Northrop Grumman Reports First Quarter 2005 Results Earnings Per

Share From Continuing Operations Increase 69 Percent to $1.08 LOS

ANGELES, April 28 /PRNewswire-FirstCall/ -- Northrop Grumman

Corporation (NYSE:NOC) reported that first quarter 2005 income from

continuing operations rose 72 percent to $398 million, or $1.08 per

diluted share, from $232 million, or $0.64 per diluted share, for

the same period of 2004. Sales for the first quarter of 2005

increased 4 percent to $7.5 billion from $7.2 billion for the same

period of 2004. First quarter 2004 sales increased $59 million as a

result of the reclassification of certain operations from

discontinued to continuing operations. First quarter 2005 income

from continuing operations includes a previously announced

after-tax gain of $45 million, or $0.12 per diluted share, from the

sale of approximately 7.3 million shares of TRW Automotive Holdings

Corp. (NYSE:TRW) common stock. "Solid sales growth, higher

operating profit from all six of our business segments, and lower

corporate and interest expense drove this quarter's strong

financial performance and demonstrate Northrop Grumman's intense

focus on operational and financial execution," said Ronald D.

Sugar, Northrop Grumman chairman, chief executive officer and

president. "Cash from operations for the quarter was solid and

supports our ongoing plan to invest for growth and distribute cash

to shareholders," Sugar concluded. Operating margin for the 2005

first quarter increased 36 percent to $595 million from $438

million for the same period of 2004. The increase was driven by

lower unallocated expenses and higher operating margin from all six

of the company's business segments. Unallocated expenses declined

to $27 million in the first quarter of 2005 from $107 million for

the same period of 2004, primarily due to lower legal costs and

lower unrecoverable costs. First quarter 2005 pension expense, as

determined in accordance with accounting principles generally

accepted in the United States, increased to $103 million from $91

million for the same period of 2004. Pension expense allocated to

contracts pursuant to government Cost Accounting Standards (CAS)

increased operating margin by $92 million in the first quarter of

2005 and $80 million for the same period of 2004. Other, net for

the 2005 first quarter increased to $82 million from $10 million

for the same period of 2004 due to the sale of approximately 7.3

million shares of TRW common stock, which resulted in a pre-tax

gain of $70 million. Net income for the 2005 first quarter

increased to $409 million, or $1.11 per diluted share, from $236

million, or $0.65 per diluted share, for the same period of 2004.

First quarter 2005 net income includes an after-tax gain of $11

million resulting from the sale of Teldix GmbH. Contract

acquisitions were $7.8 billion in the first quarter of 2005

compared with $8.5 billion for the same period of 2004. Total

backlog, which includes funded backlog and firm orders for which

funding is not currently contractually obligated by the customer,

increased to $60.4 billion at March 31, 2005, from $58.1 billion at

Dec. 31, 2004. Cash Measurements and Debt Net cash provided by

operating activities for the 2005 first quarter was $263 million,

unchanged from the first quarter of 2004. Net cash provided by

operating activities in the first quarter of 2005 was reduced by a

$99 million litigation settlement payment, and first quarter 2004

net cash provided by operating activities included federal and

state tax refunds totaling $104 million. Capital spending in the

first quarter totaled $197 million. Northrop Grumman's total debt

was $5.2 billion at March 31, 2005, unchanged from Dec. 31, 2004.

Interest expense for the first quarter of 2005 declined to $95

million in the first quarter of 2005 from $113 million in the first

quarter of 2004 primarily due to a reduction in fixed-rate debt.

2005 & 2006 Guidance The company continues to expect sales to

increase to between $31 and $31.5 billion in 2005. For 2006, the

company expects sales to increase to between $32 and $33 billion

versus its previous guidance of approximately $33 billion. The

range for 2006 sales guidance reflects the company's present

understanding of the U.S. Navy's plans for the DD(X) acquisition

strategy. The company now expects 2005 earnings per diluted share

from continuing operations to increase to between $3.70 and $3.85

versus previous guidance of $3.60 to $3.75. The company has

increased 2005 earnings per share guidance primarily to reflect the

delay in adoption of Statement of Financial Accounting Standards

(SFAS) No. 123(R), Share-Based Payment until Jan. 1, 2006. The

company's prior 2005 earnings per share guidance reflected an

estimated expense of approximately $40 million associated with

adoption of the new standard in the third quarter of 2005. Guidance

for 2005 earnings per diluted share from continuing operations also

includes estimated pension expense as determined in accordance with

accounting principles generally accepted in the United States of

$415 million and CAS pension expense of $375 million. For 2006, the

company expects earnings per diluted share from continuing

operations to increase, on a percentage basis, at a solid

double-digit rate, excluding the impact of the $45 million, or

$0.12 per share, after-tax gain on the TRW common stock sale on

2005 results. The estimated growth in 2006 earnings per diluted

share from continuing operations is before adoption of SFAS No.

