Murphy USA Inc. (NYSE: MUSA), a leading marketer of retail motor

fuel products and convenience merchandise, today announced

financial results for the three months and twelve months ended

December 31, 2023.

Key Highlights:

- Net income was $150.0 million, or $7.00 per diluted share, in

Q4 2023 compared to net income of $117.7 million, or $5.21 per

diluted share, in Q4 2022. For the full year 2023, net income was

$556.8 million, or $25.49 per diluted share, compared to 2022 net

income of $672.9 million, or $28.10 per diluted share.

- Total fuel contribution for Q4 2023 was 32.5 cpg, compared to

30.6 cpg in Q4 2022. For the year 2023, total fuel contribution was

31.4 cpg, compared to 34.3 cpg in 2022.

- Total retail gallons were 1.2 billion in both Q4 2023 and Q4

2022, while volumes on a same store sales ("SSS") basis declined

2.0% in Q4 2023 compared to Q4 2022. Total retail gallons were 4.8

billion gallons for both full year 2023 and 2022, and volumes on a

SSS basis for the full year 2023 decreased 1.8% compared to the

prior-year period.

- Merchandise contribution dollars for Q4 2023 increased 4.6% to

$197.7 million on average unit margins of 19.4%, compared to Q4

2022 contribution dollars of $189.0 million on unit margins of

19.1%. For the full year 2023, merchandise contribution dollars

increased 4.7% to $803.4 million and average unit margins were

19.7% in both 2023 and 2022.

- During Q4 2023, the Company repurchased approximately 442.2

thousand common shares for $162.0 million at an average price of

$366.42 per share. For the year 2023, the Company repurchased

slightly more than 1.0 million shares for a total of $336.2 million

at an average of $327.55 per share.

“2023 financial results and operational performance are a

testament to the strong foundations we have built at Murphy USA

over the last decade, successfully executing against our strategy,

and widening our advantage in the marketplace” said President and

CEO Andrew Clyde. “Structural resilience in fuel margins coupled

with high volumes generated over $1.5B in fuel contribution in

2023. This performance in a less volatile environment increases our

confidence in the longevity of elevated fuel margins that

complements and helps strengthen our everyday low-price model,

helping us to deliver more value to our customers. Our strategic

focus remains firmly rooted in new store growth and continuous

improvement efforts to generate higher returns from our network of

existing and new stores, meaning we are investing in people,

technology, and innovation to drive in-store performance. We

executed a balanced capital program in 2023, investing in new store

growth and repurchasing over 1 million shares, while maintaining a

strong and agile balance sheet. We are bringing a lot of momentum

with us into 2024, leveraging the highest fourth quarter net income

and Adjusted EBITDA in company history, and providing us with

further opportunities to drive shareholder value creation for

long-term investors.”

Consolidated Results

Three Months Ended

December 31,

Twelve Months Ended

December 31,

Key Operating Metrics

2023

2022

2023

2022

Net income (loss) ($ Millions)

$

150.0

$

117.7

$

556.8

$

672.9

Earnings per share (diluted)

$

7.00

$

5.21

$

25.49

$

28.10

Adjusted EBITDA ($ Millions)

$

275.2

$

230.3

$

1,058.5

$

1,190.9

Net income and Adjusted EBITDA for Q4 2023 were higher versus

the prior-year quarter, due primarily to higher total fuel

contribution, higher overall merchandise contribution, and lower

general and administrative expenses, which were partially offset by

increases in store operating expenses. Net income and Adjusted

EBITDA for the year 2023 were lower than the prior-year period, due

primarily to lower total fuel contribution, increases in store

operating expenses and general and administrative expenses, which

were partially offset by higher overall merchandise contribution

and lower payment fees.

