FALSE000117897000011789702025-01-282025-01-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): January 28, 2025

PROVIDENT FINANCIAL SERVICES, INC.

(Exact Name of Registrant as Specified in its Charter) | | | | | | | | | | | | | | |

| | | | |

Delaware | | 001-31566 | | 42-1547151 |

(State or Other Jurisdiction of Incorporation) | | (Commission File No.) | | (I.R.S. Employer Identification No.) |

| | | | |

239 Washington Street, Jersey City, New Jersey | | 07302 |

(Address of Principal Executive Offices) | | (Zip Code) |

| | | | |

Registrant's telephone number, including area code 732-590-9200 |

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17

CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17

CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

Title of each class | | Trading Symbol Symbol(s) | | Name of each exchange on which registered |

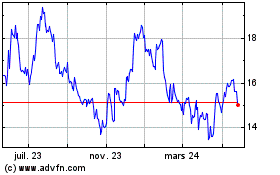

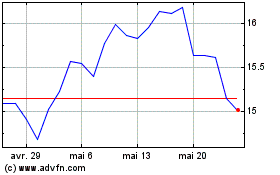

Common | | PFS | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operation and Financial Condition.

On January 28, 2025, Provident Financial Services, Inc. (the “Company”) issued a press release reporting its financial results for the quarter and year ended December 31, 2024. A copy of the release is attached as Exhibit 99.1 to this report and is being furnished to the SEC and shall not be deemed “filed” for any purpose.

Item 7.01 Regulation FD Disclosure.

On January 28, 2025, the Company announced that its Board of Directors declared a quarterly cash dividend of $0.24 per common share, payable on February 28, 2025 to stockholders of record as of the close of business on February 14, 2025. In addition, the Company announced that its Annual Meeting of Stockholders will be held on April 24, 2025 as a virtual meeting. The record date for the Annual Meeting will be February 28, 2025.

These announcements were included as part of the release announcing financial results for the quarter and year ended December 31, 2024 and attached as Exhibit 99.1 to this report. A copy of the release is being furnished to the SEC and shall not be deemed “filed” for any purpose.

Item 9.01. Financial Statements and Exhibits

(a) Financial Statements of Businesses Acquired. Not applicable.

(b) Pro Forma Financial Information. Not applicable.

(c) Shell Company Transactions. Not applicable.

(d) Exhibits.

Exhibit No. Description

99.1 Press release issued by the Company on January 28, 2025 announcing its financial results for the quarter and year ended December 31, 2024, the declaration of a quarterly cash dividend and the establishment of the date for the Annual Meeting of Stockholders.

104 Cover Page Interactive Data File (embedded within the Inline XBRL document)

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | PROVIDENT FINANCIAL SERVICES, INC. |

| | | | |

DATE: | January 29, 2025 | | By:/s/ Anthony J. Labozzetta |

| | | Anthony J. Labozzetta |

| | | President and Chief Executive Officer |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

Provident Financial Services, Inc. Announces Fourth Quarter and Full Year Earnings, Declaration of Quarterly Cash Dividend and Annual Meeting Date

ISELIN, NJ, January 28, 2025 - Provident Financial Services, Inc. (NYSE:PFS) (the “Company”) reported net income of $48.5 million, or $0.37 per basic and diluted share for the three months ended December 31, 2024, compared to $46.4 million, or $0.36 per basic and diluted share, for the three months ended September 30, 2024 and $27.3 million, or $0.36 per basic and diluted share, for the three months ended December 31, 2023. For the year ended December 31, 2024, net income totaled $115.5 million, or $1.05 per basic and diluted share, compared to $128.4 million, or $1.72 per basic and $1.71 per diluted share, for the year ended December 31, 2023.

The Company’s earnings for the three months and year ended December 31, 2024 reflect the impact of the May 16, 2024 merger with Lakeland Bancorp, Inc. (“Lakeland”), which added $10.91 billion to total assets, $7.91 billion to loans, and $8.62 billion to deposits, net of purchase accounting adjustments. The merger with Lakeland significantly impacted provisions for credit losses in 2024 due to the initial Current Expected Credit Loss ("CECL") provisions recorded on acquired loans in the second quarter. Transaction costs related to our merger with Lakeland totaled $20.2 million and $56.9 million, for the three months and year ended December 31, 2024, respectively, compared with transaction costs of $2.5 million and $7.8 million for the respective 2023 periods. Additionally, the Company realized a $2.8 million loss related to the sale of subordinated debt issued by Lakeland from the Provident investment portfolio, during the second quarter of 2024.

Anthony J. Labozzetta, President and Chief Executive Officer commented, “Provident had an eventful 2024 marked by solid financial performance and defined by the completion of our merger with Lakeland. We have maintained excellent asset quality, grown our deposits, and benefited from our expanding fee-based businesses. With core systems conversion and integration now completed, we look forward to further improving our performance across all business lines in 2025."

Performance Highlights for the Fourth Quarter of 2024

•Adjusted for transaction costs related to the merger with Lakeland, net of tax, the Company's annualized adjusted returns on average assets, average equity and average tangible equity(1) were 1.05%, 9.53% and 15.39% for the quarter ended December 31, 2024, compared to 0.95%, 8.62% and 14.53% for the quarter ended September 30, 2024. A reconciliation between GAAP and the above non-GAAP ratios is shown on page 13 of the earnings release.

•The Company's annualized adjusted pre-tax, pre-provision returns on average assets, average equity and average tangible equity(2) were 1.53%, 13.91% and 20.31% for the quarter ended December 31, 2024, compared to 1.48%, 13.48% and 19.77% for the quarter ended September 30, 2024. A reconciliation between GAAP and the above non-GAAP ratios is shown on page 13 of the earnings release.

•Net interest margin decreased three basis points to 3.28% for the quarter ended December 31, 2024, from 3.31% for the trailing quarter, mainly due to a reduction in net accretion of purchase accounting adjustments related to the Lakeland merger. However, the core net interest margin, which excludes the impact of purchase accounting accretion and amortization, increased four basis points from the trailing quarter to 2.85%. The average yield on total loans decreased 22 basis points to 5.99% for the quarter ended December 31, 2024, compared to the trailing quarter, while the average cost of deposits, including non-interest-bearing deposits, decreased 11 basis points to 2.25% for the quarter ended December 31, 2024.

•Wealth management and insurance agency income increased 12% and 19%, respectively, versus the same period in 2023.

•Asset quality improved in the quarter, as non-performing loans to total loans as of December 31, 2024 decreased to 0.39% from 0.47% as of September 30, 2024, while non-performing assets to total assets as of December 31, 2024 decreased to 0.34% from 0.41% as of September 30, 2024.

•The Company recorded a $7.8 million provision for credit losses on loans for the quarter ended December 31, 2024, compared to a $9.6 million provision for the trailing quarter. The decrease in the provision for credit losses on loans for the quarter was primarily attributable to the reclassification of $151.3 million to the held for sale portfolio, partially offset by modest deterioration in the economic forecast within our CECL model.

•Total deposits increased $247.6 million to $18.62 billion as of December 31, 2024 compared to September 30, 2024.

•In December of 2024, $151.3 million of the Bank's commercial loan portfolio was reclassified from loans held for investment into the held for sale portfolio as a result of a decision to exit the non-relationship equipment lease financing business.

•As of December 31, 2024, the Company's loan pipeline, consisting of work-in-process and loans approved pending closing, totaled $1.79 billion, with a weighted average interest rate of 6.91%.

•At December 31, 2024, CRE loans related to office properties totaled $884.1 million, compared to $921.1 million at September 30, 2024. CRE loans secured by office properties constitutes 4.6% of total loans and have an average loan size of $1.9 million, with seven relationships greater than $10.0 million. There were four loans totaling $9.1 million on non-accrual as of December 31, 2024.

•As of December 31, 2024, multi-family CRE loans secured by New York City properties totaled $244.5 million, compared to $226.6 million as of September 30, 2024. This portfolio constitutes only 1.3% of total loans and has an average loan size of $2.8 million. Loans that are collateralized by rent stabilized apartments comprise less than 0.80% of the total loan portfolio and are all performing.

Declaration of Quarterly Dividend

The Company’s Board of Directors declared a quarterly cash dividend of $0.24 per common share payable on February 28, 2025, to stockholders of record as of the close of business on February 14, 2025.

Annual Meeting Date Set

The Annual Meeting of Stockholders will be held on April 24, 2025 at 10:00 a.m. Eastern Time as a virtual meeting. February 28, 2025 has been established as the record date for the determination of stockholders entitled to vote at the Annual Meeting.

Results of Operations

Three months ended December 31, 2024 compared to the three months ended September 30, 2024

For the three months ended December 31, 2024, net income was $48.5 million, or $0.37 per basic and diluted share, compared to net income of $46.4 million, or $0.36 per basic and diluted share, for the three months ended September 30, 2024.

Net Interest Income and Net Interest Margin

Net interest income decreased $2.0 million to $181.7 million for the three months ended December 31, 2024, from $183.7 million for the trailing quarter. The decrease in net interest income was primarily due to a decrease in net accretion of purchase accounting adjustments in the loan portfolio related to the Lakeland merger.

