false

0001356115

0001356115

2023-09-01

2023-09-01

0001356115

nxdt:CommonSharesCustomMember

2023-09-01

2023-09-01

0001356115

nxdt:SeriesACumulativePreferredShares550CustomMember

2023-09-01

2023-09-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 1, 2023

NexPoint Diversified Real Estate Trust

(Exact name of registrant as specified in its charter)

| |

|

|

|

|

|

Delaware

|

|

001-32921

|

|

80-0139099

|

|

(State or other jurisdiction

|

|

(Commission File Number)

|

|

(IRS Employer

|

|

of incorporation)

|

|

|

|

Identification No.)

|

300 Crescent Court, Suite 700

Dallas, Texas 75201

(Address of principal executive offices, including zip code)

214-276-6300

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

|

|

|

☐

|

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| |

|

|

|

☐

|

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

|

|

|

☐

|

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Shares, par value $0.001 per share

|

|

NXDT

|

|

New York Stock Exchange

|

|

5.50% Series A Cumulative Preferred Shares, par value $0.001 per share

($25.00 liquidation preference per share)

|

|

NXDT-PA

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

On September 1, 2023, NexPoint Diversified Real Estate Trust (the “Company”), through its indirect subsidiary, NHF TRS, LLC (the “TRS”), entered into a contribution agreement (the “Contribution Agreement”), pursuant to which the TRS contributed a structured promissory note issued by Specialty Financial Products Designated Activity Company with a net asset value of approximately $68.5 million to NexAnnuity Holdings, Inc. (“NexAnnuity”) in exchange for 68,500 shares of Class A Preferred Stock of NexAnnuity (the “Contribution”). The Class A Preferred Stock pays a preferred return of 8% per annum for the first seven years after its issuance, increasing incrementally in subsequent years until it reaches a maximum of 12% per annum fourteen years after its initial issuance. At any time after the issuance of the Class A Preferred Stock, NexAnnuity may redeem all or a portion of the Class A Preferred Stock at a price of $1,000 per share plus accumulated but unpaid dividends.

NexAnnuity is an affiliate of the Company’s investment adviser through common beneficial ownership. In compliance with the Company’s Related Party Transaction Policy, the Contribution was approved by the Audit Committee of the Board of Trustees of the Company.

The description of the material terms of the Contribution does not purport to be complete and is qualified in its entirety by reference to the full text of the Contribution Agreement and the Second Amended and Restated Certificate of Incorporation of NexAnnuity, which are filed as Exhibits 10.1 and 10.2 to this Current Report on Form 8-K and are hereby incorporated by reference into this Item 1.01.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits.

|

Exhibit

Number

|

Exhibit Description

|

|

10.1

|

Contribution and Assignment Agreement, dated September 1, 2023, by and between NHF TRS, LLC, NexAnnuity Holdings, Inc., NexLS Holdco, LLC, NexLS II, LLC and Specialty Financial Products Designated Activity Company.

|

|

10.2

|

|

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this Current Report on Form 8-K to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

NexPoint Diversified Real Estate Trust

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Brian Mitts

|

|

|

|

Name:

|

Brian Mitts

|

|

|

|

Title:

|

Chief Financial Officer, Executive VP-Finance, Treasurer and Assistant Secretary

|

|

Date: September 1, 2023

Exhibit 10.1

Execution Version

CONTRIBUTION AND ASSIGNMENT AGREEMENT

This Contribution and Assignment Agreement (this “Agreement”) is dated effective as of September 1, 2023 (the “Effective Date”), by and among NexLS II, LLC, a Delaware limited liability company (the “Acquirer”), NexLS HoldCo, LLC, a Delaware limited liability company (the “Interim Acquirer”), NexAnnuity Holdings, Inc., a Delaware corporation (the “Issuer”), NHF TRS, LLC, a Delaware limited liability company ( “NHF TRS”) and Specialty Financial Products Designated Activity Company, an Irish designated activity company limited by shares (“SFP DAC”).

RECITALS

WHEREAS, NHF TRS is a direct and wholly-owned subsidiary of NexPoint Diversified Real Estate Trust, a Delaware statutory trust (“NXDT”);

WHEREAS SFP DAC has issued a structured note, having an aggregate notional value of up to $50,000,000 (the “Structured Note”) which is currently held by NHF TRS;

WHEREAS, Interim Acquirer and Acquirer are direct or indirect wholly-owned subsidiaries of the Issuer and are treated for U.S. federal income (and applicable state and local) tax purposes as entities disregarded as separate from the Issuer pursuant to Treasury Regulations Section 301.7701-3(b)(1)(ii);

WHEREAS, NHF TRS wishes to contribute the Structured Note to Issuer in exchange for the issuance by Issuer of certain preferred equity interests in Issuer, and Issuer wishes to accept the contribution of the Structured Note and to issue preferred equity interests in exchange;

WHEREAS, immediately following the contribution of the Structured Note to Issuer, Issuer wishes to contribute the Structured Note to Interim Acquirer, and Interim Acquirer wishes to accept this contribution;

WHEREAS, immediately following the contribution of the Structured Note to Interim Acquirer, Interim Acquirer wishes to contribute the Structured Note to Acquirer, and Acquirer wishes to accept this contribution; and

WHEREAS, SFP DAC is a party to this Agreement solely to provide its consent to the contributions of the Structured Note set out above.

