growth”, “intends”, “plans”, “predicts”, “projects”,

“will”, “would”, “could”, “can”, “may” or the negative of these

terms or other similar expressions. All forward-looking statements

are based on current expectations that are subject to numerous risk

factors that could cause actual results to differ materially. Such

risk factors include, without limitation, risks that the

transaction may not close on a timely basis or at all, that we may

be unable to obtain regulatory approvals and third-party consents

or to satisfy all closing conditions, that we may be unable to

integrate the acquisition as currently expected without

unreasonable delay or cost, or to fully realize embedded earnings

at the level expected. Additional risk factors to which the Company

is subject are provided in our periodic reports and filings with

the Securities and Exchange Commission, including the Company’s

most recent Annual Report on Form 10-K. These reports can be

accessed under the investor relations tab of the Company’s website

or on the SEC’s website at sec.gov. Given these risks and

uncertainties, the Company cannot give assurances that its

forward-looking statements will prove to be accurate. All

forward-looking statements represent the Company’s judgment as of

the date hereof, and, except as otherwise required by law, the

Company disclaims any obligation to update any forward-looking

statement to conform the statement to actual results or changes in

its expectations.

Non-GAAP Financial Measures

The Company includes in this release the financial measure, “new

store embedded earnings,” which is a non-GAAP measure. The term is

defined as the incremental diluted earnings per share impact that

we expect to achieve in future years related to newly awarded but

not yet commenced state Medicaid contracts, and recently closed and

announced acquisitions. The incremental impact reflects the

expected full-year earnings for the newly-awarded California, Iowa,

Nebraska, New Mexico, and Texas Medicaid contracts, and the

Agewell, MyChoice Wisconsin, and California Medicare Health Plans

acquisitions, not yet included in the current full-year guidance

issued by the Company. This measure excludes amortization of

intangible assets and non-recurring costs associated with

acquisitions, including various transaction and integration costs.

The Company and management believe this measure is useful to

investors in assessing the Company’s expected performance related

to new Medicaid contracts and acquisitions, and is used internally

to enable management to assess the Company’s performance

consistently over time. New store embedded earnings should be

considered as a supplement to, and not as a substitute for or

superior to, GAAP measures. Management is unable to reconcile this

measure to the growth in GAAP earnings per share, the most directly

comparable GAAP measure, without unreasonable effort due to the

unknown impact from the amortization of intangible assets related

to recently announced acquisitions, which cannot be determined

until purchase accounting valuations are completed. Non-recurring

costs associated with the recently announced acquisitions are

estimated at approximately $15 million.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240722169986/en/

Investor Contact: Jeff Geyer,

Jeffrey.Geyer@molinahealthcare.com, 305-317-3012 Media

Contact: Caroline Zubieta,

Caroline.Zubieta@molinahealthcare.com, 562-951-1588

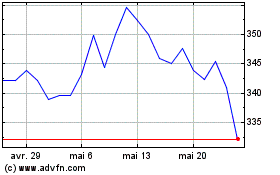

Molina Healthcare (NYSE:MOH)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Molina Healthcare (NYSE:MOH)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025