123(R). The company continues to evaluate the impact of the new

standard on future compensation plans. The estimated growth in 2006

earnings per diluted share from continuing operations assumes that

pension expense as determined in accordance with accounting

principles generally accepted in the United States and CAS pension

expense are the same as estimates for 2005. Actual 2006 pension

expense is subject to variation and will depend on plan asset

returns in 2005 and discount rate and expected rate-of-return

assumptions. Net cash provided by operating activities in 2005 is

expected to increase to between $2.2 and $2.5 billion, and net cash

provided by operating activities in 2006 is expected to be

approximately $2.5 billion. Share Repurchase Program On Oct. 26,

2004, the board of directors authorized a program to repurchase $1

billion of the company's outstanding common stock, which is

expected to be completed over 12 to 18 months, commencing in

November 2004. Share repurchases will take place at management's

discretion and under pre-established non-discretionary programs

from time to time, depending on market conditions, in the open

market, and in privately negotiated transactions. During the first

quarter of 2005 the company repurchased 6.4 million common shares

at an average price of $52.69 per share. As of March 31, 2005,

under the current authorization, the company had repurchased 11.9

million common shares at an average price of approximately $54.41

per share. Through the end of the first quarter of 2005, the

company has repurchased a total of 26.2 million shares at an

average price of approximately $51.30 since August of 2003. Segment

Results Effective Jan. 1, 2005, certain business areas within the

Electronic Systems, Ships and Space Technology segments were

realigned and some business areas have been renamed. Where

applicable, all prior period information has been reclassified to

reflect these realignments, as shown in Schedule 5 of this press

release. ELECTRONIC SYSTEMS ($ in millions) FIRST QUARTER 2005 2004

Sales $1,543 $1,538 Operating Margin 161 158 % Operating margin to

sales 10.4% 10.3% Electronic Systems first quarter 2005 sales

increased slightly from the first quarter of 2004. Sales increases

of 36 percent and 8 percent, respectively, in Government Systems

and Defensive & Navigation Systems were offset by sales

declines in Defense Other and Naval & Marine Systems. The

increase in Government Systems includes higher sales of biohazard

detection systems. Electronic Systems first quarter 2005 operating

margin increased 2 percent from the first quarter of 2004 primarily

due to improved performance in Government Systems. On Jan. 1, 2005,

the manufacturer of complex printed circuit boards and assemblies

and the electronic connector manufacturer previously reported under

"Other" were realigned to the company's Electronic Systems segment.

The impact to prior year results for Electronic Systems is not

significant and prior year results have not been reclassified.

SHIPS ($ in millions) FIRST QUARTER 2005 2004 Sales $1,514 $1,444

Operating Margin 104 86 % Operating margin to sales 6.9% 6.0% Ships

first quarter 2005 sales, which include the financial results of

the Newport News and Ship Systems sectors, increased 5 percent from

the first quarter of 2004, due to higher sales in Expeditionary

Warfare, Coast Guard and Coastal Defense, and Submarines.

Expeditionary Warfare sales rose 25 percent, due to higher revenue

in the LPD and LHD programs. Coast Guard and Coastal Defense

revenue rose 150 percent due to higher revenue in the Deepwater

program, and Submarines sales rose 12 percent due to higher revenue

in the Virginia-class program. These sales increases were partially

offset by lower revenue in Commercial and Other, and Surface

Combatants. Ships first quarter 2005 operating margin increased 21

percent from the first quarter of 2004 due to higher volume and

improved performance in Expeditionary Warfare. MISSION SYSTEMS ($

in millions) FIRST QUARTER 2005 2004 Sales $1,305 $1,183 Operating

Margin 91 76 % Operating margin to sales 7.0% 6.4% Mission Systems

first quarter 2005 sales increased 10 percent from the first

quarter of 2004 due to revenue increases in Missile Systems and

Command, Control & Intelligence Systems, which were partially

offset by lower sales in Technical & Management Services.

