By Doug Cameron

Controversy surrounding the suspected killing of journalist

Jamal Khashoggi is unlikely to derail the multibillion-dollar

relationship that makes Saudi Arabia a top customer of U.S. defense

firms, said industry executives and analysts.

The U.S. and Saudi Arabian governments have a long record of

negotiating contracts that can take years to reach fruition.

President Trump last year heralded nearly $110 billion in potential

deals during a trip to Saudi Arabia in May 2017. Many defense

analysts said that figure includes existing commitments and

contracts that could last as long as 30 years.

Mr. Trump has resisted calls to curb U.S. arms sales to Saudi

Arabia after Turkish officials alleged the kingdom killed Mr.

Khashoggi, a Saudi government critic, in its Istanbul consulate on

Oct. 2. Mr Trump said the planned deals are vital for American

companies and jobs.

The big five U.S. defense companies -- Lockheed Martin Corp.,

Raytheon Co., Boeing Co., Northrop Grumman Corp. and General

Dynamics Corp. -- all report earnings next week. Analysts are

expected to ask executives how the circumstances of Mr. Khashoggi's

disappearance might affect their business. Few expect them to

address the matter directly. All of the companies declined comment

for this story.

"We continue to believe that the death of Jamal Khashoggi will

not lead to a major break in U.S. or European defense sales to

Saudi Arabia," said Byron Callan at Capital Alpha LLC. Mr. Callan

estimated that Saudi Arabia accounts for about 5% of sales at the

big U.S. defense companies.

The specialized nature of weapons and defense systems from

companies such as Boeing, Lockheed Martin and Raytheon make them a

preferred supplier to the oil-rich monarchy, industry executives

and analysts said.

The U.S. and Saudi defense industries are becoming increasingly

intertwined, with American companies establishing joint ventures in

the Kingdom to make parts or providing repair services.

Saudi Arabia is the world's third-largest defense market after

the U.S. and China and the biggest export destination for U.S.

contractors, which made more than $3 billion in sales to the

kingdom last year, according to U.S. government data.

The biggest signed deal is a $10 billion purchase agreed in 2014

of hundreds of armored vehicles by a Canadian subsidiary of General

Dynamics, which is continuing to make shipments.

Canadian Foreign Affairs Minister Chrystia Freeland on Monday

said her country has no plans to cancel the deal, which was

approved by the previous Conservative government. The government

has proposed legislation that would toughen rules on future arms

sales, she said.

"When it comes to existing contracts, our government believes

strongly that Canada's word has to matter," Ms. Freeland said.

"Having said that, we believe in a tough arms export regime and

that is the approach we're taking going forward."

U.S. defense companies have fostered close relations with Saudi

leaders for decades. The kingdom's wealth and longstanding tensions

with Iran led it to plan to purchase best-in-class capabilities

such as Lockheed's Thaad missile-defense system. Lockheed has

previously said it hopes to close that deal by the end of the

year.

Saudi Arabia has also bought precision bombs and missiles,

though some U.S. lawmakers are seeking to block further shipments

because of their use in Yemen, which has resulted in thousands of

civilian casualties. Congress has required the Pentagon to assess

whether U.S. allies fighting in Yemen have violated human

rights.

Ties between the U.S. and Saudi Arabia have withstood previous

challenges, including the steep fall in oil prices in 2014 that has

strained Saudi Arabia's budget. Oil revenue is the overwhelming

driver of Saudi Arabia's economy and public spending.

Defense executives were among prominent attendees lined up for

the Future Investment Initiative conference in capital Riyadh next

week. A number of executives from finance and industry have pulled

out of the conference.

Raytheon Chief Executive Tom Kennedy is still listed as a

speaker on the official event website. Raytheon declined

comment.

Marc Allen, head of Boeing International, was a speaker at the

Saudi event last year and is also on the board of the U.S.-Saudi

Business Council, a business lobby group, alongside executives from

other big Pentagon contractors, such as Jacob Engineering Inc.

Lockheed Martin CEO Marillyn Hewson in April hosted a tour of a

U.S. satellite and missile facility by Crown Prince Mohammed bin

Salman, heir to the Saudi throne and the kingdom's day-to-day

ruler.

Boeing CEO Dennis Muilenburg in March hosted the prince at the

plane maker's plant in Seattle. Other executives, including Mr.

Kennedy at Raytheon, have talked of frequent trips to the

kingdom.

Saudi Arabia's huge arms bill has led the country to push for a

greater share of the economic benefits, especially jobs. The

kingdom has said it wants to become less reliant on imports and

spend half its weapons budget in domestic facilities -- compared to

just 2% at present -- part of a plan to diversify its economy

beyond the oil industry by 2030.

That has led U.S. companies to open Saudi subsidiaries and to

agree to shift assembly and other production processes to the

kingdom. Boeing announced a joint venture in March that would place

more than half the repair work for Saudi helicopters in the

country, creating 6,000 jobs.

BAE Systems plc, Europe's largest weapons maker with deep ties

to Saudi Arabia, is expected to have representatives at the

business conclave in Saudi next week, a person familiar with the

company's plans said. Saudi Arabia this year agreed to buy 48 more

Eurofighter Typhoons from BAE Systems, though the contract still

has to be finalized. It could see assembly of the planes in Saudi

Arabia.

Robert Stallard, an analyst at Vertical Research, said the

signing of the multibillion-dollar combat jet deal could be

delayed. He said, though, long-term BAE's business would not be

dented. "We think the Saudi situation will blow over," he said in a

note.

Write to Doug Cameron at doug.cameron@wsj.com

(END) Dow Jones Newswires

October 18, 2018 14:40 ET (18:40 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

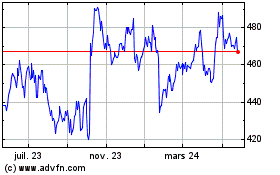

Northrop Grumman (NYSE:NOC)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

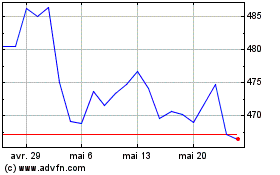

Northrop Grumman (NYSE:NOC)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024