FORM

N-CSR

CERTIFIED

SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment

Company Act file number: 811-02736

-------------------------------------------------------------------------

ADAMS

NATURAL RESOURCES FUND, INC.

-------------------------------------------------------------------------

(Exact name of registrant as specified in charter)

500

East Pratt Street, Suite 1300, Baltimore, Maryland 21202

-------------------------------------------------------------------------

(Address of principal executive offices)

Janis

F. Kerns

Adams Natural Resources Fund, Inc.

500 East Pratt Street, Suite 1300

Baltimore, Maryland 21202

-------------------------------------------------------------------------

(Name and address of agent for service)

Registrant's telephone

number, including area code: (410) 752-5900

Date of fiscal year end: December 31

Date of reporting period: December 31, 2024

Item 1. Reports to Stockholders.

ADAMS

NATURAL RESOURCES

FUND

GET THE LATEST NEWS AND INFORMATION

Managed Distribution Policy

The Board of Directors of Adams Natural Resources Fund, Inc. (the “Fund”) adopted a Managed Distribution Policy (“MDP”) to enhance long-term shareholder value by paying level quarterly distributions at a committed rate of 8% of average net asset value (“NAV”) per year. Distributions in accordance with the MDP began in the third quarter of 2024.

The Fund pays distributions four times a year. Distributions under the MDP can be derived from net investment income, realized capital gains, or possibly, returns of capital, and are payable in newly issued shares of common stock unless a shareholder specifically elects to receive cash. The Fund has committed to distribute 2% of average NAV for each quarterly distribution, with the fourth quarter distribution to be the greater of 2% of average NAV or the amount needed to satisfy minimum distribution requirements of the Internal Revenue Code for regulated investment companies. Average NAV is based on the average of the previous four quarter-end NAVs per share prior to each declaration date.

With each distribution, the Fund will issue a notice to shareholders, which will provide detailed information regarding the amount and composition of the distribution and other related information. The amounts and sources of distributions reported in the notice to shareholders are only estimates and are not being provided for tax reporting purposes. The actual amounts and sources of the distributions for tax reporting purposes will depend upon the Fund’s investment experience during its fiscal year and may be subject to changes based on tax regulations. Shareholders will receive a Form 1099-DIV in January for the previous calendar year that will indicate how to report these distributions for federal income tax purposes.

Disclaimers

The primary purpose of the MDP is to provide shareholders with a constant, but not guaranteed, rate of distribution each quarter. You should not draw any conclusions about the Fund’s investment performance from the amount of the current distribution or from the terms of the Fund’s MDP. The Board may amend or terminate the MDP at any time without prior notice to shareholders. However, at this time, there are no reasonably foreseeable circumstances that might cause the termination of the MDP.

The Fund

•

a closed-end equity investment company specializing in energy and other natural resources stocks

•

objectives: preservation of capital, reasonable income, and opportunity for capital gain

•

internally managed

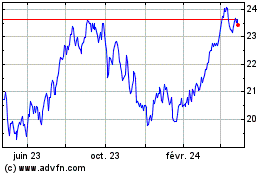

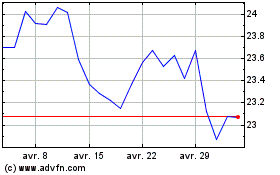

Stock Data (12/31/24)

| |

NYSE Symbol |

|

|

|

|

PEO |

|

| |

Market Price |

|

|

|

$ |

21.74 |

|

| |

52-Week Range |

|

|

|

$ |

19.85–$24.76 |

|

| |

Discount |

|

|

|

|

10.2% |

|

|

| |

Shares Outstanding |

|

|

|

|

26,284,550 |

|

Summary Financial Information

|

Year Ended December 31,

|

|

|

2024

|

|

|

2023

|

|

| Net asset value per share (NASDAQ: XPEOX) |

|

|

|

$ |

24.21 |

|

|

|

$ |

24.83 |

|

| Total net assets |

|

|

|

|

636,334,398 |

|

|

|

|

633,446,941 |

|

| Average net assets |

|

|

|

|

677,801,000 |

|

|

|

|

641,874,182 |

|

| Unrealized appreciation on investments |

|

|

|

|

149,487,033 |

|

|

|

|

164,708,957 |

|

| Net investment income |

|

|

|

|

16,160,868 |

|

|

|

|

17,091,832 |

|

| Net realized gain (loss) |

|

|

|

|

29,913,538 |

|

|

|

|

17,507,537 |

|

| Total return (based on market price) |

|

|

|

|

13.8% |

|

|

|

|

|

1.0% |

|

|

| Total return (based on net asset value) |

|

|

|

|

5.3% |

|

|

|

|

|

2.5% |

|

|

| Ratio of expenses to average net assets |

|

|

|

|

0.61% |

|

|

|

|

|

0.64% |

|

|

| Annual distribution rate |

|

|

|

|

6.7%* |

|

|

|

|

|

6.2% |

|

|

*

The Fund’s MDP was effective for the final two quarters in 2024, resulting in a less than 8% distribution rate for the year.

2024 Dividends and Distributions

|

Paid

|

|

|

Amount

(per share)

|

|

|

Type

|

|

| March 1, 2024 |

|

|

|

$ |

0.01 |

|

|

|

|

|

Long-term capital gain |

|

|

| March 1, 2024 |

|

|

|

|

0.09 |

|

|

|

|

|

Investment income |

|

|

| May 31, 2024 |

|

|

|

|

0.10 |

|

|

|

|

|

Investment income |

|

|

| August 30, 2024 |

|

|

|

|

0.22 |

|

|

|

|

|

Long-term capital gain |

|

|

| August 30, 2024 |

|

|

|

|

0.32 |

|

|

|

|

|

Investment income |

|

|

| December 19, 2024 |

|

|

|

|

0.89 |

|

|

|

|

|

Long-term capital gain |

|

|

| December 19, 2024 |

|

|

|

|

0.14 |

|

|

|

|

|

Investment income |

|

|

| |

|

|

|

$ |

1.77 |

|

|

|

|

|

|

|

|

2025 Annual Meeting of Shareholders

Location: Adams Funds, 500 East Pratt Street, Suite 1300, Baltimore, MD 21202

Date: April 17, 2025

Time: 9:30 a.m.

Letter from Chief Executive Officer & President

James P. Haynie

Dear Fellow Shareholders,

Heading into 2024, with the stock market’s impressive gains of 2023 fresh in their minds, investors were still faced with uncertainty. The contentious U.S. election promised to provide twists and turns throughout the year. Geopolitical uncertainty was high and rising. The U.S. Federal Reserve (Fed) was expected to reduce interest rates, but when, how fast, and by how much? Inflation was moderating and the U.S. economy remained resilient—in better shape than many around the world. A soft landing for the economy seemed within reach, but far from assured. The Chinese economy was beset by problems and slowing growth, but hopes were resting on a stimulus-fueled recovery. Many prognosticators opined that the U.S. led, mega-cap, artificial intelligence (AI)-fueled global equity rally would not continue on its current pace.