Missile Systems revenue increased 24 percent due to higher revenue

in the Kinetic Energy Interceptors and Intercontinental Ballistic

Missile programs. Command, Control & Intelligence Systems

revenue increased 9 percent primarily due to higher revenue from

restricted programs. Technical & Management Services revenue

declined 11 percent. Mission Systems first quarter 2005 operating

margin increased 20 percent from the first quarter of 2004 due to

higher sales volume and improved performance in Missile Systems and

Command, Control & Intelligence Systems. INTEGRATED SYSTEMS ($

in millions) FIRST QUARTER 2005 2004 Sales $1,299 $1,147 Operating

Margin 136 116 % Operating margin to sales 10.5% 10.1% Integrated

Systems first quarter 2005 sales increased 13 percent from the

first quarter of 2004 due to higher sales in Airborne Early Warning

& Electronic Warfare Systems and Air Combat Systems. Airborne

Early Warning & Electronic Warfare Systems revenue increased 33

percent due to higher volume from the E-2 Advanced Hawkeye and

EA-18G programs. Air Combat Systems revenue rose 10 percent,

primarily due to higher revenue from the Joint Unmanned Combat Air

System (J-UCAS) and Multi-Platform Radar Technology Insertion

Programs (MP-RTIP) programs. Airborne Ground Surveillance &

Battle Management Systems revenue declined 8 percent due to lower

revenue in the Joint STARS program. Integrated Systems first

quarter 2005 operating margin increased 17 percent from the first

quarter of 2004 due to higher sales volume and improved program

performance in Airborne Early Warning & Electronic Warfare

Systems. INFORMATION TECHNOLOGY ($ in millions) FIRST QUARTER 2005

2004 Sales $1,229 $1,230 Operating Margin 85 71 % Operating margin

to sales 6.9% 5.8% Information Technology first quarter 2005 sales

were essentially unchanged from the first quarter of 2004. A 7

percent increase in Technology Services revenue was primarily

offset by a revenue decline in Enterprise Information Technology.

Information Technology first quarter 2005 operating margin

increased 20 percent from the first quarter of 2004, primarily due

to improved program performance in Government Information

Technology and Commercial Information Technology. SPACE TECHNOLOGY

($ in millions) FIRST QUARTER 2005 2004 Sales $863 $806 Operating

Margin 62 51 % Operating margin to sales 7.2% 6.3% Space Technology

first quarter 2005 sales increased 7 percent from the first quarter

of 2004, primarily due to higher sales in Civil Space and

Intelligence, Surveillance & Reconnaissance, which were

partially offset by lower revenue in Satellite Communications.

Civil Space revenue increased 37 percent, due to higher volume from

NASA and National Oceanic and Atmospheric Administration programs.

Intelligence, Surveillance & Reconnaissance revenue rose 22

percent. Space Technology first quarter 2005 operating margin

increased 22 percent from the first quarter of 2004 due to higher

sales volume and improved program performance in Intelligence,

Surveillance & Reconnaissance and Civil Space. First Quarter

2005 Highlights * Northrop Grumman's quarterly common stock

dividend was increased 13 percent to $0.26 per share payable June

11, 2005 to shareholders of record on May 31, 2005. * The aircraft

carrier USS Dwight D. Eisenhower (CVN 69) was redelivered to the

Navy after completing its refueling and complex overhaul. * The

17th and final production E-8C Joint Surveillance Target Attack

Radar System (Joint STARS) aircraft was delivered to the U.S. Air

Force. * The first fuselage section for the U.S. Navy's

next-generation electronic attack aircraft, the EA-18G Prowler, was

completed. The EA-18G is expected to begin replacing the Navy's

EA-6B Prowler aircraft by the end of the decade. * The company

achieved its seventeenth CMMI(R) Level 5, the highest possible

rating for benchmarking commercial and defense industry practices

for management and engineering. * The company completed the

purchase of Integic and the sale of Teldix GmbH. * The keel was

laid for the First U.S. Coast Guard National Security Cutter (WMSL

750) * The first fire-control radar for the F-35 Joint Strike

Fighter was delivered. * The company completed delivery of 727

Biohazard Detection Systems for the U.S. Postal Service. Phase II

of the program, which will result in the deployment of 631

additional cabinets, has been accelerated and is underway. * The

company received NASA's George M. Low Award, the agency's premier

award for demonstrated excellence and outstanding technical and

managerial achievements in quality and performance. * The U.S.

