000007182912/31false00000718292024-05-162024-05-16

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 16, 2024

Newpark Resources, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-02960 | 72-1123385 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | | | | | | | |

| 9320 Lakeside Boulevard, | Suite 100 | |

| The Woodlands, | Texas | 77381 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (281) 362-6800

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13a-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.01 par value | NR | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

On May 16, 2024, Newpark Resources, Inc. (the “Company”) filed a Certificate of Elimination with the Secretary of State of the State of Delaware with respect to its Series A Cumulative Perpetual Preferred Stock, Series B Convertible Preferred Stock and Series C Convertible Preferred Stock, of which no shares were outstanding. Effective upon filing, the Certificate of Elimination amended the Company’s Restated Certificate of Incorporation to eliminate the Company’s Series A Cumulative Perpetual Preferred Stock, Series B Convertible Preferred Stock and Series C Convertible Preferred Stock.

On May 16, 2024, at the annual meeting of shareholders (the “2024 Annual Meeting”) of Newpark Resources, Inc. (the “Company”), the Company’s shareholders approved an amendment to the Company’s Restated Certificate of Incorporation to limit the liability of officers as permitted by law. Following shareholder approval, on May 16, 2024, the Company filed the Certificate of Amendment with the Secretary of State of the State of Delaware.

On May 16, 2024, the Company filed a Second Restated Certificate of Incorporation with the Secretary of State of the State of Delaware. The Second Restated Certificate of Incorporation restates and integrates into a single document, but does not further amend, the Company’s Restated Certificate of Incorporation, as amended and restated to date.

The foregoing summary of the Certificate of Elimination, the Certificate of Amendment and the Second Restated Certificate of Incorporation is qualified in its entirety by reference to the full text of the Certificate of Elimination, the Certificate of Amendment and the Second Restated Certificate of Incorporation, copies of which are attached hereto as Exhibits 3.1, 3.2 and 3.3, respectively, and incorporated herein by reference.

Item 5.07 Submission of Matters to a Vote of Security Holders.

On May 16, 2024, the following proposals were submitted to the Company’s stockholders at the 2024 Annual Meeting.

1.The election of seven director nominees to our Board of Directors;

2.An advisory vote to approve our named executive officer compensation;

3.The ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year 2024; and

4.Approval of an amendment to the Company’s Restated Certificate of Incorporation to limit the liability of officers as permitted by law.

The proposals are more fully described in the Company’s Proxy Statement. The following are the final vote results along with a brief description of each proposal.

Proposal 1: Election of Directors: The stockholders of the Company elected each of the following director nominees for a term that will continue until the 2025 Annual Meeting of Stockholders.

| | | | | | | | | | | | | | |

| Director | For | Against | Abstain/Withheld | Broker Non-Votes |

| Matthew S. Lanigan | 66,380,203 | 516,407 | 5,287 | 8,479,809 |

| Roderick A. Larson | 61,286,557 | 5,609,954 | 5,386 | 8,479,809 |

| Michael A. Lewis | 57,291,682 | 9,603,820 | 6,395 | 8,479,809 |

| Claudia M. Meer | 60,568,166 | 6,328,392 | 5,339 | 8,479,809 |

| John C. Mingé | 61,355,334 | 5,541,268 | 5,295 | 8,479,809 |

| Rose M. Robeson | 64,450,621 | 2,445,937 | 5,339 | 8,479,809 |

| Donald W. Young | 64,819,430 | 2,077,272 | 5,195 | 8,479,809 |

Proposal 2: An advisory vote on named executive officer compensation: The stockholders of the Company approved, on a non-binding advisory basis, the compensation of the named executive officers as described in the Company’s Proxy Statement.

| | | | | | | | | | | |

| For | Against | Abstain/Withheld | Broker Non-Votes |

| 60,933,947 | 5,917,171 | 50,779 | 8,479,809 |

Proposal 3: Ratification of the appointment of independent registered public accounting firm: The stockholders of the Company ratified the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year 2024.

| | | | | | | | | | | |

| For | Against | Abstain/Withheld | Broker Non-Votes |

| 74,897,457 | 481,585 | 2,664 | 0 |

Proposal 4: Approval of an amendment to our Company's Restated Certificate of Incorporation to limit the liability of officers as permitted by law: The stockholders of the Company approved the amendment of the Company’s Restated Certificate of Incorporation.