A lot changed in 2024. Donald Trump won the Presidency, and the Republicans secured a majority in both houses of Congress, settling one of 2024’s biggest questions marks. Events in Gaza, Ukraine, Syria, and elsewhere turned the geopolitical heat up, not down. The Fed started to ease monetary policy, lowering interest rates in September for the first time in four years. Although the Fed cut interest rates two more times in 2024, hotter-than-expected inflation readings called the extent of this easing cycle into question. The American economy—at least in terms of GDP growth and a cooling, yet still solid labor market—remained

“Stock selection in Energy drove our outperformance, led by relative strength in the Equipment & Services and the E&P industry groups.”

resilient, but recessionary fears flared in Europe. The effectiveness of China’s stimulus efforts remained a question mark. Meanwhile, stocks marched higher, nearly matching 2023’s gains. Led by the strength of AI stocks, the S&P 500 Index notched its best two-year run since 1997-1998. Once again, many people ended the year believing the AI trade can’t continue to drive markets higher, at least not on this trajectory.

West Texas Intermediate (WTI) crude oil prices finished the year essentially flat, just below $72 per barrel. Crude oil traded in a narrow range in 2024—the U.S. Energy Information Administration reported that adjusted for inflation, Brent crude’s range was the narrowest since 2003. The offsetting dynamics of heightened geopolitical risks and voluntary production restrictions from OPEC+against strong production growth and slower demand growth kept oil prices range bound.

While broad markets advanced sharply, the Energy sector increased a more modest 5.7% and was one of three advancing sectors to post less than double-digit gains during the year. The Materials sector was flat for the year.

The Energy sector’s performance was bolstered by a 66% surge in the Storage & Transportation group, which benefited in part from the AI theme, specifically concerning natural gas and electricity that will be required to power AI data centers. Natural gas prices surged in 2024, aided by this same AI optimism, as well as expectations that the demand for liquified natural gas (LNG) will be essential for global economic growth for decades to come. Additionally, the stable revenue and earnings profiles of Storage & Transportation stocks were beneficial in the uncertain sector environment. The Integrated Oil & Gas group also advanced for the year while Equipment & Services, Exploration & Production (E&P), and Refining & Marketing all posted annual declines.

Letter To Shareholders (continued)

The sluggish performance of the economically-sensitive Materials sector was interesting, given how well markets did and the sense of optimism about economic growth. While inventories in most chemicals and agriculture markets were fairly balanced, there wasn’t enough underlying demand growth to incentivize higher prices. In this environment, earnings growth remained challenged and the stocks failed to keep pace with the more robust growth opportunities elsewhere.

Our Fund, with exposure to both Energy and Materials, returned 5.3% on net asset value (NAV) and 13.8% on market price. Our benchmark, which is comprised of the S&P 500 Energy sector (80%) and the S&P 500 Materials sector (20%), returned 4.6%. In May 2024, the Fund’s Board of Directors adopted a managed distribution policy to distribute at least 2% of average net asset value each quarter. We distributed 6.7% to our shareholders in 2024.

2024 Market Recap

WTI oil prices rose 16% in the first quarter of 2024 and peaked for the year in April, just below $87 per barrel, pushed higher by below-average supply levels, better-than-expected global demand, and intensifying geopolitical conflicts. After that, concerns around the demand recovery from China started to apply downward pressure, and prices moved modestly lower in the second quarter. A changing supply dynamic also weighed on prices, as OPEC+ announced plans to phase out some voluntary production cuts in the fall of 2024.

Those worries lingered into September, as WTI sold off to a three-year low during the month, falling briefly below $65 per barrel. Global inventory levels remained stable, but persistent spare capacity from OPEC+, which ultimately pushed plans to increase production back April 2025, weighed on prices. Meanwhile, without the expectation of accelerating demand growth, especially from China, oil prices declined sharply.

In the fourth quarter, WTI prices rose 5.2%, aided by signs of a long-awaited economic recovery in China, where manufacturing activity data showed signs of expansion late in the year. Prices also benefited from geopolitical risk factors, including Iran’s October bombing of Israel. However, worries about oversupply in 2025 remained top of mind, as some market observers forecast sluggish demand ahead.

Natural gas prices dropped by nearly 30% in the first quarter amid elevated domestic inventories and warmer-than-expected weather. Prices began to rise in the second quarter as U.S. natural gas suppliers curtailed production and domestic inventories showed signs of normalizing towards long-term averages. By the fourth quarter, natural gas prices surged to an annual high, lifted by a colder weather forecast and prices increasing in Europe in anticipation of a January 2025 halt in Russian gas flows through a Ukrainian pipeline.

Energy stocks rallied (along with oil) to start 2024, peaking in April and outpacing the S&P 500 for a good portion of the first half of the year. A series of major mergers and acquisitions helped, highlighted by ExxonMobil’s May completion of its $60 billion purchase of Pioneer Natural Resources, and the announcement of several other deals.

In the third quarter, the sector’s decline was modest, but all other S&P 500 sectors advanced. To start the fourth quarter, Energy was one of only three sectors to advance but post-election strength gave way to a sharp decline in December. Lingering concerns in China and Europe, together with the threat of increased production from OPEC+, weighed on oil prices and energy stocks.

Materials stocks generated a return of 9.7% through the first nine months of the year. Containers & Packaging stocks led the sector, benefiting from corporate consolidation that has led to strong and sustainable pricing power. A volatile fourth quarter, however, ended with a sharp decline of over 10% in December amid weaker-than-expected earnings and forward guidance, falling commodity prices (including gold), post-election uncertainty, and worries about global economic growth.

Letter To Shareholders (continued)

Portfolio Performance

Our Fund generated a 5.3% total return on net asset value during the year, ahead of our benchmark by 0.7%. Stock selection in Energy drove our outperformance, led by relative strength in the Equipment & Services and the E&P industry groups.This positive performance was partially offset by the Storage & Transportation group, as well as the Materials sector.

Stock selection in Equipment & Services was the largest driver of relative performance, as our holdings were more resilient than those in the benchmark. The leading contributor was our position in TechnipFMC, whose shares gained 44.9% during the year. TechnipFMC, a market leader in subsea equipment, benefited from continuing increases in spending on offshore developments. The company has started to commercialize new offshore technologies, including electric subsea equipment and full subsea processing, supplementing an already robust backlog.

In E&P, Expand Energy was a key contributor. The company, the combination of Chesapeake Energy and Southwestern Energy, began trading as Expand in October and is North America’s largest independent natural gas producer. The market rewarded the company’s plans to improve the profitability of the newly-merged entity, as well as its disciplined capital management, which helps maintain profitability amid what can be a volatile pricing environment. Shares surged in the fourth quarter, supported by investor optimism about a friendly Trump administration and its support of the United States’ dominant position in the global natural gas market.

In contrast, the Fund’s positioning in the Storage & Transportation group weighed modestly on performance. Our position in Williams Companies, which operates one of the largest natural gas infrastructure systems in the U.S., performed well. But this position alone wasn’t enough to offset our underweights in the remainder of the group, which advanced 67.2% during the year.

