Filed by ConocoPhillips

pursuant to Rule 425 under the Securities

Act of 1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: Marathon Oil Corporation

Commission File No.: 001-05153

Date: May 29, 2024

[The following is a transcript of a

conference call held by ConocoPhillips on May 29, 2024 in connection with the proposed transaction between ConocoPhillips and

Marathon Oil Corporation.]

| Call Participants |

| |

EXECUTIVES

Andrew M. O’Brien

Senior Vice President of Strategy, Commercial, Sustainability & Technology

Nicholas G. Olds

Executive Vice President of Lower 48

Phil Gresh

Ryan M. Lance

Chairman & CEO

William L. Bullock

Executive VP & CFO

ANALYSTS

Alastair Roderick Syme

Citigroup Inc., Research Division

Francis Lloyd Byrne

Jefferies LLC, Research Division

John Macalister Royall

JPMorgan Chase & Co, Research

Division

Joshua Ian Silverstein

UBS Investment Bank, Research

Division

Leo Paul Mariani

ROTH MKM Partners, LLC, Research

Division

Neal David Dingmann

Truist Securities, Inc., Research

Division |

Paul Cheng

Scotiabank Global Banking and Markets,

Research Division

Roger David Read

Wells Fargo Securities, LLC,

Research Division

Ryan M. Todd

Piper Sandler & Co., Research

Division

Scott Michael Hanold

RBC Capital Markets, Research

Division

Stephen I. Richardson

Evercore ISI Institutional Equities,

Research Division

Wei Jiang

Barclays Bank PLC, Research

Division

|

|

Presentation

Operator

Welcome to the ConocoPhillips

Market Update. My name is Liz, and I will be your operator for today's call. [Operator Instructions]

I will now turn the call over to Phil Gresh, Vice President, Investor

Relations. Sir, you may begin.

Phil Gresh

Thank you, Liz, and good morning, everyone. Thank you for joining us today for our market update call to discuss this morning's

announced transaction between ConocoPhillips and Marathon Oil Corporation, as well as an update to the company's distribution plans.

On the call today, we have several members of the ConocoPhillips leadership

team, including Ryan Lance, Chairman and CEO; Bill Bullock, Executive Vice President and Chief Financial Officer; Andy O'Brien, Senior

Vice President, Strategy, Commercial, Sustainability and Technology; and Nick Olds, Executive Vice President of Lower 48.

We have a slide presentation posted on our website that we will be

walking through on today's call.

A couple of important administrative reminders. We use some non-GAAP

terms this morning, and reconciliations to the nearest GAAP measures are included in today's release and on our website.

Also please note, we will make some forward-looking statements based

on current expectations as well as statements about the proposed transaction between ConocoPhillips and Marathon. A description of the

risks associated with forward-looking statements and other important information about the proposed transaction can be found in the joint

press release and on Slides 2 through 4 of the presentation.

Finally, as a reminder, we'll be taking questions at the end of the

prepared remarks, and we'll take one question per caller. Now I'll turn it over to Ryan.

Ryan M. Lance

Chairman & CEO

Thanks, Phil, and thank you to everyone for joining our market update call to discuss ConocoPhillip's acquisition of Marathon Oil

Corporation.

Now logistics dictated that we host this call in person from New York

this morning, and Lee felt strongly he wanted to be in Houston with his team and the Marathon Oil employees. Otherwise, he would be joining

us on the call this morning.

I want to start off by saying that the acquisition of Marathon is a

perfect fit for ConocoPhillips. Under Lee's leadership, Marathon has demonstrated many of the same values and priorities around safety,

strong operational performance and a commitment to ESG leadership and a CFO-based return on capital framework where our shareholders come

first, and Marathon has a high-quality asset base with adjacencies to our own assets that will lead to a straightforward integration and

meaningful synergies.

Turning to Slide 6. I'd like to start by covering some key highlights.

First, this is an all-stock transaction with an enterprise value of $22.5 billion, inclusive of $5.4 billion of net debt. ConocoPhillips

will be issuing roughly 144 million shares in connection with the transaction. We expect the transaction to close in the fourth quarter

of 2024.

From a financial perspective, the acquisition will immediately be accretive

to earnings, cash flow and return on capital per share. We expect to achieve at least a $500 million synergy run rate within the first

full year following the closing of the transaction. And importantly, we see this transaction lowering our total company free cash flow

breakeven, which unlocks additional return of capital to our shareholders.

Along with this transaction, we are providing several shareholder distribution

updates. First, we have announced our intent to increase our ordinary base dividend by 34% starting in the fourth quarter. This is independent

of the transaction.

Second, upon closing the transaction and assuming recent commodity

prices, we will increase our annual share buyback run rate to over $7 billion, over $5 billion today.

And third, looking out further, we plan to buy back at least $20 billion

in shares in the first 3 years post close. That will allow us to retire the equivalent amount of newly issued equity in 2 to 3 years.

Moving to Slide 7. I wanted to frame out how this transaction fits

within our disciplined M&A framework that you are all very familiar with. As a reminder, our 3 key tenants are: that an acquisition

must meet our framework, it must make our plan better, and we have to be able to make the assets better. And Marathon clearly meets all

3 criteria.

In terms of our framework, Marathon's core Lower 48 assets are competitive

within our portfolio, adding more than 2 billion barrels of resource with an average point forward cost of supply below $30 WTI. Second,

as I already mentioned, the transaction makes our plan better as it's immediately accretive to earnings, cash flow and return on capital

per share. And third, we have a clear line of sight to making the assets better through a combination of synergies, differential technology

and increased scale.

Bottom line, Marathon fits very well within our current operations,

and we see a number of opportunities to unlock value from the combined portfolio.

So next, I'm going to turn the call over to Andy to walk through

some of those opportunities in more detail.

Andrew M. O’Brien

Senior Vice President of Strategy, Commercial, Sustainability & Technology

Thanks, Ryan. So moving to Slide 8. I want to start by talking about how Marathon's core Lower 48 assets line up very well with

our portfolio, which you can clearly see on the slide.

Starting in the Eagle Ford, this transaction will further enhance our

premier position in the heart of the play, increasing our production to nearly 400,000 barrels per day and adding roughly 1,000 new primary

locations to our inventory.