| | | | | | | | | | | |

| For | Against | Abstain/Withheld | Broker Non-Votes |

| 56,571,969 | 7,359,920 | 2,970,008 | 8,479,809 |

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| 3.1 | | |

| 3.2 | | |

| 3.3 | | |

| 104 | | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | NEWPARK RESOURCES, INC. |

| | | (Registrant) |

| | | | |

| Date: | May 20, 2024 | By: | /s/ M. Celeste Frugé |

| | | M. Celeste Frugé |

| | | | VP, General Counsel and Corporate Secretary |

| | | | |

Exhibit 3.1

NEWPARK RESOURCES, INC.

CERTIFICATE OF ELIMINATION

OF

SERIES A CUMULATIVE PERPETUAL PREFERRED STOCK,

SERIES B CONVERTIBLE PREFERRED STOCK AND

SERIES C CONVERTIBLE PREFERRED STOCK

Pursuant to Section 151(g) of the General Corporation Law

of the State of Delaware

Newpark Resources, Inc., a corporation organized and existing under the General Corporation Law of the State of Delaware (the “Company”), does hereby certify as follows:

1. Pursuant to Section 151(g) of the General Corporation Law of the State of Delaware (the “DGCL”), the Company’s Board of Directors (the “Board”) adopted the following resolutions respecting the Company’s Series A Cumulative Perpetual Preferred Stock, Series B Convertible Preferred Stock and Series C Convertible Preferred Stock, which resolutions have not been amended or rescinded:

WHEREAS, on April 7, 1999, the Board adopted a resolution designating a series of One Hundred Fifty Thousand (150,000) shares of Series A Cumulative Perpetual Preferred Stock (the “Series A Cumulative Perpetual Preferred Stock”);

WHEREAS, on May 26, 2000, the Board adopted a resolution designating a series of One Hundred Twenty Thousand (120,000) shares of Series B Convertible Preferred Stock (the “Series B Convertible Preferred Stock”);

WHEREAS, on December 27, 2000, the Board adopted a resolution designating a series of One Hundred Twenty Thousand (120,000) shares of Series C Convertible Preferred Stock (the “Series C Convertible Preferred Stock”); and

WHEREAS, the Board deems it advisable and in the best interest of the Company and its stockholders to eliminate the Series A Cumulative Perpetual Preferred Stock, the Series B Convertible Preferred Stock and the Series C Convertible Preferred Stock.

NOW, THEREFORE, BE IT RESOLVED, that none of the authorized shares of Series A Cumulative Perpetual Preferred Stock are outstanding, and none will be issued subject to the Certificate of Designation of Series A Cumulative Perpetual Preferred Stock previously filed with respect to the Series A Cumulative Perpetual Preferred Stock (the “Series A Certificate of Designation”);

RESOLVED, FURTHER, that none of the authorized shares of Series B Convertible Preferred Stock are outstanding, and none will be issued subject to the Certificate of Rights and Preferences of Series B Convertible Preferred Stock previously filed with respect to the Series B Convertible Preferred Stock (the “Series B Certificate of Designation”);

RESOLVED, FURTHER, that none of the authorized shares of Series C Convertible Preferred Stock are outstanding, and none will be issued subject to the Certificate of Rights and Preferences of Series C Convertible Preferred Stock previously filed with respect to the Series C Convertible Preferred Stock (the “Series C Certificate of Designation”);

RESOLVED, FURTHER, that each of the officers of the Company be, and each of them individually hereby is, authorized and directed to take any and all actions as such officers deem necessary and appropriate to (i) eliminate the Series A Cumulative Perpetual Preferred Stock, including to execute and file, or cause to be executed and filed, a Certificate of Elimination of the Series A Cumulative Perpetual Preferred Stock with the Secretary of State of the State of Delaware, (ii) eliminate the Series B Convertible Preferred Stock, including to execute and file, or cause to be executed and filed, a Certificate of Elimination of the Series B Convertible Preferred Stock with the Secretary of State of the State of Delaware, and (iii) eliminate the Series C Convertible Preferred Stock, including to execute and file, or cause to be executed and filed, a Certificate of Elimination of the Series C Convertible Preferred Stock with the Secretary of State of the State of Delaware;

2. In accordance with Section 151(g) of the DGCL, all matters set forth in the previously filed (i) Series A Certificate of Designation with respect to the Series A Cumulative Perpetual Preferred Stock, (ii) Series B Certificate of Designation with respect to the Series B Convertible Preferred Stock, and (iii) Series C Certificate of Designation with respect to the Series C Convertible Preferred Stock are hereby eliminated.

