Northrop Beats, Provides Guidance - Analyst Blog

30 Janvier 2013 - 10:50AM

Zacks

Los Angeles-based leading defense contractor, Northrop

Grumman Corporation (NOC), reported fourth quarter and

full-year 2012 results. The company reported earnings of $2.06 per

share compared with $1.85 in the fourth quarter of 2011. The

reported figures also comfortably surpassed the Zacks Consensus

Estimate of $1.74 per share.

The upside in earnings was attributable to improved performance and

lower share count. However, this was partially offset by higher

effective tax rate.

Full-year 2012 earnings came in at $7.47 per share, up 15.1% year

over year. The results also easily exceeded the Zacks Consensus

Estimate of $6.64 per share.

Operational Performance

Sales for the reported quarter decreased 0.5% year over year to

$6.5 billion. However, they were above the Zacks Consensus Estimate

by $154 million.

Full year 2012 revenue was $25.2 billion, down 4.5% year over year.

Full year revenue came below than the Zacks Consensus Estimate by

$112 million.

Northrop Grumman’s total order backlog at the end of full year 2012

stood at $40.8 billion compared with $39.5 billion at the end of

2011. New contract in full year 2012 was $26.5 billion.

Operating income in the fourth quarter of 2012 was $793 million, up

13.1% year over year. In the reported quarter, earnings from

continuing operations decreased to $533 million from $550 million

in the fourth quarter of 2011. Net earnings in the reported quarter

decreased to $533 million from $548 million in the prior-year

period.

Segment Performance

Aerospace Systems

Aerospace Systems’ quarterly sales were up 6.6% year over year to

$2.6 billion driven by higher volumes for unmanned systems, F-35

and Advanced Extremely High Frequency satellite programs. However,

these were partially offset by declines in the F/A-18 and Joint

Surveillance Target Attack Radar System programs as well as lower

volume for restricted space programs and the termination of a

weather satellite program.

Electronic Systems

Electronic Systems sales declined 5% to $1.8 billion. The decline

reflects lower volume for infrared countermeasures, LITENING

targeting systems, and postal automation programs. These declines,

however, were partially offset by higher volume for space and

international programs.

Information Systems

Information Systems sales of $1.9 billion were 1.6% lower than the

year-ago period. The downside reflects wind down and completion of

several programs and divestiture of Park Air Norway in Apr 2012.

However, these declines were partially offset by higher volume for

Consolidated Afloat Network & Enterprise Services and the

F-35.

Technical Services

Technical Services’ sales decreased 6.6% to $738 million due to

portfolio shaping actions and lower volume for the KC-10 and ICBM

programs.

Financial Condition

Northrop Grumman ended 2012 with cash and cash equivalents of

approximately $3.9 billion, up from $3 billion at year-end 2011.

Long-term debt remained approximately flat year over year at $3.9

billion at the end of Dec 31, 2012. Cash generated from operations

in 2012 totaled $2.6 billion versus cash from operations of $2.1

billion in the year-ago period.

In full-year 2012, the company repurchased 20.9 million shares of

its common stock for $1.3 billion. As of Dec 31, 2012, the company

had $1.5 billion remaining under its current share repurchase

authorization.

Guidance

The company expects revenue to be approximately $24 billion in

2013. It expects earnings from continuing operations to be in

the range of $6.85 to $7.15 in 2013. Cash provided by operations

before discretionary pension contributions are expected to be in

the range of $2.1 billion to $2.4 billion.

Our Take

Northrop surpassed the top and bottom line expectations due to its

strong presence in the current focus areas of cyber security,

modernization of defense and homeland security assets,

intelligence, surveillance and reconnaissance systems, advanced

electronics and software development. Moreover, the company’s focus

on effective cash deployment, and portfolio alignment would bring

more healthy results in the current quarter.

However, we remained concerned due to the apprehension regarding

defense cutbacks on high-cost platform programs, over-exposure to

the Department of Defense budget, cost over-runs and reductions in

the Afghanistan and Iraq operations. The company presently retains

a short-term Zacks Rank #3 (Hold).

Falls Church, Virginia-based Northrop Grumman Corporation supplies

a broad array of products and services to the U.S. Department of

Defense, including electronic systems, information technology,

aircraft, space technology, and systems integration services.

Other stocks to consider are Huntington Ingalls Industries,

Inc. (HII) and Esterline Technologies

Corp. (ESL) that carry a Zacks Rank #1 (Strong Buy) and

Lockheed Martin Corporation (LMT) with a Zacks

Rank #2 (Buy).

ESTERLINE TECHN (ESL): Free Stock Analysis Report

HUNTINGTON INGL (HII): Free Stock Analysis Report

LOCKHEED MARTIN (LMT): Free Stock Analysis Report

NORTHROP GRUMMN (NOC): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

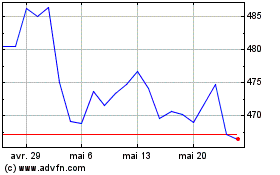

Northrop Grumman (NYSE:NOC)

Graphique Historique de l'Action

De Juil 2024 à Août 2024

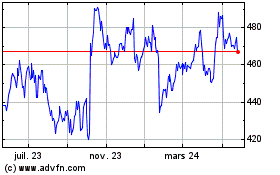

Northrop Grumman (NYSE:NOC)

Graphique Historique de l'Action

De Août 2023 à Août 2024