Lockheed Wins LRLAP Deal - Analyst Blog

25 Septembre 2013 - 12:05AM

Zacks

Aerospace and defense major Lockheed Martin

Corporation (LMT) continues to receive U.S. Department of

Defense (DoD) contracts in spite of the threat of sequestration.

The company recently won a contract from the National Warhead and

Energetic Consortium to bring the Long Range Land Attack Projectile

(LRLAP) to production.

The contract calls for Lockheed to develop production line tooling,

check equipment and manufacturing process plans for the initial

phase of production. The control unit will be assembled at Lockheed

Martin's Ocala, FL facility, while the ultimate assembly of LRLAP

will be at its Troy, AL facility.

LRLAP is an advanced new variety of GPS-guided artillery system

that integrates conventional artillery guns and rocketry with

existing lightweight guns. With a maximum range of over 63 nautical

miles (72 miles), LRLAP is the longest-range projectile in the

Navy’s history that enables the naval force to deliver 24-pound

payloads well over the horizon.

Lockheed Martin – the largest defense contractor in the world – has

a wide customer base comprising the U.S. government, foreign

governments and other commercial buyers.

Sequestration and spending cuts were expected to adversely impact

the performance of the defense behemoths that explicitly provide

products and services to these defense establishments. However, the

defense players seem to be doing well despite the cuts in defense

budgets and big-ticket programs. Small contracts doled out by the

DoD have kept alive the revenue stream of these companies.

Lockheed has, in fact, clinched a major share of DoD contracts

awarded on Sep 20, 2013. Of the total $4.95 billion worth of DoD

contracts, Lockheed sealed approximately 81% of the amount,

comprising five modification contacts. The biggest share of these

multiple contracts, with a value of $3.92 billion, would pay for

the production of Terminal High Altitude Area Defense (THAAD)

missiles for the U.S. armed forces and also for United Arab

Emirates.

Lockheed Martin presently retains a short-term Zacks Rank #1

(Strong Buy). We are impressed by the company’s strong operational

performance that drove management to raise its full-year earnings

guidance to $9.20–9.50 from $8.80–9.10.

Other stocks that are also worth considering in the space include

Northrop Grumman Corp. (NOC), Raytheon

Co. (RTN) and Alliant Techsystems Inc.

(ATK). While Alliant Techsystems carries a Zacks Rank #1 (Strong

Buy), Northrop and Raytheon hold a Zacks Rank #2 (Buy).

ALLIANT TECHSYS (ATK): Free Stock Analysis Report

LOCKHEED MARTIN (LMT): Free Stock Analysis Report

NORTHROP GRUMMN (NOC): Free Stock Analysis Report

RAYTHEON CO (RTN): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

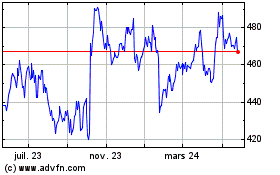

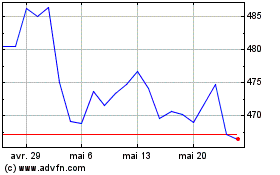

Northrop Grumman (NYSE:NOC)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Northrop Grumman (NYSE:NOC)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024