Earnings per Share From Continuing Operations of $1.02 LOS ANGELES,

April 25 /PRNewswire-FirstCall/ -- Northrop Grumman Corporation

(NYSE:NOC) reported first quarter 2006 income from continuing

operations of $357 million, or $1.02 per diluted share, compared

with $398 million, or $1.08 per diluted share, for the same period

of 2005. First quarter 2005 income from continuing operations

included an after-tax gain of $45 million, or $0.12 per diluted

share, from the sale of TRW Automotive common stock. First quarter

2006 sales decreased to $7.2 billion from $7.5 billion in the first

quarter of 2005, due to lower sales in the company's Ships

business. "As expected, our first quarter includes strong operating

performances from Information & Services, Aerospace and

Electronics. At Ships, we continue to progress toward pre-Katrina

production levels," said Ronald D. Sugar, Northrop Grumman

chairman, chief executive officer and president. "Contract bookings

during the quarter were a record $12.3 billion. Based on this

strong start, we continue to expect double-digit growth in earnings

per share and substantial cash generation in 2006." The company's

first quarter 2006 segment operating margin increased to $644

million from $638 million in first quarter of 2005. First quarter

2006 segment operating margin reflects higher operating margin in

Information & Services, Electronics and Aerospace, partially

offset by lower operating margin in Ships. Unallocated expenses for

the 2006 first quarter increased to $35 million from $27 million in

the same period of 2005. Operating margin was unchanged at $595

million. Other income/expense for the 2006 first quarter decreased

to an expense of $1 million from income of $82 million in the prior

year period. First quarter 2005 included a pre-tax gain of $70

million from the sale of approximately 7.3 million shares of TRW

Automotive common stock. The effective tax rate applied to income

from continuing operations for the 2006 first quarter was 30.9

percent compared with 33.2 percent in the 2005 first quarter. Net

income for the 2006 first quarter declined to $358 million, or

$1.02 per diluted share, from $409 million, or $1.11 per diluted

share, for the same period of 2005. First quarter 2005 net income

included the $45 million after-tax gain from the TRW Automotive

common stock sale and an $11 million after-tax gain from the sale

of Teldix GmbH. Earnings per share are based on weighted average

diluted shares outstanding of 350.8 million for the first quarter

of 2006 and 367 million for the first quarter of 2005. Contract

acquisitions increased to $12.3 billion in the first quarter of

2006 from $7.8 billion for the same period of 2005. The increase

includes the impact of contract acquisitions delayed from the 2005

fourth quarter by the delay in the passage of the 2006 defense

budget, as well as several significant new business awards. Total

backlog, which includes funded backlog and firm orders for which

funding is not currently contractually obligated by the customer,

was $58 billion at Mar. 31, 2006 compared with $56.3 billion at

Dec. 31, 2005. Cash Measurements, Debt and Share Repurchases Net

cash used by operating activities in the first quarter of 2006

totaled $115 million compared with net cash provided by operating

activities of $263 million in the first quarter of 2005. Capital

spending totaled $173 million in the 2006 first quarter, including

$54 million for Hurricane Katrina damage repair at Ships, compared

with total capital spending of $197 million in the 2005 first

quarter. During the 2006 first quarter, insurance recoveries

related to hurricane damage, repair and restoration totaled $54

million. Cash and cash equivalents declined to $373 million at Mar.