The Company’s net interest margin decreased three basis points to 3.28% for the quarter ended December 31, 2024, from 3.31% for the trailing quarter. The average yield on interest-earning assets for the quarter ended December 31, 2024 decreased 18 basis points to 5.66%, compared to the trailing quarter. The average cost of interest-bearing liabilities for the quarter ended December 31, 2024 decreased 16 basis points to 3.03%, compared to the trailing quarter. The average cost of interest-bearing deposits for the quarter ended December 31, 2024 decreased 15 basis points to 2.81%, compared to 2.96% for the trailing quarter. The average cost of total deposits, including non-interest-bearing deposits, was 2.25% for the quarter ended December 31, 2024, compared to 2.36% for the trailing quarter. The average cost of borrowed funds for the quarter ended December 31, 2024 was 3.64%, compared to 3.73% for the quarter ended September 30, 2024. The net accretion of purchase accounting adjustments contributed

43 basis points to the net interest margin for the quarter ended December 31, 2024, compared with 50 basis points in the trailing quarter. The reduction in purchase accounting accretion was largely due to the prepayment of certain loans that resulted in accelerated amortization of acquisition premiums and a decrease in accelerated accretion related to prepayments of loans with acquisition discounts.

Provision for Credit Losses on Loans

For the quarter ended December 31, 2024, the Company recorded a $7.8 million provision for credit losses related to loans, compared with a provision for credit losses on loans of $9.6 million for the quarter ended September 30, 2024. The decrease in the provision for credit losses on loans for the quarter was primarily attributable to the reclassification of $151.3 million of commercial loans to the held for sale portfolio, partially offset by modest deterioration in the economic forecast within our CECL model for the current quarter as compared to the prior quarter. For the three months ended December 31, 2024, net charge-offs totaled $5.5 million, or an annualized 12 basis points of average loans, compared to net charge-offs of $6.8 million, or an annualized 14 basis points of average loans for the trailing quarter.

Non-Interest Income and Expense

For the three months ended December 31, 2024, non-interest income totaled $24.2 million, a decrease of $2.7 million, compared to the trailing quarter. Bank owned life insurance ("BOLI") income decreased $2.0 million compared to the trailing quarter, to $2.3 million for the three months ended December 31, 2024, primarily due to a reduction in benefit claims. Insurance agency income decreased $342,000 to $3.3 million for the three months ended December 31, 2024, compared to $3.6 million for the trailing quarter, largely due to a seasonal decrease in business activity. Additionally, other income decreased $181,000 to $1.3 million for the three months ended December 31, 2024, compared to the trailing quarter, while fees and commissions decreased $129,000 to $9.7 million for the three months ended December 31, 2024, compared to the trailing quarter.

Non-interest expense totaled $134.3 million for the three months ended December 31, 2024, a decrease of $1.7 million, compared to $136.0 million for the trailing quarter. Compensation and benefits expense decreased $3.5 million to $59.9 million for the three months ended December 31, 2024, compared to $63.5 million for the trailing quarter mainly due to decreases in salary expense and payroll tax expense. Amortization of intangibles decreased $2.7 million to $9.5 million for the three months ended December 31, 2024 primarily due to a current quarter adjustment to the rate of core deposit intangible amortization related to Lakeland, as a result of lower projected attrition on core deposits. FDIC insurance decreased $769,000 to $3.4 million for the three months ended December 31, 2024, compared to $4.2 million for the trailing quarter, primarily due to a decreases in the assessment rate and average assets. Additionally, data processing expense decreased $600,000 to $9.9 million for the three months ended December 31, 2024, compared to the trailing quarter, largely due to a decrease in core system expenses. Partially offsetting these decreases, merger-related expenses increased $4.6 million to $20.2 million for the three months ended December 31, 2024, compared to the trailing quarter, while other operating expenses increased $1.6 million to $17.4 million for the three months ended December 31, 2024, compared to the trailing quarter largely due to a $1.4 million charge for contingent litigation reserves.

The Company’s annualized adjusted non-interest expense as a percentage of average assets(4) was 1.90% for the quarter ended December 31, 2024, compared to 1.98% for the trailing quarter. The efficiency ratio (adjusted non-interest expense divided by the sum of net interest income and non-interest income)(5) was 55.43% for the three months ended December 31, 2024, compared to 57.20% for the trailing quarter.

Income Tax Expense

For the three months ended December 31, 2024, the Company's income tax expense was $14.2 million with an effective tax rate of 22.6%, compared with income tax expense of $18.9 million with an effective tax rate of 28.9% for the trailing quarter. The decrease in tax expense and the effective tax rate for the three months ended December 31, 2024, compared with the trailing quarter was largely due to a $4.2 million tax benefit related to the revaluation of deferred tax assets to reflect the imposition by the State of New Jersey of a 2.5% Corporate Transit Fee, effective January 1, 2024.

Three months ended December 31, 2024 compared to the three months ended December 31, 2023

For the three months ended December 31, 2024, net income was $48.5 million, or $0.37 per basic and diluted share, compared to net income of $27.3 million, or $0.36 per basic and diluted share, for the three months ended December 31, 2023. The Company’s earnings for the quarter ended December 31, 2024 reflected the impact of the May 16, 2024 merger with Lakeland. The results of operations included transaction costs related to the merger with Lakeland totaling $20.2 million and $2.5 million for the three months ended December 31, 2024 and 2023, respectively.

Net Interest Income and Net Interest Margin

Net interest income increased $85.9 million to $181.7 million for the three months ended December 31, 2024, from $95.8 million for same period in 2023. Net interest income for the quarter ended December 31, 2024 compared to the same period in 2023 was favorably impacted by the net assets acquired from Lakeland, combined with favorable repricing of adjustable rate loans, higher market rates on new loan originations and the originations of higher-yielding loans, partially offset by unfavorable repricing of deposits.

The Company’s net interest margin increased 36 basis points to 3.28% for the quarter ended December 31, 2024, from 2.92% for the same period last year. The average yield on interest-earning assets for the quarter ended December 31, 2024 increased 62 basis points to 5.66%, compared to 5.04% for the quarter ended December 31, 2023. The average cost of interest-bearing liabilities increased 32 basis points for the quarter ended December 31, 2024 to 3.03%, compared to 2.71% for the fourth quarter of 2023. The average cost of interest-bearing deposits for the quarter ended December 31, 2024 was 2.81%, compared to 2.47% for the same period last year. The average cost of total deposits, including non-interest-bearing deposits, was 2.25% for the quarter ended December 31, 2024, compared with 1.95% for the quarter ended December 31, 2023. The average cost of borrowed funds for the quarter ended December 31, 2024 was 3.64%, compared to 3.71% for the same period last year.

Provision for Credit Losses on Loans

For the quarter ended December 31, 2024, the Company recorded a $7.8 million provision for credit losses related to loans, compared with a $500,000 provision for credit losses on loans for the quarter ended December 31, 2023. The increase in the provision for credit losses on loans was largely a function of the period-over-period deterioration in the economic forecast and an increase in loans from the Lakeland acquisition.

Non-Interest Income and Expense

Non-interest income totaled $24.2 million for the quarter ended December 31, 2024, an increase of $5.2 million, compared to the same period in 2023. Fee income increased $3.6 million to $9.7 million for the three months ended December 31, 2024, compared to the same period in 2023, primarily resulting from the Lakeland merger. Wealth management income increased $812,000 to $7.7 million for the three months ended December 31, 2024, compared to the same period in 2023, primarily due to an increase in the average market value of assets under management, while BOLI income increased $617,000 to $2.3 million for the three months ended December 31, 2024, compared to the same period in 2023 largely due to an increase in income related to the addition of Lakeland's BOLI. Insurance agency income increased $530,000 to $3.3 million, for the three months ended December 31, 2024, compared to the same period in 2023, largely due to strong retention revenue and new business activity. Partially offsetting these increases to non-interest income, other income decreased $330,000 to $1.3 million for the three months ended December 31, 2024, compared to the quarter ended December 31, 2023, primarily due to a decrease in net gains on the sale of SBA loans.

Non-interest expense totaled $134.3 million for the three months ended December 31, 2024, an increase of $58.5 million, compared to $75.9 million for the three months ended December 31, 2023. Compensation and benefits expense increased $21.2 million to $59.9 million for three months ended December 31, 2024, compared to $38.8 million for the same period in 2023. The increase in compensation and benefits expense was primarily attributable to the addition of Lakeland. Additionally, merger-related expense increased $17.7 million to $20.2 million for the three months ended December 31, 2024, compared to the same period in 2023. Amortization of intangibles increased $8.8 million to $9.5 million for the three months ended December 31, 2024, compared to $721,000 for the same period in 2023, largely due to core deposit intangible amortization related to the addition of Lakeland. Net occupancy expenses increased $4.8 million to $12.6 million for the three months ended December 31, 2024, compared to the same period

in 2023, primarily due to an increase in depreciation and maintenance expenses related to the addition of Lakeland. Data processing expense increased $3.4 million to $9.9 million for the three months ended December 31, 2024, compared to the same period in 2023, largely due to additional software and hardware expenses related to the addition of Lakeland, while other operating expenses increased $1.7 million to $17.4 million for the three months ended December 31, 2024, compared to the same period in 2023, largely due to an increase in professional service expenses.

The Company’s annualized adjusted non-interest expense as a percentage of average assets(4) was 1.90% for the quarter ended December 31, 2024, compared to 1.98% for the same period in 2023. The efficiency ratio (adjusted non-interest expense divided by the sum of net interest income and non-interest income)(5) was 55.43% for the three months ended December 31, 2024 compared to 61.32% for the same respective period in 2023.