In Materials, our investments trailed the sector’s performance by almost 1%. Ecolab was a standout performer, benefiting from its stable business mix of products serving water, hygiene, and energy businesses. This was more than offset by our position in coatings maker PPG Industries, which struggled with weaker-than-expected industrial demand and failed to gain momentum from the announced sale of its North American architectural paints business. In the Chemicals space, an early year earnings miss by Dupont de Nemours, after positive guidance just weeks earlier, caused the stock to sell off sharply.

Outlook for 2025

A year ago, we wrote that whether the glass is half full or half empty remained very much up for debate. After a two year run-up for equities, driven higher by AI and the resilience of the consumer and the U.S. economy, the glass ought to be overflowing. And yet, in many ways, uncertainty continues to reign. That’s always true, of course, but it feels a little beyond normal these days. Aside from the big-picture issues—global conflicts, still-stubborn inflation that threatens the consumer, and a lack of clarity on the path of interest rates—lie questions surrounding the incoming administration. We know a lot about what President Trump would like to do, including support a strong stock market. However, at this point we don’t know how much policies will actually change, or what impact those changes will have.

Letter To Shareholders (continued)

The market and the economy have overcome a lot of challenges in recent years. Are they up for it again in 2025? Will the Fed truly achieve its hoped-for soft landing? Will the market’s run continue as AI fuels earnings and economic growth? Or will growth slow, prompting a pullback from today’s high equity valuations? The truth is, no matter what the so-called experts say this time of year, no one knows. The reality will likely fall somewhere in the middle, and we may close 2025 still wondering about the proverbial water level in the glass. That’s why we believe that taking a long-term, disciplined view is the best way forward. Especially in times like these, it’s vitally important to continue to strike a balance between seeking growth opportunities and managing risk.

We appreciate your trust and look forward to the year ahead.

By order of the Board of Directors,

James P. Haynie, CFA

Chief Executive Officer & President

January 24, 2025

This following shows the value of hypothetical $10,000 investments in the Fund at market price and in the Fund’s benchmarks over the past 10 years with dividend and distributions reinvested. All Fund distributions are assumed to be reinvested at the lower of the net asset value per share or the closing NYSE market price on the distribution’s valuation date. Amounts do not reflect taxes paid by shareholders on distributions or the sale of shares.

| |

|

Average Annual Total Returns at 12/31/24

|

|

|

| |

|

|

|

|

Years

|

|

|

| |

|

|

|

|

1

|

|

|

3

|

|

|

5

|

|

|

10

|

|

|

| |

|

PEO Market Price |

|

|

|

|

13.8% |

|

|

|

|

|

17.8% |

|

|

|

|

|

13.0% |

|

|

|

|

|

5.8% |

|

|

|

| |

|

S&P 500 Energy Sector Index |

|

|

|

|

5.7% |

|

|

|

|

|

20.0% |

|

|

|

|

|

12.1% |

|

|

|

|

|

4.9% |

|

|

|

| |

|

S&P 500 Materials Sector Index |

|

|

|

|

0.0% |

|

|

|

|

|

-0.4% |

|

|

|

|

|

8.7% |

|

|

|

|

|

7.9% |

|

|

|

Disclaimers

This report contains “forward-looking statements” within the meaning of the Securities Act of 1933 and the Securities Exchange Act of 1934. By their nature, all forward-looking statements involve risks and uncertainties, and actual results could differ materially from those contemplated by the forward-looking statements. Several factors that could materially affect the Fund’s actual results are the performance of the portfolio of stocks held by the Fund, the conditions in the U.S. and international financial markets, the price at which shares of the Fund will trade in the public markets, and other factors discussed in the Fund’s periodic filings with the Securities and Exchange Commission.

This report is transmitted to the shareholders of the Fund for their information. It is not a prospectus, circular or representation intended for use in the purchase or sale of shares of the Fund or of any securities mentioned in the report. The rates of return will vary and the principal value of an investment will fluctuate. Shares, if sold, may be worth more or less than their original cost. Past performance is no guarantee of future investment results.

December 31, 2024

(unaudited)

Ten Largest Equity Portfolio Holdings

| |

|

|

Market Value

|

|

|

Percent

of Net Assets

|

|

| Exxon Mobil Corporation |

|

|

|

$ |

154,250,539 |

|

|

|

|

24.2% |

|

|

| Chevron Corporation |

|

|

|

|

73,893,168 |

|

|

|

|

11.6 |

|

|

| ConocoPhillips |

|

|

|

|

40,531,076 |

|

|

|

|

6.4 |

|

|

| Linde plc |

|

|

|

|

29,055,698 |

|

|

|

|

4.6 |

|

|

| EOG Resources, Inc. |

|

|

|

|

26,681,621 |

|

|

|

|

4.2 |

|

|

| Williams Companies, Inc. |

|

|

|

|

19,772,742 |

|

|

|

|

3.1 |

|

|

| ONEOK, Inc. |

|

|

|

|

18,855,120 |

|

|

|

|

3.0 |

|

|

| Hess Corporation |

|

|

|

|

18,380,519 |

|

|

|

|

2.9 |

|

|

| Baker Hughes Company |

|

|

|

|

17,560,662 |

|

|

|

|

2.8 |

|

|

| Phillips 66 |

|

|

|

|

15,742,278 |

|

|

|

|

2.5 |

|

|

| |

|

|

|

$ |

414,723,423 |

|

|

|

|

65.3% |

|

|

Industry Weightings as a Percent of Net Assets

Statement of Assets and Liabilities

| |

Assets |

|

|

|

|

|

|

|

|

|

|

|

| |

Investments at value*: |

|

|

|

|

|

|

|

|

|

|

|

| |

Common stocks (cost $483,449,796)

|

|

|

|

$ |

632,936,909 |

|

|

|

|

|

|

| |

Short-term investments (cost $4,832,291)

|

|

|

|

|

4,832,211 |

|

|

|

$ |

637,769,120 |

|

| |

Cash |

|

|

|

|

|

|

|

|

|

102,126 |

|

| |

Investment securities sold |

|

|

|

|

|

|

|

|

|

5,413,502 |

|

| |

Dividends receivable |

|

|

|

|

|

|

|

|

|

307,706 |

|

| |

Prepaid expenses and other assets |

|

|

|

|

|

|

|

|

|

1,646,703 |

|

| |

Total Assets

|

|

|

|

|

|

|

|

|

|

645,239,157 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Liabilities |

|

|

|

|

|

|

|

|

|

|

|

| |

Investment securities purchased |

|

|

|

|

|

|

|

|

|

5,838,597 |

|

| |

Due to officers and directors (note 8) |

|

|

|

|

|

|

|

|

|

1,170,903 |

|

| |

Accrued expenses and other liabilities |

|

|

|

|

|

|

|

|

|

1,895,259 |

|

| |

Total Liabilities

|

|

|

|

|

|

|

|

|

|

8,904,759 |

|

| |

Net Assets

|

|

|

|

|

|

|

|

|

$ |

636,334,398 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Net Assets

|

|

|

|

|

|

|

|

|

|

|

|

| |

Common Stock at par value $0.001 per share, authorized 50,000,000

shares; issued and outstanding 26,284,550 shares (includes 7,237

deferred stock units) (note 7)

|

|

|

|

|

|

|

|

|

$ |

26,285 |

|

| |

Additional capital surplus |

|

|

|

|

|

|

|

|

|

485,582,553 |

|

| |

Total distributable earnings (loss) |

|

|

|

|

|

|

|

|

|

150,725,560 |

|

| |

Net Assets Applicable to Common Stock

|

|

|

|

|

|

|

|

|

$ |

636,334,398 |

|

| |

Net Asset Value Per Share of Common Stock

|

|

|

|

|

|

|

|

|

$ |

24.21 |

|

*

See Schedule of Investments beginning on page 18.