Missile Defense Agency awarded the company a $142 million follow-on

contract for systems engineering, planning and logistics support

for its Airborne Laser boost phase missile defense program. About

Northrop Grumman Northrop Grumman Corporation is a global defense

company headquartered in Los Angeles, Calif. Northrop Grumman

provides a broad array of technologically advanced, innovative

products, services and solutions in systems integration, defense

electronics, information technology, advanced aircraft,

shipbuilding, and space technology. The company has more than

125,000 employees and operates in all 50 states and 25 countries

and serves U.S. and international military, government and

commercial customers. Northrop Grumman will webcast its earnings

conference call at 12 p.m. EDT on April 28, 2005. A live audio

broadcast of the conference call along with a supplemental

presentation will be available on the investor relations page of

the company's Web site at http://www.northropgrumman.com/. Note:

Certain statements and assumptions in this release contain or are

based on "forward-looking" information (that Northrop Grumman

believes to be within the definition in the Private Securities

Litigation Reform Act of 1995) and involve risks and uncertainties,

and include, among others, statements in the future tense, and all

statements accompanied by terms such as "project," "expect,"

"estimate," "assume," "believe," "guidance" or variations thereof.

This information reflects the company's best estimates when made,

but the company expressly disclaims any duty to update this

information if new data becomes available or estimates change after

the date of this release. Such "forward-looking" information

includes, among other things, financial guidance regarding sales,

segment operating margin, pension expense, employer contributions

under pension plans and medical and life benefits plans, and cash

flow, and is subject to numerous assumptions and uncertainties,

many of which are outside Northrop Grumman's control. These include

Northrop Grumman's assumptions with respect to future revenues,

expected program performance and cash flows, returns on pension

plan assets and variability of pension actuarial and related

assumptions, the outcome of litigation and appeals, environmental

remediation, divestitures of businesses, successful reduction of

debt, successful negotiation of contracts with labor unions,

effective tax rates and timing and amounts of tax payments, and

anticipated costs of capital investments, among other things.

Northrop Grumman's operations are subject to various additional

risks and uncertainties resulting from its position as a supplier,

either directly or as subcontractor or team member, to the U.S.

Government and its agencies as well as to foreign governments and

agencies; actual outcomes are dependent upon various factors,

including, without limitation, Northrop Grumman's successful

performance of internal plans; government customers' budgetary

constraints; customer changes in short-range and long-range plans;

domestic and international competition in both the defense and

commercial areas; product performance; continued development and

acceptance of new products and, in connection with any fixed price

development programs, controlling cost growth in meeting production

specifications and delivery rates; performance issues with key

suppliers and subcontractors; government import and export

policies; acquisition or termination of government contracts; the

outcome of political and legal processes; natural disasters and

terrorist acts; legal, financial, and governmental risks related to

international transactions and global needs for military aircraft,

military and civilian electronic systems and support, information

technology, naval vessels, space systems and related technologies,

as well as other economic, political and technological risks and

uncertainties and other risk factors set out in Northrop Grumman's

filings from time to time with the Securities and Exchange

Commission, including, without limitation, Northrop Grumman reports

on Form 10-K and Form 10-Q. SCHEDULE 1 NORTHROP GRUMMAN CORPORATION

FINANCIAL HIGHLIGHTS ($ in millions, except per share) (unaudited)

FIRST QUARTER 2005 2004 (4) OPERATING RESULTS HIGHLIGHTS Total

contract acquisitions (1) $7,841 $8,486 Total sales 7,453 7,164

Total operating margin 595 438 Income from continuing operations

398 232 Net income 409 236 Diluted earnings per share from

continuing operations 1.08 .64 Diluted earnings per share 1.11 .65

Net cash provided by operating activities 263 263 MAR 31, DEC 31,

2005 2004 (4) BALANCE SHEET HIGHLIGHTS Cash and cash equivalents

$784 $1,230 Accounts receivable, net 3,611 3,546 Inventoried costs,

net 1,205 1,061 Property, plant, and equipment, net 4,204 4,210

Total debt 5,164 5,158 Net debt (2) 4,380 3,928 Mandatorily

redeemable preferred stock 350 350 Shareholders' equity 16,673

16,700 Total assets 33,196 33,361 Net debt to capitalization ratio

(3) 20% 18% (1) Contract acquisitions represent orders received

during the period for which funding has been contractually

obligated by the customer. (2) Total debt less cash and cash

equivalents. (3) Net debt divided by the sum of shareholders'

