Northrop Grumman Enters into Definitive Agreement to Acquire Essex Corporation

08 Novembre 2006 - 10:39PM

PR Newswire (US)

COLUMBIA, Md., Nov. 8 /PRNewswire-FirstCall/ -- Essex Corporation

(NASDAQ:KEYW) announces that it has signed a definitive merger

agreement with a subsidiary of Northrop Grumman Corporation

(NYSE:NOC) under which Northrop Grumman will acquire Essex

Corporation for $24 in cash per common share. The transaction is

valued at approximately $580 million, which includes the assumption

of Essex' debt. The transaction is expected to close in the first

quarter of 2007, subject to customary conditions including approval

of Essex Corporation's shareholders and antitrust clearances.

"Around this time in 2000, a little known company called Essex

Corporation embarked on a strategy to increase the value it brought

to its shareholders, customers, and employees," commented Leonard

Moodispaw, CEO and President of Essex. "Since then we have grown

from fewer than 50 people to nearly 1,000 employees, and increased

revenue from a few million dollars per year to a currently

forecasted 2007 revenue range of $330-350 million. We have

completed 5 acquisitions, two follow-on primary public offerings,

and grown to become an important supplier of services and solutions

to the U.S. intelligence and defense community. For our

shareholders, we have increased the enterprise value of the Company

from less than $20 million in 2000 to approximately $580 million

under the proposed acquisition. After careful deliberation, we on

the Board of Directors believe it is time to declare victory and

success for all, and at a price that represents an attractive

valuation to our shareholders." "The proposed acquisition offers

new opportunities for Essex and its employees to continue and

expand the range and depth of solutions we offer, and to accelerate

the advancement of several of our key technologies. Northrop

Grumman offers an exciting new platform from which Essex will

continue to deliver innovative solutions to the intelligence

technology market. Following the close of the transaction Essex

will operate as a business unit within the Northrop Grumman Mission

Systems sector. Rather than being an end, I believe this will be a

new beginning, ripe with new opportunities." The Essex Board of

Directors approved the transaction unanimously. Shareholders of

Essex holding shares representing approximately 11% of the shares

outstanding have entered into agreements with Northrop Grumman

under which they have agreed to vote their shares in favor of the

proposed merger. Jefferies Quarterdeck, a division of Jefferies

& Company, Inc., has acted as exclusive financial advisor to

Essex Corporation in the proposed transaction, and Hogan &

Hartson LLP are acting as Essex' legal counsel. Important

Additional Information: Essex will file with the Securities and

Exchange Commission (SEC) a proxy statement and other documents

regarding the proposed business combination transaction referred to

in the foregoing information. Investors and security holders are

urged to read the proxy statement when it becomes available,

because it will contain important information. A definitive proxy

statement will be sent to security holders of Essex seeking their

approval of the transaction. Investors and security holders may

obtain a free copy of the definitive proxy statement (when it is

available) and other relevant documents filed by Essex with the SEC

at the Commission's web site at http://www.sec.gov/. The definitive

proxy statement and other relevant documents also may be obtained

for free by directing a request to: Corporate Secretary, Essex

Corporation, 6708 Alexander Bell Drive, Columbia, Maryland 21046,

or by phone at 301-939-7000. Essex and its directors and executive

officers may be deemed to be participants in the solicitation of

proxies from Essex stockholders. Collectively, as of May 3, 2006,

as reported in the Proxy Statement for the 2006 Annual Meeting of

Stockholders, the beneficial ownership of the directors and

executive officers of Essex was approximately 14.7%. Stockholders

may obtain additional information regarding the interests of such

participants by reading the proxy statement when it becomes

available. About Essex: Essex provides advanced signal, image,

information processing, information assurance and cyber-security

solutions, primarily for U.S. Government intelligence and defense

customers, as well as for commercial customers. We create our

solutions by combining our services and expertise with hardware,

software, and proprietary and patented technology to meet our

customers' requirements. For more information contact Essex

Corporation, 6708 Alexander Bell Drive, Columbia MD 21046; Phone

301.939.7000; Fax 301.953.7880; E-mail , or on the Web at

http://www.essexcorp.com/. This press release contains

"forward-looking statements" within the meaning of the United

States Private Securities Litigation Reform Act of 1995. These

statements are based on management's current expectations and are

subject to risks, uncertainty and changes in circumstances, which

may cause actual results, performance or achievements to differ

materially from anticipated results, performance or achievements.

All statements contained herein that are not clearly historical in

nature are forward looking. Factors, among others, that could cause

actual results to differ materially from those described in the

forward-looking statements include: the satisfaction of the

conditions to closing under the definitive merger agreement,

including receipt of stockholder and regulatory approval; general

industry and market conditions; the ability of either company to

achieve future business objectives; and the risk that the perceived

advantages of the transaction, if consummated, may not be achieved.

More detailed information about these and other factors that could

cause actual results to differ materially from those described in

the forward-looking statements is set forth in Essex's Annual

Report on Form 10-K for the fiscal year ended December 31, 2005.

Essex is under no obligation to (and expressly disclaims any such

obligation to) update or alter its forward-looking statements

whether as a result of new information, future events or otherwise.

Contact: Leonard E. Moodispaw Chairman, CEO & President

301.939.7000 DATASOURCE: Essex Corporation CONTACT: Leonard E.

Moodispaw, Chairman, CEO & President of Essex Corporation,

+1-301-939-7000 Web site: http://www.essexcorp.com/

Copyright

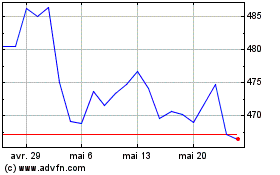

Northrop Grumman (NYSE:NOC)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

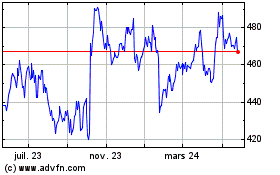

Northrop Grumman (NYSE:NOC)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024