Income Tax Expense

For the three months ended December 31, 2024, the Company's income tax expense was $14.2 million with an effective tax rate of 22.6%, compared with $12.5 million with an effective tax rate of 31.3% for the three months ended December 31, 2023. The increase in tax expense for the three months ended December 31, 2024, compared with the three months ended December 31, 2023, was primarily due to an increase in taxable income, which was partially offset by a $4.2 million tax benefit related to the revaluation of deferred tax assets to reflect the imposition by the State of New Jersey of a 2.5% Corporate Transit Fee, effective January 1, 2024. The decrease in the effective tax rate for the three months ended December 31, 2024, compared with the three months ended December 31, 2023 was primarily due to the aforementioned $4.2 million tax benefit related to the revaluation of deferred tax assets.

Year ended December 31, 2024 compared to the year ended December 31, 2023

For the year ended December 31, 2024, net income totaled $115.5 million, or $1.05 per basic and diluted share, compared to net income of $128.4 million, or $1.71 per basic and diluted share, for the year ended December 31, 2023.

Net Interest Income and Net Interest Margin

Net interest income increased $201.2 million to $600.6 million for the year ended December 31, 2024, from $399.5 million for 2023. Net interest income for the year ended December 31, 2024 was favorably impacted by the net assets acquired from Lakeland, combined with the favorable repricing of adjustable rate loans and higher market rates on new loan originations, partially offset by the unfavorable repricing of both deposits and borrowings.

For the year ended December 31, 2024, the net interest margin increased 10 basis points to 3.26%, compared to 3.16% for 2023. The weighted average yield on interest earning assets increased 81 basis points to 5.68% for the year ended December 31, 2024, compared to 4.87% for 2023, while the weighted average cost of interest-bearing liabilities increased 81 basis points to 3.05% for the year ended December 31, 2024, compared to 2.24% last year. The average cost of interest-bearing deposits increased 84 basis points to 2.83% for the year ended December 31, 2024, compared to 1.99% in the prior year. Average non-interest-bearing demand deposits increased $792.0 million to $3.12 billion for the year ended December 31, 2024, compared with $2.33 billion for 2023. The average cost of total deposits, including non-interest-bearing deposits, was 2.26% for the year ended December 31, 2024, compared with 1.54% for 2023. The average cost of borrowings for the year ended December 31, 2024 was 3.71%, compared to 3.41% in the prior year.

Provision for Credit Losses on Loans

For the year ended December 31, 2024, the Company recorded an $83.6 million provision for credit losses related to loans, compared with a provision for credit losses of $28.2 million for 2023. The increased provision for credit losses on loans for the year ended December 31, 2024 was primarily attributable to an initial CECL provision for credit losses on loans of $60.1 million recorded as part of the Lakeland merger in accordance with GAAP requirements for accounting for business combinations, partially offset by some economic forecast improvement over the current twelve-month period within our CECL model, compared to last year.

Non-Interest Income and Expense

For the year ended December 31, 2024, non-interest income totaled $94.1 million, an increase of $14.3 million, compared to 2023. Fee income increased $9.7 million to $34.1 million for the year ended December 31, 2024, compared to 2023, primarily due to the addition of Lakeland. BOLI income increased $5.2 million to $11.7 million for the year ended December 31, 2024, compared to 2023, primarily due to an increase in benefit claims, combined with an increase in income related to the addition of Lakeland's BOLI, while wealth management income increased $2.9 million to $30.5 million for the year ended December 31, 2024, compared to 2023, mainly due to an increase in the average market value of assets under management during the period. Additionally, insurance agency income increased $2.3 million to $16.2 million for the year ended December 31, 2024, compared to $13.9 million for 2023, largely due to increases in contingent commissions, retention revenue and new business activity. Partially offsetting these increases in non-interest income, net gains on securities transactions decreased $3.0 million for the year ended December 31, 2024, primarily due to a $2.8 million loss related to the sale from the Provident investment portfolio of subordinated debt issued by Lakeland. Additionally, other income decreased $2.8 million to $4.5 million for the year ended December 31, 2024, compared to $7.3 million for 2023, primarily due to a $2.0 million gain from the sale of a foreclosed commercial property recorded in the prior year, combined with a decrease in gains on sales of SBA loans in the current year.

Non-interest expense totaled $457.5 million for the year ended December 31, 2024, an increase of $182.2 million, compared to $275.3 million for 2023. Compensation and benefits expense increased $69.8 million to $218.3 million for the year ended December 31, 2024, compared to $148.5 million for 2023. The increase in compensation and benefits expense was primarily attributable to the addition of Lakeland. Merger-related expenses increased $49.0 million to $56.9 million for the year ended December 31, 2024, compared to $7.8 million for 2023. Amortization of intangibles increased $26.0 million to $28.9 million for the year ended December 31, 2024, compared to $3.0 million for 2023, largely due to core deposit intangible amortization related to the addition of Lakeland. Net occupancy expense increased $12.7 million to $45.0 million for the year ended December 31, 2024, compared to 2023, primarily due to increases in depreciation and maintenance expense related to the addition of Lakeland, while data processing expense increased $12.6 million to $35.6 million for the year ended December 31, 2024, compared to $23.0 million for 2023, primarily due to additional software and hardware expenses related to the addition of Lakeland. Other operating expenses increased $7.3 million to $54.7 million for the year ended December 31, 2024, compared to $47.4 million for 2023, primarily due to increases in consulting and other professional service expenses, while FDIC insurance increased $4.4 million to $13.0 million for the year ended December 31, 2024, primarily due to the addition of Lakeland.

Income Tax Expense

For the year ended December 31, 2024, the Company's income tax expense was $34.1 million with an effective tax rate of 22.8%, compared with $47.4 million with an effective tax rate of 27.0% for 2023. The decrease in tax expense for the year ended December 31, 2024, compared with last year was largely due to a $10.0 million tax benefit related to the revaluation of deferred tax assets to reflect the imposition by the State of New Jersey of a 2.5% Corporate Transit Fee, effective January 1, 2024, combined with a decrease in taxable income as a result of the initial CECL provision for credit losses on loans of $60.1 million recorded in accordance with GAAP requirements for accounting for business combinations and additional expenses from the Lakeland merger.

Asset Quality

The Company’s total non-performing loans at December 31, 2024 were $72.1 million, or 0.39% of total loans, compared to $89.9 million or 0.47% of total loans at September 30, 2024 and $49.6 million, or 0.46% of total loans at December 31, 2023. The $17.9 million decrease in non-performing loans at December 31, 2024, compared to the trailing quarter, consisted of a $24.3 million decrease in non-performing commercial loans and a $676,000 decrease in non-performing residential loans, partially offset by a $6.9 million increase in non-performing commercial mortgage loans and a $223,000 increase in non-performing consumer loans. As of December 31, 2024, impaired loans totaled $55.4 million with related specific reserves of $7.5 million, compared with impaired loans totaling $74.0 million with related specific reserves of $7.2 million as of September 30, 2024. As of December 31, 2023, impaired loans totaled $42.3 million with related specific reserves of $2.9 million.

At December 31, 2024, the Company’s allowance for credit losses related to the loan portfolio was 1.04% of total loans, compared to 1.02% and 0.99% at September 30, 2024 and December 31, 2023, respectively. The allowance for credit losses increased $88.0 million to $193.4 million at December 31, 2024, from $107.2 million at December 31, 2023. The increase in the allowance for credit losses on loans at December 31, 2024 compared to December 31, 2023 was due to an $83.6 million provision for credit losses on loans, which included an initial CECL provision of $60.1 million on loans acquired from Lakeland, and a $17.2 million allowance recorded through goodwill related to Purchased Credit Deteriorated loans acquired from Lakeland, partially offset by net charge-offs of $14.6 million.

The following table sets forth accruing past due loans and non-accrual loans on the dates indicated, as well as certain asset quality ratios.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | December 31, 2024 | | September 30, 2024 | | December 31, 2023 | | |

| | | Number of Loans | | Principal

Balance

of Loans | | Number of Loans | | Principal

Balance

of Loans | | Number of Loans | | Principal

Balance

of Loans | | | | |

| | (Dollars in thousands) |

| Accruing past due loans: | | | | | | | | | | | | | | | | |

| 30 to 59 days past due: | | | | | | | | | | | | | | | | |

| Commercial mortgage loans | | 7 | | | $ | 8,538 | | | 2 | | | $ | 430 | | | 1 | | | $ | 825 | | | | | |

| Multi-family mortgage loans | | — | | | — | | | — | | | — | | | 1 | | | 3,815 | | | | | |

| Construction loans | | — | | | — | | | — | | | — | | | — | | | — | | | | | |

| Residential mortgage loans | | 22 | | | 6,388 | | | 23 | | | 5,020 | | | 13 | | | 3,429 | | | | | |

| Total mortgage loans | | 29 | | | 14,926 | | | 25 | | | 5,450 | | | 15 | | | 8,069 | | | | | |

| Commercial loans | | 23 | | | 4,248 | | | 14 | | | 1,952 | | | 6 | | | 998 | | | | | |

| Consumer loans | | 47 | | | 3,152 | | | 53 | | | 4,073 | | | 31 | | | 875 | | | | | |

| Total 30 to 59 days past due | | 99 | | | $ | 22,326 | | | 92 | | | $ | 11,475 | | | 52 | | | $ | 9,942 | | | | | |

| | | | | | | | | | | | | | | | |

| 60 to 89 days past due: | | | | | | | | | | | | | | | | |

| Commercial mortgage loans | | 4 | | | $ | 3,954 | | | 1 | | | $ | 641 | | | — | | | $ | — | | | | | |

| Multi-family mortgage loans | | — | | | — | | | — | | | — | | | 1 | | | 1,635 | | | | | |

| Construction loans | | — | | | — | | | — | | | — | | | — | | | — | | | | | |

| Residential mortgage loans | | 17 | | | 5,049 | | | 11 | | | 1,991 | | | 8 | | | 1,208 | | | | | |