31, 2006 from $1.6 billion at Dec. 31, 2005. During the first

quarter of 2006 the company reduced total debt by approximately

$430 million and repurchased $787 million (including approximately

11.6 million shares under an Accelerated Share Repurchase

agreement) of its common stock. Since the inception of its share

repurchase programs in August of 2003, the company has retired

approximately 53 million shares of its common stock for

approximately $3 billion. Weighted average diluted shares

outstanding declined to 350.8 million for the first quarter of 2006

compared with 367 million for the first quarter of 2005, and common

shares outstanding totaled 343.3 million at Mar. 31, 2006. Under

the most recent $1.5 billion share repurchase authorization

announced in Oct. 2005, approximately $213 million remains. The

company intends to complete the repurchase of shares under the

current authorization by the end of 2006. 2006 Guidance For 2006,

the company continues to expect sales of approximately $31 billion,

earnings per share from continuing operations of $4.25 to $4.40 and

cash from operations of $2.3 billion to $2.6 billion. Business

Results As was previously announced, beginning with the first

quarter of 2006 the company has implemented enhancements in the

reporting of its financial results. Effective Jan. 1, 2006, the

company established a new reportable segment, Technical Services,

to leverage existing business strengths and synergies in logistics

support, sustainment and technical services. Technical Services

consolidates multiple programs in logistics operations from the

Electronics, Integrated Systems, Mission Systems and Information

Technology segments. In addition the company has categorized its

seven reporting segments into four businesses. The results of the

Mission Systems, Information Technology and Technical Services

segments are aggregated as Information & Services. The results

of the Integrated Systems and Space Technology segments are

aggregated as Aerospace, and the Electronic Systems segment is now

reported as Electronics. The Newport News and Ship Systems sectors

continue to be reported as Ships. The company has also revised its

reporting of intercompany margin recognition and elimination for

the company's operating segments. In order to provide a more

relevant depiction of the management and performance of its

businesses, operating margin for each of the company's segments

will include margin on intersegment sales. Schedule 4 provides a

reconciliation of the new reporting format with past financial

reports. Schedule 2 provides a summary of the financial results for

the four businesses and the seven reporting segments that comprise

them. The operating information shown below excludes intersegment

eliminations shown in Schedule 2. Information & Services First

Quarter ($ Millions) 2006 2005 Operating % of Operating % of Sales

Margin Sales Sales Margin Sales Mission Systems $1,264 $117 9.3%

$1,254 $93 7.4% Information Technology 1,057 75 7.1% 1,034 76 7.4%

Technical Services 275 13 4.7% 274 12 4.4% $2,596 $205 7.9% $2,562

$181 7.1% Information & Services sales increased $34 million,

or 1 percent, during the first quarter of 2006 due to higher sales

in Mission Systems and Information Technology. The increase in

sales at Mission Systems includes higher volume on Command, Control

& Intelligence Systems programs, which was partially offset by

lower volume on the Intercontinental Ballistic Missile program.

Higher sales in Information Technology include higher volume on

Defense, Civilian Agencies, and Intelligence programs. These

increases were partially offset by lower Commercial, State &

Local sales, primarily due to a $53 million sales decline in the

reseller business. In the first quarter of 2006, the company

announced the exit of the reseller business, which it expects to

complete by the end of 2006. Information & Services first

quarter 2006 operating margin increased 13 percent, primarily due

to improved performance in Missile Systems and Command, Control

& Intelligence Systems programs in the Mission Systems segment.

Aerospace First Quarter ($ Millions) 2006 2005 Operating % of

Operating % of Sales Margin Sales Sales Margin Sales Integrated

Systems $1,437 $149 10.4% $1,287 $142 11.0% Space Technology 855 71

8.3% 863 67 7.8% $2,292 $220 9.6% $2,150 $209 9.7% First quarter

2006 Aerospace sales increased 7 percent from the first quarter of

2005 reflecting a 12 percent increase in Integrated Systems sales

and slightly lower sales in Space Technology. Higher volume on the

F/A-18, F-35, E-2C Advanced Hawkeye, and E-2 Post Multi-Year

Procurement programs contributed to the increase in Integrated

Systems revenue. Space Technology sales decreased 1 percent due to

lower sales in Missile & Space Defense, Civil Space and

Software Defined Radios programs, which were partially offset by

higher sales in Satellite Communications programs. Aerospace first

quarter 2006 operating margin increased 5 percent from the first

quarter of 2005 due to higher volume at Integrated Systems and

improved performance at Space Technology. Electronics First Quarter

($ Millions) 2006 2005 Operating % of Operating % of Sales Margin

Sales Sales Margin Sales $1,509 $177 11.7% $1,547 $162 10.5%

Electronics first quarter 2006 sales decreased 2 percent from the

first quarter of 2005 primarily due to lower sales in Aerospace

Systems and Navigation Systems. In Aerospace Systems, F-16 Block 60

program sales declined as deliveries progressed, and Navigation

Systems sales were impacted by the divestiture of Teldix in 2005.

These declines were partially offset by higher sales in Government

Systems programs. Electronics first quarter 2006 operating margin

increased 9 percent from the first quarter of 2005 due to improved

performance in Defensive Systems and Aerospace Systems programs.