We also see significant upside potential on refracs. We've been implementing

new refrac techniques across our existing Eagle Ford position that expanded our refrac inventory at cost of supplies to compete with our

Tier 1 opportunities. We will be doing the same on the Marathon acreage. In fact, based on our detailed analysis, we believe that Marathon

has over 1,000 refrac locations in this Eagle Ford acreage. All totaled, we see over a decade of runway in the Eagle Ford.

In the Bakken, our pro forma production will double to over 200,000

barrels per day.

We really like the Bakken as an all way to play and has the lowest

reinvestment rate within our unconventional portfolio. Bakken will drive solid free cash flow generation with a combined drilling inventory

of over 10 years. On a stand-alone basis, both companies' Bakken programs are very similar in terms of drilling rigs and factories and

we see opportunities to rationalize the combined companies' activities to maximize capital and operating efficiencies.

Moving to the Permian. Our existing asset base is clearly much larger

in size, making the Marathon acreage position more of a traditional bolt-on, adding 400 more locations to our already deep inventory base.

Marathon's position is likely developed today and recent performance has shown strong oil productivity. Marathon's acreage will also provide

us more opportunities to core up for longer lateral development via swaps and trades, which is something that we do every day.

The Anadarko Basin is primarily focused on natural gas, we see this

as a call option on the normalization of U.S. gas fundamentals driven by growing power and LNG-related demand.

Finally, in Equatorial Guinea, we'll add 2 MTPA of net LNG capacity

to our global portfolio. Equatorial Guinea is a free cash flow engine for Marathon today and Marathon has been working hard to improve

this asset, which is evident with the 5-year free cash flow profile that the company has recently outlined. As we further build out our

LNG business, we will leverage our technical and commercial capabilities to enhance the value of these assets over time.

Moving to Slide 9. Our initial synergy target is at least $500 million

per year, which includes roughly $250 million from G&A costs, $150 million from operating costs and commercial improvements, and $100

million from capital costs. From a G&A perspective, we will reduce overlapping costs across the combined organization. Regarding operating

costs, we are streamlining field operations throughout the Lower 48, taking advantage of the adjacencies across the combined footprint.

We will also leverage our scale on the procurement side.

Similar to our prior major Permian transactions, we'll take full advantage

of our commercial capabilities in order to maximize realizations and reduce [ T&P ] costs.

Finally, moving to capital, we'll also leverage our enhanced cost base

and footprint to drive further reductions in drilling and completion costs.

Putting it all together, we see $500 million in synergies as a good

starting point, which we intend to achieve on a run rate basis within the first year after closing. As we've demonstrated in past transactions,

we think there will be upside potential as we close the deal and begin the integration process.

Moving to Slide 10. I want to step back and talk about this transaction

in the context of our overall portfolio. The key takeaway is that ConocoPhillips remains differential by its depth, durability and diversity

while adding further scale to our unconventional portfolio. Following this transaction, we will remain the largest independent global

upstream company. We'll enhance our position as one of the most durable companies in the U.S. unconventional industry as measured by debt

and -- debt and quality of our remaining inventory, and we will maintain the benefits of our diverse global portfolio with roughly 40%

of our production coming from outside of the Lower 48. And this is before the organic investments in LNG, Willow and other conventional

assets that will come online over the years ahead.

I'll now turn it back to Ryan to talk about our distributions and then

to wrap up.

Ryan M. Lance

Chairman & CEO

Thanks, Andy. Now moving to Slide 11, I wanted to provide a bit more context for our updated return on capital plan. Let me

start with the dividend.

Independent of this transaction, we have announced a plan to increase

our ordinary base dividend by 34% to $0.78 per share in the fourth quarter. This will effectively roll the current $0.20 per share VROC

into the base. We have spent a fair amount of time looking at this. Based on all of our portfolio improvements we have made in the recent

years, we feel quite comfortable with the step change in our ordinary dividend, driven by the quality of our asset base and the durability

of our stand-alone cash flow profile. And we can continue to grow the ordinary dividend at a rate that is competitive with the top quartile

of the S&P 500, and this will only be helped by the transaction. which further reduces our free cash flow breakeven.

Moving to share buybacks. Upon the closing of the transaction and assuming

recent commodity prices, we will increase the annual run rate of buybacks to over $7 billion, up from over $5 billion on a stand-alone

basis today. When combined with our higher ordinary dividend, this would put our total quantum of distributions at a run rate that is

over $11 billion.

And we are confident that this phase of share buybacks will be sustainable, allowing for at least $20 billion of buybacks in the first

3 years after the transaction closes, effectively retiring the equivalent amount of the newly issued equity within 2 to 3 years of closing.

All this is consistent with our long-term framework to return at least

30% of our CFO to shareholders through the cycles as well as our long-term track record that is well over 40% of CFO.

So to wrap up on Slide 12. As I've said at our Analyst and Investor

Meeting just over a year ago, we will continue to execute on our plan and look for ways to make it better. The acquisition of Marathon

does just that. It fits our framework, it makes our plan better, and it makes the assets better. The transaction will be accretive day

1. We have line of sight to at least $500 million in annual synergies with upside potential. The combined company will have a lower free

cash flow breakeven, and we are increasing our ordinary dividend and share buybacks, with total distributions that are consistent with

our long-term CFO based track record.

We continue to get better, and I continue to believe that ConocoPhillips

is the must owned E&P in your portfolio. Now let me turn the call back over to the operator, and we'll start the Q&A.

Question

and Answer

Operator

[Operator Instructions] Our first question comes from

the line of Lloyd Byrne with Jefferies.

Francis Lloyd Byrne

Jefferies LLC, Research Division

Congrats. Ryan, I've done this for a long time, and I would argue, no one has made

more correct M&A decisions than your team, both timing and asset quality wise.

So I guess, what I'm interested in is, why now? And what is it that

makes this opportunity the right one when so many others have gone through it? And maybe, you talked about scale a couple of times and

maybe that's something you could focus on?