Fuel

Three Months Ended

December 31,

Twelve Months Ended

December 31,

Key Operating Metrics

2023

2022

2023

2022

Total retail fuel contribution ($

Millions)

$

376.0

$

341.2

$

1,324.0

$

1,405.0

Total PS&W contribution ($

Millions)

(30.4

)

(34.1

)

(144.9

)

(80.8

)

RINs (included in Other operating revenues

on Consolidated Income Statement) ($ Millions)

47.4

62.2

328.6

305.8

Total fuel contribution ($ Millions)

$

393.0

$

369.3

$

1,507.7

$

1,630.0

Retail fuel volume - chain (Million

gal)

1,208.4

1,206.3

4,803.7

4,751.5

Retail fuel volume - per store (K gal

APSM)1

242.8

246.2

242.0

244.6

Retail fuel volume - per store (K gal

SSS)2

237.9

241.6

237.8

240.9

Total fuel contribution (cpg)

32.5

30.6

31.4

34.3

Retail fuel margin (cpg)

31.1

28.3

27.6

29.6

PS&W including RINs contribution

(cpg)

1.4

2.3

3.8

4.7

1Average Per Store Month ("APSM") metric

includes all stores open through the date of calculation

22022 amounts not revised for 2023

raze-and-rebuild activity

Total fuel contribution dollars of $393.0 million increased

$23.7 million, or 6.4%, in Q4 2023 compared to Q4 2022 due to

higher margins and increased retail volumes sold during the

quarter. Retail fuel contribution dollars increased $34.8 million,

or 10.2%, to $376.0 million compared to Q4 2022 due to higher

retail fuel margins and volumes. The increase was driven by 31.1

cpg retail fuel margins in Q4 2023, a 9.9% increase when compared

to Q4 2022, supported primarily by a declining commodity price

environment. Retail volumes were 0.2% higher compared to the

prior-year quarter. PS&W margins declined $11.1 million versus

Q4 2022, primarily due to lower unbranded margins.

For the full year 2023, total fuel contribution dollars

decreased $122.3 million, or 7.5%, due to lower retail fuel and

PS&W margins, partially offset by higher retail volumes. Retail

fuel contribution dollars decreased $81.0 million, or 5.8%, for the

year 2023, due to lower retail fuel margins partially offset by

higher volumes sold. For the full year 2023, retail fuel margins

were 27.6 cpg, a 6.8% decrease versus the prior-year period, and

overall retail volumes were 1.1% higher for the year 2023 compared

to the prior-year period. PS&W margins decreased by $41.3

million for the full year, primarily due to timing and

price-related impacts combined with lower unbranded margins.

Merchandise

Three Months Ended

December 31,

Twelve Months Ended

December 31,

Key Operating Metrics

2023

2022

2023

2022

Total merchandise contribution ($

Millions)

$

197.7

$

189.0

$

803.4

$

767.1

Total merchandise sales ($ Millions)

$

1,018.5

$

989.4

$

4,089.3

$

3,903.2

Total merchandise sales ($K SSS)1,2

$

198.8

$

195.1

$

199.8

$

193.0

Merchandise unit margin (%)

19.4

%

19.1

%

19.7

%

19.7

%

Tobacco contribution ($K SSS)1,2

$

18.8

$

17.7

$

18.4

$

17.7

Non-tobacco contribution ($K SSS)1,2

$

20.4

$

20.1

$

21.3

$

20.2

Total merchandise contribution ($K

SSS)1,2

$

39.2

$

37.8

$

39.7

$

37.9

12022 amounts not revised for 2023

raze-and-rebuild activity

2Includes store-level discounts for Murphy

Drive Reward ("MDR") redemptions and excludes change in value of

unredeemed MDR points

Total merchandise contribution increased $8.7 million, or 4.6%,

to $197.7 million in Q4 2023 compared to the prior-year quarter and

increased $36.3 million to $803.4 million for the full year 2023,

due primarily to higher merchandise sales. Total tobacco

contribution dollars in Q4 2023 increased 7.5% and non-tobacco

contribution dollars increased 3.2% compared to Q4 2022. For the

full year 2023, tobacco contribution dollars increased 4.6% and

non-tobacco contribution dollars increased 5.7% compared to prior

year.

Other Areas

Three Months Ended

December 31,

Twelve Months Ended

December 31,

Key Operating Metrics

2023

2022

2023

2022

Total store and other operating

expenses

($ Millions)

$

254.2

$

247.1

$

1,014.8

$

976.5

Store OPEX excluding payment fees and rent

($K APSM)

$

33.5

$

32.1

$

33.2

$

31.7

Total SG&A cost ($ Millions)

$

62.1

$

81.7

$

240.5

$

232.5

Total store and other operating expenses were $7.1 million

higher in Q4 2023 versus Q4 2022 and were $38.3 million higher for

the year 2023 versus 2022, mainly due to employee related expenses,

store maintenance costs, and inventory shrink costs, in each case

partially offset by lower payment fees. Store OPEX excluding

payment fees and rent on an APSM basis were 4.4% higher versus Q4

2022 and 4.7% higher for the year 2023, primarily attributable to

increased employee related expenses, maintenance, and inventory

shrink costs.