NOW, THEREFORE, for good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged and confessed, the parties do hereby agree as follows:

AGREEMENT

1. Contribution of Contributed Assets and Issuance of Class A Preferred Stock. The parties hereto acknowledge and agree that:

a. Contribution and Acceptance of Contributed Assets. NHF TRS shall contribute, convey, assign, transfer and deliver to the Issuer, and the Issuer shall accept from NHF TRS, all of NHF TRS’s rights, title and interests in and to Structured Note which, together with updated life expectancies and discount rates, total approximately $68,500,000 in net asset value (the “Contributed Assets”). Immediately following NHF TRS’ contribution to the Issuer,

(i) Issuer shall contribute, convey, assign, transfer and deliver to Interim Acquirer, and Interim Acquirer shall accept from Issuer, all of Issuer’s rights, title and interests in and to the Contributed Assets,

(ii) Interim Acquirer shall contribute, convey, assign, transfer and deliver to Acquirer, and Acquirer shall accept from Issuer, all of Issuer’s rights, title and interests in and to the Contributed Assets, (all of the foregoing, the “Contribution”).

b. Issuance of Class A Preferred Stock by Issuer. Contemporaneously with the Contribution, and in exchange for the contribution of the Contributed Assets from NHF TRS to the Issuer and from the Issuer to Interim Acquirer and from Interim Acquirer to Acquirer, Issuer shall issue to NHF TRS, and NHF TRS shall accept from the Issuer, all of its right, title and interest in and to 68,500 shares of the Issuer’s Class A preferred stock (the “Class A Preferred Stock”), including, without limitation, all voting, consent and financial rights now or hereafter existing and associated with ownership of the Class A Preferred Stock, free and clear of all liens and encumbrances, pursuant to the terms and conditions of the Second Amended and Restated Certificate of Incorporation of the Issuer, dated as of August 29, 2023 and the By-laws of the Issuer (the “Class A Preferred Stock Issuance”).

c. Consent of SFP DAC: SFP DAC hereby consents to the Contribution and any related transfer, conveyance and assignment of the Structured Note required to give effect to the Contribution.

2. Delivery of Contribution. The closing of the transactions contemplated by this Agreement shall be deemed to occur as of the Effective Date.

3. Representations and Warranties of Each Party. Each party hereto represents and warrants: (a) that it is duly formed, validly existing and in good standing under the laws of its jurisdiction of formation; (b) that it has all requisite power and authority to enter into and deliver this Agreement, to carry out the transactions contemplated hereby and to perform its obligations hereunder; (c) that this Agreement has been duly and validly executed and delivered and, assuming due and valid authorization, execution and delivery hereof by the other parties, constitutes the valid and legally binding obligation of such party and is enforceable against such party in accordance with its terms, except as may be limited by bankruptcy, insolvency, examinership, reorganization, moratorium or other similar laws affecting the enforcement of creditors’ rights in general and subject to general principles of equity (regardless of whether such enforceability is considered in a proceeding in equity or at law); and (d) that neither the execution and delivery of this Agreement nor the consummation of the transactions contemplated hereby by such party will violate its organizational documents or conflict with, result in a breach of, constitute a default under, result in the acceleration of, create in any party the right to accelerate, terminate, modify or cancel, or require any notice or consent under, any contract, or any franchise or permit to which such party is a party or by which such party is bound, other than those that have been previously obtained.

4. Representations and Warranties of NHF TRS. NHS TRS hereby represents and warrants that the following statements are true and correct as of the date hereof:

a. Organization; Authority. Other than pursuant to loan, repurchase or similar agreements, NHF TRS is the registered holder of the Contributed Assets, and holds the Contributed Assets free and clear of all liens, encumbrances, subscriptions, options, warrants, calls, proxies, rights, commitments or other restrictions of any kind.

b. Consents and Approvals. Other than those that have been previously obtained, no consent, waiver, approval, authorization, notice, order, license, permit or registration of, qualification, designation, declaration, or filing with, any person or any government or agency, bureau, board, commission, court, department, official, political subdivision, tribunal or other instrumentality of any government, whether federal, state or local, domestic or foreign (“Governmental Authority”) or under any applicable laws, statutes, rules, regulations, codes, orders, ordinances, judgments, injunctions, decrees and policies of any Governmental Authority, including, without limitation, zoning, land use or other similar rules or ordinances (“Laws”) is required to be obtained by NHF TRS in connection with the execution, delivery and performance of this Agreement and the transactions contemplated hereby.

c. No Violation. The execution, delivery or performance by NHF TRS of this Agreement, any agreement contemplated hereby between the parties to this Agreement and the transactions contemplated hereby between the parties to this Agreement does not or will not, with or without the giving of notice, lapse of time, or both, violate, conflict with, result in a breach of, or constitute a default under or give to others any right of termination, acceleration, cancellation or other right under any term or provision of any judgment, order, writ, injunction, or decree binding on NHF TRS or any of its subsidiaries or any of its respective assets or properties.

d. Investment. NHF TRS acknowledges that the offering and issuance of the Class A Preferred Stock to be acquired pursuant to this Agreement are intended to be exempt from registration under the Securities Act and that the Issuer’s reliance on such exemptions is predicated in part on the accuracy and completeness of the representations and warranties of NHF TRS contained herein. In furtherance thereof, NHF TRS represents and warrants to the Issuer as follows:

(i) NHF TRS is an “accredited investor” (as such term is defined in Rule 501(a) of Regulation D promulgated under the Securities Act).

