Amended Current Report Filing (8-k/a)

13 Janvier 2023 - 11:12PM

Edgar (US Regulatory)

0001504461false00015044612022-12-302022-12-300001504461exch:XNYSngl:LimitedPartnersCapitalAccountCommonUnitsMember2022-12-302022-12-300001504461exch:XNYSus-gaap:PreferredClassBMember2022-12-302022-12-300001504461exch:XNYSngl:PreferredClassCMember2022-12-302022-12-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

(Amendment No. 1)

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): December 30, 2022

NGL ENERGY PARTNERS LP

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-35172 | | 27-3427920 |

(State or other jurisdiction of

incorporation or organization) | | (Commission File Number) | | (I.R.S. Employer

Identification No.) |

6120 South Yale Avenue

Suite 805

Tulsa, Oklahoma 74136

(Address of principal executive offices) (Zip Code)

(918) 481-1119

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240-14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240-14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240-13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbols | | Name of Each Exchange on Which Registered |

| Common units representing Limited Partner Interests | | NGL | | New York Stock Exchange |

| Fixed-to-floating rate cumulative redeemable perpetual preferred units | | NGL-PB | | New York Stock Exchange |

| Fixed-to-floating rate cumulative redeemable perpetual preferred units | | NGL-PC | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Explanatory Note

NGL Energy Partners LP (the “Partnership”) is filing this Amendment No. 1 on Form 8-K/A to its Current Report on Form 8-K as filed with the Securities and Exchange Commission on January 3, 2023 (the “Original Report”), to amend and restate the Original Report to provide information about the compensatory arrangements related to the appointment of Brad Cooper.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On January 3, 2023, NGL Energy Partners LP (the “Partnership” or "NGL") announced the appointment of Brad Cooper to serve as the Executive Vice President and Chief Financial Officer of NGL Energy Holdings LLC (the “General Partner”), the general partner of the Partnership, effective January 13, 2023 (the “Effective Date”). Mr. Cooper will succeed Linda Bridges, who notified the Partnership on December 30, 2022, that she has resigned from her position of Executive Vice President and Chief Financial Officer effective January 13, 2023 to pursue other interests.

Mr. Cooper, 47, joined the Partnership in June 2021 as the Partnership’s Senior Vice President of Administration and Risk Management. Mr. Cooper has over 20 years of experience in the energy space working for public companies with experience across upstream, midstream and downstream sectors. Most recently prior to joining the Partnership, Mr. Cooper spent 10 years with WPX Energy where he was Vice President of Finance and Treasurer. Prior to WPX Energy, he was at The Williams Companies where he held various corporate finance and risk management leadership roles.

In connection with the appointment of Mr. Cooper as the Executive Vice President and Chief Financial Officer of the General Partner, the Board of Directors of the General Partnership authorized a compensation arrangement that provides that during the term of his role as Executive Vice President and Chief Financial Officer, he receives an annual base salary of $500,000, effective January 13, 2023.

Mr. Cooper does not have any family relationships with any director, executive officer, or any person nominated to become a director or executive officer, of the General Partner and there are no arrangements or understandings between Mr. Cooper and any other person pursuant to which Mr. Cooper was appointed as the Executive Vice President, Chief Financial Officer. There are no transactions in which Mr. Cooper had or will have an interest that would be required to be disclosed pursuant to Item 404(a) of Regulation S-K under the Securities Exchange Act of 1934, as amended.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| | | |

| 101 | | Cover Page formatted as Inline XBRL. |

| 104 | | Cover Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| NGL ENERGY PARTNERS LP |

| By: | NGL Energy Holdings LLC, |

| | its general partner |

| Date: January 13, 2023 | | By: | /s/ H. Michael Krimbill |

| | | H. Michael Krimbill |

| | | Chief Executive Officer |

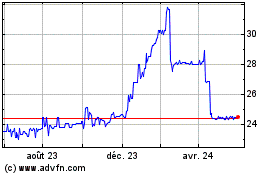

NGL Energy Partners (NYSE:NGL-C)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

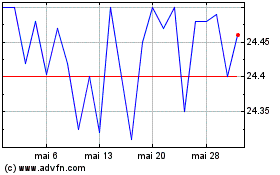

NGL Energy Partners (NYSE:NGL-C)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024