Ships First Quarter ($ Millions) 2006 2005 Operating % of Operating

% of Sales Margin Sales Sales Margin Sales $1,133 $68 6.0% $1,514

$107 7.1% Ships first quarter 2006 sales decreased 25 percent from

the first quarter of 2005 due to lower volume on the DD(X) program,

as well as lower volume due to hurricane-related work delays on the

LPD, LHD, DDG, and Coast Guard Deepwater programs. Results for

Aircraft Carrier and Submarine programs were comparable to prior

year results. Ships operating margin decreased 36 percent from the

first quarter of 2005, and reflects lower DD(X) volume and lower

volume and reduced margin rates for the LPD, LHD, DDG, and Coast

Guard Deepwater programs as a result of hurricane-related cost

growth and work delays. First Quarter 2006 Highlights * The

National Nuclear Security Administration awarded a Northrop

Grumman-led joint venture a five-year, $2.5 billion contract for

the management and operation of its Nevada Test Site. * The San

Diego County Board of Supervisors awarded Northrop Grumman a

seven-year contract, valued at approximately $600 million, to

manage the county's information technology and telecommunications

services. * The U.S. Navy awarded Northrop Grumman a contract for

work to support the Los Angeles, Ohio, Seawolf and Virginia-class

submarines. The total estimated value of the contract is

approximately $248 million through 2008. * The U.S. Air Force

awarded Northrop Grumman a $225 million, 27-month contract to

continue the full-rate production phase of the Intercontinental

Ballistic Missile Propulsion Replacement Program (PRP), the fifth

of seven full-rate production options under the nine-year PRP

contract. The PRP contract began in 1999, and is valued at $1.9

billion over the ten-year period. * The U.S. Navy exercised a $93.8

million contract modification option to Northrop Grumman for detail

design and the procurement of long-lead- time material on the LHA 6

amphibious assault ship program. This is the first option exercised

on the initial contract, awarded in July 2005. With this option,

the total contract value has increased to $203.7 million. * The

Defense Advanced Research Projects Agency (DARPA) selected Northrop

Grumman to design the first-ever supersonic flying wing aircraft

that can vary the sweep of its wing for the most efficient flight

performance. * Northrop Grumman was selected for Phase 3 of the

Joint High Power Solid-State Laser program to develop

"military-grade," solid-state laser technology expected to pave the

way for the U.S. military to incorporate high-energy laser systems

across all services, including ships, manned and unmanned aircraft,

and ground vehicles. * Two RQ-8A Fire Scout unmanned aerial

vehicles (UAVs) completed nine autonomous shipboard landings on

board USS Nashville (LPD 13) off the coast of Naval Air Station

Patuxent River, Md. This test marked the first time a U.S. Navy UAV

had performed vertical landings on a moving ship without a pilot

controlling the aircraft. * The U.S. Air Force deployed the first

two production RQ-4A Global Hawk unmanned aerial vehicles, designed

and built by Northrop Grumman, to theater. * The Aegis guided

missile destroyer USS Forrest Sherman (DDG 98) was commissioned at

Naval Air Station Pensacola, Fla. * Northrop Grumman executed a

$750 million accelerated share repurchase agreement with Credit

Suisse, New York Branch, under which the company repurchased

approximately 11.6 million shares of Northrop Grumman common stock.

* Northrop Grumman established a new sector, Northrop Grumman

Technical Services, and elected James L. Cameron corporate vice

president and president of the new sector. * Retired U.S. Air Force

Gen. Richard B. Myers, former chairman of the Joint Chiefs of

Staff, was elected to Northrop Grumman's board of directors.

Northrop Grumman's board now totals 12 members, 11 of whom are

non-employee directors. About Northrop Grumman Northrop Grumman

Corporation is a global defense company headquartered in Los

Angeles, Calif. Northrop Grumman provides technologically advanced,

innovative products, services and solutions in systems integration,

defense electronics, information technology, advanced aircraft,

shipbuilding and space technology. With approximately 125,000

employees and operations in all 50 states and 25 countries,

Northrop Grumman serves U.S. and international military, government

and commercial customers. Northrop Grumman will webcast its

earnings conference call at noon EDT on Apr. 25, 2006. A live audio

broadcast of the conference call along with a supplemental

presentation will be available on the investor relations page of

the company's Web site at http://www.northropgrumman.com/. Note:

Certain statements and assumptions in this release contain or are

based on "forward-looking" information that Northrop Grumman

Corporation (the "Company") believes to be within the definition in

the Private Securities Litigation Reform Act of 1995 and involve

risks and uncertainties, and include, among others, statements in

the future tense, and all statements accompanied by terms such as

"project," "expect," "estimate," "assume," "believe," "plan,"

"guidance" or variations thereof. This information reflects the

Company's best estimates when made, but the Company expressly

disclaims any duty to update this information if new data become

available or estimates change after the date of this release. Such

"forward-looking" information includes, among other things,

financial guidance regarding sales, segment operating margin,

pension expense, employer contributions under pension plans and

medical and life benefits plans, and cash flow, and is subject to

numerous assumptions and uncertainties, many of which are outside

the Company's control. These include the Company's assumptions with

respect to future revenues; expected program performance and cash

flows; returns on pension plan assets and variability of pension

actuarial and related assumptions; the outcome of litigation and

appeals; hurricane recoveries; environmental remediation;

divestitures of businesses; successful reduction of debt;

successful negotiation of contracts with labor unions; effective

tax rates and timing and amounts of tax payments; the results of

any audit or appeal process with the Internal Revenue Service; and

anticipated costs of capital investments, among other things. The

Company's operations are subject to various additional risks and

uncertainties resulting from its position as a supplier, either

directly or as subcontractor or team member, to the U.S. government

and its agencies as well as to foreign governments and agencies;

actual outcomes are dependent upon various factors, including,

without limitation, the Company's successful performance of

internal plans; government customers' budgetary constraints;

customer changes in short-range and long-range plans; domestic and

international competition in both the defense and commercial areas;

product performance; continued development and acceptance of new

products and, in connection with any fixed-price development

programs, controlling cost growth in meeting production

specifications and delivery rates; performance issues with key

suppliers and subcontractors; government import and export

policies; acquisition or termination of government contracts; the

outcome of political and legal processes and of the assertion or

prosecution of potential substantial claims by or on behalf of a

U.S. government customer; natural disasters, including recent

hurricanes affecting the Company's Gulf Coast shipyards and the

associated risks underlying the Company's assumptions regarding

achieving expected learning-curve progress, amounts and timing of

recoveries under insurance contracts, availability of materials and

supplies, continuation of the supply chain, contractual performance

relief and the application of cost sharing terms, impacts of timing

of cash receipts and the availability of other mitigating elements;

terrorist acts; legal, financial, and governmental risks related to

international transactions and global needs for military aircraft,

military and civilian electronic systems and support, information

technology, naval vessels, space systems and related technologies,

as well as other economic, political and technological risks and

uncertainties and other risk factors set out in the Company's

filings from time to time with the Securities and Exchange

Commission, including, without limitation, Company reports on Form

10-K and Form 10-Q. Members of the news media may receive our

releases via e-mail by registering at:

http://www.northropgrumman.com/cgi-bin/regist_form.cgi LEARN MORE

ABOUT US: Northrop Grumman news releases, product information,

photos and video clips are available on the Internet at:

http://www.northropgrumman.com/ NORTHROP GRUMMAN CORPORATION

SCHEDULE 1 FINANCIAL HIGHLIGHTS ($ in millions, except per share)

(unaudited) FIRST QUARTER 2006 2005 OPERATING RESULTS HIGHLIGHTS

Total contract acquisitions (1) $12,321 $7,841 Total sales 7,184

7,453 Total operating margin 595 595 Income from continuing

operations 357 398 Net income 358 409 Diluted earnings per share

from continuing operations 1.02 1.08 Diluted earnings per share

1.02 1.11 Net cash (used in) provided by operating activities (115)

263 MAR 31, DEC 31, 2006 2005 BALANCE SHEET HIGHLIGHTS Cash and

cash equivalents $373 $1,605 Accounts receivable, net 4,144 3,656

Inventoried costs, net 1,294 1,174 Property, plant, and equipment,

net 4,404 4,404 Total debt 4,714 5,145 Net debt (2) 4,341 3,540

Mandatorily redeemable preferred stock 350 350 Shareholders' equity

16,619 16,828 Total assets 33,517 34,214 Net debt to capitalization

ratio (3) 20% 16% (1) Contract acquisitions represent orders

received during the period for which funding has been contractually

obligated by the customer. (2) Total debt less cash and cash

equivalents. (3) Net debt divided by the sum of shareholders'

equity and total debt. NORTHROP GRUMMAN CORPORATION SCHEDULE 2

OPERATING RESULTS ($ in millions, except per share) (unaudited)