(ii) NHF TRS acknowledges that the Class A Preferred Stock has not been registered under the Securities Act and, therefore, unless registered under the Securities Act or an exemption from registration is available, must be held (and NHF TRS must continue to bear the economic risk of the investment in the Class A Preferred Stock) indefinitely.

e. No Other Representations or Warranties. Other than the representations and warranties expressly set forth in this Section 4, NHF TRS shall not be deemed to have made any other representation or warranty in connection with this Agreement or the transactions contemplated hereby.

5. Survival of Representations and Warranties. All representations and warranties of NHF TRS contained in this Agreement shall survive until the first anniversary of the Effective Date (the “Expiration Date”). If written notice of a claim in accordance with indemnification has been given prior to the Expiration Date, then the relevant representation or warranty shall survive, but only with respect to such specific claim, until such claim has been finally resolved. Any claim for indemnification not so asserted in writing by the Expiration Date may not thereafter be asserted and shall forever be waived.

6. Indemnification:

a. Indemnification of Interim Acquirer and Acquirer. Interim Acquirer and Acquirer and each of its respective directors, officers, employees, agents and representatives (each of which is an “Indemnified Party”), shall be indemnified and held harmless by NHF TRS, as applicable, under the terms and conditions of this Agreement, from and against any and all loss, liability, damage, cost and expense arising out of or relating to, asserted against, imposed upon or incurred by the Indemnified Parties in connection with or as a result of any breach of a representation or warranty contained in Section 4 of this Agreement.

7. Governing Law. This Agreement shall be governed by, and shall be construed in accordance with the domestic laws of the State of New York, without giving effect to any choice of law or conflict of law provision (whether of the State of New York or any other jurisdiction) that would cause the application of the laws of any jurisdiction other than the laws of the State of New York.

8. Binding Effect. This Agreement shall inure to the benefit of, and shall be binding upon, the parties hereto and their respective successors and permitted assigns.

9. Severability. If any provision of this Agreement or the application of any such provision to any person or circumstance shall be held invalid, illegal or unenforceable in any respect by a court of competent jurisdiction, such invalidity, illegality or unenforceability shall not affect any other provision of this Agreement.

10. Counterparts. This Agreement may be executed in counterparts, each of which shall be deemed an original, but all of which together shall be deemed to be one and the same agreement. A signed copy of this Agreement delivered by facsimile, email or other means of electronic transmission shall be deemed to have the same legal effect as delivery of an original signed copy of this Agreement.

11. Further Assurances. At any time or from time to time after the date hereof, at the request of a party hereto and without further consideration, the other parties hereto and its successors or assigns, shall execute and deliver, or shall cause to be executed and delivered, such other instruments or documents and take such other actions as such party may reasonably request to further the purposes of this Agreement and the transactions contemplated by this Agreement. The parties hereto further agree that in all instances they will take all actions, and to do, or cause to be done, all things necessary to give effect to the transactions contemplated hereby in all manners including, without limitation, economically as of the Effective Date.

12. Entire Agreement. This Agreement delivered in connection herewith constitutes the sole and entire agreement of the parties to this Agreement with respect to the subject matter contained herein, and supersedes all prior and contemporaneous understandings, representations and warranties and agreements, both written and oral, with respect to such subject matter.

13. Successors and Assigns; No Third-Party Beneficiaries. This Agreement shall be binding upon and shall inure to the benefit of the parties hereto and their respective successors and permitted assigns. This Agreement is for the sole benefit of the parties hereto and their respective successors and permitted assigns and nothing herein, express or implied, is intended to or shall confer upon any other person any legal or equitable right, benefit or remedy of any nature whatsoever, under or by reason of this Agreement.

14. Headings. The headings in this Agreement are for reference only and shall not affect the interpretations of this Agreement.

IN WITNESS WHEREOF, this Agreement has been duly executed by each of the parties hereto as of the date and year first above written.

| |

NHF TRS:

NHF TRS, LLC

By: /s/ Brian Mitts

Name: Brian Mitts

Title: Principal Financial Officer and Assistant Treasurer

ISSUER:

NEXANNUITY HOLDINGS, INC.

By: /s/ Bradford Heiss

Name: Bradford Heiss

Title: Executive Vice President and Chief Investment Officer

INTERIM ACQUIRER:

NEXLS HOLDCO, LLC

By: /s/ Eric Holt

Name: Eric Holt

Title: Secretary

ACQUIRER:

NEXLS II, LLC

By: /s/ Frank Waterhouse

Name: Frank Waterhouse

Title: Treasurer

|

[Signature Page to Contribution

and Assignment Agreement]

| |

SFP DAC:

SPECIALTY FINANCIAL PRODUCTS

DESIGNATED ACTIVITY COMPANY

By:/s/Sheila Kelly

Name: Sheila Kelly

Title: Director

|

[Signature Page to Contribution

and Assignment of Interests Agreement]

Exhibit 10.2

Execution Version

SECOND AMENDED AND RESTATED

CERTIFICATE OF INCORPORATION

OF

NEXANNUITY HOLDINGS, INC.

