GD Misses on Charges and Budget - Analyst Blog

23 Janvier 2013 - 4:39PM

Zacks

Defense and aerospace operator General Dynamics

Corporation (GD) announced fourth quarter and full year

2012 earnings. The company reported fourth quarter earnings of

$1.39 per share, missing the Zacks Consensus Estimate of $1.90 per

share.

The reported figures were below the year-ago figure of $2.20 per

share. The results reflect negative impact of defense budget.

Including one-time charges of $7.46 per share related to the

goodwill impairment and other charges, the company’s GAAP loss per

share was $6.07 as compared to earnings per share of $1.69 in the

year-ago period.

Pro forma earnings per share for full year 2012 were $6.48, down

from the Zacks Consensus Estimate of $7.10 and the year-ago figure

of $7.46. Including one-time charges of $7.42, GAAP loss per share

was 94 cents versus earnings per share of $6.87 in the year-ago

period.

Total Revenue

General Dynamics generated total revenue of $8.08 billion in the

reported quarter versus $9.15 billion in the year-ago quarter,

reflecting a decrease of 11.7%. The year-over-year decrease in

revenue reflects declining revenues at all segments, except

Aerospace. Reported quarter revenue also failed to meet the Zacks

Consensus Estimate by $731 million.

In full year 2012, the company clocked revenue of $31.51 billion,

down 3.56% year over year. The top line also failed to meet the

Zacks Consensus Estimate of $32.71 billion.

In the reported quarter, operating loss was $1.90 billion compared

with an operating profit of $0.95 billion in the year-ago period.

The company reported operating income of $0.83 billion for full

year 2012, down from $3.83 billion in the year-ago period.

At the end of fourth quarter 2012, the company’s total backlog was

$51.3 billion compared with $57.4 billion at the end of the fourth

quarter of 2011. Total potential contract value at the end of

fourth quarter 2012 was $78.1 billion versus $85.4 billion at the

end of fourth quarter 2011.

Segment Performance

The Aerospace segment reported revenues of $1.86 billion in the

fourth quarter, up 0.2% from the prior-year period.

Combat Systems reported quarterly revenue of $1.98 billion, down

24.3% year over year. During the quarter, the segment received a

contract worth $355 million for Stryker wheeled combat vehicle

program, contractor logistics support and for the production of 62

Nuclear, Biological, Chemical Reconnaissance vehicles.

Marine Systems reported revenue of $1.66 billion, down 5.3% from

the year-earlier period. The segment received a sizeable contract

worth $1.8 billion for research and development work for a new

class of ballistic-missile submarines under the Ohio Replacement

Program. It also received many other contracts.

Information Systems and Technology reported revenue of $2.58

billion, reflecting a decline of 11.8% from the previous year. In

the fourth quarter of 2012, the segment received a contract for the

production of 3,726 Handheld, Manpack and Small Form-Fit (HMS)

radios and accessory kits worth $250 million.

Financial Condition

Cash and cash equivalents as of Dec 31, 2012 were $3.30 billion

year over year, up from $2.65 billion at the end of Dec 31, 2011.

For full-year 2012, long-term debts were $3.91 billion,

approximately flat year over year.

In full year 2012, capital expenditure of the company decreased to

$0.45 billion from $0.46 billion in the year-ago period. Net cash

provided by operating activities were $2.69 billion in full year

2012, down 17% year over year.

Guidance

The company expects earnings from continuing operations to be in

the range of $6.60 to $6.70 per share.

Our Take

General Dynamics missed the Zacks Consensus Estimates. The results

indicate that some of its markets are contracting as government

budgets dip. However, the company’s ability to get consistent

contracts will boost the top line going forward. Moreover, its

relevant product and service offerings are important for its

customers.

Like Northrop Grumman Corporation (NOC), and

Raytheon Co. (RTN), General Dynamics presently

retains a short-term Zacks Rank #3 (Hold). One other Zacks Rank #3

(Hold) rating company Textron Inc. (TXT) also

announced fourth quarter 2012 adjusted earnings of 56 cents per

share versus 49 cents in the year-ago quarter. The fourth quarter

result, however, came below the Zacks Consensus Estimate of 57

cents.

GENL DYNAMICS (GD): Free Stock Analysis Report

NORTHROP GRUMMN (NOC): Free Stock Analysis Report

RAYTHEON CO (RTN): Free Stock Analysis Report

TEXTRON INC (TXT): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

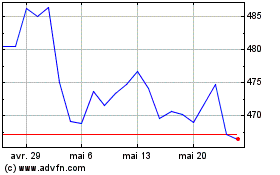

Northrop Grumman (NYSE:NOC)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

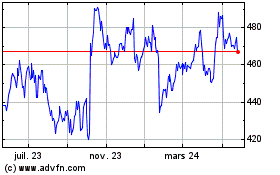

Northrop Grumman (NYSE:NOC)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024