UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT

TO RULE 13A-16 OR 15D-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

| For the month of |

June |

|

2024 |

| |

|

|

|

| Commission File Number |

001-41722 |

|

|

METALS ACQUISITION LIMITED

| (Translation of registrant’s name into English) |

| |

|

3rd Floor, 44 Esplanade, St.

St. Helier, Jersey, JE49WG

Tel: +(817) 698-9901 |

| (Address of principal executive offices) |

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F:

Form 20-F x

Form 40-F ¨

EXPLANATORY NOTE

On

June 10, 2024, Metals Acquisition Limited (the “Company”) issued a press release announcing the completion of the Company’s

redemption of all of its (i) outstanding public warrants (the “Public Warrants”) to purchase ordinary shares of the Company,

par value $0.0001 per share (the “Ordinary Shares”), that were issued under the Warrant Agreement, dated as of July 28, 2021,

between Metals Acquisition Corp (“Old MAC”) and Continental Stock Transfer & Trust Company and (ii) outstanding private

placement warrants to purchase Ordinary Shares that were issued by the Company in (a) a private placement transaction in connection with

the business combination under the Sponsor Letter Agreement, dated as of July 28, 2021, by and between Old MAC and Green Mountain Metals

LLC (the “Sponsor”) and (b) the conversion of the 2022 Sponsor Convertible Note, dated April 13, 2022, under which the Sponsor

exercised its option to convert the issued and outstanding loan amount into private placement warrants, on the same terms as the outstanding

Public Warrants. A copy of the press release is furnished as Exhibit 99.1 hereto.

The information in this Form 6-K, including Exhibit

99.1 attached hereto, is furnished and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange

Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed

to be incorporated by reference into any of the Company’s filings under the Securities Act of 1933, as amended, or the Exchange

Act.

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

|

METALS ACQUISITION LIMITED |

| |

|

(Registrant) |

| |

|

|

| Date: |

June 10, 2024 |

|

By: |

/s/ Michael James McMullen |

| |

|

|

|

Name: |

Michael James McMullen |

| |

|

|

|

Title: |

Chief Executive Officer |

Exhibit 99.1

June 10, 2024

METALS ACQUISITION LIMITED COMPLETES REDEMPTION OF PUBLIC AND PRIVATE

PLACEMENT WARRANTS AND RUSSELL 3000® INDICES INCLUSION

ST. HELIER, Jersey – (BUSINESS WIRE) – Metals Acquisition

Limited (NYSE: MTAL; ASX: MAC)

Metals Acquisition Limited ARBN 671 963 198 (NYSE: MTAL; ASX: MAC),

a private limited company incorporated under the laws of Jersey, Channel Islands (the “Company” or “MAC”),

today announced the completion of the redemption of its public warrants and private placement warrants (the “Warrants”)

to purchase ordinary shares of the Company, par value $0.0001 per share (the “Ordinary Shares”), that remained outstanding

at 5:00 p.m. New York City time on June 5, 2024 (the “Redemption Date”).

On May 6, 2024, the Company announced that it would redeem all of its

Warrants that remained outstanding on the Redemption Date for a redemption price of $0.10 per Warrant. Prior to 5:00 p.m. New York City

Time on the Redemption Date, Warrant holders could elect to: (1) exercise their Warrants for cash, at an exercise price of $11.50 per

Ordinary Share, or (2) surrender their Warrants on a “cashless basis” (a “Make Whole Exercise”) for a number

of Ordinary Shares determined in accordance with the terms of the Warrant Agreement, dated as of July 28, 2021, between Metals Acquisition

Corp and Continental Stock Transfer & Trust Company. On May 21, 2024, the Company announced that holders who exercise their Warrants

pursuant to a Make-Whole Exercise would receive 0.3063 Ordinary Shares per Warrant.

1,026 Warrants were exercised at an exercise price of $11.50 per

Ordinary Share and 15,344,751 Warrants were exercised on a “cashless basis,” resulting in the exercise of approximately 99.82%

of the outstanding Warrants (of which approximately 0.01% were exercised for cash and 99.81% were exercised on a “cashless

basis”) and in the issuance of an aggregate of 4,701,071 Ordinary Shares. The remaining 27,753 Warrants remained unexercised

on the Redemption Date and were redeemed by the Company for cash.