(Pursuant to Sections 242 and 245 of the

General Corporation Law of the State of Delaware)

NexAnnuity Holdings, Inc. a corporation organized and existing under and by virtue of the provisions of the General Corporation Law of the State of Delaware (the “General Corporation Law”),

DOES HEREBY CERTIFY:

1. That the name of this corporation is NexAnnuity Holdings, Inc., and that this corporation was originally incorporated pursuant to the General Corporation Law on October 9, 2018 under the name NexAnnuity Holdings, Inc.

2. That the Board of Directors (the “Board of Directors”) duly adopted resolutions to amend and restate the Amended and Restated Certificate of Incorporation of this corporation (the “Amended and Restated Certificate of Incorporation”) pursuant to Sections 242 and 245 of the General Corporation Law, which resolution setting forth the proposed amendment and restatement is as follows:

RESOLVED, that the Amended and Restated Certificate of Incorporation of this corporation be amended and restated in its entirety to read as follows (the “Second Amended and Restated Certificate of Incorporation”):

FIRST: The name of this corporation is NexAnnuity Holdings, Inc. (the “Corporation”).

SECOND: The address of the registered office of the Corporation in the State of Delaware is 1209 Orange Street, City of Wilmington, County of New Castle, State of Delaware 19801. The name of its registered agent at such address is The Corporation Trust Corporation.

THIRD: The nature of the business or purposes to be conducted or promoted is to engage in any lawful act or activity for which corporations may be organized under the General Corporation Law.

FOURTH: The total number of shares of all classes of stock that the Corporation shall have authority to issue is (a) 10,000,000 shares of Common Stock, $0.001 par value per share (“Common Stock”), of which (i) 5,000,100 shares shall be designated as Class A Common Stock, (“Class A Common”), and (ii) 4,999,900 shares shall be designated as Class B Common Stock (“Class B Common”), and (b) 500,000 shares of Preferred Stock, $1,000 par value per share (“Preferred Stock”), of which 68,500 shares shall be designated as Class A Preferred Stock (“Class A Preferred”). The Preferred Stock may be issued only with the unanimous written consent of affirmative vote of the Board of Directors, each of such class to consist of such number of shares and to have such terms, rights, powers and preferences, and the qualifications and limitations with respect thereto, as stated or expressed herein.

The following is a statement of the designations and the powers, privileges and rights, and the qualifications, limitations or restrictions thereof in respect of each class of capital stock of the Corporation.

Unless otherwise indicated, references to “Sections” or “Subsections” in this Article refer to sections and subsections of this Article Fourth.

A. COMMON STOCK

1. General. The voting, dividend and liquidation rights of the holders of the Common Stock are subject to and qualified by the rights, powers and preferences of the holders of the Preferred Stock set forth herein.

2. Voting. The holders of the Common Stock are entitled to ten (10) votes for each share of Common Stock held at all meetings of stockholders (and written actions in lieu of meetings). Class A Common and Class B Common shall vote as a single class. Except as otherwise expressly provided herein or as required by law, the holders of Common Stock shall vote together and not as separate classes. There shall be no cumulative voting. Subject to rights of any holders of any outstanding Preferred Stock, the number of authorized shares of Common Stock may be increased or decreased (but not below the number of shares thereof then outstanding) by the affirmative vote of the holders of shares of capital stock of the Corporation representing a majority of the votes represented by all outstanding shares of capital stock of the Corporation entitled to vote, irrespective of the provisions of Section 242(b)(2) of the General Corporation Law.

B. PREFERRED STOCK

1. General. The Preferred Stock shall have the following rights, powers, preferences, privileges and restrictions, qualifications and limitations.

The “Original Issue Price” shall mean $1,000 per share for the Class A Preferred, subject to appropriate adjustment in the event of any stock dividend, stock split, combination or other similar recapitalization with respect to the Preferred Stock.

2. Dividends.

(a) Prior to the payment of any dividends on any other class of stock of the Corporation, from and after the date of issuance of any shares of Preferred Stock, the holders of the Class A Preferred shall first receive a dividend on each outstanding share of Class A Preferred (the “Class A Preferred Return Rate”) in an amount equal to:

(i) eight percent (8.0%) of the Original Issue Price per share (as adjusted for any stock dividend, stock split, combination, reorganization, recapitalization, reclassification or other similar event with respect to such share) per annum, payable quarterly on each March 31, June 30, September 30 and December 31 (each a “Dividend Payment Date”) for the first seven (7) years following the date of effectiveness of this Second Amended and Restated Certificate of Incorporation;

(ii) nine and one-half percent (9.5%) of the Original Issue Price per share (as adjusted for any stock dividend, stock split, combination, reorganization, recapitalization, reclassification or other similar event with respect to such share) per annum, payable quarterly on each March 31, June 30, September 30 and December 31 for years eight (8) through ten (10) following the date of effectiveness of this Second Amended and Restated Certificate of Incorporation;

(iii) eleven percent (11.0%) of the Original Issue Price per share (as adjusted for any stock dividend, stock split, combination, reorganization, recapitalization, reclassification or other similar event with respect to such share) per annum, payable quarterly on each March 31, June 30, September 30 and December 31 for years eleven (11) through thirteen (13) following the date of effectiveness of this Second Amended and Restated Certificate of Incorporation; and

(iv) twelve percent (12.0%) of the Original Issue Price per share (as adjusted for any stock dividend, stock split, combination, reorganization, recapitalization, reclassification or other similar event with respect to such share) per annum, payable quarterly on each March 31, June 30, September 30 and December 31 for years fourteen (14) through sixteen (16) following the date of effectiveness of this Second Amended and Restated Certificate of Incorporation; provided that, the maximum rate of return for the Class A Preferred shall be twelve percent (12.0%) per annum.