Ryan M. Lance

Chairman & CEO

Yes. Lloyd. Appreciate the question. Look, we've always tried to be opportunistic. We look at all

the kinds of opportunities that are out there. We stepped back a number of years ago looking for where around the world have the lowest

cost of supply rocks and then who owns those rocks. So we follow the companies like that, and certainly identified the shale, both here

in North America and U.S. Lower 48, Canada and some conventional assets around the world that were very interesting to us. So we followed

this for quite some time, tend to be opportunistic, but most importantly, it has to fit our framework.

So we were very -- we were just trying to communicate to you and we

showed you repeatedly what our framework looks like. We never know when these opportunities come available, and this one certainly became

available or came to our attention here a few weeks ago. And we spent some time looking at it. We could see the -- we know the Eagle Ford

quite well, the Bakken quite well, and saw the significant overlap and the opportunity that this represented for the company. But we sat

back and made sure it fits our framework, that it makes our 10-year plan better and that we have a clear line of sight to make the assets

better. And that clearly checked all the boxes for the company.

But first and foremost, it fit our framework. It fit how we think about

the business, how we think about mid-cycle, prices, how we think about the commodity price. And look, we think we're heading into a period

of what I'd call, kind of shale 2.0, which -- it's more about using technology and efficiencies, data analytics and some of the refrac

potential that we can get into. I'm sure on the call, a little bit, that we see that allows us to extend some Tier 1 inventory, both in

the Eagle Ford and the Bakken, and we're pretty excited about what this next leg is going to show for the company. And so that's why this

is such a good fit at this particular point in time for us in the company. We weren't necessarily out looking for something, but it was

an opportunity that presented itself.

Operator

Our next question

comes from the line of Betty Jiang with Barclays.

Wei Jiang

Barclays Bank PLC, Research Division

Congratulations on the deal. I want to focus a bit more on the synergy side. Looking

at the $500 million of annual savings, specifically perhaps on the cost and commercial optimization and then the capital optimization,

do you think that Marathon did a good job managing costs? Where do you think where the most opportunities are on the cost side? Is that

going to get realized in [ LOE ]? And then on the capital optimization side, will we start seeing some different capital allocation across

the various plays in Marathon portfolio where you start seeing that topline?

Andrew M. O’Brien

Senior Vice President of Strategy, Commercial, Sustainability & Technology

Betty, this is Andy. I can take that question.

Maybe starting on the cost side of it. And I think taking it sort of really back to sort of the beginning is that we expect this to be

a pretty seamless integration after we close. I mean we touched on this in some of the prepared remarks. Marathon is a very good cultural

fit with us, similar safety, operation focus and ESG focus. And it certainly helps on the -- as we're going through the integration,

we're literally down the street from each other.

So I think maybe starting on the G&A side of things, there's some

pretty obvious G&A synergies. I think the slide we showed with the math on the overlap of the assets, given the adjacency of those

assets, and we expect the back office support to be seamlessly integrated and that's essentially going to remove any duplication.

We're also going on full math into all of our systems and processes

and fully integrate into our work streams. And then all of the corporate-related functions are going to be combined. So I think on the

G&A side, we refer to the scaling as an example of bringing it together into our scale, allow us to take all that duplication out.

On the operating cost side of things, some of the examples of synergies

there. We both have kind of base examples. We both have field offices and operations that are essentially crisscrossing each other in

the field. And we'll mobilize the workforces and combine that footprint, again, sort of seeing the savings there. But then sort of --

more sort of the technical side of running the assets, we see pretty good opportunities to rationalize the work-over rigs that we're running

on that combined footprint. So again, there'll be opportunities there.

On the capital side of the equation, what we've consistently talking

to here are the synergies that we are sort of -- and committing to the $500 million, this is going to be, to start with, again, from our

size and scale on the supply chain side of things, we're going to see advantages in things like OCTG costs and rigs, frac and sand. And

I don't want to underestimate sort of the value there is in sort of our ability to run consistent programs of scale, how that drives cost

savings for us.

Another example there in the Eagle Ford, we'd expect to implement super

zippers and remote frac operations. That's not something that Marathon is doing today. So that's kind of how we see the way we'll get

to the capital savings. But I think you also mentioned the commercial. The things that we see as upside that we haven't baked into the

valuation, and we see our global commercial footprint being a real advantage to us, just like we did when we acquired Concho. And we'd

expect to see enhanced value across oil, gas and NGL from these assets.

And then the other piece is that we are pretty excited about and we

haven't factored value into this at this point, but the ability to sort of rework the combined drilling programs within the actual assets

themselves and across the basins is going to drive value for us over time. And Bakken is a great example of this, where combining them

will be a better company. We see opportunities to reduce the total rig and frac counts that we have. We're both running very similar programs

today. We'll be able to level load frac through. So there'll be clear savings there. We haven't factored that in yet. That's sort of what

we're excited about and the team is getting their hands on it being able to optimize for those programs.

So I think we've demonstrated in the past a track record that we're

able to seamlessly integrate assets. We think this one with the overlap is going to be reasonably straightforward for us. And we expect

to basically realize a fair bit of upside to that.

Operator

Our next question

comes from the line of Roger Read with Wells Fargo.

Roger David Read

Wells Fargo Securities, LLC, Research Division

Congratulations on the transaction here. Since you kind of opened it up on

a previous response, the refrac opportunity, as we think about that within the overall cost of supply, and as you said, moving some of

the, I believe you said, Bakken acreage into a Tier 1 level. Like what exactly is that process? How should we think about that developing?

Nicholas G. Olds

Executive Vice President of Lower 48

Yes, Roger, this is Nick. Maybe just start back on the inventory that we spoke about

in the prepared remarks on the development side. Again, we start with 2,000 locations across the 3 basins, Eagle Ford, you can think

about that, about 1,000 locations there. And then between Bakken and the Permian, that's roughly equally split across that very competitive

cost of supply and very competitive in our overall portfolio. Such is the development side.

So to your question on the refracs, we have a long history, as you're

aware of, with doing refracs, specifically in Eagle Ford, over 5-plus years and where we see roughly a 60% uplift in expected ultimate

recovery. And then we continue to test newer refrac techniques and expand that across the entire Eagle Ford portfolio. And what that is

leading to, Roger, is expanding that inventory in our own company. We see very promising opportunity to expand that to Marathon. And that

leads to the 1,000 locations in Eagle Ford for refracs.