Total SG&A costs for Q4 2023 were $19.6 million lower than

Q4 2022, primarily due to a charitable pledge of $25.0 million in

Q4 2022, offset in part by higher employee and incentive costs and

professional and technology fees in support of business improvement

initiatives incurred in Q4 2023. For the year 2023, SG&A costs

were $8.0 million higher compared to the prior year, due to higher

employee and incentive costs and professional and technology fees

in support of business improvement initiatives, partially offset by

lower charitable donations in 2023.

Store Openings

The tables below reflect changes in our store portfolio in Q4

2023:

Net Change in Q4 2023

Murphy USA /

Express

QuickChek

Total

New-to-industry ("NTI")

9

1

10

Closed

—

(1

)

(1

)

Net change

9

—

9

Raze-and-rebuilds reopened in Q4*

17

—

17

Under Construction at End of Q4

NTI

5

1

6

Raze-and-rebuilds*

2

—

2

Total under construction at end of Q4

7

1

8

Net Change YTD in 2023

NTI

22

6

28

Closed

—

(7

)

(7

)

Net change

22

(1

)

21

Raze-and-rebuilds reopened YTD*

31

—

31

Store count at December 31, 2023*

1,577

156

1,733

*Store counts include raze-and-rebuild

stores

Financial Resources

As of December 31,

Key Financial Metrics

2023

2022

Cash and cash equivalents ($ Millions)

$

117.8

$

60.5

Marketable securities, current ($

Millions)

$

7.1

$

17.9

Marketable securities, non-current ($

Millions)

$

4.4

$

4.4

Long-term debt, including finance lease

obligations ($ Millions)

$

1,784.7

$

1,791.9

Cash balances as of December 31, 2023 totaled $117.8 million,

and the Company also had total marketable securities of $11.5

million. Long-term debt consisted of approximately $298.4 million

in carrying value of 5.625% senior notes due in 2027, $495.7

million in carrying value of 4.75% senior notes due in 2029, $494.6

million in carrying value of 3.75% senior notes due in 2031, and

$380.3 million of term debt, combined with approximately $115.7

million in long-term finance leases. The $350 million revolving

cash flow facility was undrawn as of December 31, 2023.

Three Months Ended

December 31,

Twelve Months Ended

December 31,

Key Financial Metric

2023

2022

2023

2022

Average shares outstanding (diluted) (in

thousands)

21,425

22,603

21,843

23,950

At December 31, 2023, the Company had common shares outstanding

of 20,837,328. Common shares repurchased during the quarter were

approximately 442.2 thousand shares for $162.0 million, which were

purchased under the 2021 share repurchase plan (now completed) and

the 2023 share repurchase plan. Common shares purchased during the

twelve months ended December 31, 2023, were slightly more than 1.0

million shares for a total of $336.2 million. As of December 31,

2023, approximately $1.4 billion remained available under the $1.5

billion 2023 plan.

The effective income tax rate for Q4 2023 was 23.6% compared to

22.3% in Q4 2022. For the year 2023, the effective income tax rate

was 24.2% compared to 23.9% in 2022.

The Company paid a quarterly cash dividend on December 1, 2023

of $0.41 per share, or $1.64 per share on an annualized basis, a

5.1% increase from the previous quarter for a total cash payment of

$8.7 million. Total cash dividends paid in 2023 were $33.4 million,

or $1.55 per share, compared to $29.9 million in 2022, an increase

of 11.7%.