(v) Such amounts as set forth in Section 2(a)(i) through Section 2(a)(iv) are referred to herein as the “Accruing Dividends”. The Accruing Dividends shall accumulate quarterly at (x) the applicable Preferred Return Rate less (y) any amount of the dividend paid in cash, payable to the holders of the Class A Preferred on each Dividend Payment Date. The Company, in its discretion, may elect not to pay such Accruing Dividends when they become due on the applicable Dividend Payment Date, in which case the Accruing Dividends will continue to accrue hereunder and shall become due at the end of sixteen (16) years.

(b) The Corporation shall not declare, pay or set aside any dividends on shares of any other class of capital stock of the Corporation (other than dividends on shares of Common Stock payable in shares of Common Stock) unless (in addition to the obtaining of any consents required elsewhere in this Second Amended and Restated Certificate of Incorporation) all Accruing Dividends that are currently unpaid, are first paid in full. Once all Accruing Dividends are paid in full to the holders of Preferred Stock, any dividends declared or paid to the holders of Common Stock in any year shall thereafter be declared or paid at the Common Stock Distribution Rate and on a pari passu basis to the holders of the Class A Common and vested Class B Common then outstanding. “Common Stock Distribution Rate” means for the purposes of any dividend or distribution contemplated hereunder, the percentage of any such dividend or distribution to any one holder of Common Stock calculated as follows: (((A*10)+(B))/(C*10)+(D))*100%, where, at the time of such distribution or dividend, “A” means the number of Class A Common held by such holder; “B” means the number of vested Class B Common held by such holder; “C” means the aggregate number of all Class A Common issued and outstanding; and “D” means the aggregate number of all vested Class B Common issued and outstanding. Any such dividends paid to the holders of shares of Class A Common and vested Class B Common shall be paid at the Common Stock Distribution Rate, on an equal priority, pari passu basis, unless different treatment of the shares of each such class is approved by the affirmative vote of the holders of a majority of the outstanding shares of the applicable class of Common Stock treated adversely, voting separately as a class.

(c) If a dividend provided for in this Section 2 shall be payable in property other than cash, the value of such dividend shall be deemed to be the fair market value of such property as determined in good faith by the Board of Directors.

3. Liquidation, Dissolution or Winding Up.

(a) Preferential Payments to Holders of Preferred Stock. In the event of any voluntary or involuntary liquidation, dissolution or winding up of the Corporation (any such event, a “Liquidation Event”), the holders of shares of Preferred Stock then outstanding shall be entitled to be paid out of the assets of the Corporation available for distribution to its stockholders, before any payment shall be made to the holders of Common Stock by reason of their ownership thereof, at an amount per share equal to $1,000 per share plus any accumulated but unpaid amount (including any Accruing Dividends) at the applicable Class A Preferred Return Rate (the amount payable pursuant to this sentence is hereinafter referred to as “Class A Preferred Liquidation Preference”). If upon any such Liquidation Event the remaining assets available for distribution to its stockholders shall be insufficient to pay the holders of shares of Class A Preferred the full Class A Preferred Liquidation Preference, the holders of shares of Class A Preferred shall share ratably in any distribution of the remaining assets available for distribution in proportion to the respective amounts that would otherwise be payable in respect of the shares held by them upon such distribution if all amounts payable on or with respect to such shares were paid in full.

(b) Payments to Holders of Class A Common. After the payment in full of the Class A Preferred Liquidation Preference required to be paid to the holders of shares of Preferred Stock in accordance with Section 3(a), the holders of shares of Class A Common then outstanding shall thereafter be entitled to be paid out of the assets available for distribution to its stockholders before any payment shall be made to the holders of Class B Common an amount per share equal to an amount per share equal to the Class A Issue Price (the amount payable pursuant to this sentence is hereinafter referred to as the “Class A Common Liquidation Amount”). If upon any such Liquidation Event the remaining assets available for distribution to its stockholders shall be insufficient to pay the holders of shares of Class A Common the full Class A Common Liquidation Amount, the holders of shares of Class A Common shall share ratably in any distribution of the remaining assets available for distribution in proportion to the respective amounts that would otherwise be payable in respect of the shares held by them upon such distribution if all amounts payable on or with respect to such shares were paid in full. The “Class A Issue Price” shall mean $10.00 per share of Class A Common, subject to appropriate adjustment in the event of any stock dividend, stock split, combination or other similar recapitalization with respect to the Class A Common. From and after the date of issuance of any shares of Common Stock and prior to a Liquidation Event, any cash dividends actually received by holders of Class A Common pursuant to this Section 3(b) shall reduce, dollar-for- dollar, the Class A Common Liquidation Amount.

(c) Distribution of Remaining Assets. After the payment in full of the Class A Preferred Liquidation Preference and the Class A Common Liquidation Amount, the remaining assets available for distribution to the Corporation’s stockholders shall be distributed among the holders of the shares of Class A Common, Class A Preferred and vested Class B Common at the Common Stock Distribution Rate based on the number of shares held by each such holder.