Now regarding to the cost of supply component, put a little bit of

background on that. A typical refrac costs about 60% to 70% of a new well. We're actually even seeing some of those costs coming even

below the 60% mark, which is very encouraging. And again, when you look at the early vintage wells that we do refracs on, we're getting

60% uplift of [indiscernible] compared to that original well location.

On the cost of supply, very competitive. They're in the low 30s to

high 30s on cost of supply. And as we talked about, that's really expanding, expanding that Tier 1 inventory. So very competitive in the

portfolio.

And then I think what gives us further confidence is that 5-year history.

So we've got demonstrated performance. We've got consistent performance on the refracs. We're looking at these new refrac techniques,

really promising results, and that gives us the confidence in that refrac strategy and the go-forward inventory that Andy referenced.

Ryan M. Lance

Chairman & CEO

And I would add one thing, Roger, real quick to remember it's where the rocks are at. So it's the

type of rocks that you have and the inventory goes consistent with that. So remember where the volatile window is and where that kind

of window is at, that makes a difference on the capability around the refracs.

Operator

Our next question

comes from the line of John Royall with JPMorgan.

John Macalister Royall

JPMorgan Chase & Co, Research Division

Congrats on the deal. I wanted to go to the return of capital. So can you

talk about how you stress test your base dividend given the hike? And if you can confirm the VROC will now fold into the base? And if

that's the case, what changed in your thinking there between previously using the VROC and now not? And should we think of the buyback

now as kind of the more variable flywheel?

William L. Bullock

Executive VP & CFO

John, this is Bill. Maybe to start with our return on capital and our ordinary dividends. So

as we talked about in our prepared remarks and as Ryan said this morning, that irrespective of the transaction, we are quite confident

in the cash flows and improvement that we've seen over time in the portfolio. So increasing the ordinary dividend in the fourth quarter

as the plan is essentially rolling VROC into that.

We really like where we're at in the portfolio on that. And of course,

we stress tested the portfolio. You saw in AIM. We do a $40 stress test on that. And it's just an indication of the strength of the portfolio

and improvements we've made over time that allows us to confidently roll that into our ordinary dividend.

I think it's important that as we look at that, as we think about that

as a company, one of the things that we believe continues to be important is the ability to grow that ordinary dividend consistent with

the top quartile of dividend paying stocks in S&P. And so we've looked through time in our plans, and we feel quite confident in our

ability to do that through the cycle. Then when you think about the overall return of capital, as we indicated today, that at current

pricing, we'd expect on close to increase our buybacks by about $2 billion, that will take the total quantum up to a little north of $11

billion. We're currently at about a 40-60 split, that will take us up to 35-65.

We really like the value of our shares. We think that there's good

value in there. So leading into that, we think, makes sense as a well-balanced portfolio. And then VROC, so certainly, leading into our

shares right now, we think makes the most sense. But VROC continues to be a tool in our portfolio, particularly if we see high price excursions

again in the future. So that really is how we're thinking about it. It's pretty consistent and it's pretty structured.

Operator

Our next question

comes from the line of Alastair Syme with Citi.

Alastair Roderick Syme

Citigroup Inc., Research Division

I just wanted to try and put that in volume terms because I think, you talked at the Analyst

Day last year about the back end coming off production plateau at the end of this decade, and I think Eagle Ford in early 2030. So sort

of -- does this transaction change your perspective on a pro forma basis of when these basins start to mature and decline?

Andrew M. O’Brien

Senior Vice President of Strategy, Commercial, Sustainability & Technology

This is Andy. I'll take that question.

So in terms of the way we think about the growth, as we always have said, our primary focus is on the returns and the growth is the outcome,

and we really focus on and make sure we execute the scope as efficient as we can, and that's where we're laser focused. But that said,

specifically to your question around sort of the impact of this on our overall growth rate, it really doesn't change what we showed at

AIM over a 10-year plan at all in terms of the output of what we see the growth of the company being.

As we combine the programs, we'll be looking to an opportunity to sort

of optimize them as we've previously talked on. And we've not really factored any of the sort of optimizing of the programs into this

yet, that's sort of all upside that will be focused on from the growth.

And I do want to sort of -- I know we're here talking about this transaction

today. But I do want to remind everybody, sort of our growth doesn't just come from the unconventionals. We're going to have a steady

run rate of growth coming in terms of -- I think of cash flow growth, but it has production obviously with it, too, as we -- in the second

half of the decade, as we have the NFE project, [ whole other ] projects, the NFS project, the Willow coming on. So I wouldn't really

be changing anything in terms of what we've previously said about growth.

Operator

Our next question

comes from the line of Stephen Richardson with Evercore ISI.

Stephen I. Richardson

Evercore ISI Institutional Equities, Research Division

A quick one, if I could. On the -- I think it's implicit, but it

hasn't been said explicitly. I mean Marathon has been spending about $2 billion a year of CapEx and running about 9 to 10 rigs in the

Lower 48. So just wondering if you could confirm as you've looked at it, acknowledging you've got $100 million of capital optimization

synergies. But in your base case, you expect to effectively run a very similar program going forward.

And if I could also slip in one. Ryan, could you just talk a little

bit about the divestiture target here? And is that weighted? I appreciate that's probably across the portfolio, but is it weighted, legacy

Conoco or anything you see at Marathon to the extent that you can divulge at this point?

Ryan M. Lance

Chairman &

CEO

Yes, Stephen. I'll take the last one first, and maybe

have Andy jump in on your first question.

But yes, the disposition target, look, we've been -- I think people

recognize some good, pretty good rationalizing the portfolio quite a bit over the last number of years. And we do this just a matter of

a good course of business. And we recognize with the acquisition of Marathon, the opportunity is going to be there to continue to hone

the portfolio, find out those pieces or assets that don't fit in the portfolio and turn them out.

So we put out a couple of billion dollar disposition target over the

next couple of years after we get through close. And that's just going to be rationalizing, growing in through it. That's the total portfolio.