2023 Guidance Range, 2023 Actual Results, and 2024 Guidance

Range

2023 Updated Guidance

Range

2023 Actual

Results

2024 Guidance

Range

Organic Growth

New Stores

27 - 30

28

30 to 35

Raze-and-Rebuilds

33

31

35 to 40

Fuel Contribution

Retail fuel volume per store (K gallons

APSM)

240 to 245

242

240 to 245

Store Profitability

Merchandise contribution ($ Millions)

$795 to $815

$803

$860 to $880

Retail store OPEX excluding credit card

fees and rent expense ($K, APSM)

$32.5 to $34.0

$33.2

$35.0 to $35.5

Corporate Costs

SG&A ($ Millions per year)

$235 to $245

$241

$255 to $265

Effective Tax Rate

24% to 26%

24.2%

24% to 26%

Capital Allocation

Capital expenditures ($ Millions)

$325 to $375

$344

$400 to $450

Management's annual guidance for 2024 reflects the Company's

economic and market environment assessment, business improvement

initiatives and known potential headwinds. Key 2024 guidance ranges

include the following assumptions and are subject to the

uncertainties noted below:

Organic Growth:

- New store additions and investments in raze-and-rebuild sites

reflect our expectation of being able to sustain a higher level of

growth into 2024 and beyond, utilizing our disciplined capital

approach and prioritizing the highest return projects across

competing opportunity sets

Fuel Contribution:

- The company's low-price offering continues to resonate with our

customers, retaining prior year market share gains in 2023 which we

expect to persist in 2024, resulting in flat to slightly higher per

store volumes

Store Profitability:

- Material growth in merchandise contribution is based on

expected impact from new stores, raze and rebuilds, and ongoing

promotional and center-of-store focused initiatives, particularly

in the food and beverage categories

- Growth in store operating expenses per site, before credit card

fees and rent, will likely be modestly higher in 2024 as we build

larger new stores, raze and rebuild existing stores, and invest in

people and technology, which will in turn drive a higher rate of

growth in merchandise contribution

Corporate Costs:

- SG&A costs reflect continued investments in productivity

initiatives that will improve the company's ability to better serve

customers through a wider variety of digital assets and creating a

more engaging customer experience over the long-term

- The effective tax rate in 2024 is expected to be in a range of

24% to 26% and is consistent with historical performance

Capital Allocation:

- Capital expenditures primarily reflect a higher expected level

of new store growth, raze-and-rebuild activity, store remodels, as

well as corporate infrastructure projects and continued investment

in digital technologies

The Company does not provide a projected range of all-in fuel

margin, Adjusted EBITDA, or Net Income. However, for modeling

purposes only, using all-in fuel margins of between 30.0 cpg and

34.0 cpg, combined with the mid-point of the official guided ranges

above, management would expect the business to generate net income

between $496 million and $631 million, respectively, which would

translate to expected Adjusted EBITDA between $1 billion and $1.2

billion. A reconciliation of the Adjusted EBITDA to Net Income is

provided as the final page of this release.

* * * * *

Earnings Call Information

The Company will host a conference call on February 8, 2024 at

10:00 a.m. Central Time to discuss fourth quarter 2023 results. The

conference call number is 1 (888) 330-2384 and the conference

number is 6680883. The earnings and investor related materials,

including reconciliations of any non-GAAP financial measures to

GAAP financial measures and any other applicable disclosures, will

be available on that same day on the investor section of the Murphy

USA website (http://ir.corporate.murphyusa.com). Approximately one

hour after the conclusion of the conference, the webcast will be

available for replay. Shortly thereafter, a transcript will be

available.

Source: Murphy USA Inc. (NYSE: MUSA)

Forward-Looking Statements

Certain statements in this news release contain or may suggest

“forward-looking” information (as defined in the Private Securities

Litigation Reform Act of 1995) that involve risk and uncertainties,

including, but not limited to our outlook for 2024, M&A

activity, anticipated store openings, fuel margins, merchandise

margins, sales of RINs, trends in our operations, dividends, and

share repurchases. Such statements are based upon the current

beliefs and expectations of the Company’s management and are

subject to significant risks and uncertainties. Actual future

results may differ materially from historical results or current

expectations depending upon factors including, but not limited to:

The Company's ability to successfully expand our food and beverage

offerings; our ability to continue to maintain a good business

relationship with Walmart; successful execution of our growth

strategy, including our ability to realize the anticipated benefits

from such growth initiatives, and the timely completion of

construction associated with our newly planned stores which may be

impacted by the financial health of third parties; our ability to

effectively manage our inventory, disruptions in our supply chain

and our ability to control costs; geopolitical events that impact

the supply and demand and price of crude oil; the impact of severe

weather events, such as hurricanes, floods and earthquakes; the

impact of a global health pandemic, the impact of any systems

failures, cybersecurity and/or security breaches of the company or

its vendor partners, including any security breach that results in

theft, transfer or unauthorized disclosure of customer, employee or

company information or our compliance with information security and

privacy laws and regulations in the event of such an incident;