4. Asset Transfer or Acquisition.

(a) An Asset Transfer or Acquisition shall be deemed a Liquidation Event for purposes of Section 3. Accordingly, in the event that the Corporation is a party to an Acquisition or Asset Transfer, then upon the closing of such Acquisition or Asset Transfer, each holder of Class A Preferred shall be entitled to receive, for each share of Class A Preferred then held, subject to the provisions of Section 4(c) and 4(d), below, each holder of Class A Common shall be entitled to receive, for each share of Class A Common then held, and each holder of vested Class B Common shall be entitled to receive, for each share of vested Class B Common then held, out of the proceeds of such Acquisition or Asset Transfer, the amount of cash, securities or other property to which such holder would be entitled to receive in a Liquidation Event pursuant to Section 3.

(b) For the purposes of this Section 4: (i) “Acquisition” shall mean (A) any consolidation or merger of the Corporation with or into any other entity or any other reorganization, other than any such consolidation, merger or reorganization in which the stockholders of the Corporation immediately prior to such consolidation, merger or reorganization, continue to hold at least fifty percent (50%) of the voting power of the surviving entity (or, if the surviving entity is a wholly owned subsidiary, its parent) immediately after such consolidation, merger or reorganization; or (B) any transaction or series of related transactions to which the Corporation is a party in which in excess of 50% of the Corporation’s voting power is transferred; provided that an Acquisition shall not include any transaction or series of transactions principally for bona fide equity financing purposes in which cash is received by the Corporation or any successor or indebtedness of the Corporation is cancelled or converted or a combination thereof; and “Asset Transfer” shall mean a sale, lease, exclusive license or other disposition of all or substantially all of the assets of the Corporation, except where such sale, lease, exclusive license or other disposition is to a wholly owned subsidiary of the Corporation. The treatment of any particular transaction or series of related transactions as an Acquisition or Asset Transfer may be waived by the vote or written consent of the holders of Common Stock, voting together as a single class as provided herein.

(c) Mandatory Preferred Stock Redemption. In the event of a Liquidation Event referred to in Section 3(b), or upon the closing of the sale of shares of Common Stock to the public in a firm-commitment underwritten public offering pursuant to an effective registration statement under the Securities Act of 1933, as amended, on a major stock exchange (i.e., NASDAQ, NYSE or similar) resulting in at least $500,000,000 of net proceeds (before deduction of underwriter commissions and expenses) to the Corporation (a “Qualified IPO”), then each outstanding share of Preferred Stock shall be automatically repurchased by the Corporation within sixty (60) days of the occurrence of such Liquidation Event or Qualified IPO at a price per share equal to the Class A Preferred Liquidation Preference.

(d) Optional Preferred Stock Redemption. Each outstanding share of Preferred Stock may be repurchased by the Corporation, at the sole discretion of the Corporation, in full or in part at any time following the effective date of this Second Amended and Restated Certificate amount at a price per share equal to the Class A Preferred Liquidation Preference.

(e) Redeemed or Otherwise Acquired Shares Treatment. Any shares of Preferred Stock that are redeemed, converted or otherwise acquired by the Corporation or any of its subsidiaries shall be automatically and immediately cancelled and retired and shall not be reissued, sold or transferred. Neither the Corporation nor any of its subsidiaries may exercise any voting or other rights granted to the holders of Preferred Stock following redemption, conversion or acquisition.

5. Voting.

(a) General. The holders of the Class A Preferred are entitled to one (1) vote for each share of Class A Preferred held at all meetings of stockholders (and written actions in lieu of meetings). Except as provided by law or by the other provisions in this Second Amended and Restated Certificate of Incorporation, holders of Class A Preferred shall vote together with the holders of Common Stock as a single class and on an as-converted to Common Stock basis.

(b) Election of Directors. The Board of Directors shall initially consist of one person (the “Common Director”). The holders of Class A Common shall at all times have the ability to appoint the Director. In the event that the Class A Preferred has not been redeemed pursuant to Section 4(c) or 4(d), on the sixteenth (16th) anniversary of the effectiveness of this Second Amended and Restated Certificate of Incorporation, then the holders of record of the Class A Preferred, exclusively and as a separate class, shall, after such date, be entitled to elect one (1) Director of the Corporation (the “Preferred Director”). Any Director elected pursuant to the preceding sentences may be removed without cause by, and only by, the affirmative vote of the holders of the shares of the class of capital stock entitled to elect such Directors, given either at a special meeting of such stockholders duly called for that purpose or pursuant to a written consent of stockholders. If the holders of the shares of the class of capital stock entitled to elect directors fail to elect a sufficient number of directors to fill all directorships for which they are entitled to elect directors, then any directorship not so filled shall remain vacant until such time as the holders of shares of the class of capital stock entitled to elect such director elect a person to fill such directorship by vote or written consent in lieu of a meeting; and no such directorship may be filled by stockholders of the Corporation other than by the stockholders of the Corporation that are entitled to elect a person to fill such directorship. At any meeting held for the purpose of electing a director, the presence in person or proxy of the holders of a majority of the outstanding shares of the class entitled to elect such director shall constitute a quorum for the purpose of electing such director. Except as otherwise provided in this Section 5(b), a vacancy in any directorship filled by the holders of any class of capital stock shall be filled only by vote or written consent in lieu of a meeting of the holders of such class.

