Raytheon's Profit Falls 15% in Third Quarter

22 Octobre 2015 - 2:20PM

Dow Jones News

Raytheon Co. on Thursday reported a 15% slide in third-quarter

profit, although the U.S. defense contractor boosted its full-year

sales guidance as it digested the purchase of a commercial

cybersecurity provider.

Raytheon left its 2015 profit guidance unchanged, unlike rivals

Lockheed Martin Corp. and Boeing Co., though operating cash flow in

the quarter almost trebled to $1.1 billion. It expects net sales

for the full year between $23 billion and $23.3 billion, up from

its previous forecast of $22.7 billion to $23.2 billion.

The maker of Tomahawk missiles and the market-leading Patriot

missile-defense system has differentiated itself from peers by

winning more export deals and pursuing commercial cyber work in the

wake of attacks on government systems, financial-service providers

and retailers. However, Raytheon has struggled to convince

investors that the enlarged cybersecurity business can boost

profits.

Lockheed, Northrop Grumman Corp. and others have focused

relatively more of their free cash on share buybacks and higher

dividends.

Raytheon is betting it can leverage the cybersecurity skills it

honed for the U.S. military and intelligence agencies to sell to

banks and retailers, investing almost $1.7 billion earlier this

year to establish a stand-alone business in an area where its

defense peers have struggled to make money.

The company bought control of Websense Inc. from private-equity

firm Vista Partners LLC in April. Raytheon said Websense, which has

21,000 data-security clients, half of them overseas, will form the

core of a new cyber joint venture with forecast sales of $500

million this year and margins of around 20%.

The Austin, Texas, cyber unit delivered margins of 17.5% in the

third quarter compared with 16.7% a year earlier, the best of

Raytheon's five divisions, three of which reported lower operating

profits.

Net profits fell to $443 million in the three months to Sept. 27

from $519 million a year earlier, with per-share earnings slipping

to $1.47 from $1.66. Sales rose to $5.8 billion from $5.5

billion.

Write to Doug Cameron at doug.cameron@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 22, 2015 08:05 ET (12:05 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

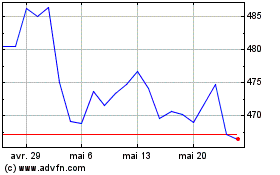

Northrop Grumman (NYSE:NOC)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

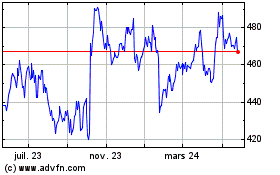

Northrop Grumman (NYSE:NOC)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024