successful execution of our information technology strategy;

reduced demand for our products due to the implementation of more

stringent fuel economy and greenhouse gas reduction requirements,

or increasingly widespread adoption of electric vehicle technology;

future tobacco or e-cigarette legislation and any other efforts

that make purchasing tobacco products more costly or difficult

could hurt our revenues and impact gross margins; changes to the

Company's capital allocation, including the timing, declaration,

amount and payment of any future dividends or levels of the

Company's share repurchases, or management of operating cash; the

market price of the Company's stock prevailing from time to time,

the nature of other investment opportunities presented to the

Company from time to time, the Company's cash flows from

operations, and general economic conditions; compliance with debt

covenants; availability and cost of credit; and changes in interest

rates. Our SEC reports, including our most recent annual Report on

Form 10-K and quarterly report on Form 10-Q, contain other

information on these and other factors that could affect our

financial results and cause actual results to differ materially

from any forward-looking information we may provide. The Company

undertakes no obligation to update or revise any forward-looking

statements to reflect subsequent events, new information or future

circumstances.

Murphy USA Inc.

Consolidated Statements of

Income

(Unaudited)

Three Months Ended

December 31,

Twelve Months Ended

December 31,

(Millions of dollars, except share and per

share amounts)

2023

2022

2023

2022

Operating Revenues

Petroleum product sales1

$

4,000.8

$

4,312.8

$

17,104.4

$

19,230.1

Merchandise sales

1,018.5

989.4

4,089.3

3,903.2

Other operating revenues

49.6

64.1

335.7

312.8

Total operating revenues

5,068.9

5,366.3

21,529.4

23,446.1

Operating Expenses

Petroleum product cost of goods sold1

3,656.6

4,006.8

15,929.7

17,910.1

Merchandise cost of goods sold

820.8

800.4

3,285.9

3,136.1

Store and other operating expenses

254.2

247.1

1,014.8

976.5

Depreciation and amortization

57.0

55.9

228.7

220.4

Selling, general and administrative

62.1

81.7

240.5

232.5

Accretion of asset retirement

obligations

0.8

0.7

3.0

2.7

Acquisition and integration related

costs

—

0.1

—

1.5

Total operating expenses

4,851.5

5,192.7

20,702.6

22,479.8

Gain (loss) on sale of assets

(0.2

)

(0.1

)

(0.8

)

2.1

Income (loss) from operations

217.2

173.5

826.0

968.4

Other income (expense)

Investment income

2.2

1.2

6.9

3.0

Interest expense

(24.0

)

(23.7

)

(98.5

)

(85.3

)

Other nonoperating income (expense)

0.9

0.4

—

(2.3

)

Total other income (expense)

(20.9

)

(22.1

)

(91.6

)

(84.6

)

Income before income taxes

196.3

151.4

734.4

883.8

Income tax expense (benefit)

46.3

33.7

177.6

210.9

Net Income

$

150.0

$

117.7

$

556.8

$

672.9

Basic and Diluted Earnings Per Common

Share

Basic

$

7.12

$

5.31

$

25.91

$

28.63

Diluted

$

7.00

$

5.21

$

25.49

$

28.10

Weighted-average Common shares outstanding

(in thousands):

Basic

21,072

22,148

21,493

23,506

Diluted

21,425

22,603

21,843

23,950

Supplemental information:

1Includes excise taxes of:

$

570.1

$

541.8

$

2,291.2

$

2,180.2

Murphy USA Inc.

Segment Operating

Results

(Unaudited)

(Millions of dollars, except revenue per

same store sales (in thousands) and store counts)

Three Months Ended

December 31,

Twelve Months Ended

December 31,

Marketing Segment

2023

2022

2023

2022

Operating Revenues

Petroleum product sales

$

4,000.8

$

4,312.8

$

17,104.4

$

19,230.1

Merchandise sales

1,018.5

989.4

4,089.3

3,903.2

Other operating revenues

49.3

63.8

335.2

312.1

Total operating revenues

5,068.6

5,366.0

21,528.9

23,445.4

Operating expenses

Petroleum products cost of goods sold

3,656.6

4,006.8

15,929.7

17,910.1

Merchandise cost of goods sold

820.8

800.4

3,285.9

3,136.1

Store and other operating expenses

254.1

247.1

1,014.6

976.5

Depreciation and amortization

53.0

51.9

211.9

204.8

Selling, general and administrative

62.1

81.7

240.5

232.5

Accretion of asset retirement

obligations

0.8

0.7

3.0

2.7

Total operating expenses

4,847.4

5,188.6

20,685.6

22,462.7

Gain (loss) on sale of assets

(0.2

)