The accompanying notes are an integral part of the financial statements.

Year Ended December 31, 2024

| |

Investment Income |

|

|

|

|

|

|

| |

Income:

|

|

|

|

|

|

|

| |

Dividends (net of $19,876 in foreign taxes)

|

|

|

|

$ |

20,086,221 |

|

| |

Other income

|

|

|

|

|

242,612 |

|

| |

Total Income

|

|

|

|

|

20,328,833 |

|

| |

Expenses:

|

|

|

|

|

|

|

| |

Investment research compensation and benefits

|

|

|

|

|

1,792,597 |

|

| |

Administration and operations compensation and benefits

|

|

|

|

|

767,316 |

|

| |

Occupancy and other office expenses

|

|

|

|

|

254,890 |

|

| |

Investment data services

|

|

|

|

|

196,114 |

|

| |

Directors’ compensation

|

|

|

|

|

419,000 |

|

| |

Shareholder reports and communications

|

|

|

|

|

189,268 |

|

| |

Transfer agent, custody, and listing fees

|

|

|

|

|

151,801 |

|

| |

Accounting, recordkeeping, and other professional fees

|

|

|

|

|

103,762 |

|

| |

Insurance

|

|

|

|

|

72,692 |

|

| |

Audit and tax services

|

|

|

|

|

125,488 |

|

| |

Legal services

|

|

|

|

|

95,037 |

|

| |

Total Expenses

|

|

|

|

|

4,167,965 |

|

| |

Net Investment Income

|

|

|

|

|

16,160,868 |

|

| |

|

|

|

|

|

|

|

| |

Realized Gain (Loss) and Change in Unrealized Appreciation |

|

|

|

|

|

|

| |

Net realized gain (loss) on investments

|

|

|

|

|

29,378,789 |

|

| |

Net realized gain (loss) on total return swap agreements

|

|

|

|

|

534,749 |

|

| |

Change in unrealized appreciation on investments

|

|

|

|

|

(15,221,924) |

|

|

| |

Net Gain (Loss)

|

|

|

|

|

14,691,614 |

|

| |

Change in Net Assets from Operations |

|

|

|

$

|

30,852,482

|

|

The accompanying notes are an integral part of the financial statements.

Statements of Changes in Net Assets

| |

|

|

For the Year Ended December 31,

|

|

| |

2024

|

|

|

2023

|

|

| From Operations: |

|

|

|

|

|

|

|

|

|

|

|

|

Net investment income

|

|

|

|

$ |

16,160,868 |

|

|

|

$ |

17,091,832 |

|

|

Net realized gain (loss)

|

|

|

|

|

29,913,538 |

|

|

|

|

17,507,537 |

|

|

Change in unrealized appreciation

|

|

|

|

|

(15,221,924) |

|

|

|

|

|

(24,905,493) |

|

|

|

Change in Net Assets from Operations

|

|

|

|

|

30,852,482 |

|

|

|

|

9,693,876 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Distributions to Shareholders from: |

|

|

|

|

|

|

|

|

|

|

|

|

Total distributable earnings

|

|

|

|

|

(45,343,603) |

|

|

|

|

|

(33,803,770) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| From Capital Share Transactions: |

|

|

|

|

|

|

|

|

|

|

|

|

Value of shares issued in payment of distributions (note 5)

|

|

|

|

|

18,794,765 |

|

|

|

|

10,099,505 |

|

|

Cost of shares purchased (note 5)

|

|

|

|

|

(1,416,187) |

|

|

|

|

|

(3,879,111) |

|

|

|

Change in Net Assets from Capital Share Transactions

|

|

|

|

|

17,378,578 |

|

|

|

|

6,220,394 |

|

|

Total Change in Net Assets

|

|

|

|

|

2,887,457 |

|

|

|

|

(17,889,500) |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Net Assets: |

|

|

|

|

|

|

|

|

|

|

|

|

Beginning of year

|

|

|

|

|

633,446,941 |

|

|

|

|

651,336,441 |

|

|

End of year

|

|

|

|

$ |

636,334,398 |

|

|

|

$ |

633,446,941 |

|

The accompanying notes are an integral part of the financial statements.

Notes To Financial Statements

Adams Natural Resources Fund, Inc. (the “Fund”) is registered under the Investment Company Act of 1940 (“1940 Act”) as a non-diversified investment company. The Fund is an internally managed closed-end fund specializing in energy and other natural resources stocks. Its investment objectives are preservation of capital, the attainment of reasonable income from investments, and an opportunity for capital appreciation.

1. SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation — The Fund is an investment company and applies the accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946 Financial Services - Investment Companies. The accompanying financial statements were prepared in accordance with accounting principles generally accepted in the United States of America (GAAP), which require the use of estimates by Fund management. Management believes that estimates and valuations are appropriate; however, actual results may differ from those estimates and the valuations reflected in the financial statements may differ from the value the Fund ultimately realizes. Additionally, unpredictable events such as natural disasters, war, terrorism, global pandemics, and similar public health threats may significantly affect the economy, markets, and companies in which the Fund invests. The Fund could be negatively impacted if the value of portfolio holdings are harmed by such events.

Affiliates — Adams Diversified Equity Fund, Inc. (“ADX”), a diversified, closed-end investment company, owns 8.9% of the Fund’s outstanding shares and is, therefore, an “affiliated company” as defined by the 1940 Act. During the year ended December 31, 2024, the Fund paid dividends and capital gain distributions of $3,924,052 to ADX. Directors of the Fund are also directors of ADX. The Fund, ADX, and Adams Funds Advisers, LLC (“AFA”), an ADX-affiliated investment adviser to external parties, have a shared management team.

Distributions — Distributions to shareholders are recorded on the ex-dividend date. Effective in the third quarter of 2024, the Fund employs a Managed Distribution Policy (“MDP”) that pays level quarterly distributions at a committed rate of 8% of average net asset value per year. Average net asset value is based on the average of the previous four quarter-end net asset values per share prior to the declaration date. Distributions are generated from portfolio income and capital gains derived from managing the portfolio. If such earnings do not meet the distribution commitment, or it’s deemed in the best interest of shareholders, the Fund may return capital. A return of capital is not taxable to shareholders and does not necessarily reflect the Fund’s investment performance.

Expenses — The Fund shares personnel, systems, and other infrastructure items with ADX and AFA and is charged a portion of the shared expenses. To protect the Fund from potential conflicts of interest, policies and procedures are in place covering the sharing of expenses among the entities. Expenses solely attributable to an entity are charged to that entity. Expenses that are not solely attributable to one entity are allocated in accordance with the Fund’s expense sharing policy. The Fund’s policy dictates that expenses, other than those related to personnel, are attributed to AFA based on the average estimated amount of time spent by all personnel on AFA-related activities relative to overall job functions; the remaining portion is attributed to the Fund and ADX based on relative net assets excluding affiliated holdings. Personnel-related expenses are attributed to AFA based on the individual’s time spent on AFA-related activities; the remaining portion is attributed to the Fund and ADX based on relative market values of portfolio securities covered for research staff and relative net assets excluding affiliated holdings for all others. Expense allocations are updated quarterly. Because AFA has no assets under management, only those expenses directly attributable to AFA are charged to AFA.

