Northrop Grumman Reports Higher Earnings, Outlook

28 Octobre 2015 - 1:40PM

Dow Jones News

Northrop Grumman Corp. posted Wednesday better-than-expect

quarterly results after capturing a hotly sought after government

contract to build long-range bombers for the Air Force.

The Pentagon on Tuesday announced the contract valued at more

than $20 billion. Northrop Grumman was selected over a Boeing Co.

and Lockheed Martin Corp. team to build the first 21 jets to

replace aging B-52 and B-1 warplanes.

On Wednesday, Northrop raised its earnings per share forecast

for the year to a range of $9.70 and $9.80 from a previous

prediction of $9.55 to $9.70. The company also raised the low end

of its sales forecast, now projecting a range of $23.6 billion to

$23.8 billion, compared with $23.4 billion to $23.8 billion.

Northrop has been one of the defense industry's top performers,

with share prices tripling since 2013 when it launched a buyback

effort. For the latest quarter, Northrop repurchased 5.6 million

shares for $944 million, bringing the total for the year so far to

17.7 million shares for $2.9 billion.

Investors had increasingly viewed Northrop's prospects as tied

to the outcome of the award by the Air Force of the contract to

build the new long-range bomber. On Wednesday, shares of the

company rose 6.4% to $192.15 in premarket trading.

Northrop has a big role in the Lockheed-led F-35 fighter, drones

and satellite systems, and plans to shrink to three from four

business units, combining parts of existing operations into a

single mission systems segment.

Beefed-up aerospace and technical-services units complete the

revamped lineup, which Northrop said would help it enhance

innovation.

The company's moves come as senior Pentagon officials have in

recent months been highly critical of established defense

contractors' ability to meet the challenge of more sophisticated

weapons systems being developed by China and Russia.

Overall, the company posted a profit of $516 million, or $2.75 a

share, up from $473 million, or $2.26 a share, a year earlier.

Adjusted for pension-related costs, per-share earnings rose to

$2.41 from $2.32.

Revenue slipped to $5.979 billion from $5.984 billion.

Analysts surveyed by Thomson Reuters forecast per-share earnings

of $2.19 on revenue of $5.86 billion.

Write to Ezequiel Minaya at ezequiel.minaya@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 28, 2015 08:25 ET (12:25 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

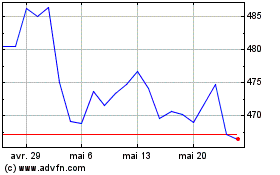

Northrop Grumman (NYSE:NOC)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

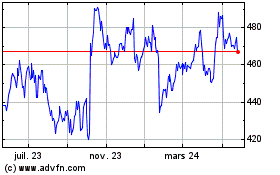

Northrop Grumman (NYSE:NOC)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024