U.S. Postal Contract for NOC - Analyst Blog

30 Novembre 2012 - 12:50PM

Zacks

Northrop Grumman

Corporation (NOC) was awarded a three-year contract to

operate its central repair facility in Topeka, Kansas by the U.S.

Postal Service. The program provides repair services for the Postal

Service mail processing equipment, including electronic, mechanical

and hydraulic equipment as well as reverse engineering and

fabrication services. The contract is worth more than $30

million.

Going forward, Northrop Grumman’s strong balance sheet and cash

flows provide substantial financial flexibility and a cushion for

improving shareholder value through incremental dividend, ongoing

share repurchases and earnings accretive acquisitions. In the third

quarter of 2012, the company repurchased 4.4 million shares for

approximately $290 million. At the end of the first nine months of

2012, the company had a low long-term debt-to-capitalization of

27.0%. Total long-term debt was approximately $3.9 billion, with no

significant maturities in the near term, along with cash holdings

of $3.5 billion.

Falls Church, Virginia-based Northrop Grumman Corporation is one of

the largest defense contractors in the U.S. The company supplies a

broad array of products and services to the U.S. Department of

Defense including electronic systems, information technology,

aircraft, space technology, and systems integration services. The

positive case for Northrop Grumman stems from revenue growth across

the board and a broad diversification of programs.

Northrop Grumman offers a strong program portfolio positioned to

take advantage of focus areas in the defense space, an improving

balance sheet and an ongoing share repurchase program. Also, its

product line in high priority categories, such as defense

electronics, unmanned aircraft and missile defense, gives Northrop

Grumman an edge over competition.

Northrop Grumman’s backlog is expected to see further upside in the

near future through unmanned aerial vehicle (UAV) platforms,

including Broad Area Maritime Surveillance (BAMS), Fire Scout and

Navy Unmanned Combat Air System (UCA).

Going forward, Northrop Grumman offers a strong program portfolio

positioned to take advantage of focus areas in the defense space,

an improving balance sheet and an ongoing share repurchase

program.

However, these are offset by apprehension regarding defense

cutbacks on high-cost platform programs, over-exposure to the DoD

budget, lower backlog, cost over-runs and reductions in Afghanistan

and Iraq operations.

Like its peers, Embraer SA (ERJ) and

General Dynamics Corporation (GD), the company

presently retains a short-term Zacks #3 Rank (Hold) that

corresponds with our long-term Neutral recommendation on the

stock.

EMBRAER AIR-ADR (ERJ): Free Stock Analysis Report

GENL DYNAMICS (GD): Free Stock Analysis Report

NORTHROP GRUMMN (NOC): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

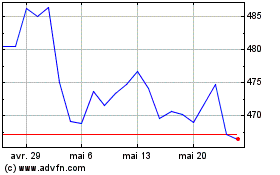

Northrop Grumman (NYSE:NOC)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

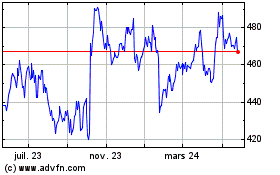

Northrop Grumman (NYSE:NOC)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024