IN WITNESS WHEREOF, the Company has caused this Certificate to be signed by its duly authorized officer this 16th day of May, 2024.

NEWPARK RESOURCES, INC.

By: /s/ Celeste Frugé

Name: Celeste Frugé

Title: Vice President – General Counsel,

Chief Compliance Officer, and Corporate Secretary

Exhibit 3.2

CERTIFICATE OF AMENDMENT

TO THE

RESTATED CERTIFICATE OF INCORPORATION

OF

NEWPARK RESOURCES, INC.

Newpark Resources, Inc. (the “Corporation”), a corporation organized and existing under and by virtue of the General Corporation Law of the State of Delaware (the “DGCL”), hereby certifies as follows:

FIRST: The name of the Corporation is Newpark Resources, Inc. The Restated Certificate of Incorporation of the Corporation was filed with the Delaware Secretary of State’s Office on November 5, 1998.

SECOND: This Certificate of Amendment to the Restated Certificate of Incorporation was duly adopted in accordance with Section 242 of the DGCL. The Board of Directors duly adopted resolutions setting forth and declaring advisable this Certificate of Amendment to the Restated Certificate of Incorporation of the Corporation and directed that the proposed amendment be considered by the stockholders of the Corporation. The proposed amendment was considered at the annual meeting of stockholders duly called upon notice in accordance with Section 222 of the DGCL and held on May 16, 2024, at which meeting the necessary number of shares were voted in favor of the proposed amendment. The stockholders of the Corporation duly adopted this Certificate of Amendment to the Restated Certificate of Incorporation.

THIRD: the Restated Certificate of Incorporation of the Corporation is hereby amended by adding a new Article FOURTEENTH to read in its entirety as follows:

FOURTEENTH. To the fullest extent permitted by law, as the same exists or as may hereafter be amended, an officer of the corporation shall not be personally liable to the corporation or its stockholders for monetary damages for breaches of fiduciary duty as an officer. Neither any amendment nor repeal of this Article Fourteenth nor the adoption of any provision of this Certificate of Incorporation inconsistent with this Article Fourteenth, shall eliminate or reduce the effect of this Article Fourteenth in respect of any matter occurring, or any cause of action, suit or claim that, but for this Article Fourteenth would accrue or arise, prior to such amendment, repeal or adoption of an inconsistent provision.

FOURTH: This Certificate of Amendment to the Restated Certificate of Incorporation shall become effective on the date this Certificate of Amendment to the Restated Certificate of Incorporation is filed with the Secretary of State of the State of Delaware.

IN WITNESS WHEREOF, this Certificate of Amendment to the Restated Certificate of Incorporation has been executed for and on behalf of the Corporation by an officer thereunto duly authorized and attested to as of May 16, 2024.

NEWPARK RESOURCES, INC.

By: /s/ Celeste Frugé

Name: Celeste Frugé

Title: Vice President – General Counsel, Chief Compliance Officer, and Corporate Secretary

Exhibit 3.3

SECOND RESTATED CERTIFICATE OF INCORPORATION

OF

NEWPARK RESOURCES, INC.

(ORIGINAL CERTIFICATE OF INCORPORATION

FILED WITH THE SECRETARY OF STATE

OF THE STATE OF DELAWARE JUNE 3, 1988)

This Second Restated Certificate of Incorporation of Newpark Resources, Inc. (i) was duly adopted by the Board of Directors of without a vote of the stockholders in accordance with Section 245 of the General Corporation Law of the State of Delaware, (ii) only restates and integrates and does not further amend the provisions of the Certificate of Incorporation of Newpark Resources, Inc., as heretofore amended; and there is no discrepancy between those provisions and the provisions of this Second Restated Certificate of Incorporation.

FIRST: The name of the corporation is:

NEWPARK RESOURCES, INC.

SECOND: The address of the registered office of the corporation in the State of Delaware is Capitol Services, Inc., 108 Lakeland Ave., in the City of Dover 19901, County of Kent. The name of its registered agent at that address is Capitol Services, Inc.