(0.1

)

(0.7

)

(0.7

)

Income (loss) from operations

221.0

177.3

842.6

982.0

Other income (expense)

Interest expense

(2.2

)

(2.3

)

(8.9

)

(9.0

)

Other nonoperating income (expense)

0.1

—

0.2

—

Total other income (expense)

(2.1

)

(2.3

)

(8.7

)

(9.0

)

Income (loss) before income taxes

218.9

175.0

833.9

973.0

Income tax expense (benefit)

52.8

39.1

203.0

232.1

Net income (loss) from operations

$

166.1

$

135.9

$

630.9

$

740.9

Total tobacco sales revenue same store

sales1,2

$

128.8

$

124.7

$

127.2

$

123.3

Total non-tobacco sales revenue same store

sales1,2

70.0

70.4

72.6

69.7

Total merchandise sales revenue same store

sales1,2

$

198.8

$

195.1

$

199.8

$

193.0

12022 amounts not revised for 2023

raze-and-rebuild activity

2Includes store-level discounts for Murphy

Drive Reward ("MDR") redemptions and excludes change in value of

unredeemed MDR points

Store count at end of period

1,733

1,712

1,733

1,712

Total store months during the period

5,134

5,079

20,535

20,172

Same store sales information compared to APSM metrics

Variance from prior year

period

Three months ended

Twelve months ended

December 31, 2023

December 31, 2023

SSS1

APSM2

SSS1

APSM2

Retail fuel volume per month

(2.0

)%

(1.4

)%

(1.8

%)

(1.0

%)

Merchandise sales

1.4

%

1.8

%

2.7

%

2.9

%

Tobacco sales

3.2

%

3.0

%

3.5

%

2.9

%

Non tobacco sales

(1.7

)%

0.1

%

1.4

%

3.1

%

Merchandise margin

3.2

%

3.4

%

3.0

%

2.9

%

Tobacco margin

7.1

%

6.3

%

4.3

%

2.7

%

Non tobacco margin

(0.2

)%

2.1

%

1.9

%

3.8

%

1Includes store-level discounts for MDR

redemptions and excludes change in value of unredeemed MDR

points

2Includes all MDR activity

Notes

Average Per Store Month (APSM) metric includes all stores open

through the date of the calculation, including stores acquired

during the period.

Same store sales (SSS) metric includes aggregated individual

store results for all stores open throughout both periods

presented. For all periods presented, the store must have been open

for the entire calendar year to be included in the comparison.

Remodeled stores that remained open or were closed for just a very

brief time (less than a month) during the period being compared

remain in the same store sales calculation. If a store is replaced

either at the same location (raze-and-rebuild) or relocated to a

new location, it will be excluded from the calculation during the

period it is out of service. Newly constructed stores do not enter

the calculation until they are open for each full calendar year for

the periods being compared (open by January 1, 2022 for the stores

being compared in the 2023 versus 2022 comparison). Acquired stores

are not included in the calculation of same store sales for the

first 12 months after the acquisition. When prior period same store

sales volumes or sales are presented, they have not been revised

for current year activity for raze-and-rebuilds and asset

dispositions.

QuickChek uses a weekly retail calendar where each quarter has

13 weeks. The QuickChek results for Q4 2023 covers the period

September 30, 2023 to December 29, 2023 and for the full year 2023

covers the period December 31, 2022 to December 29, 2023. The

QuickChek results for Q4 2022 covers the period October 1, 2022 to

December 30, 2022 and for the full year 2022 covers the period

January 1, 2022 to December 30, 2022. The difference in the timing

of the period ends is immaterial to the overall consolidated

results.

Murphy USA Inc.

