Earnings Beat at Northrop, Backlog Falls - Analyst Blog

31 Janvier 2014 - 4:40PM

Zacks

Northrop Grumman

Corp. (NOC) reported fourth quarter 2013 results before

the opening bell today. Adjusted earnings per share of $2.00

comfortably surpassed the Zacks Consensus Estimate of $1.94 by

3.1%. The earnings beat was attributable to a lower share count and

strong operating performance. However, the bottom line came in

below the year-ago figure of $2.06 by 2.9% mainly due to lower

revenue generation.

Full year 2013 adjusted earnings came in at $7.88 per share, below

our forecast of $8.16 by 3.4%. Yet, the company managed to lift its

full year earnings on a year-over-year basis by 5.5%.

Operational Update

Sales in the reported quarter declined 4.9% to $6,157 million from

$6,476 million in the year-ago quarter. However, quarterly revenues

surpassed the Zacks Consensus Estimate of $6,019 million by

2.3%.

In 2013, the company’s top line slipped 2.2% year over year to

$24,661 million but beat the Zacks Consensus Estimate of $24,509

million. While revenues at the Aerospace and Electronics segments

increased, Information Systems and Technical Systems saw a downward

movement in revenues.

Northrop Grumman’s total order backlog as of Dec 31, 2013 was

$37,033 million, down from $40,809 million as of Dec 31, 2012. Of

the backlog, $18,321 million belonged to Aerospace Systems and

$9,037 million to Electronics Systems. The rest of the backlog

comprised $6,864 million for Information Systems and $2,811 million

for Technical Services.

During the quarter under review, the company received new contracts

worth $5.7 billion with a book-to-bill of 92%. For the year 2013,

new contracts totaled $21.9 billion and the book-to-bill was 89%.

The decline in backlog reflects a cautious stance on the part of

customers in response to the current U.S. government budget

environment.

Quarterly Segmental Revenue

Aerospace Systems: Aerospace Systems’ quarterly

sales decreased 6.6% year over year to $2,432 million. The decline

reflects lower volume from unmanned as well as space programs.

These were, however, partially offset by higher sales for the James

Webb Space Telescope.

Electronic Systems: Segment sales climbed 6.1%

year over year to $1,883 million. The increase reflects higher

volume for international, combat avionics as well as space

programs. These increases were partially offset by lower volume for

navigation and maritime systems programs.

Information Systems: Sales at the segment were

$1,614 million, down 14.1% year over year. The decline reflects

lower funding levels and contract completions across the board.

Technical Services: Technical Services’ quarterly

sales dropped 6.4% year over year to $691 million due to lower

volume for integrated logistics and modernization programs and

lower volume for the ICBM program.

Financial Condition

Cash and cash equivalents as of Dec 31, 2013 were $5,150 million

versus $3,862 million as of Dec 31, 2012. Long-term debt, net of

current portion as of Dec 31, 2013 was $5,928 million versus $3,930

million as of Dec 31, 2012. Net cash provided by operating

activities during 2013 decreased to $2,483 million from $2,640

million in the year-ago period.

During the fourth quarter of 2013, the company repurchased 6.6

million shares of its common stock, bringing the number to 20.8

million shares repurchased to date. Northrop has plans to buy back

60 million shares of its outstanding common stock by the end of

2015.

Guidance

For full-year 2014, Northrop Grumman expects revenues between

$23,500 million and $23,800 million. Earnings per share are

expected in the range of $8.70 to $9.00 while the Zacks Consensus

Estimate for 2014 is lower at $8.53.

Northrop Grumman expects total operating margin on the higher side

of the 12% range and free cash flow in the $1,700–$2,000 million

range.

At the Peers

Yesterday, aerospace giant The Boeing Company (BA)

reported stellar fourth quarter 2013 results on the back of solid

performance across the company's businesses and robust deliveries.

Its adjusted fourth quarter 2013 earnings came in at $1.88 per

share, beating the Zacks Consensus Estimate of $1.58 by 19.0% as

well as the year-ago profit of $1.46 by 28.8%.

The world’s largest stand-alone defense contractor,

Lockheed Martin Corp. (LMT), posted fourth quarter

2013 adjusted earnings from continuing operations of $2.38 per

share, comfortably surpassing the Zacks Consensus Estimate of $2.00

by 19.0%. Earnings in the reported quarter also surged almost 21.4%

from the year-ago adjusted profit level of $1.96 per share. The

upcast in earnings was mainly attributable to its strong

operational performance.

Defense and aerospace operator General Dynamics

Corp.’s (GD) fourth-quarter 2013 operating earnings were

$1.76 per share, in line with the Zacks Consensus Estimate.

Earnings were ahead of the year-ago figure of $1.39.

Our View

Northrop Grumman’s top- and bottom-line results succeeded in

beating the Zacks Consensus Estimate driven by the company’s strong

operational performance. The company continues to focus on superior

program performance, effective cash deployment and portfolio

alignment which would sustain the earnings surprise trend.

However, the lower backlog at the end of the reported quarter

evokes concern. This is due to the uncertain and constrained

domestic budget environment.

Northrop Grumman currently carries a short-term Zacks Rank #2

(Buy), while Boeing and Lockheed Martin sport a Zacks Rank #1

(Strong Buy).

BOEING CO (BA): Free Stock Analysis Report

GENL DYNAMICS (GD): Free Stock Analysis Report

LOCKHEED MARTIN (LMT): Free Stock Analysis Report

NORTHROP GRUMMN (NOC): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

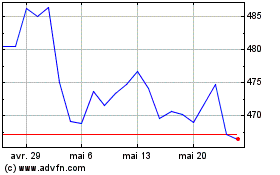

Northrop Grumman (NYSE:NOC)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

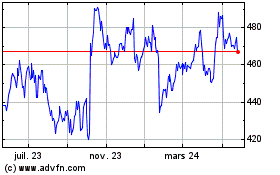

Northrop Grumman (NYSE:NOC)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024