Mutual Fund Summary Prospectus (497k)

18 Janvier 2013 - 8:15PM

Edgar (US Regulatory)

Ivy Micro Cap Growth Fund

Summary Prospectus | December 18, 2012, as supplemented January 18, 2013

Share Class (Ticker):

Class R Shares (IYMRX)

Before you invest, you may want to review the Fund’s prospectus, which contains more information about the Fund and

its risks. You can find the Fund’s prospectus and other information about the Fund (including the Fund’s SAI) online at

www.ivyfunds.com/prospectus

. You can also get this information at no cost by calling 800.777.6472 or by sending

an e-mail request to

IMCompliance@waddell.com

. You can also get this information from your investment provider. The Fund’s prospectus and SAI dated December 18, 2012 (as each may be amended or supplemented) are incorporated herein by

reference.

Objective

To seek to

provide growth of capital.

Fees and Expenses

This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund.

Shareholder Fees

|

|

|

|

|

|

|

(fees paid directly from your investment)

|

|

Class R

|

|

|

Maximum Sales Charge (Load) Imposed on Purchases

(as a % of offering price)

|

|

|

None

|

|

|

Maximum Deferred Sales Charge (Load)

(as a % of lesser of amount invested or redemption value)

|

|

|

None

|

|

Annual Fund Operating Expenses

|

|

|

|

|

|

|

(expenses that you pay each year as a % of the value of your investment)

|

|

Class R

|

|

|

Management Fees

|

|

|

0.95%

|

|

|

Distribution and Service (12b-1) Fees

|

|

|

0.50%

|

|

|

Other Expenses

|

|

|

0.47%

|

1

|

|

Total Annual Fund Operating Expenses

|

|

|

1.92%

|

|

|

Fee Waiver and/or Expense Reimbursement

|

|

|

0.00%

|

|

|

Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement

|

|

|

1.92%

|

|

|

1

|

The percentage shown for Other Expenses is based on estimated amounts for the current fiscal year.

|

Example

This example is

intended to help you compare the cost of investing in the shares of the Fund with the cost of investing in other mutual funds.

The example assumes that you invest $10,000 in the particular class of shares of the Fund for the time periods indicated and then redeem all your

shares at the end of those periods. The example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions,

your costs would be:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 Year

|

|

|

3 Years

|

|

|

5 Years

|

|

|

10 Years

|

|

|

Class R Shares

|

|

$

|

195

|

|

|

$

|

603

|

|

|

$

|

1,037

|

|

|

$

|

2,243

|

|

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio

turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s

performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 78% of the average value of its portfolio.

Principal

Investment Strategies

Ivy Micro Cap Growth Fund seeks to achieve its objective by investing, under normal circumstances, at least 80% of

its net assets in equity securities of micro cap companies. Micro cap companies typically are companies with float-adjusted market capitalizations below $1 billion at the time of acquisition. The Fund primarily invests in common stock, which may

include common stocks that are offered in initial public offerings (IPOs).

In selecting equity securities for the Fund, Wall Street Associates, LLC (WSA), the Fund’s investment

subadviser, utilizes a bottom-up stock selection process and seeks to invest in securities of companies that it believes exhibit extraordinary earnings growth, earnings surprise potential, fundamental strength and management vision.

Generally, in determining whether to sell a security, WSA uses the same type of analysis that it uses in buying securities. For example, WSA may sell a

security if it determines that the issuer’s growth and/or profitability characteristics are deteriorating or the issuer no longer maintains a competitive advantage, when more attractive investment opportunities arise, when WSA believes a

company’s valuation has become unattractive relative to industry leaders and industry-specific metrics, to reduce the Fund’s holding in that security or its exposure to a particular sector, or to raise cash.

Principal Investment Risks

As with any mutual

fund, the value of the Fund’s shares will change, and you could lose money on your investment. The Fund is not intended as a complete investment program. A variety of factors can affect the investment performance of the Fund and prevent it from

achieving its objective. These include:

|

n

|

|

Company Risk

. A company may perform worse

than the overall market due to specific factors, such as adverse changes to its business or investor perceptions about the company.

|

|

n

|

|

Growth Stock Risk

. Prices of growth stocks

may be more sensitive to changes in current or expected earnings than the prices of other stocks. Growth stocks may not perform as well as value stocks or the stock market in general.

|

|

n

|

|

Initial Public Offering Risk

. Investments in

IPOs can have a significant positive impact on the Fund’s performance; however, any positive effect of investments in IPOs may not be sustainable because of a number of factors. Namely, the Fund may not be able to buy shares in some IPOs, or

may be able to buy only a small number of shares. Also, the Fund may not be able to buy the shares at the commencement of the offering, and the general availability and performance of IPOs are dependent on market psychology and economic conditions.