FIRST QUARTER 2006 2005 (1) Sales Information & Services

Mission Systems $1,264 $1,254 Information Technology 1,057 1,034

Technical Services 275 274 Total Information & Services 2,596

2,562 Aerospace Integrated Systems 1,437 1,287 Space Technology 855

863 Total Aerospace 2,292 2,150 Electronics 1,509 1,547 Ships 1,133

1,514 Other -- 11 Intersegment Eliminations (346) (331) $7,184

$7,453 Operating margin Information & Services Mission Systems

117 93 Information Technology 75 76 Technical Services 13 12 Total

Information & Services 205 181 Aerospace Integrated Systems 149

142 Space Technology 71 67 Total Aerospace 220 209 Electronics 177

162 Ships 68 107 Other -- (1) Intersegment Eliminations (26) (20)

Total segment operating margin (2) 644 638 Reconciliation to

operating margin Unallocated expenses (35) (27) Net pension expense

adjustment (10) (11) Reversal of royalty income included above (4)

(5) Operating margin 595 595 Interest income 13 14 Interest expense

(90) (95) Other, net (1) 82 Income from continuing operations

before income taxes 517 596 Federal and foreign income taxes 160

198 Income from continuing operations 357 398 Discontinued

operations, net of tax 1 11 Net income $358 $409 Weighted average

diluted shares outstanding, in millions 350.8 367.0 Diluted

earnings per share Continuing operations $1.02 $1.08 Discontinued

operations $.00 .03 Diluted earnings per share $1.02 $1.11 (1)

Certain prior year amounts have been reclassified to conform to the

2006 presentation. (2) Non-GAAP measure. Management uses segment

operating margin as an internal measure of financial performance

for the individual business segments. The net pension expense

adjustment reflects the excess pension expense determined in

accordance with accounting principles generally accepted in the

United States of America over the pension expense included in the

segments' cost of sales to the extent that these costs are

currently recognized under US Government Cost Accounting Standards.

NORTHROP GRUMMAN CORPORATION SCHEDULE 3 ADDITIONAL SEGMENT

INFORMATION ($ in millions) (unaudited) CONTRACT FUNDED

ACQUISITIONS(1) BACKLOG(2) FIRST QUARTER March 31, 2006 2005 (3)

2006 2005 (3) Information & Services Mission Systems $1,728

$1,229 $2,940 $3,034 Information Technology 1,278 1,103 2,631 2,280

Technical Services 451 270 552 495 Total Information & Services

3,457 2,602 6,123 5,809 Aerospace Integrated Systems 2,735 1,926

5,043 5,314 Space Technology 1,641 873 1,785 1,759 Total Aerospace

4,376 2,799 6,828 7,073 Electronics 1,846 1,670 6,694 6,899 Ships

3,054 1,166 8,050 8,817 Other (5) 13 -- 30 Intersegment

Eliminations (407) (409) (531) (677) Total $12,321 $7,841 $27,164

$27,951 TOTAL BACKLOG, March 31, 2006 FUNDED UNFUNDED(4) TOTAL

BACKLOG Information & Services Mission Systems $2,940 $7,706

$10,646 Information Technology 2,631 2,326 4,957 Technical Services

552 868 1,420 Total Information & Services 6,123 10,900 17,023

Aerospace Integrated Systems 5,043 6,408 11,451 Space Technology

1,785 8,668 10,453 Total Aerospace 6,828 15,076 21,904 Electronics

6,694 1,803 8,497 Ships 8,050 3,065 11,115 Intersegment

Eliminations (531) -- (531) Total $27,164 $30,844 $58,008 (1)

Contract acquisitions represent orders received during the period

for which funding has been contractually obligated by the customer.

(2) Funded backlog represents unfilled orders for which funding has

been contractually obligated by the customer. (3) Certain prior

year amounts have been reclassified to conform to the 2006

presentation. (4) Unfunded backlog represents firm orders for which

funding is not currently contractually obligated by the customer.