| Total mortgage loans | | 21 | | | 9,003 | | | 12 | | | 2,632 | | | 9 | | | 2,843 | | | | | |

| Commercial loans | | 9 | | | 2,377 | | | 9 | | | 1,240 | | | 3 | | | 198 | | | | | |

| Consumer loans | | 15 | | | 856 | | | 10 | | | 606 | | | 5 | | | 275 | | | | | |

| Total 60 to 89 days past due | | 45 | | | 12,236 | | | 31 | | | 4,478 | | | 17 | | | 3,316 | | | | | |

| Total accruing past due loans | | 144 | | | $ | 34,562 | | | 123 | | | $ | 15,953 | | | 69 | | | $ | 13,258 | | | | | |

| | | | | | | | | | | | | | | | |

| Non-accrual: | | | | | | | | | | | | | | | | |

| Commercial mortgage loans | | 17 | | | $ | 20,883 | | | 17 | | | $ | 13,969 | | | 7 | | | $ | 5,151 | | | | | |

| Multi-family mortgage loans | | 6 | | | 7,498 | | | 6 | | | 7,578 | | | 1 | | | 744 | | | | | |

| Construction loans | | 2 | | | 13,246 | | | 2 | | | 13,151 | | | 1 | | | 771 | | | | | |

| Residential mortgage loans | | 23 | | | 4,535 | | | 24 | | | 5,211 | | | 7 | | | 853 | | | | | |

| Total mortgage loans | | 48 | | | 46,162 | | | 49 | | | 39,909 | | | 16 | | | 7,519 | | | | | |

| Commercial loans | | 65 | | | 24,243 | | | 69 | | | 48,592 | | | 26 | | | 41,487 | | | | | |

| Consumer loans | | 23 | | | 1,656 | | | 32 | | | 1,433 | | | 10 | | | 633 | | | | | |

| Total non-accrual loans | | 136 | | | $ | 72,061 | | | 150 | | | $ | 89,934 | | | 52 | | | $ | 49,639 | | | | | |

| | | | | | | | | | | | | | | | |

| Non-performing loans to total loans | | | | 0.39 | % | | | | 0.47 | % | | | | 0.46 | % | | | | |

| Allowance for loan losses to total non-performing loans | | | | 268.43 | % | | | | 217.09 | % | | | | 215.96 | % | | | | |

| Allowance for loan losses to total loans | | | | 1.04 | % | | | | 1.02 | % | | | | 0.99 | % | | | | |

At December 31, 2024 and December 31, 2023, the Company held foreclosed assets of $9.5 million and $11.7 million, respectively. During the year ended December 31, 2024, there were four properties sold with an aggregate carrying value of $861,000 and one write-down of a foreclosed commercial property of $1.3 million. Foreclosed assets at December 31, 2024 consisted primarily of commercial real estate. Total non-performing assets at December 31, 2024 increased $20.2 million to $81.5 million, or 0.34% of total assets, from $61.3 million, or 0.43% of total assets at December 31, 2023.

Balance Sheet Summary

Total assets at December 31, 2024 were $24.05 billion, a $13.78 billion increase from December 31, 2023. The increase in total assets was primarily due to the addition of Lakeland.

The Company’s loans held for investment portfolio totaled $18.66 billion at December 31, 2024 and $10.87 billion at December 31, 2023. The loan portfolio consists of the following:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| December 31, 2024 | | September 30, 2024 | | December 31, 2023 | | | | | | | | | | |

| (Dollars in thousands) |

| Mortgage loans: | | | | | | | | | | | | | | | |

| Commercial | $ | 7,228,078 | | | $ | 7,342,456 | | | $ | 4,512,411 | | | | | | | | | | | |

| Multi-family | 3,382,933 | | | 3,226,918 | | | 1,812,500 | | | | | | | | | | | |

| Construction | 823,503 | | | 873,509 | | | 653,246 | | | | | | | | | | | |

| Residential | 2,014,844 | | | 2,032,671 | | | 1,164,956 | | | | | | | | | | | |

| Total mortgage loans | 13,449,358 | | | 13,475,554 | | | 8,143,113 | | | | | | | | | | | |

| Commercial loans | 4,604,367 | | | 4,710,601 | | | 2,440,621 | | | | | | | | | | | |

| Consumer loans | 613,819 | | | 623,709 | | | 299,164 | | | | | | | | | | | |

| Total gross loans | 18,667,544 | | | 18,809,864 | | | 10,882,898 | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Premiums on purchased loans | 1,338 | | | 1,362 | | | 1,474 | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Net deferred fees and unearned discounts | (9,512) | | | (16,617) | | | (12,456) | | | | | | | | | | | |

| Total loans | $ | 18,659,370 | | | $ | 18,794,609 | | | $ | 10,871,916 | | | | | | | | | | | |

As part of the merger with Lakeland, we acquired $7.91 billion in loans, net of purchase accounting adjustments. For the year ended December 31, 2024, the Company experienced net increases of $1.57 billion in multi-family loans, $2.16 billion in commercial loans and $2.72 billion in commercial mortgage loans, partially offset by net decreases of $170.3 million in construction loans and net decreases in residential mortgage and consumer loans of $849.9 million and $314.7 million, respectively. Commercial loans, consisting of commercial real estate, multi-family, commercial and construction loans, represented 85.9% of the loan portfolio at December 31, 2024, compared to 86.5% at December 31, 2023.

For the year ended December 31, 2024, loan funding, including advances on lines of credit, totaled $4.73 billion, compared with $3.34 billion for the same period in 2023.

At December 31, 2024, the Company’s unfunded loan commitments totaled $2.73 billion, including commitments of $1.62 billion in commercial loans, $608.1 million in construction loans and $85.1 million in commercial mortgage loans. Unfunded loan commitments at September 30, 2024 and December 31, 2023 totaled $2.97 billion and $2.09 billion, respectively.

The loan pipeline, consisting of work-in-process and loans approved pending closing, totaled $1.79 billion at December 31, 2024, compared to $1.98 billion at September 30, 2024 and $1.70 billion at December 31, 2023.

Total investment securities were $3.21 billion at December 31, 2024, a $2.26 billion increase from December 31, 2023. This increase was primarily due to the addition of Lakeland.

Total deposits increased $10.56 billion during the year ended December 31, 2024, to $18.62 billion. Total savings and demand deposit accounts increased $6.26 billion to $15.46 billion at December 31, 2024, while total time deposits increased $2.07 billion to $3.17 billion at December 31, 2024. The increase in savings and demand deposits was largely attributable to a $3.13 billion increase in interest-bearing demand deposits, a $1.59 billion increase in non-interest-bearing demand deposits, a $1.04 billion increase in money market deposits and a $504.0 million increase in savings deposits. The increase in time deposits consisted of a $1.98 billion increase in retail time deposits and a $91.1 million increase in brokered time deposits.

Borrowed funds increased $1.34 billion during the year ended December 31, 2024, to $2.02 billion. The increase in borrowings was largely due to the addition of Lakeland. Borrowed funds represented 8.4% of total assets at December 31, 2024, an decrease from 13.9% at December 31, 2023.

Stockholders’ equity increased $1.60 billion during the year ended December 31, 2024, to $2.60 billion, primarily due to common stock issued for the purchase of Lakeland, net income earned for the period and a slight improvement in unrealized losses on available for sale debt securities, partially offset by cash dividends paid to stockholders. For the year ended December 31, 2024, common stock repurchases totaled 89,569 shares at an average cost of $14.90 per share, all of which were made in connection with withholding to cover income taxes on the vesting of stock-based compensation. At December 31, 2024, approximately 3.1 million shares remained eligible for repurchase under the current stock repurchase authorization. Book value per share and tangible book value per share(6) at December 31, 2024 were $19.93 and $13.66, respectively, compared with $22.38 and $16.32, respectively, at December 31, 2023.

About the Company

Provident Financial Services, Inc. is the holding company for Provident Bank, a community-oriented bank offering "commitment you can count on" since 1839. Provident Bank provides a comprehensive array of financial products and services through its network of branches throughout New Jersey, Bucks, Lehigh and Northampton counties in Pennsylvania, as well as Orange, Queens and Nassau Counties in New York. The Bank also provides fiduciary and wealth management services through its wholly owned subsidiary, Beacon Trust Company and insurance services through its wholly owned subsidiary, Provident Protection Plus, Inc.

Post Earnings Conference Call

Representatives of the Company will hold a conference call for investors on Wednesday, January 29, 2025 at 10:00 a.m. Eastern Time to discuss the Company’s financial results for the quarter and year ended December 31, 2024. The call may be accessed by dialing 1-888-412-4131 (United States Toll Free) and 1-646-960-0134 (United States Local). Speakers will need to enter conference ID code (3610756) before being met by a live operator. Internet access to the call is also available (listen only) at provident.bank by going to Investor Relations and clicking on "Webcast."