To the extent that IPOs have had a significant impact on the Fund’s performance, such may not be able to be replicated in the future.

|

|

n

|

|

Liquidity Risk

. Generally, a security is

liquid if the Fund is able to sell the security at a fair price within a reasonable time. Liquidity is generally related to the market trading volume for a particular security. Illiquid securities may trade at a discount from comparable, more liquid

investments, and may be subject to wider fluctuations in market value. Less liquid securities are more difficult to dispose of at their recorded values and are subject to increased spreads and volatility. Also, the Fund may not be able to dispose of

illiquid securities when that would be beneficial at a favorable time or price.

|

|

n

|

|

Management Risk

. Fund performance is

primarily dependent on WSA’s skill in evaluating and managing the Fund’s portfolio and the Fund may not perform as well as other similar mutual funds.

|

|

n

|

|

Market Risk

. Adverse market conditions,

sometimes in response to general economic or industry news, may cause the prices of the Fund’s holdings to fall as part of a broad market decline. The financial crisis in the U.S. and foreign economies over the past several years, including the

European sovereign debt crisis, has resulted, and may continue to result, in an unusually high degree of volatility in the financial markets, both U.S. and foreign, and in the NAVs of many mutual funds, including to some extent the Fund. Global

economies and financial markets are becoming increasingly interconnected, which increases the possibilities that conditions in one country or region may adversely affect issuers in another country or region, which may adversely affect securities

held by the Fund. These circumstances have also decreased liquidity in some markets and may continue to do so. In addition, certain unanticipated events, such as natural disasters, terrorist attacks, and other geopolitical events, can have a

dramatic adverse effect on securities held by the Fund.

|

|

n

|

|

Small Company Risk

. Equity securities of

small to micro capitalization companies are subject to greater price volatility, lower trading volume and less liquidity due to, among other things, such companies’ small size, limited product lines, limited access to financing sources and

limited management depth. In addition, the frequency and volume of trading of such securities may be less than is typical of larger companies, making them subject to wider price fluctuations. In some cases, there could be difficulties in selling

securities of small to micro capitalization companies at the desired time.

|

Performance

The chart and table below provide some indication of the risks of investing in the Fund. The chart shows how performance has varied from year to year for

Class A shares. The table shows the average annual total returns for Class A shares of the Fund and also compares the performance with those of broad-based securities market indices and a Lipper peer group (a universe of mutual funds with

investment objectives similar to that of the Fund).

Because Class R shares do not have any performance history, the annual returns in the bar

chart, the best and worst quarter returns and the average annual total return chart are those of the Fund’s Class A shares, which are not offered in this prospectus. The annual returns in the bar chart are for the Fund’s Class A

shares without reflecting payment of any front-end sales charge; if they did reflect payment of sales charges, annual returns would be lower. Performance for Class R shares would be similar because the shares are invested in the same portfolio of

securities and have the same portfolio management. Class R shares are not subject to a sales charge, but have a higher distribution fee. Please see the section entitled “Your Account.”

After-tax returns are calculated using the historical highest individual Federal marginal income tax rates and do not reflect the impact of state and

local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns are not relevant to

investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts (IRAs), or to shares held by non-taxable entities. Return After

Taxes on Distributions and Sale of Fund Shares may be better than Return Before Taxes due to an assumed tax benefit from losses on a sale of the Fund’s shares at the end of the period. After-tax returns are shown only for the Class A

shares; after tax returns for Class R shares of the Fund will vary from those shown.

Performance results may include the effect of expense

reduction arrangements for some or all of the periods shown. If those arrangements had not been in place, the performance results for those periods would have been lower.

The Fund’s past performance (before and after taxes) does not necessarily indicate how it will perform in the future. Current performance may be lower or higher. Please visit

www.ivyfunds.com

or call 800.777.6472 for the Fund’s updated performance.