It's not focused on one area or another, but recognize that we've done that over the past, and we'll continue to do that. It's just good

business. Put the cash on the balance sheet and just make our company stronger and lower breakevens, lower decline rates, lower capital

intensity. So it's the right thing to do, especially for those uncompetitive assets.

So maybe I'll have Nick answer the first part of your question on the

scope of the Marathon program.

Nicholas G. Olds

Executive Vice President of Lower 48

Yes. If you look at what they're running, as you mentioned, kind of typically, as I

guided to in the Q1 call, kind of a 9 to 10 rig program out there, majority of those rigs, roughly 4 in the Eagle Ford, as Andy mentioned,

kind of 3 in the Bakken, and then lesser extent in Permian as well as Anadarko.

So as we've done, since the second half of 2022, we're really going

to focus on level-loaded steady state programs where we can drive that operating efficiency, which leads to the improved capital efficiency.

So with more feet per day, more stages per day, Andy referenced super zippers and Eagle Ford, remote frac, we see opportunities to drive

that. And that's through that level-loaded steady-state program.

On the refracs as well, there's an opportunity where we use remote

frac, which we've been doing over the last couple of years and seeing really good improvements there on total pumping hours per day. So

very similar, that 9 to 10 rigs, we don't expect to do any immediate plans to change activity, but we will do some rationalization, as

Andy mentioned, for example, in the Bakken. So we'll look at frac gaps and overall operating efficiency there. Do we drop a rig and go

to 1 to 1.5 frac crews in there as an example as we further dig into it.

So, excited about the opportunity as we go in and look at the total

rig count and then the fracs.

Ryan M. Lance

Chairman & CEO

Yes. And I think, Stephen, we're going to find opportunity to move stuff around the basins and reoptimize

the program based on a bigger footprint that we have, and which will lead to upside value that Andy talked about, and some of the capital

synergies that we see. We see a lot of opportunity there.

Operator

Our next question

comes from the line of Scott Hanold with RBC Capital Markets.

Scott Michael Hanold

RBC Capital Markets, Research Division

Ryan, could you talk a little bit about your thoughts on the timing of closing by the end

of this year? And regarding maybe some FTC scrutiny around kind of market share in Eagle Ford, Bakken and the Permian?

Ryan M. Lance

Chairman & CEO

Yes, Scott. I think, look, well, it will be up to the FTC ultimately. I think the fourth quarter

sort of anticipated close. It kind of takes a look at the past transactions that the FTC has done, and they'll have to make a decision

whether there's a second request or not, which is really what extends the timeline a little bit. We think this is pretty clean.

And I think we're encouraged by the commentary that's coming out of

the FTC that they recognize this -- that oil is a global market, and it trades in a global market, and this is a very, very, very small

percent of that global market. So I think that's an important first step, that they've already kind of gotten over that Rubicon with some

of the deals that have come over the last couple of years that you're familiar with.

But we're trying to be a little bit conservative in terms of timeline.

But ultimately, it's up to the FTC. We'll put all the information in the shareholder vote will occur on the Marathon side, and then we'll

put the information on the Hart-Scott-Rodino filing and then it's really up to the FTC to take a look at that and make their decision

on if any more data or information is required. But our timeline expects that will take about what we've seen with some of the prior transactions

and the kind of timeline that they've been under.

Operator

Our next question

comes from the line of Neal Dingmann with Truist Securities.

Neal David Dingmann

Truist Securities, Inc., Research Division

Just a quick one on capital allocation. I'm just wondering, now with the

new portfolios that you're adding, obviously, some quality assets, will that change? Any thoughts regarding whether Alaska LNG as far

as allocating capital to other non-Lower 48 areas?

Ryan M. Lance

Chairman & CEO

No, we're pretty -- I think we've been pretty transparent and clear about how we allocate capital

inside the company. We still use a $40-ish cost of supply cutoff to allocate capital, so any project or any drilling program or any opportunity

within our portfolio has got to meet that kind of criteria.

Specific to your point on Alaska LNG, that's not a project that we've

indicated the desire to participate and although we're willing to be a [indiscernible] seller of gas.

Operator

Our next question

comes from the line of Ryan Todd with Piper Sandler.

Ryan M. Todd

Piper Sandler & Co., Research Division

Maybe a follow-up on the Bakken. I mean, I don't know if it's fair

to say. Historically, the Bakken has always felt a little less core for you relative to some of the other assets in your portfolio. How

does this deal impact how you view the Bakken kind of internally within the portfolio? And what types of upside there? I think Marathon

recently had been seeing some good results of 3-mile laterals. Is that -- is that something that you're interested in and you see upside

in? Does the combination to provide a greater ability to do, to extend longer laterals or allocate, I guess, change the way in terms

of how you view the Bakken within the portfolio?

Nicholas G. Olds

Executive Vice President of Lower 48

Yes, Ryan, we definitely like the Marathon's Bakken footprint, and the inventory up

there. I'll speak to the 3-mile laterals here in a second. If you look at kind of 3 main asset areas, I got the assets up to the

north and then you come down in the Hector and Ajax units, and that's where you roughly got 70% of that inventory.

But I can step back a little bit on the Bakken, as we've talked about

as a stand-alone company, we have roughly a decade of drilling inventory there, the same with Marathon. So combined on a pro forma basis,

we've got well over a decade of drilling inventory that's very competitive within the Bakken. It's oil weighted. We know it really well.

As I talked about on the Southern Bakken assets down in Ajax and Hector, strong adjacent components between the 2 companies. As you referenced,

they've had some really good results in some 3-mile laterals, very encouraging results there. We have direct adjacent acreage with 3-mile

opportunities that are in our plan, both near term and midterm. So very excited about sharing development strategies, ensuring results

across as we think about how to optimize those longer lateral development.

So yes, I think Bakken is going to be an opportunity where we

can continue to look at expanding the long lateral inventory. And as we talked about, there's some, definitely some activity rationalization

when we look at overall rigs and frac crews, when we look at the operating components, we're seeing more stages per day or more feet per

day being executed in that asset.

Operator

Our next question

comes from the line of Josh Silverstein with UBS.