Forward Looking Statements

Certain statements contained herein are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such forward-looking statements may be identified by reference to a future period or periods, or by the use of forward-looking terminology, such as “may,” “will,” “believe,” “expect,” “estimate,” "project," "intend," “anticipate,” “continue,” or similar terms or variations on those terms, or the negative of those terms. Forward-looking statements are subject to numerous risks and uncertainties, including, but not limited to, those set forth in Item 1A of the Company's Annual Report on Form 10-K, as supplemented by its Quarterly Reports on Form 10-Q, and those related to the economic environment, particularly in the market areas in which the Company operates, inflation and unemployment, competitive products and pricing, real estate values, fiscal and monetary policies of the U.S. Government, the effects of the recent turmoil in the banking industry, changes in accounting policies and practices that may be adopted by the regulatory agencies and the accounting standards setters, changes in government regulations affecting financial institutions, including regulatory fees and capital requirements, changes in prevailing interest rates, potential goodwill impairment, acquisitions and the integration of acquired businesses, credit risk management, asset-liability management, the financial and securities markets, the availability of and costs associated with sources of liquidity, the ability to complete, or any delays in completing, the pending merger between the Company and Lakeland; any failure to realize the anticipated benefits of the transaction when expected or at all; the possibility that the transaction may be more expensive to complete than anticipated, including as a result of unexpected conditions, factors or events; potential adverse reactions or changes to business, employee, customer and/or counterparty relationships, including those resulting from the completion of the merger and integration of the companies; and the impact of a potential shutdown of the federal government.

The Company cautions readers not to place undue reliance on any such forward-looking statements which speak only as of the date they are made. The Company advises readers that the factors listed above could affect the Company's financial performance and could cause the Company's actual results for future periods to differ materially from any opinions or statements expressed with respect to future periods in any current statements. The Company does not

assume any duty, and does not undertake, to update any forward-looking statements to reflect events or circumstances after the date of this statement.

Footnotes

(1) Annualized adjusted pre-tax, pre-provision return on average assets, annualized return on average tangible equity, tangible book value per share, annualized adjusted non-interest expense as a percentage of average assets and the efficiency ratio are non-GAAP financial measures. Please refer to the Notes following the Consolidated Financial Highlights which contain the reconciliation of GAAP to non-GAAP financial measures and the associated calculations.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| PROVIDENT FINANCIAL SERVICES, INC. AND SUBSIDIARY |

| Consolidated Financial Highlights |

| (Dollars in Thousands, except share data) (Unaudited) |

| | | |

| At or for the

Three months ended | | At or for the

Year ended |

| December 31, | | September 30, | | December 31, | | December 31, | | December 31, |

| 2024 | | 2024 | | 2023 | | 2024 | | 2023 |

| Statement of Income | | | | | | | | | |

| Net interest income | $ | 181,737 | | | $ | 183,701 | | | $ | 95,788 | | | $ | 600,614 | | | $ | 399,454 | |

| Provision for credit losses | 8,880 | | | 9,299 | | | (863) | | | 87,564 | | | 28,168 | |

| Non-interest income | 24,175 | | | 26,855 | | | 18,968 | | | 94,113 | | | 79,829 | |

| Non-interest expense | 134,323 | | | 136,002 | | | 75,851 | | | 457,548 | | | 275,336 | |

| Income before income tax expense | 62,709 | | | 65,255 | | | 39,768 | | | 149,615 | | | 175,779 | |

| Net income | 48,524 | | | 46,405 | | | 27,312 | | | 115,525 | | | 128,398 | |

| Diluted earnings per share | $ | 0.37 | | | $ | 0.36 | | | $ | 0.36 | | | $ | 1.05 | | | $ | 1.71 | |

| Interest rate spread | 2.63 | % | | 2.65 | % | | 2.33 | % | | 2.63 | % | | 2.63 | % |

| Net interest margin | 3.28 | % | | 3.31 | % | | 2.92 | % | | 3.26 | % | | 3.16 | % |

| | | | | | | | | |

| Profitability | | | | | | | | | |

| Annualized return on average assets | 0.81 | % | | 0.76 | % | | 0.77 | % | | 0.57 | % | | 0.92 | % |

Annualized adjusted return on average assets (1) | 1.05 | % | | 0.95 | % | | 0.83 | % | | 0.78 | % | | 0.97 | % |

| Annualized return on average equity | 7.36 | % | | 6.94 | % | | 6.60 | % | | 5.07 | % | | 7.81 | % |

Annualized adjusted return on average equity (1) | 9.53 | % | | 8.62 | % | | 7.10 | % | | 6.95 | % | | 8.22 | % |

Annualized return on average tangible equity (3) | 12.21 | % | | 12.06 | % | | 9.32 | % | | 8.58 | % | | 11.01 | % |

Annualized adjusted return on average tangible equity (1) | 15.39 | % | | 14.53 | % | | 9.99 | % | | 11.29 | % | | 11.54 | % |

Annualized adjusted non-interest expense to average assets (4) | 1.90 | % | | 1.98 | % | | 1.98 | % | | 1.97 | % | | 1.90 | % |

Efficiency ratio (4) | 55.43 | % | | 57.20 | % | | 61.32 | % | | 57.67 | % | | 55.19 | % |

| | | | | | | | | |

| Asset Quality | | | | | | | | | |

| Non-accrual loans | | | $ | 89,934 | | | | | $ | 72,061 | | | $ | 49,639 | |

| 90+ and still accruing | | | — | | | | | — | | | — | |

| Non-performing loans | | | 88,061 | | | | | 72,061 | | | 49,639 | |

| Foreclosed assets | | | 9,801 | | | | | 9,473 | | | 11,651 | |

| Non-performing assets | | | 97,862 | | | | | 81,534 | | | 61,290 | |

| Non-performing loans to total loans | | | 0.47 | % | | | | 0.39 | % | | 0.46 | % |

| Non-performing assets to total assets | | | 0.41 | % | | | | 0.34 | % | | 0.43 | % |

| Allowance for loan losses | | | $ | 191,175 | | | | | $ | 193,432 | | | $ | 107,200 | |

| Allowance for loan losses to total non-performing loans | | | 217.09 | % | | | | 268.43 | % | | 215.96 | % |

| Allowance for loan losses to total loans | | | 1.02 | % | | | | 1.04 | % | | 0.99 | % |

| Net loan charge-offs | $ | 5,493 | | | 6,756 | | | $ | 4,010 | | | $ | 14,560 | | | $ | 8,129 | |

| Annualized net loan charge offs to average total loans | 0.12 | % | | 0.14 | % | | 0.16 | % | | 0.09 | % | | 0.08 | % |

| | | | | | | | | |

| Average Balance Sheet Data | | | | | | | | | |

| Assets | $ | 23,908,514 | | | $ | 24,248,038 | | | $ | 14,114,626 | | | $ | 20,382,148 | | | $ | 13,915,467 | |

| Loans, net | 18,487,443 | | | 18,531,939 | | | 10,660,201 | | | 15,600,431 | | | 10,367,620 | |

| Earning assets | 21,760,458 | | | 21,809,226 | | | 12,823,541 | | | 18,403,149 | | | 12,637,224 | |

| Savings and demand deposits | 15,581,608 | | | 15,394,715 | | | 9,210,315 | | | 13,103,803 | | | 9,358,290 | |

| Borrowings | 1,711,806 | | | 2,125,149 | | | 1,873,822 | | | 1,983,674 | | | 1,636,572 | |

| Interest-bearing liabilities | 17,093,382 | | | 17,304,569 | | | 10,020,726 | | | 14,596,325 | | | 9,671,794 | |

| Stockholders' equity | 2,624,019 | | | 2,660,470 | | | 1,642,854 | | | 2,279,525 | | | 1,644,529 | |

| Average yield on interest-earning assets | 5.66 | % | | 5.84 | % | | 5.04 | % | | 5.68 | % | | 4.87 | % |

| Average cost of interest-bearing liabilities | 3.03 | % | | 3.19 | % | | 2.71 | % | | 3.05 | % | | 2.24 | % |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

Notes and Reconciliation of GAAP and Non-GAAP Financial Measures

(Dollars in Thousands, except share data)

The Company has presented the following non-GAAP (U.S. Generally Accepted Accounting Principles) financial measures because it believes that these measures provide useful and comparative information to assess trends in the Company’s results of operations and financial condition. Presentation of these non-GAAP financial measures is consistent with how the Company evaluates its performance internally and these non-GAAP financial measures are frequently used by securities analysts, investors and other interested parties in the evaluation of companies in the Company’s industry. Investors should recognize that the Company’s presentation of these non-GAAP financial measures might not be comparable to similarly-titled measures of other companies. These non-GAAP financial measures should not be considered a substitute for GAAP basis measures and the Company strongly encourages a review of its condensed consolidated financial statements in their entirety.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

| | | | | | |

| | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| (1) Annualized Adjusted Return on Average Assets, Equity and Tangible Equity | | | | | | | | | | |

| | Three Months Ended | | Year Ended |

| | December 31, | | September 30, | | December 31, | | December 31, | | December 31, |

| | 2024 | | 2024 | | 2023 | | 2024 | | 2023 |

| Net Income | | $ | 48,524 | | | $ | 46,405 | | | $ | 27,312 | | | $ | 115,525 | | | $ | 128,398 | |

| Merger-related transaction costs | | 20,184 | | | 15,567 | | | 2,477 | | | 56,867 | | | 7,826 | |

| Less: income tax expense | | (5,819) | | | (4,306) | | | (465) | | | (14,010) | | | (1,480) | |

| Annualized adjusted net income | | $ | 62,889 | | | $ | 57,666 | | | $ | 29,324 | | | $ | 158,382 | | | $ | 134,744 | |

| Less: Amortization of Intangibles (net of tax) | | $ | 6,649 | | | $ | 8,551 | | | $ | 504 | | | $ | 20,226 | | | $ | 2,064 | |

| Annualized adjusted net income for annualized adjusted return on average tangible equity | | $ | 69,538 | | | $ | 66,216 | | | $ | 29,828 | | | $ | 178,607 | | | $ | 136,808 | |

| | | | | | | | | | |

| Annualized Adjusted Return on Average Assets | | 1.05 | % | | 0.95 | % | | 0.83 | % | | 0.78 | % | | 0.97 | % |

