More Orders for Boeing's 737 MAX - Analyst Blog

03 Janvier 2013 - 1:45PM

Zacks

The Boeing Company (BA) has received an order

worth $6 billion at current list prices for 60 737 MAX airplanes

from Aviation Capital Group (“ACG”). The order, consisting of 50

737 MAX 8s and 10 737 MAX 9s was finalized last month.

The Boeing 737 MAX – is a new family of aircraft being developed by

Boeing Commercial Airplanes. It is based on the Boeing 737

Next-Generation family and is the fourth generation of the 737

family.

The Boeing 737 MAX is an improvised version of the Next-Generation

737. It has more advanced fuel efficiency as it is equipped with

new LEAP-1B engines from CFM International and improvements such as

the Advanced Technology Winglet. Apart from maintaining an 8%

operating cost advantage, Boeing 737 MAX’s developed technology

reduces fuel burn and CO2 emissions by nearly 13%. Moreover, its

noise footprint is 40% smaller than other current single-aisle

airplanes. The first delivery of 737 MAX is expected in 2017.

These non-comparable efficiencies have helped Boeing in creating a

remarkable number of orders. With this order in hand, Boeing now

has orders for 1,029 737 MAX airplanes from airlines and leasing

companies worldwide. In October 2012, Boeing had also received an

order worth $5 billion for 20 737 MAX 8s, 17 737 MAX 9s and 13

Next-Generation 737-900ERs.

Boeing is trying to move hand in hand with the growing number of

orders. During the first quarter of 2012, production had increased

from 31.5 to 35 airplanes per month. The company continues to

increase the production rate to 38 airplanes per month beginning in

2013 and 42 airplanes per month beginning in 2014. In first half of

2012, the majority of orders received were for 737 MAX.

Based in Chicago, Boeing Company is a premier jet aircraft

manufacturer and one of the largest defense contractors in the U.S.

The company’s customers include domestic and foreign airlines, the

U.S. Department of Defense, the Department of Homeland Security,

the National Aeronautics and Space Administration, other aerospace

prime contractors, and certain U.S. government and commercial

communications customers.

The Boeing Company is among the best positioned in its sector due

to its balanced exposure to commercial aircraft and defense

equipment. Boeing’s revenue exposure is spread across more than 90

countries around the globe.

Due to the continuing recovery of the global economy, demand for

Boeing’s Commercial Airplanes is benefiting from a steady

improvement in passenger and freight traffic. Moreover, this

continuous increase in number of orders would boost the company’s

top and bottom lines.

However, headwinds over the global airline industry along with

expected cutbacks in the U.S. defense budget are the major

concerns. The company presently retains a short-term Zacks #3 Rank

(Hold) that corresponds with our long-term Neutral recommendation

on the stock.

The company mainly competes with Lockheed Martin

Corporation (LMT) and Northrop Grumman

Corporation (NOC).

BOEING CO (BA): Free Stock Analysis Report

LOCKHEED MARTIN (LMT): Free Stock Analysis Report

NORTHROP GRUMMN (NOC): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

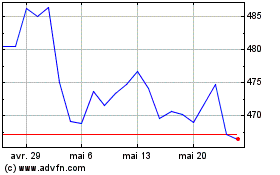

Northrop Grumman (NYSE:NOC)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

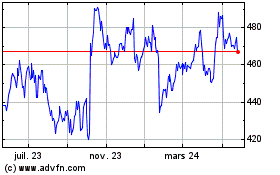

Northrop Grumman (NYSE:NOC)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024