Joshua Ian Silverstein

UBS Investment Bank, Research Division

I was curious how the EG assets play into your LNG strategy. If you're thinking about

accelerating any of the projects that Marathon had over there for the next couple of years? And as you're kind of thinking about matching

up supply and demand offtakes, does this impact that thought as well?

Andrew M. O’Brien

Senior Vice President of Strategy, Commercial, Sustainability & Technology

This is Andy. I can take that one. Again,

so Equatorial Guinea, as I've said in the prepared remarks, it's a solid free cash flow asset, and I think Marathon's has outlined a

very credible plan for what they plan to do over the next 5 years or so. And also we look very closely at that. And that's sort of how

we really sort of take a look at the asset.

But as you referenced, there's upside here. This is an LNG plant that

isn't at full capacity, and there is opportunity here to third-party tiebacks. And I think with our global LNG footprint, we see this

as kind of another very interesting sort of liquefaction point as we're building out our global portfolio and ability to move LNG between

Europe and Asia. So yes, it's going to be a very helpful sort of asset to add into our portfolio.

And I should also mention, we kind of know this asset pretty well because

it is using our Cascade technology. So we're very familiar with the facility and sort of what the abilities of the facility are. So yes,

this is one that we're intrigued by, and it's a nice addition basically in terms of building out our global LNG portfolio.

Operator

Our next question

comes from the line of Paul Cheng with Scotiabank.

Paul Cheng

Scotiabank Global Banking and Markets, Research Division

One, if we look at this transaction, all -- everything looked great,

and that is accretive with the exception of one item, which is Marathon. The inventory backlog life is much shorter than you guys. I

mean with the 2,000 gross inventory, to maintain their production is probably about 220 to 250 wells. So we may be talking about, say,

somewhere in the 8 to 10 years on their life. You have much longer.

So how important is that into your thinking or does it matter to you?

And for a company like you guys, for the Lower 48, what is the optimum inventory life in your opinion?

Ryan M. Lance

Chairman & CEO

Yes. I don't know if we think about sort of an optimum inventory life, Paul. We mostly are focused

on how much low cost of supply inventory does it create, and how much can we create using some of our technology operating practices

and what we think. So as we got into their data room and looked a little bit harder at the data, I think your data is probably right

on a gross basis. But on a net basis, it would be in that 8 years, on a net basis, it's well over 10 years. So one, you have a gross

net, you have to be careful with, Paul, a little bit there.

But more importantly for us is, as we got in there and looked, we saw

some of the recent refracing results that we've had in our portfolio. And as we start to apply that in a broader sense than what Marathon

has been doing in their portfolio, we see some extension of some great opportunities to bring acreage back into what we would call that

Tier 1 category. And again, these are assets both in the Eagle Ford and the Bakken that they've been managing similar to us in a plateau

setting. So it reduces the capital intensity, doesn't require a lot, so you're not battling. High growth rates coming into the assets

and you're not battling the kind of a higher decline rate.

So for us, we see a great fit into the portfolio, just adds duration,

depth and durability and resilience to our portfolio and gives us a lot more optionality around areas that we know really well. We know

the Eagle Ford, we know the Bakken and obviously, the Permian and we know the Anadarko Basin, we were there for a long, long time as well

and kind of back into that basin as well.

But for us, it does -- we see over a decade of opportunity that fits

it in a competitive place in terms of how we're allocating capital inside the portfolio today. So we're pretty excited to bring it in.

We think there's going to be more optionality as we get in and close the deal and understand the assets and apply some of the technology

that Nick talked about to those assets.

Phil Gresh

I think we have

time for one more.

Operator

This question

comes from the line of Leo Mariani with ROTH MKM.

Leo Paul Mariani

ROTH MKM Partners, LLC, Research Division

I just wanted to ask about consideration on the transaction here. So you obviously

came out into an all-stock transaction, but you're up in the buyback with the plan to basically buyback all those shares within 3 years.

Was there not any consideration of maybe some kind of cash component? It feels like that might have juiced the returns a bit here. Just

wanted to see if you can kind of comment on how you thought about the consideration paid here.

Ryan M. Lance

Chairman & CEO

Yes, Leo. That's fairly easy. The seller wanted all stock, seller didn't want any cash. So with

full participation in the upside. So the structure was more of the demand of the seller.

Operator

We have no further questions at this time. Thank you, ladies and gentlemen.

This concludes today's conference. Thank you for participating. You may now disconnect.

Forward-Looking Statements

This communication includes “forward-looking statements”

as defined under the federal securities laws. All statements other than statements of historical fact included or incorporated by reference

in this communication, including, among other things, statements regarding the proposed business combination transaction between ConocoPhillips

(“ConocoPhillips”) and Marathon Oil Corporation (“Marathon”), future events, plans and anticipated results of

operations, business strategies, the anticipated benefits of the proposed transaction, the anticipated impact of the proposed transaction

on the combined company’s business and future financial and operating results, the expected amount and timing of synergies from

the proposed transaction, the anticipated closing date for the proposed transaction and other aspects of ConocoPhillips’ or Marathon’s

operations or operating results are forward-looking statements. Words and phrases such as “ambition,” “anticipate,”

“estimate,” “believe,” “budget,” “continue,” “could,” “intend,”

“may,” “plan,” “potential,” “predict,” “seek,” “should,” “will,”

“would,” “expect,” “objective,” “projection,” “forecast,” “goal,”

“guidance,” “outlook,” “effort,” “target” and other similar words can be used to identify

forward-looking statements. However, the absence of these words does not mean that the statements are not forward-looking. Where, in any

forward-looking statement, ConocoPhillips or Marathon expresses an expectation or belief as to future results, such expectation or belief

is expressed in good faith and believed to be reasonable at the time such forward-looking statement is made. However, these statements

are not guarantees of future performance and involve certain risks, uncertainties and other factors beyond ConocoPhillips’ or Marathon’s

control. Therefore, actual outcomes and results may differ materially from what is expressed or forecast in the forward-looking statements.