Unfunded backlog excludes unexercised contract options and unfunded

Indefinite Delivery Indefinite Quantity contract awards. NORTHROP

GRUMMAN CORPORATION REALIGNED SEGMENT OPERATING RESULTS ($ in

millions) (unaudited) AS REPORTED 2005 Three Months Ended Total

SALES Mar 31 Jun 30 Sep 30 Dec 31 Year Information & Services

Mission Systems $1,305 $1,320 $1,405 $1,332 $5,362 Information

Technology 1,229 1,331 1,311 1,383 5,254 Technical Services Total

Information & Services 2,534 2,651 2,716 2,715 10,616 Aerospace

Integrated Systems 1,299 1,404 1,426 1,483 5,612 Space Technology

863 875 842 815 3,395 Total Aerospace 2,162 2,279 2,268 2,298 9,007

Electronics 1,543 1,765 1,594 1,740 6,642 Ships 1,514 1,587 1,222

1,463 5,786 Other 11 11 9 11 42 Intersegment Eliminations (311)

(331) (363) (367) (1,372) Total Sales $7,453 $7,962 $7,446 $7,860

$30,721 SEGMENT OPERATING MARGIN Information & Services Mission

Systems $91 $99 $100 $91 $381 Information Technology 85 89 93 88

355 Technical Services Total Information & Services 176 188 193

179 736 Aerospace Integrated Systems 136 108 112 118 474 Space

Technology 62 69 67 57 255 Total Aerospace 198 177 179 175 729

Electronics 161 198 182 169 710 Ships 104 101 (68) 104 241 Other

(1) (5) (5) (6) (17) Intersegment Eliminations Total Segment

Operating Margin (1) $638 $659 $481 $621 $2,399 (1) Non-GAAP

measure. Management uses segment operating margin as an internal

measure of financial performance for the individual business

segments. NORTHROP GRUMMAN CORPORATION REALIGNED SEGMENT OPERATING

RESULTS ($ in millions) (unaudited) REALIGNED 2005 Three Months

Ended Total SALES Mar 31 Jun 30 Sep 30 Dec 31 Year Information

& Services Mission Systems $1,254 $1,271 $1,356 $1,279 $5,160

Information Technology 1,034 1,127 1,110 1,194 4,465 Technical

Services 274 286 276 267 1,103 Total Information & Services

2,562 2,684 2,742 2,740 10,728 Aerospace Integrated Systems 1,287

1,391 1,417 1,474 5,569 Space Technology 863 875 842 815 3,395

Total Aerospace 2,150 2,266 2,259 2,289 8,964 Electronics 1,547

1,769 1,595 1,743 6,654 Ships 1,514 1,587 1,222 1,463 5,786 Other

11 11 9 11 42 Intersegment Eliminations (331) (355) (381) (386)

(1,453) Total Sales $7,453 $7,962 $7,446 $7,860 $30,721 SEGMENT

OPERATING MARGIN Information & Services Mission Systems $93 $99

$101 $94 $387 Information Technology 76 77 81 79 313 Technical

Services 12 14 17 17 60 Total Information & Services 181 190

199 190 760 Aerospace Integrated Systems 142 117 120 126 505 Space

Technology 67 74 72 61 274 Total Aerospace 209 191 192 187 779

Electronics 162 199 182 169 712 Ships 107 102 (65) 105 249 Other

(1) (5) (5) (6) (17) Intersegment Eliminations (20) (18) (22) (24)

(84) Total Segment Operating Margin (1) $638 $659 $481 $621 $2,399

(1) Non-GAAP measure. Management uses segment operating margin as

an internal measure of financial performance for the individual

business segments. DATASOURCE: Northrop Grumman Corporation

CONTACT: Dan McClain (Media), +1-310-201-3335, or Gaston Kent

(Investors), +1-310-201-3423, both of Northrop Grumman Corporation

Web site: http://www.northropgrumman.com/

Copyright

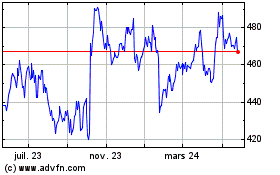

Northrop Grumman (NYSE:NOC)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

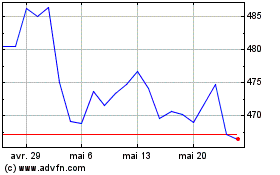

Northrop Grumman (NYSE:NOC)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024