6. Conversion. The Class A Preferred shall not be convertible.

7. Transferability. The Board of Directors may, in its sole and absolute discretion, prohibit the transfer of shares of Class A Preferred to any party that is not (a) 100% owned and controlled by, or (b) an affiliate of, NexPoint Diversified Real Estate Trust, a Delaware statutory trust.

8. Subject to the terms of this Amended and Restated Certificate of Incorporation, the holders of Preferred Stock may transfer their shares by an instrument of transfer; provided that the transferee files with the Corporation a written and dated instrument of such transfer, in form and substance reasonably satisfactory to the Board of Directors, executed by both the transferor and transferee, which instrument shall contain the acceptance by the transferee of all of the terms and provisions of this Second Amended and Restated Certificate of Incorporation, to the extent applicable to the transferee, (b) contain such representations as the Board of Directors may deem necessary or advisable to assure that such transfer need not be registered under any applicable federal or state securities laws, (c) instruct the Board of Directors as to the shares of Preferred Stock transferred and to whom and at what address Corporation distributions and notifications in respect of such shares of Preferred Stock should henceforth be sent, and (d) contain any information required under the U.S. Internal Revenue Code of 1986, as amended, that is requested by the Board of Directors; provided further, that the Board of Directors must unanimously consent to the transfer of shares of Preferred Stock, in whole or in part, to any party that is not an affiliate of the Corporation.

FIFTH: Subject to any additional vote required by this Certificate of Incorporation, in furtherance and not in limitation of the powers conferred by law, the Board of Directors is expressly authorized to make, repeal, alter, amend and rescind any or all of the Bylaws of the Corporation; provided, that, in the event any such amendment adversely affects a class of stock in a manner disproportionate to the effect on other classes, such amendment shall require the prior written consent of the holders of a majority of the outstanding shares of such adversely-affected class of stock.

SIXTH: SIXTH: Subject to Section 5(b) of Article Fourth, the Board of Directors shall initially consist of one (1) Director.

SEVENTH: Elections of the Director need not be by written ballot unless the Bylaws of the Corporation shall so provide.

EIGHTH: Meetings of stockholders may be held within or without the State of Delaware, as the Bylaws of the Corporation may provide. The books of the Corporation may be kept outside the State of Delaware at such place or places as may be designated from time to time by the Board of Directors or in the Bylaws of the Corporation.

NINTH: To the fullest extent permitted by law, a director of the Corporation shall not be personally liable to the Corporation or its stockholders for monetary damages for breach of fiduciary duty as a director. If the General Corporation Law or any other law of the State of Delaware is amended after approval by the stockholders of this Article Ninth to authorize corporate action further eliminating or limiting the personal liability of directors, then the liability of a director of the Corporation shall be eliminated or limited to the fullest extent permitted by the General Corporation Law as so amended.

Any repeal or modification of the foregoing provisions of this Article Ninth by the stockholders of the Corporation shall not adversely affect any right or protection of a director of the Corporation existing at the time of, or increase the liability of any director of the Corporation with respect to any acts or omissions of such director occurring prior to, such repeal or modification.

TENTH:

(a) The Corporation shall indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative (other than an action by or in the right of the Corporation), by reason of the fact that he or she is or was a director, officer, employee or agent of the Corporation, or is or was serving at the request of the Corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise, against expenses (including attorneys’ fees), judgments, fines and amounts paid in settlement actually and reasonably incurred by him or her in connection with such action, suit or proceeding if he or she acted in good faith and in a manner he or she reasonably believed to be in or not opposed to the best interests of the Corporation, and, with respect to any criminal action or proceeding, had no reasonable cause to believe his or her conduct was unlawful. The termination of any action, suit or proceeding by judgment, order, settlement or conviction, or upon a plea of nolo contendere or its equivalent, shall not, of itself, create a presumption that such person did not act in good faith and in a manner which he or she reasonably believed to be in or not opposed to the best interests of the Corporation, and, with respect to any criminal action or proceeding, had reasonable cause to believe that his or her conduct was unlawful.

(b) The Corporation shall indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action or suit by or in the right of the Corporation to procure a judgment in its favor by reason of the fact that he or she is or was a director, officer, employee or agent of the Corporation, or is or was serving at the request of the Corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise, against expenses (including attorneys’ fees) actually and reasonably incurred by him or her in connection with the defense or settlement of such action or suit if he or she acted in good faith and in a manner he or she reasonably believed to be in or not opposed to the best interests of the Corporation, except that no indemnification shall be made in respect of any claim, issue or matter as to which such person shall have been adjudged to be liable to the Corporation unless and only to the extent that the Court of Chancery of the State of Delaware or the court in which such action or suit was brought shall determine upon application that, despite the adjudication of liability but in view of all the circumstances of the case, such person is fairly and reasonably entitled to indemnity for such expenses which such Court of Chancery or such other court shall deem proper.

(c) To the extent that a director, officer, employee or agent of the Corporation has been successful on the merits or otherwise in defense of any action, suit or proceeding referred to in Sections A and B of this Article Tenth, or in defense of any claim, issue or matter therein, he or she shall be indemnified against expenses (including attorneys’ fees) actually and reasonably incurred by him or her in connection therewith.