The following important factors and uncertainties,

among others, could cause actual results or events to differ materially from those described in forward-looking statements: ConocoPhillips’

ability to successfully integrate Marathon’s businesses and technologies, which may result in the combined company not operating

as effectively and efficiently as expected; the risk that the expected benefits and synergies of the proposed transaction may not be fully

achieved in a timely manner, or at all; the risk that ConocoPhillips or Marathon will be unable to retain and hire key personnel; the

risk associated with Marathon’s ability to obtain the approval of its stockholders required to consummate the proposed transaction

and the timing of the closing of the proposed transaction, including the risk that the conditions to the transaction are not satisfied

on a timely basis or at all or the failure of the transaction to close for any other reason or to close on the anticipated terms, including

the anticipated tax treatment (and with respect to increases in ConocoPhillips’ share repurchase program, such increases are not

intended to exceed shares issued in the transaction); the risk that any regulatory approval, consent or authorization that may be required

for the proposed transaction is not obtained or is obtained subject to conditions that are not anticipated; the occurrence of any event,

change or other circumstance that could give rise to the termination of the proposed transaction; unanticipated difficulties, liabilities

or expenditures relating to the transaction; the effect of the announcement, pendency or completion of the proposed transaction on the

parties’ business relationships and business operations generally; the effect of the announcement or pendency of the proposed transaction

on the parties’ common stock prices and uncertainty as to the long-term value of ConocoPhillips’ or Marathon’s common

stock; risks that the proposed transaction disrupts current plans and operations of ConocoPhillips or Marathon and their respective management

teams and potential difficulties in hiring or retaining employees as a result of the proposed transaction; rating agency actions and ConocoPhillips’

and Marathon’s ability to access short- and long-term debt markets on a timely and affordable basis; changes in commodity prices,

including a prolonged decline in these prices relative to historical or future expected levels; global and regional changes in the demand,

supply, prices, differentials or other market conditions affecting oil and gas, including changes resulting from any ongoing military

conflict, including the conflicts in Ukraine and the Middle East, and the global response to such conflict, security threats on facilities

and infrastructure, or from a public health crisis or from the imposition or lifting of crude oil production quotas or other actions that

might be imposed by Organization of Petroleum Exporting Countries and other producing countries and the resulting company or third-party

actions in response to such changes; insufficient liquidity or other factors that could impact ConocoPhillips’ ability to repurchase

shares and declare and pay dividends such that ConocoPhillips suspends its share repurchase program and reduces, suspends or totally eliminates

dividend payments in the future, whether variable or fixed; changes in expected levels of oil and gas reserves or production; potential

failures or delays in achieving expected reserve or production levels from existing and future oil and gas developments, including due

to operating hazards, drilling risks or unsuccessful exploratory activities; unexpected cost increases, inflationary pressures or technical

difficulties in constructing, maintaining or modifying company facilities; legislative and regulatory initiatives addressing global climate

change or other environmental concerns; public health crises, including pandemics (such as COVID-19) and epidemics and any impacts or

related company or government policies or actions; investment in and development of competing or alternative energy sources; potential

failures or delays in delivering on ConocoPhillips’ current or future low-carbon strategy, including ConocoPhillips’ inability

to develop new technologies; disruptions or interruptions impacting the transportation for ConocoPhillips’ or Marathon’s oil

and gas production; international monetary conditions and exchange rate fluctuations; changes in international trade relationships or

governmental policies, including the imposition of price caps, or the imposition of trade restrictions or tariffs on any materials or

products (such as aluminum and steel) used in the operation of ConocoPhillips’ or Marathon’s business, including any sanctions

imposed as a result of any ongoing military conflict, including the conflicts in Ukraine and the Middle East; ConocoPhillips’ ability

to collect payments when due, including ConocoPhillips’ ability to collect payments from the government of Venezuela or PDVSA; ConocoPhillips’

ability to complete any other announced or any other future dispositions or acquisitions on time, if at all; the possibility that regulatory

approvals for any other announced or any future dispositions or any other acquisitions will not be received on a timely basis, if at all,

or that such approvals may require modification to the terms of those transactions or ConocoPhillips’ remaining business; business

disruptions following any announced or future dispositions or other acquisitions, including the diversion of management time and attention;

the ability to deploy net proceeds from ConocoPhillips’ announced or any future dispositions in the manner and timeframe anticipated,

if at all; potential liability for remedial actions under existing or future environmental regulations; potential liability resulting

from pending or future litigation; the impact of competition and consolidation in the oil and gas industry; limited access to capital

or insurance or significantly higher cost of capital or insurance related to illiquidity or uncertainty in the domestic or international

financial markets or investor sentiment; general domestic and international economic and political conditions or developments, including

as a result of any ongoing military conflict, including the conflicts in Ukraine and the Middle East; changes in fiscal regime or tax,

environmental and other laws applicable to ConocoPhillips’ or Marathon’s businesses; disruptions resulting from accidents,

extraordinary weather events, civil unrest, political events, war, terrorism, cybersecurity threats or information technology failures,

constraints or disruptions; and other economic, business, competitive and/or regulatory factors affecting ConocoPhillips’ or Marathon’s

businesses generally as set forth in their filings with the Securities and Exchange Commission (the “SEC”). The registration

statement on Form S-4 and proxy statement/prospectus that will be filed with the SEC will describe additional risks in connection

with the proposed transaction. While the list of factors presented here is, and the list of factors to be presented in the registration

statement on Form S-4 and proxy statement/prospectus are considered representative, no such list should be considered to be a complete

statement of all potential risks and uncertainties. For additional information about other factors that could cause actual results to

differ materially from those described in the forward-looking statements, please refer to ConocoPhillips’ and Marathon’s respective

periodic reports and other filings with the SEC, including the risk factors contained in ConocoPhillips’ and Marathon’s most

recent Quarterly Reports on Form 10-Q and Annual Reports on Form 10-K. Forward-looking statements represent current expectations

and are inherently uncertain and are made only as of the date hereof (or, if applicable, the dates indicated in such statement).

Except as required by law, neither ConocoPhillips nor Marathon undertakes or assumes any obligation to update any forward-looking statements,

whether as a result of new information or to reflect subsequent events or circumstances or otherwise.

No Offer or Solicitation

This communication is not intended to and

shall not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any securities, or a solicitation of any vote

or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful

prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made,

except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended.

