Will Raytheon (RTN) Beat Earnings Estimates This Quarter? - Analyst Blog

23 Juillet 2013 - 6:10PM

Zacks

We expect aerospace and defense

company Raytheon Company (RTN) to beat

expectations when it reports second-quarter 2013 results on Jul 25,

2013.

Why a Likely Positive Surprise?

Our proven model shows that Raytheon is likely to beat earnings

because it has the right combination of key factors.

Positive Zacks ESP: Expected Surprise Prediction

or ESP (Read: Zacks Earnings ESP: A Better Method), which

represents the difference between the Most Accurate estimate and

the Zacks Consensus Estimate, is +1.54%. This is meaningful and a

leading indicator of a likely positive earnings surprise for this

company.

Zacks #3 Rank (Hold): We note that stocks with

Zacks Ranks of #1, 2 and 3 have a significantly higher chance of

beating earnings. The Sell rated stocks (#4 and 5) should never be

considered going into an earnings announcement.

The combination of Raytheon’s Zacks Rank #3 (Hold) and +1.54% ESP

make us confident of a positive earnings beat on Jul 25.

What is Driving the Better than Expected

Earnings?

We view Raytheon as one of the well-positioned companies among the

large-cap defense players due to its non-platform-centric focus.

This factor shields the company from program specific risks related

to cancellation or deferral of any specific program.

Raytheon is flooded with a number of contracts from several

national as well as international government establishments. On Jul

8 2013, the company was awarded a cost-plus-incentive-fee contract,

worth $279.4 million, by the U.S. Department of Defense (DoD) to

develop a new electronic jammer for the U.S. Navy.

Apart from domestic contracts, Raytheon is progressing well on

foreign military sales opportunities, including the Kuwait Patriot,

the Oman ground-based air defense system, radars and missiles. We

believe international sales continue to be a key source of future

revenue generation for the company.

The positive trend is seen in the trailing four quarter average

surprise of 19.90%. The company’s first-quarter 2013 surprise was

21.87%. Benefits from an effective cash deployment strategy and

operational improvements aided the surprise.

Other Stocks to Consider

Raytheon is not the only organization looking up this earnings

season. We also see other aerospace and defense players to beat

earnings.

The Boeing Company (BA), Earnings ESP of +1.27%

and Zacks Rank #2 (Buy).

General Dynamics Corporation (GD), Earnings ESP of

+0.61% and Zacks Rank #3 (Hold).

Northrop Grumman Corporation (NOC), Earnings ESP

of + 0.59% and Zacks Rank #3 (Hold).

BOEING CO (BA): Free Stock Analysis Report

GENL DYNAMICS (GD): Free Stock Analysis Report

NORTHROP GRUMMN (NOC): Free Stock Analysis Report

RAYTHEON CO (RTN): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

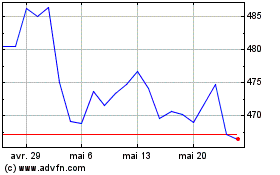

Northrop Grumman (NYSE:NOC)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

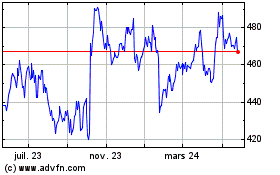

Northrop Grumman (NYSE:NOC)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024