Pricing Represents a Blended Coupon of

7.885%

Medical Properties Trust, Inc. (the “Company” or “MPT”) (NYSE:

MPW) today announced the pricing of the private offering of $1.5

billion in aggregate principal amount of senior secured notes due

2032 (the “USD Notes”) and €1.0 billion aggregate principal amount

of senior secured notes due 2032 (the “Euro Notes” and together

with the USD Notes, the “Notes”) to be issued by its operating

partnership, MPT Operating Partnership, L.P., and MPT Finance

Corporation, a wholly-owned subsidiary of the operating partnership

(together, the “Issuers”). The offering sizes of the USD Notes and

the Euro Notes were revised from the previously announced offering

sizes of $2.0 billion and €500 million. The USD Notes priced with a

coupon of 8.500% and the Euro Notes priced with a coupon of 7.000%,

representing a blended coupon of 7.885%. Interest on the Notes will

be payable semi-annually in arrears on February 15 and August 15 of

each year, commencing on August 15, 2025, and will mature on

February 15, 2032. The offering is expected to close on February

13, 2025, subject to customary closing conditions.

The Issuers estimate that the net proceeds from the offering of

the USD Notes will be approximately $1.46 billion and that the net

proceeds from the offering of the Euro Notes will be approximately

€974 million, in each case, after deducting discounts and

commissions to the initial purchasers but before deducting offering

related expenses. The Issuers intend to use a portion of the net

proceeds of the Notes to fund the redemption in full of the

Issuers’ 3.325% senior notes due 2025, 2.500% senior notes due 2026

and 5.250% senior notes due 2026, including related accrued

interest, fees and expenses. The Issuers intend to use the

remaining net proceeds, estimated to be approximately $0.8 billion,

for general corporate purposes, which may include repaying other

indebtedness, including amounts outstanding from time-to-time under

the Company’s revolving credit facility, working capital, capital

expenditures and potential future acquisitions.

The Notes will be fully and unconditionally guaranteed, on a

joint and several basis by the Company and its collateral-owning

subsidiaries, in addition to any other subsidiaries that are

guarantors under the Company’s senior credit facilities and any

U.S. domestic restricted subsidiaries that in the future borrow

under or guarantee borrowings under the Company’s senior credit

facilities. The Notes and the guarantees thereof will be secured by

first-priority liens on equity of the Company’s subsidiaries that,

as of the date hereof, directly own or ground lease a diversified

pool of 167 properties with 19 different operators in the U.S.,

U.K. and Germany. Concurrent with closing the Notes, the Company

expects to enter into an amendment to its senior revolving credit

and term loan agreement to cause the senior revolving credit

facility and senior term loan facility to share in the collateral

and guarantees on a pro rata basis and to make certain other

amendments with respect to the financial covenants.

The offering of the Notes and the related guarantees was and

will be made in a private transaction in reliance upon an exemption

from the registration requirements of the Securities Act of 1933,

as amended (the “Securities Act”), in the United States only to

persons reasonably believed to be “qualified institutional buyers,”

as that term is defined in Rule 144A under the Securities Act, or

outside the United States pursuant to Regulation S under the

Securities Act. The Notes and the related guarantees have not been

registered under the Securities Act or the securities laws of any

other jurisdiction and may not be offered or sold in the United

States without registration or an applicable exemption from

registration requirements.

This press release shall not constitute an offer to sell or a

solicitation of an offer to buy nor shall there be any sale of

these securities in any state or jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such state or

jurisdiction. This notice is being issued pursuant to and in

accordance with Rule 135c under the Securities Act.

About Medical Properties Trust, Inc.

Medical Properties Trust, Inc. is a self-advised real estate

investment trust formed in 2003 to acquire and develop net-leased

hospital facilities. From its inception in Birmingham, Alabama, the

Company has grown to become one of the world’s largest owners of

hospital real estate with 402 facilities and approximately 40,000

licensed beds in nine countries and across three continents as of

September 30, 2024. MPT’s financing model facilitates acquisitions

and recapitalizations and allows operators of hospitals to unlock

the value of their real estate assets to fund facility

improvements, technology upgrades and other investments in

operations.

Forward-Looking Statements

This press release includes forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. Forward-looking statements can generally be identified by

the use of forward-looking words such as “may”, “will”, “would”,

“could”, “expect”, “intend”, “plan”, “estimate”, “target”,

“anticipate”, “believe”, “objectives”, “outlook”, “guidance” or

other similar words, and include statements regarding our

strategies, objectives, asset sales and other liquidity

transactions (including the use of proceeds thereof), expected

re-tenanting of facilities and any related regulatory approvals,

and expected outcomes from Prospect’s Chapter 11 restructuring

process. Forward-looking statements involve known and unknown risks

and uncertainties that may cause our actual results or future

events to differ materially from those expressed in or underlying

such forward-looking statements, including, but not limited to: (i)

our ability to successfully consummate the senior notes offering

described in this press release, on the terms described herein or

at all; (ii) the risk that the outcome and terms of the bankruptcy

restructuring of Prospect will not be consistent with those

anticipated by the Company; (iii) the risk that previously

announced or contemplated property sales, loan repayments, and

other capital recycling transactions do not occur as anticipated or

at all; (iv) the risk that MPT is not able to attain its leverage,

liquidity and cost of capital objectives within a reasonable time

period or at all; (v) MPT’s ability to obtain or modify the terms

of debt financing on attractive terms or at all, as a result of

changes in interest rates and other factors, which may adversely

impact its ability to pay down, refinance, restructure or extend

its indebtedness as it becomes due, or pursue acquisition and

development opportunities; (vi) the ability of our tenants,

operators and borrowers to satisfy their obligations under their

respective contractual arrangements with us; (vii) the ability of

our tenants and operators to operate profitably and generate

positive cash flow, remain solvent, comply with applicable laws,

rules and regulations in the operation of our properties, to

deliver high-quality services, to attract and retain qualified

personnel and to attract patients; (viii) the risk that we are

unable to monetize our investments in certain tenants at full value

within a reasonable time period or at all, (ix) our success in

implementing our business strategy and our ability to identify,

underwrite, finance, consummate and integrate acquisitions and

investments; and (x) the risks and uncertainties of litigation or

other regulatory proceedings.

The risks described above are not exhaustive and additional

factors could adversely affect our business and financial

performance, including the risk factors discussed under the section

captioned “Risk Factors” in our most recent Annual Report on Form

10-K and our Form 10-Q, and as may be updated in our other filings

with the SEC. Forward-looking statements are inherently uncertain

and actual performance or outcomes may vary materially from any

forward-looking statements and the assumptions on which those

statements are based. Readers are cautioned to not place undue

reliance on forward-looking statements as predictions of future

events. We disclaim any responsibility to update such

forward-looking statements, which speak only as of the date on

which they were made.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250130801790/en/

Drew Babin, CFA, CMA Head of Financial Strategy and Investor

Relations Medical Properties Trust, Inc. (646) 884-9809

dbabin@medicalpropertiestrust.com

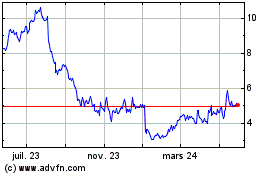

Medical Properties (NYSE:MPW)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

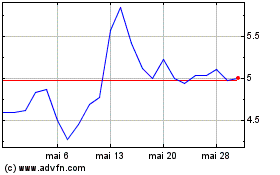

Medical Properties (NYSE:MPW)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025