THIRD: The purpose of the corporation is to engage in any lawful act or activity for which a corporation may be organized under the General Corporation Law of the State of Delaware.

FOURTH: A. The corporation is authorized to issue two classes of shares to be designated, respectively, “Preferred Stock” and “Common Stock.” The total number of shares which this corporation shall have authority to issue is Two Hundred One Million (201,000,000), of which One Million (1,000,000) shall be Preferred Stock and Two Hundred Million (200,000,000) shall be Common Stock. The Preferred Stock and the Common Stock shall each have a par value of $.01 per share.

B. The shares of Preferred Stock may be issued from time to time in one or more series. The Board of Directors is hereby authorized to fix or alter by resolution the number of shares constituting each such series and the dividend rights, dividend rate, conversion rights, voting rights, rights and terms of redemption (including sinking fund provisions), the redemption price or prices, the liquidation preferences, and all other designations, preferences, and relative, optional and other special rights, and the qualifications, limitations and restrictions thereof, of the shares of each wholly unissued series of Preferred Stock, and to increase or decrease the number of shares of any series subsequent to the issue of shares of that series, but not below the number of shares of such series then outstanding. In case the outstanding shares of any series shall be reacquired or the number of shares of any series shall be decreased, the shares reacquired or the

shares constituting such decrease shall resume the status of authorized but unissued shares which they had prior to the adoption of the resolution originally fixing the number of shares of such series.

C. Except for and subject to such voting rights as may be granted to the holders of Preferred Stock from time to time outstanding, the holders of Common Stock issued and outstanding shall have and possess the exclusive right to notice of stockholders’ meetings and exclusive voting rights and powers. Subject to all of the rights of Preferred Stock from time to time outstanding, dividends may be paid on the Common Stock, as and when declared by the Board of Directors, out of any funds of the corporation legally available for the payment of such dividends.

D. No stockholder of this corporation shall by reason of his holding shares of any class or series have any preemptive or preferential rights to purchase or subscribe to any shares of any class or series of this corporation now or hereafter to be authorized, or any notes, debentures, bonds or other securities convertible into or carrying options or warrants to purchase shares of any class or series now or hereafter to be authorized, whether or not the issuance of any such shares or such notes, debentures, bonds or other securities would adversely affect the dividend or voting rights of such stockholder, other than such rights, if any, as the Board of Directors, in its discretion from time to time, may grant, and at such price as the Board of Directors, in its discretion, may fix; and the Board of Directors, if otherwise authorized by the provisions of this Article, may issue shares of any class or series of this corporation or any notes, debentures, bonds or other securities convertible into or carrying options or warrants to purchase shares of any class or series, without offering any such shares of any class or series either in whole or in part to the existing stockholders of any class or series.

FIFTH: The corporation is to have perpetual existence.

SIXTH: In furtherance and not in limitation of the powers conferred by statute, the Board of Directors shall have the power to make, alter, amend and repeal the Bylaws of the corporation. Elections of directors need not be by written ballot unless the Bylaws so provide.

SEVENTH: A. The Board of Directors or stockholders may change the number of directors from time to time, provided, however, that the number of directors shall not be increased by more than one (1) within any period of twelve (12) months unless the increase (by more than one) is approved by the affirmative vote of two-thirds (2/3) of the authorized number of directors or by the affirmative vote or written consent of two-thirds (2/3) of the outstanding shares of each class entitled to vote. A reduction of the authorized number of directors shall not operate to remove any director prior to the expiration of such director’s term of office.

B. Any director may be removed from office, with or without cause, only upon the vote or written consent of stockholders representing not less than two-thirds (2/3) of the issued and outstanding capital stock of each class then entitled to vote in elections of directors.

C. This Article Seventh may not be amended, altered, changed or repealed except upon the affirmative vote of two-thirds (2/3) of the authorized number of directors and the affirmative vote or written consent of two-thirds (2/3) of all outstanding shares of each class entitled to vote.

EIGHTH: Meetings of stockholders may be held within or without the State of Delaware, as the Bylaws may provide. The books of the corporation may be kept (subject to any provision contained in the statutes) outside the State of Delaware at such place or places as may be designated from time to time by the Board of Directors or in the Bylaws of the corporation.