equity and total debt. (4) Certain prior year amounts have been

reclassified to conform to the 2005 presentation. SCHEDULE 2

NORTHROP GRUMMAN CORPORATION OPERATING RESULTS ($ in millions,

except per share) (unaudited) FIRST QUARTER 2005 2004 (1) Sales

Electronic Systems $1,543 $1,538 Ships 1,514 1,444 Mission Systems

1,305 1,183 Integrated Systems 1,299 1,147 Information Technology

1,229 1,230 Space Technology 863 806 Other 11 59 Intersegment

Eliminations (311) (243) $7,453 $7,164 Operating margin Electronic

Systems $161 $158 Ships 104 86 Mission Systems 91 76 Integrated

Systems 136 116 Information Technology 85 71 Space Technology 62 51

Other (1) 2 Total segment operating margin (2) 638 560

Reconciliation to operating margin Unallocated expenses (27) (107)

Pension expense (103) (91) Reversal of CAS pension expense included

above 92 80 Reversal of royalty income included above (5) (4)

Operating margin 595 438 Interest income 14 16 Interest expense

(95) (113) Other, net 82 10 Income from continuing operations

before income taxes 596 351 Federal and foreign income taxes 198

119 Income from continuing operations 398 232 Income from

discontinued operations, net of tax 1 Gain from disposal of

discontinued operations, net of tax 11 3 Net income $409 $236

Weighted average diluted shares outstanding, in millions 367.0

365.2 Diluted earnings per share Continuing operations $1.08 $.64

Disposal of discontinued operations .03 .01 Diluted earnings per

share $1.11 $.65 (1) Certain prior year amounts have been

reclassified to conform to the 2005 presentation. (2) Non-GAAP

measure. Management uses segment operating margin as an internal

measure of financial performance for the individual business

segments. Pension expense is included in determining segment

operating margin to the extent that the cost is currently

recognized under U.S. Government Cost Accounting Standards (CAS).

In order to reconcile from segment operating margin to total

company operating margin, these amounts are reported under the

caption "Reversal of CAS pension expense included above." Total

pension expense or income determined in accordance with accounting

principles generally accepted in the United States is reported

separately as a reconciling item under the caption "Pension

expense." The reconciling item captioned "Unallocated expenses"

includes the portion of corporate, legal, environmental, other

retiree benefits, stock compensation, and other expenses not

allocated to the segments. SCHEDULE 3 NORTHROP GRUMMAN CORPORATION

ADDITIONAL SEGMENT INFORMATION ($ in millions) (unaudited) CONTRACT

FUNDED ACQUISITIONS(1) BACKLOG(2) FIRST QUARTER MARCH 31, 2005 2004

(3) 2005 2004 (3) Electronic Systems $1,672 $1,772 $6,907 $6,702

Ships 1,166 1,518 8,817 9,823 Mission Systems 1,255 1,336 3,117

3,058 Integrated Systems 1,939 1,768 5,331 4,919 Information

Technology 1,306 1,212 2,645 2,283 Space Technology 873 1,133 1,759

1,885 Other 13 66 30 70 Intersegment Eliminations (383) (319) (655)

(490) Total $7,841 $8,486 $27,951 $28,250 TOTAL BACKLOG, MARCH 31,

2005 TOTAL FUNDED UNFUNDED(4) BACKLOG Electronic Systems $6,907

$2,094 $9,001 Ships 8,817 3,385 12,202 Mission Systems 3,117 7,657

10,774 Integrated Systems 5,331 9,352 14,683 Information Technology

2,645 2,524 5,169 Space Technology 1,759 7,425 9,184 Other 30 30

Intersegment Eliminations (655) (655) Total $27,951 $32,437 $60,388

(1) Contract acquisitions represent orders received during the

period for which funding has been contractually obligated by the

customer. (2) Funded backlog represents unfilled orders for which

funding has been contractually obligated by the customer. (3)

Certain prior year amounts have been reclassified to conform to the

2005 presentation. (4) Unfunded backlog represents firm orders for

which funding is not currently contractually obligated by the

customer. Unfunded backlog excludes unexercised contract options

and unfunded Indefinite Delivery Indefinite Quantity (IDIQ).