| Annualized Adjusted Return on Average Equity | | 9.53 | % | | 8.62 | % | | 7.10 | % | | 6.95 | % | | 8.22 | % |

| Annualized Adjusted Return on Average Tangible Equity | | 15.39 | % | | 14.53 | % | | 9.99 | % | | 11.29 | % | | 11.54 | % |

| | | | | | | | | | |

(2) Annualized adjusted pre-tax, pre-provision ("PTPP") returns on average assets, average equity and average tangible equity | | | | | | | | | | |

| | Three Months Ended | | Year Ended |

| | December 31, | | September 30, | | December 31, | | December 31, | | December 31, |

| | 2024 | | 2024 | | 2023 | | 2024 | | 2023 |

| Net income | | $ | 48,524 | | | $ | 46,405 | | | $ | 27,312 | | | $ | 115,525 | | | $ | 128,398 | |

| Adjustments to net income: | | | | | | | | | | |

| Provision charge (benefit) for credit losses | | 8,880 | | | 9,299 | | | (863) | | | 87,564 | | | 28,168 | |

| Net loss on Lakeland bond sale | | — | | | — | | | — | | | 2,839 | | | — | |

| Merger-related transaction costs | | 20,184 | | | 15,567 | | | 2,477 | | | 56,867 | | | 7,826 | |

| Contingent litigation reserves | | — | | | — | | | 3,000 | | | — | | | 3,000 | |

| Income tax expense | | 14,185 | | | 18,850 | | | 12,456 | | | 34,090 | | | 47,381 | |

| Adjusted PTPP income | | $ | 91,773 | | | $ | 90,121 | | | $ | 44,382 | | | $ | 296,885 | | | $ | 214,773 | |

| | | | | | | | | | |

| Annualized Adjusted PTPP income | | $ | 365,097 | | | $ | 358,525 | | | $ | 176,081 | | | $ | 296,885 | | | $ | 214,773 | |

| Average assets | | $ | 23,908,514 | | | $ | 24,248,038 | | | $ | 14,114,626 | | | $ | 20,382,148 | | | $ | 13,915,467 | |

| Average equity | | $ | 2,624,019 | | | $ | 2,660,470 | | | $ | 1,642,854 | | | $ | 2,279,525 | | | $ | 1,644,529 | |

| Average tangible equity | | $ | 1,797,994 | | | $ | 1,813,327 | | | $ | 1,184,444 | | | $ | 1,581,339 | | | $ | 1,185,026 | |

| | | | | | | | | | |

| Annualized Adjusted PTPP return on average assets | | 1.53 | % | | 1.48 | % | | 1.25 | % | | 1.46 | % | | 1.54 | % |

| Annualized PTPP return on average equity | | 13.91 | % | | 13.48 | % | | 10.72 | % | | 13.02 | % | | 13.06 | % |

| Annualized PTPP return on average tangible equity | | 20.31 | % | | 19.77 | % | | 14.87 | % | | 18.77 | % | | 18.12 | % |

| | | | | | | | | | |

| (3) Annualized Return on Average Tangible Equity | | | | | | | | | | |

| | Three Months Ended | | Year Ended |

| | December 31, | | September 30, | | December 31, | | December 31, | | December 31, |

| | 2024 | | 2024 | | 2023 | | 2024 | | 2023 |

| Total average stockholders' equity | | $ | 2,624,019 | | | $ | 2,660,470 | | | $ | 1,642,854 | | | $ | 2,279,525 | | | $ | 1,644,529 | |

| Less: total average intangible assets | | 826,025 | | | 847,143 | | | 458,410 | | | 698,186 | | | 459,503 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total average tangible stockholders' equity | | $ | 1,797,994 | | | $ | 1,813,327 | | | $ | 1,184,444 | | | $ | 1,581,339 | | | $ | 1,185,026 | |

| | | | | | | | | | |

| Net income | | $ | 48,524 | | | $ | 46,405 | | | $ | 27,312 | | | $ | 115,525 | | | $ | 128,398 | |

| Less: Amortization of Intangibles, net of tax | | 6,649 | | | 8,551 | | | 504 | | | 20,226 | | | 2,064 | |

| Total net income (loss) | | $ | 55,173 | | | $ | 54,956 | | | $ | 27,816 | | | $ | 135,751 | | | $ | 130,462 | |

| | | | | | | | | | |

| Annualized return on average tangible equity (net income/total average tangible stockholders' equity) | | 12.21 | % | | 12.06 | % | | 9.32 | % | | 8.58 | % | | 11.01 | % |

| | | | | | | | | | |

| | | | | | | | | | |

| (4) Annualized Adjusted Non-Interest Expense to Average Assets | | | | | | | | | | |

| | Three Months Ended | | Year Ended |

| | December 31, | | September 30, | | December 31, | | December 31, | | December 31, |

| | 2024 | | 2024 | | 2023 | | 2024 | | 2023 |

| Reported non-interest expense | | $ | 134,323 | | | $ | 136,002 | | | $ | 75,851 | | | $ | 457,548 | | | $ | 275,336 | |

| Adjustments to non-interest expense: | | | | | | | | | | |

| Merger-related transaction costs | | 20,184 | | | 15,567 | | | 2,477 | | | 56,867 | | | 7,826 | |

| Contingent litigation reserves | | — | | | — | | | 3,000 | | | — | | | 3,000 | |

| | | | | | | | | | |

| Adjusted non-interest expense | | $ | 114,139 | | | $ | 120,435 | | | $ | 70,374 | | | $ | 400,681 | | | $ | 264,510 | |

| | | | | | | | | | |

| Annualized adjusted non-interest expense | | $ | 454,075 | | | $ | 479,122 | | | $ | 279,201 | | | $ | 400,681 | | | $ | 264,510 | |

| | | | | | | | | | |

| Average assets | | $ | 23,908,514 | | | $ | 24,248,038 | | | $ | 14,114,626 | | | $ | 20,382,148 | | | $ | 13,915,467 | |

| | | | | | | | | | |

| Annualized adjusted non-interest expense/average assets | | 1.90 | % | | 1.98 | % | | 1.98 | % | | 1.97 | % | | 1.90 | % |

| | | | | | | | | | |

| (5) Efficiency Ratio Calculation | | | | | | | | | | |

| | Three Months Ended | | Year Ended |

| | December 31, | | September 30, | | December 31, | | December 31, | | December 31, |

| | 2024 | | 2024 | | 2023 | | 2024 | | 2023 |

| Net interest income | | $ | 181,737 | | | $ | 183,701 | | | $ | 95,788 | | | $ | 600,614 | | | $ | 399,454 | |

| Non-interest income | | 24,175 | | | 26,855 | | | 18,968 | | | 94,113 | | | 79,829 | |

| Adjustments to non-interest income: | | | | | | | | | | |

| Net loss (gain) on securities transactions | | 14 | | | (2) | | | 7 | | | 2,986 | | | (30) | |

| Adjusted non-interest income | | 24,189 | | | 26,853 | | | 18,975 | | | 97,099 | | | 79,799 | |

| Total income | | $ | 205,912 | | | $ | 210,554 | | | $ | 114,756 | | | $ | 694,727 | | | $ | 479,283 | |

| | | | | | | | | | |

| Adjusted non-interest expense | | $ | 114,139 | | | $ | 120,435 | | | $ | 70,374 | | | $ | 400,681 | | | $ | 264,510 | |

| | | | | | | | | | |

| Efficiency ratio (adjusted non-interest expense/income) | | 55.43 | % | | 57.20 | % | | 61.32 | % | | 57.67 | % | | 55.19 | % |

| | | | | | | | | | |

| (6) Book and Tangible Book Value per Share | | | | |

| | | | | | | | December 31, | | December 31, |

| | | | | | | | 2024 | | 2023 |

| Total stockholders' equity | | | | | | | | $ | 2,601,207 | | | $ | 1,690,596 | |

| Less: total intangible assets | | | | | | | | 819,230 | | | 457,942 | |

| Total tangible stockholders' equity | | | | | | | | $ | 1,781,977 | | | $ | 1,232,654 | |

| | | | | | | | | | |

| Shares outstanding | | | | | | | | 130,489,493 | | | 75,537,186 | |

| | | | | | | | | | |

| Book value per share (total stockholders' equity/shares outstanding) | | | | | | | | $19.93 | | | $22.38 | |

| Tangible book value per share (total tangible stockholders' equity/shares outstanding) | | | | | | | | $13.66 | | | $16.32 | |

| | | | | | | | | | |

| | | | | | | | | | | | | |

| PROVIDENT FINANCIAL SERVICES, INC. AND SUBSIDIARY |

| Consolidated Statements of Financial Condition |

December 31, 2024 (Unaudited) and December 31, 2023 |

| (Dollars in Thousands) |

| | | | | |

| Assets | December 31, 2024 | | | | December 31, 2023 |

| Cash and due from banks | $ | 166,914 | | | | | $ | 180,241 | |

| Short-term investments | 25 | | | | | 14 | |

| Total cash and cash equivalents | 166,939 | | | | | 180,255 | |

| Available for sale debt securities, at fair value | 2,768,915 | | | | | 1,690,112 | |

| Held to maturity debt securities, (net of $14,000 allowance as of December 31, 2024 (unaudited) and $31,000 allowance as of December 31, 2023) | 327,623 | | | | | 363,080 | |