Chart of Year-by-Year Returns

as of December 31 each year

|

|

|

|

|

|

|

In the period shown in the chart, the highest quarterly return was 20.33% (the fourth quarter of 2010) and the lowest quarterly return was -25.41% (the third quarter of 2011). The Class A

return for the year through September 30, 2012 was -3.01%.

|

Average Annual Total Returns

|

|

|

|

|

|

|

|

|

|

|

as of December 31, 2011

|

|

1 Year

|

|

|

Life of

Class

|

|

|

Class A

(began on 02-17-2009)

|

|

|

|

|

|

|

|

|

|

Return Before Taxes

|

|

|

-12.94%

|

|

|

|

21.50%

|

|

|

Return After Taxes on Distributions

|

|

|

-14.52%

|

|

|

|

20.01%

|

|

|

Return After Taxes on Distributions and Sale of Fund Shares

|

|

|

-7.10%

|

|

|

|

18.42%

|

|

|

|

|

|

|

|

|

|

|

|

|

Indexes

|

|

1 Year

|

|

|

Life of

Class

|

|

|

Russell 2000 Growth Index (reflects no deduction for fees, expenses or taxes)

(Life of Class index comparison begins on

March 1, 2009)

|

|

|

-2.91%

|

|

|

|

28.50%

|

|

|

Russell Microcap Growth Index (reflects no deduction for fees, expenses or taxes)

(Life of Class index comparison begins on

March 1, 2009)

|

|

|

-8.43%

|

|

|

|

27.29%

|

|

|

Lipper Small-Cap Growth Funds Universe Average (net of fees and expenses)

(Life of Class index comparison begins on

March 1, 2009)

|

|

|

-3.43%

|

|

|

|

27.38%

|

|

Investment Adviser

The Fund is managed by Ivy Investment Management Company (IICO) and sub-advised by Wall Street Associates, LLC (WSA).

Portfolio Managers

The WSA Investment Team is

primarily responsible for the day-to-day management of the Fund. The WSA Investment Team consists of William Jeffery III, President and Chief Investment Officer of WSA, Kenneth F. McCain, Executive Vice President of WSA, Paul J. Ariano, Senior Vice

President of WSA, Paul K. LeCoq, Senior Vice President of WSA, Luke A. Jacobson, Vice President of WSA, and Alexis C. Waadt, Vice President of WSA. They have each co-managed the Fund since its inception in February 2009, except for Mr. Jacobson

who became a co-manager in January 2012 and Ms. Waadt who became a co-manager in January 2013.

Purchase and Sale of Fund Shares

The Fund’s shares are redeemable. You may purchase or redeem shares at the Fund’s NAV per share next calculated after your order is received in

proper form, subject to any applicable sales charge, on any business day through your dealer or financial adviser or by writing to WI Services Company, P.O. Box 29217, Shawnee Mission, Kansas 66201-9217. If your individual account is not maintained

on the Fund’s shareholder servicing system, please contact your selling broker-dealer, plan administrator or third-party record keeper to sell shares of the Fund.

Please check with your selling broker-dealer, plan administrator or third-party record keeper to sell Class R shares of the Fund and for information about minimum investment requirements. The Fund and/or

Ivy Funds Distributor, Inc. (IFDI) may reduce or waive the minimums in some cases.

Tax Information

The Fund’s distributions are generally taxable to you as ordinary income, long-term capital gain, or a combination of the two, unless you are

investing through a tax-deferred arrangement, such as a 401(k) plan or an individual retirement account.

Payments to Broker-Dealers and other Financial Intermediaries

If you purchase the Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund and/or IICO and/or its affiliates may pay the

intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your

salesperson or visit your financial intermediary’s web site for more information.

IVSUM-IYMRX

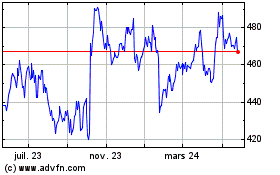

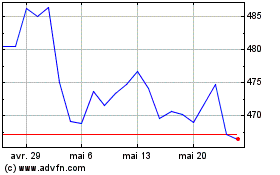

Northrop Grumman (NYSE:NOC)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Northrop Grumman (NYSE:NOC)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024