AMORTIZATION OF PURCHASED INTANGIBLES FIRST QUARTER 2005 2004

Electronic Systems $21 $21 Ships 10 10 Mission Systems 8 8

Integrated Systems 4 4 Information Technology 2 5 Space Technology

9 8 Total $54 $56 SCHEDULE 4 NORTHROP GRUMMAN CORPORATION SALES BY

BUSINESS AREA WITHIN SEGMENTS ($ in millions) (unaudited) FIRST

QUARTER 2005 2004 (1) Electronic Systems Defensive & Navigation

Systems $474 $440 Aerospace Systems 400 403 Naval & Marine

Systems 187 205 Government Systems 174 128 C4ISR & Space

Systems 161 161 Defense Other 147 201 1,543 1,538 Ships Surface

Combatants 445 462 Aircraft Carriers 436 440 Expeditionary Warfare

382 306 Submarines 182 162 Coast Guard and Coastal Defense 40 16

Services 27 30 Commercial and Other 21 41 Intrasegment Eliminations

(19) (13) 1,514 1,444 Mission Systems Command, Control &

Intelligence Systems 790 723 Missile Systems 353 285 Technical

& Management Services 168 188 Intrasegment Eliminations (6)

(13) 1,305 1,183 Integrated Systems Air Combat Systems 786 712

Airborne Early Warning/Electronic Warfare Systems 373 280 Airborne

Ground Surveillance/Battle Management Systems 143 156 Intrasegment

Eliminations (3) (1) 1,299 1,147 Information Technology Government

Information Technology 756 753 Commercial Information Technology

173 175 Technology Services 170 159 Enterprise Information

Technology 167 176 Intrasegment Eliminations (37) (33) 1,229 1,230

Space Technology Intelligence, Surveillance & Reconnaissance

290 237 Civil Space 213 155 Software Defined Radios 135 143 Missile

& Space Defense 122 119 Satellite Communications 97 138

Technology 28 27 Intrasegment Eliminations (22) (13) 863 806 Other

11 59 Intersegment Eliminations (311) (243) Total Sales $7,453

$7,164 (1) Certain prior year amounts have been reclassified to

conform to the 2005 presentation. SCHEDULE 5 NORTHROP GRUMMAN

CORPORATION SEGMENT SALES RESULTS - AFTER REALIGNMENT ($ IN

MILLIONS) (unaudited) Electronic Systems Pro-Forma Sales - After

Realignment 2004 Three Months Ended Total Mar 31 Jun 30 Sep 30 Dec

31 Year Defensive & Navigation Systems $440 $465 $433 $497

$1,835 Aerospace Systems 403 367 417 422 1,609 Naval & Marine

Systems 205 205 207 240 857 Government Systems 128 180 158 223 689

C4ISR & Space Systems 161 167 155 169 652 Defense Other 201 207

188 179 775 TOTAL SALES $1,538 $1,591 $1,558 $1,730 $6,417 Ships

Pro-Forma Sales - After Realignment 2004 Three Months Ended Total

Mar 31 Jun 30 Sep 30 Dec 31 Year Surface Combatants $462 $486 $486

$487 $1,921 Aircraft Carriers 440 475 466 520 1,901 Expeditionary

Warfare 306 346 344 440 1,436 Submarines 162 178 180 210 730 Coast

Guard & Coastal Defense 16 30 29 39 114 Services 30 24 19 26 99

Commercial and Other 41 40 38 23 142 Intrasegment Eliminations (13)

(22) (25) (31) (91) TOTAL SALES $1,444 $1,557 $1,537 $1,714 $6,252

Space Technology Pro-Forma Sales - After Realignment 2004 Three

Months Ended Total Mar 31 Jun 30 Sep 30 Dec 31 Year Intelligence,

Surveillance & Reconnaissance $237 $263 $281 $260 $1,041 Civil

Space 155 163 152 168 638 Software Defined Radios 143 142 138 123

546 Missile & Space Defense 119 128 121 119 487 Satellite

Communications 138 131 127 113 509 Technology 27 32 15 26 100

Intrasegment Eliminations (13) (23) (11) (5) (52) TOTAL SALES $806

$836 $823 $804 $3,269 DATASOURCE: Northrop Grumman Corporation

CONTACT: Frank Moore (Media), +1-310-201-3335, or Gaston Kent

(Investors), +1-310-201-3423, both of Northrop Grumman Corporation

Web site: http://www.northropgrumman.com/

Copyright

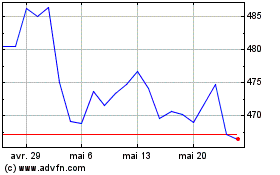

Northrop Grumman (NYSE:NOC)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

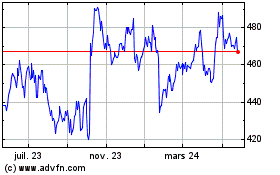

Northrop Grumman (NYSE:NOC)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024