| Equity securities, at fair value | 19,762 | | | | | 1,270 | |

| Federal Home Loan Bank stock | 112,115 | | | | | 79,217 | |

| Loans held for sale | 162,453 | | | | | 1,785 | |

| Loans held for investment | 18,659,370 | | | | | 10,871,916 | |

| Less allowance for credit losses | 193,432 | | | | | 107,200 | |

| Net loans | 18,628,391 | | | | | 10,766,501 | |

| Foreclosed assets, net | 9,473 | | | | | 11,651 | |

| Banking premises and equipment, net | 119,622 | | | | | 70,998 | |

| Accrued interest receivable | 91,160 | | | | | 58,966 | |

| Intangible assets | 819,230 | | | | | 457,942 | |

| Bank-owned life insurance | 405,893 | | | | | 243,050 | |

| Other assets | 582,702 | | | | | 287,768 | |

| Total assets | $ | 24,051,825 | | | | | $ | 14,210,810 | |

| | | | | |

| Liabilities and Stockholders' Equity | | | | | |

| Deposits: | | | | | |

| Demand deposits | $ | 13,775,991 | | | | | $ | 8,020,889 | |

| Savings deposits | 1,679,667 | | | | | 1,175,683 | |

| Certificates of deposit of $250,000 or more | 789,342 | | | | | 218,549 | |

| Other time deposits | 2,378,813 | | | | | 877,393 | |

| Total deposits | 18,623,813 | | | | | 10,292,514 | |

| Mortgage escrow deposits | 42,247 | | | | | 36,838 | |

| Borrowed funds | 2,020,435 | | | | | 1,970,033 | |

| Subordinated debentures | 401,608 | | | | | 10,695 | |

| Other liabilities | 362,515 | | | | | 210,134 | |

| Total liabilities | 21,450,618 | | | | | 12,520,214 | |

| | | | | |

| Stockholders' equity: | | | | | |

| Preferred stock, $0.01 par value, 50,000,000 shares authorized, none issued | — | | | | | — | |

| Common stock, $0.01 par value, 200,000,000 shares authorized, 137,565,966 shares issued and 130,489,493 shares outstanding as of December 31, 2024 and 75,537,186 outstanding as of December 31, 2023. | 1,376 | | | | | 832 | |

| Additional paid-in capital | 1,834,495 | | | | | 989,058 | |

| Retained earnings | 989,111 | | | | | 974,542 | |

| Accumulated other comprehensive loss | (135,355) | | | | | (141,115) | |

| Treasury stock | (88,420) | | | | | (127,825) | |

| Unallocated common stock held by the Employee Stock Ownership Plan | — | | | | | (4,896) | |

| Common Stock acquired by the Directors' Deferred Fee Plan | — | | | | | (2,694) | |

| Deferred Compensation - Directors' Deferred Fee Plan | — | | | | | 2,694 | |

| Total stockholders' equity | 2,601,207 | | | | | 1,690,596 | |

| Total liabilities and stockholders' equity | $ | 24,051,825 | | | | | $ | 14,210,810 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| PROVIDENT FINANCIAL SERVICES, INC. AND SUBSIDIARY |

| Consolidated Statements of Income |

Three months ended December 31, 2024, September 30, 2024 (Unaudited) and December 31, 2023,

and year ended December 31, 2024 (Unaudited) and 2023 |

| (Dollars in Thousands, except per share data) |

| | | | | | | | | |

| Three Months Ended | | Year Ended |

| December 31, | | September 30, | | December 31, | | December 31, | | December 31, |

| 2024 | | 2024 | | 2023 | | 2024 | | 2023 |

| Interest and dividend income: | | | | | | | | | |

| Real estate secured loans | $ | 194,236 | | | $ | 197,857 | | | $ | 109,112 | | | $ | 655,868 | | | $ | 408,942 | |

| Commercial loans | 75,978 | | | 81,183 | | | 34,939 | | | 251,793 | | | 128,854 | |

| Consumer loans | 10,815 | | | 12,947 | | | 5,020 | | | 36,635 | | | 18,439 | |

| Available for sale debt securities, equity securities and Federal Home Loan Bank stock | 27,197 | | | 25,974 | | | 12,042 | | | 85,895 | | | 46,790 | |

| Held to maturity debt securities | 2,125 | | | 2,136 | | | 2,303 | | | 8,885 | | | 9,362 | |

| Deposits, federal funds sold and other short-term investments | 1,596 | | | 2,425 | | | 755 | | | 7,062 | | | 3,433 | |

| Total interest income | 311,947 | | | 322,522 | | | 164,171 | | | 1,046,138 | | | 615,820 | |

| | | | | | | | | |

| Interest expense: | | | | | | | | | |

| Deposits | 105,922 | | | 110,009 | | | 50,579 | | | 349,523 | | | 159,459 | |

| Borrowed funds | 15,652 | | | 19,923 | | | 17,527 | | | 73,523 | | | 55,856 | |

| Subordinated debt | 8,636 | | | 8,889 | | | 277 | | | 22,478 | | | 1,051 | |

| Total interest expense | 130,210 | | | 138,821 | | | 68,383 | | | 445,524 | | | 216,366 | |

| Net interest income | 181,737 | | | 183,701 | | | 95,788 | | | 600,614 | | | 399,454 | |

| Provision charge (benefit) for credit losses | 8,880 | | | 9,299 | | | (863) | | | 87,564 | | | 28,168 | |

| Net interest income after provision for credit losses | 172,857 | | | 174,402 | | | 96,651 | | | 513,050 | | | 371,286 | |

| | | | | | | | | |

| Non-interest income: | | | | | | | | | |

| Fees | 9,687 | | | 9,816 | | | 6,102 | | | 34,114 | | | 24,396 | |

| Wealth management income | 7,655 | | | 7,620 | | | 6,843 | | | 30,533 | | | 27,669 | |

| Insurance agency income | 3,289 | | | 3,631 | | | 2,759 | | | 16,201 | | | 13,934 | |

| Bank-owned life insurance | 2,261 | | | 4,308 | | | 1,644 | | | 11,709 | | | 6,482 | |

| Net (loss) gain on securities transactions | (14) | | | 2 | | | (7) | | | (2,986) | | | 30 | |

| Other income | 1,297 | | | 1,478 | | | 1,627 | | | 4,542 | | | 7,318 | |

| Total non-interest income | 24,175 | | | 26,855 | | | 18,968 | | | 94,113 | | | 79,829 | |

| | | | | | | | | |

| Non-interest expense: | | | | | | | | | |

| Compensation and employee benefits | 59,937 | | | 63,468 | | | 38,773 | | | 218,341 | | | 148,497 | |

| Net occupancy expense | 12,562 | | | 12,790 | | | 7,797 | | | 45,014 | | | 32,271 | |

| Data processing expense | 9,881 | | | 10,481 | | | 6,457 | | | 35,579 | | | 22,993 | |

| FDIC Insurance | 3,411 | | | 4,180 | | | 2,890 | | | 12,964 | | | 8,578 | |

| Amortization of intangibles | 9,511 | | | 12,231 | | | 721 | | | 28,931 | | | 2,952 | |

| Advertising and promotion expense | 1,485 | | | 1,524 | | | 1,100 | | | 5,146 | | | 4,822 | |

| Merger-related expenses | 20,184 | | | 15,567 | | | 2,477 | | | 56,867 | | | 7,826 | |

| Other operating expenses | 17,352 | | | 15,761 | | | 15,636 | | | 54,706 | | | 47,397 | |

| Total non-interest expense | 134,323 | | | 136,002 | | | 75,851 | | | 457,548 | | | 275,336 | |

| Income before income tax expense | 62,709 | | | 65,255 | | | 39,768 | | | 149,615 | | | 175,779 | |

| Income tax expense | 14,185 | | | 18,850 | | | 12,456 | | | 34,090 | | | 47,381 | |

| Net income | $ | 48,524 | | | $ | 46,405 | | | $ | 27,312 | | | $ | 115,525 | | | $ | 128,398 | |

| | | | | | | | | |

| Basic earnings per share | $ | 0.37 | | | $ | 0.36 | | | $ | 0.36 | | | $ | 1.05 | | | $ | 1.72 | |

| Average basic shares outstanding | 130,067,244 | | 129,941,845 | | 74,995,705 | | 109,668,911 | | 74,844,489 |

| | | | | | | | | |

| Diluted earnings per share | $ | 0.37 | | | $ | 0.36 | | | $ | 0.36 | | | $ | 1.05 | | | $ | 1.71 | |

| Average diluted shares outstanding | 130,163,872 | | 130,004,870 | | 75,041,545 | | 109,712,732 | | 74,873,256 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| PROVIDENT FINANCIAL SERVICES, INC. AND SUBSIDIARY |

| Net Interest Margin Analysis |

| Quarterly Average Balances |

| (Dollars in Thousands) (Unaudited) |

| December 31, 2024 | | September 30, 2024 | | December 31, 2023 |

| Average Balance | | Interest | | Average

Yield/Cost | | Average Balance | | Interest | | Average

Yield/Cost | | Average Balance | | Interest | | Average

Yield/Cost |

| Interest-Earning Assets: | | | | | | | | | | | | | | | | | |

| Deposits | $ | 117,998 | | | $ | 1,596 | | | 5.38 | % | | $ | 179,313 | | | $ | 2,425 | | | 5.38 | % | | $ | 54,998 | | | $ | 745 | | | 5.37 | % |

| Federal funds sold and other short-term investments | — | | | — | | | — | % | | — | | | — | | | — | % | | 838 | | 10 | | | 4.39 | % |

| Available for sale debt securities | 2,720,065 | | 25,063 | | 3.69 | % | | 2,644,262 | | 24,884 | | | 3.72 | % | | 1,647,906 | | 9,858 | | 2.39 | % |