NINTH: This Corporation shall indemnify, to the fullest extent now or hereafter permitted by applicable law, each of its officers, directors, employees, and agents who was or is made a party or is threatened to be made a party to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative, by reason of the fact that he is or was an officer, director, employee or representative of the corporation, against all expenses (including attorneys’ fees and disbursements), judgments, fines (including excise taxes and penalties) and amounts paid in settlement actually and reasonably incurred by him in connection with such action, suit or proceeding.

TENTH: To the fullest extent permitted by law, as the same exists or as may hereafter be amended, a director of the corporation shall not be personally liable to the corporation or its stockholders for monetary damages for breaches of fiduciary duty as a director. Neither any amendment nor repeal of this Article Tenth nor the adoption of any provision of this Certificate of Incorporation inconsistent with this Article Tenth, shall eliminate or reduce the effect of this Article Tenth in respect of any matter occurring, or any cause of action, suit or claim that, but for this Article Tenth would accrue or arise, prior to such amendment, repeal or adoption of an inconsistent provision.

ELEVENTH: A. The corporation may purchase and maintain insurance on behalf of any person who is or was a director, officer, employee or agent of the corporation, or is serving at the request of the corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust, employee benefit plan or other enterprise against any liability asserted against him and incurred by him in any such capacity, or arising out of his status as such, whether or not the corporation would have the power to indemnify him against such liability under the provisions of law.

B. The corporation may create a trust fund, grant a security interest and/or use other means (including, without limitation, letters of credit, surety bonds and/or other similar arrangements), as well as enter into contracts providing indemnification to the full extent authorized or permitted by law and including as part thereof provisions with respect to any or all of the foregoing to ensure the payment of such amounts as may become necessary to effect indemnification as provided therein, or elsewhere.

TWELFTH: No “business combination” (as now or hereafter defined in Section 203 of the Delaware General Corporation Law) shall be subject to Section 203 of the Delaware General Corporation Law.

THIRTEENTH: The corporation reserves the right to amend, alter, change or repeal any provision contained in this Certificate of Incorporation, in the manner now or hereafter prescribed by law, and all rights conferred herein upon stockholders are granted subject to this reservation.

FOURTEENTH. To the fullest extent permitted by law, as the same exists or as may hereafter be amended, an officer of the corporation shall not be personally liable to the corporation or its stockholders for monetary damages for breaches of fiduciary duty as an officer. Neither any amendment nor repeal of this Article Fourteenth nor the adoption of any provision of this Certificate of Incorporation inconsistent with this Article Fourteenth, shall eliminate or reduce the effect of this Article Fourteenth in respect of any matter occurring, or any cause of action, suit or claim that, but for this Article Fourteenth would accrue or arise, prior to such amendment, repeal or adoption of an inconsistent provision.

IN WITNESS WHEREOF, I have executed this Second Restated Certificate of Incorporation this 17th day of May, 2024.

NEWPARK RESOURCES, INC.

By: /s/ Celeste Frugé

Name: Celeste Frugé

Title: Vice President – General Counsel, Chief Compliance Officer, and Corporate Secretary

v3.24.1.1.u2

Cover Page

|

May 16, 2024 |

| Cover [Abstract] |

|

| Entity Central Index Key |

0000071829

|

| Current Fiscal Year End Date |

--12-31

|

| Document Type |

8-K

|

| Document Period End Date |

May 16, 2024

|

| Entity Registrant Name |

Newpark Resources, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-02960

|

| Entity Tax Identification Number |

72-1123385

|

| Entity Address, Address Line One |

9320 Lakeside Boulevard,

|

| Entity Address, Address Line Two |

Suite 100

|

| Entity Address, City or Town |

The Woodlands,

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

77381

|

| City Area Code |

281

|

| Local Phone Number |

362-6800

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Title of 12(b) Security |

Common Stock, $0.01 par value

|

| Trading Symbol |

NR

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

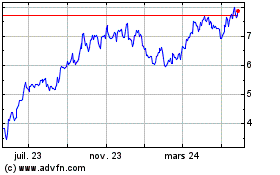

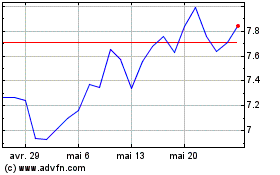

Newpark Resources (NYSE:NR)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Newpark Resources (NYSE:NR)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024