For the year ended December 31, 2024, shared expenses totaled $19,514,999, of which $15,344,993 and $2,041 were charged to ADX and AFA, respectively, in accordance with the Fund’s expense sharing policy. There were no amounts due to, or due from, affiliated companies at December 31, 2024.

Notes To Financial Statements (continued)

Investment Transactions and Income — The Fund’s investment decisions are made by the portfolio management team with recommendations from the research staff. Policies and procedures are in place covering the allocation of investment opportunities among the Fund and its affiliates to protect the Fund from potential conflicts of interest. Investment transactions are accounted for on trade date. Realized gains and losses on sales of investments are recorded on the basis of specific identification. Dividend income is recognized on the ex-dividend date.

Segment Reporting — The Fund’s primary business is to invest assets to generate returns from investment income and capital appreciation and is operated as a single segment in carrying out its investment objective. The Fund’s management committee, comprised of the Fund’s chief executive officer, chief financial officer, and general counsel, serves as the chief operating decision maker in determining key operating decisions that include capital allocation and expense structure for the Fund and executing significant contracts on behalf of the Fund. All significant expense categories are presented on the Statement of Operations and used for budgeting purposes. The management committee uses change in net assets from operations, as presented on the Statement of Operations, and total investment return based on net asset value and ratio of expenses to average net assets, as presented on the Financial Highlights, to assess fund performance and allocate resources.

Valuation — The Fund’s financial instruments are reported at fair value, which is defined as the price that would be received from selling an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The Fund has a Valuation Committee (“Committee”) so that financial instruments are appropriately priced at fair value in accordance with GAAP and the 1940 Act. Subject to oversight and approval by the Board of Directors, the Committee establishes methodologies and procedures to value securities for which market quotations are not readily available.

GAAP establishes the following hierarchy that categorizes the inputs used to measure fair value:

•

Level 1 — fair value is determined based on market data obtained from independent sources; for example, quoted prices in active markets for identical investments;

•

Level 2 — fair value is determined using other assumptions obtained from independent sources; for example, quoted prices for similar investments;

•

Level 3 — fair value is determined using the Fund’s own assumptions, developed based on the best information available under the circumstances.

Investments in securities traded on national exchanges are valued at the last reported sale price as of the close of regular trading on the relevant exchange on the day of valuation. Over-the-counter and listed equity securities for which a sale price is not available are valued at the last quoted bid price. Money market funds are valued at net asset value. These securities are generally categorized as Level 1 in the hierarchy.

Total return swap agreements are valued using independent, observable inputs, including underlying security prices, dividends, and interest rates. These securities are generally categorized as Level 2 in the hierarchy.

At December 31, 2024, the Fund’s financial instruments were classified as follows:

| |

|

|

Level 1

|

|

|

Level 2

|

|

|

Level 3

|

|

|

Total

|

|

| Assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Common stocks |

|

|

|

$ |

632,936,909 |

|

|

|

|

$ |

— |

|

|

|

|

$ |

— |

|

|

|

|

$ |

632,936,909 |

|

|

| Short-term investments |

|

|

|

|

4,832,211 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

|

|

4,832,211 |

|

|

| Total investments |

|

|

|

$ |

637,769,120 |

|

|

|

|

$ |

— |

|

|

|

|

$ |

— |

|

|

|

|

$ |

637,769,120 |

|

|

2. FEDERAL INCOME TAXES

No federal income tax provision is required since the Fund’s policy is to qualify as a regulated investment company under the Internal Revenue Code and to distribute substantially all of its taxable income and gains to its shareholders. Additionally, management has analyzed the tax positions included in federal income tax

Notes To Financial Statements (continued)

returns from the previous three years that remain subject to examination, and concluded no provision was required. Any income tax-related interest or penalties would be recognized as income tax expense. At December 31, 2024, the identified cost of securities for federal income tax purposes was $488,454,414 and net unrealized appreciation aggregated $149,314,706, consisting of gross unrealized appreciation of $185,053,138 and gross unrealized depreciation of $35,738,432.

Distributions are determined in accordance with the Fund’s MDP and income tax regulations, which may differ from GAAP. Such differences are primarily related to the Fund’s retirement plan, equity-based compensation, wash sales, and tax straddles for total return swaps. Differences that are permanent, while not material for the year ended December 31, 2024, are reclassified in the capital accounts of the Fund’s financial statements and have no impact on net assets. For tax purposes, distributions paid by the Fund during the years ended December 31, 2024 and December 31, 2023 were classified as ordinary income of $16,613,652 and $17,057,323, respectively, and long-term capital gain of $28,776,315 and $16,800,584, respectively. The tax basis of distributable earnings at December 31, 2024 was $569,649 of undistributed ordinary income and $1,326,177 of undistributed long-term capital gain.

3. INVESTMENT TRANSACTIONS

Purchases and sales of portfolio investments, other than short-term investments, securities lending collateral, and derivative transactions, during the year ended December 31, 2024 were $137,419,012 and $149,137,783, respectively.

4. DERIVATIVES

The Fund may invest in derivative instruments. The Fund uses derivatives for a variety of purposes, including, but not limited to, the ability to gain or limit exposure to particular market sectors or securities, to provide additional capital gains, to limit equity price risk in the normal course of pursuing its investment objectives, and/or to obtain leverage.

Total Return Swap Agreements — The Fund utilizes total return swap agreements in carrying out a paired trade strategy, where it enters into a long contract for a single stock and a short contract for a sector exchange-traded fund in comparable notional amounts. Total return swap agreements involve commitments based on a notional amount to pay interest in exchange for a market-linked return of a reference security. Upon closing a long contract, the Fund will receive a payment to the extent the total return of the reference security is positive for the contract period and exceeds the offsetting interest rate obligation or will make a payment if the total return is negative for the contract period. Upon closing a short contract, the Fund will receive a payment to the extent the total return of the reference security is negative for the contract period and exceeds the offsetting interest rate obligation or will make a payment if the total return is positive for the contract period. The fair value of each total return swap agreement is determined daily and the change in value is recorded as a change in unrealized appreciation on total return swap agreements in the Statement of Operations. Payments received or made upon termination during the period are recorded as a realized gain or loss on total return swap agreements in the Statement of Operations.