(d) Any indemnification under Sections A and B of this Article Tenth (unless ordered by a court) shall be made by the Corporation only as authorized in the specific case upon a determination that indemnification of the director, officer, employee or agent is proper in the circumstances because he or she has met the applicable standard of conduct set forth in Sections A and B of this Article Tenth. Such determination shall be made, with respect to a person who is a director or officer at the time of such determination, (i) by a majority vote of the directors who were not parties to such action, suit or proceeding, even though less than a quorum, (ii) by a committee of such directors designated by majority vote of such directors, even though less than a quorum, (iii) if there are no such directors, or if such directors so direct, by independent legal counsel in a written opinion or (iv) by the stockholders.

(e) Expenses (including attorneys’ fees and costs) incurred by a director or officer in defending any civil, criminal, administrative or investigative action, suit or proceeding may be paid by the Corporation in advance of the final disposition of such action, suit or proceeding upon receipt of an undertaking by or on behalf of such director or officer to repay such amount if it shall ultimately be determined that he or she is not entitled to be indemnified by the Corporation pursuant to this Article Tenth. Such expenses (including attorneys’ fees) incurred by former directors and officers or other employees and agents may be so paid upon such terms and conditions, if any, as the Board of Directors deems appropriate.

(f) The indemnification and advancement of expenses provided by, or granted pursuant to, this Article Tenth shall not be deemed exclusive of any other rights to which those seeking indemnification or advancement of expenses may be entitled under any by-law, agreement, vote of stockholders or disinterested directors or otherwise, both as to action in such person’s official capacity and as to action in another capacity while holding such office.

(g) For purposes of this Article Tenth, any reference to the “Corporation” shall include, in addition to the resulting or surviving corporation, any constituent corporation (including any constituent of a constituent) absorbed in a consolidation or merger which, if its separate existence had continued, would have had power and authority to indemnify its directors, officers, employees or agents, so that any person who is or was a director, officer, employee or agent of such constituent corporation, or is or was serving at the request of such constituent corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise, shall stand in the same position under the provisions of this Article Tenth with respect to the resulting or surviving corporation as he or she would have with respect to such constituent corporation if its separate existence had continued.

(h) For purposes of this Article Tenth, any reference to “other enterprise” shall include employee benefit plans; any reference to “fines” shall include any excise taxes assessed on a person with respect to any employee benefit plan; and any reference to “serving at the request of the Corporation” shall include any service as a director, officer, employee or agent of the Corporation which imposes duties on, or involves services by, such director, officer, employee or agent with respect to an employee benefit plan, its participants or beneficiaries; and a person who acted in good faith and in a manner he or she reasonably believed to be in the interest of the participants and beneficiaries of an employee benefit plan shall be deemed to have acted in a manner “not opposed to the best interests of the Corporation” as referred to in this Article Tenth.

Any amendment, repeal or modification of the foregoing provisions of this Article Tenth shall not adversely affect any right or protection of any director, officer or other agent of the Corporation existing at the time of, or increase the liability of any director, officer or other agent of the Corporation with respect to any acts or omissions of such director, officer or other agent occurring prior to, such amendment, repeal or modification.

ELEVENTH: Subject to any additional vote required by this Certificate of Incorporation, the Corporation reserves the right to amend, alter, change or repeal any provision contained in this Certificate of Incorporation, in the manner now or hereafter prescribed by statute, and all rights conferred upon stockholders herein are granted subject to this reservation.

* * *

3. That said Amended and Restated Certificate of Incorporation, which restates and integrates and further amends the provisions of the Corporation’s Certificate of Incorporation, has been duly adopted in accordance with Sections 241 and 245 of the General Corporation Law.

(remainder of page intentionally left blank; signature page follows)

IN WITNESS WHEREOF, this Amended and Restated Certificate of Incorporation has been executed by a duly authorized officer of the Corporation on this 29th day of August, 2023.

|

|

|

|

|

|

By:

|

/s/ James Dondero

|

|

|

|

Name:

|

James Dondero

|

|

|

|

Title

|

President

|

|

[Signature Page to Amended and Restated Certificate of Incorporation]

v3.23.2

Document And Entity Information

|

Sep. 01, 2023 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

NexPoint Diversified Real Estate Trust

|

| Document, Type |

8-K

|

| Document, Period End Date |

Sep. 01, 2023

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-32921

|

| Entity, Tax Identification Number |

80-0139099

|

| Entity, Address, Address Line One |

300 Crescent Court, Suite 700

|

| Entity, Address, City or Town |

Dallas

|

| Entity, Address, State or Province |

TX

|

| Entity, Address, Postal Zip Code |

75201

|

| City Area Code |

214

|

| Local Phone Number |

276-6300

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001356115

|

| CommonShares Custom [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Shares

|

| Trading Symbol |

NXDT

|

| Security Exchange Name |

NYSE

|

| SeriesACumulativePreferredShares550 Custom [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

5.50% Series A Cumulative Preferred Shares

|

| Trading Symbol |

NXDT-PA

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=nxdt_CommonSharesCustomMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=nxdt_SeriesACumulativePreferredShares550CustomMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

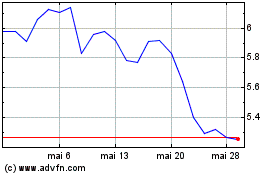

NexPoint Diversified Rea... (NYSE:NXDT)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

NexPoint Diversified Rea... (NYSE:NXDT)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024