Accordingly, the Company will have 74,055,263 Ordinary Shares and

no public warrants or private placement warrants outstanding as a result of the redemption of the Warrants. The Company continues to

have 3,187,500 financing warrants outstanding to purchase Ordinary Shares, which were issued to Sprott Private Resource Lending II

(Collector-2), LP in connection with a mezzanine loan note facility entered into on March 10, 2023.

The table below sets out the impact of the Warrant redemption on the

share capital and cash position of the Company as well as the dilution to the holders of Ordinary Shares (including Ordinary Shares which

are represented by Chess Depository Interests (“CDIs”) on the Australian Securities Exchange (“ASX”)

as at the time of the initial announcement on May 6, 2024:

| Aggregate number of Ordinary Shares issued |

4,701,071 |

| Cash received from redemption of Warrants |

$11,799.00 |

| Dilution to existing issued Ordinary Shares (%) |

6.35% |

| Total number of Ordinary Shares on issue |

74,055,263 |

The Warrants have ceased trading on the New York Stock Exchange and

have been delisted. The redemption of the Warrants had no effect on the trading of the Ordinary Shares which continue to trade on the

New York Stock Exchange under the symbol MTAL.

Updated Substantial Shareholder Information

As a result of the Warrant redemption, the table below sets out the

information known to MAC as at the date of this announcement concerning the substantial holdings in MAC’s Ordinary Shares and CDIs.

Terms which are defined in Chapter 6C of the Australian Corporations Act 2001 (Cth) (“Corporations Act”) are

used with their defined meanings.

Name of

substantial

holder | |

Record Holder(s) (if

different) | |

Ordinary

Shares /

CDIs held

(as at date

of previous

notices) | | |

% of

total

Ordinary

Shares /

CDIs

on

issue

(as at

date of

previous

notices) | | |

Ordinary

Shares /

CDIs

held (as

at date

of this

notice) | | |

% of

total

Ordinary

Shares /

CDIs

on issue

(as at

date of

this

notice) | |

| Glencore Operations Australia Pty Limited | |

N/A | |

| 10,000,000 | 1 | |

| 14.4 | % | |

| 10,000,000 | | |

| 13.5 | % |

| Blackrock, Inc. | |

BlackRock Commodity Strategies Fund

BlackRock World Mining Trust plc

BlackRock Global Funds – World Mining Fund

BlackRock Commodity Strategies Fund – Metals and Mining Sleeve | |

| 6,332,511 | 2 | |

| 9.1 | % | |

| 6,332,511 | | |

| 8.6 | % |

| Fourth Sail | |

Fourth Sail Discovery LLC

Fourth Sail Long Short LLC

| |

| 5,954,545 | 1 | |

| 8.6 | % | |

| 6,104,694 | | |

| 8.2 | % |

| United Super Pty Ltd | |

United Super Pty Ltd ABN 46 006 261 623 as trustee for the Construction and Building Unions Superannuation Fund ABN 75 493 363 | |

| 5,337,434

| 3 | |

| 7.7 | % | |

| 4,845,138 | | |

| 6.5 | % |

| Osisko Bermuda Limited | |

N/A | |

| 4,000,000 | 1 | |

| 5.8 | % | |

| 4,000,000 | | |

| 5.4 | % |

1 As at notice dated

February 19, 2024.

2 As at notice dated

May 3, 2024.

3 As at notice dated

February 26, 2024.

As a private limited company incorporated under

the laws of Jersey, Channel Islands, Chapter 6C of the Corporations Act does not apply to shareholders of MAC. However, the Company has

agreed with the ASX to release to the market certain information about a person becoming a substantial holder in the Company within the

meaning of section 671B of the Corporations Act, varying its substantial holding by 1% or more or ceasing to be a substantial holder.