Total return swap agreements entail risks associated with counterparty credit, liquidity, and equity price risk. Such risks include that the Fund or the counterparty may default on its obligation, that there is no liquid market for these agreements, and that there may be unfavorable changes in the price of the reference security. To mitigate the Fund’s counterparty credit risk, the Fund enters into master netting and collateral arrangements with the counterparty. A master netting agreement allows either party to terminate the agreement prior to termination date and provides the ability to offset amounts the Fund owes the counterparty against the amounts the counterparty owes the Fund for a single net settlement. The Fund’s policy is to net all derivative instruments subject to a netting agreement and offset the value of derivative liabilities against the value of derivative assets. The net cumulative unrealized gain (asset) on open total

Notes To Financial Statements (continued)

return swap agreements or the net cumulative unrealized loss (liability) on open total return swap agreements is presented in the Statement of Assets and Liabilities. At December 31, 2024, there were no open total return swap agreements. During the year ended December 31, 2024, the average daily notional amounts of open long and short total return swap agreements, an indicator of the volume of activity, were $1,619,710 and $(1,618,606), respectively.

A collateral arrangement requires each party to provide collateral with a value, adjusted daily and subject to a minimum transfer amount, equal to the net amount owed to the other party under the agreement. The counterparty provides cash collateral to the Fund and the Fund provides collateral by segregating portfolio securities, subject to a valuation allowance, into a tri-party account at its custodian. At December 31, 2024, there were no securities pledged as collateral and no cash collateral was held by the Fund.

5. CAPITAL STOCK

The Fund has 5,000,000 authorized and unissued preferred shares, $0.001 par value.

The Fund pays distributions four times a year under the MDP in newly issued shares of its Common Stock, unless a shareholder elects to receive cash. Shares are issued at the lower of the net asset value per share or the closing market price on the date of valuation. Prior to the adoption of the MDP, the Fund issued shares in payment of the fourth quarter distribution, by shareholder election, at the average market price on the date of valuation. Additionally, the Fund issues shares as dividend equivalents to holders of deferred stock units under the 2005 Equity Incentive Compensation Plan.

The Fund may purchase shares of its Common Stock from time to time, in accordance with parameters set by the Board of Directors, at such prices and amounts as the portfolio management team deems appropriate. Additionally, the Fund will repurchase shares under the Fund’s enhanced discount management and liquidity program, subject to certain restrictions, when the discount exceeds 15% of net asset value for at least 30 consecutive trading days. The enhanced program also provides that the Fund will engage in a proportional tender offer to repurchase shares when the discount exceeds 19% of net asset value for 30 consecutive trading days, not to exceed one such offer in any twelve-month period.

Transactions in its Common Stock for 2024 and 2023 were as follows:

| |

|

|

Shares

|

|

|

Amount

|

|

| |

|

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

|

Shares issued in payment of distributions (at a weighted

average discount from net asset value of 14.9% and 18.8%,

respectively)

|

|

|

|

|

831,069 |

|

|

|

|

|

505,897 |

|

|

|

|

$ |

18,794,765 |

|

|

|

$ |

10,099,505 |

|

|

Shares purchased (at a weighted average discount from net asset value of 15.4% and 16.0%, respectively)

|

|

|

|

|

(60,960) |

|

|

|

|

|

(185,012) |

|

|

|

|

|

(1,416,187) |

|

|

|

|

|

(3,879,111) |

|

|

| Net change |

|

|

|

|

770,109 |

|

|

|

|

|

320,885 |

|

|

|

|

$ |

17,378,578 |

|

|

|

$ |

6,220,394 |

|

6. RETIREMENT PLANS

The Fund sponsors a qualified defined contribution plan for all employees with at least six months of service and a nonqualified defined contribution plan for eligible employees to supplement the qualified plan. The Fund matches employee contributions made to the plans and, subject to Board approval, may also make a discretionary contribution to the plans. During the year ended December 31, 2024, the Fund recorded matching contributions of $111,923 and a liability, representing the 2024 discretionary contribution, of $94,989.

Notes To Financial Statements (continued)

7. EQUITY-BASED COMPENSATION

The Fund’s 2005 Equity Incentive Compensation Plan, adopted at the 2005 Annual Meeting and reapproved at the 2010 Annual Meeting, expired on April 27, 2015. Restricted stock units granted to non-employee directors that are 100% vested, but payment of which has been deferred at the election of the director, remain outstanding at December 31, 2024.

Outstanding awards were granted at fair market value on grant date (determined by the average of the high and low price on that date) and earn an amount equal to the Fund’s per share distribution, payable in reinvested shares, which are paid concurrently with the payment of the original share grant.

A summary of the activity during the year ended December 31, 2024 is as follows:

|

Awards

|

|

|

Units

|

|

|

Weighted Average

Grant-Date

Fair Value

|

|

| Balance at December 31, 2023 |

|

|

|

|

10,974 |

|

|

|

|

$ |

26.68 |

|

|

| Reinvested dividend equivalents |

|

|

|

|

1,519 |

|

|

|

|

|

21.96 |

|

|

| Issued |

|

|

|

|

(5,256) |

|

|

|

|

|

22.53 |

|

|

| Balance at December 31, 2024 |

|

|

|

|

7,237 |

|

|

|

|

$ |

28.70 |

|

|

At December 31, 2024, the Fund had no unrecognized compensation cost. The total fair value of awards issued during the year ended December 31, 2024 was $113,059.

8. OFFICER AND DIRECTOR COMPENSATION

The aggregate remuneration paid by the Fund during the year ended December 31, 2024 to officers and directors amounted to $2,107,437, of which $419,000 was paid to non-employee directors. These amounts represent the taxable income to the Fund’s officers and directors and, therefore, may differ from the amounts reported in the accompanying Statement of Operations that are recorded and expensed in accordance with GAAP. At December 31, 2024, $1,170,903 was due to officers and directors, representing amounts related to estimated cash compensation and estimated retirement plan discretionary contributions payable to officers and reinvested dividend payments on deferred stock awards payable to directors.

9. PORTFOLIO SECURITIES LOANED

The Fund makes loans of securities to approved brokers to earn additional income. The loans are collateralized by cash and/or U.S. Treasury and government agency obligations valued at 102% of the value of the securities on loan. The market value of the loaned securities is calculated based upon the most recent closing prices and any additional required collateral is delivered to the Fund on the next business day. On loans collateralized by cash, the cash collateral is invested in a registered money market fund. The Fund accounts for securities lending transactions as secured financing and retains a portion of the income from lending fees and interest on the investment of cash collateral. The Fund also continues to receive dividends on the securities loaned. Gain or loss in the fair value of securities loaned that may occur during the term of the loan will be for the account of the Fund. At December 31, 2024, the Fund had no securities on loan. The Fund is indemnified by the custodian, serving as lending agent, for the loss of loaned securities and has the right under the lending agreement to recover the securities from the borrower on demand.

Notes To Financial Statements (continued)

10. LEASES

The Fund and its affiliates jointly lease office space and equipment under non-cancelable lease agreements expiring at various dates through 2029. Payments are made in aggregate pursuant to these agreements but are deemed variable for each entity, as the allocable portion to each entity fluctuates when applying the expense sharing policy among all affiliates at each payment date. Variable payments of this nature do not require recognition of an asset or an offsetting liability in the Statement of Assets and Liabilities and are recognized as rental expense on a straight-line basis over the lease term within occupancy and other office expenses in the Statement of Operations. During the year, the Fund recognized rental expense of $92,301.

