Matador Resources Company (NYSE: MTDR) (“Matador”) today

announced that it has commenced a cash tender offer (the “Tender

Offer”) to purchase any and all of the approximately $699.2 million

outstanding aggregate principal amount of its 5.875% senior notes

due 2026 (the “2026 Notes”) with a portion of the net proceeds from

Matador’s concurrent private placement of $800 million in aggregate

principal amount of senior unsecured notes due 2032 (the “New

Notes”), which was also announced today by Matador. The Tender

Offer is being made pursuant to an offer to purchase and related

notice of guaranteed delivery, each dated as of March 26, 2024. The

Tender Offer will expire at 5:00 p.m., New York City time, on April

1, 2024 (as such time and date may be extended, the “expiration

time”). Tendered 2026 Notes may be withdrawn at any time before the

expiration time.

Under the terms of the Tender Offer, holders of the 2026 Notes

that are validly tendered and accepted at or prior to the

expiration time, or holders who deliver to the depository and

information agent a properly completed and duly executed notice of

guaranteed delivery and subsequently deliver such 2026 Notes, each

in accordance with the instructions described in the offer to

purchase, will receive total cash consideration of $1,000.75 per

$1,000 principal amount of 2026 Notes, plus an amount equal to any

accrued and unpaid interest up to, but not including, the

settlement date, which is expected to be April 2, 2024, subject to

satisfaction of the Financing Condition described below.

The Tender Offer is contingent upon the satisfaction of certain

conditions, including the condition that Matador shall have raised

at least $700 million in gross proceeds from the offering of the

New Notes on or prior to the settlement date (the “Financing

Condition”). The Tender Offer is not conditioned on any minimum

amount of 2026 Notes being tendered. Matador may terminate, extend

or amend the Tender Offer in its sole discretion and postpone the

acceptance for purchase of, and payment for, 2026 Notes

tendered.

To the extent any 2026 Notes remain outstanding after the

consummation of the Tender Offer, Matador intends to satisfy and

discharge any remaining 2026 Notes in accordance with the terms of

the indenture governing the 2026 Notes.

The Tender Offer is being made pursuant to the terms and

conditions contained in the offer to purchase and related notice of

guaranteed delivery, each dated March 26, 2024, copies of which may

be requested from the information agent for the tender offer,

Global Bondholder Services Corporation, at (212) 430-3774 (brokers

and banks) and (855) 654-2015 (all others; toll-free), by email at

contact@gbsc-usa.com or via the following web address:

www.gbsc-usa.com/matadorresources. BofA Securities, Inc. will act

as Dealer Manager for the Tender Offer. Questions regarding the

Tender Offer may be directed to the Dealer Manager at (980)

388-4370 (collect) and (888) 292-0070 (toll free), or by email at

debt_advisory@bofa.com.

This press release is for informational purposes only, does not

constitute a notice of redemption or satisfaction and discharge

under the indenture governing the 2026 Notes and is neither an

offer to sell nor a solicitation of an offer to buy any security,

including the New Notes, nor a solicitation for an offer to

purchase any security, including the New Notes or the 2026 Notes,

nor does it constitute an offer, solicitation or sale in any

jurisdiction in which such offer, solicitation or sale would be

unlawful.

About Matador Resources Company

Matador is an independent energy company engaged in the

exploration, development, production and acquisition of oil and

natural gas resources in the United States, with an emphasis on oil

and natural gas shale and other unconventional plays. Its current

operations are focused primarily on the oil and liquids-rich

portion of the Wolfcamp and Bone Spring plays in the Delaware Basin

in Southeast New Mexico and West Texas. Matador also operates in

the Eagle Ford shale play in South Texas and the Haynesville shale

and Cotton Valley plays in Northwest Louisiana. Additionally,

Matador conducts midstream operations in support of its

exploration, development and production operations and provides

natural gas processing, oil transportation services, oil, natural

gas and produced water gathering services and produced water

disposal services to third parties.

Forward-Looking Statements

This press release includes “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. “Forward-looking statements” are statements related to

future, not past, events. Forward-looking statements are based on

current expectations and include any statement that does not

directly relate to a current or historical fact. In this context,

forward-looking statements often address expected future business

and financial performance, and often contain words such as “could,”

“believe,” “would,” “anticipate,” “intend,” “estimate,” “expect,”

“may,” “should,” “continue,” “plan,” “predict,” “potential,”

“project,” “hypothetical,” “forecasted” and similar expressions

that are intended to identify forward-looking statements, although

not all forward-looking statements contain such identifying words.

Such forward-looking statements include, but are not limited to,

statements about guidance, projected or forecasted financial and

operating results, future liquidity, the payment of dividends,

results in certain basins, objectives, project timing, expectations

and intentions, regulatory and governmental actions and other

statements that are not historical facts. Actual results and future

events could differ materially from those anticipated in such

statements, and such forward-looking statements may not prove to be

accurate. These forward-looking statements involve certain risks

and uncertainties, including, but not limited to, risks and

uncertainties related to the capital markets generally, whether the

Company will offer the New Notes or consummate the offering, the

anticipated terms of the New Notes and the anticipated use of

proceeds, including the repurchase of the 2026 Notes, as well as

the following risks related to financial and operational

performance: general economic conditions; the Company’s ability to

execute its business plan, including whether its drilling program

is successful; changes in oil, natural gas and natural gas liquids

prices and the demand for oil, natural gas and natural gas liquids;

its ability to replace reserves and efficiently develop current

reserves; the operating results of the Company’s midstream oil,

natural gas and water gathering and transportation systems,

pipelines and facilities, the acquiring of third-party business and

the drilling of any additional salt water disposal wells; costs of

operations; delays and other difficulties related to producing oil,

natural gas and natural gas liquids; delays and other difficulties

related to regulatory and governmental approvals and restrictions;

impact on the Company’s operations due to seismic events; its

ability to make acquisitions on economically acceptable terms; its

ability to integrate acquisitions; disruption from the Company’s

acquisitions making it more difficult to maintain business and

operational relationships; significant transaction costs associated

with the Company’s acquisitions; the risk of litigation and/or

regulatory actions related to the Company’s acquisitions;

availability of sufficient capital to execute its business plan,

including from future cash flows, available borrowing capacity

under its revolving credit facilities and otherwise; the operating

results of and the availability of any potential distributions from

our joint ventures; weather and environmental conditions; and the

other factors that could cause actual results to differ materially

from those anticipated or implied in the forward-looking

statements. For further discussions of risks and uncertainties, you

should refer to Matador’s filings with the Securities and Exchange

Commission (“SEC”), including the “Risk Factors” section of

Matador’s most recent Annual Report on Form 10-K and any subsequent

Quarterly Reports on Form 10-Q. Matador undertakes no obligation to

update these forward-looking statements to reflect events or

circumstances occurring after the date of this press release,

except as required by law, including the securities laws of the

United States and the rules and regulations of the SEC. You are

cautioned not to place undue reliance on these forward-looking

statements, which speak only as of the date of this press release.

All forward-looking statements are qualified in their entirety by

this cautionary statement.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240325481309/en/

Mac Schmitz Vice President – Investor Relations

investors@matadorresources.com (972) 371-5225

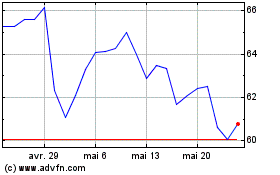

Matador Resources (NYSE:MTDR)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Matador Resources (NYSE:MTDR)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024