The Manitowoc Company, Inc. Announces Proposed Offering of $300 Million of Senior Secured Second Lien Notes due 2031

03 Septembre 2024 - 1:58PM

Business Wire

The Manitowoc Company, Inc. (NYSE: MTW) (“Manitowoc”) announced

today that it has commenced a private offering (the “Offering”) of

$300,000,000 aggregate principal amount of senior secured second

lien notes due 2031 (the “Notes”), subject to market and other

conditions, including Manitowoc entering into an amendment to its

existing asset-based revolving credit facility that will among

other things increase the commitments by $50 million to $325

million (as amended, the “Amended ABL Credit Facility”). The Notes

will be guaranteed on a senior secured second lien basis, jointly

and severally, by each of Manitowoc’s domestic subsidiaries that

will continue to guarantee the Amended ABL Credit Facility. There

can be no assurance that the Offering or the Amended ABL Credit

Facility will be completed on a timely basis, or at all.

Manitowoc intends to use the net proceeds from the Offering,

together with other cash on hand as necessary, to (i) redeem all of

its outstanding 9.00% Senior Secured Second Lien Notes due 2026

(the “Existing Notes”); and (ii) pay

related fees and expenses. Manitowoc intends to use any remaining

net proceeds for general corporate purposes.

The Notes will be offered and sold to persons reasonably

believed to be qualified institutional buyers in reliance on Rule

144A and outside the United States to certain non-U.S. persons in

reliance on Regulation S. The Notes and related guarantees have not

been, and will not be, registered under the Securities Act of 1933,

as amended (the “Securities Act”), any state securities laws or the

securities laws of any other jurisdiction and, unless so

registered, may not be offered or sold in the United States except

pursuant to an exemption from, or in a transaction not subject to,

the registration requirements of the Securities Act and applicable

state securities laws.

This press release shall not constitute an offer to sell, or a

solicitation of an offer to buy, the Notes or any other securities

and shall not constitute an offer to sell, or a solicitation of an

offer to buy, or a sale of, the Notes or any other securities in

any jurisdiction in which such offer, solicitation or sale is

unlawful. This press release is not an offer to purchase or a

solicitation of an offer to sell the Existing Notes and does not

constitute a redemption notice for the Existing Notes.

Forward-Looking Statements

This press release includes “forward-looking statements”

intended to qualify for the safe harbor from liability under the

Private Securities Litigation Reform Act of 1995. Any statements

contained in this press release that are not historical facts are

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. These statements, which

include, but are not limited to, statements regarding the Offering

and the timing of the closing of the Offering and the anticipated

use of proceeds therefrom, are based on the current expectations of

the management of Manitowoc and are subject to uncertainty and

changes in circumstances. Forward-looking statements include,

without limitation, statements typically containing words such as

“intends,” “expects,” “anticipates,” “targets,” “estimates,” and

words of similar import. By their nature, forward-looking

statements are not guarantees of future performance or results and

involve risks and uncertainties because they relate to events and

depend on circumstances that will occur in the future. There are a

number of factors that could cause actual results and developments

to differ materially from those expressed or implied by such

forward-looking statements. Factors that could cause actual results

and developments to differ materially include, among others:

- Macroeconomic conditions, including inflation, high interest

rates and recessionary concerns, as well as continuing global

supply chain constraints, labor constraints, logistics constraints

and cost pressures such as changes in raw material and commodity

costs, have had, and may continue to have, a negative impact on

Manitowoc’s ability to convert backlog into revenue which could,

and has, impacted its financial condition, cash flows, and results

of operations (including future uncertain impacts);

- actions of competitors;

- changes in economic or industry conditions generally or in the

markets served by Manitowoc;

- geopolitical events, including the ongoing conflicts in Ukraine

and in the Middle East, other political and economic conditions and

risks and other geographic factors, has had and may continue to

lead to market disruptions, including volatility in commodity

prices (including oil and gas), raw material and component costs,

energy prices, inflation, consumer behavior, supply chain, and

credit and capital markets, and could result in the impairment of

assets;

- changes in customer demand, including changes in global demand

for high-capacity lifting equipment, changes in demand for lifting

equipment in emerging economies and changes in demand for used

lifting equipment including changes in government approval and

funding of projects;

- the ability to convert backlog, orders and order activity into

sales and the timing of those sales;

- failure to comply with regulatory requirements related to the

products and aftermarket services Manitowoc sells;

- the ability to capitalize on key strategic opportunities and

the ability to implement Manitowoc’s long-term initiatives;

- impairment of goodwill and/or intangible assets;

- changes in revenues, margins and costs;

- the ability to increase operational efficiencies across

Manitowoc and to capitalize on those efficiencies;

- the ability to generate cash and manage working capital

consistent with Manitowoc’s stated goals;

- work stoppages, labor negotiations, labor rates and labor

costs;

- Manitowoc’s ability to attract and retain qualified

personnel;

- changes in the capital and financial markets;

- the ability to complete and appropriately integrate

acquisitions, strategic alliances, joint ventures or other

significant transactions;

- issues associated with the availability and viability of

suppliers;

- the ability to significantly improve profitability;

- realization of anticipated earnings enhancements, cost savings,

strategic options and other synergies, and the anticipated timing

to realize those savings, synergies and options;

- the ability to focus on customers, new technologies and

innovation;

- uncertainties associated with new product introductions, the

successful development and market acceptance of new and innovative

products that drive growth;

- the replacement cycle of technologically obsolete

products;

- risks associated with high debt leverage;

- foreign currency fluctuation and its impact on reported

results;

- the ability of Manitowoc's customers to receive financing;

- risks associated with data security and technological systems

and protections;

- the ability to direct resources to those areas that will

deliver the highest returns;

- risks associated with manufacturing or design defects;

- natural disasters, other weather events, pandemics and other

public health crises disrupting commerce in one or more regions of

the world;

- issues relating to the ability to timely and effectively

execute on manufacturing strategies, general efficiencies and

capacity utilization of Manitowoc’s facilities;

- the ability to focus and capitalize on product and service

quality and reliability;

- issues associated with the quality of materials, components and

products sourced from third parties and the ability to successfully

resolve those issues;

- issues related to workforce reductions and potential subsequent

rehiring;

- changes in laws throughout the world, including governmental

regulations on climate change;

- the inability to defend against potential infringement claims

on intellectual property rights;

- the ability to sell products and services through distributors

and other third parties;

- issues affecting the effective tax rate for the year;

- acts of terrorism; and

- other risks and factors detailed in Manitowoc's 2023 Annual

Report on Form 10-K and its other filings with the United States

Securities and Exchange Commission (the “SEC”).

Manitowoc undertakes no obligation to update or revise

forward-looking statements, whether as a result of new information,

future events or otherwise. Forward-looking statements only speak

as of the date on which they are made. Information on the potential

factors that could affect Manitowoc’s actual results of operations

is included in its filings with the SEC, including but not limited

to its Annual Report on Form 10-K for the fiscal year ended

December 31, 2023.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240903564772/en/

Ion Warner SVP, Marketing and Investor Relations +1

414-760-4805

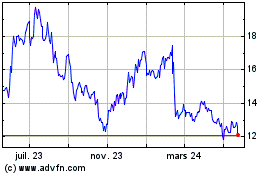

Manitowoc (NYSE:MTW)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

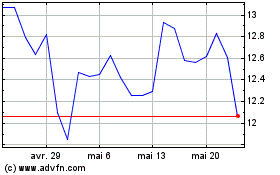

Manitowoc (NYSE:MTW)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024