11. COMMITMENTS AND CONTINGENCIES

In the normal course of business, the Fund enters into agreements that can expose the Fund to some risk of loss. The risk of future loss arising from any such agreements, while not quantifiable, is expected to be remote. As such, and as of the end of the reporting period, the Fund did not have any unfunded commitments. From time to time, the Fund may be a party to certain legal proceedings in the ordinary course of business, including proceedings relating to the enforcement of the Fund’s rights under contracts or within bylaws. As of the end of the reporting period, management has determined that any legal proceedings the Fund is subject to are unlikely to have a material impact to the Fund’s financial statements.

| |

|

|

Year Ended December 31,

|

|

| |

2024

|

|

|

2023

|

|

|

2022

|

|

|

2021

|

|

|

2020

|

|

| Per Share Operating Performance |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net asset value, beginning of year |

|

|

|

|

$24.83 |

|

|

|

|

|

$25.85 |

|

|

|

|

|

$19.22 |

|

|

|

|

|

$13.76 |

|

|

|

|

|

$18.79 |

|

|

|

Net investment income

|

|

|

|

|

0.63 |

|

|

|

|

|

0.68 |

|

|

|

|

|

0.80 |

|

|

|

|

|

0.55 |

|

|

|

|

|

0.45 |

|

|

|

Net realized gain (loss) and change in unrealized appreciation

|

|

|

|

|

0.64 |

|

|

|

|

|

(0.28) |

|

|

|

|

|

7.57 |

|

|

|

|

|

5.86 |

|

|

|

|

|

(4.85) |

|

|

| Total from operations |

|

|

|

|

1.27 |

|

|

|

|

|

0.40 |

|

|

|

|

|

8.37 |

|

|

|

|

|

6.41 |

|

|

|

|

|

(4.40) |

|

|

| Less distributions from: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net investment income

|

|

|

|

|

(0.65) |

|

|

|

|

|

(0.65) |

|

|

|

|

|

(0.79) |

|

|

|

|

|

(0.56) |

|

|

|

|

|

(0.47) |

|

|

|

Net realized gain

|

|

|

|

|

(1.12) |

|

|

|

|

|

(0.70) |

|

|

|

|

|

(0.84) |

|

|

|

|

|

(0.35) |

|

|

|

|

|

(0.26) |

|

|

| Total distributions |

|

|

|

|

(1.77) |

|

|

|

|

|

(1.35) |

|

|

|

|

|

(1.63) |

|

|

|

|

|

(0.91) |

|

|

|

|

|

(0.73) |

|

|

|

Capital share repurchases (note 5)

|

|

|

|

|

0.01 |

|

|

|

|

|

0.03 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

|

|

0.14 |

|

|

|

Reinvestment of distributions (note 5)

|

|

|

|

|

(0.13) |

|

|

|

|

|

(0.10) |

|

|

|

|

|

(0.11) |

|

|

|

|

|

(0.04) |

|

|

|

|

|

(0.04) |

|

|

| Total capital share transactions |

|

|

|

|

(0.12) |

|

|

|

|

|

(0.07) |

|

|

|

|

|

(0.11) |

|

|

|

|

|

(0.04) |

|

|

|

|

|

0.10 |

|

|

|

Net asset value, end of year

|

|

|

|

|

$24.21 |

|

|

|

|

|

$24.83 |

|

|

|

|

|

$25.85 |

|

|

|

|

|

$19.22 |

|

|

|

|

|

$13.76 |

|

|

| Market price, end of year |

|

|

|

|

$21.74 |

|

|

|

|

|

$20.63 |

|

|

|

|

|

$21.80 |

|

|

|

|

|

$16.52 |

|

|

|

|

|

$11.37 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Investment Return (a) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Based on market price

|

|

|

|

|

13.8% |

|

|

|

|

|

1.0% |

|

|

|

|

|

42.2% |

|

|

|

|

|

53.6% |

|

|

|

|

|

-26.6% |

|

|

|

Based on net asset value

|

|

|

|

|

5.3% |

|

|

|

|

|

2.5% |

|

|

|

|

|

44.9% |

|

|

|

|

|

47.7% |

|

|

|

|

|

-22.2% |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Ratios/Supplemental Data |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net assets, end of year (in millions)

|

|

|

|

|

$636 |

|

|

|

|

|

$633 |

|

|

|

|

|

$651 |

|

|

|

|

|

$471 |

|

|

|

|

|

$332 |

|

|

|

Ratio of expenses to average net assets

|

|

|

|

|

0.61% |

|

|

|

|

|

0.64% |

|

|

|

|

|

0.56% |

|

|

|

|

|

0.88% |

|

|

|

|

|

1.47% |

|

|

|

Ratio of net investment income to average net assets

|

|

|

|

|

2.38% |

|

|

|

|

|

2.66% |

|

|

|

|

|

3.31% |

|

|

|

|

|

3.15% |

|

|

|

|

|

3.27% |

|

|

|

Portfolio turnover

|

|

|

|

|

20.4% |

|

|

|

|

|

19.8% |

|

|

|

|

|

24.3% |

|

|

|

|

|

20.7% |

|

|

|

|

|

31.8% |

|

|

|

Number of shares outstanding at end of year (in 000’s)

|

|

|

|

|

26,285 |

|

|

|

|

|

25,514 |

|

|

|

|

|

25,194 |

|

|

|

|

|

24,485 |

|

|

|

|

|

24,122 |

|

|

(a)

Total investment return is calculated assuming a purchase of a Fund share at the beginning of the period and a sale on the last day of the period reported either at net asset value or market price per share, excluding any brokerage commissions. Distributions are assumed to be reinvested at the lower of the net asset value per share or the closing NYSE market price on the distribution’s valuation date.

The accompanying notes are an integral part of the financial statements.

| |

|

|

Shares

|

|

|

Value (a)

|

|

| Common Stocks — 99.5% |

|

|

Energy — 80.0%

|

|

|

Energy Related — 0.5%

|

|

|

Itron, Inc. (b)

|

|

|

|

|

28,300 |

|

|

|

|

$ |

3,072,814 |

|

| |

|

|

Equipment & Services — 6.3%

|

|

|

Baker Hughes Company

|

|

|

|

|

428,100 |

|

|

|

|

|

17,560,662 |

|

|

Halliburton Company

|

|

|

|

|

177,353 |

|

|

|

|

|

4,822,228 |

|

|

Schlumberger N.V.

|

|

|

|

|

377,933 |

|

|

|

|

|

14,489,951 |

|

|

TechnipFMC plc

|

|

|

|

|

109,500 |

|

|

|

|

|

3,168,930 |

|

| |

|

|

|

|

40,041,771 |

|

|

Exploration & Production — 20.7%

|

|

|

APA Corporation

|

|

|

|

|

56,000 |

|

|

|

|

|

1,293,040 |

|

|

Chord Energy Corporation

|

|

|

|

|

225 |

|

|

|

|

|

26,307 |

|

|

Chord Energy Corporation warrants, strike price $133.70,

1 warrant for .5774 share, expires 9/1/25 (b)

|

|

|

|

|

1,327 |

|

|

|

|

|

4,512 |

|

|

ConocoPhillips

|

|

|

|

|

408,703 |

|

|

|

|

|

40,531,076 |

|

|

Coterra Energy Inc.