Consolidated Balance

Sheets

(Millions of dollars, except share

amounts)

December 31,

2023

December 31, 2022

(unaudited)

Assets

Current assets

Cash and cash equivalents

$

117.8

$

60.5

Marketable securities, current

7.1

17.9

Accounts receivable—trade, less allowance

for doubtful accounts of $1.3 and $0.3 at 2023 and 2022,

respectively

336.7

281.7

Inventories, at lower of cost or

market

341.2

319.1

Prepaid expenses and other current

assets

23.7

47.6

Total current assets

826.5

726.8

Marketable securities, non-current

4.4

4.4

Property, plant and equipment, at cost

less accumulated depreciation and amortization of $1,739.2 and

$1,553.1 at 2023 and 2022, respectively

2,571.8

2,459.3

Operating lease right of use assets,

net

452.1

449.6

Intangible assets, net of amortization

139.8

140.4

Goodwill

328.0

328.0

Other assets

17.5

14.7

Total assets

$

4,340.1

$

4,123.2

Liabilities and Stockholders'

Equity

Current liabilities

Current maturities of long-term debt

$

15.0

$

15.0

Trade accounts payable and accrued

liabilities

834.7

839.2

Income taxes payable

23.1

—

Total current liabilities

872.8

854.2

Long-term debt, including capitalized

lease obligations

1,784.7

1,791.9

Deferred income taxes

329.5

327.4

Asset retirement obligations

46.1

43.3

Non-current operating lease

liabilities

450.3

444.2

Deferred credits and other liabilities

27.8

21.5

Total liabilities

3,511.2

3,482.5

Stockholders' Equity

Preferred Stock, par $0.01 (authorized

20,000,000 shares, none outstanding)

—

—

Common Stock, par $0.01 (authorized

200,000,000 shares, 46,767,164 shares issued at 2023 and 2022,

respectively)

0.5

0.5

Treasury stock (25,929,836 and 25,017,324

shares held at

2023 and 2022, respectively)

(2,957.8

)

(2,633.3

)

Additional paid in capital (APIC)

508.1

518.9

Retained earnings

3,278.1

2,755.1

Accumulated other comprehensive income

(loss) (AOCI)

—

(0.5

)

Total stockholders' equity

828.9

640.7

Total liabilities and stockholders'

equity

$

4,340.1

$

4,123.2

Murphy USA Inc.

Consolidated Statements of

Cash Flows

(Unaudited)

Three Months Ended

December 31,

Twelve Months Ended

December 31,

(Millions of dollars)

2023

2022

2023

2022

Operating Activities

Net income

$

150.0

$

117.7

$

556.8

$

672.9

Adjustments to reconcile net income (loss)

to net cash provided by operating activities

Depreciation and amortization

57.0

55.9

228.7

220.4

Deferred and noncurrent income tax charges

(benefits)

1.9

16.5

2.0

31.5

Accretion of asset retirement

obligations

0.8

0.7

3.0

2.7

Amortization of discount on marketable

securities

(0.4

)

(0.1

)

(0.4

)

(0.1

)

(Gains) losses from sale of assets

0.2

0.1

0.8

(2.1

)

Net (increase) decrease in noncash

operating working capital

55.1

26.0

(42.1

)

44.8

Other operating activities - net

8.5

6.4

35.2

24.6

Net cash provided (required) by operating

activities

273.1

223.2

784.0

994.7

Investing Activities

Property additions

(111.0

)

(82.2

)

(335.6

)

(305.3

)

Proceeds from sale of assets

0.1

0.3

2.4

8.8

Investment in marketable securities

(1.5

)

(22.2

)

(12.8

)

(22.2

)

Redemptions of marketable securities

6.0

—

24.0

—

Other investing activities - net

(0.2

)

—

(1.6

)

(0.6

)

Net cash provided (required) by investing

activities

(106.6

)

(104.1

)

(323.6

)

(319.3

)

Financing Activities

Purchase of treasury stock

(160.5

)

(239.5

)

(333.2

)

(806.4

)

Dividends paid

(8.7

)

(7.8

)

(33.4

)

(29.9

)

Borrowings of debt

—

5.0

8.0

5.0

Repayments of debt

(3.8

)

(8.8

)

(23.4

)

(20.2

)

Amounts related to share-based

compensation

(0.5

)

(0.2

)

(21.1

)

(19.8

)

Net cash provided (required) by financing

activities

(173.5

)

(251.3

)

(403.1

)

(871.3

)

Net increase (decrease) in cash, cash

equivalents and restricted cash

(7.0

)

(132.2

)

57.3

(195.9

)