It is important to note that:

| · | MAC is not required to, and does not intend to, make enquiries of any person, including (without limitation)

its shareholders, to identify or verify details of substantial holdings; |

| · | unless a holder advises MAC of the details of any associates (or other relevant persons) that have a relevant

interest (or deemed relevant interest) in its Ordinary Shares, MAC will be unaware of these other relevant interests, if any; and |

| · | accordingly, any information that MAC provides

to the ASX is provided only to the best of the knowledge and belief of MAC and MAC expressly disclaims responsibility for the accuracy

and completeness of the information provided to the maximum extent permitted by law. |

Russell

3000® Indices Inclusion

MAC is expected to join the broad-market

Russell 3000® Index at the conclusion of the 2024 Russell US Indexes annual reconstitution, effective at the open of

US equity markets on July 1, 2024, according to a preliminary list of additions posted May 24, 2024.

The annual Russell US Indexes reconstitution captures

the 4,000 largest US stocks as of April 30, 2024, ranking them by total market capitalization. Membership in the US all-cap Russell 3000®

Index, which remains in place for one year, means automatic inclusion in the large-cap Russell 1000® Index or small-cap

Russell 2000® Index as well as the appropriate growth and value style indexes. FTSE Russell determines membership for its

Russell indexes primarily by objective, market-capitalization rankings, and style attributes.

For more information on the Russell 3000® Index and

the Russell indexes reconstitution, go to the “Russell Reconstitution” section on the FTSE Russell website.

***

-ENDS-

Contacts

Mick

McMullen

Chief Executive Officer & Director

Metals Acquisition Limited.

investors@metalsacqcorp.com |

Morne Engelbrecht

Chief Financial Officer

Metals Acquisition Limited |

About Metals Acquisition Limited

Metals Acquisition Limited (NYSE: MTAL; ASX: MAC)

is a company focused on operating and acquiring metals and mining businesses in high quality, stable jurisdictions that are critical in

the electrification and decarbonization of the global economy.

No Offer or Solicitation

This press release shall not constitute an offer

to sell or the solicitation of an offer to buy nor shall there be any offer of any of the Company’s securities in any jurisdiction

in which such offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any

such jurisdiction.

Forward Looking Statements

This press release includes “forward-looking

statements.” MAC’s actual results may differ from expectations, estimates, and projections and, consequently, you should not

rely on these forward-looking statements as predictions of future events. Words such as “expect,” “estimate,”

“project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,”

“may,” “will,” “could,” “should,” “believes,” “predicts,” “potential,”

“continue,” and similar expressions (or the negative versions of such words or expressions) are intended to identify such

forward-looking statements. These forward-looking statements involve significant risks and uncertainties that could cause the actual results

to differ materially from those discussed in the forward-looking statements. Most of these factors are outside MAC’s control and

are difficult to predict. MAC cautions readers not to place undue reliance upon any forward-looking statements, which speak only as of

the date made. MAC does not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward-looking

statements to reflect any change in its expectations or any change in events, conditions, or circumstances on which any such statement

is based.

More information on potential factors that could

affect MAC’s or CSA Mine’s financial results is included from time to time in MAC’s public reports filed with the SEC.

If any of these risks materialize or MAC’s assumptions prove incorrect, actual results could differ materially from the results

implied by these forward-looking statements. There may be additional risks that MAC does not presently know, or that MAC currently believes

are immaterial, that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking

statements reflect MAC’s expectations, plans or forecasts of future events and views as of the date of this communication. MAC anticipates

that subsequent events and developments will cause its assessments to change. However, while MAC may elect to update these forward-looking

statements at some point in the future, MAC specifically disclaims any obligation to do so, except as required by law. These forward-looking

statements should not be relied upon as representing MAC’s assessment as of any date subsequent to the date of this communication.

Accordingly, undue reliance should not be placed upon the forward-looking statements.

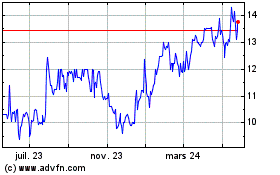

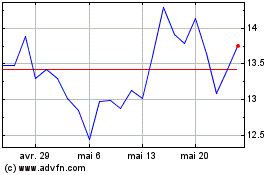

MAC Copper (NYSE:MTAL)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

MAC Copper (NYSE:MTAL)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025