Held to maturity debt securities, net (1) | 328,147 | | 2,125 | | 2.59 | % | | 342,217 | | 2,136 | | | 2.50 | % | | 364,433 | | 2,303 | | 2.53 | % |

| Equity securities, at fair value | 19,920 | | | — | | | — | % | | 19,654 | | | — | | | — | % | | 1,016 | | | — | | | — | % |

| Federal Home Loan Bank stock | 86,885 | | 2,134 | | 9.82 | % | | 91,841 | | 1,090 | | 4.75 | % | | 94,149 | | 2,184 | | 9.28 | % |

Net loans: (2) | | | | | | | | | | | | | | | | | |

| Total mortgage loans | 13,287,942 | | 194,236 | | 5.75 | % | | 13,363,265 | | 197,857 | | 5.83 | % | | 8,028,300 | | 109,112 | | 5.34 | % |

| Total commercial loans | 4,587,048 | | 75,978 | | 6.54 | % | | 4,546,088 | | 81,183 | | 7.05 | % | | 2,329,430 | | 34,939 | | 5.90 | % |

| Total consumer loans | 612,453 | | 10,815 | | 7.02 | % | | 622,586 | | 12,947 | | 8.27 | % | | 302,471 | | 5,020 | | 6.58 | % |

| Total net loans | 18,487,443 | | 281,029 | | 5.99 | % | | 18,531,939 | | 291,987 | | 6.21 | % | | 10,660,201 | | 149,071 | | 5.50 | % |

| Total interest-earning assets | $ | 21,760,458 | | | $ | 311,947 | | | 5.66 | % | | $ | 21,809,226 | | | $ | 322,522 | | | 5.84 | % | | $ | 12,823,541 | | | $ | 164,171 | | | 5.04 | % |

| | | | | | | | | | | | | | | | | |

| Non-Interest Earning Assets: | | | | | | | | | | | | | | | | | |

| Cash and due from banks | 159,151 | | | | | | 341,505 | | | | | | 111,610 | | | | |

| Other assets | 1,988,905 | | | | | | | 2,097,307 | | | | | | | 1,179,475 | | | | |

| Total assets | $ | 23,908,514 | | | | | | | $ | 24,248,038 | | | | | | | $ | 14,114,626 | | | | | |

| | | | | | | | | | | | | | | | | |

| Interest-Bearing Liabilities: | | | | | | | | | | | | | | | | | |

| Demand deposits | $ | 10,115,827 | | | $ | 71,265 | | | 2.80 | % | | $ | 9,942,053 | | | $ | 74,864 | | | 3.00 | % | | $ | 5,856,916 | | | $ | 39,648 | | | 2.69 | % |

| Savings deposits | 1,677,725 | | 968 | | 0.23 | % | | 1,711,502 | | 1006 | | 0.23 | % | | 1,183,857 | | 602 | | 0.20 | % |

| Time deposits | 3,187,172 | | 33,689 | | 4.21 | % | | 3,112,598 | | 34,139 | | 4.36 | % | | 1,095,468 | | 10,329 | | 3.74 | % |

| Total Deposits | 14,980,724 | | 105,922 | | 2.81 | % | | 14,766,153 | | 110,009 | | 2.96 | % | | 8,136,241 | | 50,579 | | 2.47 | % |

| | | | | | | | | | | | | | | | | |

| Borrowed funds | 1,711,806 | | 15,652 | | 3.64 | % | | 2,125,149 | | 19,923 | | 3.73 | % | | 1,873,822 | | 17,527 | | 3.71 | % |

| Subordinated debentures | 400,852 | | | 8,636 | | | 8.57 | % | | 413,267 | | | 8,889 | | | 8.56 | % | | 10,663 | | | 277 | | | 10.27 | % |

| Total interest-bearing liabilities | 17,093,382 | | 130,210 | | 3.03 | % | | 17,304,569 | | 138,821 | | 3.19 | % | | 10,020,726 | | 68,383 | | 2.71 | % |

| | | | | | | | | | | | | | | | | |

| Non-Interest Bearing Liabilities: | | | | | | | | | | | | | | | | | |

| Non-interest bearing deposits | 3,788,056 | | | | | | 3,741,160 | | | | | | 2,169,542 | | | | |

| Other non-interest bearing liabilities | 403,057 | | | | | | 541,839 | | | | | | 281,504 | | | | |

| Total non-interest bearing liabilities | 4,191,113 | | | | | | 4,282,999 | | | | | | 2,451,046 | | | | |

| Total liabilities | 21,284,495 | | | | | | 21,587,568 | | | | | | 12,471,772 | | | | |

| Stockholders' equity | 2,624,019 | | | | | | 2,660,470 | | | | | | 1,642,854 | | | | |

| Total liabilities and stockholders' equity | $ | 23,908,514 | | | | | | | $ | 24,248,038 | | | | | | | $ | 14,114,626 | | | | | |

| | | | | | | | | | | | | | | | | |

| Net interest income | | | $ | 181,737 | | | | | | | $ | 183,701 | | | | | | | $ | 95,788 | | | |

| | | | | | | | | | | | | | | | | |

| Net interest rate spread | | | | | 2.63 | % | | | | | | 2.65 | % | | | | | | 2.33 | % |

| Net interest-earning assets | $ | 4,667,076 | | | | | | | $ | 4,504,657 | | | | | | | $ | 2,802,815 | | | | | |

| | | | | | | | | | | | | | | | | |

Net interest margin (3) | | | | | 3.28 | % | | | | | | 3.31 | % | | | | | | 2.92 | % |

| | | | | | | | | | | | | | | | | |

| Ratio of interest-earning assets to total interest-bearing liabilities | 1.27x | | | | | | 1.26x | | | | | | 1.28x | | | | |

| | | | | |

| |

| (1) | Average outstanding balance amounts shown are amortized cost, net of allowance for credit losses. |

| (2) | Average outstanding balances are net of the allowance for loan losses, deferred loan fees and expenses, loan premiums and discounts and include non-accrual loans. |

| (3) | Annualized net interest income divided by average interest-earning assets. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| The following table summarizes the quarterly net interest margin for the previous five quarters. | | | |

| 12/31/24 | | 9/30/24 | | 6/30/24 | | 3/31/24 | | 12/31/23 |

| 4th Qtr. | | 3rd Qtr. | | 2nd Qtr. | | 1st Qtr. | | 4th Qtr. |

| Interest-Earning Assets: | | | | | | | | | |

| Securities | 3.78 | % | | 3.69 | % | | 3.40 | % | | 2.87 | % | | 2.79 | % |

| Net loans | 5.99 | % | | 6.21 | % | | 6.05 | % | | 5.51 | % | | 5.50 | % |

| Total interest-earning assets | 5.66 | % | | 5.84 | % | | 5.67 | % | | 5.06 | % | | 5.04 | % |

| | | | | | | | | |

| Interest-Bearing Liabilities: | | | | | | | | | |

| Total deposits | 2.81 | % | | 2.96 | % | | 2.84 | % | | 2.60 | % | | 2.47 | % |

| Total borrowings | 3.64 | % | | 3.73 | % | | 3.83 | % | | 3.60 | % | | 3.71 | % |

| Total interest-bearing liabilities | 3.03 | % | | 3.19 | % | | 3.09 | % | | 2.80 | % | | 2.71 | % |

| | | | | | | | | |

| Interest rate spread | 2.63 | % | | 2.65 | % | | 2.58 | % | | 2.26 | % | | 2.33 | % |

| Net interest margin | 3.28 | % | | 3.31 | % | | 3.21 | % | | 2.87 | % | | 2.92 | % |

| | | | | | | | | |

| Ratio of interest-earning assets to interest-bearing liabilities | 1.27x | | 1.26x | | 1.25x | | 1.28x | | 1.28x |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| PROVIDENT FINANCIAL SERVICES, INC. AND SUBSIDIARY |

| Net Interest Margin Analysis |

| Average Year to Date Balances |

| (Dollars in Thousands) (Unaudited) |

| | | | | | | | | | | |

| December 31, 2024 | | December 31, 2023 |

| Average | | | | Average | | Average | | | | Average |

| Balance | | Interest | | Yield/Cost | | Balance | | Interest | | Yield/Cost |

| Interest-Earning Assets: | | | | | | | | | | | |

| Deposits | $ | 36,932 | | | $ | 7,062 | | | 5.23 | % | | $ | 65,991 | | | $ | 3,421 | | | 5.18 | % |

| Federal funds sold and other short-term investments | — | | | — | | | — | % | | 255 | | | 12 | | | 4.55 | % |

| Available for sale debt securities | 2,323,158 | | | 77,617 | | | 3.32 | % | | 1,745,105 | | | 40,678 | | | 2.33 | % |

Held to maturity debt securities, net (1) | 344,903 | | | 8,885 | | | 2.58 | % | | 375,436 | | | 9,362 | | | 2.49 | % |

| Equity securities, at fair value | 12,367 | | | — | | | — | % | | 1,020 | | | — | | | — | % |

| Federal Home Loan Bank stock | 85,358 | | | 8,278 | | | 9.70 | % | | 81,797 | | | 6,112 | | | 7.47 | % |

Net loans: (2) | | | | | | | | | | | |

| Total mortgage loans | 11,333,540 | | | 655,868 | | | 5.79 | % | | 7,813,764 | | | 408,942 | | | 5.23 | % |

| Total commercial loans | 3,768,388 | | | 251,793 | | | 6.68 | % | | 2,251,175 | | | 128,854 | | | 5.72 | % |