Cash, cash equivalents and restricted cash

at beginning of period

124.8

192.7

60.5

256.4

Cash, cash equivalents and restricted cash

at end of period

$

117.8

$

60.5

$

117.8

$

60.5

Supplemental Disclosure Regarding Non-GAAP Financial

Information

The following table reconciles EBITDA and Adjusted EBITDA to Net

Income for the three months and twelve months ended months ended

December 31, 2023 and 2022. EBITDA means net income (loss) plus net

interest expense, plus income tax expense, depreciation and

amortization, and Adjusted EBITDA adds back (i) other non-cash

items (e.g., impairment of properties and accretion of asset

retirement obligations) and (ii) other items that management does

not consider to be meaningful in assessing our operating

performance (e.g., (income) from discontinued operations, net

settlement proceeds, (gain) loss on sale of assets, loss on early

debt extinguishment, transaction and integration costs related to

acquisitions, and other non-operating (income) expense). EBITDA and

Adjusted EBITDA are not measures that are prepared in accordance

with U.S. generally accepted accounting principles (GAAP).

We use Adjusted EBITDA in our operational and financial

decision-making, believing that the measure is useful to eliminate

certain items in order to focus on what we deem to be a more

reliable indicator of ongoing operating performance and our ability

to generate cash flow from operations. Adjusted EBITDA is also used

by many of our investors, research analysts, investment bankers,

and lenders to assess our operating performance. We believe that

the presentation of Adjusted EBITDA provides useful information to

investors because it allows understanding of a key measure that we

evaluate internally when making operating and strategic decisions,

preparing our annual plan, and evaluating our overall performance.

However, non-GAAP measures are not a substitute for GAAP

disclosures, and EBITDA and Adjusted EBITDA may be prepared

differently by us than by other companies using similarly titled

non-GAAP measures.

The reconciliation of net income (loss) to EBITDA and Adjusted

EBITDA is as follows:

Three Months Ended

December 31,

Twelve Months Ended

December 31,

(Millions of dollars)

2023

2022

2023

2022

Net income

$

150.0

$

117.7

$

556.8

$

672.9

Income tax expense (benefit)

46.3

33.7

177.6

210.9

Interest expense, net of investment

income

21.8

22.5

91.6

82.3

Depreciation and amortization

57.0

55.9

228.7

220.4

EBITDA

$

275.1

$

229.8

$

1,054.7

$

1,186.5

Accretion of asset retirement

obligations

0.8

0.7

3.0

2.7

(Gain) loss on sale of assets

0.2

0.1

0.8

(2.1

)

Acquisition and integration related

costs

—

0.1

—

1.5

Other nonoperating (income) expense

(0.9

)

(0.4

)

—

2.3

Adjusted EBITDA

$

275.2

$

230.3

$

1,058.5

$

1,190.9

Required Non-GAAP Reconciliation

An itemized reconciliation of Adjusted EBITDA to Net Income for

the full year 2024, which is provided for modeling purposes only,

is as follows:

Calendar Year 2024

(Millions of dollars)

Low

High

Net Income

$

496

$

631

Income taxes

$

157

$

222

Interest expense, net of interest

income

$

97

$

97

Depreciation and amortization

$

249

$

249

Other operating and nonoperating, net

$

1

$

1

Adjusted EBITDA

$

1,000

$

1,200

The Company does not provide a projected range of all-in fuel

margin, Adjusted EBITDA, or Net Income. However, for modeling

purposes only, using all-in fuel margins of between 30.0 cpg and

34.0 cpg, combined with the mid-point of the official guided ranges

above, management would expect the business to generate net income

between $496 million and $631 million, respectively, which would

translate to expected Adjusted EBITDA of between $1 billion and

$1.2 billion.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240207388318/en/

Investor Contact: Christian Pikul Vice President,

Investor Relations and Financial Planning and Analysis

christian.pikul@murphyusa.com

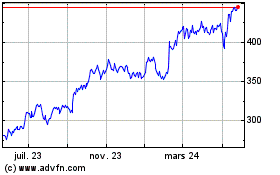

Murphy USA (NYSE:MUSA)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

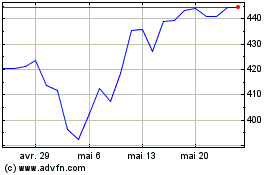

Murphy USA (NYSE:MUSA)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025