|

|

|

|

|

125,900 |

|

|

|

|

|

3,215,486 |

|

|

Devon Energy Corporation

|

|

|

|

|

126,200 |

|

|

|

|

|

4,130,526 |

|

|

Diamondback Energy, Inc.

|

|

|

|

|

79,400 |

|

|

|

|

|

13,008,102 |

|

|

EOG Resources, Inc.

|

|

|

|

|

217,667 |

|

|

|

|

|

26,681,621 |

|

|

EQT Corporation

|

|

|

|

|

89,300 |

|

|

|

|

|

4,117,623 |

|

|

Expand Energy Corporation

|

|

|

|

|

65,100 |

|

|

|

|

|

6,480,705 |

|

|

Hess Corporation

|

|

|

|

|

138,189 |

|

|

|

|

|

18,380,519 |

|

|

Occidental Petroleum Corporation

|

|

|

|

|

150,051 |

|

|

|

|

|

7,414,020 |

|

|

Texas Pacific Land Corporation

|

|

|

|

|

5,550 |

|

|

|

|

|

6,138,078 |

|

|

|

|

|

|

131,421,615 |

|

|

Integrated Oil & Gas — 35.8%

|

|

|

Chevron Corporation

|

|

|

|

|

510,171 |

|

|

|

|

|

73,893,168 |

|

|

Exxon Mobil Corporation

|

|

|

|

|

1,433,955 |

|

|

|

|

|

154,250,539 |

|

| |

|

|

|

|

228,143,707 |

|

|

Refining & Marketing — 6.4%

|

|

|

Marathon Petroleum Corporation

|

|

|

|

|

108,812 |

|

|

|

|

|

15,179,274 |

|

|

Phillips 66

|

|

|

|

|

138,175 |

|

|

|

|

|

15,742,278 |

|

|

Valero Energy Corporation

|

|

|

|

|

81,200 |

|

|

|

|

|

9,954,308 |

|

|

|

|

|

|

40,875,860 |

|

Schedule of Investments (continued)

| |

|

|

Shares

|

|

|

Value (a)

|

|

|

Storage & Transportation — 10.3%

|

|

|

Kinder Morgan, Inc.

|

|

|

|

|

445,392 |

|

|

|

|

$ |

12,203,741 |

|

|

ONEOK, Inc.

|

|

|

|

|

187,800 |

|

|

|

|

|

18,855,120 |

|

|

Targa Resources Corp.

|

|

|

|

|

83,300 |

|

|

|

|

|

14,869,050 |

|

|

Williams Companies, Inc.

|

|

|

|

|

365,350 |

|

|

|

|

|

19,772,742 |

|

| |

|

|

|

|

65,700,653 |

|

|

Materials — 19.5%

|

|

|

Chemicals — 13.0%

|

|

|

Air Products and Chemicals, Inc.

|

|

|

|

|

21,500 |

|

|

|

|

|

6,235,860 |

|

|

Albemarle Corporation

|

|

|

|

|

7,200 |

|

|

|

|

|

619,776 |

|

|

Celanese Corporation

|

|

|

|

|

6,877 |

|

|

|

|

|

475,957 |

|

|

CF Industries Holdings, Inc.

|

|

|

|

|

29,369 |

|

|

|

|

|

2,505,763 |

|

|

Corteva Inc.

|

|

|

|

|

91,945 |

|

|

|

|

|

5,237,187 |

|

|

Dow, Inc.

|

|

|

|

|

63,945 |

|

|

|

|

|

2,566,113 |

|

|

DuPont de Nemours, Inc.

|

|

|

|

|

36,926 |

|

|

|

|

|

2,815,608 |

|

|

Eastman Chemical Company

|

|

|

|

|

52,800 |

|

|

|

|

|

4,821,696 |

|

|

Ecolab Inc.

|

|

|

|

|

48,400 |

|

|

|

|

|

11,341,088 |

|

|

FMC Corporation

|

|

|

|

|

7,255 |

|

|

|

|

|

352,665 |

|

|

International Flavors & Fragrances Inc.

|

|

|

|

|

56,606 |

|

|

|

|

|

4,786,037 |

|

|

Linde plc

|

|

|

|

|

69,400 |

|

|

|

|

|

29,055,698 |

|

|

LyondellBasell Industries N.V.

|

|

|

|

|

20,600 |

|

|

|

|

|

1,529,962 |

|

|

Mosaic Company

|

|

|

|

|

21,201 |

|

|

|

|

|

521,121 |

|

|

PPG Industries, Inc.

|

|

|

|

|

18,100 |

|

|

|

|

|

2,162,045 |

|

|

Sherwin-Williams Company

|

|

|

|

|

23,000 |

|

|

|

|

|

7,818,390 |

|

| |

|

|

|

|

82,844,966 |

|

|

Construction Materials — 1.5%

|

|

|

Martin Marietta Materials, Inc.

|

|

|

|

|

5,400 |

|

|

|

|

|

2,789,100 |

|

|

Vulcan Materials Company

|

|

|

|

|

25,400 |

|

|

|

|

|

6,533,642 |

|

| |

|

|

|

|

9,322,742 |

|

|

Containers & Packaging — 1.9%

|

|

|

Amcor plc

|

|

|

|

|

92,400 |

|

|

|

|

|

869,484 |

|

|

Avery Dennison Corporation

|

|

|

|

|

6,300 |

|

|

|

|

|

1,178,919 |

|

|

Ball Corporation

|

|

|

|

|

23,300 |

|

|

|

|

|

1,284,529 |

|

|

Crown Holdings, Inc.

|

|

|

|

|

42,200 |

|

|

|

|

|

3,489,518 |

|

|

International Paper Company

|

|

|

|

|

21,500 |

|

|

|

|

|

1,157,130 |

|

|

Packaging Corporation of America

|

|

|

|

|

7,400 |

|

|

|

|

|

1,665,962 |

|

|

Smurfit Westrock plc

|

|

|

|

|

41,300 |

|

|

|

|

|

2,224,418 |

|

| |

|

|

|

|

11,869,960 |

|

Schedule of Investments (continued)

| |

|

|

Shares

|

|

|

Value (a)

|

|

|

Metals & Mining — 3.1%

|

|

|

Freeport-McMoRan, Inc.

|

|

|

|

|

259,400 |

|

|

|

|

$ |

9,877,952 |

|

|

Newmont Corporation

|

|

|

|

|

153,100 |

|

|

|

|

|

5,698,382 |

|

|

Nucor Corporation

|

|

|

|

|

22,600 |

|

|

|

|

|

2,637,646 |

|

|

Steel Dynamics, Inc.

|

|

|

|

|

12,526 |

|

|

|

|

|

1,428,841 |

|

| |

|

|

|

|

19,642,821 |

|

| Total Common Stocks |

|

|

(Cost $483,449,796)

|

|

|

|

|

|

|

|

|

|

|

632,936,909 |

|

| Short-Term Investments — 0.7% |

|

|

Money Market Funds — 0.7%

|

|

|

Morgan Stanley Institutional Liquidity Funds Prime Portfolio, Institutional Class, 4.47% (c)

|

|

|

|

|

4,200,169 |

|

|

|

|

|

4,201,009 |

|