Additional Information about the Merger

and Where to Find It

In connection with the proposed transaction,

ConocoPhillips intends to file with the SEC a registration statement on Form S-4, which will include a proxy statement of Marathon

that also constitutes a prospectus of ConocoPhillips common shares to be offered in the proposed transaction. Each of ConocoPhillips

and Marathon may also file other relevant documents with the SEC regarding the proposed transaction. This communication is not a substitute

for the proxy statement/prospectus or registration statement or any other document that ConocoPhillips or Marathon may file with the SEC.

The definitive proxy statement/prospectus (if and when available) will be mailed to stockholders of Marathon. INVESTORS AND SECURITY

HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT, PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS THAT MAY BE FILED

WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE

BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders will be

able to obtain free copies of the registration statement and proxy statement/prospectus (if and when available) and other documents containing

important information about ConocoPhillips, Marathon and the proposed transaction, once such documents are filed with the SEC through

the website maintained by the SEC at www.sec.gov. Copies of the documents filed with the SEC by ConocoPhillips will be available

free of charge on ConocoPhillips’ website at www.conocophillips.com or by contacting ConocoPhillips’ Investor Relations

Department by email at investor.relations@conocophillips.com or by phone at 281-293-5000. Copies of the documents filed with the

SEC by Marathon will be available free of charge on Marathon’s website at www.ir.marathonoil.com or by contacting Marathon

at 713-629-6600.

Participants in the Solicitation

ConocoPhillips, Marathon and certain of their

respective directors and executive officers may be deemed to be participants in the solicitation of proxies in respect of the proposed

transaction. Information about the directors and executive officers of ConocoPhillips is set forth in (i) ConocoPhillips’

proxy statement for its 2024 annual meeting of stockholders under the headings “Executive Compensation”, “Item 1: Election

of Directors and Director Biographies” (including “Related Party Transactions” and “Director Compensation”),

“Compensation Discussion and Analysis”, “Executive Compensation Tables” and “Stock Ownership”, which

was filed with the SEC on April 1, 2024 and is available at https://www.sec.gov/ix?doc=/Archives/edgar/data/1163165/000130817924000384/cop4258041-def14a.htm,

(ii) ConocoPhillips’ Annual Report on Form 10-K for the fiscal year ended December 31, 2023, including under the

headings “Item 10. Directors, Executive Officers and Corporate Governance”, “Item 11. Executive Compensation”,

“Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters” and “Item

13. Certain Relationships and Related Transactions, and Director Independence”, which was filed with the SEC on February 15,

2024 and is available at https://www.sec.gov/ix?doc=/Archives/edgar/data/1163165/000116316524000010/cop-20231231.htm and (iii) to

the extent holdings of ConocoPhillips securities by its directors or executive officers have changed since the amounts set forth in ConocoPhillips’

proxy statement for its 2024 annual meeting of stockholders, such changes have been or will be reflected on Initial Statement of Beneficial

Ownership of Securities on Form 3, Statement of Changes in Beneficial Ownership on Form 4 or Annual Statement of Changes in

Beneficial Ownership of Securities on Form 5, filed with the SEC (which are available at EDGAR Search Results https://www.sec.gov/edgar/search/#/category=form-cat2&ciks=0001163165&entityName=CONOCOPHILLIPS%2520(COP)%2520(CIK%25200001163165)).

Information about the directors and executive officers of Marathon is set forth in (i) Marathon’s proxy statement for its 2024

annual meeting of stockholders under the headings “Proposal 1: Election of Directors”, “Director Compensation”,

“Security Ownership of Certain Beneficial Owners and Management”, “Compensation Discussion and Analysis”, “Executive

Compensation” and “Transactions with Related Persons”, which was filed with the SEC on April 10, 2024 and is available

at https://www.sec.gov/ix?doc=/Archives/edgar/data/101778/000010177824000082/mro-20240405.htm, (ii) Marathon’s Annual Report

on Form 10-K for the fiscal year ended December 31, 2023, including under the headings “Item 10. Directors, Executive

Officers and Corporate Governance”, “Item 11. Executive Compensation”, “Item 12. Security Ownership of Certain

Beneficial Owners and Management and Related Stockholder Matters” and “Item 13. Certain Relationships and Related Transactions,

and Director Independence”, which was filed with the SEC on February 22, 2024 and is available at https://www.sec.gov/ix?doc=/Archives/edgar/data/101778/000010177824000023/mro-20231231.htm

and (iii) to the extent holdings of Marathon securities by its directors or executive officers have changed since the amounts set

forth in Marathon’s proxy statement for its 2024 annual meeting of stockholders, such changes have been or will be reflected on

Initial Statement of Beneficial Ownership of Securities on Form 3, Statement of Changes in Beneficial Ownership on Form 4, or

Annual Statement of Changes in Beneficial Ownership of Securities on Form 5, filed with the SEC (which are available at EDGAR Search

Results https://www.sec.gov/edgar/search/#/category=form-cat2&ciks=0000101778&entityName=MARATHON%2520OIL%2520CORP%2520(MRO)%2520(CIK%25200000101778)).

Other information regarding the participants in the proxy solicitations

and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus

and other relevant materials to be filed with the SEC regarding the proposed transaction when such materials become available. Investors

should read the proxy statement/prospectus carefully when it becomes available before making any voting or investment decisions.

Copies of the documents filed with the SEC by ConocoPhillips and Marathon will be available free of charge through the website maintained

by the SEC at www.sec.gov. Additionally, copies of documents filed with the SEC by ConocoPhillips will be available free of charge

on ConocoPhillips’ website at www.conocophillips.com/ and those filed by Marathon will be available free of charge on Marathon’s

website at www.ir.marathonoil.com/.

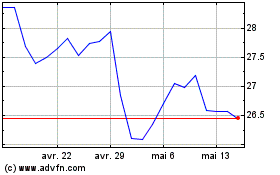

Marathon Oil (NYSE:MRO)

Graphique Historique de l'Action

De Mai 2024 à Juin 2024

Marathon Oil (NYSE:MRO)

Graphique Historique de l'Action

De Juin 2023 à Juin 2024