Independent Members of MPT’s Board of

Directors Stand Firmly Behind Management

The independent members of the Board of Directors of Medical

Properties Trust, Inc. (the “Company” or “MPT”) (NYSE: MPW) today

released a letter to shareholders regarding the findings of an

independent, forensic investigation into short-seller allegations,

including with respect to transactions between the Company and

Steward Healthcare (“Steward”). The Board’s Audit Committee engaged

Wachtell, Lipton, Rosen & Katz (“Wachtell Lipton”) to conduct

this investigation, which was completed in February 2023.

The full text of the letter is included below.

Dear fellow shareholder,

Over much of the past two years, Medical Properties Trust has

been the target of considerable scrutiny from short-selling hedge

funds as well as certain media outlets. As fiduciaries for our

shareholders, the Board treats these matters with the utmost

seriousness.

In response to certain claims asserted by Viceroy Research, the

Board’s Audit Committee engaged Wachtell Lipton in early 2023 to

conduct an independent investigation into the short-seller

allegations, including with respect to MPT transactions involving

Steward Healthcare beginning in 2016. Wachtell Lipton in turn

retained a leading global consulting firm to assist with financial

forensics as part of this investigation. No limitations or

restrictions were placed on the scope of the investigation and

management cooperation with the investigation was exemplary.

As has been previously reported, in March 2023 MPT filed suit

against Viceroy for defamation, civil conspiracy, and tortious

interference (among other claims). Due to the active and sensitive

nature of this litigation, our Board kept the investigation

findings confidential at that time. However, as the OCCRP and

Boston Globe resurfaced many of those same allegations in their

respective stories published on October 9, 2024, we believe it is

now critically important for all investors to have access to this

information.

The key findings from the investigation are as follows:

- The investigation identified no evidence that MPT gratuitously

overpays its operator-tenants for real estate.

- The investigation identified no evidence of improper

round-tripping.

- The investigation found no evidence of improper recognition of

“uncollectable” rent through GAAP-mandated straight-line revenue

recognition. The investigation also found no evidence to

substantiate the allegation that MPT was required to consolidate

Steward’s financial results.

- The investigation concluded that neither Manolete Health nor

MPT has an ownership interest in any Malta property or

hospital.

- The investigation yielded no evidence that management

manipulated acquisitions or other metrics to meet compensation

targets.

- The investigation yielded no evidence of concerns regarding

management integrity.

Our Board continues to stand firmly behind our management

team.

During Steward’s lengthy bankruptcy process, MPT’s team worked

tirelessly to avoid hospital closures, protect jobs, and ensure

continuity of care for patients. Our recently announced global

settlement agreement with Steward and its creditors, which was

approved by the bankruptcy court in September 2024, enabled MPT to

take back control of its real estate, immediately transition

operations to quality replacement operators, and sever its

relationship with Steward.

With Steward’s removal from our portfolio, we look forward to

demonstrating the strength and resilience of MPT’s diversified

portfolio of hospital real estate, our ability to create value for

shareholders over the long-term, and the importance of our business

model to an industry in dire need for more capital solutions.

Sincerely,

Michael G. Stewart, Lead Independent Director G. Steven Dawson,

Independent Director Caterina A. Mozingo, Independent Director

Emily W. Murphy, Independent Director Elizabeth N. Pitman,

Independent Director D. Paul Sparks, Jr., Independent Director G.

Reynolds Thompson, III, Independent Director

About Medical Properties Trust, Inc.

Medical Properties Trust, Inc. is a self-advised real estate

investment trust formed in 2003 to acquire and develop net-leased

hospital facilities. From its inception in Birmingham, Alabama, the

Company has grown to become one of the world’s largest owners of

hospital real estate with 435 facilities and approximately 42,000

licensed beds in nine countries and across three continents as of

June 30, 2024. MPT’s financing model facilitates acquisitions and

recapitalizations and allows operators of hospitals to unlock the

value of their real estate assets to fund facility improvements,

technology upgrades and other investments in operations. For more

information, please visit the Company’s website at

www.medicalpropertiestrust.com.

Forward-Looking Statements

This press release includes forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. Forward-looking statements can generally be identified by

the use of forward-looking words such as “may”, “will”, “would”,

“could”, “expect”, “intend”, “plan”, “estimate”, “target”,

“anticipate”, “believe”, “objectives”, “outlook”, “guidance” or

other similar words, and include statements regarding our

strategies, objectives, asset sales and other liquidity

transactions (including the use of proceeds thereof), expected

re-tenanting of vacant facilities and any related regulatory

approvals, and expected outcomes from Steward’s Chapter 11

restructuring process, including the terms of the agreement

described in this press release. Forward-looking statements involve

known and unknown risks and uncertainties that may cause our actual

results or future events to differ materially from those expressed

in or underlying such forward-looking statements, including, but

not limited to: (i) the risk that the outcome and terms of the

bankruptcy restructuring of Steward will not be consistent with

those anticipated by the Company; (ii) the risk that the Company is

unable to successfully re-tenant the Steward portfolio hospitals,

on the terms described herein or at all; (iii) the risk that

previously announced or contemplated property sales, loan

repayments, and other capital recycling transactions do not occur

as anticipated or at all; (iv) the risk that MPT is not able to

attain its leverage, liquidity and cost of capital objectives

within a reasonable time period or at all; (v) MPT’s ability to

obtain debt financing on attractive terms or at all, as a result of

changes in interest rates and other factors, which may adversely

impact its ability to pay down, refinance, restructure or extend

its indebtedness as it becomes due, or pursue acquisition and

development opportunities; (vi) the ability of our tenants,

operators and borrowers to satisfy their obligations under their

respective contractual arrangements with us; (vii) the ability of

our tenants and operators to operate profitably and generate

positive cash flow, remain solvent, comply with applicable laws,

rules and regulations in the operation of our properties, to

deliver high-quality services, to attract and retain qualified

personnel and to attract patients; (viii) the risk that we are

unable to monetize our investments in certain tenants at full value

within a reasonable time period or at all, (ix) our success in

implementing our business strategy and our ability to identify,

underwrite, finance, consummate and integrate acquisitions and

investments; and (x) the risks and uncertainties of litigation or

other regulatory proceedings.

The risks described above are not exhaustive and additional

factors could adversely affect our business and financial

performance, including the risk factors discussed under the section

captioned “Risk Factors” in our most recent Annual Report on Form

10-K and our Form 10-Q, and as may be updated in our other filings

with the SEC. Forward-looking statements are inherently uncertain

and actual performance or outcomes may vary materially from any

forward-looking statements and the assumptions on which those

statements are based. Readers are cautioned to not place undue

reliance on forward-looking statements as predictions of future

events. We disclaim any responsibility to update such

forward-looking statements, which speak only as of the date on

which they were made.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241014517610/en/

Drew Babin, CFA, CMA Head of Financial Strategy and Investor

Relations Medical Properties Trust, Inc. (646) 884-9809

dbabin@medicalpropertiestrust.com

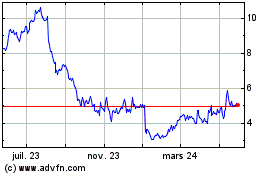

Medical Properties (NYSE:MPW)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

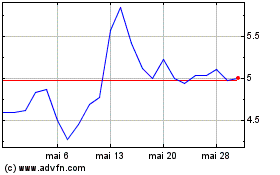

Medical Properties (NYSE:MPW)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024